Entering the European market for candles

The European market for candles offers opportunities, but competition is strong. The mid- to high-end segments are your best options, as mass-producing countries dominate the lower-end market. To compete, you need to add value to your products through your ingredients, craftsmanship, designs, gift packaging and sustainability. You must meet mandatory (legal) requirements as well as any additional requirements your buyers may have.

Contents of this page

1. What requirements must candles meet to be allowed on the European market?

The following requirements apply to candles in the European market. For a more detailed overview, see our study on buyer requirements for Home Decorations and Home Textiles (HDHT).

What are mandatory requirements?

When exporting to Europe, you have to meet the following legal requirements:

- General Product Safety Directive/Regulation;

- Restricted chemicals: REACH;

- Intellectual property rights;

- Packaging legislation; and

- Upcoming sustainability legislation.

General Product Safety Directive/Regulation

According to the General Product Safety Directive (GPSD, 2001/95/EC), all non-food products marketed in the European Union (EU) must be safe to use. In 2023, the European Council adopted a new regulation to replace the GPSD. This General Product Safety Regulation (GPSR, EU 2023/988) will ensure that products in the EU, whether sold online or in traditional shops, meet the highest safety requirements. It came into force in June 2023 and will apply from December 2024 onwards.

Technical standards

To help you meet the requirements, the European Committee for Standardisation (CEN) has 5 candle standards:

- EN 15426:2018 Candles – Specification for sooting behaviour

- EN 15493:2019 Candles – Specification for fire safety

- EN 15494:2019 Candles – Product safety labels

- EN 17616:2022 Outdoor candles – Specification for fire safety

- EN 17617:2022 Outdoor candles – Product safety labels

There are also 3 CEN standards for combustible air fresheners, which apply to scented candles:

- EN 16738:2015 Emission safety of combustible air fresheners – Test methods

- EN 16739:2015 Emission safety of combustible air fresheners – Methodology for the assessment of test results and application of recommended emission limits

- EN 16740:2015 Emission safety of combustible air fresheners – User safety information

Unsafe products are rejected at the European border or withdrawn from the market. The EU uses the Safety Gate system to list and share information about such products.

Does it look like food?

GPSR Article 6 lists aspects to take into account when assessing product safety. This includes whether a product resembles food. Some decorative items look so much like food that consumers could mistake them for real foodstuffs – such as fruit-shaped candles. Because people (especially children) could be tempted to eat them, these products pose a choking hazard. The GPSR bans such products from the market, replacing Directive 89/357/EEC on dangerous products resembling foodstuffs.

When designing your candles, make sure they do not resemble food too closely in characteristics like:

- Shape;

- Colour;

- Scent; and

- Size.

Tips:

- RRead more about the new GPSR.

- Make sure to comply with the GPSR by December 2024.

- Use your common sense to ensure that normal use of your product does not cause any danger.

- Search the Safety Gate alerts for candles to get an idea of potential issues.

Restricted chemicals: REACH

The REACH regulation (EC 1907/2006) lists restricted chemicals in products that are marketed in Europe. Because candles are a combination of a carrier article (the wick) and a mixture (the wax, fragrance, colouring and other additives), REACH also applies to candles. They are considered to be articles that intentionally release a substance during use. Although the waxes used to make candles are generally not harmful, the additives may be.

Restricted chemicals in the production of candles include:

- Lead in wicks; and

- Phthalates in scented candles.

Tips:

- Comply with the restrictions for the use of chemicals as laid down in REACH.

- For information and tips from the European Chemical Agency (ECHA), see, for instance, its list of all restricted chemicals (REACH Annex XVII), information for non-EU companies and questions & answers.

Intellectual property rights

When you develop products, make sure not to copy an existing design. Intellectual property (IP) is protected in Europe, and products that violate IP rights are banned from the market. The European Commission’s IP action plan gives European companies easier access to fast, effective and affordable protection tools.

Tips:

- For more information, visit the websites of the European Union Intellectual Property Office (EUIPO) and the World Intellectual Property Office (WIPO).

- Keep track of developments via the state-of-play of the implementation of the key actions in the IP action plan.

European Green Deal

The European Green Deal provides a legal aspect to social and environmental sustainability. A main building block is the Circular Economy Action Plan, which includes initiatives along products’ entire life cycle.

In this context, many European laws are under revision and new legislation is on the way. Some of this legislation will apply to you directly, and some indirectly via your buyers. Particularly relevant proposals for the candle industry include:

- Packaging and Packaging Waste Regulation;

- Corporate Sustainability Due Diligence Directive;

- Forced Labour Regulation;

- Green Claims Directive.

Packaging legislation

The Packaging Directive (94/62/EC) aims to prevent or reduce the impact of packaging and packaging waste on the environment. Buyers may therefore ask you to minimise the use of packaging and/or use sustainable (recycled) materials.

According to the Circular Economy Action Plan, all packaging on the European market should be reusable or recyclable in an economically viable way by 2030. To help achieve this, a new Packaging and Packaging Waste Regulation (PPWR) is in the works.

Europe also has requirements for wood packaging material and dunnage (WPM) used for transport, such as packing cases and pallets. The goal is to prevent organisms that are harmful to plants or plant products from entering and spreading within the EU.

Tips:

- For more information, see the EU’s packaging and packaging waste legislation and wood packaging material factsheet.

- Stay updated on the proposal for a new regulation.

Corporate Sustainability Due Diligence Directive and Forced Labour Regulation

Important upcoming Green Deal legislation includes the Corporate Sustainability Due Diligence Directive (CSDDD) and Forced Labour Regulation (FLR). In 2022, the European Commission adopted a proposal for a CSDDD. This requires larger companies to identify and prevent, end or reduce any negative impacts of their activities on human rights and the environment, both in the company’s own operations and in its value chains. This means that the new rules may apply to you indirectly via your buyers. The proposed FLR bans products made using forced labour.

As these laws have yet to be finalised and approved, their exact implications are still unclear. You should nonetheless familiarise yourself with them and prepare for their rollout.

Tips:

- Read more about the CSDDD.

- See the FLR questions and answers and factsheet.

- Stay updated on the proposed rollout of the CSDDD and FLR.

Green Claims Directive

Another upcoming law is the Green Claims Directive. In a recent European screening of websites, many green claims were believed to be exaggerated, false or deceptive. Via this ‘greenwashing’, companies pretend to be doing more for the environment than they really are.

In 2023, the European Commission proposed a Green Claims Directive to:

- Make green claims reliable, comparable and verifiable;

- Protect consumers from greenwashing;

- Contribute to a circular and green economy; and

- Help establish a level playing field.

Tips:

- For details, see the questions and answers and factsheet.

- Stay updated on the proposed rollout of the Green Claims Directive.

- For help with communicating your sustainable performance honestly and effectively, use the Dutch guidelines regarding sustainability claims and/or the British guidance for businesses on making environmental claims.

What additional requirements do buyers often have?

Buyers often have additional requirements for:

- Quality;

- Sustainability;

- Labelling and packaging; and

- Payment and delivery terms.

RAL Quality Mark for Candles

The RAL Quality Mark for Candles is a voluntary quality mark for European candle manufacturers. It has standards for characteristics such as burning duration and behaviour, raw materials and additives, and appearance.

Tip:

- Study and meet the quality specifications of the RAL Quality Mark for Candles.

Sustainability

Social and environmental sustainability are becoming increasingly important in the European HDHT market, due to buyer and consumer values as well as new Green Deal legislation. Environmental sustainability focuses on your company’s impact on the environment, for example via raw materials and production processes. Social sustainability focuses on your company’s impact on the wellbeing of your workers and the community. Key topics include issues like fair wages and safe working conditions. You can highlight your sustainable activities and policies in the ‘story’ behind your product and company. Buyers appreciate good storytelling that invokes an emotional connection.

Consumers value sustainability

The increasing importance of sustainability is reflected in a Maison&Objet Barometer, where 62% of HDHT retailers noticed growing interest from their customers in ethical products. 92% indicated that their customers think natural materials are (very) important, 77% that they value socially responsible production methods, and 71% that they care about recyclable/recycled materials.

In addition to legal compliance, a growing number of European buyers would like you to comply with:

- Business Social Compliance Initiative (BSCI): an initiative of European retailers to improve social conditions in sourcing countries. They expect their suppliers to follow the BSCI Code of Conduct.

- Ethical Trading Initiative (ETI): an alliance of companies, trade unions and voluntary organisations. ETI aims to improve the working conditions in global supply chains via their ETI Base Code of labour practice.

- Sedex: a membership organisation striving to improve working conditions in global sourcing chains. The Sedex platform lets you share your sustainable performance, based on a self-assessment.

You can learn about sustainable options from standards like ISO 14001 and SA 8000. However, only niche market buyers demand certification.

If you adhere to such initiatives and standards, this may help your buyers comply with the proposed CSDDD and FLR, which require ‘proof’ of sustainable practices.

Tips:

- Optimise your sustainability performance. Study initiatives like BSCI and ETI to learn what to focus on.

- Demonstrate your sustainability performance for a competitive advantage. You can use self-assessments like that of the Sedex platform, or a code of conduct such as the ETI Base Code.

- For more information, see our special study on sustainability in HDHT, our tips to go green and tips to become socially responsible, and our webinars on sustainability in the European HDHT market and sustainable innovations for your HDHT business.

- Read more about BSCI, ETI, Sedex and SA8000in the ITC Standards Map. You can also conduct a free online self-assessment.

Labelling

The information on the outer packaging should match the packing list sent to the importer.

Outer packaging labels should include:

- Producer name;

- Consignee name;

- Quantity;

- Size;

- Volume; and

- Caution signs.

Your buyer will specify what information they need on the product labels or on the item itself, such as logos or 'made in' information. This is part of the order specifications. In Europe, EAN or barcodes are commonly used on the product label.

Packaging specifications

Importer specifications

You should pack candles according to the importer’s instructions. They have their own requirements for packaging materials, filling boxes, palletisation and stowing containers. Always ask for the importer’s order specifications, which are part of the purchase order.

Damage prevention

Proper packaging minimises the risk of damage caused by shocks. How an item is packaged for export depends on how easily it can be damaged. Packaging should ensure that the items inside a box cannot damage each other. It should also prevent damage to the boxes when they are stacked inside the container. Packaging therefore usually consists of inner and outer cardboard boxes. The inner boxes are filled with protective materials or clever partitioning with corrugated cardboard.

Dimensions and weight

Packaging must be easy to handle in terms of size and weight. Standards are often related to labour regulations at the point of destination and must be specified by the buyer.

Cost reduction

Boxes are usually palletised for transport, and you have to maximise the use of pallet space. Consider this when designing your products.

Packaging must provide maximum protection, but you must also avoid using excess materials or shipping ‘air’. Waste removal is a cost for buyers.

You can reduce the amount and diversity of packing materials by:

- Partitioning inside the boxes, using folded cardboard;

- Matching inner and outer boxes by using standard sizes;

- Considering packing and logistical requirements when designing your products; and

- Asking your buyer for alternatives.

Materials

Importers are increasingly banning wooden crating and packaging. Economical and sustainable packaging materials are more popular. Using biodegradable packing materials can be a market opportunity. Some buyers may even demand it.

Consumer packaging

Candles are often gifts, for which consumers appreciate a gift box. This can be the original export packaging, or a box provided by the importer-wholesaler or retailer with their branding or messaging. Candles in containers are often labelled to highlight the brand story and product features like special ingredients, scents or origin. These candles are often also packed in a branded box to add consumer value.

Tips:

- Always ask for the importer’s order specifications, including their packaging and labelling requirements.

- See Packaging Europe for more information on the latest packaging developments, including news articles about biodegradable packaging.

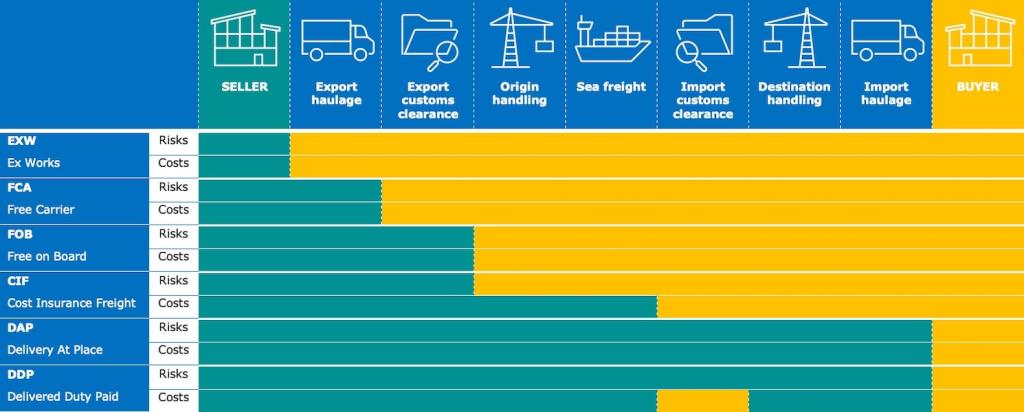

Payment and delivery terms

Payment terms are usually confirmed in the buyer’s order contract. They vary from buyer to buyer and are related to the volume and value of the order, the type of distribution partner, whether or not an agent is involved, and what delivery terms apply.

Delivery terms, known as Incoterms, depend on the type of distribution partner. HDHT importers generally prefer Free On Board (FOB) or Free Carrier (FCA) arrangements.

Tips:

- See our tips to organise your export for more information.

- Study the different types of Incoterms, including what your and your buyer’s rights and obligations are.

- See our study on terms & conditions for a more detailed explanation of terms and conditions, how to work with them, and the benefits of having your own.

What are the requirements for niche markets?

Fair-trade practices and sustainability certification are the most common niche market requirements.

Ecocert natural origin certification

Ecocert candles and home fragrances certification provides a voluntary standard for natural or organic candles. It applies to both scented and non-scented candles. To qualify, 100% of the candles’ ingredients must be of natural origin. For organic candles, at least 95% of plant ingredients (excluding alcohol) must come from organic farming.

The certification also guarantees:

- Environmentally friendly production and processing;

- Responsible management of natural resources; and

- Prohibition of most petrochemical ingredients.

Tips:

- For more information, see the Ecocert natural origin and organic candles and home fragrances standard.

- Use the standard in your production process, even if you do not apply for certification.

Fair trade

The concept of fair trade supports fair pricing and improved social conditions for producers and their communities. Fair-trade certification can give you a competitive advantage, especially if the production of your items is labour-intensive. It often includes aspects of environmental sustainability too.

Common fair-trade labels are the World Fair Trade Organization (WFTO) Guarantee System and Fair for Life certification. For most fair-trade oriented buyers in Europe, however, complying with WFTO’s 10 principles of fair trade is enough.

Tips:

- Ask buyers what they are looking for. Especially in the fair-trade sector, you can use the story behind your product for marketing purposes.

- Determine which label would be the best fit for you and apply for it if you can.

- If certification is not feasible, work according to WFTO’s principles without being officially guaranteed or certified. Carefully document your company processes so you can support your story.

- Read more about Fair for Life in the ITC Standards Map.

Sustainable palm oil

Palm oil production can involve deforestation and poor working conditions, making it a focus product of the new EU Deforestation Regulation (EUDR). The Roundtable on Sustainable Palm Oil (RSPO) is a global partnership that develops and implements global standards for producing and sourcing certified sustainable palm oil. Although the system is still under scrutiny for its effectiveness, 20% of the world’s palm oil is now RSPO-certified. IKEA is an active member – any palm oil in their candles is certified sustainable from segregated RSPO sources.

Tip:

- Check where to purchase certified sustainable palm oil from licenced distributors.

2. Through which channels can you get candles on the European market?

The European candle market consists of low-, mid- and high-end (premium) segments. Candles are put on the market through importers/wholesalers that supply to retailers, as well as retailers that buy directly from suppliers.

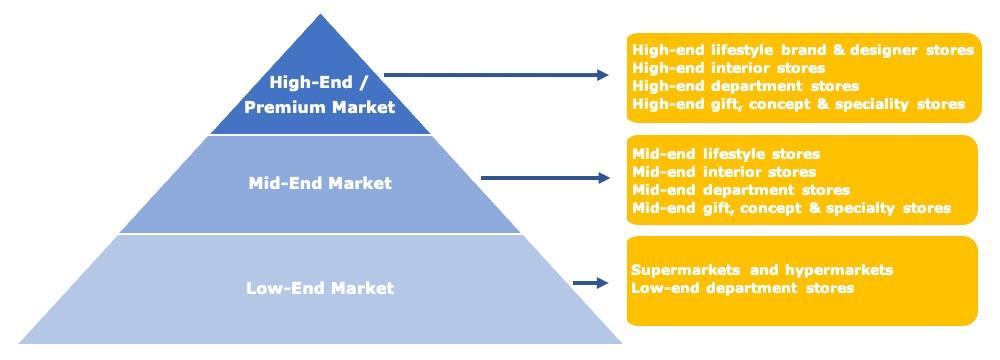

How is the end-market segmented?

Figure 1: Candle market segmentation in Europe

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

Low-end market

The low-end segment focuses on functionality, like burning hours and a stable flame. The candles often come in sets and at a low price. Typical retailers include hypermarkets like Carrefour and garden centres. Because low-cost and mass-produced items dominate this segment, opportunities are limited for smaller manufacturers like you. Instead, you should focus on the mid- to high-end market.

Mid-end market

The mid-end segment follows trends, mainly through decoration and colour. Fancy candles are part of this segment. Prices are reasonable and the candles are often gift-packed. Anthropologie and Rituals are examples of players in this market. Craftsmanship, natural or sustainable values, and branding play a role in the mid-high segment. Candles do not usually exceed this level.

High-end/premium market

Occasionally, candles move into the high-end/premium segment. For example, candles in containers or holders made from precious materials or with superb craftsmanship. In this case, the container is often what adds value instead of the candle inside. Luxury department stores like Harrods play an important role in this market. Consumers in this segment often buy candles from well-known luxury brands like Diptyque or Jo Malone.

Figure 2: Diptyque – Luxury scented candles in refillable glass containers

Source: Diptyque @ YouTube

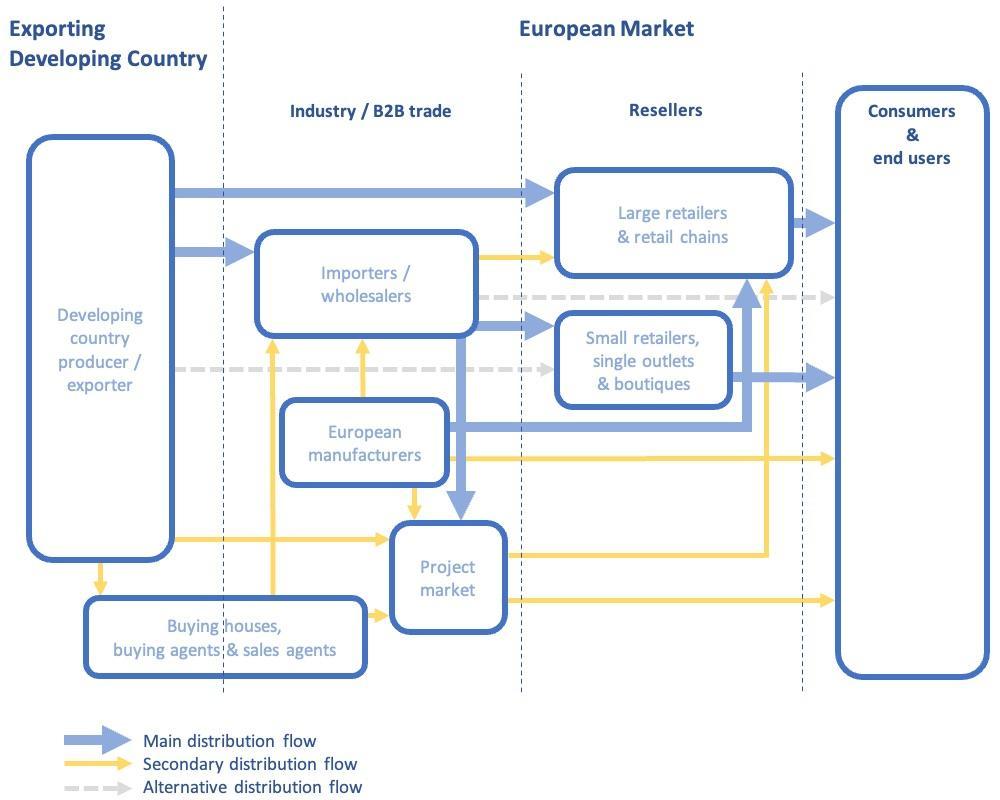

Through which channels do candles end up on the end-market?

Market access channels for candles mainly follow the traditional HDHT patterns. Importers/wholesalers supply to retailers. Larger retail chains often bypass the importers/wholesalers and import for themselves, while more and more smaller retailers have also started buying directly from the supplier. In some cases, buying agents play a role.

Figure 3: Trade channels for candles in Europe

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

Importers/wholesalers

Importers/wholesalers sell products to retailers in their own country or region, or re-export across Europe. Supplying to buyers in the project market (such as hotels and spas) is another distribution flow for them.

These importers/wholesalers handle the import procedures. They take ownership of the goods when they buy from you (unlike agents), taking on the risk of the onward sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, new trends, use of materials, types of finishing, and quality requirements.

Importing retailers

Retailers come in many sizes: large and part of a chain, or small and independent. Especially larger retail chains often import directly from their suppliers in developing countries. Many even have their own buying offices in developing countries. Others – mainly smaller independent stores – order in Europe from wholesalers.

There is a tendency towards consolidation in European retail. Large retail brands are becoming more widespread and more ‘lifestyle-centred’, offering home decoration and textiles as well as fashion accessories.

Buying agents, buying houses and sales agents

You can encounter several types of intermediaries when doing business with European buyers:

- European buying agents represent European buyers in sourcing countries and do not import products themselves. Sometimes they have a more limited role, such as checking the quality of the products. They can work individually or as part of a purchasing company.

- Buying houses are comparable to buying agents, but they are based in your country and usually offer more services. These can range from raw material sourcing to design and sampling services.

- European sales agents can help you find European buyers. However, you should be careful before entering into agreements with commercial agents, because European legislation protects their position.

Agents and buying houses mostly work on commission. They may approach you directly, or your buyer may request an intermediary. However, you should always try to work with your buyer directly. This saves on commission and allows you to communicate with your buyer.

E-commerce

E-commerce has grown in recent years. Your easiest way to benefit is by supplying to a European wholesaler or retailer with a strong online presence. This is usually not a separate channel. Retailers often combine online and offline channels, and the way of supplying to them is the same. Companies that only sell online also need to take stock before they can sell.

Direct business-to-consumer (B2C) sales

Selling directly to European consumers via your own website can be complicated and costly. You are responsible for factors like aftersales obligations and payment systems for consumer use. For most exporters from developing countries this is not feasible. In addition, according to Dutch consumer association Consumentenbond, Dutch consumers bought less from non-EU web shops after new EU VAT rules were rolled out in 2021. This could make direct online sales even less attractive.

Tips:

- To find buyers, search the exhibitor lists or attend the main trade fairs in Europe: Ambiente and Christmasworld (January/February) in Frankfurt, Maison&Objet (January and September) in Paris, and spoga + gafa (June) in Cologne.

- Search the member lists of candle associations for potential buyers, like the European Candle Manufacturers Association (ECMA) and the European Quality Association for Candles.

- See our tips for finding buyers.

- For more information about trading directly with smaller retailers and e-commerce, see our study about alternative distribution channels.

What is the most interesting channel for you?

Importers/wholesalers are the main channel between exporters in developing countries and European retailers. They are interesting if you want to develop a long-term relationship. These importers usually know the European market well, so they can provide you with valuable information and guidance on market preferences. They generally prefer FOB or FCA Incoterms.

Figure 4: Incoterms

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

Large retailers are increasingly importing for themselves to cut the margins of importers/wholesalers, reduce time to market, and have more control over product design and finish. In the lower-end market segments, self-importing retailers might want to drive a much harder bargain with you. However, price is a bit less sensitive in the mid- to high-end segment, which offers you the most opportunities.

Smaller, independent retailers continue to buy mainly from domestic importers/wholesalers. But as in other sectors, they struggle to compete with retail chains. They need to differentiate on value-added service, specialised offers and authenticity. Buying directly from producers in developing countries is an interesting way for them to do so. They typically prefer small order quantities per item, small total order volumes, and delivery to their doorstep via Delivered Duty Paid (DDP) or Delivery At Place (DAP). Repeat orders are less likely.

The trend of direct sourcing is expected to continue. This may create more opportunities for you, as a growing pool of buyers could improve your bargaining position. Because importing retailers order for their own shops, they can place orders much quicker than importers/wholesalers who may need to show samples to their retailers before ordering. You need to calculate whether trading directly with (smaller) retailers is cost-effective for you.

Tips:

- Consider targeting retailers directly to improve your bargaining position and potentially close deals faster.

- Relate your offer and terms to the targeted retailer (large/small). Ask your existing buyers how they operate if you are unsure. The better informed you are, the better you will be able to set prices.

- Build a relationship based on mutual benefits by offering services like fast delivery and after-sales support.

- If you are interested in selling to small independent retailers, make sure to have a policy for them when you participate in international trade fairs. You must have appropriate terms of trading, like low minimum order quantities or pre-stocking.

3. What competition do you face on the European candle market?

Poland and China are Europe’s leading candle suppliers, providing nearly half of the imports. These countries supply mainly low-cost items, so your best opportunities are in the mid- to high-end market, where you can add value. Poland is Europe’s main candle supplier with 30% of the imports in 2022, followed by China (21%), Germany (6.8%) and Belgium (5.1%).

Re-exporters or producers

European countries have different roles in the HDHT market. Some are mainly importers and others are mainly manufacturers. Western European countries are mainly importers. Most Western European importers are re-exporters. They do not just sell their products in their own country, but they distribute them across the continent.

European production mainly takes place in Eastern Europe, mostly because of relatively low transport and labour costs. This can make these countries a good alternative for European buyers to source low- to mid-end products. Western and Southern Europe also produce some high-end products from well-known premium brands with a long history.

Which countries are you competing with?

Source: UN Comtrade

Poland is Europe’s leading candle supplier

With 30% of the import market in 2022, Poland is Europe’s main candle supplier. As an Eastern European country, Poland benefits from being located close to the Western European market. This allows suppliers to offer short delivery times. At the same time, labour is relatively affordable compared to Western Europe. Suppliers have a good understanding of the European consumer and have well-established and efficient production lines. In addition, products ‘Made in Europe’ are increasingly popular.

Poland’s candle exports to other European countries grew from €479 million in 2018 to €747 million in 2022, at an average annual rate (CAGR) of 12%. This includes 6.7% growth in 2020, when the COVID-19 pandemic disrupted international trade and imports from leading suppliers outside Europe fell.

To compete, you should focus on design, branding, material use and handmade candles. Offer a high level of service to build strong relationships.

China provides low-cost mass production

Europe’s second-largest candle supplier is China. Chinese producers mainly supply the lower-end market with low-priced products, as product development and creativity are not their core strengths.

China’s supplies to Europe grew from €271 million in 2018 to €517 million in 2022. The country is competitive because of its low-cost workforce, availability of raw materials and efficient shipping to Europe compared to other Asian countries. However, rising labour costs have affected China’s price competitiveness. In the coming years, China’s trade war with the United States and other disruptions may affect the country’s exports. This could benefit companies from other developing countries, like yours.

To avoid competing on costs, you should stay away from mass-produced candles. Focus on products with high emotional value that are sustainable and have a story. This allows you to enter the mid- to higher-end markets.

The United States exports high-end brands

The United States is home to well-known candle brands like Yankee Candle, Capri Blue and Bath & Body Works. These brands have marketing power, and usually target the upper ends of the market. They offer an expressive range of candles, often combined with fragrance, soap and body care. Such brands are normally beyond the reach of a small manufacturer from a developing country, but they are good to learn from.

Between 2018 and 2022, European imports of candles from the United States fluctuated around €110 million. This is considerably less than in previous years, and is probably related to Yankee Candle’s production moving to Czechia in 2016.

Vietnam is another low-cost producer

Like producers from China, Vietnamese suppliers are very productive and can produce at low cost. These suppliers generally have a good idea of what is commercial and trendy. They effectively combine handmade and mechanised production and can cater to a wide range of lower- and mid-end markets. As such, they can be an effective (second-sourcing) alternative to China.

Between 2017 and 2020, Vietnamese candle exports to Europe were about €34 million. After doubling in 2021 they kept growing, to €87 million in 2022. This resulted in a CAGR of 29% and a direct European import market share of 3.5%.

In higher-end segments, Vietnamese suppliers may need to cooperate with European brands. For example, Dutch luxury lifestyle brand WOO produces its candles in Vietnam through co-creation, with a focus on sustainable values.

Which companies are you competing with?

The following companies are examples of your competition.

WOO (World of Opportunities), the Netherlands / Vietnam

WOO is a Dutch social enterprise that produces candles in Vietnam within a community-based concept. They partner with, educate and employ disadvantaged people. The brand ‘seeks to bring about a positive social and sustainable impact’ throughout its value chain. WOO mainly offers candles and home fragrances, made from upcycled materials and natural ingredients. Their hand-poured scented candles come in upcycled bottles and are packaged in cotton pouches. WOO also sells refills, so their containers can be re-used again and again.

Figure 6: Introduction to WOO and its guiding principles

Source: WOO @ Youtube

KOBO, United States

KOBO makes scented candles from environmentally sustainable soybeans, which are hand-poured into glass containers in KOBO’s family-run facility. Some come with accessories like lids and matches, and gift packaging. The scents are created using ‘complex, blended layers of high-grade oils in collaboration with the finest boutique fragrance houses in the US’. This premium offer with ‘bold pricing’ brings wellness and sustainability to the higher-end market segments.

Their Plant the Box collection takes things one step further. These soy candles come in plantable, seed-infused packaging that will grow the scent of the candle. The biodegradable box is FSC-certified, made of 100% post-consumer-waste recycled packaging, and printed with vegetable-based inks.

Figure 7: How to plant KOBO’s seed-infused candle packaging

Source: KOBO @ YouTube

The MUNIO, Latvia

Latvian brand the MUNIO is an artisanal candle, home fragrance and organic skincare studio. The family business is inspired by Northern nature. They use locally picked flowers and herbs, which are showcased in the design of their pillar candles. Their branding invites people to connect with the Nordic wilderness and meadows. This is a good example of using what you have available locally to add value, and it fits in perfectly with the wellness trend.

Figure 8: The MUNIO’s production process

Source: Elīna Bumbiere @ YouTube

The MUNIO also values sustainability. Their candles are handmade of soy wax and scented with natural fragrances and essential oils. Most of their ingredients are COSMOS-certified, a natural and organic standard for cosmetics. The company uses biodegradable, reusable and/or recyclable packaging. Their pillar candles are packaged in a cotton cloth and a recycled unbleached cardboard box. The votive candles come in a glass jar and hand-sewn fabric pouch.

In a fun addition to their range, the MUNIO offers a ‘DIY candle making kit’. Playing into the home sweet home trend, they market this as an opportunity to spend quality time together or a gift for a crafting enthusiast.

Which products are you competing with?

Electric lighting also creates ambience. As such, candles compete with smart lighting concepts. Scented candles also compete with a more industrial variety: diffusers and liquid-based home fragrances. Where scented candles are more tactile and authentic, diffusers are ‘cleaner’ and offer a perfectly adjustable scent experience. It is tradition versus modern, and the consumer can decide what style suits their cocooning experience best. In hospitality settings, the industrial variety often wins.

Tips:

- Compare your products and company to the competition. You can use ITC Trade Map to find exporters per country.

- Consider offering both traditional candles and diffusers to potentially broaden your market. You could collaborate with manufacturers near you.

- Focus on design, quality, branding and handmade candles to stand out from your competitors.

4. What are the prices of candles on the European market?

Prices for candles vary across market segments. After adding logistics costs, wholesaler and retail margins, and Value Added Tax (VAT), European consumer prices are about 4-6.5 times your selling price.

Table 1 gives an overview of candle prices across market segments.

Table 1: Indicative consumer prices of candles in Europe

| Low-end | Mid-end | High-end | |

| Basic candle (taper) | about €5 for a set of 20 | about €7 for a set of 15 | about €10 for a set of 12 |

| Fancy candle | up to €5 | €5-30 | €30 or more |

| Scented candle (in container) | up to €7 | €7-15 | €15 or more |

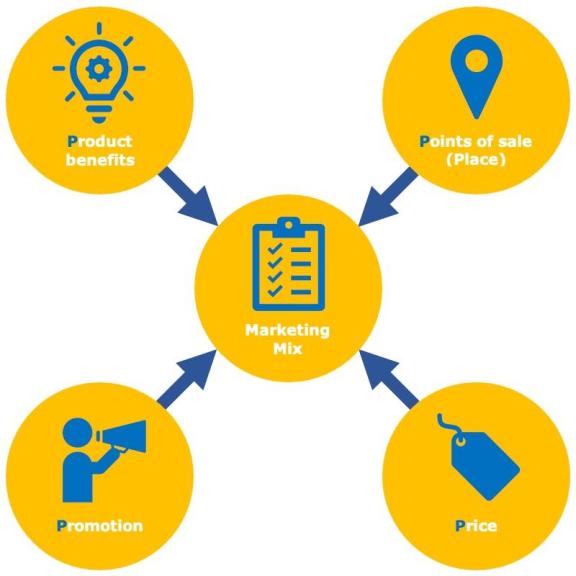

Consumer prices depend on the value perception of your product in a particular segment. This is influenced by your marketing mix.

Figure 9: Marketing mix – the 4 Ps

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

The European consumer price of your candles is about 4-6.5 times your FOB price. In addition to energy, labour and transport costs, FOB prices depend heavily on the availability and cost of raw materials. Occasional cost increases are not directly passed on to the consumer, so they put pressure on margins in the supply chain. However, recent disruptions have resulted in longer-term cost increases. This continuing pressure made many retailers raise their consumer prices. If costs drop again, consumer prices may follow.

Consumer prices generally consist of:

- Your FOB price;

- Shipping, import, handling costs;

- Wholesaler margins;

- Retail margins; and

- VAT – varies per country, about 20% on average.

Figure 10: Price breakdown indication for candles in the supply chain

Source: Globally Cool, GO! GoodOpportunity & Remco Kemper

To illustrate: in Table 2 the FOB price is set at €10. Depending on the segment your product is designed for, the consumer price ranges from €41 (low-end) to €65.50 (high-end).

Table 2: Example of the price breakdown per market segment

| Low margin | Middle margin | High margin | ||

| FOB price | €10.00 | €10.00 | €10.00 | Your FOB price |

| Transport, handling charges, transport insurance, banking services (20/15/15%) | +2.00 €12.00 | +1.50 €11.50 | +1.50 €11.50 | Landed price for the wholesale importer |

| Wholesalers' margins (50/75/90%) | +6.00 €18.00 | +8.60 €20.10 | +10.40 €21.90 | Selling price from the wholesale importer to the retailer |

| Retailers' margins (90/110/150%) | +16.20 €34.20 | +22.20 €42.30 | +32.70 €54.60 | Selling price excluding VAT from the retailer to the end consumer |

| Selling price including VAT (20%) | +6.80 €41.00 | +8.50 €50.80 | +10.90 €65.50 | Selling price including VAT from the retailer to the end consumer |

The FOB price of €10 includes your own margins. These depend on your efficiency and price setting. Margins in the lower segment are generally smaller than in the middle and higher segments.

Examples of consumer prices:

- Rustic square paraffin wax candle, Kerzenwelt, €3.50;

- 2-pack decorated stearin candles, H&M, €8.99;

- Coconut wax and beeswax candle in a jar, The Wick & Wax, £20.

Tips:

- Study consumer prices in your target segment to determine your price and adjust your cost accordingly. Your quality and price must match your target segment.

- Calculate your prices regularly and carefully, especially if the prices of your raw materials fluctuate. When raw material prices put pressure on your margin for a longer period, consider increasing your price or finding an alternative.

- Understand your segment. Offer a correct marketing mix to meet consumer expectations. Adapt your business model to your position in the market.

Globally Cool carried out this study in partnership with GO! GoodOpportunity on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research