The European market potential for blankets and throws

There is strong demand in Europe for imported blankets and throws. Nearly two-thirds comes directly from developing countries. This makes Europe an interesting market for you. An increased interest in social and environmental sustainability is a key trend that influences the market for blankets and throws. Buyers are also interested in co-creation and range development. Developing a range of matching or complementary cushion covers helps them market a concept.

Contents of this page

1. Product description: blankets and throws

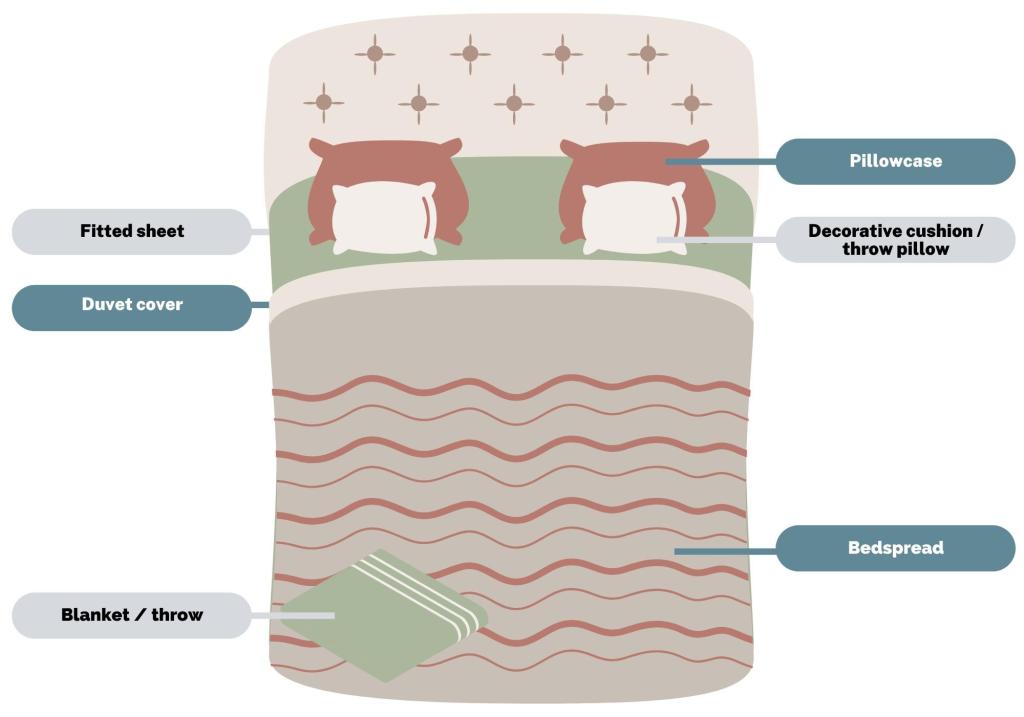

In home decoration and home textiles (HDHT), there are several categories consisting of various product groups. Blankets and throws are categorised under home textiles. A blanket is a piece of cloth designed to provide warmth to the user, usually when they are sleeping. It can also be used to decorate the bed. A throw – or ‘throw blanket’ – is a smaller blanket, often used outside the bedroom as well. However, the terms ‘blanket’ and ‘throw’ are often used interchangeably.

Figure 1: Bedroom textiles

Source: Globally Cool, GO! Good Opportunity & Remco Kemper

This study uses the following codes to refer to trade in different types of blankets and throws:

Table 1: Product codes

| Harmonised System (HS) | Description |

|---|---|

| 6301 20 | Blankets and travelling rugs of wool or of fine animal hair |

| 6301 30 | Blankets and travelling rugs of cotton |

| 6301 40 | Blankets and travelling rugs of synthetic fibres |

| 6301 90 | Blankets and travelling rugs of other (non-synthetic) materials |

Functionality

The main purpose of a blanket is to provide warmth as a (bed) covering. Blankets can be decorative as well.

Throws also offer warmth, but they mainly serve as decoration on a couch or sofa – anywhere in the house. They have become popular accessories, providing an easy and inexpensive way to add style to any interior. Throws can be combined with matching cushions or cushion covers, which can be sold together in sets.

In addition, blankets and throws can also be used outdoors. They can provide warmth in the garden, or serve as decoration or picnic blankets.

Material

Blankets and throws are often made of wool, because of its warmth and ability to absorb moisture. Other options include cotton, linen, silk, recycled or leftover fabrics, blended yarns and mixed (manmade) fibres. Baby blankets should be made from breathable fabrics, like soft cotton or wool. High-end blankets and throws can also be made of materials like (kid) mohair, merino, alpaca or cashmere. Alternative fibres like bamboo, jute and hemp can be used, but are less common. Items for outdoor use, like picnic blankets, may also use water-resistant fabrics.

Most blankets and throws available on the European market are woven or knitted. Another production method is crocheting.

Size

Blanket sizes vary depending on bed dimensions. Common sizes for blankets in Europe are:

- 150cm x 210cm (single bed);

- 200cm x 200cm (double bed);

- 240cm x 220cm (king bed);

- 260cm x 220cm (super king bed).

Throws come in a wide variety of sizes, the most common of which are:

- 90cm x 200cm;

- 130cm x 180cm;

- 140cm x 200cm.

Other sizes are also available, for example for baby blankets. Ask your European buyers what specific sizes they are looking for in the early stages of collaboration.

Design

Blankets vary in thickness, texture and elasticity. They come in a wide variety of colours and patterns. Because throws mainly have a decorative purpose, they are more sensitive to fashion trends. With colours ranging from neutral to vibrant, and designs varying from plain to intricate patterns or embroideries – there is a throw to suit every consumer’s personal style.

2. What makes Europe an interesting market for blankets and throws?

The European market for blankets and throws is growing. Nearly two-thirds of the import value comes directly from developing countries, making Europe an interesting market for you.

Source: UN Comtrade & Eurostat Comext (2025)

After a dip due to COVID-related trade disruptions, Europe’s imports of blankets and throws grew from €760 million in 2020 to €981 million in 2024, at an average annual rate (CAGR) of 6.6%. This included a peak of €1.2 billion in 2022. In 2024, Europe accounted for about a quarter of the worldwide import market for blankets and throws.

The imports of blankets and throws from developing countries grew from €450 million in 2020 to €621 million in 2024, at an average annual rate (CAGR) of 8.4%. As a result, their direct import market share grew from 59% to 63%. Overall, this makes Europe an interesting market for you, as an exporter from a developing country.

Various international trade disruptions continue to affect the cost and availability of raw materials, energy and transport. At the same time, lockdowns during COVID-19 have led to an increased focus on the home. Combined with trends like wellness and sustainability, this may (partially) compensate for the pressure that the ‘cost-of-living crisis’ has put on consumer spending. For more drivers of demand, see the section on trends.

3. Which European countries offer the best opportunities for blankets and throws?

The larger Western European economies are the main importers of blankets and throws. However, importers in these countries generally sell their products across Europe. Your best strategy therefore is to focus on a particular segment, rather than a specific country.

Source: UN Comtrade & Eurostat Comext (2025)

Germany is Europe’s leading importer of blankets and throws, accounting for 16% of imports in 2024. France followed with 13% and the United Kingdom (UK) with 11%. The Netherlands (9.5%), Poland (6.5%) and Spain (6.0%) rounded out the top 6.

Focus on segments

European countries have different roles in the HDHT market. Some are mainly importers and others are mainly manufacturers. Western European countries are mainly importers, and most Western European importers are re-exporters. They do not just sell products in their own country, but also distribute them across the continent. This explains why in HDHT, small countries like the Netherlands often import much more than they consume.

In terms of marketing, you should know that countries are not markets. The HDHT market consists of different segments, ranging from low- to high-end (also see our study on Entering the market for blankets and throws). Every European country has these segments, although their size may vary. It makes much more sense for you to focus on a specific segment and connect with importers and distributors in that segment. They will then sell your products across Europe.

Consumer spending is under pressure

Sales of blankets and throws are sensitive to economic cycles. When economic circumstances and prospects are down, consumers postpone buying items they do not urgently need. When economic conditions are good, purchases of such non-essential products tend to rise. Reflecting this, 94% of consumers in an international survey said they would consider cutting spending on home décor in the event of an economic downturn.

European consumer confidence fell sharply in March 2022 due to the situation in Ukraine and the cost-of-living crisis that followed. Although it has improved since then, consumer confidence is still fragile, scoring below its long-term average.

* forecast

Source: OECD Economic Outlook 116

The cost-of-living crisis has clearly affected consumer spending (‘private consumption expenditure’) in the leading European markets. Forecasts for 2025/2026 continue to be modest, reflecting consumer confidence.

Germany is Europe’s largest importer of blankets and throws

Europe’s leading importer of blankets and throws is Germany. Its imports grew from €144 million in 2020 to €161 million in 2024, at a CAGR of 2.9%. This included a peak of €206 million in 2022. Germany’s leading supplier of blankets and throws is China (52% in 2024), which dominates the market – especially the lower ends. It is followed by the Netherlands (11%) and Poland (9.0%).

About two-thirds of Germany’s import value came directly from developing countries, which is slightly above the European average. These imports grew from €89 million in 2020 to €106 million in 2024, at a CAGR of 4.4%. Besides China, important developing countries included India (5.3% in 2024), Türkiye (4.7%) and Pakistan (0.8%). These countries managed to increase their direct market shares, whereas China’s direct market share showed a slight decline.

Its strong domestic market, role as a key European trade hub, and relatively large market for developing countries make Germany an interesting market for you. However, China’s dominance may limit your opportunities in the lower-end markets. To set your products apart from mass-produced items made in China, you need to focus on the mid- to high-end segments and add value to your products. You can do this by using traditional techniques and designs, and sustainable materials.

France’s imports of blankets and throws are booming

France has become Europe’s second-largest importer of blankets and throws, after overtaking the UK in 2022. Its imports grew from €77 million in 2020 to €125 million in 2024, at a strong CAGR of 13%. Leading suppliers were China (44% in 2024) and the UK (12%).

France’s imports of blankets and throws from developing countries grew from €37 million in 2020 to €63 million in 2024, at a CAGR of 14%. This amounted to a direct market share of 50% in 2024, which is relatively low, but an improvement compared to the 48% recorded in 2020. Besides China, developing countries that supplied blankets and throws to France included Nepal (2.6% in 2024), India (2.3%) and Türkiye (0.6%). Nepal performed especially well, nearly tripling its supplies between 2020 and 2024. This suggests there could be opportunities in the French market.

The UK imports most of its blankets and throws from China

The UK’s imports of blankets and throws grew from €96 million in 2020 to €107 million in 2024, at a CAGR of 2.8%. This included a peak of €129 million in 2022. China is especially dominant in the British market. Its direct import market share grew from 61% in 2020 to 74% in 2024.

In 2024, 89% of the UK’s imports came directly from developing countries. This is the largest share among Europe’s leading markets. In addition to China, important developing countries included India (5.5% in 2024) Pakistan (2.5%), Cambodia (2.3%), Türkiye (1.3%), Nepal and Bangladesh (0.3% each).

Brexit may stimulate direct imports from developing countries, allowing British buyers to avoid additional fees now that they are no longer part of the European Union’s single market. Considering the potential increased interest in sourcing directly from developing countries, the UK could offer opportunities for you. Again, you need to focus on the mid- to high-end segments and add value to your products to set yourself apart from Chinese competitors.

The Netherlands is an important European trade hub

The Netherlands is another important European trade hub. This could make the country an interesting market for you. Its imports of blankets and throws grew from €58 million in 2020 to €93 million in 2024, at a strong CAGR of 13%. Most of these came from China (70% in 2024).

Dutch imports of blankets and throws from developing countries grew from €43 million in 2020 to €75 million in 2024, at a CAGR of 15%. As a result, developing countries’ direct import market share grew from 73% to 80% - well above the European average. Other than China, important developing countries included India (5.5% in 2024), Pakistan (1.9%), Türkiye (1.8%), Indonesia and Egypt (0.3% each). All of these countries managed to increase their direct import market shares, except for Türkiye.

Poland is an emerging Eastern European market

Poland’s growing imports have made the country a leading European importer of blankets and throws. Its imports grew from €52 million in 2020 to €64 million in 2024, at a CAGR of 5.3%. In 2024, leading suppliers were China (64%) and Germany (18%).

In 2024, 69% of Poland’s imports of blankets and throws came directly from developing countries. This was well above the European average. In addition to China, suppliers from developing countries included India (3.0%), Thailand (0.7%) and Bangladesh (0.6%). These countries all increased their direct import market shares. As the Polish market matures, it may become interesting for you.

Spain’s imports of blankets and throws peaked in 2022

Spain’s imports of blankets and throws had been declining for years before the country was hit hard by the COVID-19 pandemic. In 2020, its imports plummeted further. Since then, they have bounced back, with a peak of €68 million in 2022. Overall, imports of blankets and throws grew from €42 million in 2020 to €59 million in 2024, at a CAGR of 8.4%. However, they have still not returned to pre-pandemic levels.

In 2024, Spain sourced 79% of its imports directly from developing countries. This was well above the European average. These imports grew from €31 million in 2020 to €46 million in 2024, at a CAGR of 10%. However – as in many European markets – most of them came from China, Spain’s leading supplier. In 2024, China accounted for 64% of Spain’s imports. Other important developing countries included India (5.7%), Egypt (1.4%), Türkiye (1.1%) and Pakistan (1.0%). Spain could offer opportunities, but they may be limited, as the market was already in decline before the pandemic.

Tip:

- Do not just focus on specific European countries. Instead, identify the appropriate segment and let your buyers distribute your products across Europe within that segment.

4. Which trends offer opportunities or pose threats in the European blankets and throws market?

The market for blankets and throws is influenced by various trends, often related to trends for HDHT on a sector level. Key topics are wellness, ‘home sweet home’ and sustainability. Aspects of these trends are connected.

Wellness at home

European consumers are constantly trying to improve themselves, both in mind and body. In a global survey, 89% of respondents said they took more action to improve their wellbeing in 2024 than the year before. To boost their mental and spiritual wellness, consumers increasingly value healthy sleeping habits, connecting with nature, and spa and yoga practices.

In a Life at Home survey, 40% of respondents who felt more positive about their home also saw a positive impact on their mental health. The 2 most important activities for achieving a sense of wellbeing at home are sleeping and relaxing. Sleep consistently ranks as the second-highest wellness priority for international consumers, behind health. Having comfortable blankets and soft throws fits in perfectly with this. Serving both as functional items and as decoration, blankets and throws can help consumers create a relaxed and cozy atmosphere.

As part of the wellness trend, European consumers are trying to feel closer to nature – both inside and outside the home. Natural materials cater to this need. Consumers also like to spend time outdoors, in their gardens and in public spaces. They decorate their outdoor spaces like they are part of the living room, and bring blankets to the beach or park for a picnic.

Tips:

- Use natural materials, such as wool, (organic) cotton, silk or linen.

- If you offer functional items for outdoor use, like picnic- or camping blankets, consider water-resistant fabrics or linings.

- See our webinar on wellness in HDHT for more information.

Home sweet home: cocooning

In this trend, the home functions as a shelter – often for older consumers with relatively high disposable incomes. These consumers make the home a retreat from a stressful outside world by creating a comfortable, luxurious interior. The trend is also about families or groups of friends enjoying each other’s company, entertaining, cooking and dining, or just relaxing. Central to this is the idea of ‘cocooning’ – the need to surround yourself with people and things you love, inside the warmth and familiarity of your own home.

Blankets and throws can play a role in this trend by creating a cosy atmosphere (also known as ‘hygge’). They can add a decorative touch, and provide warmth and softness to create a comfortable cocooning space. Especially in combination with other home textiles, like cushions with soft and decorative covers.

Tips:

- For optimal cocooning, use soft and comfortable fabrics.

- For high-end blankets and throws, you can use luxurious materials like mohair, merino, alpaca or cashmere, or blends of these fibres.

- Add soft cushion covers to your range to cater to this trend.

- If you also make homewear, consider creating a small coherent collection with complementary blankets and/or throws (and cushion covers).

Environmental and social sustainability

European consumers and designers are making more sustainable choices, especially in the mid-high to high-end market segments. They are increasingly aware of and concerned about the negative impacts of production and consumption. This is driving the popularity of sustainability labels and commitments in the textile industry.

For many consumers in leading European markets, sustainability is highly or extremely important when buying home textiles, according to an IFH KÖLN study for Messe Frankfurt. Most are prepared to spend a bit more on sustainable options. The study also revealed that sustainable materials, fair working conditions, sustainable production and waste prevention are most important for bedding (including blankets/throws). Other key aspects include environmentally friendly packaging, recyclability and certification – especially of sustainable materials and production processes.

For blankets and throws, key topics regarding social and environmental sustainability include:

- Materials: Are your materials renewable? Are they traceable and responsibly traded?

- Production process: Can you reduce your energy use? Can you prevent water, air and soil pollution, for example in the dyeing process? Can you reuse waste, either inside the production system or elsewhere? In general, can you ensure low-impact production?

- Labour and ethical practices: Does production take place in a safe and healthy way? Are your labour contracts fair?

- Transport: Do you use clean transport options? Do you pack containers effectively? Are your packing materials recyclable?

Using natural materials such as wool or (certified) organic cotton as your main raw material fits in well with this trend. Organic, hypoallergenic materials are especially popular for baby blankets. Another sustainable option is to use recycled fabrics/fibres or leftovers from the production of other textile products. In the high-end market, there is an even larger variety of sustainably produced natural fibres, such as (kid) mohair, alpaca and cashmere. Textile production is estimated to be responsible for about 20% of global clean water pollution through dyeing and finishing products, so natural dyes add an extra sustainable feature to your blankets and throws.

Figure 5: URBANARA – ethically produced blankets

Source: URBANARA @ YouTube

Traditional artisanry and design

Products that are rooted in tradition may have extra appeal for European customers. If you use techniques and materials that have a distinct history, this can help you tell an interesting story behind the products you make. For example, traditional Ethiopian Gabi blankets become softer after use, which is a great product feature.

Special embroidery or weaving techniques can help you create designs that stand out. An example is the Bangladeshi Nakshi Kantha technique, which was originally meant to strengthen old fabrics. Some companies use this technique to create beautiful designs.

Tips:

- Use natural, recycled or leftover raw materials and natural dyes. Also invest in sustainable production, packaging and transport methods.

- Promote the sustainable aspects of your blankets and throws as an added benefit. Emphasise the story behind your product in your promotion strategy.

- If your buyer is interested, consider certification options such as fair trade or organic. For more information, see our studies on Entering the market for blankets and throws and buyer requirements for HDHT.

- Try not to simply reproduce traditional techniques like Kantha, but to reinterpret them in a modern way.

- For more information, see our study on sustainability in HDHT, our tips on going green and becoming socially responsible, and our webinars on sustainability in the European HDHT market, sustainable innovations for your HDHT business and the sustainable transition in apparel and home textiles.

Co-creation and range development

European buyers are increasingly trying to stand out from their competitors by focusing on their own image and design. They look for producers they can cooperate with to develop their own products, which is known as ‘co-creation’. This makes it extra important to showcase your unique skills, production techniques and the variety of raw materials you work with. This stimulates buyers to imagine what kind of designs they could collaborate on with you.

Figure 6: Quote Copenhagen – co-creating recycled sari throws

Source: Quote Copenhagen @ YouTube

More and more buyers are selling concepts rather than single products to their clients – especially in the middle-high segment. They do this for marketing and positioning purposes, to broaden their range and to push sales. To benefit from this trend, you can add matching products to your range of blankets and especially throws. Cushion covers are ideal for this purpose. Their style could be similar to your blanket or throw, but you can also use complementary designs and materials.

Tips:

- Make sure your collection showcases the different materials and production techniques you have to offer.

- Consider developing a small range of cushion covers that go well with the design of your blankets and throws.

Example company: Basha

Basha is a social enterprise that successfully taps into several trends. The company produces textile items that reflect Bangladesh’s heritage and artisanry, using recycled and locally sourced materials and natural dye. Basha’s artisans create blankets from recycled saris, using the traditional Kantha embroidery technique. They make cushion covers in matching or complementary styles. For an added contemporary twist, the vintage saris are also used to crochet chunky knit throws. Hand-stitched blankets made from unbleached cotton offer a neutral option.

Figure 7: Basha Boutique – company profile

Source: Basha Boutique @ YouTube

As part of Bangladesh’s fair trade network ECOTA and the Freedom Business Alliance, Basha provides a sustainable livelihood for women at risk and survivors of trafficking. These women are paid fairly for dignified work, to create a sustainable livelihood for themselves and their families. Basha gives them access to ongoing mentoring, training, education, support and encouragement. On its website, Basha showcases the stories of individual artisans and allows you to send them a message.

Globally Cool carried out this study in partnership with GO! Good Opportunity and Remco Kemper on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research