The European market potential for hemp apparel

Hemp production and demand for hemp apparel are rising. The global hemp fibre market will likely grow from $5.76 billion to $23.57 billion between 2022 and 2030. Compared to virgin cotton, hemp fibre’s market size is still very small, but it is an ideal sustainable fibre to blend with cotton. This is because hemp is versatile and strong. As much as 60% of womenswear and 75% of menswear apparel products contain cotton, so hemp has a lot of potential.

Contents of this page

1. Product description

Hemp (or Industrial Hemp) is made from the stems of cannabis plants with very low levels of the psychoactive substance Tetrahydrocannabinol or THC. Through a process called ‘cottonisation’, hemp fibres are made shorter, softer and compatible with modern textile machinery. It is then blended with staple fibres such as cotton, silk, Tencel, wool and polyester to make fabrics.

Hemp can be cottonised mechanically or chemically. Mechanically cottonised hemp results in a fabric that is more coarse than chemically processed hemp. However, better processing techniques are making mechanically cottonised hemp fibres ever finer and softer. Mechanically cottonised hemp’s properties are similar to linen. It has a coarse texture that softens over time with washing. It wrinkles easily.

One benefit of mechanical processing is that it saves many of hemp’s natural properties. It results in one of the strongest and most durable natural textile fibres. This fibre is also lightweight, breathable, biodegradable and has moisture wicking, thermo-regulating, hypoallergenic and antibacterial qualities. It shares many of these positive traits with linen but is 8 times stronger, and it is UV resistant.

Figure 1: Hemp textile fibres are made from a hemp variety that has very low levels of THC

Source: Crispin Jones on Unsplash

The sustainable properties of hemp

Hemp fibres that are grown without the use of irrigation or pesticides and that are mechanically cottonised are one of the most sustainable textile fibres in the world. It is more sustainable than many of the fibres it is usually blended with, including cotton, silk, Tencel, wool and polyester.

Hemp is one of the fastest-growing plants on earth. In suitable conditions, it requires no irrigation and is pest resistant. As a result, it requires far fewer pesticides and less water than conventional cotton, which is responsible for 4.7% of the world’s pesticide sales, 10% of its insecticides sales and 3% of global water consumption. Growing hemp uses 90% less water than growing conventional cotton.

Hemp is also a ‘regenerative’ fibre. Its deep root systems help to replenish soil quality, which in turn helps to capture carbon from the atmosphere. While the global consumption of cotton produces around 220 million tonnes of carbon dioxide, hemp is largely a carbon-negative material. This means it absorbs more carbon dioxide from the atmosphere than it produces. Growing hemp also improves biodiversity by providing shelter for birds and food for animals, and it produces pollen.

Global production overview

Hemp cloth was used as early as the 5th millennium BC. The fibre was one of the most widely used textile fibres until the mid-19th century. In 1850, about 75% of the world’s textiles were made from hemp. In the 20th century, the use of hemp as a textile went down as the popularity of cotton and synthetic fibres grew. Many countries outlawed the growing of hemp due to its association with cannabis.

Global production of hemp fibre fell after 1965: from 450,000 tonnes to 100,000 tonnes in the 1990s. By this time, hemp apparel was only sold in specialist hemp clothing stores.

Hemp is now making a comeback thanks to more liberal laws on hemp growing and increasing awareness of the benefits of hemp products. Compared to 1993 figures, the number of hectares used to grow industrial hemp in Europe grew by more than 600% by 2018.

China, Canada, USA and France produce the most hemp, with estimated total areas used for hemp growing of 66,700 (2019), 36,900 (2019), 28,500 (2020) and 17,000 (2020) hectares, respectively. China and France focus on the production of hemp fibre. In the USA and Canada, hemp is mostly grown for medicinal use. In the EU, France is the largest producer of hemp. In 2022, it grew more than 60% of EU hemp, followed by Germany (17%) and the Netherlands (5%). Other important EU-producers are Italy, Austria, Lithuania and Poland.

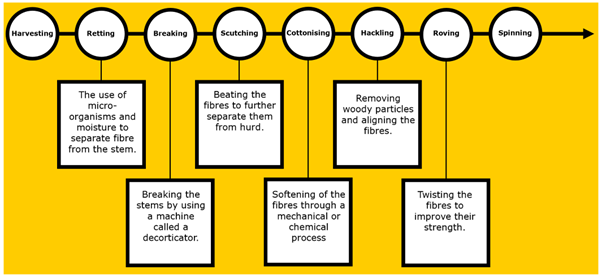

Figure 2: The Hemp textile fibre production process

Source: FT Journalistiek

The price of hemp fabric remains higher than that of cotton. This is due to economies of scale. In its 2023 materials market report, Textile Exchange said that the 2022 market share of hemp was only 0.26% of the total global fibre market (300,000 tonnes per year).

At present, trade classifications for textile-related hemp products are limited to hemp fibre and hemp yarn as shown below:

| 53021000 | True hemp, raw or retted |

| 53029000 | True hemp, processed but not spun; tow and waste hemp including yarn waste and garneted stock |

| 53082010 | Hemp yarn (excluding that put up for retail use) |

2. What makes Europe an interesting market for hemp?

No import or export data are available for apparel or fabrics made of hemp. However, it is possible to understand the European market potential for hemp apparel by looking at the following:

- The European market for apparel in general;

- The European market for more sustainable fashion;

- European consumer attitudes toward the use of hemp and cannabis-derived products.

World’s largest importer of apparel and textiles

According to the World Trade Organisation’s 2022 World Trade Statistical Review report, the EU is the world’s largest importer of apparel and textiles. Between 2017 and 2022 (latest available statistics), the European apparel market grew on average by 6.75%. Europe’s apparel import market was valued at €191.4 billion in 2022 (up from €138 billion in 2017). This equates to 32.2 billion units of clothing (up from 27.8 billion).

Hemp and cannabis-derived products are becoming less ‘taboo’

As the benefits of hemp and cannabis-derived products are more recognised, legislation at EU and individual country level is becoming more relaxed. Consumer attitudes towards hemp and cannabis-derived products are changing.

Many European countries have legalised the medical use of cannabis, including Croatia, Cyprus, the Czech Republic, Denmark, Finland, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Spain, Switzerland and the United Kingdom (UK).

Europe is the ‘leading global pathway towards sustainable clothing’

Europe is one of the most interesting markets for sustainable apparel. There is a lot of awareness about sustainability amongst consumers, retailers, brands, governments and non-governmental organisations (NGOs).

The EU sees the apparel sector as a priority sector as it moves towards sustainability. Under the Circular Economy Action Plan, the EU Strategy for Sustainable and Circular Textiles aims to ensure that textile products sold in the EU will be ‘long-lived and recyclable…, free of hazardous substances and produced in respect of social rights and the environment’ by 2030.

Consumer awareness about sustainability is also increasing in Europe. In a 2020 survey of British and German consumers by consulting company McKinsey, 67% of respondents considered the use of sustainable materials to be an important purchasing factor.

The European fashion industry is scaling up its use of more sustainable materials, and an increasing number of brands are starting to include hemp fibres into their collections, particularly in hemp/organic cotton blends for denim and T-shirts.

Tips:

- For more information, read the CBI report on the European market for sustainable materials

- Include hemp in your yarn and fabric development and educate your buyers on the properties and use of hemp in apparel.

- Convince your buyers to start including hemp fibres in their designs by presenting them with a comparison in the environmental impact of hemp fibre versus virgin cotton. For example, read this 2020 article from The Journal of Cleaner Production, which explains the environmental benefits of Hemp production compared to virgin cotton.

Figure 3: Hemp fibres are usually blended with other staple fibres, such as with cotton to produce denim

3. Which European countries offer the most opportunities for hemp?

Current and future demand for apparel made from more sustainable materials in EU countries is driven mostly by EU legislation. Accordingly, the size of the individual apparel markets is the most important factor in determining which EU countries have the most potential for hemp apparel.

The top 6 apparel import markets in the EU by size are Germany, France, Spain, the Netherlands, Italy and Poland. Together, these top 6 countries account for 73% of the entire EU apparel import market.

Initiatives and targets on the national or industry level for the uptake of more sustainable materials (in particular organic cotton) are also an important indicator of hemp’s potential.

Consumer-driven demand is also worth noting. Although Denmark has a population of under 10 million and Sweden’s population sits at just over 10 million, both countries (and their neighbour Norway) have high GDPs and average wages. Scandinavian consumers are willing to pay more for value-added products; particularly sustainable products.

Scandinavian brands that incorporate hemp in their collections include H&M, Arket, Samsøe Samsøe, Jack and jones, Fjällräven and Tiger of Sweden.

Table 1: Comparison of EU countries, market potential indicators for hemp fashion

| Country | Apparel imports 2022 (EUR) | Average import growth 2017-2022 | Developing country share of apparel imports | Developing country imports 5-year growth | Sustainable behaviour index | Rank number of shipments of organic cotton (global)* |

| Germany | 41.83 bn | 6% | 54.1% | 6% | 7* | 3 |

| France | 25.7 bn | 5% | 48.6% | 6.5% | 6 | 9 |

| Spain | 21.17 bn | 6% | 68.4% | 5.4% | 14 | 18 |

| Netherlands | 19.24 bn | 6.9% | 61.1% | 6.7% | 2 | 6 |

| Italy | 18.28 bn | 6.5% | 51.3% | 5.8% | 23 | 23 |

| Poland | 13.23 bn | 17% | 35% | 22.3% | 26 | 25 |

| Belgium | 9.3 bn | 4.1% | 55.9% | 4.6% | 8 | 19 |

| Austria | 6.64 bn | 3.2% | 17% | 2.4% | 11 | 42 |

| Denmark | 5.54 bn | 8.1% | 65% | 8.8% | 3 | 5 |

| Sweden | 5.38 bn | 7.8% | 55.1% | 8.7% | 1 | 10 |

*West Germany only

Sources: Eurostat, University of Padua, 2022

Source: Eurostat 2022

Of the top ten apparel-importing countries, Spain stands out with a 68.4% share of imports from developing countries. Poland has grown its apparel imports from developing countries by an average of over 22% between 2017 and 2022 to almost 7%. France, Sweden and Denmark have all grown their market share of imports from developing countries by 1.9% or more. Other top ten countries show stagnating or decreasing market shares. This means that nearshoring and regional distribution are increasing.

Germany: The largest apparel market in the European Union (EU)

Germany is Europe’s largest importer of apparel with a total import value of €41.8 billion in 2022. Of this, 44.8% was intra-EU imports and 55.1% was extra-EU imports. In the 2017–2022 period, intra-EU imports grew by an average of 7.9% per year, while extra-EU imports increased by 4.6%, compared to an overall import growth of 6%. The larger increase of intra-EU imports highlights the growing trend of importing apparel from other European countries, like Poland and the Netherlands. According to Statista, the German apparel market is likely to grow annually by 0.85% in the next 3 years.

Germany has strict sustainability requirements, driven by national legislation and policies. The country also has its own social and environmental standard, the Grüner Knopf label, which is displayed on garments at the point of sale. Carbon savings are one of 5 key environmental product criteria for Grüner Knopf product certification.

The German Partnership for Sustainable Textiles (a multistakeholder initiative that represents 50% of German retail in the textile industry) wants its members to use 70% more sustainable cotton by 2025, of which 20% should be organic cotton. This represents an opportunity for hemp suppliers.

Germany legalised the growing of industrial hemp in 1996. By 2019, there were 575 industrial hemp producing companies in Germany. The total declared cultivation area grew by 47% between 2018 and 2019.

Hempage is an example of a German specialist hemp brand. Sustainability-focussed brands that include hemp into their collections include Lanius and Walkiddy. Mainstream brands that include hemp in their collections include Esprit, Hugo Boss and Drykorn.

France: A volume market with increasing sustainability requirements

France is Europe’s second largest importer of apparel with an import value of €25.7 billion as of 2022. Of this value, 47.7% was intra-EU imports and 52.3% came from outside the EU. France sources 48.6% of its imports from developing countries, less than most other Western European markets. While intra-EU imports grew at a lower average annual rate than the overall rate of 5% between 2017–2022, developing-country imports grew by 6.45%. The French apparel market is expected to grow annually by 1.05% over the next 3 years.

The country is introducing laws that empower consumers to make better purchase decisions. The new legislation also makes sure brands and retailers cannot make false sustainability claims. It is now a legal requirement in France to inform customers about products that contain one or more substances on the REACH Substances of Very High Concern (SVHC) list at point of sale. By 2025, every item of clothing sold in France will require a label detailing its precise climate impact. ‘Vague’ environmental claims are not allowed.

France is the leader of the European hemp industry, both in terms of growing and processing. Half of all processing facilities in Europe are located in France, and the country has 6 hemp cooperatives that focus on processing. Most hemp producers are under contract with these cooperatives. France’s Marmara Hemp is the first hemp fibre to be certified as fully traceable, sustainable, Cradle to Cradle (Platinum level) and with a Life Cycle Assessment performed by a certified body.

Couleur Chanvre, Mon Chanvre, Maison Chanvre, Atelier Tuffery and Le Gaulois are examples of French brands that specialise in hemp. Sustainability-focussed brands that include hemp in their collections include Daregreen and Ecoline. Mainstream and luxury brands that feature hemp in their collections include Villebrequin, Lacoste and Balmain.

Spain: Home to some of the largest international retailers in Europe

Spain is Europe’s third-largest importer of apparel with an import value of €21.1 billion as of 2022. Of this, 30.7% was intra-EU imports and 69.3% came from outside the EU. Between 2017 and 2022, the value of non-EU imports grew by about 5%. In the same time period, intra-EU imports grew by almost 8.5%. Spain recorded the highest decrease in market share from developing countries of the top ten importers(-2.1%). According to Statista, Spain’s apparel market is expected to grow annually by 0.46% in the next 3 years.

Several large fast fashion retailers are responsible for most of Spain’s apparel imports. Accordingly, import statistics do not reflect the country’s relatively low GDP, average wages and underperforming local market.

Sustainability-focussed brands that include hemp in their collections include Ecoalf, Two Thirds, Fieto, Thinking Mu and SJFK. Mainstream brands that include hemp in their collections include Massimo Dutti and Pull & Bear, both owned by Inditex Group. One of the Inditex Group’s goals is to ensure that 100% of its textile products will only use materials with a lower environmental impact by 2030.

The Netherlands: A key European distribution hub

The Netherlands is Europe’s fourth-largest importer of apparel products with a total import value of €19.2 billion in 2022. Of this, 35.5% was intra-EU imports, and 64.5% came from outside the EU. Between 2017 and 2022, the overall Dutch import market grew by almost 7%. During this time, the intra-EU market grew by 7.4%, and the non-EU market grew by 6.7%. The Netherlands’ apparel market is expected to grow by 2.06% annually over the next 3 years. This is the second highest rate of the top 6 countries after Poland.

The Netherlands has a good business climate for trade. It is close to the sea and has a large number of harbours, making it an ideal channel to export your product into Europe. For this reason, many foreign brands have their headquarters in Amsterdam, including Nike, Karl Lagerfeld and Tommy Hilfiger.

The Netherlands is home to several industry support organisations that focus on sustainability, including Fashion for Good (an innovation platform and accelerator for fashion start-ups), MODINT (trade association) and the non-profit Sustainable Apparel Coalition.

The Netherlands is a strong player in the world of European hemp. The country has 2 hemp processing facilities. One is operated by HempFlax (Europe’s biggest hemp grower) and the other by Dun Agro. HempFlax, founded in 1993, has roughly 2,200 hectares of hemp in cultivation in the Netherlands, Germany and Romania. The Netherlands is the world’s largest exporter of both raw/retted hemp (30% of global exports) and hemp that is processed but not spun (22% alongside Italy).

By 2023, the government of the Netherlands wants all textile products on the market to contain 50% sustainable materials. Freshemp is an example of a Dutch specialist hemp brand. Sustainability-focussed brands that include hemp in their collections include Iron Roots, KUYICHI and Ecotex. Mainstream brands that include hemp in their collections include C&A and Scotch & Soda.

The Netherlands is an important player in the sustainable transition of denim. Two of the biggest denim trade fairs are hosted in Amsterdam and the city is also home to the only ‘Jean School’ in the world. Mainstream Dutch denim brands that lead the way in the use of hemp include Tommy jeans, G-Star, Denham, MUD jeans and Kings of Indigo.

Italy: A large market for innovative products

Italy is Europe’s fifth largest importer of apparel with a total import value of €18.2 billion in 2022. Of this, 45.3% was intra-EU imports, 54.7% came from outside the EU, and 51.4% was developing country imports. The share of intra-EU imports increased by 2.5% between 2017 and 2022. China is the largest exporter but lost 2.7% of its market share in the 2017–2022 period. However, the market shares of Germany, the Netherlands and Spain increased over the same period (1.1%, 2.4% and 1%, respectively).

Apparel is a well-established industry in Italy with a long tradition of combining knowledge, technological research and creativity in the production of garments made using high-quality fabrics. Italian excellence in apparel manufacturing spans the entire supply chain, from spinners, knitters, weavers, laboratories, dyers and machine manufacturers.

According to Statista, the Italian apparel market is expected to grow annually by just 0.01% over the next 3 years.

After a decline in production that started in the 1960s, the Italian hemp industry started to grow again in 2016. Italy is currently the second largest exporter of raw/retted fibre (24% of global exports) and is the top exporter of hemp fibre that has been processed but not spun (22%) alongside the Netherlands.

The leading Italian denim mill, Candiani, partners with leading brands and industry experts to create innovative denim products. In 2019, Levi’s introduced hemp to its collection with a 70% cottonised hemp, 30% cotton Candiani fabric. Candiani has also partnered with Austrian fibre company Lenzing to create a biodegradable stretch denim fabric of 80% cotton, 18% Tencel Limited Edition with hemp and 2% Coreva natural rubber yarns.

Opera Campi is an example of an Italian specialist hemp brand. Sustainability-focussed brands that include hemp in their collections include Po.Etica and Tu&Tu. Mainstream and/or luxury brands that include hemp in their collections include Diesel, Emporio Armani and Salwea.

Poland: The fastest growing economy in Europe

Poland is Europe’s sixth largest importer of apparel with a total import value of €13.2 billion in 2022. Of this, as much as 64.8% was intra-EU imports and 35.2% came from outside the EU. According to Statista, the Polish apparel market is expected to grow by 5.61% annually over the next 3 years.

With low GDP and wages, and lagging behind its western European counterparts in terms of sustainability awareness, Poland is not a suitable market for more value added or sustainable products yet. The average price paid by Polish importers in 2022 for apparel from developing countries was extremely low, at just €2.62 per unit.

Poland’s largest clothing manufacturer is LPP with its umbrella of brands, including Reserved, Cropp, House, Mohito and Sinsay. It does not currently carry any products made from hemp.

The United Kingdom and Switzerland

It is worth mentioning that the UK has long been a leader in the manufacture and sale of hemp clothing. Specialist hemp brands include The Hemp Shop, Hemp and Hope, The Hemp Trading Company, Himal Natural Fibres and OPS clothing. Sustainability-focussed brands that include hemp in their collections include Komodo, Thought and Superdry.

In 2022, the UK grew around 800 hectares of industrial hemp. The government-backed HEMP 30 project aims to increase the amount grown to 80,000 hectares per year by 2031.

In 2022, Switzerland was the third-largest exporter of raw/retted hemp fibre (14.5% of world exports). Its small but steadily growing area of hemp cultivation is mainly for CBD extracts. The country also has a THC threshold of 1%, which is significantly higher than the European limit of 0.3%.

Tips:

- Research local legislation and use hemp as a solution for compliance.

- Connect with local manufacturing and processing companies that use and produce hemp fibres to learn and try to collaborate on developing a product range.

4. Which trends offer opportunities or pose threats in the European hemp apparel market?

Increasing global demand for organic cotton indicates a growing potential for hemp

The global organic cotton market is expected to expand at a CAGR of 41.59% between 2022 and 2028, reaching $6.76 billion. According to the latest Textile Exchange Organic Cotton Market Report, organic cotton fibre growth reached 37% in 2021, compared to the previous year. The demand for organic cotton is bigger than supply. A 2021 survey of brands engaged in organic cotton sourcing showed a potential 84% growth in demand for organic cotton by 2030 compared to 2020.

The market share of cotton covered by programmes recognised by the 2025 Sustainable Cotton Challenge (including the Better Cotton Initiative (BCI), Fairtrade and Cotton Made in Africa) was 27% in 2021–2022, up from 3% in 2011–2012. However, pesticides still account for 7-10% of the BCI’s greenhouse gas emissions. The organisation has published a new target to reduce the use and risk of synthetic pesticides applied by Better Cotton Farmers and workers by at least 50%.

As a largely pest-resistant crop, hemp has a great deal of potential for increasing the successful uptake of organic fibres in the textile industry. In the future, the Textile Exchange’s standard system (which includes the Organic Content Standard and the Content Claim Standard) will include hemp production practices with tracking and handling of the certified material through the Content Claim Standard (CCS).

Cottonised hemp fibre from China may bring hemp to mainstream EU fashion

The production of high-quality hemp yarn made with long hemp fibres is limited to premium clothing. This is because there is a lack of processing capacity for long hemp fibres and the lower productivity of the traditional hemp and linen spinning system. The cottonisation of hemp generally involves either mechanical or chemical processing. The challenge is ensuring that this process limits both negative environmental impact and damage to the functional properties of hemp fibre (for example, tensile strength and resistance to pilling).

While cottonised short fibre hemp may result in lower quality yarn, it also produces textiles that are more resistant to wrinkling and can have stretch properties. Textile innovators around the world are improving the cottonisation process to achieve better quality hemp fibres and yarns at more reasonable prices. By tapping into its established cotton processing infrastructure and EU buyer network, China is in a good position to benefit from technical advances.

China already dominates the hemp value chain from growing to yarn-making. In 2016, China’s 13th Five-Year Plan published a target to grow hemp on 1.3 million hectares of land for the production of 2 million tons of textile fibres by 2030. The country was responsible for 83% of global hemp yarn exports in 2022 according to Trademap data. Top export destinations for China’s hemp yarn are India (20% of global hemp yarn exports), Korea (13%) and Cambodia (10%).

Developing country apparel manufacturers can take advantage of China’s existing fabric sourcing networks to become pioneers in the production and sale of hemp clothing to the EU. Reistor is an example of an Indian sustainable clothing brand that carries a large collection of hemp products. The brand has a significant presence in the EU market, and its hemp products are sold on e-commerce sites like Wolf & Badger, LYST and Poshmark.

Localised hemp supply chains offer opportunities for the Green Economy in Europe

Hemp cultivation offers good opportunities to contribute to EU ‘Green Deal’ objectives, which includes decarbonisation, soil erosion, biodiversity and pesticide use. As a multipurpose crop, hemp can be applied in industries including food and beverage, textiles, cosmetics, medical, pharmaceutical, cosmetics, biomaterials and energy. Pollution and waste are minimised as all parts of the plant can be used (roots, flowers, fruit, stems and leaves).

EU legislation is changing in favour of local hemp cultivation. As of 2023, more than 500 varieties can be grown with subsidies (compared to 75 previously). This has made the European industrial hemp industry more competitive.

Hemp’s resurgence is happening at a time when the EU is focussed on circularity, waste reduction and fighting climate change. This presents an opportunity to ‘do things right’ from the outset, which means prioritising the development of sustainable processes and shorter, more localised supply chains. The fact that hemp is bulky and more costly to transport provides another incentive.

In recent years, the area dedicated to hemp cultivation in the EU has increased significantly from 20,540 hectares in 2015 to 33,020 hectares in 2022 (a 60% increase). In the same period, the production of hemp increased from 97,130 tonnes to 179,020 tonnes (an 84.3% increase).

The EU-funded HEMP4CIRCULARITY project was launched in 2023 to promote the industrialisation of long hemp fibre in northwest Europe by tapping into the existing value chain for flax and linen in the coastal region of France, Belgium and the Netherlands. This region was responsible for up to 64% of the flax used for fibres in 2022. Through pilot actions, the project aims to develop solutions and capabilities for all stages of the value chain from cultivation to fabric manufacturing and recycling.

For short fibre hemp, there are 12 facilities (in France, Germany, the Netherlands, Romania and Lithuania) for decortication (separating the fibre from the ‘hurd’ or woody core) and 6 facilities exist (in Belgium, France and Lithuania) that are capable of cottonising hemp.

This should create opportunities for apparel manufacturers located in developing countries to benefit from proximity to north-west Europe.

Tips:

- Visit exhibitions dedicated to showcasing textile innovations, such as ITMA in Milan.

- Follow sustainable materials initiatives where brands and innovators share information and innovations (for example, Fashion For Good (FFG) and H&M Foundation Global Change Award).

- Create and promote a special hemp collection using cottonised hemp or consider the use of Agraloop™ BioFibre™, which processes leftovers from various food and medicine crops, including hemp, using sustainable methods.

- Visit the websites of leading Chinese producers of Hemp yarn and fabrics, such as Hemp Fortex and Tung Ga, to get an idea about available products (including recycled hemp), relevant certifications and marketing messages.

- Aim for certified sources (C2C, GOTS or OekoTex) that can verify the organic processing of hemp.

Frans Tilstra carried out this study for FT Journalistiek in partnership with Giovanni Beatrice on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research