Entering the European market for tree-to-bar chocolates

Compliance with European legislation that applies to chocolate products is a minimum requirement for entering the European market. To position your product adequately in Europe, you will also need excellent marketing skills, good knowledge and connections on the market. As tree-to-bar is such a small niche market, there is no established trade structure, and products usually enter the European market through alternative channels. The exact channel will depend on your product and its profile, and your connections on the market. Your most direct competitors will come from Europe itself, with its growing number of local bean-to-bar makers.

Contents of this page

1. What requirements and certifications must tree-to-bar chocolate comply with to be allowed on the European market?

You can only export tree-to-bar chocolate products to Europe if you comply with strict European Union requirements. Buyer requirements can be divided into the following categories:

- Mandatory requirements.

- Additional requirements that buyers often have.

- Requirements for niche markets.

Legal and non-legal requirements you must comply with

Legal requirements

Like all food products marketed in the European Union, chocolate products must comply with the General Food Law (Regulation (EC) 178/2002) and the general rules on Food Hygiene (Regulation (EU) 2017/625). The General Food Law focuses on traceability. Therefore, it is important for tree-to-bar chocolate exporters to have reliable and well-documented information on their cocoa beans’ origins, including specific lot numbers and producer information.

Other legal requirements refer specifically to contaminants and residues. The most common are:

- Pesticides: There are no maximum levels for chocolate products specifically, but general maximum residue levels (MRLs) are defined at 0.01 mg/kg.

- Polycyclic-aromatic hydrocarbons (PAHs): For cocoa and derived products, the maximum Benzo(a)pyrene level is set at 5.0 μg/kg fat.

- Microbiological contamination such as salmonella. Although cocoa is considered low-risk, food safety authorities can withdraw imported chocolate products or prevent them for entering Europe when microorganisms are found.

- Heavy metals, especially cadmium. Maximum cadmium levels in the EU, as of 2019, are given in the table below. Note that some importers may require you to have cadmium lab results available.

Table 1: The EU’s maximum permitted levels of cadmium in chocolate

| Specific cocoa and chocolate products | Maximum permitted cadmium levels |

| Milk chocolate with ≤30% total dry cocoa solids | 0.10 mg/kg |

| Chocolate with ≥30 to <50% total dry cocoa solids | 0.30 mg/kg |

| Chocolate with ≥50% total dry cocoa solids | 0.80 mg/kg |

Source: European Commission

There is a specific Directive relating to cocoa and chocolate products intended for human consumption: 2000/36/EC. This document states that, to avoid substitution with other vegetable oil alternatives by mainstream chocolate makers, the European Commission regulates the use of these alternatives within the chocolate industry. An addition of up to 5% of vegetable fats other than cocoa butter is allowed in Europe. But fine chocolate makers in Europe often commit to using 100% cocoa butter in their products. High-quality tree-to-bar chocolates are also expected to use cocoa butter, and no other substitute vegetable oils.

Labelling requirements

European Union food labelling rules ensure that consumers receive essential information that allows them to make an informed choice when purchasing their food. The information on the label must be accurate, easy to see and understand, not misleading and hard to remove/erase. The language to be used on the label depends on your target market. In general, the label should be in the official language of the country where your product is sold. But multi-language labels can also be used.

The following information is required on the packaging:

- Name of the product

- Ingredient list (including any additives like sweeteners)

- Allergen information

- Quantity of certain ingredients

- Date marking (best before / use by)

- Country of origin

- Name and address of the food business operator established in the EU or importer

- Net quantity

- Any special storage conditions and/or conditions of use

- Nutrition declaration

In case your chocolate is organic and/or fair-trade certified, the label may contain the certification logo. Note that the term organic and the European Union’s organic logo can only be used for products which comply with Regulation (EU) 2018/848.

Figure 1: An example of tree-to-bar packaging and labelling for the European market

Source: Kuná Chocolate

Packaging requirements

There are specific rules for consumer packaging materials which come in contact with the chocolate. Rules regarding this are given in Regulation (EC) No 1935/2004. It is important that packaging materials used for your chocolate product do not endanger human health, change the composition of the food in an unacceptable way or deteriorate its taste and odour. Common restricted substances include:

- Vinyl chloride monomer N-nitrosamines

- N-nitrosatable BADGE

- NOGE

- BFDGE

- Heavy metals

Import tariff on chocolate

Tariffs may apply to the import of chocolate products. This depends on the individual country, however, as European countries apply different import regimes for chocolate depending on an individual producing country’s status in terms of the Generalised System of Preferences (GSP), Economic Partnership Agreements (EPAs), or Bilateral Trade Agreements. To see if your country falls under one of these schemes, consult the list of trade agreements on Access2Markets.

The standard third country duty applicable to chocolate imports is: 8.30% + EA (Agricultural Component) MAX 18.70% + ADSZ (additional duty on sugar contents). Access this webpage to learn more about the EU/UK taxation and custom information.

Tips:

- Activate the “Translation” function in your browser to make the studies available in your native language.

- Refer to our study on buyer requirements for cocoa for a complete overview of standards for cocoa beans. You may also consult the specific requirements for cocoa on the European Commission’s Access2Markets website.

- Learn more about maintaining the quality of your chocolate during transportation on the website of the Transportation Information Service.

- Think about the packaging of your chocolate product beyond the legal requirements. Consider the size, bearing in mind that most high-quality chocolate products are presented in smaller packaging sizes, ranging from 50 to 100 grammes. Read this article by the Chocolate Journalist to learn more about attractive high-quality packaging for your chocolate product.

- To learn more about payment and delivery terms, refer to our study on Organising your cocoa export to Europe.

Additional requirements to keep up with the market

Additional food safety requirements

Food safety certification is not obligatory under European legislation. However, given the legal guidelines for food hygiene safety and traceability, distributors and importers will likely request extra food safety guarantees from you. A system based on Hazard analysis and critical control points (HACCP) is often a minimum standard required. Also, Good Manufacturing Practices (GMP) are the basic operational and environmental conditions required to produce safe foods. Buyers may require additional certification schemes, especially those recognised by the Global Food Safety Initiative, such as:

- British Retail Consortium Global Standards (BRC)

- International Featured Standards: Food (IFS)

- Food Safety System Certification (FSSC 22000)

Quality requirements

The quality requirements for tree-to-bar chocolate will vary widely according to the market segment you are aiming at accessing, as well as very specific buyer and end-consumer preferences. But there are general guidelines you can follow to benchmark and/or improve the quality of your product(s).

Quality begins at the raw material level. The quality requirements for cocoa beans are explained in our study on European market requirements for cocoa beans: Quality criteria. Besides flavour, the quality of the speciality cocoa is also related to the uniqueness and scarcity of the origins of specific varieties.

Branding and story

To market your product, you will need to define your story. The story of your product will contribute to its market value. It is therefore important to identify your unique selling point (USP). Your USP can be based on various aspects of your product and company, such as your company’s social and/or environmental mission, the beneficial impact your company has on producing communities or the conservation of biodiversity, the uniqueness of the cocoa varieties you use or the specific location of your cocoa-growing farm or chocolate making facilities, among other things.

Your story must always be consistent, and should also be reflected on your packaging and labelling materials. Your study must be well documented, and supported by transparency, figures and facts. An example of a tree-to-bar exporter that has successfully managed to build a consistent story around its brand is Marou Chocolate (Vietnam).

Additional sustainability requirements

Corporate responsibility and sustainability have become very important in the entire European chocolate sector. The European Green Deal (EGD), launched in 2019, is driving this further. The EGD is a package of actions to reduce greenhouse gas emissions and minimise the use of resources while achieving economic growth. The aim is to transform the EU into a climate-neutral and resource-efficient economy by 2050. This means that products sold on the EU market will need to meet higher sustainability standards. This means that you need to start documenting and reporting about your sustainability efforts, such as specific sourcing practices and your efforts to promote a sustainable cocoa economy. Importing companies or distributors may require such proof that you do your business in a responsible way.

In the high-end chocolate segment in Europe, sustainability issues that receive attention include:

- Agroforestry efforts

- Carbon neutrality

- Impact on producing communities

- Impact on the local biodiversity

Tips:

- Refer to the International Trade Centre Standards Map or the Global Food Safety Initiative website to learn about the different food safety management systems, hygiene standards and certification schemes.

- Check the CBI website for information on what the EU Green Deal can mean for your business.

- Read this article about the importance of branding and packaging, according to craft chocolate shops around the world.

Niche requirements

Organic

In order to market your cocoa as organic on the European market, it must comply with the European Union’s regulations on organic production and labelling. Obtaining the EU Organic label is the minimum legislative requirement for marketing organic chocolate in the EU.

Before you can market your chocolate as organic, an accredited certifier must audit your growing and processing facilities. If you do not grow your own cocoa beans yourself, you must make sure that your suppliers are organic certified according to the EU regulation. Other raw materials used in your chocolate, such as sugar and dried fruit, must also be organic certified and compliant with the EU regulation.

Refer to this list of recognised control bodies and control authorities issued by the EU to ensure that you always work with an accredited certifier. To become organic certified, you can expect a yearly inspection and audit which aims to ensure that you comply with the rules on organic production and/or handling and processing.

Note that all organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by control authorities prior to the departure of a shipment. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

In addition to organic, Demeter might be an interesting certification for your product. This certifies biodynamic farming; it is limited to small niche segments but is seeing increased interest in markets like Germany and Switzerland.

Tips:

- Learn more about organic farming and organic guidelines on the European Union website and the Organic Export Info website.

- Read this article (in Dutch) to learn what can happen to your chocolate products if they are not registered in TRACES (in good time).

- Try to visit trade fairs for organic products if you are organic certified. The largest organic fair in Europe is Biofach in Germany. Check out its website for a list of exhibitors, seminars and other events at this trade fair.

- Read why some tree-to-bar makers decide not to become certified. For instance, refer to page 12 to read why Marou decided not to go for organic nor fair trade certification.

2. Through what channels can you get tree-to-bar chocolates on the European market?

How is the end market segmented?

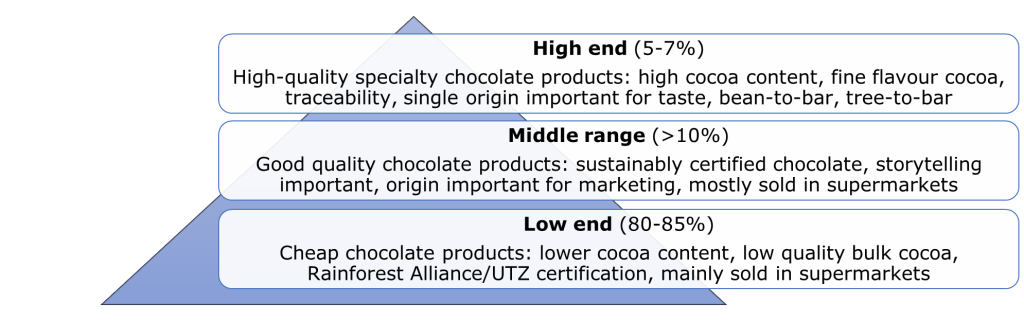

The chocolate confectionery industry can be segmented according to the quality of the end products. The figure below shows the general segmentation of the chocolate end market. Tree-to-bar products that reach the European market are categorised as high-end products. The high-end segment is the smallest but fastest growing segment, with an estimated share of around 5-7%.

Figure 2: Segmentation of the chocolate market based on quality

Source: ProFound

The high-end segment is characterised by smaller, more specialised chocolate makers that produce high-end chocolate products, mainly using fine flavour cocoa (usually Criollo and Trinitario varieties, and/or to a lesser extent Forastero). These products are characterised by a high cocoa content. The single origin of the cocoa beans is important, both for the taste as the traceability of the cocoa. Both bean-to-bar and tree-to-bar chocolates are examples of high-end products.

In Europe, specialty chocolate shops, delicatessen shops and luxury department stores are the main sales channel for tree-to-bar chocolate products. See for examples of these shops, the section below. Tree-to-bar products are also sold at specific chocolate trade fairs, such as Salon du Chocolat (with events in France and Belgium) and Chocoa (the Netherlands). Both fairs are directed at businesses and consumers alike.

Some examples and an indication of consumer prices for tree-to-bar chocolate products for sale in Europe are given in the below table (based on retail prices of in 2022). To compare, chocolate products on the low end of the market typically range between €7.50 and €15 per kilogramme.

| Product | Picture* | Price (€/kg) | |

| High-end | Brand: Menakao Type of chocolate: Dark, 72% Cocoa bean: Trinitario Region: Madagascar Certification/claims: direct trade and fair trade Weight: 65 grams |

| €90.80/kg |

| Brand: Marou Type of chocolate: Dark, 76% Cocoa bean: Trinitario Region: Vietnam, Ba Ria province Certification/claims: direct trade and fair trade Weight: 80 grams |

| €93.80/kg | |

| Brand: Pacari Type of chocolate: Dark, 70% Cocoa bean: Piura cocoa bean Region: Ecuador, Piura Quemazón Certification/claims: B-Corporation, Organic certification, direct trade and fair trade, fully recyclable Weight: 50 grams |

| €136/kg |

*Source of pictures: Chocolats De Luxe

Value distribution

The value distribution of a tree-to-bar product depends on several factors, including the market access channel, traded volumes and the negotiation between exporter and buyer. Although price distribution varies per case, a rough indication is that:

- An agent takes a commission of between 8 to 12% of the end price.

- An importing distributor may take around 30% of the price.

- The final retailer of the product may take up between 25-30% of the end price in the case of a large retailer, and more towards 35-45% for smaller specialised shops.

Tips:

- Monitor end-consumer prices of tree-to-bar chocolates to get an idea of price ranges. Good sources for price information are the websites of chocolate specialty stores like Cocoa Runners.

- To export tree-to-bar chocolate, you must have a defined and clear cost structure. Your price should be competitive in relation to similar products. It will be difficult to sell similar products at a higher price, and that is why differentiation is key.

- Refer to our study on trends in the cocoa sector to learn more about developments within different market segments.

- Want to sell your tree-to-bar products to the European market? Try to establish direct trade relationships with distributors to find an entry channel into the market.

- Learn more about cocoa quality. You might be interested in participating in one of the cocoa programmes of the Chocolate Institute, such as the cocoa grading course or the specialty cocoa growing training.

Through what channels does tree-to-bar chocolate end up on the end market?

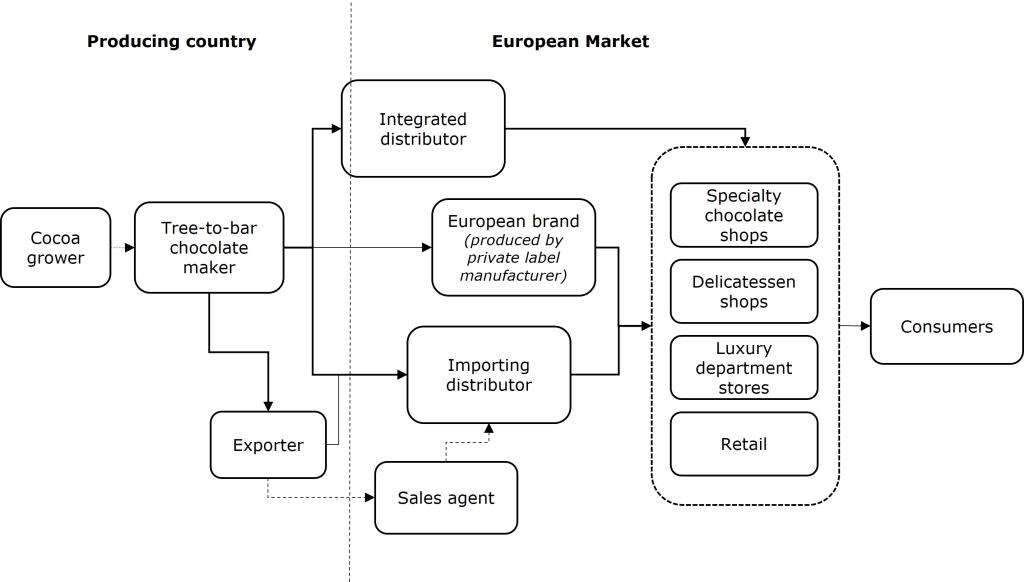

The majority of chocolate products available on the European market are manufactured by European companies. These products are distributed to different retailers and shops throughout Europe. Tree-to-bar chocolate is a small niche product and not sold in mainstream retail outlets. Therefore, these products usually enter the European market through alternative channels.

Companies that successfully accessed the market have made use of different channels with different strategies. How to enter the market will vary according to the availability of your products, your business structure and your connections on the market. The figure below shows you the most common entry channels for tree-to-bar products in Europe.

Figure 3: The main channels for export of tree-to-bar chocolates to Europe

Source: ProFound, adapted from UNCTAD/G. Ferro (2021)

Importing distributor

There are a number of chocolate distributors on the European market that are specialised in high-quality chocolates. Examples of these include ClearChox and High Five Company (the Netherlands), Club del Chocolate (Spain) and Cocoa Runners (the United Kingdom).

This is one of the more common entry channels into Europe. Importing distributors buy and sell a wide range of chocolate types and brands, from bean-to-bar made in Europe to tree-to-bar made in origin countries. These distributors tend to have a lot of knowledge of the local market and a widespread retail network, usually consisting of specialised shops. They assume ownership of the product and provide a large number of services, including logistics and storage, marketing and after-sales customer support.

Importing distributors are the most suitable point of contact if you aim to get access to a wide network of specialised shops in Europe. It is not common to have direct contact with and/or sell directly to these shops due to their small order quantities and high frequency of deliveries. In addition, the existing network of distributors will diminish your marketing costs.

Integrated distributor

Integrated distribution refers to a business with a registered company in a cocoa producing country, as well as a subsidiary or counterpart that formally represents the company in Europe. Examples of this are Meybol Cacao (Peru/Germany), MIA (Madagascar/UK) and Fairafric (Ghana/Germany).

In these companies there is an integration of cocoa production, chocolate making and exporting activities in the origin country with importing, marketing and distribution activities in the destination market. This allows both parts of the company to coordinate closely. For instance, cocoa growing and chocolate making can be planned according to market demand and sales projections. In addition, the business in Europe can optimise its market knowledge and local distribution network, as well as provide aftersales and other customer support services.

As an integrated distributor is an essential part of a company’s business model, it is ideal for companies that have a strong partner and an existing foothold on the destination market. This includes legal representation, vast knowledge of the market as well as distribution (including warehousing) and aftersales capacities.

Private-label chocolate making

A few chocolate exporters from producing countries have entered the European market by making chocolate for European brands or retailers. In the case of private-label chocolate making, you must comply with the specifications of the European brand in terms of packaging and quality. This requires your company to be able to meet high food safety standards and guarantee strict compliance to the requirements of your buyer. By making chocolate products for a European brand, you provide your company with potential for scale, a lower marketing budget and an existing consumer base, as these are elements taken care of by the brand for whom you produce. Some examples of companies producing chocolates under private label include Ecuatoriana de Chocolates (Ecuador) and Machu Picchu Foods (Peru).

Private-label manufacturing is interesting for companies with excellent food safety and processing volume capacities, in addition to quality consistency and good access to raw materials. Experience and good track record in processing for domestic chocolate brands can also be a competitive advantage.

Agents

Tree-to-bar chocolate makers may want a partner who is familiar with the target market. For starting exporters, the use of an agent could be a point of departure in finding the best distribution channel and partner in Europe. They can help you find, assess and select interesting buyers.

An agent might charge a fee for the assignment, in addition to a commission of between 5 to 10% of any resulting business between the supplier and the retailer. This is excluding the costs (listing fees, marketing fees etc. of the retailer). The agent is never responsible for the logistics since he does not assume ownership or storage of the product.

Agents can be important to exporters that have limited knowledge of the European market or limited export experience. They can also be relevant to exporters that have limited travel possibilities, and a limited presence on the European market, so that agents can act on their behalf as product ambassadors and in contacting potential buyers.

Less common to sell directly to retailers or other specialised outlets in Europe

It is not common for tree-to-bar exporters to sell directly to European retailers and department stores, nor to smaller delicatessen shops or specialty chocolate shops. Retailers usually work with large brands from origin countries, with equally large production capacity and distribution network within its domestic market. These players require a relatively large supply of chocolate products, which may be out of reach for many tree-to-bar chocolate makers.

Delicatessen shops and specialty chocolate shops are usually too small to import directly from origin. It is often not cost-effective for these shops to source directly from producing countries. Instead, they get their chocolate products from importing distributors (such as ClearChox and High Five Company from the Netherlands) who can offer them a wide array of products to choose from.

Schokov Shop (Austria), Chocolats De Luxe (Germany) and Craft Chocolate Shop (the Netherlands) are examples of chocolate shops in Europe. Examples of delicatessen shops include Mantequerías Bravo (Spain) and Lingenhel (Austria). The luxury department stores with an offer of tree-to-bar chocolates in Europe include Harrods (the United Kingdom), El Corte Inglés (Spain) and Kadewe (Germany).

Tips:

- Participate in award shows to increase your market visibility and test your products in the market. The most important events to consider are the International Chocolate Awards and the Academy of Chocolate. The AVPA International Contest: Chocolates processed at Origin can also be an interesting contest to provide visibility to your product.

- Attend trade fairs in Europe to meet potential buyers. Interesting cocoa and chocolate trade fairs include Salon du Chocolat (France) and Chocoa (Netherlands). Larger fairs like Biofach (Germany, for organic products), Nordic Organic Food Fair (Sweden) and the Speciality and Fine Food Fair (UK, for high-quality products) may also be interesting, although those fairs are not specifically focused on cocoa or chocolate.

- Attend the above physical or virtual events to gain additional insight into the preferences of European buyers, with regards to origin, flavour and sustainability certification. By understanding the market better, you can ensure that your specific product corresponds to the demand and requirements.

- Invest in long-term relationships with a representative in Europe. This will help you become more competitive, manage market risks, improve the quality of your product and reach a fair quality/price balance. For more tips, read our study on doing business with European cocoa buyers.

- See our study on finding buyers on the European cocoa market for more tips on finding the right buyer, specifically for your cocoa beans.

3. What competition do you face on the European market for tree-to-bar chocolate?

Your main competition within the chocolate market will come from European companies. There is a growing number of bean-to-bar and other craft chocolate makers with easier access to market knowledge and distribution channels. Competition is most prominent in tree-to-bar chocolate makers from those countries with a larger access to unique and high-quality raw materials: Latin American countries and Madagascar stand out in this perspective.

Competition from Europe itself: growing number of bean-to-bar makers in Europe

The number of craft chocolate makers in Europe is growing. Refer to our Market potential study for tree-to-bar products to read more about this. The large number of bean-to-bar makers in Europe poses a great barrier for small new entrants from origin countries. Bean-to-bar chocolate makers in Europe have the advantage of knowing their market well. Also, their close proximity to the market allows them to use their own distribution channels like a physical shop. One important trend which favours European companies is the growing support for local-owned business, a development which gained momentum during the COVID-19 momentum and beyond.

But the fine chocolate market is a difficult market in itself, even for European bean-to-bar makers. Although it is gaining popularity and consumption levels are growing, it still represents a niche segment. A large share of consumers is not (yet) willing to pay a higher price for unique and high-quality products. The fine chocolate market is expected to continue to grow, because of a wider availability of the offer, as well as a diversification of channels through which such products are offered. At the same time, there is also a developing market for lower priced and good-quality chocolates sold via supermarkets with concepts that mimic fine chocolate.

Examples of European bean-to-bar makers include Blanxart (Spain), Georgia Ramon (Germany). Heinde & Verre (Netherlands), Domori (Italy) and Zotter (Austria). Check this list for more examples of bean-to-bar makers in Europe.

Fine flavour cocoa producing countries: Latin America in unique position

According to the International Cocoa Organization (ICCO), there are 25 countries that export fine flavour cocoa, of which 20 are from Latin America and the Caribbean. Ecuador, Brazil and Peru are the largest producers of fine flavour cocoa beans in the region. Colombia and the Dominican Republic are other interesting countries when it comes to high-quality cocoa and an upcoming tree-to-bar chocolate scene.

Latin America also contains 7 of the 11 genetic clusters of cocoa. This has in part enabled the strategic positioning of the region as the main supplier of high-quality varieties of cocoa. For tree-to-bar makers it is a great competitive advantage to have access to these varieties and raw material of potentially high-quality. It gives chocolate makers from the region great potential to access the European high-value speciality market.

On the other hand, the competitiveness of some origins in Latin America is threatened by the regulation on cadmium in cocoa for the European market. This has led to stricter controls on cocoa beans and chocolate imports from the region.

Ecuador: largest producer of fine flavour cocoa

Ecuador was the fifth-largest cocoa producer in the world in 2020, and the largest producer of fine flavour cocoa. About 75% of Ecuadorian cocoa exports is classified as fine flavour cocoa by ICCO.

Ecuador has a high genetic diversity of cocoas. From a commercial point of view, five varieties are most representative: 1) Cocoa Nacional; 2) Cocoa Criollo; 3) Cocoa CCN-51; 4) Super Tree Cocoa; 5) Cocoa Amazónico. The tree-to-bar chocolates made from these cocoa varieties are characterised as having an exotic mixture of flavours and aromas of fruit, herbs, spices, as well as a particular floral aroma. Ecuadorian cocoa and chocolate products have won many awards and recognitions around the world.

Ecuador has its own Salon del Chocolate event. This helps to boost the cocoa and chocolate sector by promoting consumption, supporting production and educating the sector and consumers about value addition opportunities.

Examples of well-known tree-to-bar chocolate makers from Ecuador include Pacari, República del Cacao, Hoja Verde, Kuná, and To’ak Chocolate.

Peru: large variety of cocoa flavours

Peru is the ninth-largest cocoa producer in the world. About 40% of cocoa cultivation is considered to be fine cocoa quality in Peru. 75% of Peruvian cocoa exports is classified as fine flavour cocoa by ICCO. Of the total Peruvian cocoa production, about 8.9% is exported in chocolate tablets.

Just like Ecuador, Peru has its own Salón del Cacao y Chocolate, promoting the commercial activity of cocoa and chocolate making on the national and international market.

Peru is the country with the highest genetic biodiversity in the world, resulting in a wide range of different flavours that can be found in its cocoas. Depending on the region, Peruvian cocoa will have a fruitier, chocolate-like, floral, sweeter or more nutty flavour.

Examples of Peruvian tree-to-bar chocolate brands with market presence in Europe are Cacaosuyo, Amazona Chocolate, Maraná Chocolate and Shattell.

Brazil: grown to recognised high-end chocolate producer

Brazil is the seventh-largest cocoa producer in the world. Since 2019, ICCO has recognised Brazil as a fine flavour cocoa exporter: 100% of its cocoa exports is considered fine cocoa. Historically, Brazil has not been known as a producer of fine quality cacao. The local chocolate making industry mainly manufactured low-end chocolate products, paying little attention to flavour.

Since about 2010, however, local demand for high-quality cocoa and chocolates has grown by 10%. As a result, the number of Brazilian chocolate makers has grown significantly. Today there are over 75 companies producing chocolate in smaller batches with tree-to-bar and bean-to-bar operations. As one of the few cocoa producing countries, Brazil even has its own bean-to-bar association.

Given the size of the country, the variety of cocoa flavour attributes is large. Examples of tree-to-bar chocolate makers from Brazil that are present on the European market include AMMA and Luisa Abram.

Madagascar: well-known origin of high-quality cocoa and chocolate

Madagascar is a relatively small cocoa producer, ranking as the 20th-largest cocoa producer worldwide in 2020. Trinitario, Criollo and Forastero cocoa plants all grow on the island; with Trinitario being the main variety. According to ICCO, 100% of cocoa exports from Madagascar is classified as fine flavour cocoa.

Madagascan cocoa is much used and highly valued by craft chocolate makers in Europe. As Italian chocolate manufacturer ICAM says it: “Madagascar cocoa is a unique variety, considered one of the best in the world, renowned for being extremely rare and grown on small farms.” If processed correctly, Madagascar cacao has the potential to produce dark chocolate with strong, bright red fruit flavours, hints of citrus, and a fair bit of acidity.

Examples of tree-to-bar products from Madagascar that are available on the European market are Chocolat Madagascar, Menakao, Beyond Good and MIA.

Identifying your potential competitors and learning from them

Besides the above-mentioned tree-to-bar chocolate companies based in countries that are well-known for their high-quality cocoas, there are a range of other successful tree-to-bar chocolate exporters in other regions. Examples of these are Marou (Vietnam), Fu Wan (Taiwan), Diogo Vaz (São Tomé and Príncipe) and Auro Chocolate (Philippines).

A good way to become successful as an exporter of tree-to-bar chocolates is to identify and learn from these potential competitors. Study their business, their product offer and the product characteristics they highlight. What kind of ingredients do they use? How do they talk about these ingredients, do they specifically link them back to their origin or culture? Do they mention participation in award shows and any awards their products may have won?

By studying their webpages you can also learn how they talk about their cocoa beans and their relation with their cocoa growing communities. Also, check for specific information about their cocoa growing region (origin) and the varieties, qualities and maybe processing techniques. Read about their philosophy as well, and how they adhere to sustainability practices. These are all elements that make their company unique. The trick is to find your unique selling point and differentiate your product on the market to stand out.

Tips:

- Identify and promote your unique selling points. Give detailed information about your company’s social and environmental ethics, the cocoa you use (including cocoa growing region (origin) and the varieties and qualities used), processing techniques, and your sustainability practices.

- Actively promote your company on your website and at trade fairs.

- Join flavour quality competitions. They provide good opportunities to gain visibility on a market, know your competition and to share your story: International Chocolate Awards, Academy of Chocolate, AVPA: Chocolates processed at Origin, or Cocoa of Excellence for your cocoa beans specifically.

- Learn how Nordic bean-to-bar makers set themselves apart from their competition by reading this article on the Chocolate Journalist.

- Consider diversifying your product offer. Besides selling chocolate products to the international market, consider also selling cocoa beans and/or semi-finished cocoa products.

- Learn more about specific fine cocoa producing countries by reading their country profiles on the Make Mine Fine website, an initiative of the Fine Chocolate Industry Association.

This study was carried out on behalf of CBI by ProFound – Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research