Entering the European market for hammam towels

The mid and higher-end segments of the European market offer good opportunities for hammam towels, but competition is strong. You can add value to your products through the use of special techniques and materials, as well as sustainable values. Entering the European market means you need to comply with the European Union’s mandatory legal requirements, as well as any additional or niche requirements your buyers may have.

Contents of this page

1. What requirements must hammam towels comply with to be allowed on the European market?

The following requirements apply to hammam towels on the European market. For a more detailed overview, see our study on buyer requirements for home decorations and home textiles (HDHT).

What are the mandatory requirements?

When exporting to Europe, you must comply with the following legal requirements:

- General Product Safety Directive

- REACH

- Textile Regulation

- Packaging and packaging waste legislation

General Product Safety

Europe’s General Product Safety Directive states that all products marketed in Europe must be safe to use. It provides a framework for all legislation regarding specific products and issues. If there are no specific legal requirements established for your product and its use, the General Product Safety Directive still applies. If specific requirements do apply, the Directive applies in addition to those, covering other safety aspects that may not have been described specifically.

Unsafe products are rejected at the European border or withdrawn from the market. The European Union has introduced a rapid alert system (RAPEX) to list such products.

Tips:

- Read more about the General Product Safety Directive in the EU Trade Helpdesk.

- Use your common sense to ensure that normal use of your product does not cause any danger.

- Search the RAPEX database for hammam towels for an idea of what issues may arise.

Restricted chemicals: REACH

The REACH regulation (EC 1907/2006) lists restricted chemicals in products that are marketed in Europe. For example, REACH restricts the use of azo dyes in textile products. If you dye the materials for your towels, make sure you do not use certain azo dyes that release any of the 22 aromatic amines that are prohibited. Be aware that the legislation lists the aromatic amines, not the azo dyes that release them.

In addition, REACH restricts the use of certain flame retardants in textiles, including Tris (2.3 dibromopropyl) phosphate (TRIS), Tris (aziridinyl) phosphineoxide (TEPA) and Polybromobiphenyles (PBB), which are prohibited in products intended to come into contact with the skin.

In October 2018, the European Commission announced new limits for 33 CMR substances (substances that are carcinogenic, mutagenic or toxic for reproduction), which will apply from 1 November 2020 and affect textiles, such as hammam towels. They are listed in entry 72 of Annex XVII and include substances such as formaldehyde, heavy metals and benzenes. In general, the maximum concentration is 1 mg/kg, but there are exceptions.

Tips:

- Make sure you comply with the restrictions for the use of chemicals as laid down in the REACH regulation, including the latest amendment EU 2018/1513 that will come into force by November 2020.

- In case of dyeing, make sure your products do not contain any of the azo dyes that release the prohibited aromatic amines. This includes checking your own suppliers; ask for certified azo-free dyes.

- Follow developments in the field of flame retardants, as new alternatives are being developed. You can do so for instance through the European Flame Retardants Association (EFRA).

- Familiarise yourself with the full list of restricted substances in products marketed in Europe by checking out restricted chemicals in textile products in the EU Trade Helpdesk.

- For useful information and tips from the European Chemical Agency, see REACH Annex XVII (a list of all restricted chemicals), Information on REACH for companies established outside Europe and Questions & Answers on REACH.

Textile Regulation

The European Textile Regulation states that textile products need to be labelled or marked. Its purpose is to make sure that consumers within the European Union know what they are buying. The regulation applies to all products that contain at least 80% (by weight) of textile fibres. It requires textile products to have a label that states the full fibre composition of the product and, if applicable, the presence of non-textile parts of animal origin. The label should be durable, easily legible, visible, and accessible. It should also be printed in all the official national languages of the European countries the product is sold in.

There is no Europe-wide legislation on the use of symbols for washing instructions and other care aspects of textile articles. Because consumers do consider care information to be important information on a product label, you are advised to follow the ISO 3758: 2012 standards on the care labelling code using symbols for textiles.

Tips:

- For more information, see the Frequently Asked Questions about the Textile Regulation.

- Know your own product and study the European labelling rules to find out how it should be labelled in Europe. For example, if you use a cotton name, trademark or other term that implies the presence of a type of cotton, the generic fibre name ‘cotton’ must be used with it. Find out more about textile labelling rules in the EU Trade Helpdesk.

Packaging

Europe has specific packaging and packaging waste legislation. EU Directive 2015/720 was adopted to harmonise measures at European level concerning the management of packaging and packaging waste and to prevent or reduce their impact on the environment. Buyers may therefore ask you to minimise the use of packaging materials (paper, carton, plastic) or to use a different kind of material, including recycled materials.

Europe also has requirements for wood packaging materials (WPM) used for transport, such as:

- packing cases

- boxes

- crates

- drums

- pallets

- box pallets

- dunnage

All wood packaging material and dunnage from non-European Union countries must be:

- either heat treated or fumigated in line with ISPM15 procedures;

- officially marked with the ISPM15 stamp consisting of 3 codes (country, producer and measure applied) and the IPPC logo;

- debarked.

These requirements do not apply to:

- wood 6 mm thick or less;

- wood packaging material made entirely from processed wood produced using glue, heat, and pressure, such as plywood, oriented strand board, and veneer;

- wood packaging material used in trade within the European Union.

The objective of this directive is to prevent organisms that are harmful to plants or plant products from being introduced into and spreading within the European Union. It also regulates imports from third countries in line with international plant health standards. Keep this in mind when you decide on the packaging of your hamma towels.

What additional requirements do buyers often have?

Sustainability

Social and environmental sustainability make your products stand out in the European market. Think of sustainable raw materials and production processes, as well as the impact your company has on the environment, the well-being of your workers and society as a whole. Buyers appreciate a strong story to create an emotional connection with their customers.

An increasing number of European buyers now require the following certification schemes:

- Business Social Compliance Initiative (BSCI): European retailers developed this initiative to improve social conditions in sourcing countries. They expect their suppliers to comply with the BSCI Code of conduct. To prove compliance, the importer can request an audit of your production process. Once a company is audited, it is included in a database for all BSCI participants.

- Ethical Trading Initiative (ETI): this initiative is an alliance of companies, trade unions and voluntary organisations. It aims to improve the working lives of people across the globe that make or grow consumer goods.

You can use standards such as ISO 14001 and SA 8000 to read up on sustainable options. However, only niche market buyers require compliance with such standards.

In the home textiles industry, organic cotton is becoming an increasingly popular sustainable option. You can obtain certification via The Global Organic Textile Standard (GOTS). The easiest way to use certified organic cotton is by either sourcing certified yarn or, if you do not weave yourself, certified organic cotton fabric.

A recent study by the International Trade Centre concluded that, irrespective of the product, retailers in the major European markets are putting more environmentally and socially sustainable products on their shelves. And that is simply because consumers ask for it. According to the survey, 98.5% of retailers consider sustainability as a factor in their product sourcing decisions.

Tips:

- Optimise your sustainability performance. Reading up on the issues included in initiatives such as BSCI and ETI will give you an idea of what to focus on.

- If you can show your sustainability performance, this may be a competitive advantage. For instance with a self-assessment like the BSCI Producer Self-Assessment, or a code of conduct such as the ETI base code.

- For more information, see our special study on sustainability.

Labelling

The information on the outer packaging of hammam towels should correspond to the packing list sent to the importer. The external packaging labels should include:

- producer name

- consignee name

- quantity

- size

- volume

- caution signs

The most important information on the product labels of hammam towels is composition, size, origin and care labelling. Your buyer will further specify what information they need on the product labels or on the item itself, such as logos or ‘Made in…’ information. This is part of the order specifications. It is common in Europe to use EAN or barcodes on the product label. For more information, please refer to the labelling-specific rules under the Textile Regulation.

Packaging

Importer specifications

You should pack hammam towels according to the importer’s instructions. They have their own specific requirements for the use of packaging materials, filling boxes, palletisation, and stowing containers. Always ask for the importer’s order specifications, which are part of the purchase order. Packaging usually consists of plastic wrapping to protect the fabric from water, solar radiation and staining.

Damage prevention

Properly packaging hammam towels minimises the risk of damage by shocks, temperature or humidity. Packaging should make sure the items inside a cardboard box cannot damage each other. It should also prevent damage to the boxes when they are stacked inside the container. Packaging therefore usually consists of outer and inner cardboard boxes filled with protective materials, like bubble wrap or paper.

Dimensions and weight

Packaging must be easy to handle in terms of dimensions and weight. Standards are often related to labour regulations at the point of destination and must be specified by the buyer.

Cost reduction

Boxes are usually palletised for air or sea transport, and you have to maximise pallet space. Packaging must provide maximum protection. However, you should also avoid using excess materials or shipping ‘air’. Waste removal is a cost for buyers. You can reduce the amount and diversity of packing materials by:

- partitioning inside the boxes, using folded cardboard;

- matching inner and outer boxes by using standard sizes;

- considering packing and logistical requirements when designing your products;

- asking the buyer for alternatives.

Material

Importers are increasingly banning wooden crating and packaging due to their unsustainability and high material and disposal costs. Economical and sustainable packaging materials are more popular. Using biodegradable packing materials can be a market opportunity. For some buyers, it can even be a requirement.

Consumer packaging

Hammam towels are usually displayed unpacked or with a simple wrapping, making attractive consumer packaging of minor importance. In general, consumer packaging can be simple in design, usually following the towels’ design and material.

Tips:

- Always ask the importer’s order specifications, packaging, and labelling requirements.

- See Packaging Europe for more information on the latest packaging developments, including regular news articles about biodegradable packaging.

Payment and delivery terms

Payment terms are usually agreed upon with the buyer in the order contract. They vary from buyer to buyer and are related to the volume and value of the order, the type of distribution partner, whether or not an agent is involved, and what delivery terms apply.

Delivery terms, officially known as Incoterms, depend on the type of distribution partner and their preferences regarding physical distribution. Importers generally prefer Free On Board (FOB) or Free Carrier (FCA) arrangements.

FOB is restricted to goods transported by sea or inland waterway. It means that the seller pays for transportation of the goods to the port of shipment, plus loading costs. The buyer pays the cost of marine freight transport, insurance, unloading and transportation from the arrival port to the final destination. FCA can be used for any transportation mode. In this type of arrangement, the seller fulfils his obligation to deliver when he has handed over the goods, cleared for export, into the charge of the carrier named by the buyer at the specified place or point.

Retail multiples can ask for Cost Insurance Freight (CIF). That means that they will ask you to include the shipping and insurance charges in your quotation. Small retailers may go a step further and ask you to arrange that the goods will be delivered to their doorstep via a Delivered Duty Paid (DDP) arrangement. For importers who consolidate orders in your country, Ex Works (EXW) terms are often best.

Tips:

- For a more elaborate overview of the various terms and conditions, and how to work with these, see our study on terms and conditions, which also explains the benefits of having your own terms and conditions.

- Study the different types of Incoterms, including what your and your buyer’s rights and obligations are.

What are the requirements for niche markets?

Fair trade

The concept of fair trade supports fair pricing and improved social conditions for producers and their communities. Especially when the production of your hammam towels is labour-intensive, fair-trade certification can give you a competitive advantage. Common fair-trade certifications are issued by the World Fair Trade Organisation (WFTO) and Fair For Life.

Tips:

- Ask buyers what they are looking for. Especially in the fair-trade sector, you can use the story behind your product for marketing purposes.

- Check the ITC Sustainability Map database for more information on voluntary standards and their requirements, including fair production.

Sustainable textile certification

While sustainability is gaining ground, the actual use of certification is still not common in this sector, apart from organic certifications that are becoming widespread. As this is a means of demonstrating sustainability, there is an increasing interest from buyers.

There are several eco-labels used for textiles:

- The Global Organic Textile Standard (GOTS) is a textile-processing standard for organic fibres. It ensures environmental and social responsibility throughout the production chain of textile products.

- OEKO-TEX Standard 100 certification guarantees that no hazardous chemicals are used in the production of textiles. It provides textile and clothing companies with more transparent supplier relationships and facilitates the flow of information regarding potential problematic substances.

- The European Union’s Ecolabel seeks to minimise products’ environmental impact by looking at the use of environmentally friendly chemical options. The label is awarded only to products with the lowest environmental impact in a product range.

- The voluntary Nordic Swan eco-label is used for textile products in Sweden, Norway, Finland, Denmark and Iceland.

Tips:

- Check the possibility of sourcing organic cotton for your hammam towels. Textile products containing a minimum of 70% organic fibres can become GOTS certified. The easiest way is to use certified organic cotton yarn if you are weaving the fabric yourself, or certified organic cotton fabric if you are into cutting making trimming (CMT) only.

- Read more about GOTS, OEKO-TEX and the European Union’s Ecolabel on the ITC Standards Map.

- Determine which certification programme would be the best fit for you and apply if possible.

2. Through what channels can you get hammam towels on the European market?

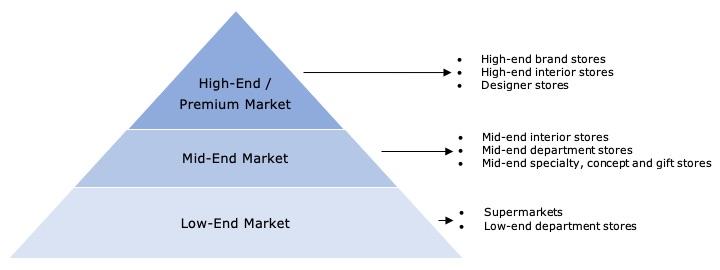

The hammam towel market is segmented into low, mid and high-end premium market segments. The towels are put on the market through the traditional channels: importers and wholesalers that supply to retailers, as well as retailers that buy directly from suppliers.

How is the end-market segmented?

Figure 1: Hammam towel market segmentation in Europe

Low-end market

In this segment, price is the leading factor and, as such, the hammam towels are simple and inexpensive. The focus is on functionality, while the colours, patterns, weaving techniques, finishing, material, etcetera in this segment are basic. Value addition is very hard, and therefore this segment offers you limited possibilities.

Mid-end market

The middle segment puts more emphasis on design, material and finish, while prices are still reasonable. Value addition can be achieved through special techniques such as printing, applique and embroidery, and by combining different materials or adding accessories and embellishments such as fringes, pompoms or tassels. The mid-and high-end segments offer you the most opportunities.

High-end or premium market

Craftsmanship, natural or sustainable values and branding play a role in the high-end segment. This is a truly premium product with exceptional finishing, integration of materials like bamboo or fine animal hair, and high-end design in colouring and weaving patterns. The towels in this upper segment are often made of organic certified cotton. The products are strongly backed by high-quality web promotion materials with excellent photography and a powerful story behind the product. Designer quality is common and private labels are the standard.

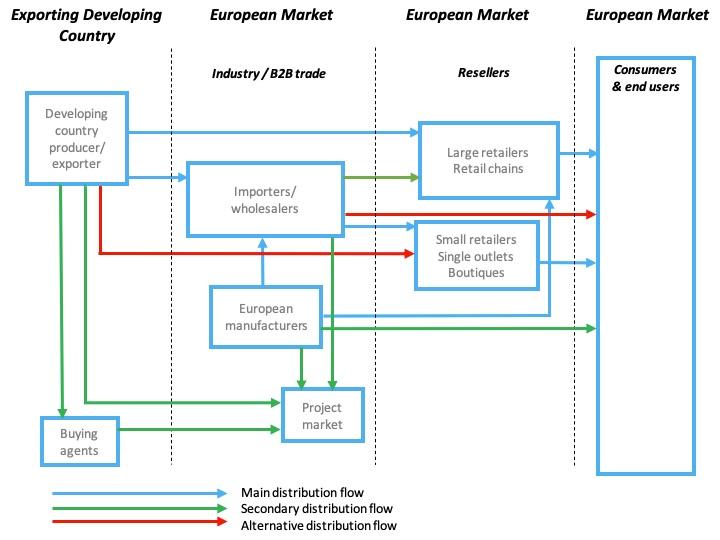

Through what channels do hammam towels end up on the end-market?

The channels through which hammam towels are put on the market follow the traditional patterns: import takes place via importers and wholesalers that supply to retailers. Larger retail chains often bypass the importers and wholesalers and import themselves, while more and more smaller retailers have also started buying directly from suppliers. In some cases, buying agents play a role. Below, we highlight the main actors in the market for hammam towels.

Importers/wholesalers

Importers/wholesalers sell products to retailers in their own country or region, or re-export to the broader European continent. Some European markets are therefore supplied by wholesalers/importers from other European countries (internal European trade). Supplying to buyers in the project market can be considered as a secondary distribution flow for European importing wholesalers.

These importers/wholesalers take care of the import procedures. They take ownership of the goods when they buy from an exporter (as opposed to agents), taking on the risk of the onward sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, new trends, use of materials, type of finishing and quality requirements.

Importing retailers

Some retailers, especially the larger chains, are increasingly importing directly from their suppliers in developing countries. Many large retail chains even have their own buying offices in developing countries, such as Ikea. Others, mainly the smaller independent stores, order in Europe from wholesalers.

Retailers come in many sizes: large and part of a chain, or small and independent. There is a tendency for consolidation in European retail, with large retail brands becoming more widespread in Europe and more ‘lifestyle-centred’ (offering home decoration and textiles as well as fashion accessories and furniture).

Buying agents

Buying agents do not import, but instead represent European buyers in the sourcing country. Sometimes agents have a more limited role, such as checking the quality of the hammam towels in your warehouse on behalf of a specific importer or checking the codes of conduct that exporters have agreed with the buyer. Agents can work individually or as part of purchasing companies. They mostly operate based on commission.

E-commerce

E-commerce in the HDHT sector is increasing and can help you reach a broader range of customers. However, it is important to understand that for most producers this is not a completely separate channel in itself and that catering to buyers that sell online does not differ from your regular business. Retailers often combine online and offline channels, but the way of supplying to them is the same. Companies that only sell online also need to take stock before they can sell.

Online retailers vary in size. Larger online retailers such as Zusenzomer, Hamamista and Bohemia Design typically procure directly from manufacturers/exporters, while smaller platforms like Urbanara and Hammams source their towels from importing wholesalers. Hammam towels are also abundantly found on mega multi-product platforms like Amazon, Bol and eBay.

Developing country exporters are also entering the online retail space, such as Fouta Tunisia and Orientina. However, most exporters are online for the purpose of promoting awareness about hammam towels and positioning their offer, not selling online. The main reason for this is that it is quite challenging to manage stocks and delivery to online customers from the producer country.

Channeling online sales via your own website would mean:

- supplying small batches/individually packaged items and being prepared to pre-stock and offer more just-in-time supply concepts

- needing to be found in a crowded space of European and producer country wholesalers and retailers that are ahead of the game in understanding and responding to online consumers’ needs

- being able to deal with aftersales on a B2C level, including returns and replacing items.

For these reasons, selling online to consumers in Europe is not feasible for most exporters from developing countries.

Tips:

- To find potential buyers, search the list of exhibitors or attend the main trade fairs in Europe: Ambiente - Frankfurt (February), Heimtextil - Frankfurt (January) and Maison et Objet - Paris (January especially, and September.

- Search the member lists of relevant industry associations to find potential buyers, such as EURATEX (European Apparel and Textile Confederation).

- See our tips for finding buyers on the European market.

- To help you enter the market, consider working with an agent or representative with a good reputation. You can look for commercial agents on the website of Internationally United Commercial Agents and Brokers (IUCAB).

- For more information about trading directly with smaller retailers, see our special study about alternative distribution channels.

Figure 2: Trade channels for hammam towels in Europe

What is the most interesting channel for you?

Wholesale importers are the main channel between exporters in developing countries and European retailers. They are interesting if you want to develop a long-term relationship and they usually have good knowledge of the European market. They can provide you with valuable information and guidance on European market preferences and will normally provide you with design input.

However, as the market is becoming more and more competitive, large retailers are increasingly importing themselves instead of through European wholesale importers. The obvious advantages are cutting out the margins of the wholesaler and reducing delivery time to the market. In the lower-end market segments, self-importing retailers might want to drive a much harder bargain with you. However, in the higher middle segment, which offers you the most opportunities, price is less of an issue.

Smaller independent European retailers continue to purchase mainly from domestic wholesalers and importers. As in other European market sectors (such as food or clothing), independent HDHT retailers struggle to compete with retail chains. They need to differentiate on value-added service, as well as specialised offers and authenticity. They typically prefer small order quantities per item, small total order volumes and delivery to their doorstep, with a limited likelihood of repeat orders. You need to calculate if this is cost-effective for you.

The trend of direct sourcing is expected to continue in future and may create more opportunities for you. The pool of buyers may increase if more retailers become importers, possibly resulting in an improvement of your bargaining position. Importing retailers order for their own shops and can therefore place orders much more quickly than some of the importers and wholesalers, who first need to show samples to their retailers before exporters receive their orders.

Tips:

- Consider targeting retailers directly, to improve your bargaining position and increase your chances of closing deals faster.

- Relate your offer and terms to the targeted retailer (large or small). Ask your existing buyers how they operate if you are unsure. The better informed you are about this aspect, the better you will be able to set prices.

- For more information on the pros and cons of dealing directly with small retailers, read our study on alternative distribution channels.

- Offer suitable services such as fast delivery and after sales support to build a relationship based on mutual benefits.

- When you participate in international trade fairs, especially within Europe, make sure that you have a policy for small, independent retailers coming to your booth. If you choose to sell to them, you must have appropriate terms of trading, such as low minimum order quantities, delivery to the doorstep of the retailer or pre-stocking.

3. What competition do you face on the European hammam towels market?

Pakistan and India supply more than a third of European imports of cotton toilet and kitchen linen. For hammam towels specifically however, Turkey and Tunisia are key suppliers. These countries have a long tradition in hammam towel manufacturing and set the standard for this product group.

The coronavirus pandemic and the measures taken against it worldwide are expected to have a large impact on international trade and the European market for many products and services, including HDHT. Please note that the below analysis is based on the statistics that are currently available (2015–2019). Therefore, the expected impact of the pandemic on the European market and global supply chains have not been taken into account in this report. For the latest news in your sector, please check CBI News.

No specific trade data is available for hammam towels, so these statistics cover cotton toilet and kitchen linen in general.

Pakistan and India are the main suppliers of cotton toilet and kitchen linen to Europe, providing 19% and 18% of the total imports respectively. Turkey (9.8%), China (9.5%), Germany (9.2%) and Egypt (7.1%) follow. Important to note is that for hammam towels specifically, Turkey and Tunisia probably are much more important suppliers than the statistics reflect.

You should be aware that in the European market, countries have different roles. You can make a rough distinction between countries that are mainly importers and countries that are mainly manufacturers. Most importers in western European countries do not just sell their products in their own country, but across Europe. This explains why in HDHT, small countries like Denmark and the Netherlands often import much more than the demand in their own domestic markets.

European production mainly takes place in Eastern European countries. This is mostly because of their location already in the European market and their relatively low labour costs. This sometimes makes them a good alternative to sourcing from Asia.

In general, western European countries are mainly re-exporters, countries in Asia are the manufactures and eastern European countries are the new manufacturers. Mass-produced basketry is segmented in the lower ends of the market and produced in the most cost-effective country. You do not compete with these countries, as your focus should be on the mid- to high-end market. Western European countries could therefore be interesting trading partners for you.

Which countries are you competing with?

Turkey is the traditional home of Turkish ‘hammam’ baths

Famous for its Turkish hammam tradition, Turkey is your main competition on the European market for hammam towels. The ‘ancient’ Turkish story behind the product, along with claims that Turkish cotton is softer and more absorbent, serve well to promote the products’ higher value.

Turkish supplies of cotton toilet and kitchen linen to Europe dipped between 2016 and 2018 but recovered strongly in 2019, when they reached €28 million. More than a third of these Turkish exports were destined for the United Kingdom, which is also the market that caused this pattern. Which exact product types caused the fluctuation is unclear. Turkey’s supplies to other European countries were relatively stable.

In addition to Turkey’s strong ties to the product’s origins, the country’s strengths are its low-cost workforce and its location close to the European market. This makes manufacturing locations in Turkey more attractive, primarily based on cost.

Tunisia mainly supplies to France

Tunisian hammam towels are also known as foutas. Between 2015 and 2019, Tunisia’s exports of cotton toilet and kitchen linen to Europe increased from €4.0 million to €6.1 million. This represents a strong average growth of 11% per year. France is Tunisia’s overall main international trade partner. This is also reflected in Tunisia’s exports of cotton toilet and kitchen linen, of which 82% is destined for France. To become less dependent on the French market, Tunisian suppliers could consider diversifying into other European countries.

Like Turkey, Tunisia’s strengths are its low-cost workforce and its location close to the European market, allowing suppliers to offer short delivery times. An additional advantage when it comes to trading with France, is the shared language.

Egypt is known for its high-quality cotton

Egyptian cotton is renowned for its luxurious properties. The hand-picked material creates softer and finer fabrics that are lightweight yet durable. Egyptian cotton is used worldwide for high-end products.

Egypt itself exported €20 million worth of cotton toilet and kitchen linen to Europe in 2019, after an average annual increase of 3.9% since 2015. Like Turkey and Tunisia, Egypt benefits from its competitive wages and from being near the European market. However, exports from countries like Egypt mainly consist of ‘regular’ toilet and kitchen linen, rather than hammam towels. This also applies to Pakistan, India, and China.

Pakistan now the largest supplier of cotton toilet and kitchen linen

With an impressive average annual growth rate of 10%, Pakistani supplies of cotton toilet and kitchen linen to Europe increased from €36 million in 2015 to €53 million in 2019. Thanks to this strong performance, Pakistan has overtaken India as Europe’s leading supplier of cotton toilet and kitchen linen. About a quarter of these exports are destined for the United Kingdom, and a further 18% to Germany.

Pakistan has cheap and plentiful labour and is a high-volume, low-pricing sourcing hub in Asia. It traditionally is one of the leading producers of cotton in the world and has a large spinning capacity to produce textile products from cotton. As such, Pakistan has a competitive edge in the production of cotton.

Indian supplies are relatively stable

Between 2015 and 2019, Indian supplies of cotton toilet and kitchen linen to Europe fluctuated slightly around €50 million. This has allowed Pakistan to overtake it as Europe’s leading supplier in 2019.

India can offer skilled labour and transport at relatively low costs. It is one of the biggest cotton producers in the world, which gives manufacturers direct access to high-quality cotton for relatively low prices. In addition, the Indian government’s recent efforts to reach out to the leading nations in the world have resulted in strong bilateral trade relationships with these countries.

China not a dominant player in this product group

Chinese supplies decreased considerably between 2015 and 2019, from €37 million to €27 million, at an average rate of -7.5% per year. This is due to the increasing competition from other upcoming markets such as Pakistan, a strong and growing player in textile products. The disruptions following the trade war with the United States may further negatively impact the trade performance of China and benefit companies from the other supplying nations.

China’s strengths are its low-cost workforce and access to raw materials, as well as its relatively low cost and frequent shipping to Europe. However, product development and creativity are not the core strengths of Chinese manufacturers.

Which companies are you competing with?

Peshtemal City, Turkey

Peshtemal City’s main focus is on hammam towels, even though they also manufacture bathrobes and blankets. As a Turkish producer, they use Turkish cotton, but they have also started using recycled materials. The company has an OEKO-TEX certification.

When it comes to techniques and finishes, Peshtemal City shows a wide range of possibilities, from printing to different kinds of weaving and washing techniques. The company profiles itself as a specialist in the field of hammam towels, also offering the possibility of customisation and co-creation.

Hamman Havlu, United Kingdom and Turkey

The British company Hammam Havlu works closely together with a traditional Turkish producer of hammam towels. What makes this company interesting is how they promote their products and the use of their towels. The blog section of their website boasts a wide variety of articles in which the hammam towels feature prominently. These stories are in line with the way in which Hammam Havlu promotes itself on social media.

The company describes itself as ethical and sustainable, however, the website does not explain it any further. This is a gap in the company’s story and a missed opportunity.

Fouta Tunisia, Tunisia

Fouta Tunisia is an example of a company that has successfully tapped into some of the key trends. The company offers fouta (hammam) towels in many different colours, textures, and designs, and clearly explains their advantages over regular terry towels. They can also embroider and print personalised fouta towels, although this option comes with a minimum order volume of 100 pieces.

On Fouta Tunisia’s dedicated wholesale website, the company offers customisation and tailor-made solutions. While their headquarters are in Tunisia, they also have a store, showroom and warehouse in Paris. Buyers are invited to visit the location in France and discuss projects, which is a convenient option for European parties.

Which products are you competing with?

Consumers are increasingly committed to living and travelling responsibly and minimising their environmental impact. Eco-friendly hammam towels are an ongoing trend, competing with mainstream hammam towels. An example of this is the organic hammam towel, also called the durable hammam towel. This type of towel is produced with 100% organic cotton and often uses natural dyes.

Hammam towels of soft-woven bamboo and organic cotton are another example. These towels are manufactured by combining 100% organic cotton with bamboo fibres. Bamboo fibres are extremely absorbent and have natural anti-bacterial qualities. The combination with organic cotton creates a soft feeling hammam towel that is lightweight and durable.

Tips:

- Compare your products and company to the competition. You can use ITC Trademap to find exporters per country. You can compare on, market segment, price, quality and target countries.

- To differentiate from your main competitors, focus on design, craftsmanship, quality and the story behind your products.

4. What are the prices for hammam towels on the European market?

Prices for hammam towels vary across market segments, ranging from low end to high end. After adding logistics costs, wholesaler and retail margins and VAT, European consumer prices amount to about 4–6.5 times your selling price.

Table 1 gives an overview of the indicative prices of hammam towels in the low-, mid- and high-end market segments. ‘Indicative’ is key here, since prices for hammam towels vary depending on technique, size, material, design, brand, and other ways of value addition.

Table 1: Indicative consumer prices of hammam towels in Europe

| Low-end | Mid-end | High-end / premium | |

| Hammam towels | €5 - €15 | €19–€50 | €50 or more |

Consumer prices depend on the value perception of your product in a particular segment. This is influenced by your marketing mix:

- product benefits

- promotion (brand or not, communication of product benefits)

- points of sale (reseller positioning)

- price

The European consumer price of your rugs is around 4–6.5 times your selling (FOB) price. Besides energy, labour, and transport costs, FOB prices depend heavily on the availability and cost of raw materials. For example, in recent years the price of wool has increased considerably, largely due to renewed demand from China. Occasional increases in the price of raw materials are not directly passed on to the consumer, but do put pressure on exporters’, importers’ and retailers’ margins.

The following percentages give an indication of a price breakdown for hammam towels in the supply chain:

- shipping, import, handling costs: +15-20%

- wholesaler: +50-90%

- retail: +90-150%

- VAT*: +20%

*VAT percentages in Europe range from 18% in Malta to 27% in Sweden. On average, these percentages are around 20%.

For example, in Table 2, the FOB price is set at €10. Depending on the market segment your product is designed for, the consumer price ranges from €41 in the low-end market to €65.50 in the high-end market.

Table 2: Example of the price breakdown per market segment

| Low margin | Middle margin | High margin | ||

| FOB price | €10 | €10 | €10 | Your FOB price |

| Transport, handling charges, transport insurance, banking services (20%/15%/15%) | +2 €12 | +1.50 €11.50 | +1.50 €11.50 | Landed price for the wholesale importer |

| Wholesalers’ margins (50%/75%/90%) | +6 €18 | +8.60 €20.10 | +10.40 €21.90 | Selling price from the wholesale importer to the retailer |

| Retailers’ margins (90%/110%/150%) | +16.20 €34.20 | +22.20 €42.30 | +32.70 €54.60 | Selling price excluding VAT from the retailer to the end consumer |

| Selling price incl. VAT (20%) | +6.80 €41 | +8.50 €50.80 | +10.90 €65.50 | Selling price including VAT from the retailer to the end consumer |

Some examples of hammam towel prices across Europe:

- OEKO-TEX certified cotton hammam towel, rêve vert (Denmark): €27 (approx.)

- 30% bamboo hammam towel, Hamam Secrets (Netherlands): €32.90

- GOTS-certified 100% organic cotton peshtamel, Kin and Kloth (United Kingdom): €70 (approx.)

Tips:

- Study consumer prices in your target segment to determine your price and adjust your cost accordingly. Your hammam towels’ quality and price must match what is expected in your chosen target segment.

- Calculate your prices regularly and carefully, especially when you know that prices of your raw materials are regularly fluctuating. When prices of your raw materials pressure your margin for a longer period, consider increasing your price or finding another suitable alternative.

- Understand your segment. Offer a correct marketing mix to meet consumer expectations. Adapt your business model to your position in the market.

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with Remco Kemper.

Please review our market information disclaimer.

Search

Enter search terms to find market research