The European market potential for urban experiences tourism

City tourism and the desire for authentic urban experiences are on the rise amongst European travellers. They provide a unique opportunity for visitors to have an immersive and authentic experience delivered by a passionate local. City break tourism is growing fast amongst European travellers; top source countries are Spain, Italy and France, which are especially keen on other cultures and gastronomy. Choosing an experience over a material possession is a key trend today, and urban experiences fit that profile perfectly.

Contents of this page

1. Product description

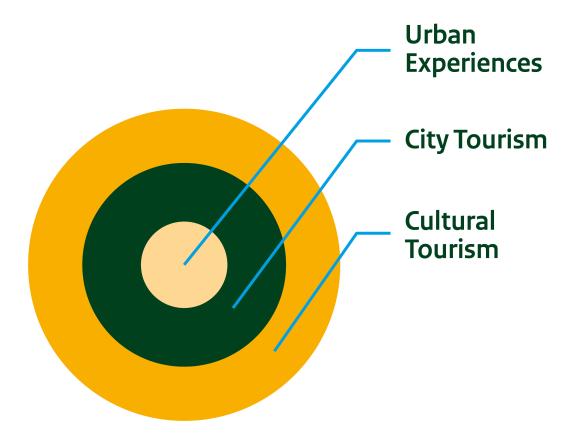

Urban experiences refer to guided or self-guided tours that take place in urban settings, usually larger towns and cities. They are generally short in duration, from a few hours to a full day. Urban experiences are distinct from similar touristic activities that take place in small villages and communities. These are usually referred to as part of rural tourism. Urban experiences are part of city tourism, which is part of the major tourism segment, cultural tourism.

Figure 1: Urban Experiences relative to City Tourism and Cultural Tourism

Source: Acorn Tourism Consulting, 2024

City tourism is dominated by the world’s largest cities, like Bangkok, Paris and London, which have millions of visitors every year. They have numerous attractions and experiences available to visitors. But the market for city tourism in lesser-visited cities is also significant. Smaller urban destinations are becoming increasingly popular, as tourists seek unique and different experiences in places more off the beaten track. The table below gives an idea of the wide range of lesser-known cities that offer authentic experiences to visitors.

Table 1: Examples of lesser-visited city destinations in developing countries

| Africa | Asia | Latin America |

Djibouti City, Djibouti Durban, South Africa Ibadan, Nigeria Kigali, Rwanda Lichinga, Mozambique Mutare, Zimbabwe Saly, Senegal Stone Town, Zanzibar, Tanzania Tangier, Morocco Windhoek, Namibia | Da Nang, Vietnam Dalat, Vietnam Davao, Philippines Ipoh, Malaysia Jaffna, Sri Lanka Karak, Jordan Leshan, China Nay Pyi Taw, Myanmar Nikko, Japan Pakse, Laos Samarkand, Uzbekistan Solo, Indonesia | Cahuita, Costa Rica Chachapoyas, Peru Concepción, Chile Córdoba, Argentina Cuenca, Ecuador Flores, Guatemala Jardin, Colombia Leon, Nicaragua Punta Arenas, Chile Suchitoto, El Salvador Tarija, Bolivia Valparaiso, Chile |

Source: Acorn Tourism Consulting, 2024

Urban experiences in cities and towns are very popular amongst world-travelling Europeans. Guided tours led by knowledgeable, enthusiastic and engaging local guides who know the destination well provide some of the most immersive tourism experiences. Self-guided tours are another way to partake in urban experiences. Both enable visitors to learn much more about a destination and enjoy an authentic experience. Tours that include a hands-on element like cooking, learning a language, or joining a local activity like dancing are also immersive and authentic.

There are multiple benefits to urban experiences. They can:

- offer authentic and immersive experiences to European tourists.

- provide employment for good, well-trained guides who are good communicators, knowledgeable and inspirational in order to provide the desired learning experience.

- help create strong connections and interactions between visitors and local people and places.

- help develop skills of local people through training, and encourage more people to take part, particularly women and young people.

- be relatively easy to establish, such as a simple walking tour, as long as the service provided meets the expectation.

Examples of urban experiences on the market

There are many urban experiences on the market, and they are quite varied. They cover all sorts of tour types, such as cultural and heritage tours, food tours, walking tours, wine and beer experiences, learning a new skill, cooking classes, dance classes and sports tours. Although it is a competitive market, tour operators and SMEs can create opportunities by devising something a little different from others on the market.

Table 2: Examples of Urban Experiences on the market in 2024

| Urban Experience | Details |

| Take a traditional tour of Ho Chi Minh City, Vietnam | A food walk to sample some of the best street food that Vietnam has to offer, including stops at popular destinations like Co Giang Street. As well as food, the tour guide also talks about the history of Vietnam and its cultural revolution over the past few decades. |

| Off the beaten track in Comuna 13, Medellín, Colombia | This tour takes in some of the lesser-known spots of Medellín, guided by locals who have firsthand knowledge of the area and its history. Comuna 13 was once the most dangerous area of the city. Today it is a model of how peace, community and artistic collaboration can transform a region. The tour is available in English, Spanish, French and Portuguese. |

| Treasures of Marrakech: Souks and Artisans Tour, Morocco | A private tour of the souks (markets) and local artisans’ shops, accompanied by storytelling to find out all about the local culture, traditions, beliefs, customs, stories and legends of the city. The local hosts are natural storytellers. Each guide is an expert in his/her own field, such as art or history. |

| Urban Safari in Cape Town, South Africa | A tour in a ‘rustic van’ covered in eye-catching art around the lesser-known sites of the city. The tour is led by an accredited local guide, visiting ‘hidden gems’ only known to locals. Visitors learn about the true spirit of Cape Town, and the tour includes visits to wineries and breweries. |

A Magical Evening in Oaxaca: City Tour, Mexico | An evening tour of the city when the day trippers have gone and the city is at its atmospheric best. Visitors discover details that may have been missed during a day trip and give a more local perspective. |

Market Tour and Seasonal North Indian Vegetarian Cooking Class, Jaipur, India | Before cooking, guests accompany the local host to the market to select the produce they will be cooking. The trip includes a tour of spice shops to learn how Indian spices are used in cooking and about local and seasonal fruits and vegetables. After the cooking class, the meal is enjoyed with the participants and the host. |

| Lima Discovery Experience | This is a Lima tour that ‘puts you in the shoes of locals’. The tour takes in local architecture, city sights and hidden gems, plus local markets. It is led by a local guide who will educate guests about the city’s history and teach them new Spanish phrases. |

Samba Class and Samba Night Tour in Rio, Brazil | A four-hour experience that includes a samba lesson from a professional local dancer plus joining a local samba class for dancing and a live samba band. |

Source: Acorn Tourism

End-market segmentation and consumer behaviour

Broadly speaking, any traveller type will choose to take part in an urban experience. Traveller types include:

- Fully independent travellers (FIT) – FITs make all their own travel arrangements. They are big users of urban experiences and will book either before they arrive or while in the destination.

- Tourists on package, group or tailor-made tours – budget, mid-range and luxury. During downtime, they might choose to book a food tour or cultural experience, depending upon what is included in their package.

- Visiting family and friends (VFR) and Diaspora markets – tourists with family or heritage connections with a destination. These are often domestic and regional markets and are substantial.

- Business travellers – particularly those who also take some leisure time while on a business trip. The trend for ‘bleisure’, combining business with leisure, is also evolving. Leisure is increasingly becoming the larger portion of a bleisure trip as travellers’ priorities change towards a healthier work-life balance.

The urban experiences market includes all major consumer groups – baby boomers, Gen X, Gen Y and Gen Z – each with its own motivations and travel characteristics. This makes that market competitive, but also offers good opportunities for local operators to find gaps in the market for unique tours.

The main characteristics of the consumer groups are outlined as follows:

- Baby boomers: born between 1946 and 1964, aged 60-78 today. Baby boomers are active, discerning and influential. They are also the wealthiest group and like luxury travel experiences. Budget is less important when the experience meets their need. They are looking to take part in unique experiences and are prepared to pay more for an authentic experience.

- Gen X: born between 1965 and 1980, aged 44-59 today. They are usually still working full-time so have less time to travel. Family life remains a priority, so budgets are tighter although they like to have family learning experiences. They are careful how they spend money on travel and will engage in considerable online research. As they age and their children leave home, they have more to spend on travel. Gen X places an emphasis on authenticity and learning new things in their travel experiences.

- Gen Y: born between 1981 and 1995, aged 29-43 today. Travel is very important to Gen Y, also known as millennials, the world’s largest consumer group. They are a key target group for immersive travel experiences like urban experiences. Millennials are heavy users of technology and like to research and book their trips and experiences online. Social networking is second-nature to them, and they rely heavily on word-of-mouth in their decision-making processes.

- Gen Z: born between 1996 and 2012, aged 12-28 today. Gen Z is the youngest group of consumers. As the first generation to be wholly shaped by technology, they are often referred to as ‘digital natives’. From the age of 18, when they finish grade school and enter the workforce, their importance as a consumer group with spending power will increase. They have limited budgets and developing countries are popular destinations, as they are generally cheaper to travel around. The characteristics by budget and time to travel for each group is outlined in the chart below.

Table 3: Travel Characteristics of Consumer Groups, by budget and time to travel

| Demographic | Budget | Mid-Budget | Luxury | Time Rich | Time Poor |

| Gen Z | ✓ | ✓ | |||

| Millennials/Gen Y | ✓ | ✓ | ✓ | ✓ | |

| Gen X | ✓ | ✓ | ✓ | ✓ | |

| Baby boomers | ✓ | ✓ | ✓ |

Source: Acorn Tourism Consulting

Although European cities are the most popular destinations for city breaks and urban experiences, several factors motivate European tourists to travel beyond Europe.

- Experience a new culture – cities and towns beyond Europe allow tourists to experience completely different cultures. This is appealing to those who are curious about the world and want to broaden their horizons. Immersive and authentic experiences are amongst the number-one tourism trends today.

- Explore historical sites – there are so many fascinating ancient ruins, historical landmarks and architectural wonders all over the world. European city break tourists are interested to learn about these sites to get a good understanding of the history, culture and sense of a place through someone who knows the destination well.

- Try new foods – a major part of any travel experience these days is to try new foods. Cities and towns around the world offer great opportunities to sample a wide range of cuisines. For some tourists, food is the number-one reason to choose a destination.

- To learn a new language – a city break offers a good opportunity to improve language skills and/or pick up some new words and phrases. Being able to communicate with local people greatly enhances the experience for both tourists and locals.

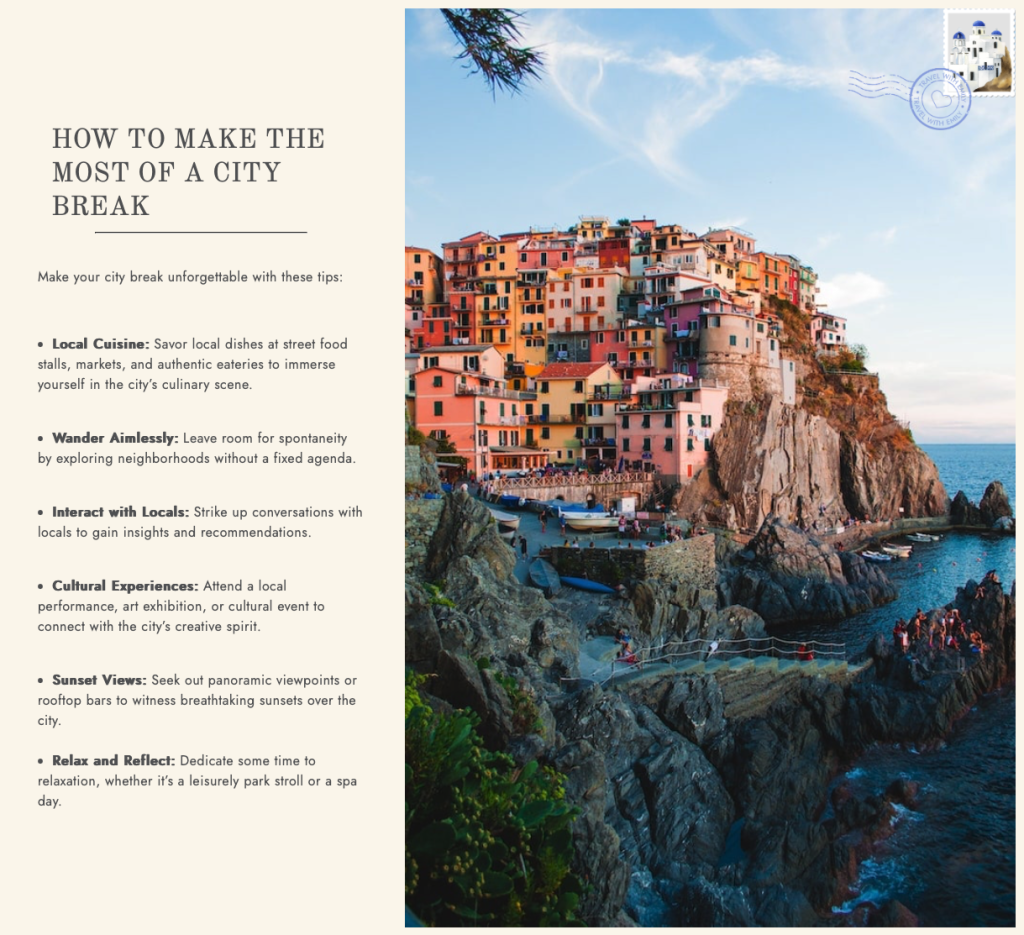

Figure 2: Tips for Europeans to enjoy city breaks

Source: The Luxury Travel List

Tips:

- To learn more about the relevant markets, read the CBI studies on opportunities in the European FIT tourism market and the European diaspora tourism market, and on how to successfully attract domestic and regional markets.

- Read CBI’s target market studies on baby boomers, Gen X, Gen Y and Gen Z.

Accessible tourism on the European market

Accessible tourism is the ongoing endeavour to ensure tourist destinations, products and services are accessible to all people, regardless of physical limitations, disabilities or age. It encompasses publicly and privately owned tourist locations. The improvements not only benefit those with permanent physical disabilities, but also parents with small children, elderly travellers, people with temporary injuries such as a broken leg, as well as their travel companions. Disabled tourists may travel individually, in groups, with their family or with carers.

Accessibility and urban experiences

Accessibility needs are varied in the urban experiences niche, given the broad range of traveller types. Be aware that there are many different types of disabilities, not just wheelchair users. The baby boomer market is older and may have mobility issues. By contrast, the Gen-X and Gen-Y travellers may have young children or include pregnant women who have different needs.

You should be very clear about what you can and cannot offer people with disabilities. For instance, if you offer a walking tour that involves long distances or lots of steps, be sure to advise whether it’s suitable for persons with mobility issues. Alternatively, if you advertise a tour as suitable for wheelchair users, make sure you fully understand what their needs are.

Find out more on how people with disabilities feel about city tourism. The blogs A disabled travel blogger’s favourite accessible city breaks and Four cities putting disabled travellers first provide some interesting information and good tips.

Tip:

- Read the CBI studies The European market potential for accessible tourism and Entering the European market for accessible tourism products for practical and useful advice to make your tours accessible.

2. What makes Europe an interesting market for urban experiences?

Europe is a key outbound market for cultural tourism, and therefore for city tourism and urban experiences. It is estimated that cultural tourism accounts for 40% of all European tourism. Put another way, 4 out of 10 European tourists choose their destination based on its cultural offerings. This means there are significant opportunities for developing authentic and immersive urban experiences to attract the city break market.

City breaks are popular holiday choices for European outbound tourists. In CBI research from 2022, city breaks were cited as a top reason for travel to developing destinations (36%), after beach tourism (56%). Tangible culture, and food and wine, which are both popular things to do while on a city break, were also significant reasons.

Table 4: Main activities during a holiday abroad amongst European respondents, 2022

| Activity | All destinations | Developing Destinations |

| Beach tourism | 40% | 56% |

| City break | 48% | 36% |

| Tangible culture | 25% | 19% |

| Food and wine | 20% | 18% |

Source: CBI

Europeans taking city breaks are a significant growth market. Since the end of the pandemic, city destinations have become increasingly appealing. Some experts suggest city breaks are becoming more popular than beach holidays. Although European cities are the top preference for European tourists, there is also a high interest in cultural and urban experiences when travelling to long-haul destinations.

Today, people are much more motivated to spend money on experiences rather than buying possessions. Global spending on travel experiences was reported to be up by 65% in 2023, compared to 12% on things. This growth is expected to continue over the coming years. Gen Y and Gen Z are helping drive this growth, as they are especially keen on experiences. Destinations featured in TV shows and films are also having a positive impact.

Europeans who like city breaks are tech-savvy. They have a greater preference for booking accommodation services online through OTAs (66%) than other niches (57%). Just over one-third of European city breakers also use OTAs to book experiences (36%), while 17% use a travel agent, and 13% book experiences while at their destination.

Tip:

- Make your experiences bookable online. When Europeans research their city break they look online for exciting and interesting things to do. Urban experiences are a key choice. If you have a good presence online, you are more likely to be found. Use the CBI study How to be a successful tourism company online?[TC-VU1] to help you improve your online presence.

3. Which European countries offer the most opportunities for urban experiences?

The European countries that offer the most opportunities for urban experiences in developing destinations are Spain, Italy, France, the Netherlands, Germany and the UK. Food and culture are important to all the source markets, so these present the biggest opportunities for local operators seeking the enter the urban experiences market. There are many city destinations popular amongst European tourists, such as Marrakech in Morocco, well-known for its rich culture and food offerings.

Spain

Spanish tourists like to take a city break more than other source markets. 2022 research by CBI (Centre for the Promotion of Imports) showed that two out of three (66%) respondents had booked a city trip in the previous 12 months. A further 56% were planning a city break trip. This means they are a valuable market to target with urban experiences. Spanish tourists are particularly interested in immersive local experiences – local markets, traditional practices and meeting local people.

Spanish tourists plan to spend more on travel over the next few years, prioritising sustainable travel and ‘slow tourism’. The concept of slow travel means staying local, connecting with local cultures and minimising impact on the environment. Cultural experiences are set to be another priority for Spanish tourists, along with budgetary concerns. City breaks and guided tours are high on their list of preferences for 2024. Low-season trips to international destinations with good sustainability credentials will also be important. This is good news for operators in lesser-visited destinations.

The infographic below shows the importance of local culture and historical experiences when planning a trip. The most common activities on trips are cultural and gastronomic.

Figure 3: Top factors impacting travel choices for Spaniards, 2023

Source: TGM Global Travel Survey 2023

Spanish consumers are more likely than other markets to make their travel plans online. The Spanish are heavy users of social media, like most European source markets. Internet penetration is high, at 96% of the population. YouTube, Instagram and Facebook are amongst the top social media channels. Spaniards regularly use social media while on a trip abroad, more than most other markets except for Germany and Italy.

In 2020, there were around 9,700 travel agencies and tour operators in Spain. They are mostly located in Madrid (20%), Catalonia (17%) and Andalusia (17%). Personal relationships are very important to Spanish operators and take time to build. Amongst the top tour operators are Tourmundial, Travelplan and Catai Tours.

The most popular developing country destinations for Spanish tourists include Morocco, Mexico and Turkey. Mexico is a good choice for Spanish tourists, because of the common language. Other Spanish-speaking destinations are popular too, like Costa Rica and Colombia.

Italy

Italians are enthusiastic city breakers and are the next main market after Spain. Over half of Italian respondents took a city break in a 12-month period between 2021 and 2022 (55%), according to CBI research. Almost half more (49%) were planning to take a city break.

Since the end of the pandemic, outbound tourism from Italy has recovered well. A current trend is that Italians prefer to stay away for longer and visits to cities and villages have remained the top favourite cultural activity for Italian tourists. According to Visit Britain, sightseeing is a popular activity amongst Italians; they also like to socialise with locals, which helps them get a true sense of place.

Culture and gastronomy are amongst the most popular activities Italians take part in while on holiday, as displayed in the infographic below. Local culture and history are a key consideration when planning a trip.

Figure 4: Top factors impacting travel choices for Italians, 2023

Source: TGM Global Travel Survey 2023

Italians are very influenced by friends and family when deciding on travel plans, along with traveller review websites. They also use comparison websites and online travel blogs and websites, like Alessandro Marras and Marco Togni. Like much of Western Europe, Italians are very tech-savvy, with 87.7% internet penetration. Facebook, Instagram and WhatsApp were the most popular social media sites in June 2024, followed by Pinterest and TikTok. All these platforms are widely used for travel research.

The Italian travel trade is very fragmented, with about 11,925 tourism companies. They are mostly in large cities like Rome, Milan and Naples. Musement is a well-known OTA that originated in Italy and is now owned by TUI. Other tour operators are Alpitour, Gattinoni and Veratour.

Egypt, Turkey and Morocco are the most popular developing destinations for Italian outbound tourists.

France

French tourists love to travel to cities for a break. CBI research in 2022 showed that over half of respondents (52%) had taken a break during the previous 12 months, and 47% were planning a city break trip.

Eating out is a key priority for French tourists when on holiday. This makes them a good market for urban food experiences. They are also keen on local culture and history, which plays an important role in their planning.

Figure 5: Top factors impacting travel choices for the French, 2023

Source: TGM Global Travel Survey 2023

The trend for ‘micro breaks’ and short breaks has grown in France. The desire for unusual and immersive experiences while on a short break is also higher: 72% of respondents want to enjoy unusual experiences in less touristy areas, such as urban hikes, and 96% want to consume local produce. While this research has a focus on domestic tourism, it provides a useful indicator of French tourists’ motivation for interesting and exciting urban experiences.

Internet penetration in France is very high, at 93.8%, and the French are very connected to social media. Facebook, WhatsApp and Instagram are the top platforms. French consumers are more likely to use a travel agent to make a booking than many of the other source markets (40%). The pandemic resulted in more French travellers wanting to travel sustainably, with 60% saying they expected the tourism sector to offer more sustainable options.

The travel trade in France is complex, and businesses are subject to registration with Atout France, the national organisation responsible for the licensing of tourism products. There are around 4,015 officially registered businesses. They include Groupe Voyageurs du Monde and Exotismes.

French outbound tourists like to travel to Morocco, Tunisia, Turkey and Thailand. As French is also spoken in Morocco, this makes it an attractive choice for French nationals.

The Netherlands

CBI research (2022) found that 41% of Dutch respondents took a city break in the previous 12 months and 36% planned to take a city break. Culture and history are important factors for Dutch tourists when planning their trips, while culture and gastronomy are preferred activities.

Figure 6: Top factors impacting travel choices for the Dutch, 2023

Source: TGM Global Travel Survey 2023

For 2024, city trips were found to be one of the most popular choices amongst Dutch tourists (10%), after beach holidays (18%) and nature holidays (11%). Dutch tourists are amongst the keenest of European source markets to travel beyond Europe, with 18% stating they would choose medium- or long-haul travels in 2024.

Internet penetration in the Netherlands is highest amongst all the source market countries, at 99%. The Dutch are very tech-savvy: there were 15 million social media users in January 2024, accounting for 85% of the total population. They speak English very well, which makes them an interesting market to target if your business is English-speaking. Facebook and Instagram are the top social media platforms, along with LinkedIn.

Dutch consumers are amongst the most sustainably minded of all the source markets, with 53% stating they will think more about sustainability and environmental impact when planning a future holiday. The younger generations tend to be more sustainably minded than older cohorts.

The Dutch travel trade includes both travel agents and tour operators. Niche operators like ANWB Reizen Group and De Jong Intra Vakanties are becoming more widespread as demand for niche holidays grows. Popular developing country destinations for Dutch tourists are Turkey, Thailand and Morocco. Study this report on Tourism in Turkey and Istanbul for opportunities to attract the German market.

Germany

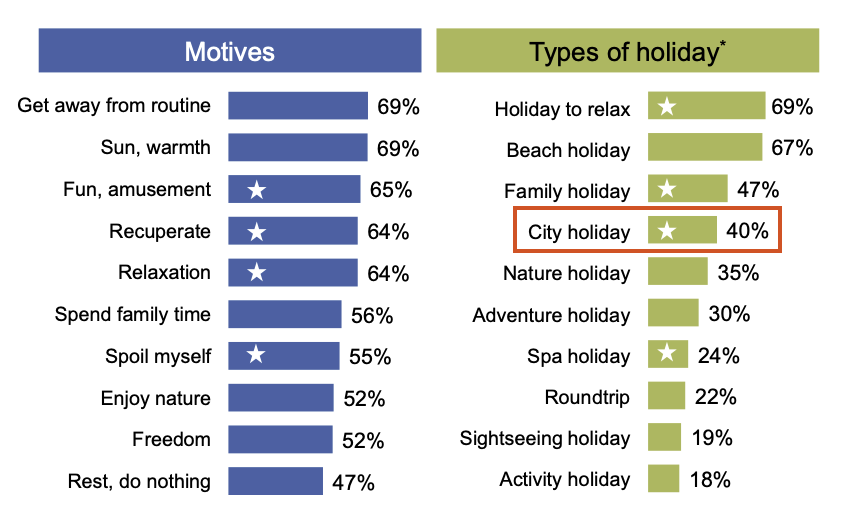

Research by ReiseAnalyse states that city holidays were amongst the most popular for German tourists. In 2023, 40% of German tourists stated an interest in a city holiday. The results of the chart below show an increasing interest in several types of trips, including city holidays. Urban experiences fit well with German motives, namely to have fun, recuperate, relax and spoil oneself.

Figure 7: Motives and interests of German tourists, 2023

Source: ReiseAnalyse

CBI research in 2022 also showed the popularity of city breaks. Nearly two in five German respondents (39%) had taken a break during the previous 12 months, and 30% were planning a city break trip. Amongst the most common activities on trips and culture and gastronomy.

Figure 8: Top factors impacting travel choices for Germans, 2023

Source: TGM Global Travel Survey 2023

Like all source market countries, Germans are digitally minded, with 93.3% internet penetration. WhatsApp and Instagram are the most popular social media platforms in Germany. Germans like to book their holidays further in advance than other markets, by 6 months or more.

Germany’s travel industry is well-established. TUI and DERTOUR dominate the marketplace and together account for around 20-25% of the market. While Germans are increasingly choosing to book online, booking directly with travel agents continues to be important in the market.

Germans’ interest in long-haul destinations has returned following the pandemic. In 2019, 8% of outbound German tourists chose long-haul destinations. In 2023 this had increased to 9%, a trend expected to continue in the coming years. Most popular developing destinations for Germans are Turkey, Egypt and Thailand.

The United Kingdom (UK)

Research conducted by the CBI in 2022 found that 34% of British respondents took a city break in the previous 12 months, with 30% planning to take a city break.

British tourists like short breaks, and city breaks are at the top of the list. Mintel Research (2021) found that 55% of respondents took a city break abroad in the previous 12 months and 55% planned to take one in the next 12 months. In addition, 53% of British tourists said they were more interested in visiting less well-known cities in overseas destinations than the traditional major cities. This offers good potential for tour operators to reach out to British tourists seeking immersive urban experiences.

Local culture was stated to be a strong attraction for overseas short breaks (60%), stronger than for domestic tourism (56%). Exploring local cuisine was another key attractor for overseas short breaks (55%), along with discovering ‘secret places’ known only to locals (40%) .

Source: Mintel, 2021

Internet penetration in the UK stands at 97.8%, and 82.8% of the population are social media users. This means the nation is very digitally-minded. The most popular platform in the UK is Facebook, followed by iMessage and Instagram.

In 2021, there were about 8,670 tour operators and travel agencies in the UK. Some of the largest are Hays Travel and Trailfinders, selling holidays on behalf of other tour operators. Responsible Travel is an interesting British OTA that only sells holidays that are proven to be sustainable.

Tips:

- Offer tours in languages other than just English, including Spanish, Italian, French and German. Dutch tourists generally speak very good English, but Europeans will appreciate the effort made to try to speak their language. You will also set yourself apart if you can offer your experiences in multiple languages.

- Improve your visibility online. European markets are heavy users of social media channels, and to reach them you must use your website and social media channels. The CBI study How to be a successful tourism business online? can be a useful tool.

- Make a list of the top markets you want to do business with. Build a profile of each market by doing your own research into source markets so you expand your understanding of the different markets. Tourist boards often publish market profiles, including Visit Britain. They give useful insights into the consumer and into the trade.

- Use the CBI study 10 tips for doing business with European tourism buyers to help you approach the European consumer and business markets.

4. Which trends offer opportunities or pose threats in the European urban experiences market?

City breaks are more popular than ever now that the pandemic is over. Visiting cities has always been a great way for visitors to learn about local cultures and people. Urban experiences in city/town destinations are rising in popularity and are proving a major tourism trend. However, it is important that local tour operators manage urban experiences responsibly and sustainably to avoid the harmful impacts of overtourlsm.

City breaks are back in favour

Now that the pandemic is over, travellers are once again choosing to visit city and urban destinations, driven by the growing interest in culture, heritage and traditions. Between 2020 and 2021 there were 28% more travellers choosing cities and other urban destinations, a trend that has continued to rise. While domestic and short-haul city breaks will dominate the city break market, the principle of enjoying a short stay in an urban destination while on a broader trip is very appealing to European tourists. As international travel continues to recover to pre-pandemic levels in 2024 and is estimated to exceed 2019 levels by 2% by the end of the year, the future for city tourism continues to be bright.

Yearning for experiences continues to rise

Consumer preference for experiences over the purchase of things is a current trend that continues to rise in popularity. These days people place less value on material things in favour of real-life experiences, whether at home or overseas. This has led to the rise in experiential travel where holidaymakers choose first-hand, immersive experiences to find out about local cultures and traditions, engage with local communities and enjoy natural environments.

Growth in this market is expected to continue at around 7% a year from 2024, more than hotel and airline growth (4.6% and 5%, respectively). Many experiences are sold through OTAs, a sector that itself is also expanding. Today, experiences sold online through OTAs account for around 10% of the market. Travellers themselves are taking part in more experiences while on a trip. In the US, travellers are spending 25% more on experiences and are taking an average of 7 tours, activities or attraction visits on one trip.

Local operators of urban experiences are well-placed to take advantage of this trend. Culinary experiences, sightseeing tours, hands-on learning activities, community engagement and volunteering are all common enjoyments in urban destinations. Driven by social media, travellers are also seeking to visit lesser-known destinations for cultural experiences and immersive activities.

There are multiple opportunities for SMEs who can craft unique and authentic tours in urban destinations to attract this ready-and-willing market of travellers. Key to success is creating original and unique experiences that are different from the many tours on the market. This needs careful, imaginative planning and management, delivered by enthusiastic and knowledgeable guides.

Private tours rising in popularity

The trend of taking a private tour rather than a small group tour is rising is popularity, particularly amongst international travellers. Family groups and group travellers are increasingly looking to enjoy an exclusive experienced tailored especially for them. Private tours can offer a more meaningful and immersive experience, as a guide can be more focused on individuals in the group and respond to the group dynamic.

Other factors driving this growth is ease of planning. Booking an exclusive trip allows the group to arrange it at a time and place that is most convenient for them, rather than joining a scheduled departure. Control of an itinerary and schedule is another important factor whereby travellers can design the experience they want.

Tips:

- Offer private trips if you can. People are prepared to pay more for private trips if you can meet their needs.

- Be flexible. Create a range of suggested itineraries that can be adapted to suit groups’ needs. Give travellers the flexibility to customise trips further, designing schedules and other tour components.

- Use relevant marketing messages to promote private trips. Talk about ‘exclusivity’, ‘unique access’, ‘tailor-made’ and ‘fully customisable’.

City destinations take steps to address overtourism and be more sustainable

Overtourism is a major problem in cities and urban destinations everywhere. Places and residents are known to be suffering from the effects of too many visitors. Issues include overcrowding, litter, strain on resources and services, and environmental damage, which is having a significantly negative impact on the health of the destination.

Many top tourist European cities like Venice, Barcelona, Dubrovnik and Amsterdam are putting measures in place to deal with these issues, such as limiting visitor numbers, imposing day tourist taxes and managing cruise ship numbers. In 2023 Amsterdam launched a ‘stay away’ marketing campaign aimed at British stag and hen parties by warning of steep fines for nuisance behaviour.

As a result, many people are choosing to visit places with fewer tourists but which are equally interesting and rich in culture, to provide a more meaningful and unique experience. However, to avoid the negative impacts of tourism all destinations have a responsibility to manage it responsibly and sustainably, and it is important that providers of urban experiences embed sustainability within their business.

Ideas to make your tours more sustainable include:

- Make it a walking tour. Walking tours are intimate and immersive, and give guide and guest a great opportunity to get to know each other.

- Use sustainable forms of transport in your tours, like bicycles and electric vehicles. Tours by public transport are also a more sustainable form of transport than private vehicles.

- Make your tours ‘small group tours’ only. This is more immersive and satisfying for both guide and guest.

- Employ local people to lead the tour. Help them develop their guiding skills through suitable training.

- Involve local communities, producers and providers wherever you can. Incorporate visits to their shops/places of business, where they can meet your guests and interact with them directly.

- Restrict or ban single-use plastics, like plastic bottles, on your tours.

Tip:

- Read the CBI studies How to be a sustainable tourism business and 10 tips to go green in the tourism sector to help you make your business sustainable.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research