Entering the European market for hemp apparel

Before you can start doing business with new buyers in new markets, you need to research the potential market. After a preparation phase in which you create an inspiring, sustainable and commercial story for your product, company and proposal, you will need to actively approach buyers to open doors. This report will help you understand the European market for hemp apparel, its requirements, sales channels, niches and your competitors.

Contents of this page

- What requirements and certifications should hemp apparel comply with to be allowed on the European market?

- Through what channels can you get hemp apparel onto the European market?

- What competition do you face on the European hemp apparel market?

- What are the prices of hemp apparel on the European market?

1. What requirements and certifications should hemp apparel comply with to be allowed on the European market?

You need to meet several requirements if you want to export hemp apparel to Europe. Some are mandatory (both legal and non-legal), but others are voluntary. Meeting them can give you a competitive advantage. Some requirements only apply to certain niches in the hemp apparel market.

What are mandatory requirements?

There are many legal requirements for exporting all kinds of apparel to Europe, including hemp apparel. These requirements concern product safety, the use of chemicals (REACH), quality and labelling. Check the EU Access2Markets online helpdesk for an overview.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Make sure that your product complies with the European Union's (EU) General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Make sure you comply with the EU’s REACH Regulation. This regulation restricts the use of chemicals in apparel and trims, including certain azo dyes, flame retardants, waterproofing and stain-repelling chemicals, and nickel.

- Specify the material composition of every item of apparel that you export to the EU, in accordance with Regulation (EU) 1007/2011. Check the EU Access2Markets online helpdesk on how to do it.

- Do not violate any Intellectual Property (IP) rights and do not copy or share designs with other buyers. If your buyer provides the design, they will be liable if the item is found to violate a property right. Tips:

- Read the CBI study on buyer requirements for more information on the requirements you need to comply with before you can export apparel to the EU.

- Complying with REACH can be challenging. With small orders, most European buyers will not ask for expensive testing, but you will bear all expenses involved if illegal chemicals are discovered after delivery. If you want to be sure that your products are REACH compliant, make sure you test your materials.

- If you need help, always discuss challenges and possible solutions with your buyer.

Tips:

- Read the CBI study on buyer requirements for more information on the requirements you need to comply with before you can export apparel to the EU.

- Complying with REACH can be challenging. With small orders, most European buyers will not ask for expensive testing, but you will bear all expenses involved if illegal chemicals are discovered after delivery. If you want to be sure that your products are REACH compliant, make sure you test your materials.

- If you need help, always discuss challenges and possible solutions with your buyer.

Figure 1: Denim is a popular fabric for blending with hemp fibres, but hemp is also used for wovens and T-shirts

Non-legal mandatory requirements

Buyers may approach you with additional, company-specific terms and conditions. Requirements like these are usually laid down in a buyer manual. By signing a contract with your new buyer, you confirm that you will comply with all the requirements listed in their manual. You will be held accountable if there are any problems after the delivery of an order. The following topics may be found in buyer manuals.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL). This refers to the worst quality level that is still tolerable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the items are defective.

Packaging requirements

Your buyer will typically give you instructions on how to package orders. If you agree on delivering Free on Board (FOB), your buyer will clear customs in the country of import. It is their responsibility to ensure the instructions on the packaging comply with EU import procedures.

It is always a good idea to try to reduce the environmental impact and financial cost of packaging materials, for instance you could use materials made from recycled cardboard or biodegradable plastics.

Payment terms

For first-time orders, European buyers may agree to give you a down payment (of 30%, for example). They will pay the rest (70%) once the order has been completed. The safest payment method for you as a manufacturer is to use LCs (Letters of Credit). LCs obligates a buyer’s bank to pay the supplier once both parties meet the conditions they have agreed on. However, many buyers no longer favour LC payments, as this will block their cash flow. Be aware that LCs do not offer financial protection against bankruptcies.

For any further orders, most European buyers will ask for a TT (Telegraphic Transfer) after 30, 60, 90 or sometimes even 120 days. This means you, as a manufacturer, finish the production and hand over the shipment to the buyer, including the original documents, before payment is due. The payment will be made after the number of days that you have agreed on with the buyer. This is a risky payment agreement because you take the full financial risk.

Transparency

Supply chain transparency is very important to European buyers because of the ever stricter laws at EU and national levels, such as the EU’s CSDDD and the CSRD. Transparency includes tracing back the suppliers that produced the hemp (fabrics), as well as measuring and disclosing the environmental impact of the materials, such as the carbon footprint. Always help buyers to gain as much insight into their entire supply chain as possible. Read the CBI study Tips to go green for more information.

Restricted substances

Your buyer’s manual may mention a Restricted Substances List (RSL). These lists are often inspired by the guideline on safe chemicals use by the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance for more information.

Recycling

Recycling materials is important for European apparel buyers because the EU is continually introducing new legal measures to increase circularity in textiles. These include new legal requirements for the durability of textile products and the ‘right to repair’. The EU is also considering the introduction of an EU-wide EPR for apparel (extended producer responsibility). This makes companies responsible for how their products are disposed of, recycled or repaired. Some countries already have national EPR schemes.

Equality

Your buyer may also have requirements regarding diversity and inclusion in your workforce. By ensuring that all individuals, regardless of gender, race, religion or any other characteristics, have equal opportunities for employment, advancement and participation, your company can benefit from a wider pool of talent. This can result in greater creativity, innovation and problem-solving.

Certification and standards

Many European buyers require suppliers to get certified for sustainable and/or fair production. The following standards and certifications are the most popular in Europe. Note that BSCI is almost a standard requirement for many European apparel companies. For a more elaborate overview of popular standards, read the CBI study on buyer requirements.

Table 1: Europe’s most popular textile standards

| Name of standard | Logo | Type of compliance | Further information on getting certification |

| Amfori BSCI | Social | On invitation by buyers. Amfori provides a list of organisations that can perform an audit | |

| SA8000® |

| Social | Check the SA8000 certification process here |

| WRAP |

| Social | Check the WRAP certification process here |

| Sedex |

| Social, environmental | Check the Sedex certification process here |

| B-Corp |

| Social, environmental | Check the B-corp certification process here |

| OEKO-TEX® STeP |

| Social, environmental | Check the OEKO-TEX® STeP application process here |

| ZDHC | Environmental (chemical use) | The ZDHC provides a guide that outlines the requirements for indicating ZDHC MRSL conformance | |

| EU Organic |

| Environmental (organic production) | Check the criteria here |

| (GOTS) |

| Environmental (organic production, social responsibility) | Check how to get certified |

| Cradle to Cradle Certified™ |

| Environmental, social (material recycling, social responsibility, chemical management) | Check how to get certified |

Source: FT Journalistiek

Tips:

- Research the most popular standards in your target market and ask your (potential) buyers before you decide on which certificate you want to pursue. Getting and staying certified takes time, effort and money.

- Check the European Industrial Hemp Association (EIHA) website for news on hemp-related policies in the EU and information on the sustainability of hemp-related products. The EIHA has 200+ members both in and beyond Europe, comprising of farmers, processors and manufacturers.

What additional requirements and certifications do buyers often have?

In addition to legal and non-legal mandatory requirements, there are many services that buyers implicitly expect or at least greatly appreciate if you want to do business with them.

Product design and development

Not all hemp fabric is the same. The way hemp is cultivated and how it is processed affects its sustainability, appearance and feel. Hemp is a bast fibre that requires relatively little irrigation, fertilisers or pesticides to grow. It also captures carbon dioxide and nutrients in the soil. Rain-fed, organically certified cultivation is the most sustainable way to grow hemp and is the best choice to win over buyers that appreciate the sustainable qualities of hemp textiles.

For this type of buyer, the way the hemp is processed into fabric is also important. After harvesting, hemp fibres are softened through a process called ‘cottonisation’. This can be done mechanically or chemically. Both methods have their benefits and downsides in terms of sustainability, feel and appearance. Always make sure your buyer understands and agrees on the specific type of hemp textile you work with.

Table 2: The benefits and downsides of mechanical vs. chemical cottonisation of hemp fibres

| Hemp fibre cottonisation method | Sustainability | Feel | Natural qualities | Processing cost |

| Mechanical cottonisation | Does not require chemicals. | Results in a relatively coarse fibre that is often blended with staple fibres such as cotton, silk, Tencel, wool and polyester. The fabric wrinkles easily and has a feel similar to linen. | Preserves the natural properties of hemp; results in a lightweight, breathable, biodegradable fabric with moisture wicking, thermo-regulating, hypoallergenic and antibacterial properties. | Processing/spinning is relatively slow and can be costly if not automated. |

| Chemical cottonisation | Requires chemicals in a process similar to creating viscose. | Results in a fine, supple fibre. | Does not preserve the natural properties of hemp. | Relatively fast and cheap production process. |

Source: FT Journalistiek

Figure 2: Mechanically cottonised hemp fabrics have linen-like properties

Source: Maite Oñate on Unsplash

Communication

Always communicate with your buyers and manage expectations. Reply to every email, call and WhatsApp message within 24 hours, even if it is just to confirm that you have received the message and will reply more completely later. If you encounter a problem with a production order, immediately notify your buyer and try to offer a solution. Create a T&A (time and arrival) of every order and share it with your buyer. This file will help you manage expectations, monitor progress and is the best way to guarantee on-time delivery.

Flexibility

If you want to start a business relationship with a European buyer, be prepared to accept small, complicated orders first. Buyers will test your factory before giving you large, easy orders. Make sure that buyers will not continue to place only difficult orders with you and convenient orders elsewhere at the start.

In their first order, expect European buyers to require:

- Order quantities below your normal minimum order quantity (MOQ);

- A price level that is lower than you would normally accept for small quantity orders;

- High material quality and impeccable workmanship.

What are the requirements for niche markets?

There are many interesting niches in hemp apparel. Be aware that niche buyers usually request smaller orders and require a relatively high level of service. This means that you may need to adjust your manufacturing and sourcing if you want to be profitable.

Sustainable hemp apparel

Many people consider hemp apparel as a sustainable material because it can be grown without using fertilisers, pesticides, herbicides or irrigation. However, this says nothing about how hemp is processed into yarns and fabrics. Mechanically, cottonisation is the most eco-friendly method. For inspiration, you could study Marmara hemp. Grown in France but processed in France, Türkiye, India, Pakistan, China and Bangladesh, it is the first hemp manufacturer to receive C2C certification. It also provides a Life Cycle Analysis for its product(s).

Hemp denim

One of the most popular applications of cottonised hemp fibre is denim. This is mainly because the relative coarseness of mechanically cottonised denim is well suited to this type of fabric. However, make sure that your buyer understands that the feel of 25% hemp denim is different from denim made with 100% cotton. For more about sustainable finishing options and design for denim apparel, read our study Entering the European market for Denim.

Hemp outerwear

Hemp fibres are often blended with cotton, wool and other staple fibres for use in jackets and coats, sometimes in combination with faux fur to create ‘vegan’ styles. Take a look at Hoodlamb or Opera Campi for instance. The use of synthetic yarns may appeal to vegan consumers but deter consumers who appreciate the natural origin of hemp.

Hemp T-shirts

Hemp can be blended with cotton to create jersey T-shirts, such as Kuyichi’s cotton-hemp styles. Note that fabrics made with mechanically cottonised hemp typically have an appearance and feel similar to linen. Innovation in spinning techniques, however, has led to cotton-hemp blends becoming ever more similar to 100% cotton fabrics.

2. Through what channels can you get hemp apparel onto the European market?

There are several different channels you can use to get your product onto the European market. Each one has its own strengths and challenges. Study each channel and adjust your offer accordingly.

How is the end-market segmented?

The apparel market is typically segmented by price/quality level. Hemp apparel mostly appeals to consumers that value sustainability, so it makes sense to focus on these consumers within the most common market segments.

Table 3: Hemp apparel market segmentation

| Consumer type | Description | Price level | Fashion | Material use | Functionality |

Luxury consumer (premium market) | Affluent consumers, fashion enthusiasts and eco-conscious individuals who value style and sustainability. | Very high prices | Unique, creative designs | High-quality hemp fabrics and trims, nominated suppliers | Highly fashionable and functional |

Premium sustainable consumer (premium sustainable market) | Eco-conscious consumers who prioritise sustainability and eco-friendliness in their purchasing decisions. | High prices | On-trend designs | High-quality hemp fabrics and trims, nominated suppliers, preference for mechanically cottonised hemp | Fashionable and functional |

Outdoor and sportsenthusiasts (premium outdoor sports market) | Adventurous consumers interested in hemp-based outdoor apparel and gear | Medium-high prices | Prioritise durability and sustainability over design | High-quality hemp fabrics and trims, nominated suppliers | Highly functional |

Fashion-conscious consumer (upper-middle market) | Consumers who appreciate brand image, original designs and high-quality, sustainable materials, at a reasonable price point. | Medium-high prices | Fashionable designs inspired by the luxury market made with more affordable materials | Good quality hemp fabrics, sometimes nominated suppliers | Fashionable and functional |

Practical consumer (middle market) | Price-conscious eco consumers who shop for good quality, basic designs at large retail chains. | Medium prices | Wide range of products from basic to fashion manufactured in affordable hemp fabrics | Medium quality | Fashionable and functional |

Source: FT Journalistiek

Tips:

- Hemp is still a niche material, so it is important to educate your potential buyers about its qualities and sustainability.

- Investigate your buyer’s reason for their interest in hemp. If they are interested in its sustainable properties, try working with organically cultivated, mechanically cottonised hemp fibres.

- Follow the economic situation in your country of focus and develop a suitable price strategy. Take a look at the CBI’s Market Analysis study for hemp apparel for tips.

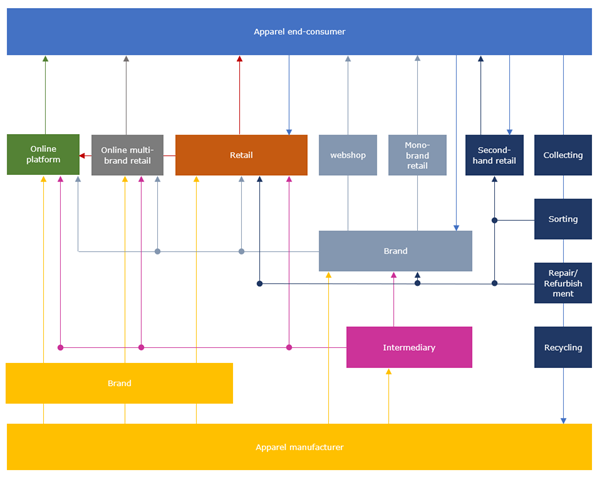

Through which channels does the product end up on the end-market?

Always try to find out if you are dealing with a brand, a retailer, an intermediary or another type of buyer. Every buyer has a different sourcing and sales strategy and different challenges. Adapt your pitch accordingly.

Table 4: Different sales channels and their characteristics

| Sales channel | Who’s your buyer? | Requirements | Examples |

| 1 | European end-consumer | You will need to invest in a web shop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness. | Alibaba, Wish, Amazon, ASOS marketplace, Rakuten (Spain and France), Allegro (Poland), Wolf & Badger |

| 2 | Online multi-brand platform | Online multi-brand platforms sell existing apparel and other brands and often develop their own private collections – mostly value brands. They can detect market trends very fast and will react to sales data immediately. Usually, these companies will place small test orders first. If the item sells well, they will place the actual production order. Fast delivery is a must. | Zalando, Asos, Farfetch, Boozt (Scandinavia), About you, La Redoute (France), Yoox |

| 3 | Retailer | Besides big chains, most apparel is sold in boutique shops that can be found in almost every European city. These shops sell existing brands, but some also order products specifically developed and manufactured for them. This market level is less competitive and relatively easy to enter. | H&M, Inditex, Primark, Next, M&S, C&A, Mango, KiK |

| 4 | Apparel brand | Apparel brands typically develop collections 6 to 9 months in advance. You will need a large sample room, as brands require salesman samples (SMS) of each collection style. Every salesman sample needs to be current. This means it should look exactly like the product will in the shop, with branded hangtags and accessories. It may take many months before orders are placed. | Patagonia, Levi’s, Tommy Hilfiger, Thought, Toad&Co, Komodo, Afends, Passenger, Lanius |

| 5 | Intermediary | Agents, traders, importers and private label companies sell your product on to buyers up the value chain. They are extremely price focussed and require flexibility in terms of quantity and quality. Some are located near or in the production countries and primarily do sourcing and logistics. Others work from Europe and also do market research, design and stock keeping. Their service level determines the commission rate they charge. | Li & Fung, Miles Group, Hongyu Apparel, HVEG Fashion Group, Wonnda, Ro & Ritzy |

Source: FT Journalistiek

Figure 3: Hemp apparel market value chain

Source: FT Journalistiek

Tips:

- Check online shopping platforms, such as Yoox (luxury and middle market segments), Zalando (all market segments) and Asos (middle and budget market) for inspiration, but never copy the styles.

- Study the collections of your prospects to develop a product in a price range that meets your prospect’s expectations.

What is the most interesting channel for you?

If you do not have much experience exporting to Europe, intermediaries and small brands are likely the best starting point. Big brands and retailers may be potential buyers too, but only if you have the right certifications, production efficiency and if you can handle large volume orders. End-consumers are a difficult target group because of high service demands.

Intermediaries

Agents, traders, importers and private label companies are usually the first to explore new sourcing destinations, and they can be a great way to get introduced to the European market and its many brands. Be aware that intermediaries are very price focussed. They act as ‘middle-men’ between you and companies further up the value chain, which means they need to keep their prices close to your factory price. This leaves little negotiation room for you as a manufacturer.

Small (niche) brands and retailers

Many European fashion brands and retailers are trying to cut out intermediaries and source directly from manufacturers. This means these companies can be an interesting category of buyers. But beware: size matters. Supplying major European brands and retailers as a small or medium enterprise may not be realistic due to the high requirements and high volumes. It may also be difficult to source hemp fabrics in large quantities.

Unless you have the right certifications (BSCI is minimum), material suppliers and production setup for volume production, small (niche) brands and retailers are likely the most suitable business partners.

Tips:

- Determine your target market segment within the hemp industry and identify your unique selling points (USP). Source high-quality hemp fabrics from reliable suppliers, ensuring compliance with EU regulations and quality standards. Invest in product development and innovation to create unique and appealing hemp-based products tailored to European consumers’ preferences and needs.

- Explore different distribution channels to reach European consumers, including online sales, retail stores, wholesalers, distributors and partnerships with local businesses. Consider collaborating with established retailers or distributors with expertise in the European market to expand your distribution network.

- Find potential buyers or suppliers at trade fairs for hemp fabrics and/or sustainable apparel. Even if you don’t plan to attend, you can check the exhibitors list. Check, for instance, the following trade fairs: Future Fabrics Expo (fabric sourcing, UK), Texworld (fabric sourcing, France), Première Vision (manufacturing, fabric sourcing, France) NOPE (Natural, Organic products, UK), Kingpins (denim, the Netherlands), CIFF (brands, Denmark), Modefabriek (brands, the Netherlands).

3. What competition do you face on the European hemp apparel market?

The biggest global producers of hemp fibre are China and France, of which China also has a significant apparel industry. India also produces hemp fibre and has its own apparel industry. This easy access to local hemp fabrics gives Chinese and Indian apparel manufacturers a competitive advantage.

Which countries are you competing with?

| Country | Strengths | Weaknesses | Image in Europe | Future developments |

| China | Technical innovation, good quality, high efficiency, good customer service, flexible MOQs and local availability of hemp fabrics (mostly chemically cottonised). | Increasing labour, transport and production costs, human rights concerns. China also lacks a General Scheme of Preferences (GSP) status that removes import duties to the EU. | Inconsistent quality standards, high service, high volume, high cost | Technical innovation focussed on producing good-quality semi-finished products |

| India | High-quality workmanship, local availability of cotton and hemp fibres for blending. | Lower service level than China, struggling to comply with social standards. | Good quality, lower service | Increasing investment in hemp production (fibres and fabrics) |

| Türkiye | Close to Europe, which results in very short lead times. Produces low to high-quality apparel in many categories, offers high flexibility and has a European business culture. Payment in Euros accepted. | Turkish prices are structurally higher than many Asian countries. They are currently even higher due to inflation. | Good quality, high service, high cost | Increasing investment in hemp production (fibres and fabrics) |

| Pakistan | Produces good-quality, relatively cheap apparel items. The country grows its own high-quality long staple cotton suitable for blending with hemp fibre and enjoys GSP status. | Relatively high MOQs and security issues. Many buyers do not want to travel to Pakistan or their company prohibits them from doing so. | Good quality, difficult doing business | Innovation and investment in processing mechanically cottonised hemp |

| Bangladesh | High-volume production, low production costs and competitive prices. Bangladesh enjoys GSP status. | Less flexible than China. Although yarns are increasingly spun locally, Bangladesh still imports many materials. | High volume | Growing industry, orders shifting from China to Bangladesh, investment in more technical styles. |

Tips:

- Take a look at how other countries benefit from the Generalised Scheme of Preferences on the European Commission’s website on international trade. This scheme removes duties when EU countries import from countries on the list.

- Study the conditions in your competitors’ countries. Compare their strengths and weaknesses to yours and advertise the advantages of doing business with you. In addition to GSP, consider factors like distance to Europe, ease of doing business, transparency and CSR risks.

Which companies are you competing with?

- NHempco in India focusses on agriculture research, regenerative cultivation, machinery, process development and the manufacturing of hemp-derived products, including fibres, fabrics and ready-made garments.

- Hemp Republic in India focusses on the valorisation of the entire hemp plant. The company produces many semi-finished and ready-made products, including apparel, fibres, yarns and paper. Thanks to its investments in innovation, Hemp Republic aims to bring other products to the market as well, including bio-plastics and bio-composites.

- Richeng is a Chinese manufacturer specialised in the production of fibres, yarns, fabrics and ready-made items made with natural fibres including hemp, linen and ramie. Richeng is known for its comprehensive range of hemp products and international certifications, like ISO and Oeko-Tex Standard 100.

Tips:

- Check the free online database Open Apparel Registry, which lets you look up the suppliers of hundreds of European fashion brands, including buyers of leather bags.

- Study your competitors and try to understand why European buyers are interested in placing orders with them.

- Read the CBI study 11 Tips for doing business with European apparel buyers to learn how to approach and engage with buyers.

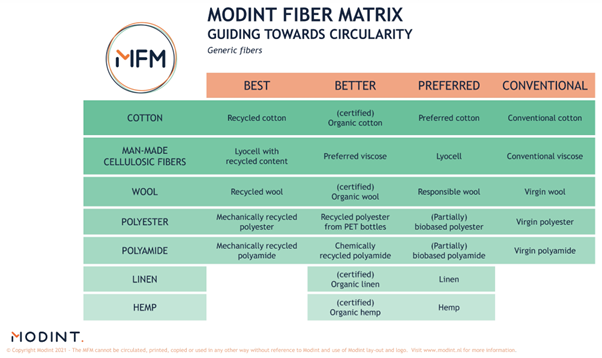

Which products are you competing with?

Hemp is mostly appreciated for its sustainability and its natural origin. As a material, it competes with other fibres and fabrics that are perceived as both sustainable and natural, including preferred, organic and recycled cotton and linen. Check Modint’s fibre matrix below for a comparison between hemp and other staple fibres.

Figure 4: Modint’s Fibre Matrix for guidance on the sustainability of different textile fibres

Source: Modint

Tips:

- Try to create a unique company presentation that shows the quality of your craftmanship and manufacturing. Positioning your product starts with positioning your company.

- Create a unique product presentation that highlights the unique character, quality and innovation in your product. Show the different styles that you can produce.

4. What are the prices of hemp apparel on the European market?

The factory price of your product (your ‘FOB price’ – Free On Board) is influenced by a large number of factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin.

The average cost breakdown of your FOB price should look like this:

Source: FT Journalistiek

The percentages may differ per factory and per order. Some factories accept lower profit margins during off-season periods or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of the materials. Efficiency goes up and material prices go down when producing large volume orders.

Retail pricing

The retail price of an apparel item is, on average, 4 to 8 times the FOB price. This is called the ‘retail markup’. It follows that the FOB-price is 12.5–25% of the retail price of the product on average. However, there are exceptions. In the budget market, some large European retail chains may only double the FOB price mark up. Retailers mark the FOB price up by 4 to 8 times because they need to account for import duties, transport, rent, marketing, overhead, stock keeping, markdowns and VAT (15–27% in EU-countries), among other things.

Source: Eurostat

According to Eurostat’s 2022 comparison of retail prices for apparel in Europe, of the top 3 European importers of apparel and footwear, France has the highest price level at 105.4 points compared to the European average of 100, followed by Germany (98.7) and Spain (84.8). Denmark has the highest price point in Europe (134.4), while Switzerland is the most expensive European country for apparel (141.5).

Tip:

- Read the CBI study on cost-price calculation for a step-by-step guide on how to calculate your FOB price.

FT Journalistiek carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research