Entering the European market for speciality cocoa

The specialty cocoa market values transparency, innovation, expertise and quality. Companies are willing to pay higher prices for these qualities. It is important to identify the aspects that differentiate your cocoa from conventional cocoa. These differences can be based on origin, flavour, post-harvest practices, sustainability and more. Direct trade, long-term relationships and fair pricing are important features in the specialty cocoa trade. It is a high-potential market for cocoa producers and exporters.

Contents of this page

1. What requirements and certifications must specialty cocoa comply with to be allowed on the European market?

To export specialty cocoa to the European Union (EU), you need to meet strict requirements and expectations set by public policy and the market. For a complete overview of these standards, refer to our study on buyer requirements for cocoa. You can also consult the specific requirements for cocoa on the EU’s Access2Markets website.

The requirements can be divided into the following.

- Mandatory requirements: legal and non-legal requirements you must meet to enter the market.

- Additional requirements: requirements you need to comply with to keep up with the market.

- Niche requirements: requirements that apply to specific niche markets.

The main requirements are given below and specified for the specialty cocoa market when possible. In general, specialty cocoa commands higher prices, and buyers have more expectations in terms of quality and food safety.

What are mandatory requirements?

Food safety

You must comply with European Union legal requirements in terms of food safety and hygiene. There are several key requirements on the legal limits for food contaminants. The most common include:

- Pesticides. Consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide.

- Mycotoxins. Ochratoxin A is of special relevance for cocoa powder and updated in January 2023.

- Mineral oil aromatic hydrocarbons (MOAH) of synthetic origins. Packaging and processing contaminants cause health concerns, particularly in food for infants and young children.

- Microbiological contamination, such as salmonella, although cocoa is considered low-risk.

Heavy metals like cadmium pose a health risk. Cadmium occurs naturally in soil. Pesticides and chemical fertilisers that contain cadmium are also contamination sources. The presence of cadmium is a particular problem in cocoa grown in some Latin American countries. This is due to factors like volcanic activity and forest fires. The European Union strengthened its regulation on maximum cadmium levels in chocolate and derived products in January 2019. Note that these levels relate to finished chocolate products. However, European importers adjust them so they apply to the cocoa beans they source. Cocoa bean buyers need to perform analyses to test cadmium levels.

Climate change mitigation

Specialty cocoa might have stricter requirements on the use of pesticides and fertilisers than bulk cocoa. As part of the EU Green Deal (EGD), the Farm to Fork strategy has targets to reduce the use of agrochemical pesticides and fertilisers and increase organic farming surface area to create a healthier and more sustainable food system. The EU cooperation strategy supports producing countries in contributing to these objectives.

Another important EU legal requirement is the regulation on deforestation-free products. This came into effect in June 2023. One key aim is to ensure the EU market does not contribute to deforestation through the consumption of cocoa products. Cocoa buyers in the EU need to specify the origins of their products to national regulators. This requires better traceability systems in their value chains. Traceability systems can be less relevant for specialty cocoa, especially craft manufacturers. Greater product traceability and transparency on farm practices already exist in the specialty cocoa value chain. This regulation is part of the broader Corporate sustainability due diligence regulation. The directive was approved by the European Commission in February 2022 and went to the European Parliament and the European Council for approval.

Quality

If you want to access the European market for specialty cocoa beans, you need to meet your buyer’s quality standards. Quality in the specialty cocoa segment refers to:

- Physical requirements, like the cocoa having no defects;

- Sensory aspects, such as taste and aroma;

- Uniqueness;

- Specific qualities that are unique to certain origins.

There is no generally accepted definition of specialty cocoa. As such, there is not an agreed international methodology for assessing high quality cocoa for buyers and consumers.

In general, European buyers assess the quality of cocoa beans in different ways. The guide, Cocoa Beans: Chocolate & Cocoa Industry Quality Requirements, provides recommendations on cocoa farming, post-harvest practices and quality evaluation methods that contribute to quality.

Other cocoa quality assessment methodologies and international cocoa standards that are commonly used among chocolate makers and cocoa traders include:

- The ISO’s Standards on classification and sampling for cocoa beans.

- The Fine Cacao and Chocolate Institute (FCCI)’s cocoa sampling protocol and cocoa grading form.

- Heirloom Cacao Preservation’s genetic evaluation of cocoa to identify and value cocoa and its flavour.

- Equal Exchange/TCHO’s quality assessment and tasting guide to assess the quality of cocoa along the value chain.

In September 2023, the Cocoa of Excellence Programme published the Guide for the Assessment of Cocoa Quality and Flavour. This was coordinated by the Alliance of Bioversity International and the International Center for Tropical Agriculture (CIAT). These standards describe how to:

1) Sample cocoa beans for evaluation;

2) Assess their physical quality;

3) Process them into coarse powder, liquor and chocolate;

4) Establish a sensory evaluation of the flavours expressed in these three products.

The standards do not have a scoring system like the coffee sector does. The Specialty Coffee Association’s cupping protocol developed a 100-point scale in which coffees are considered as specialty coffees if they score above 80 points.

Buyers of specialty cocoa may also have strict requirements on the use of agrochemical pesticides and fertilisers. Consumers increasingly associate health and cocoa quality with organic farming. As such, buyers may require organic certification. This complements the sensory experience for consumers and encourages more sustainable farming practices. These practices are also healthier for farmers.

Labelling and packaging

Jute bags are still common in the specialty cocoa segment. For high-quality micro-lots, vacuum-sealed GrainPro packaging can be used. Although very common, it is important to ensure that jute bags are made with vegetable oils rather than synthetic materials. Mineral oil aromatic hydrocarbons (MOAH) are one such synthetic material. These are known to be contaminants that pose a health concern. There are currently no legal limits for MOAH but, in Germany, recommended ‘benchmark levels’ have been created. One study found that half of the sampled packaging in Italy and all of the sampled packaging in Northern Macedonia exceeded these limits.

The labelling of specialty cocoa beans exported to Europe should comply with the general food labelling requirements of the European Union. Labels should be in English and need to include the following topics to ensure traceability of individual batches:

- Product name

- Grade or specification

- Lot or batch code

- Country of origin

- Net weight in kilogrammes

- Supplier’s name

If your cocoa is organic, Fairtrade or has another certification, the label should also include the name/code of the inspection body and the certificate number.

Tips:

- Read the study on buyer requirements for cocoa beans in Europe for full buyer requirements.

- Check the EUROLex website for more detailed information about the regulations concerning cocoa products.

- Read more about the quality requirements of the European industry for cocoa beans on the Cocoa Quality website.

- Learn more about maintaining the quality of your cocoa during transportation on the Transportation Information Service website.

- Read more about trading and shipping cocoa beans in the International Trade Centre’s Cocoa guide to trade practices.

Additional requirements

Food safety and hygiene

Buyers in Europe might ask for extra food safety practices from you. Regarding production and handling processes, you should consider the following:

- Implementing good agricultural practices (GAPs). The main standard for good agricultural practices is provided by GLOBALG.A.P. This is a voluntary standard for the certification of agricultural production processes that provide safe and traceable products. Certification organisations (e.g. the Rainforest Alliance) often incorporate GAPs in their standards.

- Implementing a quality management system (QMS). A system based on Hazard Analysis and Critical Control Points (HACCP) is often a minimum standard. This is required at the level of storage and handling of cocoa beans.

Sustainability

Many traders and chocolate makers in the specialty segment follow the principles of sustainable sourcing. This means that they expect greater transparency throughout the value chain. They promote and invest in sustainable farming practices at origin. They do so through price premiums and projects. Examples include equipment and having systems in place to trace cocoa products across suppliers. Company sustainability programmes can be assessed by company visits and/or third-party audits. Some specialty cocoa importers with sustainability programmes include Ethiquable, Alter Eco, Kaoka and Saveurs & Nature, and German companies GEPA and El Puente.

Tips:

- Refer to the International Trade Centre (ITC) Standards Map App or the Global Food Safety Initiative (GFSi) website. Here, you can learn about the different food safety management systems, hygiene standards and certification schemes.

- Find out what standards or certifications are potential buyers in your target segment prefer. Buyers may prefer a certain food safety management system. Learn more about organic farming and organic guidelines on the European Union website and the OrganicExportInfo website.

Niche market expectations

Organic certification

Although a small portion of the global cocoa market, the organic segment is growing. The market value for organic chocolate is expected to grow by 2.39% between 2022 and 2026 (year-on-year growth). To market your cocoa as organic in the European market, it needs to comply with the European Union’s regulations for organic production and labelling. If you want to export to European countries outside of the EU, check the required legislation for that country. For instance, Switzerland has its own Swiss Organic Law.

Several changes have been made to the EU organic regulations over the past four years. You can check the IFOAM Organics Europe website to keep up with developments. In February 2020, an important change was implemented: Certificates of Inspection (COIs) must be issued by control authorities prior to the departure of a shipment. If this is not done, your product cannot be sold as organic in the EU. It will be sold as a conventional product instead. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

In January 2022, the European Union's organic regulation saw important changes to group certification and internal control systems (ICS). A key change made to the definition of ‘group of operators’ will require most already-certified organic smallholder producer groups to restructure their organisations so they comply.

Before you can market your cocoa as organic, an accredited certifier must audit your farming operations and processing facilities. Refer to this list of recognised control bodies and control authorities issued by the EU. It ensures that you always work with an accredited certifier.

Tips:

- Find importers that specialise in organic products on the Organic-bio website.

- Visit trade fairs for organic products, like Biofach in Germany. Check out their website for a list of exhibitors, seminars and other events.

- If you have more than one certification, try to combine audits to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region. See the study on Multi-certified coffee for more details about multi-certification in coffee. The study is not about cocoa, but the motivations and the requirements for multi-certification are similar in cocoa.

2. Through what channels can you get specialty cocoa on the European market?

The market for specialty cocoa is relatively small and highly specialised. It operates on its own dynamics of supply and demand. Quality, uniqueness and scarcity are distinctive features. Specialty cocoa targets the high-end market segment. The value chain is often more direct and transparent between chocolate makers and cocoa producers. This closer relationship makes it more possible to share value fairly throughout the supply chain.

How is the end-market segmented?

This is where ICCO’s two separate definitions for fine cocoa and flavour cocoa are important. In the high-end segment, specialty cocoa is usually used without blending with other beans for fine chocolate products. Specialty cocoa in the middle-range segment can be used for single origin cocoa (without blending). The cocoa can also be blended with other specialty cocoa to ensure consistency in the chocolate’s flavour and aroma profile. However, if different origins are blended together, then the cocoa cannot be considered single origin.

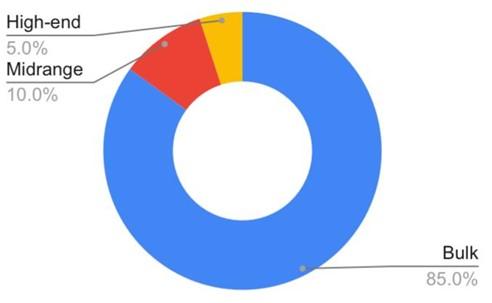

Figure 1: Segmentation of the chocolate market based on product quality

Source: Author’s estimation based on available literature

Middle range

The middle range segment includes chocolate products that have good quality cocoa and are sold under both branded and private labels. Brands are increasingly telling the story of how cocoa is grown at its origin. This is mainly done for marketing purposes. Certified cocoa is increasingly used and helps the storytelling surrounding sustainable cocoa farming. Examples of brands promoting storytelling include the Rainforest Alliance, Fairtrade and organic. A well-known example of a European middle-range brand that does not use certification is the Swiss brand Lindt & Sprüngli.

Retailers are making more private-label chocolate products with specialty cocoa. These products can also be organic certified. Not all specialty cocoa is organic certified, but the combination can add more value to the product and appeal to more consumers. These products are often more affordable than branded products and then reach consumers of all profiles. The private-label specialty chocolate market is expected to continue growing in the coming years.

Middle-range products are mainly sold at supermarkets and specialised shops. These specialised shops can include organic supermarkets. Examples are Farmy (Switzerland) and Ekoplaza (the Netherlands).

High-end

The high-end segment uses specialty cocoa for their chocolate products. This is mostly fine flavour cocoa. These chocolate makers tend to be specialised and small-scale. This allows them to have closer relationships with cocoa producers and exporters. This means they can source cocoa that is unique, scarce, and has desirable tastes and aromas. They might have preferences for specific cocoa varieties. High-end products are characterised by high cocoa content.

Single-origin chocolates are an important part of this segment. These products target consumers of premium products. As such, there is greater revenue that can be more fairly and directly shared with suppliers. One example is bean-to-bar chocolate. With bean-to-bar chocolate, the chocolate is made from scratch by a single producer. The whole supply chain is controlled, and there is a direct link to producers of premium cocoa beans.

High-end chocolates are mainly sold through specialty shops, online or at public events. European bean-to-bar brands include:

- Blanxart (Spain)

- Original Beans (the Netherlands)

- Domori (Italy)

- mi joya (Belgium)

- Fjåk Chocolate (Norway)

Examples of specialty web shops in Europe are Chocolats-de-Luxe.de (Germany) and Chocoladeverkopers (the Netherlands). Trade fairs where high-end chocolate can be bought include:

- Salon du Chocolat (with fairs in France, Belgium, Italy and the United Kingdom)

- Chocoa (the Netherlands)

Tips:

- Take a look at the ICCO website to see which countries export Fine Flavour cocoa.

- See this map on the Fine Cacao and Chocolate Institute website to find companies active in the specialty cocoa market.

Through what channels does a product end up on the end market?

Specialty cocoa beans in Europe are sourced through a few main types of buyers. These companies tend to vary in:

- Company size;

- Operations’ scope;

- Product specialisation;

- Directness of relationship with cocoa producers.

The relationship with cocoa producers is less direct if volumes are aggregated or combined by aggregators. This can be done to organise producers and meet buyers’ requirements in terms of volume.

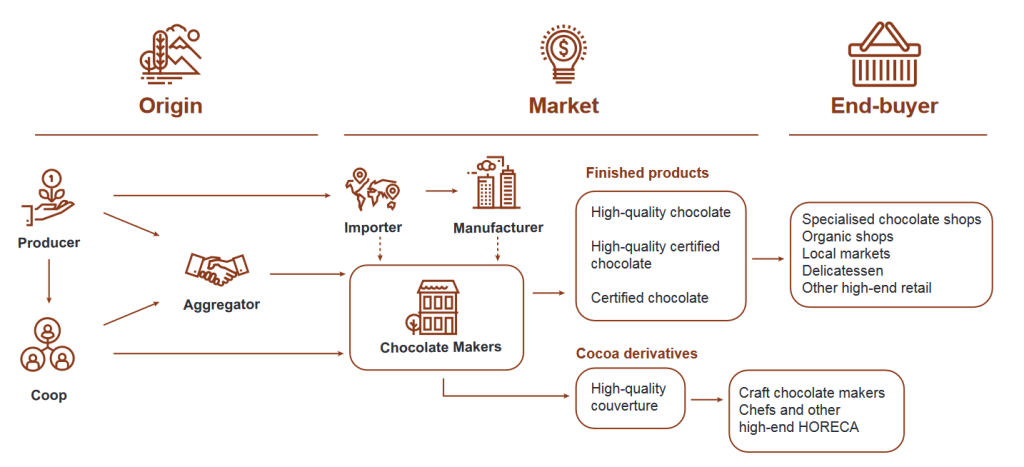

Figure 2: Chocolate market channels by buyer type

Source: GROW Liberia

Importers

There are importers that specialise in the specialty cocoa trade. They typically source smaller volumes and distribute in their own countries or regions. Craft manufacturers are key clients for them. These importers have more direct relationships with producers like co-operatives and carry out their own quality checks. They sometimes engage in processing as well.

Examples of specialty cocoa traders are:

- Bohnkaf-Kolonial (Germany)

- WalterMatter (Switzerland)

- Le Cercle du Cacao (Belgium)

- Tradin Organic and Cocoanect (the Netherlands)

Medium to large chocolate manufacturers

Some branded chocolate manufacturers source specialty cocoa beans. Examples are:

- Lindt & Sprüngli (Switzerland)

- HALBA (Switzerland)

- Ritter Sport (Germany)

- Valrhona (France)

The largest chocolate manufacturers are also entering the specialty chocolate market. For example, Nestlé’s brand L’Atelier chocolate is marketed as craft and artisanal chocolate. Mondelez owns the Swedish brand Marabou, which also has a premium range.

Specialised private label manufacturers are gaining influence as private label specialty chocolate is becoming more popular. As such, these companies can also be an interesting channel for your specialty cocoa beans. Examples include Dillicious (Germany) and Felchlin (Switzerland). A few manufacturers offer high quality chocolate for the private label market while producing its own bean-to-bar brands. An example is Chocolate Naïve (Lithuania).

Small chocolate makers

This buyer type works almost exclusively with specialty cocoa. This is their competitive advantage in the market. These highly specialised companies have more direct relationships with producers to support farmers in growing the high quality cocoa they require. However, some small-scale manufacturers are not able to sustain direct trade. They may not have the capacity to carry out all the responsibilities necessary to export to the EU or to meet the buyer requirements.

Examples of bean-to-bar brands in Europe that source part of their cocoa directly from producing countries are:

- Blanxart (Spain)

- Mesjokke and Original Beans (the Netherlands)

- Domori (Italy)

- Svenska Kakao (Sweden)

- Georgia Ramon (Germany)

What is the most interesting channel for you?

The most promising market channel for your business depends on how well-positioned your product and organisation are. A producer group selling specialty cocoa is likely to be successful by selling its cocoa beans directly to specialised cocoa importers. If you produce and/or export high-quality cocoa beans at their origin, it might be interesting to try to work with high-end chocolate makers directly. Targeting specialty chocolate makers directly – particularly bean-to-bar – producers and exporters are recommended to deal with specialty cocoa beans. This means you need to have the financial and technical capacity to organise export activities.

For larger-scale producer groups (e.g. unions) and exporters who can demonstrate experience serving this market, you could explore supplying larger chocolate makers, if there is a product-market fit. There are some examples of producers setting up local processing facilities to add more value. However, this requires a lot of financial and technical capacity. Promising examples tend to be through joint ventures with European-based companies. Our study on the European market for semi-finished cocoa products discusses this subject in more depth.

Tips:

- Find buyers who match your business philosophy and export capacities in terms of quality, volume and certifications. See our study on finding buyers on the European cocoa market for practical tips.

- Attend trade fairs in Europe to meet potential buyers. Interesting trade events include Biofach (organic products only), Chocoa (the Netherlands) and Salon du Chocolat (with events in France, Belgium, Italy and the United Kingdom). Attending these events can provide you with additional insight into European buyers’ preferences in terms of origin, flavour and sustainability certification. By understanding the market better, you can ensure that your specific product corresponds to the demand and requirements.

- Use industry associations focused on the specialty market to find potential buyers in Europe. Examples are the Fine Cacao and Chocolate Institute (FCCI) and the Fine Chocolate Industry Association (FCIA).

- Invest in long-term relationships. Whether you are working through an importer or directly with a chocolate maker, it is important to establish a strategic and sustainable relationship with them. This will help you manage market risks, improve the quality of your product and reach a fair quality/price balance. For more tips, read our study on doing business with European cocoa buyers.

3. What competition do you face on the European specialty cocoa market?

On the EU market, you will compete on agricultural factors. Examples are country of origin, flavour profile, farming practices and post-harvest practices (fermentation style). You will also compete at a business level on how much value you can add to your cocoa products. Examples are local processing, the scale of your business, and directness of relationship with chocolate makers. Traditionally, Latin America has led the world in fine flavour and organic supply.

The factors that differentiate you in the market are even more important as large, established chocolate manufacturers are increasingly entering this segment.

Bear in mind that the government policies in cocoa-producing countries have a significant influence on the sector’s development and opportunities in specialty cocoa. This includes being listed in ICCO’s list of fine flavour producing countries.

Which countries are you competing with?

You will compete with other specialty cocoa producers and exporters that can be found on the ICCO’s Fine Flavour country list. Traditionally, Latin America has led the world in fine flavour and organic supply. Countries in Africa and Asia have potential but have to compete with Latin America.

The specialty cocoa market is competitive and hard to enter

The barrier to entering the specialty cocoa market is relatively high. Quality requirements are demanding from buyers and can vary greatly across buyers due to their specialisation. The Cocoa of Excellence standard (published in September 2023) for assessing cocoa quality makes a significant contribution to providing a single reference. Yet, it may not fully satisfy all aspects in determining fine flavour.

In addition, only governments can apply for fine flavour status, which adds a political component to this market. Producing countries with an organised cocoa sector, governmental support and lobbying power have higher chances of success. Governments that strongly support their fine flavour cocoa sector include Ecuador, Peru, and the Dominican Republic. For example, in December 2020, Brazil and Haiti, were added to the ICCO list of fine flavour producing countries.

Ecuador, Peru and the Dominican Republic lead the supply of fine flavour and organic cocoa to Europe

Of the 25 fine flavour cocoa producing countries, the majority (20) are located in Latin America. Latin America accounts for about 80% of all fine flavour cocoa production in the world. Ecuador is the leading supplier globally with over 260,000 metric tonnes of fine flavour cocoa exported in 2021. Ecuador’s cocoa is known for its floral and fruity notes. Peru and the Dominican Republic are also important global players accounting for around 40,000 metric tonnes of fine flavour cocoa exports in 2021. Although big producers of fine flavour cocoa, Brazil and Colombia do not export much, and they mainly serve national markets.

In 2021, the largest suppliers to Europe from the ICCO list were Ecuador with 70,648 metric tonnes, the Dominican Republic with 33,246 metric tonnes, and Peru with 22,654 metric tonnes. Note that most cocoa beans from these countries are defined as fine flavour. This leading position is mainly explained by natural advantages (varieties and soil) in the countries of origin. However, Ecuador and Peru, for instance, the stricter EU regulation on cadmium levels in chocolate present a challenge.

The total volume of organic cocoa beans imported into the EU was 65,761 metric tonnes in 2019. Dominican Republic and Peru were the largest exporters of organic cocoa beans to the EU, with a 37% and 20% share of the total volume. Both countries have national strategies to distinguish their cocoa in the global market by focusing on quality and sustainability.

Fine flavour cocoa is also produced in other Latin American countries. Successful companies that already export to the European market and that you can learn from include Casa Franceschi (Venezuela), Hacienda Betulia (Colombia), Ingemann (Nicaragua) and Xoco Gourmet (Central America, mainly active in Honduras, Guatemala, Belize and Nicaragua).

Madagascar, Sierra Leone and the Democratic Republic of Congo are promising suppliers but lack volumes

Madagascar is known for the desirable fruity and citrus tastes and aromas of its specialty cocoa. It is in high demand in Switzerland. In 2020, the country produced only 12,500 metric tonnes. The market has recognised Uganda for the uniqueness of its cocoa, some of which is organic certified. The country is increasing exports to Europe, exporting over 13,000 metric tonnes in 2021. However, it is an origin not listed with ICCO as a fine flavour country. This can make it more difficult to have buyers recognise the cocoa as high quality and to sell it for a higher price.

Sierra Leone and the Democratic Republic of Congo (DRC) are Africa’s largest suppliers of organic cocoa to Europe. The countries are not considered fine flavour. In 2019, Sierra Leone increased exports to the EU to 11,166 metric tonnes or 17% of the EU’s organic cocoa imports. Although in decline recently, the DRC exported 5,679 metric tonnes to Europe the same year. Both countries have seen efforts by donors and companies to promote organic cocoa as an alternative source to Latin American cocoa beans due to the cadmium issue.

Asia has yet to get established as a fine flavour supplier

In Asia, the main origins for fine flavour cocoa are Vietnam, Indonesia and Papua New Guinea.

Vietnam achieved fine flavour status in 2016. ICCO recognises 40% of exports as being in this segment. Despite this achievement, the country has consistently exported less than 50 metric tonnes annually to Europe. Vietnamese cocoa has been known to have unbalanced acidity, although there have been efforts to address the issue. The country also has high levels of agrochemical pesticide and fertiliser use, which is supported by the government. This is less desired by many specialty cocoa buyers.

Indonesia has increased production of fine flavour cocoa and ICCO now recognises 10% of the total exports as fine flavour. That is an important volume considering the country grew 170.000 metric tonnes of cocoa in 2020. However, it is less interesting for Europe from the perspective of bean exports. Indonesia has differentiated itself by focusing on local processing of bulk cocoa by both national and European companies.

Papua New Guinea is an increasingly relevant fine flavour origin. In 2021, total exports amounted to 26,000 metric tonnes. However, export volumes to Europe are modest at 1,500 metric tonnes, and goes principally to Belgium.

Table 1: The top five suppliers of fine flavour cocoa beans to the European market before and after the COVID-19 pandemic (in metric tonnes)

| Country | Fine Flavour % | Total EU imports 2019 | Total EU imports 2021 |

| Ecuador | 75% | 86,040 | 70,648 |

| Dominican Republic | 60% | 33,364 | 33,246 |

| Peru | 75% | 32,528 | 22,654 |

| Madagascar | 100% | 7,478 | 6,473 |

| Venezuela | 100% | 3,508 | 2,298 |

Source: World Integrated Trade Solution (WITS) by World Bank in collaboration with United Nations Conference on Trade and Development (UNCTAD)

Tips:

- Identify potential competitors. To be successful as an exporter, it is important to learn from them. Focus on their marketing strategies, the product characteristics they highlight and their approaches to value addition. By following strict quality regulations, using technical standards and choosing the right marketing strategies, you can stand out from your competition.

- Identify and communicate your unique selling points. Give detailed information about your cocoa growing region (origin) and the varieties, qualities, processing techniques and certification of the cocoa you offer. You can also share information about the history of your organisation, your cocoa growing farm(s), and the passion and dedication of the people working there. These are all elements that make your company unique.

- Actively promote your company on your website and at trade fairs. Flavour quality competitions also provide an excellent opportunity to share your story. One example is the International Chocolate Awards of the Cocoa of Excellence Programme.

- Work together with other cocoa producers and exporters in your region if you lack company size or product volume. Together, you can promote good-quality cocoa from your region and be a more attractive and more competitive supplier for the European market.

- Develop long-term partnerships with your buyer. This is often intrinsic to the specialty cocoa segment and implies that you always have to comply with buyer requirements and keep your promises. Doing so will provide you with a competitive advantage, more knowledge and stability on the European specialty market.

- Read more about the profiles of the different fine flavour cocoa origins in the world in this Perfect Daily Grind blog post. Also take a look at our studies on how to find buyers and how to do business for more information on how to access the European market successfully.

Which companies are you competing with?

The type of companies you will compete with partly depends on your country of origin. If you are based in Latin America, producers and exporters tend to be larger in the specialty cocoa segment, for instance in Ecuador and the Dominican Republic. It might be difficult to compete if you are a small-scale producer and are part of a local co-operative with limited export potential. This is even more true if local processing is not feasible for you. Producers in Peru and the Dominican Republic also tend to differentiate themselves with more sustainable farming practices, such as organic certification. If not yet certified, it might be interesting to see if a certification would be beneficial for you.

Producers in other regions with limited scale likely could find success by focusing on the unique tastes and aromas in their country of origin. In this case, direct trade can help you compete. Specialised buyers could support investments in farming and post-harvest practices necessary to bring your fine flavour cocoa to market. They will need to be able to tell the story of origin to their customers. Researching which markets and companies might have a potential product-market fit with the profile of your specialty cocoa is worthwhile.

Some inspiring company examples include:

- Paccari in Ecuador (local processing);

- Conacado in the Dominican Republic (large scale organisation, organic certified);

- Éthiquable (direct trade with Lazan’Ny Sambirano in Madagascar).

4. What are the prices for specialty cocoa?

Several factors affect the prices of specialty cocoa, including market and competitive forces. The futures market, currency exchange rates and public policy also play important roles. Retail prices can vary widely. They start from 20 EUR per kilogramme for brands and private labels in the supermarket. Prices may also amount 80–115 EUR per kilogramme, and they may be much higher in specialty and online shops. Specific value data is not publicly available.

Several factors influence prices for specialty cocoa

It is first important to understand the main factors that influence prices of specialty cocoa, particularly for bean exports. As a starting point, public policy in producing countries (e.g. subsidies) and importing countries (e.g. taxes) shapes the competitiveness of specialty cocoa exporters in the European market. Then the market logic of supply and demand can determine the price. The market logic includes production output, weather patterns, and pest and disease outbreaks. The specialty cocoa segment focuses on quality. Competitive forces are highly important, such as the comparative advantage of producing countries, product differentiation, value addition, directness and fairness in trading relations.

The role of the futures market for bulk cocoa is important to highlight here. Specialty cocoa sold to the middle range quality segment uses the price in London and New York as a reference. Buyers will pay a premium for sustainability characteristics and expect good quality cocoa. This approach tends to be seen with certified cocoa from Latin America. Specialty cocoa that is sold to the high-end quality segment has less need for the futures price as a reference. Price-setting is more subjective, particularly when considering uniqueness, scarcity and flavour profile. Buyers may be willing to pay more for the quality attributes they look to satisfy consumers with. This approach tends to be seen with craft manufacturers.

Retail prices for specialty chocolate can range between 20–200 EUR per kilogramme and more

Considering the key factors that influence price and how the high-end specialty chocolate operates separately from the commodity market, it is no surprise that retail prices can vary widely within the product segment and across countries. Using a 70% dark chocolate 100 gram tablet as a benchmark, a check of retail prices (September 2023) in specialty shops, supermarkets, and online revealed the following.

Middle range

A middle range branded chocolate bar, like Lindt & Sprüngli, retails between 30 and 70 EUR per kilogramme in the Netherlands. Brands that focus on sustainability, like Alter Eco, sells at 33.50 EUR per kilogramme in France. Nestle’s Atelier brand can be found at the Carrefour supermarket in France, costing between 18.75 and 20.25 EUR per kilogramme. Private label single origin chocolates, like Delicata, retail for around 20 EUR per kilogramme in supermarkets, in the Netherlands. In Switzerland, Halba sells for between 18.50 and 21 EUR per kilogramme at the Coop supermarket.

High-end

High-end chocolate in some of France’s premier specialty shops, like Chocolat Bonnat, can cost between 79 and 115 EUR per kilogramme. High-end chocolate bars, like Swiss brand Choba Choba, sell for 89 EUR per kilogramme. In the Netherlands, Original Beans retails at between 68 and 72 EUR per kilogramme in specialty shops.

Specialty chocolate prices have been largely unaffected by rising inflation in recent years. As part of the segment does not follow world prices, brands and retailers can see an opportunity for growth as consumers cut costs (e.g. eating in restaurants), preferring to indulge at home with premium chocolate. Some parts of the middle range specialty segment and low-end chocolate have been more affected by inflation. This is also due to an increase in the price of sugar.

Table 2: An overview of retail prices of dark chocolate (70% minimum cocoa) in selected European markets (as of September 2023)

| Brand | Price (€) per kilogramme (low) | Price (€) per kilogramme (high) |

| High-end | ||

| Chocolat Bonnat | 79 | 115 |

| Choba Choba | 89 | |

| Original Beans | 68 | 72 |

| Midrange | ||

| Lindt & Sprüngli | 30 | 70 |

| AlterEco | - | 33.50 |

| Halba | 18.50 | 21 |

Source: Author’s check of retail prices (September 2023) in specialty shops, supermarkets and online.

Tips:

- Learn more about promoting standard quality and specialty chocolate in mainstream European supermarkets. Examples include Albert Heijn (the Netherlands), Coop (Switzerland) and Carrefour (France). Compare their product ranges and price levels with specialised online stores. Another example is Chocoladeverkopers (the Netherlands).

- Refer to our study on trends in the cocoa sector to learn more about developments within different market segments.

Molgo Research carried out this study in partnership with Long Run Sustainability, Amonarmah Consults and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research