The European market potential for roasted coffee

Exporting roasted coffee is complex and requires a long-term strategy. It requires years of investments with potential rewards. By roasting the coffee in the country of origin, exporters can add more value to their products. Western and Northern European countries provide the most opportunities. The consumers’ desire for a more equitable value distribution drives the demand for coffee roasted at origin.

Contents of this page

1. Product description

This study focuses on coffee that is roasted in the country where it is grown, also known as coffee roasted at origin. Typically, roasted coffee is packaged for consumption before it is exported, to keep the coffee fresh.

For the European border authorities, roasted coffee is labelled:

- HS 090121 for roasted, non-decaffeinated coffee

- HS 090122 for roasted, decaffeinated coffee

Soluble coffees, administered under HS code 210111, are excluded from this study.

Though labelled by only two HS codes, roasted coffee can come in many varieties. It can be classified based on caffeine, species and variety, quality, certification/verification, taste, roast, packaging, postharvest procedure, and origin. Figure 1 shows how roasted coffee can be characterised. Although it gives insight into the diversity of coffee, Figure 1 is still a simplification of the reality. The market is known for its many hybrids and overlap between the characteristics, giving each coffee a unique profile.

Figure 1: Characteristics of roasted coffee

Source: Molgo Research, design by Bart Wortel

There are different consumer preferences for coffee in the European market. Consumers in Southern European countries traditionally prefer darker roasts containing Robusta. Northern European consumers favour lighter roasts and milder coffees. Lighter roasts are generally preferred within the specialty segment across Europe due to the use of higher-quality Arabica beans with fewer defects. Specialty coffee is mostly consumed by young coffee drinkers.

2. Why (not) export roasted coffee?

The majority of coffee exports are green coffee beans. In some coffee-producing countries, large roasting industries have emerged to meet local consumer demands, for instance, in Brazil and Indonesia. However, despite the growth of these industries, only a small portion of the roasted coffee finds its way to the export markets in the EU or the United States.

There are many reasons for exporting or not exporting roasted coffee. This paragraph looks into these reasons.

The perception is that coffee is only fresh when roasted locally

Some European consumers think that coffee is only fresh if roasted locally. Although this perception is widespread, it is not true. The freshness depends on the time between roasting and consumption, not the distance between roasting and consumption. Many large European roasters, such as Lavazza and IllyCaffè, export their roasted coffee worldwide.

The vital aspect is the shelf life. Green coffee beans have a much longer shelf life than roasted coffee. This makes green coffee easier to store and transport over long distances. The actual shelf life of roasted coffee depends on the packaging, grinding, and storage of the coffee. After roasting, the coffee needs to be sold within several months. The shelf life also depends on the quality of the coffee and consumer demands. In the specialty segment, coffee is considered fresh for only a few weeks.

A short shelf life makes it harder to sell your roasted coffee, especially if you only have a small market in the country of consumption. This requires the production and transport of small batches to Europe, which increases your costs. Because all new players start with a small market, exporting roasted coffee requires investments and a long-term strategy.

Roasting coffee at origin could also contribute positively to the shelf life. Because the roasting is done closer to the farm, the time between harvest and hulling can be reduced. Hulling just before roasting is a factor that maintains the coffee’s aroma longer.

Roasting in the country of consumption is more efficient

The efficiency of roasting depends heavily on how much a company roasts. Roasting large quantities is generally more efficient. Most African production countries typically have a small consumer market and limited roasting capacity.

Companies roasting small amounts of coffee at origin will probably be less efficient than European roasters. This reduces the competitiveness of your range. If a roaster cannot roast efficiently, the only option is to focus on the premium or speciality segment, where the price is less critical.

Some coffee-producing countries have a better-developed roasting industry. Examples are Brazil and Colombia. These countries usually consume more coffee domestically. Due to lower costs, roasters producing large quantities of coffee for a domestic market may be more efficient than European roasters. If so, these roasters may be able to compete in the European commodity coffee market.

Some companies based in coffee-growing countries mainly roast for the domestic market but also find their way onto the European market. The volumes these companies sell on the European market are mostly very small. These companies mainly roast for their local market. Examples are:

- 3 Corações Group, a Brazilian company partly owned by Strauss Group;

- Café Pilão, a company based in Brazil, owned by JDE Peet’s;

- Cacique, since 2024 owned by Louis Dreyfus Company, is a Brazilian roaster focusing on soluble coffee;

- Café de Colombia mainly exports green coffee but is also present in the European commodity and specialty market;

- Juan Valdez Café, recently started exporting roasted commodity coffee to the European market.

Closer contact with the farmer but less contact with the client

Roasting at origin can also improve the quality of your product. Growers and roasters can work towards a better product if they work closely together. By working together, roasters can create a higher sense of ownership for farmers. This is easier when roasters and farmers work in the same country. On the other hand, the geographical distance to the client is greater. This makes it harder to stay in touch with your clients and get their feedback on your coffees.

Europe protects its market by trade duties

Europe protects its market by raising trade tariffs. The standard third-country duty that applies to roasted coffee imports is 7.5%. For decaffeinated roasted coffee, this is 9%. These trade duties may apply to you. However, the EU has trade agreements with most large coffee-growing countries. If the EU has a trade tariff with your country, the trade tariff is lower or zero. You can read more about this in our study on Entering the European market for roasted coffee.

Exporting roasted coffee requires expertise and a network

The global market structure is based on small-scale farmers selling their coffee to international commodity traders. Hardly any traders are willing to buy roasted coffee because they cannot sell it to their clients, who are primarily roasters. Exporting roasted coffee requires a good network in the European market.

In addition to a network, selling roasted coffee to Europe requires solid expertise. Coffee roasting, packaging, and branding for a local market differ greatly from how this is done for the European market. Exporting to the European market requires in-depth knowledge of their wishes. It also requires additional processing, strict food safety measures (HACCP), packaging, and meeting labelling/regulatory requirements in the EU market, which adds complexity.

You can read more about market channels and requirements in our study on Entering the European market for roasted coffee.

Exporting roasted coffee increases the value at origin

Exporting roasted value means that more value is created at origin. When exporting green coffee, this is generally less than 10%. When roasting the coffee at origin, this can increase to 40-55% of the retail price. The percentage of added value is based on a few companies and highly depends on the context. It is essential to realise that adding this value also comes with increased costs. Examples are roasting, shipping, insurance, customs clearance and marketing.

Roasting coffee at origin does not always benefit farmers

If a company that roasts coffee at origin successfully exports its coffee to Europe, then the roaster will profit primarily. Farmers will only profit if local roasters pay better prices than those exporting green coffee to the European market. But even if local roasters do not pay better prices, they still create jobs in the country where the coffee is grown.

There is an interest in sustainably-produced coffee

Some European consumers are interested in sustainably produced coffee. Studies show that 56% of the European Union (EU) consumers consider the sustainability impacts of goods and services they buy. Two-thirds of these consumers report purchasing sustainable products, even at a higher cost. Roasting coffee in its country of origin can boost its perceived sustainability. By roasting coffee at its source, a greater portion of the added value remains within the producing country, potentially resulting in a more equitable value chain.

Tips:

- Know the characteristics of the coffee you export. European roasted coffee buyers are more demanding than green coffee buyers.

- Read stories of other exporters of roasted coffee. One example is the story of Caravala.

- Visit the websites of other companies that roast at origin. The Roasted@Origin website offers a directory with many examples.

3. What makes Europe an interesting market for roasted coffee?

Europe is the world’s largest coffee consumption market. However, most imports in Europe are green roasted coffee. Only a very small share is roasted at origin, making exporting coffee roasted at origin a niche market. Coffee pods are a main driver of Europe’s coffee market value growth. However, most roasted-at-origin coffee is exported as whole beans or ground coffee, not as pods.

Europe is the world’s largest consumption market of roasted coffee

Europe accounted for 32% of global coffee consumption in 2022. The total amount of coffee consumed was 3,300 thousand tonnes of coffee. Asia-Pacific is the second-largest market, with a market share of 25%, followed by North America (18%) and South America (15%).

Source: International Coffee Organisation, 2023

European consumption is expected to remain stable in volume but grow in value. In 2022, European coffee consumption was 3,323,280 tonnes. This excludes soluble coffee. The European consumption market volume is expected to stay at the same level. Almost all Europeans can afford coffee, and economic growth will hardly lead to more coffee consumption. Between 2017-2022, European coffee consumption fluctuated between 3,136 thousand tonnes and 3,327 thousand tonnes.

The European consumption market value is expected to grow. This applies both to the at-home and out-of-home markets. The coffee consumption market value is expected to grow from €153 million in 2023 to €186 in 2028. There are multiple drivers behind the growing consumption market value. These are the increasing demand for coffee pods and more demand for high-quality and sustainable coffee.

The demand for coffee pods drives the coffee market

In the at-home market, the high demand for coffee pods drives the retail value. The market for coffee pods was 16% of the retail market volume in 2022. Coffee pods, however, are much more expensive than ground coffee or coffee beans. The coffee pods market is, therefore, a high-value market. Coffee pods account for a market share of 39% of the European coffee retail market value. Most coffee pods consumed in Europe are also produced in Europe.

Exporting coffee pods could be interesting for producing country suppliers. Aluminium-based pods in particular have a very long shelf life. The first advantage is that the shelf life is highly extended. This solves many of the logistical issues that small exporters of roasted coffee suffer. Because of longer shelf lives, the produced batches can be larger, and freights can include larger volumes. This reduces the costs.

The second advantage is that selling pods adds more value to the product than selling whole beans or ground coffee. Coffee pods are more expensive than other packaged roasted coffee. This applies especially to coffee capsules. If you supply directly to consumers, the prices in the premium-capsule market are around €0.45 per capsule.

Net profit margins are much larger for manufacturers of capsules and soft pods than for whole beans and ground coffee. According to a study on the German market, the manufacturer’s net profit margin per kilogram of roasted coffee was €1.64 for capsule producers, €0.35 for soft pods producers, €0.20 for whole beans producers and €0.06 for ground coffee producers.

Entering the European market for coffee pods, however, isn’t easy. First of all, Europeans are used to very high-quality cups. The quality standards are hard to meet. Besides good coffee and roasting, it also requires high-quality grinding and encapsulating. Encapsulating can be especially expensive. Next to the quality of the coffee, shipment is more costly because coffee pods require a lot of space. Pods are mostly sold via supermarkets, which is a highly competitive market. This market is dominated by Nestlé and JDE Peet’s. Marketing and branding efforts are necessary to build awareness and loyalty among consumers.

When targeting the European market, it is important to know that coffee pods' market share differs greatly per country. Ireland's share is the largest, representing 78% of the total retail value. Slovenian consumers show the lowest interest in coffee pods, with a mere 2% of the market retail value.

In our study, we found only very few suppliers of coffee pods produced at origin. Most pod suppliers that entered the European market focus on the origin market and supply small quantities via their webshop to Europe.

Tips:

- Read an article on Perfect Daily Grind about the production of coffee capsules.

- For more information on the demand for coffee pods, read our study on the demand for coffee from producing countries on the European market. Here you can find the demand for pods per European country and statistics on how the market value of pods has developed over the years.

- Inform yourself well before deciding to export coffee pods to the European market. You can start by reading this article with tips on the at-home market on the Algrano website.

- Read the Global Coffee Report edition of September 2024 to learn more about the coffee capsule market.

Only a small part of Europe’s imports consists of roasted coffee

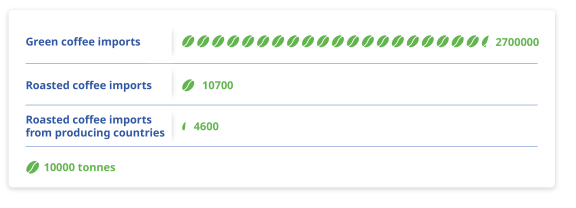

Europe has a huge roasting industry. Therefore, most imported coffee is green coffee. In 2023, Europe imported 3 million tonnes of green coffee (caffeinated and decaffeinated combined). This is a huge amount, compared to the 10.7 thousand tonnes of roasted coffee. Most roasted coffee is imported from non-producing countries. These are countries close to the EU, offering short supply chains, or countries with a large domestic market. Some non-producing countries exporting large amounts of roasted coffee to the EU in 2023 are:

- Bosnia and Herzegovina: 1,200 tonnes

- Serbia: 892 tonnes

- United States of America: 777 tonnes

- Turkey: 746 tonnes

4.6 thousand tonnes are imported from producing countries.

Figure 3: Imports of green coffee, roasted coffee and roasted-at-origin coffee, in tonnes

Source: Eurostat and Trademap, 2023

According to Eurostat data, the imports of roasted coffee from producing countries have grown by 11% yearly between 2017 and 2021. This is much higher than the average yearly 3.8% growth rate of all imported coffee (green and roasted combined) in the same period. However, between 2021-2023, the imports of roasted coffee from producing countries declined by 2.5% per year.

4. Which European countries offer most opportunities for roasted coffee?

Norway, Denmark, the United Kingdom, the Netherlands, Germany, the Czech Republic, and Spain import the most roasted coffee from producing countries. These countries are responsible for 90% of all roasted coffee imports from producing countries. Figure 3 shows their imports of roasted coffee in recent years.

Sources: Eurostat and ITC Trademap

Even in the top 8 countries, the percentage of national consumption that is sourced from producing countries is very small. Figure 4 shows the percentage of the national consumption roasted in producing countries. In Norway, Europe’s country with the largest share of coffee roasted in producing countries, the percentage of the total consumption is close to 4%.

Sources: Eurostat, ITC Trademap, and European Coffee report 2023

We selected Norway, Denmark, the Netherlands, the United Kingdom, Spain, and Germany as the top 6 countries to elaborate further in this study.

The Czech republic was not selected because of its relatively small market size. Also, it sources a lot from large companies. This means it offers fewer opportunities to small and medium-sized enterprises (SMEs). 95% of all coffee roasted at origin came from Vietnam. Trung Nguyen is a large Vietnamese exporter of roasted coffee, supplying the Czech market. They mainly supply third-party roasted coffee for supermarket brands to the Czech market.

France was also not selected because the country showed the least willingness to source coffee roasted at origin. An important share of the French roasted-at-origin coffee imports is purchased via Alternative Café. This company offers a marketplace for companies that roast at origin. It focuses on the high-end segment. Only participants in the World Coffee Challenge can sell their coffees via Alternative Café. The Alternative Café website doesn’t use the common SCA rating uses but the World Coffee Challenge ratings instead.

Norway is Europe’s largest importer of roasted-at-origin coffee

Norway sourced 1.8 thousand tonnes of roasted coffee from producing countries in 2023. This is 39% of the total amount of Europe’s roasted coffee imports from producing countries. Although this is more than other European countries import, it is still a very small part of the total consumption. Only 3.93% of the consumption is sourced as roasted coffee from producing countries. Almost all of this coffee is sourced from Brazil.

Source: ITC Trade Map

Norway has a relatively small consumption market, with only 5.4 million inhabitants. Brazil is Norway’s main supplier of both green and roasted coffee. Norway has a relatively large specialty coffee sector. The famous Specialty Coffee Association (SCA) even originates from Norway. Fairtrade, Rainforest Alliance and Organic certifications are very important in the Norwegian supermarket chain.

Our study did not provide examples of traders importing or exporting roasted coffee from producing countries into Norway.

Denmark sources mostly from African Coffee Roasters

Denmark is the second-largest importer of roasted coffee from producing countries. In 2023, the imports from producing countries amounted to 935 tonnes of roasted coffee. This is about 20% of all Europe's roasted coffee imports from producing countries. This is a very small part of the total consumption. Only 2.75% of the consumption was sourced as roasted coffee from producing countries. 100% of this import was caffeinated coffee.

99.5% of all roasted coffee from producing countries was sourced from Kenya. Almost all coffee from Kenya was roasted by African Coffee Roasters (ACR). African Coffee Roasters was founded by Coop Denmark, a large supermarket chain. Currently, African Coffee Roasters supplies many other clients as well. The company now supplies over 2000 European stores and produces 2200 MT of roasted coffee yearly. The company provides mostly white labels. African Coffee Roasters is certified Organic, Rainforest Alliance and Fairtrade. Next to their website, you can find more information about the company via Business Daily Africa.

Source: Eurostat

ACR is Denmark’s largest supplier, but it is not the only one. Another supplier is Beean Coffee. Beean Coffee was founded in Denmark and has built its story around the fact that its coffee is roasted at origin, which is fairer for producing countries.

The Danish have a strong coffee culture and a preference for sustainable sourcing. Denmark is a relatively small country, with only 5.9 million inhabitants. Their coffee consumption lies above the European average, with 6.9 kg consumption per capita. You can read more about the Danish coffee market in our market study on the Scandinavian market.

The Netherlands sources mostly from East African countries

In 2023, the Netherlands sourced 326 tonnes of roasted coffee from producing countries. This is 7% of Europe’s roasted coffee imports from producing countries. This is a very small part of the total consumption. Only 0.33% of consumption was sourced as roasted coffee from producing countries. The largest producing country suppliers are Kenya, Ethiopia, and Vietnam.

Source: Eurostat

A leading supplier of roasted coffee to the Netherlands is Moyee. The company presents itself as the first fair chain company in the world. Their promise is that 50% of the value remains in the producing country. This highly exceeds the industry’s average of 10%. Moyee sells the coffee under its own brand-name in the large Dutch supermarket chain Albert Heijn. 74% of Dutch consumers buy their coffee in a supermarket.

A newer roasted coffee exporter and importer is Guzo Coffee. Instead of fairchain coffee, they sell their coffee as ‘fair share coffee’. They also focus on keeping a large share of the value in the producing country. Guzo is based in the Netherlands and Ethiopia. The company mainly focuses on the B2B market.

The Dutch drink a lot of coffee, mainly in the morning. Dutch citizens drink about 4 cups of coffee per day on average. With only 18 million inhabitants, they are the sixth largest coffee-consuming country in Europe. In 2022, they consumed 98,000 tonnes of coffee. This represents a €1.2 billion retail value.

The Netherlands are an interesting country for companies that focus on sustainability, because the sustainability awareness among consumers is very high, and consumers have the money to pay for sustainability. However, there is also a lot of competition from other sustainability-focused coffee suppliers.

You can find more information in our study on Exporting coffee to the Netherlands.

Imports from the United Kingdom are highly volatile

In 2023, the United Kingdom sourced 423 tonnes of roasted coffee from producing countries. This is 9% of Europe’s roasted coffee imports from producing countries. This is a very small part of the total consumption. Only 0.24% of the consumption was sourced as roasted coffee from producing countries.

The sourcing of roasted coffee from producing countries fluctuates greatly from year to year. In 2023, these imports were only a little over half of the value in 2021. The supply from Brazil dropped by over 70% between 2019-2023. Colombia, Vietnam and Peru saw high peaks followed by rapid decline.

Source: Eurostat

The United Kingdom is the largest specialty coffee market in Europe. British out-of-home specialty coffee consumption amounted to 23% of all out-of-home consumption. The expansion of specialty coffee chains is shaping the British specialty market. One example is GAIL’s. Established chains, such as Starbucks, Costa Coffee and Caffè Nero, are also drivers of this growth. But British consumers also show increased interest in brewing great coffee at home. The average weekly household spending on coffee at home equals €7.75.

Our study did not provide examples of traders importing or exporting roasted coffee from producing countries into the United Kingdom. You can find more information on the British coffee market in our market study on Exporting coffee to the United Kingdom.

Spain is an interesting market for Latin American diaspora consumers

Spain sourced 176 tonnes of roasted coffee from producing countries in 2023. This is 4% of the total amount of Europe’s roasted coffee imports from producing countries. This is a very small part of the total consumption. Only 0.12% of consumption was sourced as roasted coffee from producing countries. The largest producing country suppliers are all Latin American countries, with Colombia in the lead. Colombia is accountable for about two-thirds of the imports of coffee roasted at origin.

Source: Eurostat

What makes Spain an interesting market for exporters of roasted coffee are its ties with Latin America, which shows specific opportunities for exporters in this region. Specifically, there are relatively large retailers targeting the Latin American (mainly Spanish-speaking) community in Spain. Examples of such retailers are Tu Tienda Latina and Latín Cor. The Colombian brand Juan Valdez is also expanding its presence in Spain. It currently has 5 outlets, aiming to open 100 within five years’ time.

Spain is Europe’s fourth-largest consumer market. In 2023, the Spanish consumed 144 thousand tonnes of coffee, representing €2 billion in retail value. The Spanish market is an espresso-based market, with large demands for average-quality Robusta and Arabica. The demand for specialty coffee is rising, mainly in large cities such as Barcelona and Madrid.

Germany hosts few importers of coffee roasted at origin

Germany sourced 223 tonnes of roasted coffee from producing countries in 2023. This is 5% of Europe’s roasted coffee imports from producing countries. This is a very small part of the total consumption. Only 0.05% of German consumption was sourced as roasted coffee from producing countries. Ethiopia, Vietnam, Cuba, and Colombia are the largest producing country suppliers.

Source: Eurostat

Coffee Annan and Roasted at Origin are suppliers of coffee roasted at origin operating on the German market. Coffee Annan sells organic and non-organic coffees. Roasted at Origin is a marketplace selling multiple brands. Both companies focus their marketing on sustainability.

Germany is Europe's largest consumer market. In 2023, the Germans consumed 450,000 tonnes of coffee, which represents a €6.1 billion retail value. The German market is known as a battleground for cheap coffees from discounters, but it also focuses heavily on organic coffee.

You can find more information in our study on Exporting coffee to the German market.

Tips:

- Refer to our specific country studies to read more about the specific markets mentioned above, as well as additional markets that might interest you.

- Consider joining competitions like AVPA’s Coffees Roasted at Origin International Contest or World Coffee Challenge in Spain. Participation in such events may be an interesting way to test and showcase your roasted coffee on the European market.

- Check out (online) shops in specific target markets to discover the range of origins, qualities and profiles of roasted at origin coffees available in Europe. For example: Kaffee Zentrale (Germany) and Alternative Café (France).

5. Which trends offer opportunities or pose threats in the European roasted coffee market?

More demand for (biodegradable) coffee pods

The market for coffee pods is rising. This market is mainly driven by convenience. The European market size for coffee pods and capsules was €5.5 billion in 2020. The largest consumer markets are Germany (€1.5 billion), France (€1.2 billion) and Italy (€800 million). The market is dominated by huge roasters, such as Lavazza, Starbucks, JAB and Nestlé.

There is also an increasing awareness of the sustainability of coffee pods. This drives the demand for biodegradable pods. Traditional coffee pods are very difficult to recycle due to the mix of plastics and aluminium. Also, the production of cups leads to additional carbon emissions. In the last few years, the demand for more sustainable pods has increased. A large share of the consumers is willing to pay more for more sustainable pods. Young consumers are especially critical of plastic and aluminium capsules.

Multiple initiatives have been launched in recent years to produce biodegradable coffee pods. One example is the German company Golden Compound, which manufactures biodegradable cups from sunflower seed hulls. Ernani, based in Spain, produces paper-based biodegradable coffee capsules.

The quality of biodegradable cups was considered far lower than aluminium cups. Coffee in biodegradable cups degraded faster than in plastic- and aluminium-based capsules. However, the quality of biodegradable cups is quickly improving, and there are biodegradable cups that show no difference in quality. Therefore, more specialty coffee suppliers are entering the market for coffee capsules. The Dutch specialty coffee roaster Wakuli is an example of a supplier of specialty coffee cups. Other examples are Served, Woken Coffee, de Koffie Jongens, and Carita Coffee.

Tips:

- Inform yourself of the viability of reusable coffee pods. If your marketing focuses on the social sustainability of roasting at origin, then it makes sense also to emphasise environmental sustainability and offer biodegradable pods.

- Inform yourself of the popularity and manufacturing process of coffee pods.

Growing interest in sustainable coffee

Coffee faces international trade imbalances. The asymmetric income distribution between producing and importing countries threatens the livelihood of smallholder producers.

European consumer awareness of sustainability and fair trade is increasing. Consumers are more interested in fair pricing, profit sharing, and supporting local economies. Marketing stories highlighting this aspect are interesting to consumers in Northwestern Europe. In this area, the penetration of fairly-traded products and consumer awareness are highest. An increase in ethical shops and fairtrade retailers in this region supports that growth.

Despite the growing emphasis on sustainability, the demand for ‘ethically-sourced coffee’ remains a niche market. The demand for certified products remains stable. According to the Coffee Barometer, the demand for certified coffee hasn’t grown in the past few years.

Several brands on the European market, that roast coffee at origin, have sustainability high at stake. These brands allow producers in developing economies to roast their coffees to add value at origin. Examples include:

- Solino (Ethiopia/Germany) also roasts and packs coffee in Ethiopia to add value and create jobs in its Trade not Aid approach. Coffee experts regularly travel to Ethiopia to train employees in coffee roasting.

GEPA (Germany), with its collection #mehrWertFürAlle / More value for all, GEPA offers three coffees roasted at origin (Guatemala, Honduras and Rwanda). With this collection, the fairtrade company states it triples value added at origin.

Other initiatives also promote and market products fully produced in origin countries, such as coffee. Examples include Proudly Made in Africa (Ireland), which promotes high-quality products fully made in Africa. Another example is the Agency for the Valorisation of Agricultural Products (France). This organisation organises an annual coffee-roasted-at-origin contest. In its 2023 contest, nearly 200 coffees from 25 countries were tasted.

It remains important to stay critical of the sustainability of companies that export coffee roasted at origin. Most companies which export roasted coffee into Europe work with small batches. It is costly to ship small batches of roasted coffee to Europe. Therefore, many small exporters also partly or fully transport their freights by air. Another reason for transporting roasted coffee by air is that transport by air is faster, which reduces the problem of the short shelf life. Transport by air is, obviously, less climate-friendly.

In some cases, roasting in the country of origin also proves to be difficult. Shipping times are longer, which makes stock management more difficult. Moyee, for example, also roasts part of its production in the consuming country. On its website, the company explains that (civil) war or a ship being stuck in the Suez Channel are examples of difficulties affecting roasting in Africa.

Molgo Research carried out this study in partnership with Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research