Entering the German market for cocoa

The German cocoa processing industry relies heavily on cocoa supplies from West Africa. However, the market attracts further interest in cocoa beans from other regions around the world; this is particularly so given the growing markets for organic and Fairtrade-certified cocoa beans in Germany. Producers and exporters of organic cocoa beans are likely to find the widest opportunities in Germany, where the market is large and diverse.

Contents of this page

1. What requirements and certification must cocoa comply with to be allowed on the German market?

You can only export cocoa to Germany if you comply with strict European Union requirements. For a complete overview of these standards refer to our study on buyer requirements for cocoa or consult the specific requirements for cocoa on the European Commission’s website, Access2Markets.

Buyer requirements can be divided into the following.

- Legal and non-legal requirements you must comply with.

- Additional requirements to keep up with the market.

- Requirements for niche markets.

The highlights for these requirements are given below, specified for the German market when relevant.

Legal and non-legal requirements you must comply with

Legal requirements

You must follow the European Union legal requirements for cocoa, mainly dealing with food safety and hygiene. Related to this are the legal limits for food contaminants, of which the most common are:

- Pesticides (consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide)

- Mycotoxins (ochratoxin A is of special relevance for cocoa)

- Polycyclic-aromatic hydrocarbons (PAHs)

- Microbiological contamination such as salmonella (although cocoa is considered low-risk)

- Heavy metals such as cadmium (which is a particular problem for cocoa from some Latin American countries due to factors like volcanic activity and forest fires).

Quality requirements

If you want to access the German market for cocoa beans, you will have to meet your buyer’s quality standards. They are particularly high within the speciality segment for fine-flavour cocoa beans.

Buyers in Germany and elsewhere currently assess the quality and flavour of cocoa beans in different ways and often use a combination of two or more methodologies. The guide Cocoa Beans: Chocolate & Cocoa Industry Quality Requirements provides recommendations on cocoa growing, post-harvest practices and quality evaluation methods that contribute to cocoa quality.

Other common cocoa quality assessment methodologies and international cocoa standards commonly used by chocolate makers and cocoa traders include the following.

- ISO’s Standards on classification and sampling for cocoa beans.

- The Fine Cacao and Chocolate Institute (FCCI): check its website and contact FCCI for its sampling protocol and grading form.

- Heirloom Cacao Preservation’s genetic evaluation of cocoa to identify and value cocoa and its flavour.

- Equal Exchange/TCHO’s quality assessment and tasting guide to assess the quality of cocoa along the value chain.

In addition, a working group of the Cocoa of Excellence Programme, which is co-ordinated by The Alliance of Bioversity International and CIAT, has launched the International Standards for the Assessment of Cocoa Quality and Flavour website. Here you can download the protocols on the quality standards.

These protocols describe step by step how to: 1) sample cocoa beans for evaluation; 2) assess their physical quality; 3) process them into coarse powder, liquor and chocolate; and 4) establish a sensory evaluation of the flavours expressed in these three products.

Labelling requirements

The information provided by labels must be easy to understand, easily visible, clearly readable and written in a language easily understood by the purchaser. That is usually English.

The label should include the following details to ensure the traceability of individual batches.

- Product name

- Grade

- Lot or batch code

- Country of origin

- Net weight in kilograms

In case your cocoa is organic and/or fair trade certified, the label should contain the name/code of the inspection body and certification number.

Figure 1: An example of cocoa-bean labelling

Source: Zorzal / Credit: Gustavo Ferro

Packaging requirements

Cocoa beans are traditionally shipped in jute bags, which can weigh between 60 and 65 kilograms. On the mainstream market, bulk shipment of cocoa beans has become more popular. This means cocoa beans are loaded directly into the ship’s cargo hold or in shipping containers containing a flexi-bag (see figure 2). This mega bulk method is often adopted by larger cocoa processors, which handle cocoa beans of standard qualities.

In the speciality cocoa segment, jute bags are still commonly used. For very high-quality micro lots, vacuum-sealed GrainPro packaging can be used.

Figure 2: Examples of packaging for cocoa: jute bag, container-sized flexi bag and GrainPro

Sources: Osu.edu, Bls.bulk.com and GrainPro

Tips:

- Activate the “Translation” function of your browser to make the studies available in your native language.

- For the full buyer requirements, read our study on buyer requirements for cocoa in Europe.

- Check the website of EURO-Lex for more detailed information about the regulations concerning cocoa products.

- Read more about the quality requirements of the European industry for cocoa beans on the Cocoa Quality website.

- Learn more about maintaining the quality of your cocoa during transportation on the website of the Transportation Information Service.

- Read more about delivery and payment terms for your cocoa-bean exports in our study Organising your cocoa exports to Europe.

Additional requirements to keep up with the market

Additional food safety requirements

You can expect buyers in Germany to request extra food safety guarantees from you. Regarding production and handling processes you should consider the following.

- Implementation of good agricultural practices (GAPs): The main standard for good agricultural practices is provided by GLOBALG.A.P. This is a voluntary standard for the certification of agricultural production processes that provide safe and traceable products. Note that certification organisations (such as Rainforest Alliance/UTZ) often incorporate GAP in their standards.

- Implementation of a quality management system (QMS): A system based on Hazard analysis and critical control points (HACCP) is often a minimum standard required at the level of storage and handling of cocoa beans. If you export semi-finished cocoa products, some buyers will also expect you to have certification, such as International Featured Standards: Food (IFS), Food Safety System Certification (FSSC 22000) or British Retail Consortium Global Standards (BRCGS) certificates for your manufacturing facilities.

Additional sustainability requirements

Corporate responsibility and sustainability are becoming increasingly important in the European cocoa sector. At a general level, there are initiatives to develop legally binding measures for the use of sustainable cocoa, such as the due diligence laws to protect and restore global forests. Another example is the proposed EU Regulation on deforestation-free products, which will ban the sale of goods containing cocoa produced on deforested and degraded land.

Germany also has its own sustainability policies. The most notable of these is the Supply Chain Act, published in 2021. German companies now have a legal obligation to respect human rights in global supply chains by applying defined due diligence obligations. For example, they must establish a risk management system to identify, prevent and minimise human rights violations.

The German Initiative on Sustainable Cocoa is also driving sustainability in the sector. This initiative promotes the sustainable production and usage of cocoa. Members are committed to increase the share of sustainably certified cocoa in their chocolate products to at least 85% by 2025.

All leading companies on the German chocolate market (such as Ritter Sport and Stollwerck) have sustainability policies emphasising the contact with producers, transparency in their operations, as well their social and environmental impact.

Certification standards like Rainforest Alliance (merged with UTZ in 2018) have become key on the mainstream chocolate market. Over 230 traders, cocoa processors and chocolate manufacturers operating in Germany are Rainforest Alliance/UTZ-certified.

As an exporter, adopting codes of conduct or sustainability policies related to your company’s environmental and social impacts may give you a competitive advantage. In general, it is likely that buyers will require you to comply with their code of conduct and/or fill out supplier questionnaires about your sustainability practices.

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Find out which standards or certifications are preferred by potential buyers in your target segment. Buyers may have preferences for a certain food safety management system or sustainability label, depending on their end clients and/or distribution channels.

- Carry out a self-assessment to measure how sustainable your production practices are. You can fill out this online self-assessment form by Amfori BSCI to assess your social performance. This Excel form by the Sustainable Agriculture Initiative (SAI) Platform can be used to assess the sustainability performance of your farm.

- See our study on certified cocoa for more information about the demand for sustainable cocoa on the European market, trends and specific trade channels.

Niche requirements

EU Organic

In order to market your cocoa as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. Note that a new EU organic regulation came into force on 1 January 2022, designed to prevent fraud and to maintain consumer trust. Producers in third countries will have to comply with the same set of rules as those producing in the EU, and inspections of organic production and products will be stricter to strengthen the control system.

Obtaining the EU Organic label is the minimum legislative requirement for marketing organic cocoa in the European Union. In addition, other organic certification schemes in Germany are Biosiegel, Bioland and Naturland. Each scheme has its own requirements, and may be required by specific buyers. For instance, check the differences between Naturland and the EU organic regulation, and note that Naturland sets higher standards.

Before you can market your cocoa beans as organic, an accredited certifier must audit your growing and processing facilities. Refer to this list of recognised control bodies and control authorities, issued by the EU, to ensure that you always work with an accredited certifier. To become organic certified, you can expect a yearly inspection and audit to ensure that you comply with the rules on organic production.

Note that all organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by control authorities prior to the departure of a shipment. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

Fair trade

The market for fair-trade cocoa is also growing in Germany, offering interesting opportunities in this niche market. The most common fair-trade standards on the German market are Fairtrade and GEPA. The Naturland Fair logo is for products that are organically produced and also fairly traded.

As with organic products, an accredited certifier must audit your growing and processing facilities before you can market your cocoa beans as fair trade. Examples of accredited certifiers are Control Union, Ecocert, FLOCERT (only for Fairtrade) ProCert and SGS.

Tips:

- Learn more about organic farming and organic guidelines on the European Union website and the Organic Export Info website.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search with the organic movement in your own country and ask if it has its own support programmes or knows about existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- Find companies that specialise in organic products on the website of Organic-bio.

- Try to visit trade fairs for organic products, like Biofach in Germany. Check out their website for a list of exhibitors, seminars and other events at this trade fair.

- If you produce cocoa according to a Fairtrade scheme, find a specialised German buyer who is familiar with sustainable and/or fair-trade products. For instance, check the FLOCERT customer database.

- Try to combine audits, if you have more than one certification, to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

2. Through what channels can you put cocoa on the German market?

Cocoa beans and cocoa products are used for processing in four different industries: confectionery, food, cosmetics and pharmaceuticals. This document focuses only on confectionery, as it is the main segment for cocoa beans. The confectionery industry mainly processes cocoa liquor and butter into chocolate products, such as chocolate bars, candy bars and bonbons.

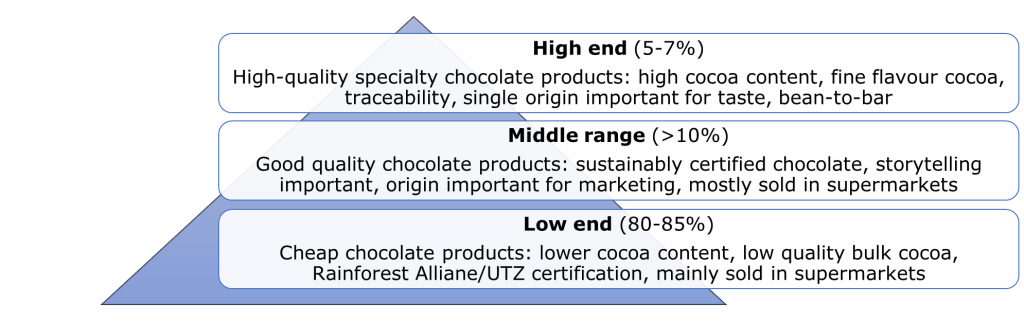

How is the end market segmented?

The confectionery industry can be segmented according to the quality of the end products. For cocoa beans, the end products mainly consist of chocolate bars.

Figure 3: Segmentation of the chocolate market based on quality

Source: ProFound

In Germany, supermarkets are the main sales channel for chocolate products; they stock a wide variety, ranging from low-end to higher-end products. The largest supermarkets in Germany are:

- Edeka (part of Edeka group, Germany);

- REWE (part of REWE group, Germany);

- Lidl (part of Schwarz group, Germany);

- Aldi Süd (part of Aldi, Germany);

- Kaufland (part of Schwarz group, Germany).

Low end The overall market share of private labels in German supermarkets amounted to 38% in 2022. This includes a wide variety of private-label chocolate brands. These are increasingly popular because consumers can buy quality products at more competitive prices, compared with branded products.

The low-end segment offers cheap cholate products, with lower cocoa content. The products are often produced by large chocolate manufacturers, using mainly bulk cocoa from West Africa (Forastero variety). Bulk cocoa is characterised by high volumes, low value and standard quality. Rainforest Alliance/UTZ-certified cocoa has become mainstream, and is often used to certify low-end products.

Many chocolate manufacturers use mass balance sourcing for their cocoa, meaning that Rainforest Alliance-certified cocoa and non-certified cocoa are mixed during shipping and manufacture. As a consequence, certified cocoa may end up in non-certified products, or the other way around. Still, the volumes of certified cocoa that are sourced by a certain company will match the number of chocolate products that carry the Rainforest Alliance logo. The lower-end chocolate products are usually mass-market products from big brands, mainly found in supermarkets.

Below are some examples of lower-end chocolate brands found in German supermarkets, with an indication of their consumer prices (based on REWE’s retail prices in 2022).

| Product | Image* | Price (€/kg) | |

| Lower end | Ja! (dark chocolate, Fairtrade certified, 100 grams) |

| 5.90 |

| Milka (Alpenmilch, 100 grams) |

| 11.50 | |

| Schogetten (dark chocolate, 50%, 100 grams) |

| 11.90 |

*Source: REWE

Middle range The middle-range segment includes chocolate products of good quality, which are commonly sustainably certified. Storytelling and the origin of the cocoa beans are important in this segment, mainly for marketing purposes.

Middle-range products are mainly sold through supermarkets and are usually the high-quality category for these retailers. Supermarkets are increasingly offering their own premium private label chocolate products. These offer much the same quality and characteristics as branded chocolates, but their prices are usually more competitive. Besides mainstream supermarkets, middle-range products can also be found in more specialised organic or fair-trade shops.

The table below gives some examples of middle-range products available in Germany, with an indication of their consumer prices (based on REWE’s retail prices in 2022).

| Product | Image* | Price (€/kg) | |

| Middle range | REWE (organic dark chocolate, 60%, 100 grams) |

| 12.90 |

| Ritter Sport (dark chocolate, 61%, Nicaragua, 100 grams) |

| 13.90 | |

| Lindt (dark chocolate, 85%, 100 grams) |

| 22.90 | |

| GEPA (organic fine dark chocolate, 85%, 100 grams) |

| 22.90 |

*Source: REWE

High end Smaller, more specialised chocolate makers produce high-end chocolate products, mainly using fine-flavour cocoa (usually Criollo, Trinitario and/or, to a lesser extent, Forastero). These products are characterised by a high cocoa content. Single-origin cocoa beans are important, both for the taste as the traceability of the cocoa. Single origin means that the buyer knows exactly where their cocoa beans are from and that it is a specific cocoa rather than a blend. Bean-to-bar chocolate is a good example of a high-end product.

High-end products are mainly sold at chocolate events and in specialist shops. Examples of specialist webshops in Germany include Chocolats de Luxe, Feine Schokolade and Schoko und Rum.

Some examples of high-end chocolate products, with an indication of their consumer prices (based on Feine Schokolade retail prices in 2022), are shown below.

| Prosuct | Image* | Price (€/kg) | |

| High end | Edelmond (organic dark chocolate, 75%, 75 grams) |

| 74.67 |

| Georgia Ramon (organic dark chocolate, Panama, 72%, 50 grams) |

| 118.00 | |

| Belyzium 31° (dark chocolate, Belize single estate, 78%, 50 grams) |

| 120.00 |

*Source: Feine-Schokolade

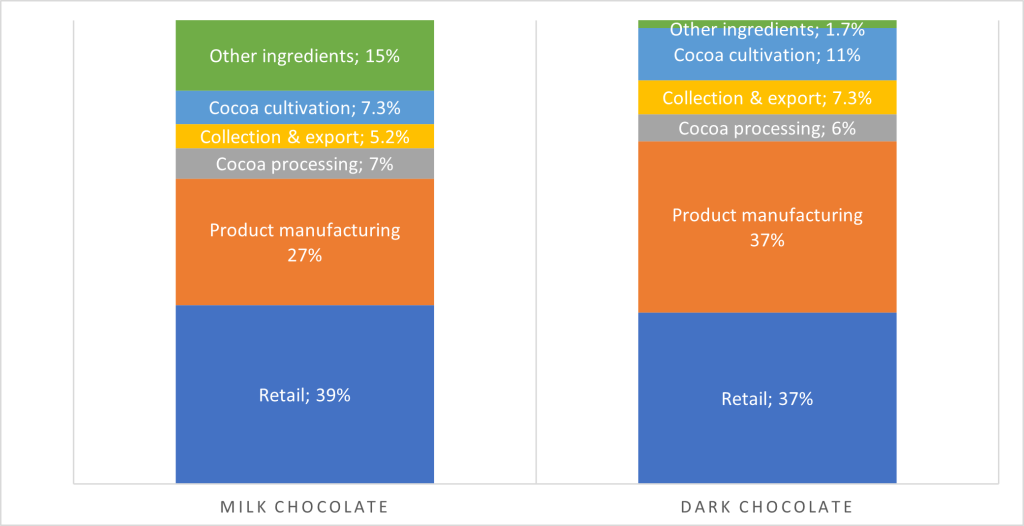

For exporters, it is important to realise that trade and retail prices for chocolates are not always directly linked. As the figure below shows, depending on the end product in which cocoa beans will be used, between 7.3% and 11% of the added value goes to farmers. In general, cocoa-bean export prices, and the share kept by cocoa producers, will depend on the cocoa beans’ quality, the size of the lot and the supplier’s relationship with the buyer. The largest shares are kept by chocolate companies and retailers.

Figure 4: Estimated value distribution per actor in %, for dark and milk chocolate

Source: BASIC, 2020

Tips:

- Learn more about the promotion of standard quality and speciality chocolate by mainstream German supermarkets such as REWE. Compare their product assortment and price levels with specialised stores such as Chocolats de Luxe.

- Refer to our study on trends in the cocoa sector to learn more about developments within different market segments.

- Monitor end-consumer prices of chocolate to get an idea of price ranges. Good sources for price information are the websites of supermarket chains and specialist chocolate stores.

- Try to establish direct trade relationships with smaller traders and chocolate makers to find shorter entry channels into the market. Also, learn more about cocoa quality. You might be interested in participating in one of the cocoa programmes of the Chocolate Institute, such as its cocoa grading course or the speciality cocoa-growing training.

Through what channels does cocoa end up on the end market?

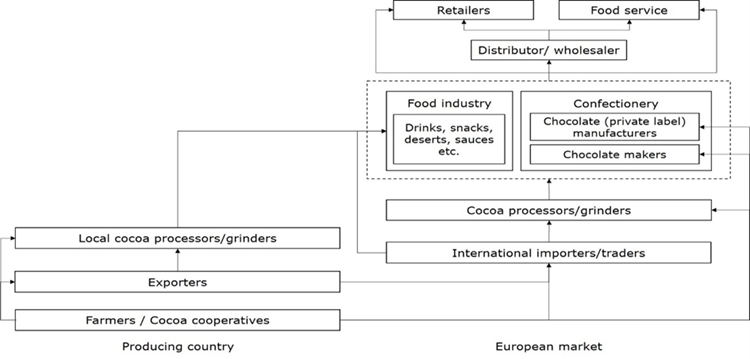

As an exporter, you can use different channels to bring your cocoa to the German market. Entering the market will vary according to the quality of your cocoa beans and your supply capacities.

It is important to realise that the European market is moving towards shortened supply chains. This means retailers and cocoa-processing companies are increasingly sourcing their cocoa beans directly. The figure below shows you the most important channels for cocoa beans in Germany.

Figure 5: The main channels for export of cocoa to Germany

Source: ProFound

Cocoa bean processors/grinders

Large processors/grinders source their cocoa beans directly from producing countries. They process the raw material into cocoa mass, cocoa butter and/or cocoa powder, which they distribute to the confectionery, food, cosmetic and pharmaceutical industries throughout Europe. Some cocoa processors also manufacture end products to supply directly to the retail or food service sector. Examples of cocoa-bean processors/grinders in Germany are Cargill, Olam and Barry Callebaut.

For whom is this an interesting channel? If you are an exporter of high volumes of bulk beans, then your direct trading partner is usually a cocoa grinder/processor. These companies tend to buy high volumes of standard qualities. They usually have cocoa-buying stations in producing countries to which you can sell your cocoa beans directly.

Importers

Importers of bulk cocoa normally handle large quantities and have direct contacts with exporters in producing countries. In most cases, importers have long-standing relationships with their suppliers. Importers either sell the cocoa beans to companies in Germany or re-export them to other European buyers.

Examples of large importers of cocoa beans and/or cocoa derivatives active in Germany are Albrecht & Dill Trading and Traub Trading. The previously mentioned Cargill, Olam and Barry Callebaut also import cocoa beans directly.

Importers active in the speciality segment usually deal with smaller quantities, and often work directly with producers and producer co-operatives. Examples of speciality trading companies in Germany are Naturkost Übelhör and Rapunzel (focused on organic produce), Bohnkaf Kolonial (focused on fine flavour) and GEPA (which sources fair-trade certified cocoa beans).

Specialised importers could also be interested in value-added cocoa products processed at the country of origin, as described in our study on the European market for semi-finished cocoa products, or even in finished products like chocolate. El Puente is a German company that imports chocolate fully produced at origin.

For whom is this an interesting channel? For exporters working with high volumes of bulk beans from producers/co-operatives, large importing companies that engage in cocoa processing activities can serve as a gateway to the German market. If you deal in bulk cocoa, discuss certification possibilities with your buyer.

Farmers or producers’ associations with speciality or certified cocoa can best sell their beans directly to specialised cocoa importers, as many of them prefer to work directly with producers and/or co-operatives and not through exporters.

If you produce or have very high-quality cocoa beans and are working through an importer, it might be interesting to discuss possibilities to link up directly with high-end chocolate makers. This is mainly an opportunity for those with the financial means and technical know-how to organise export activities and to access the market directly.

Large (private label) chocolate manufacturers

The largest industrial chocolate manufacturer worldwide is Barry Callebaut, which also has production and grinding facilities in Germany. Other large chocolate manufacturers active on the German market are Mars, Mondelez, Nestlé, Ferrero, Lindt & Sprüngli and Alfred Ritter & Co. These companies all have their own importing departments and source their cocoa beans directly from producing countries.

Private label manufacturers may also be an interesting entry point for your cocoa beans. These companies are growing in importance as it becomes more common for large brands to outsource their production to specialised private label manufacturers. Examples of private label manufacturers in Germany are Delitzscher, Farüchoc and Weinrich, the latter produces large shares of both organic and fair-trade products, such as the popular organic Vivani brand. Ludwig Schokolade and Storck (apart from producing their own chocolate brands) also produce private label brand products for retailers.

For whom is this an interesting channel? Selling to these players is interesting if you have cocoa beans of a standard quality, and available in large volumes. This may also be an interesting channel for local grinders with cocoa mass and cocoa butter which meet high quality standards.

Small chocolate makers

Especially in the speciality and fine-flavour segments, cocoa beans are increasingly being traded directly from farmers (or farmers’ associations and co-operatives) to chocolate makers. Although direct trade is growing, it still represents a very small part of the cocoa market. Not all chocolate makers are able to sustain direct trade and to assume all the responsibilities that are usually outsourced to traders, such as logistics, documentation and pre-financing.

In this sense, direct trade can also happen with an importer as intermediary, who acts as a service provider and contact point in the transactions between the source and the chocolate market. Importers can also safeguard traceability and communicate the story of the cocoa beans accurately along the chain.

Examples of specialised chocolate (bean-to-bar) makers in Germany that source speciality cocoa directly from producing countries are Belyzium 31°, Coppeneur, Georgia Ramon, Kilian & Close and Rausch.

For whom is this an interesting channel? Targeting speciality chocolate makers directly is recommended for producers and exporters dealing with speciality cocoa beans. This requires financial means and technical know-how to organise export activities. You could also consider setting up local processing facilities to add more value to your cocoa beans. Our study on the European market for semi-finished cocoa products discusses this more in depth.

Intermediaries/agents

Agents act as intermediaries between you, cocoa importers and chocolate makers. Some agents are independent, but others are hired to procure cocoa beans on behalf of a company. An agent acts as an intermediary and has the knowledge to evaluate and select interesting buyers for you. Examples of brokers/agents in European countries are H.C.C.O Hanseatic Cocoa & Commodity Office (Germany) and Amius (United Kingdom).

For whom is this an interesting channel? If you have limited experience exporting to European countries, agents can play a very important role. They are also interesting if you lack the financial and logistical resources needed to carry out trade activities. Working with an agent is also useful if you need a trusted and reputable partner within the cocoa sector. Be prepared to pay a commission for their work.

Tips:

- Find buyers in Germany who match your business philosophy and export capacities (in terms of quality, volume, certifications). For more tips on finding the right buyer for you, see our study on finding buyers on the European cocoa market.

- Attend trade fairs in Europe to meet potential buyers, such as Chocoa (Netherlands) and Salon du Chocolat (France). Interesting trade events in Germany include ISM, Anuga, Biofach (organic products) and Internorga (catering and food service). Attending such events can provide you with additional insight into the preferences of German buyers, with regard to origin, flavour and sustainability certification. By understanding the market better, you can ensure that your specific product corresponds to the demand and requirements.

- Use industry associations to find potential buyers in Germany. Examples are the German Cocoa Trade Association or the Association of the German Confectionery Industry (BDSI).

- Invest in long-term relationships. Whether you are working through an importer or directly with a chocolate maker, it is important to establish a strategic and sustainable relationship with them. This will help you manage market risks, improve the quality of your product and reach a fair quality/price balance. For more tips, read our study on doing business with European cocoa buyers.

3. What competition do you face on the German cocoa market?

The intensity of rivalry on the market is generally high for bulk cocoa with low added value. This segment is mainly dominated by major suppliers and co-operatives able to deliver large quantities so they can compete on price. It is difficult for small and medium-sized companies to compete within this segment. In the speciality cocoa market, there is more focus on quality, taste and sustainability. However, this market commands smaller volumes, so rivalry is also becoming increasingly intense.

West African countries dominate German cocoa imports: Ivory Coast, Nigeria and Ghana

Bulk beans from West Africa account for largest share of German cocoa-bean imports. Most of the cocoa produced in West Africa comes from the Forastero tree and is used mainly in the mainstream high-volume market. Ivory Coast, Nigeria and Ghana supply the majority of the German cocoa processing industry (86% of total cocoa-bean supplies).

Germany imported about 59% of its cocoa beans from Ivory Coast in 2021, amounting to 191,000 tonnes. Between 2017 and 2021, German cocoa-bean imports from Ivory Coast decreased at an average annual rate of 0.6%. Nigeria was the second largest supplier, with 47,000 tonnes of cocoa beans, corresponding to 15% of total German cocoa imports. On average, imports from Nigeria decreased by 7.3% a year during the period 2017-2021. This may be explained by lower yields and productivity related to ageing trees and farms, pests and disease attacks, labour shortages and lack of agricultural mechanisation. Ghana was the third-largest supplier, with 38,000 tonnes and a share of 12% of total cocoa-bean imports. Between 2017 and 2021, cocoa imports from Ghana saw an average year-to-year growth rate of 0.7%.

These supplying countries rely on well-established cocoa supply chains. There is a large presence of multinational processing companies (examples: OLAM and Cargill), to which small cocoa producers and co-operatives are strongly linked, especially in Ivory Coast. Also, a large share of cocoa produced in these countries is Rainforest Alliance/UTZ-certified, which is a market entry requirement to large manufacturers and retailers operating in mainstream markets.

Despite certification efforts, there are widespread sustainability concerns, especially regarding the cocoa sector in Ghana and Ivory Coast. For instance, cocoa farming has been identified as a main driver of deforestation, which contributes to climate change. In response, industry players, donors and the governments of Ghana and Ivory Coast have launched the Cocoa and Forests Initiative. In addition, child labour in both countries is a recurring concern: an estimated 1.5 million children still work in their cocoa fields.

In a bid to tackle farmer poverty, the governments of Ghana and Ivory Coast have raised the minimum export prices for their cocoa to US$2,600 per tonne, with the addition of a fixed ‘living income differential’ on all their cocoa sales (at US$400 per tonne) applicable from the 2020/2021 crop.

Examples of cocoa exporters and producers’ organisations from West Africa are: Agro Trades, Gbemtan Investment Limited, and Olantunde International (Nigeria), ECOOKIM and ECAKOOG (Ivory Coast) and ABOCFA and Kuapa Kokoo Co-operative Cocoa Farmers and Marketing Union Limited (Ghana).

Cameroon is committed to improving cocoa quality

Cameroon is the fifth-largest supplier of cocoa beans to Germany, with a market share of about 3.5%, and the fourth-largest African supplier. According to data from the International Trade Centre, Germany imported more than 11,000 tonnes of cocoa beans directly from Cameroon in 2021. Cocoa-bean supplies from Cameroon to Germany increased at an average rate of 4.4% per year during the period 2017-2021.

Cocoa is the most important agricultural crop in Cameroon and an estimated 8 million people live directly or indirectly from its production. Cameroon mainly cultivates Trinitario cocoa beans. However, the Cameroonian type is often classified as bulk cocoa.

The Cameroonian government and cocoa producer associations have launched programmes to improve nationwide post-harvest techniques to improve cocoa quality. About one-third of cocoa exported by Cameroon is certified as Rainforest Alliance/UTZ. An example of a Cameroonian cocoa-bean exporter is Telcar Cocoa.

Increasing Latin American cocoa supplies to Germany

Latin American countries are known for the high shares of fine-flavour cocoa in their total production, as well as for the production of organic cocoa. In 2020, about 56% of global organic cocoa production was in Africa, followed by 43% in Latin America. The largest Latin American suppliers of cocoa beans to Germany are Ecuador and Peru.

Ecuador

In 2021, Ecuador was the largest Latin American cocoa-bean supplier to Germany, with a volume of 16,000 tonnes. Cocoa-bean supplies from Ecuador registered an average annual growth rate of 0.2% between 2017 and 2021.

FAO data shows that Ecuador was the world’s fifth-largest cocoa producer in 2020, and the largest in Latin America. As much as 75% of Ecuador’s cocoa exports are considered to be fine flavour, which makes it the world’s largest fine-flavour cocoa producer.

Ecuador is strongly marketing the origin of its cocoa beans. ANECACAO, the country’s national association of cocoa exporters, heavily publicises the history of cocoa in Ecuador on its website. It also describes the main varieties produced and the quality requirements that exporters must comply with. Moreover, Ecuador has distinguished itself in the region as a pioneer in the fight against deforestation and for the development of sustainable agriculture, which also represents an added value for Ecuadorian cocoa.

Examples of successful exporters of cocoa beans from Ecuador include UNOCACE, COFINA, Ecuacoffee SA and Cacaos Finos Ecuatorianos SA.

Peru stands out for its organic cocoa

Peru was the second-largest Latin American cocoa-bean supplier to Germany in 2021, with 5,900 tonnes. Peruvian cocoa-bean exports to Germany increased at an average year-to-year rate of 5.0% between 2017 and 2021.

According to data from FAO, Peru ranked as the ninth-largest cocoa producer in 2020. The country produces fine-flavour cocoa, mainly consisting of Trinitrio and Criollo beans. About 75% of Peru’s total exports are registered as fine-flavour cocoa. Peru is also known as a major supplier of organic cocoa: in 2020, it grew the third-highest share of organic cocoa by area and ranked as the world’s-second largest organic cocoa producer (on FiBL statistics: select “Cocoa” under Items, and “Organic area [ha.]” under Elements), after DR Congo. This high share of organic production in combination with high-quality cocoa and the large share of fair trade-certified cocoa gives Peru a strong competitive advantage.

In addition, Peru has managed to strongly promote the quality and unique origin of its cocoa beans. Its national cocoa association, APPCACAO, is a driving force in developing the sector through a co-ordinated nationwide effort by cocoa associations/co-operatives, companies, support organisations and the government.

Examples of Peruvian cocoa exporters are Ecoandino and Norandino.

Tips:

- Identify your potential competitors. To be successful as an exporter, it is important to learn from them. Focus on their marketing strategies, the product characteristics they highlight and their value addition approaches. Successful companies that already export to the European market from which you can learn include Casa Franceschi (Venezuela), Kokoa Kamili (Tanzania), Hacienda Victoria (Ecuador), Ingemann (Nicaragua) and Xoco Gourmet (Central America, mainly active in Honduras, Guatemala, Belize and Nicaragua). Have a look at their websites to see how they highlight information about their products, such as their cocoa varieties, origin and processing methods.

- Identify and promote your unique selling points. Give detailed information about your cocoa growing region (origin), the varieties, qualities, processing techniques and certification of the cocoa you offer. You can also tell about the history of your organisation, your cocoa growing farm(s) and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and at trade fairs. Flavour quality competitions also provide good opportunities to share your story (example: International Chocolate Awards of the Cocoa of Excellence Programme).

- Read our study on how to do business with European cocoa buyers to find more tips on marketing your cocoa.

- Work together with other cocoa producers and exporters in your region when you lack company size or product volume. Together you can promote good-quality cocoa from your region and be a more attractive and more competitive supplier for the European market.

- Develop long-term partnerships with your buyer. This implies always complying with buyer’s requirements and keeping your promises. This will provide you with a competitive advantage, more knowledge and stability on the German market.

- Learn more about organic cocoa production in different countries by referring to the World of Organic Agriculture 2022 yearbook. Information about cocoa can be found on pages 96-98.

- Check possible programmes to support your crop and crop productivity. Refer to your national Ministry of Agriculture and other local programmes. Also check if there are local support programmes in your region managed by the Food and Agriculture Organization (FAO), International Finance Corporation (IFC), World Agroforestry Centre (ICRAF) or other organisations.

This study was carried out on behalf of CBI by Gustavo Ferro and Lisanne Groothuis of ProFound – Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research