The European market potential for semi-finished cocoa products

The European market potential for semi-finished cocoa products generally benefits from the high demand for chocolate and confectionery in Europe. In addition, there is a growing trend of processing cocoa into semi-finished products at its origin. This is expected to continue as big multinationals and local governments are investing into semi-processing at its origin to feed the European chocolate and confectionery industry.

Contents of this page

1. Product description

Semi-finished cocoa products are very important in the food, drink and confectionary industries. The products are made at the first stage of cocoa processing in factories and used as secondary products for chocolate, food and drink manufacturers. Common semi-finished cocoa products include cocoa paste, cocoa butter and cocoa powder. Food manufacturers use these semi-finished cocoa products to make many chocolate items, cocoa drinks and candies. Using semi-finished cocoa products facilitates manufacturing because some steps of cocoa processing are already done.

The beverage industry primarily utilises cocoa powder, while the baking industry requires both cocoa paste and cocoa powder. The chocolate industry relies on cocoa liquor and cocoa butter. Cocoa butter is in demand in the cosmetics and pharmaceutical industries.

Cocoa paste

Cocoa paste, also called cocoa liquor, is a thick, smooth liquid obtained after cocoa beans are roasted and ground. The butter from cocoa beans contributes to the smooth texture of the liquor. There are two types of cocoa paste. One type is called 'not defatted' cocoa paste, which still contains all the butter of the cocoa after grinding. The other type is called wholly or partly defatted cocoa paste – when all or some of the cocoa butter has been removed from the cocoa paste.

Cocoa paste is very important in making chocolate, giving it its characteristic flavour and smooth texture. Manufacturers can control how much fat is in the chocolate by using either wholly or partly defatted cocoa paste, depending on what kind of chocolate they want to make.

Cocoa butter

Cocoa butter is a type of fat and oil that is safe to eat and is naturally found in cocoa beans. Cocoa butter is separated from cocoa paste when cocoa paste goes through additional processing. This process is called extraction.

Cocoa butter has a special quality. It is solid when it's not too hot, but melts when it is in contact with our body heat. The melting point of cocoa butter is just below our body temperature. This quality makes it good for making smooth and creamy chocolate and other sweet treats. It gives chocolate that melt-in-your-mouth feel. Apart from being used in food, cocoa butter is also used in skincare products, makeup and medicines. This is because it can help keep the skin soft and heal certain skin issues.

Cocoa powder

Cocoa powder is made from the solid that is left after taking out cocoa butter from cocoa paste. The solid is called cocoa cake or cocoa powder cake, and is ground into cocoa powder. It can also be used as animal feed. Cocoa powder has no sweetness of its own, and retains the strong chocolate flavour and dark colour of cocoa beans.

Cocoa powder is used in baking, cooking, and making chocolate-flavoured products like hot cocoa, chocolate cakes, brownies and desserts. It can help create a very intense chocolate taste.

These products have been classified with the unique Harmonized System (HS) code for purposes of international trading, taxation, etc. HS codes help customs authorities in different countries understand what is being imported or exported.

Table 1: HS code and product

|

HS code |

Description |

|

180310 |

Cocoa Paste, Not Defatted |

|

180320 |

Cocoa paste, wholly or partly defatted |

|

180400 |

Cocoa butter, fat and oil |

|

180500 |

Cocoa Powder, Not Containing Added Sugar or Other Sweetening Matter |

Other semi-finished cocoa products – Cocoa nibs and couvertures

Cocoa nibs are also intermediate products used by the food industry. They are small pieces of crushed, roasted cocoa beans. Cocoa nibs have a deep, intense chocolate flavour and a slightly crunchy texture. They are often used in various culinary applications, such as baking and cooking, or as a topping for desserts, smoothie bowls or yogurt. Some people also enjoy eating them as a snack.

Cocoa nibs are known for their rich cocoa flavour and are a source of antioxidants and nutrients found in cocoa beans. They are a popular ingredient for people who want a more intense chocolate experience with less sugar and processing than traditional chocolate products. But there is no specific trade data available for only cocoa nibs. It is usually classified as part of cocoa beans with HS code 180100.

Couverture is a high-quality chocolate that is specifically designed for use by professional chocolatiers and pastry chefs. It contains a high percentage of cocoa butter, typically around 32% to 39%, making it excellent for tempering and coating confections. Couverture is used to make pastries, bonbons, truffles, chocolate bars and other confections.

There is no specific HS code for couverture; together with other chocolate products it is registered under HS code 180620, 180632 or 180690. Like cocoa nibs, trade data do not distinguish between chocolate and couverture, so it is not possible to give specific figures for couverture alone in this report.

Processes for making semi-finished cocoa products

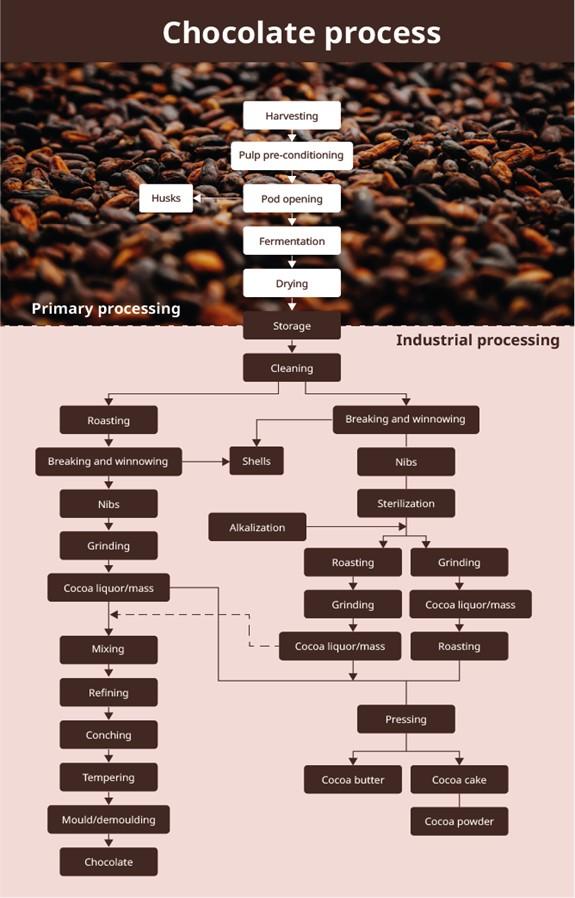

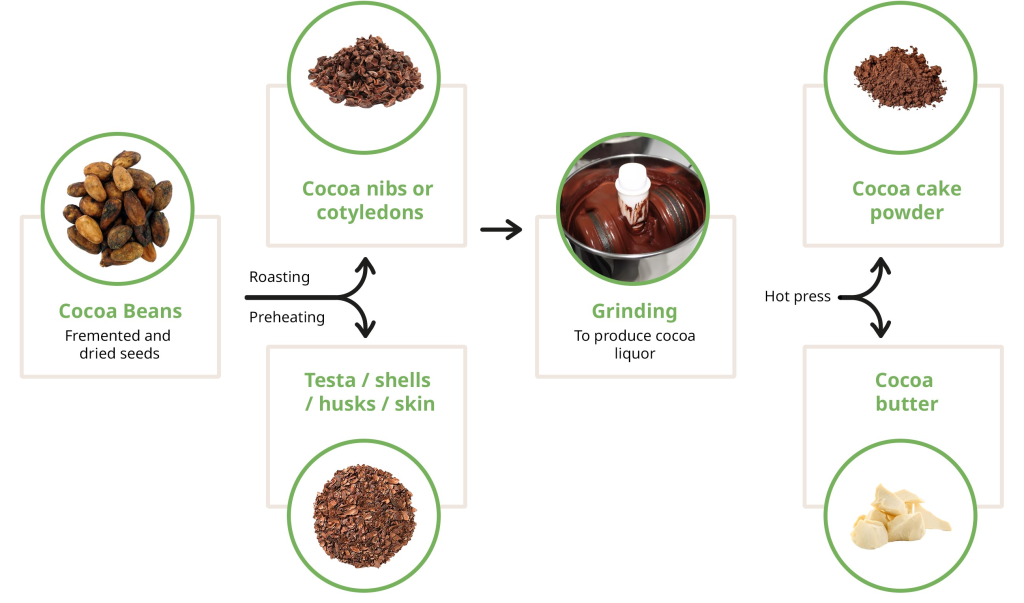

Various steps are involved in the production of semi-finished cocoa products (Figures 1 and 2). First, the producer begins primary cocoa-processing activities after harvest on the farm. Pod maturity at harvest is important for the quality of semi-finished and final cocoa products.

Producers break pods and remove the beans which are then fermented, dried and sorted before sales. The way cocoa beans are treated after harvest, especially through fermentation and drying, is also very important. They contribute to the development of the right flavour, colour and quality of semi-finished and final cocoa products.

By fermenting and drying properly, cocoa beans can be used to make different semi-finished cocoa products. Cocoa beans are typically evaluated and graded based on various factors, including size, appearance, moisture content, fermentation and overall bean quality. When cocoa beans do not meet the required standards, they are referred to as sub-standard cocoa beans. The chocolate and confectionary industry prefers not to use sub-standard cocoa beans because it is difficult to make quality products with them.

But cocoa butter can be extracted from sub-standard cocoa beans without deshelling by using continuous expeller presses. A solvent extraction process can also be used to extract butter from the cake residue left after the expeller process. A refinement process is required for this type of cocoa butter and it is mostly used by the cosmetic and pharmaceutical industries.

Figure 1: Steps in the production of semi-finished cocoa products and chocolate

Source: Goya et al. 2022, re-designed by Bart Wortel

Figure 2: Components of the cocoa bean from processing

Source: Peña-Correa et al. 2022, re-designed by Bart Wortel

Common cocoa varieties used by manufacturers

Different types of cocoa are used to make these semi-finished cocoa products. Manufacturers are aware that harvest and post-harvest practices affect cocoa bean quality and hence the quality of semi-finished products. They are also aware that the quality of semi-finished products and hence of chocolate and confections can vary significantly due to different types of cocoa beans.

Cocoa products can be made of any cocoa variety, most common being:

Forastero: the predominant cocoa variety. It is mainly cultivated in Africa but also in Central and South America. It accounts for around 80% of global cocoa production. Forastero grows faster and gives a higher yield than other cocoa varieties. The beans are bitter, have a strong earthy flavour and are acidic. Bulk cocoa beans generally come from Forastero trees. Well-known Forastero subspecies are Amelonado, Amazonia and Nacional. Nacional trees in Ecuador produce fine flavour cocoa.

Criollo (original cocoa tree): mainly grown in Central America, northern South America, the Caribbean and Sri Lanka. This variety is slightly less resilient compared to Forastero and is less commonly grown worldwide. Criollo makes up around 5% of global cocoa production. The cacao beans produced by these trees are renowned as some of the finest globally.

Criollo beans produce much more aromatic and fruitier flavour, with less bitterness. It is often mixed with other varieties when making chocolate, since it is scarce and expensive. There is a good chance that high-quality, premium chocolate bars that sell at much higher price tags contain Criollo beans. Criollo beans are regarded as super fine cocoa, so most fine flavour cocoa beans are produced from Criollo cocoa trees. Well-known varieties are Chuao, Porcelana and Ocumare.

Trinitario: mainly cultivated in Central and South America, the Caribbean and Asia. The beans are a hybrid of Criollo and Forastero trees. This variety is not quite as rare as Criollo and represents around 10-15% of global cocoa production. The beans have a floral, fruity flavour. Cocoa beans from Trinitario trees are also classified as fine flavour cocoa. There are exceptions, however, as Cameroonian cocoa beans produced from Trinitario trees are classified as bulk cocoa beans. Well-known varieties are Carenero, Rio Caribe and Sur del Lago.

Figure 3: Common cocoa varieties

Source: Amonarmah Consults, designed by Bart Wortel

Tip:

- See our study on finding buyers in the European cocoa market, which gives you a few ideas on where to search and how to establish direct contact with buyers operating in the high-quality, fine flavour cocoa segment.

2. What makes Europe an interesting market for semi-finished cocoa products?

Europe has a rich chocolate culture, a diverse food industry, and a commitment to quality and innovation. This makes it an exciting and thriving market for semi-finished cocoa products. European chocolate is loved worldwide, and the chocolate industry in Europe keeps striving to be the best and most creative.

Europe has a long and unique history of making chocolate and sweet treats.

European countries have been leaders in chocolate production for a very long time. They process 35% of the world's cocoa. Many famous brands that are known for their high-quality and delicious chocolates are European: August Storck KG (Germany), Cemoi (France), Lindt & Sprüngli (Switzerland), Ferrero Group (Italy), Nestle SA (Switzerland), and Tony's Chocolonely (Netherlands).

Europe is also home to many specialty chocolate makers known for their craftsmanship and dedication to producing high-quality chocolates. They take great pride in their creations and are always coming up with new and delightful chocolate experiences for their customers: Pierre Marcolini (Belgium), Jacques Genin (France), Amedei (Italy), Valrhona (France) and Demarquette (United Kingdom) are among them.

To keep their chocolates top-notch, these famous chocolate brands and skilled chocolatiers need the best ingredients, including high-quality semi-finished cocoa products. By using premium cocoa ingredients they can make sure that their final chocolates meet the high standards of their discerning customers.

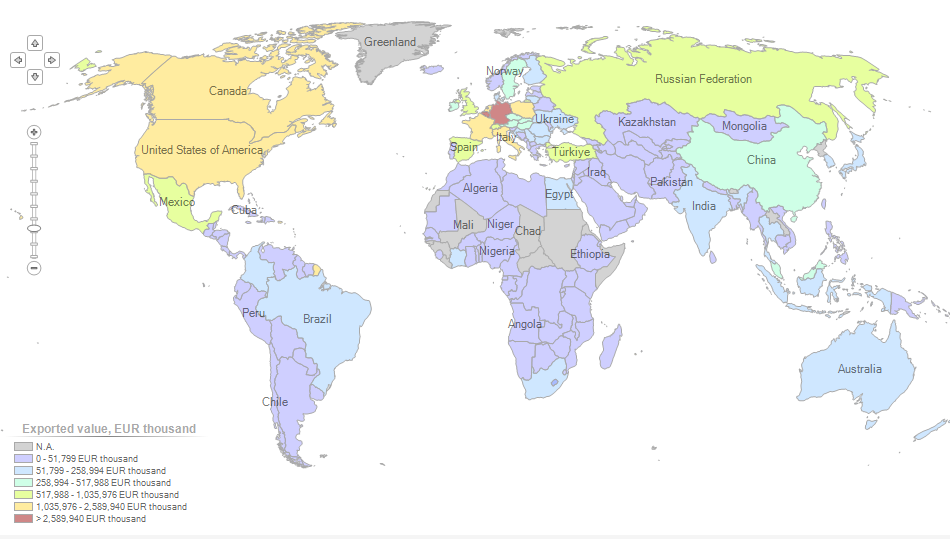

In 2022, European countries exported the most chocolate in the world (Figure 3). They earned $24.3 billion from the exports, accounting for about 73.5% of all chocolate exported globally. The five biggest chocolate exporters were Germany, Belgium, Italy, Poland and the Netherlands. Together, these five countries account for almost half (47.7%) of the world's chocolate exports.

Figure 4: 2022 export value of countries exporting chocolate and other food preparations containing cocoa (product code 1806)

Source: ITC calculations based on UN COMTRADE and ITC statistics

Multinationals like Barry Callebaut, Cargill, Cémoi, ECOM/Dutch Cocoa, Olam, Nederland SA and Crown of Holland (only organic) are based in Europe. The European food and confectionery industry rely on these suppliers for all types of semi-finished cocoa products. Apart from chocolates and confectionaries, the European market provides a wide range of opportunities for using semi-finished cocoa products in baking, desserts, and beverage manufacturing.

While Europe has many chocolate manufacturers, most of them process cocoa beans themselves. Some also buy semi-finished cocoa products from European processors. Usually, chocolate makers and manufacturers prefer getting cocoa products from the multinationals. This is because multinationals have the resources and financial capacity to ensure consistent quality and availability of cocoa products. This creates tough competition for exporters of semi-finished cocoa products from cocoa-producing countries.

Europe has the highest chocolate consumption

Europe is famous for having the highest chocolate consumption per person compared to other parts of the world (Figure 5). Europeans consume 45% of the world's chocolate. They really love chocolate as it is deeply connected to their culture and history. Solid chocolate, in the form of chocolate bars, was invented in Europe. Europeans enjoy many different kinds of chocolate products, like chocolate bars, pralines, truffles and other delicious treats. It is so popular that you can find innumerable shops, bakeries and places that sell chocolate all across the continent.

Countries like Switzerland, Austria, Germany, Ireland and the UK consume a lot of chocolate compared to the rest of the world (Figure 5). European consumers don't just love chocolate, they also have a discerning taste for it and appreciate products of excellent quality. This places semi-finished cocoa products that can deliver superior flavour, texture and overall sensory experience in high demand in the European market.

Source: Amonarmah consults; data from world population review

European demand for chocolate products is expected to increase. This is because the chocolate and confectionery industry is thriving after a slowdown due to the Covid-19 pandemic. In 2022, the European chocolate market was valued at $44,762.65 million and is expected to grow by about 4.79% every year up to 2027. The chocolate market in Europe is really competitive, with many big companies having most of the market. People are liking dark and organic chocolates more, which is expanding the market. Manufacturers are also finding new ways and ideas to make chocolates that are healthful. This brings in more customers and strengthens their brand.

The European premium chocolate market is also projected to experience substantial growth between 2023 and 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.4% during the 2023-2040 forecast period, to reach an estimated value of USD 18,397,412.04 by 2030. The primary driver behind the growth of the European premium chocolate market is the increasing demand for exceptionally luxurious chocolates.

Chocolate is not only tasty, it also plays a big part in European celebrations and special occasions. People have a strong tradition of enjoying chocolate. It is a special treat that brings joy and comfort. For example, people give each other chocolate eggs during Easter and have chocolate advent calendars during Christmas. Chocolate is an essential part of these traditions. Chocolate companies try different shapes, flavours and packaging to sell more during special seasons.

Chocolate is also popular for everyday snacking as well as for special occasions. For instance, many European pastries and desserts, such as chocolate cakes, brownies and cookies, use cocoa powder or cocoa liquor to impart a rich chocolate flavour. Also, semi-finished cocoa products are used to make delicious chocolate ice cream with a smooth and creamy texture. This means that Europe's demand for semi-finished cocoa products which are building blocks that help chocolatiers will also continue to rise.

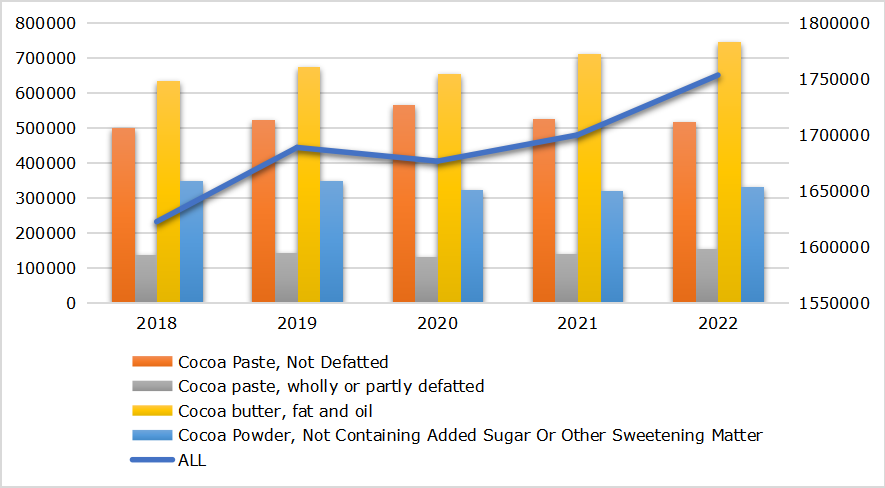

European direct imports of semi-finished cocoa products keep increasing

Between 2018 and 2022, there was growth in the direct imports of semi-finished cocoa products in Europe. From 2021 to 2022, the total European imports of all semi-finished cocoa products (cocoa paste, butter and powder) grew by 3.1% (Figure 6).

Figure 6: European imports of semi-finished cocoa products

Source: Amonarmah consults; data from EUROSTAT

Among these products, partially or wholly defatted cocoa paste had the highest year-to-year growth at 9.8% in 2022. This was followed by cocoa butter and cocoa powder imports, which grew at 5.0% and 3.9%, respectively. But most of the imports are a result of trade within Europe. Cocoa-producing countries that supply semi-finished products face strong competition from European players. Generally, the share of direct imports from cocoa-producing countries is about 38%, which gives room for growth.

Partially or wholly defatted cocoa paste had the largest share of direct imports from cocoa-producing countries at 89.9%. Not defatted cocoa paste followed at 38.5% and cocoa butter at 35.8% market share for direct imports. Cocoa powder had the lowest share of direct imports from producing countries, accounting for 17.3% of total EU imports in 2022.

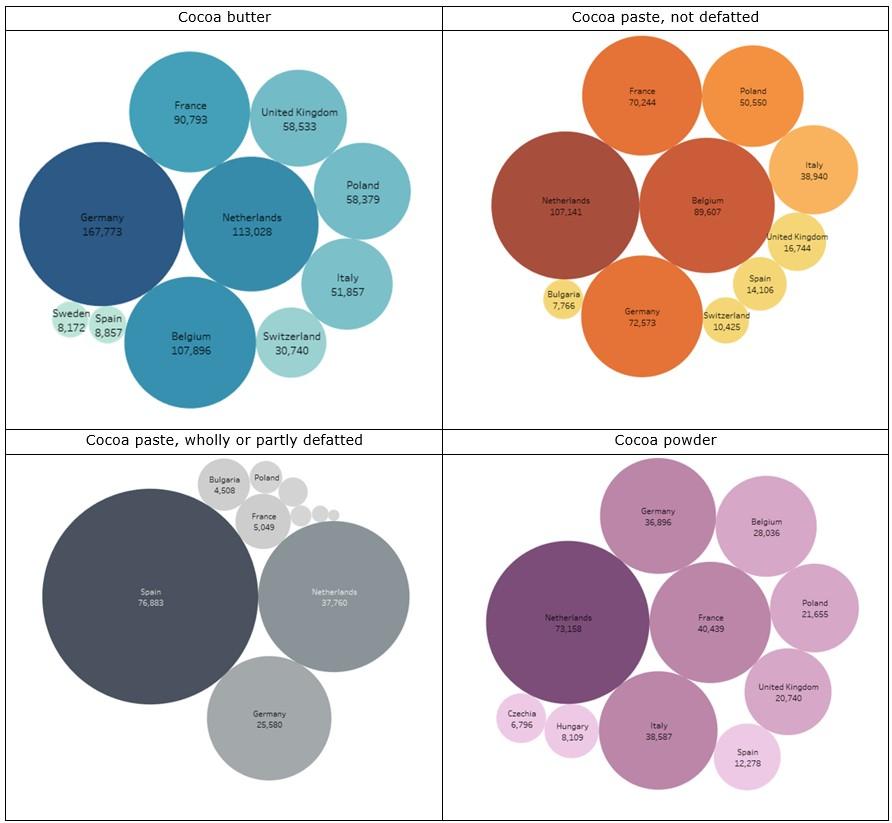

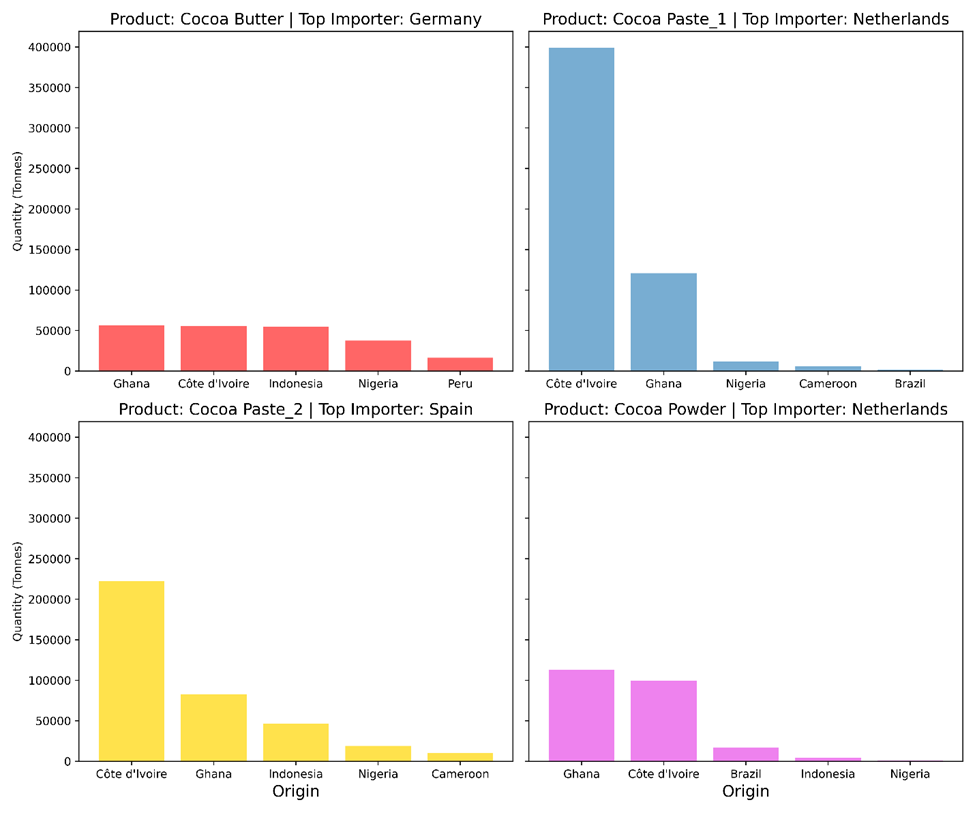

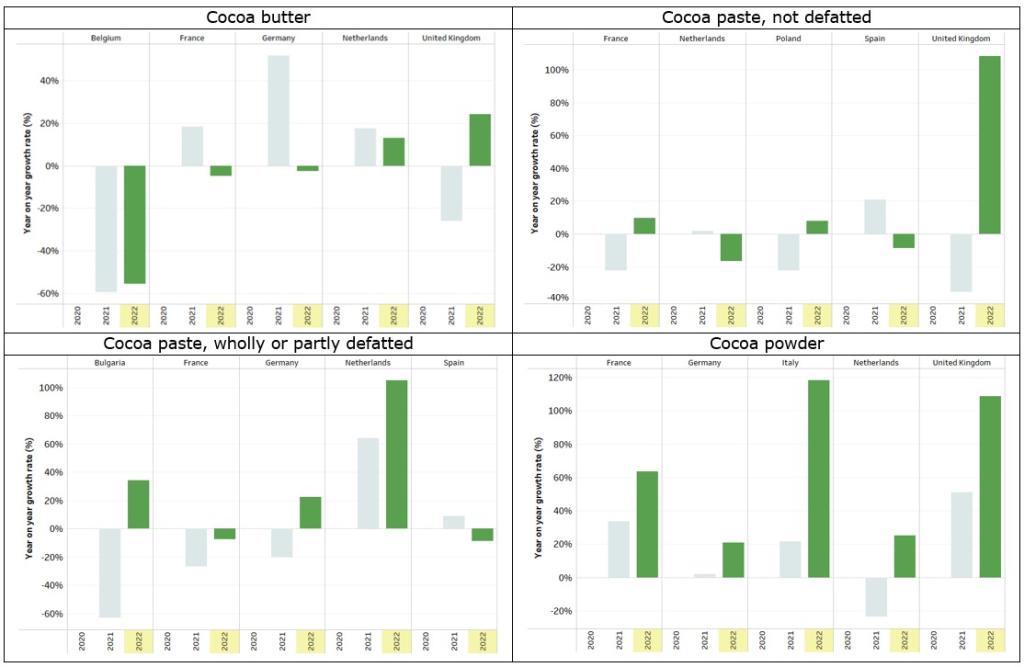

In 2022 the top importer of cocoa butter was Germany, while that of not defatted cocoa paste and cocoa butter was the Netherlands (Figure 7). Spain was the top importer of wholly or partially defatted cocoa paste. Among the top suppliers for these products to these destinations are Côte d'Ivoire, Ghana, Indonesia and Nigeria (Figure 8).

Figure 7: top-10 European country importers of semi-finished cocoa products, 2022

Source: Amonarmah consults; data from EUROSTAT

Figure 8: top-5 suppliers from cocoa-producing countries to the top importers of each semi-finished product, 2022

Note: Cocoa Paste_1 is cocoa paste, Not Defatted and Cocoa Paste_2 is cocoa paste, wholly or partly defatted

Source: Amonarmah consults; data from EUROSTAT

The cocoa derivatives market in Europe is expected to grow from $10,670.46 million in 2022 to $14,331.79 million by 2028. This growth will happen at a steady yearly rate of 5.0% between 2022 and 2028. The market's expansion is driven by Europeans' increasing interest in gourmet chocolates. Because of this, luxury chocolate brands are trying to make their products unique. They are also focusing on getting cocoa from specific places, known as single-estate products.

Tips:

- Learn more about the food and confectionery industries using cocoa products on the website of CAOBISCO, the Association of Chocolate, Biscuit and Confectionery Industries of Europe. The food and confectionery industries will be the most interesting for semi-finished cocoa products.

- See our study on trade statistics for cocoa for more detailed information about the European trade in cocoa beans.

- Create special and unique semi-finished cocoa products that are different from what multinational companies offer. This could include using specific cocoa varieties, using cocoa from a single place, or making products that cater to a niche or specific groups of customers.

- Build strong and lasting relationships with buyers from the EU. Having personal connections and providing excellent service can help you get and keep customers.

- Read our study on trends on the European cocoa market for insight into the consumer market for chocolate.

3. Which European countries offer most opportunities for semi-finished cocoa products?

The main importers of cocoa products sourced directly from cocoa-producing countries vary according to the type of product. Some countries act as places where the products are traded, while others use them for making things or for selling to people. Germany and the Netherlands are big and important markets in Europe for semi-finished cocoa products. These countries have big factories that process cocoa, and send a lot of semi-finished cocoa products to other countries in Europe.

The Netherlands dominates imports of semi-finished cocoa products in Europe

In Europe, the Netherlands is a significant importer of semi-finished cocoa products (Figure 9). Cote d'Ivoire and Ghana stand as the main suppliers of not defatted cocoa paste and cocoa powder to the Netherlands (Figure 8). Four main things make the Netherlands an attractive location to consider when looking for business partners and manufacturers who may be interested in your products:

- The role it plays in the chocolate industry

- The increasing import of semi-finished cocoa products from cocoa-producing countries

- The location of ports

- The large cocoa and chocolate industry

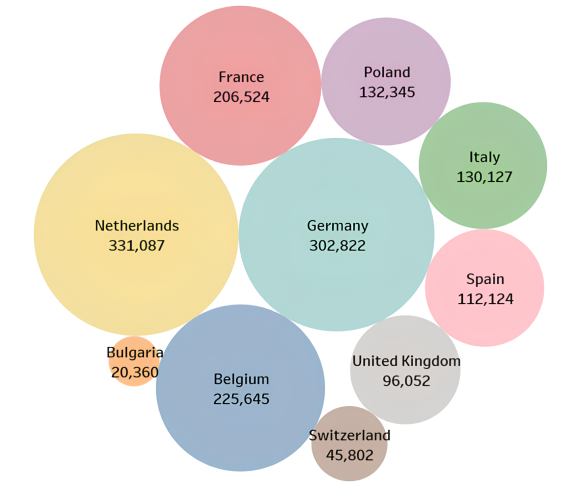

Figure 9: Total quantity of semi-finished cocoa products (paste, butter and powder) for top ten importing European Union countries in tonnes, 2022

Source: Amonarmah consults; data from EUROSTAT

The Netherlands plays a prominent role in the global chocolate market (Figure 4). It is the fifth exporter of chocolate in the world. Exports of Dutch chocolate are predicted to reach $2.4 billion by 2026, reflecting a 1.7% growth compared to 2021.

Cocoa butter exports to the Netherlands from all origins grew by 15% and imports from cocoa-producing countries grew by 13% in 2022. Even though the Netherlands was the leading importer of not defatted cocoa paste, the quantity of imports decreased at a year-on-year rate of 16.8%% in 2022 from all origins. It also decreased by 16.3% from cocoa-producing countries.

But imports of defatted cocoa paste and cocoa powder registered a year-on-year growth rate of 104.1% and 18.9%, respectively, from all origins. The year-on-year growth rates from producing countries were 105.1% and 25%, respectively. These are higher compared to imports from all other origins.

The Port of Amsterdam is the largest cocoa port in the world. Its location makes it a strategic import destination for semi-finished cocoa products. This gives it a major place in the international cocoa trade given its expertise and the concentration of facilities and actors around it, plus a strong focus on sustainability and great openness to innovations. The Netherlands is therefore an important supplier of cocoa products to its neighbouring countries (Figure 10).

The Netherlands also offers opportunity for organic and fair trade semi-finished cocoa products. The organic retail sector expanded by 0.9% in 2020/21, a growth that is anticipated to continue. This positive trajectory can be partly attributed to nationwide initiatives.

One noteworthy organic retail store in the country is Ekoplaza, offering a diverse selection of organic chocolate products. Also, Dutch organic chocolate brands like Chocolatemakers and Lovechock are gaining recognition for their commitment to organic quality.

The country has seen growth in the fair trade cocoa market. The most common fair trade standard is Fairtrade, which is certified by FLOCERT. There is another standard called SPP (Small Producers' Symbol), but it isn't as widely used.

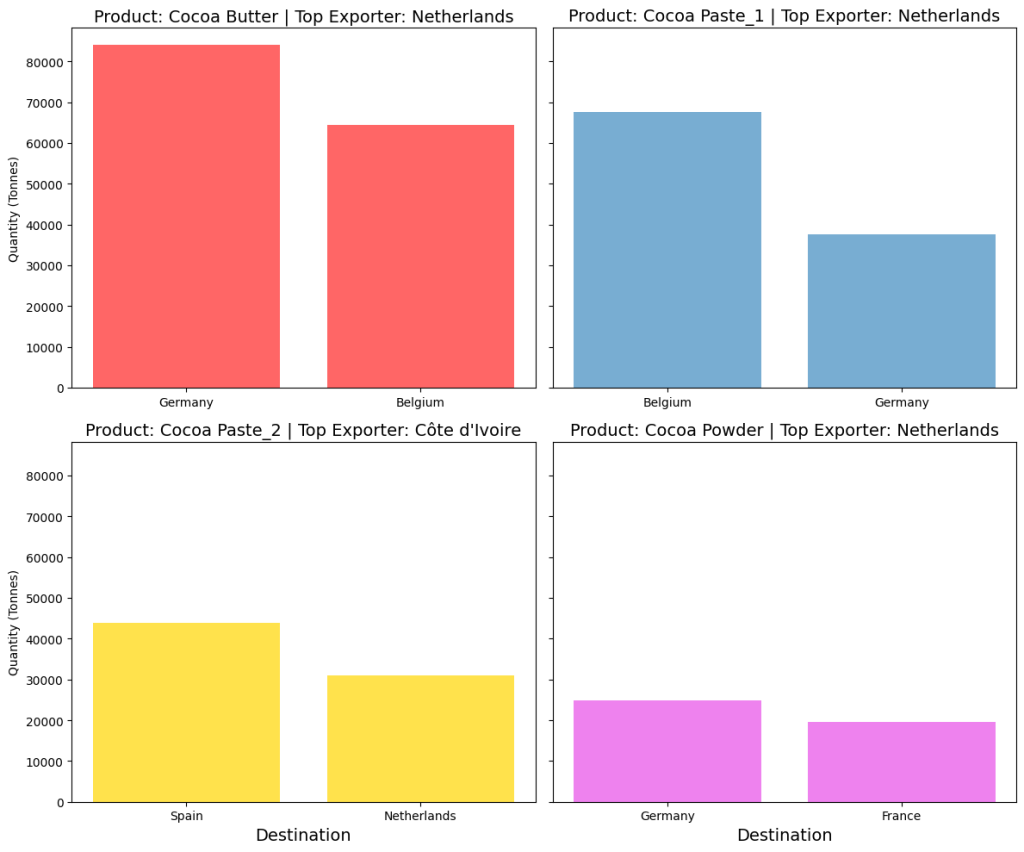

Figure 10: Top exporters of semi-finished products and their top-2 destinations in Europe, 2022

Note: Cocoa Paste_1 is not defatted cocoa paste, and Cocoa Paste_2 is wholly or partly defatted cocoa paste

Source: Amonarmah consults; data from EUROSTAT

The Netherlands has the second-largest cocoa-processing industry globally, behind Côte d'Ivoire. The country also refines cocoa butter imports for use in cosmetics and health products, among other things. Some companies based in the Netherlands that source semi-finished cocoa products are Huyser Möller, Gaia Cacao, Daarnhouwer, Campo Lindo, JS Cocoa and Rhumveld Winter & Konijn.

Germany follows the Netherlands on imports of semi-finished cocoa products in Europe

Germany is the top European market for semi-finished cocoa products (Figure 9) after the Netherlands. Top producing countries supplying cocoa butter to Germany are Ghana, Côte d'Ivoire, Indonesia, Nigeria and Peru (Figure 8). Several factors make Germany an important place to consider when looking for manufacturers to supply to.

Germany is a top exporter of chocolate (Figure 4) in the world. It holds the position of being the largest chocolate manufacturing industry within Europe. This is attributed to the presence of various multinational chocolate manufacturers operating their production facilities in the German market. Also, the country plays a substantial role in global chocolate exports, as it is the top exporter of chocolate products worldwide.

People in Germany usually buy chocolate on impulse, like in other European countries. This makes demand for chocolate always high. In fact, Germany has the third highest per capita chocolate consumption in the world, at 7.9 kg per year.

Germany is also the largest market for organic food in Europe. This means that people like to buy food that is made in a natural way without harming the environment. This enhances the chances for growth in the organic cocoa market in Germany.

The country has a big need for cocoa products because it has the largest market of chocolate consumers and a big food-processing industry in Europe. Additionally, Germany serves as a trade hub thanks to its central location and excellent logistical network.

In recent years, Germany has experienced a gradual rise in cocoa butter imports and is the leader of cocoa butter imports within Europe (Figure 8). In 2018-2022, the import volume increased from 151,176 tons to nearly 167,773 tons. In 2022, Germany experienced a 1.8% year-on-year increase in cocoa butter imports from all origins.

Germany experienced a year-on-year growth rate of 1.33% and 15% on not defatted cocoa paste and defatted cocoa paste imports, respectively, from all origins in 2022. However, imports of cocoa powder decreased by 2.3%. Germany's imports of defatted cocoa paste and cocoa powder from producing countries increased by 23% and 21%, respectively, in 2022.

Some companies dealing with cocoa products based in Germany are Stollwerck, Storck, Albrecht & Dill Trading, CARE Naturkost and Naturkost Übelhör (only organic-certified products).

Figure 11: Year-on-year growth rate of imports of each semi-finished cocoa product for top-5 countries in Europe that import from producing countries

Source: Amonarmah consults; data from EUROSTAT

French chocolate and confectionery industry keep growing

France is the 4th importer of semi-finished cocoa products. It has a big chocolate-making industry with well-developed production capacities for manufacturing cocoa products. France imports semi-finished cocoa products from countries like Côte d'Ivoire, Cameroon, Ghana, Malaysia and Brazil.

French cocoa powder imports from cocoa-producing countries increased by a year-on-year rate of 14% in 2020, 34% in 2021 and 64% in 2022. France also increased imports of not defatted cocoa paste from origin countries by 10% in 2022.

France has the 5th highest per capita consumption of chocolate in the world. The French confectionery and snacks market is expected to grow annually by 3.48% in 2023-2028. In 2024, it is expected to show a growth of 2.5% in volume, a growth projected to reach 3.1 billion kg by 2028. This expectation suggests that the growth of imports of semi-finished cocoa products will also continue to increase.

Cémoi is a large French chocolate maker. Other chocolate-making companies in France are Chocolaterie Abtey, Mazet Confiseur, Révillon Chocolatier and Valrhona. One French trading company importing semi-finished cocoa products is SALDAC.

France is well-known for its large demand for organic products. It therefore offers great opportunity for high demand of semi-finished organic cocoa products. It is Europe's second-largest organic retail market, worth about €12.7 billion in sales. It also experienced an annual growth of nearly 7% in xxxx year(s), which is expected to continue. The most popular organic chocolate brand in France is Ethiquable. A lower-end chocolate brand offering organic milk chocolate bars is Poulain.

Poland's import of cocoa butter and paste on the Rise

Poland is the world's 5th importer of semi-finished cocoa products. The chocolate business in Poland is also getting bigger. Many companies, both Polish and from other countries, have put a lot of money into expanding the Polish food and confectionary industry. For instance, market leader Mondelez and national companies Wawel and Lotte Wedel have all invested in increasing their production capacity in the country in recent years. This contributes to making Poland the 4th exporter of chocolate in the world.

In 2022, Poland brought in 58,379 tons of cocoa butter, which is 58% more than back in 2018. In that same year it also sold 672 tons of cocoa butter to other countries. Poland mostly gets its cocoa butter from nearby countries in Europe, like Germany, the Netherlands, France, Italy and Switzerland. This situation provides opportunity for cocoa origins to export to Poland.

Poland's import of not defatted cocoa paste from cocoa origins also increased by a year-on-year rate of ‑17% in 2021 to 7.9% in 2022. Ghana and Côte d'Ivoire were the largest producing country suppliers. While imports of cocoa paste grows, Poland's confectionery and snacks market is also expected to grow even more than France's. The expected growth rate is 7.87% for 2023-2028, with an expected growth rate of 7.87% for 2023-2028 and an expected growth of 6.5% in volume for 2024, reaching a projected 2.7 billion kg by 2028. This expectation suggests that the growth of imports of semi-finished cocoa products will also continue to increase.

Italy's artisanal chocolates industry keeps increasing

Italy is Europe's 6th importer of semi-finished cocoa products. Known for its rich culinary heritage, Italy boasts a thriving confectionery industry with a deep appreciation for chocolate, pastries and desserts. It was the third chocolate exporter in the world in 2022.

Italian cocoa powder imports grew from ‑57% in 2020 to 22% in 2021 and 118% in 2022. Italy's confectionery and snacks market is also expected to grow by an annual rate of 4.5% in 2023-2028. In 2024 it is expected to show a growth of 3.5% in volume, projected to reach 2.9 billion kg by 2028.

The Italian market offers a wide array of opportunities for semi-finished cocoa products, particularly in the context of traditional Italian sweets and chocolate-based confections. In Italy, chocolatiers who make special chocolate called artisanal chocolate work together in a group called the Association of Italian Artisan Chocolatiers (ACAI).

The bigger chocolate industry in Italy is represented by another group, the Italian Association of Confectionery Industry and Pasta Industries (AIDEPI). These groups believe in using pure ingredients to make chocolate. Members of ACAI and AIDEPI promise to only use 100% cocoa butter in making chocolates that are called 'pure'. They are not allowed to use substitutes like vegetable oils instead of cocoa butter.

Italy also offers great opportunity for the growth of sustainable products like fair trade and organic. It is Europe's third largest market for organic foods and products. Its organic retail sales reached nearly €4 billion in 2021 and are expected to continue growing. ICAM, an Italian chocolate confectionery company, is a leader in the organic market and one of the largest global manufacturers of organic chocolate. It owns premium organic chocolate brands like Vanini. Chocolate products certified as both Fairtrade and organic are also very common in Italy, like those of Otto Chocolates and Alce Nero.

Italian chocolate companies like Ferrero, Perugina and Venchi have made significant contributions to the global chocolate industry. These companies are celebrated for their artisanal techniques and use of high-quality ingredients, and the artistry displayed in their chocolate creations. Italian chocolate products are highly regarded for their rich flavours, elegant packaging, and the incorporation of regional specialties.

Some other well-known Italian companies that make artisanal chocolate are Staccoli, Lorenzo Zuccarello Fine Chocolate and Buffa Cioccolato. Italy also has several bean-to-bar chocolate makers with larger-scale operations, including Guido Castagna, Domori and Amedei.

Italy's prominent position in the European chocolate manufacturing industry, in combination with the growing demand for chocolate worldwide, continues to make it an interesting destination for semi-finished cocoa products.

The United Kingdom's Fairtrade-certified chocolate is growing

The UK is Europe's 8th importer of semi-finished cocoa products. In 2022, British cocoa butter imports from cocoa producing countries increased by 24%. In that same year, the UK's imports of not defatted cocoa paste and cocoa powder increased by 108% and 109%, respectively. But demand is expected to keep increasing, providing opportunities for SMEs.

The UK also ranks fifth globally when it comes to chocolate consumption. On average, each person in the UK consumes around 7.6 kg of chocolate per year. The UK's confectionery market is expected to experience an average annual growth rate of 3.41% in 2023-2028. The compound chocolate market in the UK is also expected to grow by 3% in 2023-2028. This growth is driven by factors like increasing disposable income in emerging economies and a growing interest in healthier snacking options.

Major players in the British chocolate and confectionery industry contributing significantly to its growth are Pladis and Hotel Chocolat, British companies ranked among the top-100 global candy companies. This presents a good opportunity for SMEs exporting semi-finished cocoa products. They have the chance to tap into this expanding demand and foster collaborations within the UK market.

Chocolates categories such as single-origin, organic, bean-to-bar and ethical chocolates are rapidly gaining popularity in UK's confectionery industry. The expectation for the next few years is that the fair trade market will be pushed by strong consumer interest in affordable and sustainable products. Many supermarkets in the UK are now offering fair trade chocolate and cocoa products.

SMEs exporting semi-finished cocoa products can target this market segment. They can do this by offering Fairtrade-certified options. They can also collaborate with brands known for their ethical practices, like Green & Black's, a British brand of organic and Fairtrade-certified chocolate.

A large number of consumers express interest in buying fair trade and organic items in the future. SMEs can position themselves to meet the demand for these increasingly sought-after products. This not only allows them to tap into a growing market but also aligns their business with the evolving consumer preferences for sustainable and responsible consumption.

Tips:

- Visit EU Access2Markets to analyse European trade dynamics yourself and to build your export strategy. By selecting a specific country, you will be able to follow developments such as trade flows with established suppliers, the emergence of new suppliers, and changing patterns in direct and indirect imports.

- Consider looking for business partners in Germany if you process organic cocoa. Some German premium organic chocolate brands are Vivani and Belyzium.

- Investigate whether your target market is an important trade hub and/or a large consumer market. This information will help you create a more accurate export strategy for cocoa products. For example, if you know which industries in which countries demand your cocoa products, you can try to contact end-user industries directly.

- Use industry associations of specific countries to understand their markets and to find buyers, like the Association of the Belgium Confectionery Industry, the Dutch Association of Bakery Goods and Sweets, the Association of the German Confectionery Industry, the Confederation of Chocolate and Confectioners of France or the Italian Association of Confectionary Industry and Pasta Industries.

4. Which trends offer opportunities on the European semi-finished cocoa products market?

European manufacturers usually process cocoa beans or buy semi-finished cocoa products from other European manufacturers. But processing cocoa beans at the place where they are grown is also becoming more important. This provides opportunities for exporting semi-finished products to Europe.

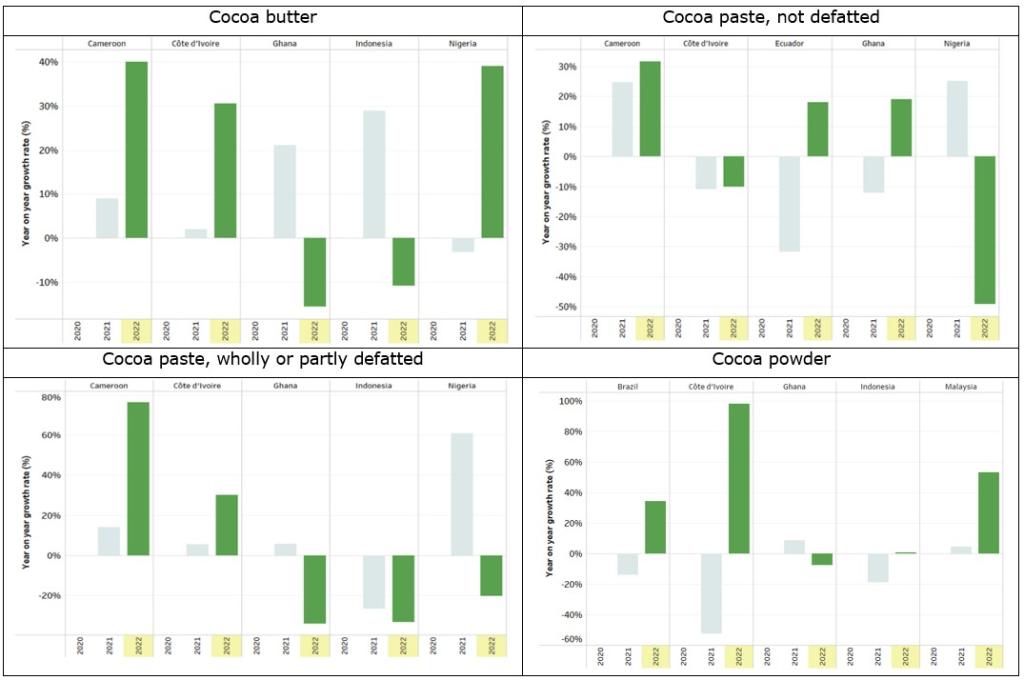

Figure 12: Year-on-year growth rate of imports from top-5 producing countries for each semi-finished cocoa product

Note: Cocoa paste_1 is not defatted cocoa paste, and Cocoa paste_2 is wholly or partly defatted cocoa paste

Source: Amonarmah consults; data from EUROSTAT

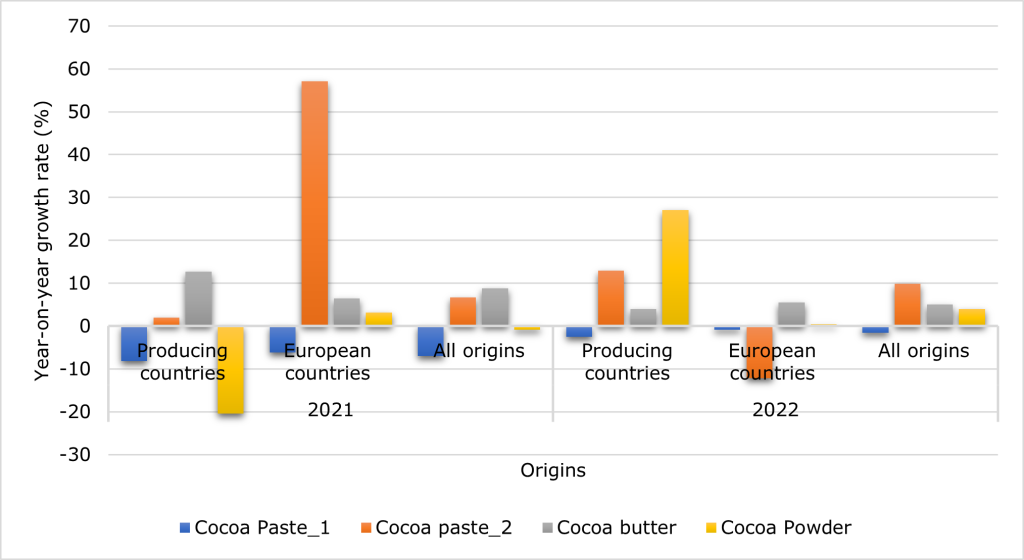

Growing demand for origin-based cocoa products

The demand for partially or wholly defatted cocoa paste from cocoa-producing countries keeps increasing (Figure 13). A year-on-year growth of 2% was experienced in 2021, climbing to 13% in 2022. However, intra-European trade decreased by 12% in 2022. The average growth rate between 2018 and 2022 of Europe's import of partially or wholly defatted cocoa paste sourced directly from cocoa-producing countries was 13.3%. This is higher than the growth rate of trade within Europe at 3.7% for the same period.

Also, the year-on-year growth of cocoa powder imports from developing countries was 27% in 2022 compared to ‑20% in 2021 (Figure 13). Only Europe's imports of not defatted cocoa paste had a positive growth rate of 10% for trade within Europe but negative (‑6.6%) for sourcing from producing countries. Overall, imports from European processors decreased but imports from producing countries increased and are projected to stay that course.

Figure 13: 2021 and 2022 year-on-year growth rates of European imports of semi-finished cocoa products from different origins

Note: Cocoa paste_1 is not defatted cocoa paste, and Cocoa paste_2 is wholly or partly defatted cocoa paste

Source: Amonarmah consults; data from EUROSTAT

Processors are increasingly expanding their grinding facilities in the countries of origin. Local governments of producing countries are likewise increasing or creating a support environment to increase local processing into semi-finished products. These initiatives partly contribute to lower the share of cocoa beans imported from producing countries (Figure 12). The initiatives are also partly contributing to the increased share of semi-finished products imported into Europe from cocoa origins.

For instance, in Côte d'Ivoire, the leading cocoa producer, the government reduced export taxes on processed cocoa products for companies that expanded their facilities. Instead of a fixed rate of 14.6%, export taxes on cocoa butter were reduced to 11%, on cocoa paste to 13.2%, and on cocoa powder to 9.6%. In Ghana, the second leading producer, there is a special area called the Ghana Free Zones allocated to processing companies. These companies receive benefits if they export at least 70% of their products, plus are allowed to import raw materials and machinery without paying taxes.

Such incentives are contributing to increased grinding at origin. The grinding capacity of Côte d'Ivoire is currently estimated to exceed 700,000 tonnes. Many new cocoa processing facilities are being set to be built in Côte d'Ivoire in 2023 and beyond. The private sector is also supporting local processors. For example, since 2018 GIZ has supported small factories in Côte d'Ivoire to process cocoa. The export volumes of semi-finished products from Côte d'Ivoire increased by 3.2% year-on-year, rising from 109,000 tonnes in the last quarter of 2021 to 112,500 tonnes in the last quarter of 2022.

Growing interest in single-origin chocolate in Europe is also contributing to interest in semi-finished products from origin countries. The place where the cocoa comes from is important for the taste and how it is marketed. This applies to both convenience and specialty brands. Some European chocolate makers, traders and distributors buy semi-finished cocoa products directly from the countries where the cocoa is grown. They do this to sell to other companies in Europe or directly to customers. Companies include Estonian trader Panamir and Dutch distributor Vehgro.

Tracing of origin is a big, developing trend in the cocoa industry that is expanding the processing of cocoa beans into semi-finished products at origins. You can find many single-origin cocoa products in Europe. For example, Barry Callebaut offers single-origin cocoa powders. This trend also means more investments and demand for cocoa products processed in the countries the cocoa comes from. In 2021, Cargill completed a US$100M cocoa-processing expansion in Côte d'Ivoire, meeting growing customer demand for dark brown cocoa powders. They also committed an additional US$13M to support local sustainability and traceability efforts.

Growing cosmetic and pharmaceutical market for cocoa products

The confectionery sector is the main user of semi-finished cocoa products. Most semi-finished products are used in the production of cocoa and chocolate-based compounds. But the cosmetics and pharmaceutical industries are increasingly using cocoa products like cocoa butter as inputs in their manufacturing.

Europe is a leading market for cosmetics and personal care products. It is also home to the global pharmaceutical industry and the oldest active pharmaceutical company, Merck KGaA. The pharmaceutical and cosmetics markets are expected to grow steadily by 5.4% and 2.9% yearly, respectively, until 2028. As the use of cocoa butter in these industries increases, the demand for cocoa butter is also expected to rise The biggest cosmetics markets in Europe are Germany (€13.6 billion), France (€12.0 billion), Italy (€10.6 billion), the UK (€9.9 billion), Spain (€6.9 billion) and Poland (€4.0 billion).

The growing interest in cocoa butter by the cosmetics and pharmaceutical industries is due to the benefits of cocoa butter: it is rich in fatty acids and known for its hydrating, nourishing and elasticity-improving properties. Cocoa butter is used in cosmetics to smooth scars, wrinkles and other skin marks. It forms a protective layer on the skin to keep it moisturised. It also contains natural plant compounds called phytochemicals, which improve blood flow and protect against harmful UV rays.

Pharmaceutical companies also utilise cocoa butter for its physical properties. It is especially known as a non-toxic solid that melts at body temperature. This makes it an ideal base for medicinal suppositories. Cocoa ingredients are increasingly incorporated into medicinal formulations for various health and gastrointestinal disorders.

In response to the growing demand for cocoa and also for ethical products, Cargill Beauty sources cocoa butter for the cosmetics market. This is part of Cargill's sustainability initiative, a cocoa promise that started ten years ago. This cocoa butter is sourced from Ghana, Cameroon and Côte d'Ivoire, and has been certified by the Rainforest Alliance. Companies supplying cocoa butter in Europe include Dietz Cacao Trading, CocoaSupply and Tunteya.

Growing interest in premium and specialty chocolates

The size of the European premium chocolate market reached €6.6 billion in 2022 and is expected to grow considerably in 2023-2028, to a worth of €10.2 billion. This growth is to be driven by the rise in demand for vegan, organic and gluten-free chocolates. Health, seasonal demand and gifting are also drivers of the expected growth.

Premium chocolate is a special kind of chocolate that is better than and different from regular chocolate: it is made from top-quality cocoa beans and has a higher percentage of cocoa. It also has unique features like ethical sourcing, special ingredients like raspberries or alcohol to enhance flavour, and fancy packaging. It may come in different cocoa amounts, like 50-60%, 61-70%, 71-80%, 81-90% and 91-100%. Lindt & Sprüngli (Switzerland) is famous for its premium chocolate products.

While the premium chocolate market sees growth, so does that of specialty chocolates – in fact, at an expected average annual rate of 9.93% for 2023-2028. Specialty chocolates often emphasise unique or rare cocoa bean varieties. They highlight the distinct flavours associated with specific regions or origins. They may feature single-origin cocoa beans or unique blends known for their exceptional taste profiles. Europe plays an important role in the specialty chocolate market, with an expected superlative growth for 2023-2028.

Cargill is planning to invest in increasing the capacities of their production lines to expand their footprint in specialties. They plan to add 60% capacity to their chocolate coatings & fillings plant in Deventer (Netherlands). At the same time, they are tripling their white liquid chocolate line in Berlin (Germany) by installing new equipment and upgrading old equipment. The new line will become operational in April 2024.

Some specialty chocolates are made from couvertures. A large share of the couvertures used for the manufacturing of specialty chocolate in Europe are produced in Europe itself. Barry Callebaut and Valrhona (France) dominate the couverture market in Europe. There are also numerous European artisanal chocolate makers that produce couverture, like Chocolaterie de l'Opéra and Chocolaterie du Pecq (France), Zotter (Austria), Original Beans (Netherlands) and Chocolate Tree (UK). One European distributor selling couvertures is The High Five Company (Netherlands).

Companies in cocoa-producing countries that are tapping into the trend of offering craft couverture include CocoaRunners (Colombia), Cafiesa (Ecuador), Orquídea (Peru), To'ak (Ecuador), Ingemann (Nicaragua) and Xoco Gourmet (Honduras).

Increased competition for cocoa beans due to price hikes

The pandemic made people buy less chocolate, so there was more cocoa in storage. But now that people are eating more chocolate again, the stockpile is going down. Cocoa bean imports are also dropping, leading to a decline in grindings at export destinations. This is because cocoa bean prices have gone up substantially, reaching the highest levels in more than ten years.

Bean processing by multinational companies at destination have also decreased due to higher cocoa bean prices. High operating costs, inflation pressures and increased energy costs are also reasons for decreased processing at destination. But chocolate makers expect cocoa bean prices to remain high until 2024. Some companies protected themselves from major price increases in the past, but might feel the impact by the second half of 2023.

One main reason for the price hikes is declining cocoa production in West Africa. This is where most cocoa comes from. The El Niño weather pattern and crop-damaging diseases are causing problems. Côte d’Ivoire, the world's biggest cocoa producer, expects to have almost 20% less cocoa in its upcoming harvest compared to last year. Ghana, the second-largest producer, is also having a lower output than usual. This might cause a shortage of cocoa for the third year in a row.

Despite rising prices, cocoa beans vary in cost due to factors like size, quality and flavour. High-quality fine flavour beans command premium prices compared to lower-grade varieties. Certification, growing region, processing, and fermentation methods also impact cocoa prices, with superior beans fetching higher rates. For instance, Ghana’s cocoa beans receive high premium compared to cocoa from other origins.

The hikes in cocoa bean prices can make it difficult for SMEs to compete with large multinationals for cocoa beans processing. SMEs can prepare for higher prices by keeping more cocoa beans in storage, yet this can also affect their processing and sales. To compete, some SMEs might choose to buy cheaper or low-grade cocoa beans. But this could affect the quality of their cocoa products, since cheaper or low-grade beans are sub-standard in terms of quality. Good quality is important to keep customers happy and do well in the market. In a busy market, SMEs need to be different to get customers. They should offer special flavours or special types of cocoa. When high prices make it difficult for you to compete for cocoa beans, look for markets that want cheaper semi-finished products and also do not care about quality.

The bean shortage can make it challenging for small cocoa processors to get enough cocoa beans. This can affect the making of high-quality products to stand out in the market. In producing countries like Ghana, the government sells beans through contracts, but these contracts might not be available for small cocoa processors. The government might first give beans to large multinationals and only after that think about the small factories.

The European Union Deforestation Regulation (EUDR) offers both opportunities and threats for semi-finished cocoa products

The EUDR came into full force on 23 June 2023. Exporters into the European Union have up to 30 December 2024 to fully comply with the regulation, which aims to prevent deforestation associated with the production of certain commodities, including cocoa. The EUDR will ensure that semi-finished cocoa products imported into the EU are deforestation-free. Specifically, these products should not be associated with any deforestation that took place after 31 December 2020.

The rule makes it hard for products that aren't environmentally friendly to be sold in Europe. Semi-finished cocoa products that come from places or processors that do not follow the EUDR rules cannot be sold in Europe.

On the other hand, the EUDR offers great opportunities for processors and sellers of semi-finished cocoa products that adhere to the regulations, granting them access to the EU market. In Europe there is a strong emphasis on eco-consciousness and responsible sourcing. Therefore, cocoa-processing ccompanies in producing countries who demonstrate their commitment to environmentally friendly products can readily find European business partners. Conversely, European businesses seeking partners in cocoa-producing countries will prefer those that comply with these standards and can provide evidence of their commitment. Such cocoa origin processing companies will enjoy an expanded customer base.

Tips:

- Read our study on trends for cocoa to learn more about current trends on the European market. Also check out our study on Entering the European market for semi-finished cocoa products to be aware of European Union regulation important to accessing the European market for semi-finished cocoa products. Check out these 10 key things you should know about the new EU Deforestation Regulation.

- Promote sustainable and ethical aspects of your production process. Support these claims with certification. Read our study on doing business with European buyers of cocoa for more tips on marketing and promotional aspects of your cocoa.

- Find potential business partners in Europe by checking the lists of Fairtrade-certified operators, Rainforest Alliance/UTZ-certified cocoa supply chain actors and organic-certified companies.

- Develop and articulate your unique selling points as a supplier of cocoa products. Consider which factors set you apart from your competitors, as mentioned in the text above, and create your marketing story around these factors. Such factors could relate to your cocoa characteristics (origin, agroclimatic characteristics of producing region, quality and flavour profile) and value addition (your processing techniques, the culture of the producing communities, certifications and accompanying documentation).

- Explore different markets for your cocoa products. This might involve targeting local markets, specialty or niche markets, or even exporting to neighbouring countries.

Amonarmah Consults carried out this study in partnership with Molgo Research and Long Run Sustainability on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research