Entering the European market for cashew nuts

Food safety certification, combined with frequent laboratory testing and good product quality, is necessary for cashew nut producers who wish to export to Europe. Sustainable production and social responsibility standards will help emerging suppliers to the European market to improve their long-term business operations. Exporters from Southeast Asia are strong competitors for new suppliers of shelled cashew nuts, but Côte d'Ivoire has recently shown that African exporters can compete on an equal footing. Established exporters, such as Vietnam and India, can often keep their prices low because of their large-scale production and mechanised processing methods.

Contents of this page

1. What requirements must cashew nuts comply with to be allowed on the European market?

What are the mandatory requirements?

All food products, including cashew nuts, that are sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom must be safe. This also applies to imported products. Only approved additives are allowed. Food products must conform to maximum levels for harmful contaminants, such as bacteria, viruses, pesticide residues and heavy metals.

The labelling should make it obvious whether a food contains allergens. Research shows that the cashew nut is a potent allergen, causing severe allergic reactions that persist for a longer period when compared with other food allergies. Clinical reaction to cashew nuts may be severe, including anaphylaxis, according to recent research.

Certain plants and plant products entering the EU must have a phytosanitary certificate. A phytosanitary certificate is required for the import of some forms of cashew nuts into the EU from third countries, other than Switzerland. This applies specifically to cashew nuts, whole, fresh in the green husk, according to Regulation (EU) 2019/2072.

If present, additives must be approved by the European safety authorities. Additives should meet the specifications outlined in Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008. Labels should make it obvious for consumers if a product contains cashew nuts, as they can cause severe allergies.

Contaminant control in cashew nuts

Food contaminants are unwanted and harmful substances in food that can cause illness. The EU places strict controls on contaminants in food, especially on aflatoxins, as per Regulation (EU) 2023/915 on maximum levels for certain contaminants in food. This regulation entered into force on 25 May 2023. Annex I contains the maximum permitted levels for regulated contaminants.

The most common requirements regarding contaminants in cashew nuts relate to the presence of mycotoxins, pesticide residues, micro-organisms and heavy metals. If a product contains more contaminants than allowed, it will be withdrawn from the market. These cases are reported by the European Rapid Alert System for Food and Feed (RASFF).

An example of an incident related to cashew nuts is a border rejection notification from the Netherlands of a shipment of organic cashew kernels from Togo. The shipment was rejected in December 2021 because of aflatoxin contamination. A cheese substitute made from dehydrated cashew nuts was withdrawn from European markets in September 2021 because of Listeria monocytogenes contamination.

Mycotoxins

Fungi can produce aflatoxins on cashew nuts in the field or during storage, especially under warm conditions and high humidity. Aflatoxins are stable compounds that are not eliminated during roasting or cooking of nuts, so products made from cashew nuts can contain aflatoxins.

Contamination of cashew nut shipments with mycotoxins is the cause of a few border rejections of shipments destined for Europe. In 2022, the Rapid Alert System for Food and Feed (RASFF) recorded 1 serious risk report for cashew nut shipments due to aflatoxin contamination, When a shipment of cashew nuts from Vietnam was stopped in Italy because of a high aflatoxin content.

The presence of mycotoxins (aflatoxins, in particular) is a frequent reason why some nut shipments may be prevented from entering the European market. The level of aflatoxin B1 in tree nuts (including cashews) must not exceed 5 μg/kg and the total aflatoxin content (sum of B1, B2, G1 and G2 aflatoxins) must not exceed 10 μg/kg. However, the incidence of aflatoxins is much lower in cashew nuts than, for example, in groundnuts.

Cashew nuts can be vulnerable to pre- and/or post-harvest mould attacks due to their high nutritional content and these may be accelerated by inappropriate storage conditions.

Pesticide residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. The European Union regularly publishes a list of approved pesticides that are authorised for use in the European Union. This list is frequently updated. In 2022, the European Commission approved 27 new implementing regulations that modified this list through new approvals, extensions, renewals, amendments or restrictions.

Commission Regulation (EU) 2020/749 set the maximum permissible level of chlorates to 0.1 for all tree nuts including cashews. In the production of cashew nuts, chlorates are not typical pesticides, but they can come in contact with cashews through the use of chlorinated water and chlorinated detergents. Cashew nut exporters must therefore control the use of water and detergents in their production facilities.

The biology of the cashew plant helps to protect the kernel from pesticides. Cashews have 2 protective coverings in the form of the outer shell and inside testa layer. The shell, in which residues may accumulate, is removed before the nuts are imported into Europe. Most of the time, cashew nuts are significantly safer when compared to other conventional food products. Still, many European importers will request a detailed test on the presence of many pesticides.

Cashew farms are located mostly in tropical areas with high pest pressure, which can lead to a reliance on pesticides over traditional methods of pest control. Aerial spraying of endosulfan in the cashew estates of Kerala, India, over several decades led to 779 deaths due to endosulfan poisoning. Recent research has shown high exposure of producers to herbicides in Côte d'Ivoire. Such overuse of pesticides represents a real handicap for the sustainability of cashew farming (PDF) and suppliers need to monitor and help prevent such practices.

Heavy metals

Regulation (EU) 2023/915 sets the maximum level of cadmium for cashew nuts (and all other tree nuts except pine nuts) at 0.20 mg/kg of wet weight. The maximum levels do not apply to nuts for crushing and oil refining, provided that the remaining pressed tree nuts are not placed on the market as food.

Microbiological contaminants

The presence of very low levels of salmonella and E. coli in ready-to-eat or processed foods, including cashews, is an important cause of foodborne illness. Tree nut processors should consider salmonella and E. coli as major public health risks in their hazard analysis and critical control point (HACCP) plans.

Tips:

- Follow the Codex Alimentarius Code of Hygienic Practice for Tree Nuts (PDF). For cashew nuts, specifically, it is important to control the moisture level during storage and transport (<65% relative humidity) in order to avoid the product being damaged by mould and enzymatic changes.

- Read more about MRLs on the European Commission website on maximum residue levels. To be prepared for any new changes in the MRLs, read the ongoing reviews of MRLs in the European Union.

What additional requirements do buyers often have?

Quality requirements

The quality of cashew nut kernels is determined by the percentage of defective produce, by number or weight, and by their size, shape and colour. The industry has defined several quality criteria but some of them, such as taste and flavour, are subjective and cannot easily be determined based on physical characteristics.

Specific quality standards for cashew nuts have not been officially defined by European authorities. The most widely applied standard in Europe is the standard established by the United Nations Economic Commission for Europe (UNECE). UNECE standards for cashew kernels (PDF) were last updated in 2013. The Codex Alimentarius does not have a specific standard for cashew nuts.

The UNECE standards include several general quality requirements for commercial kernels, such as a maximum moisture content of 5%. They also define characteristics to enable the categorisation of cashew kernels into the 3 main quality classes of extra (white), class I (scorched) and class II (scorched seconds or dessert). Whole nuts are further classified into 7 categories or grades ranging from 150 to 500 according to the maximum number of kernels per pound.

The various sizes of the cashews are denoted as W450, W320, W240, W210 and W180. The smaller the number, the larger the cashew kernels in the wholesale trade. These size designations also indicate that the products are of the highest quality. Broken pieces of nut typically arise from machine processing of cashew kernels. The designation “chopped cashews LP” stands for “large pieces” and refers to chopped cashews that fit through a sieve with a mesh size of 4.75 millimetres. By contrast, “SP” stands for “small pieces”.

Cashew kernels should be dry and completely free from living insects, moulds, rodent contamination and insect damage. Cashew nut kernels are easily damaged by worms (black or brown spots on cashews). The less damaged the cashew kernels, the better quality they are.

Other quality classification systems for cashew kernels include the cashew kernel industry standards of the Association of Food Industries, which apply to the United States market. Different standards are also used or developed by several producing countries such as India, Brazil, Vietnam (PDF), Tanzania, Kenya and the Association of Southeast Asian Nations. Even the INC has published cashew technical information (PDF) highlighting important quality requirements with the supervision and approval of the main producing countries.

Table 1: Common criteria defining cashew kernel quality (example for white whole cashew 320 grade)

|

Condition |

Whole cashew nut kernel |

|

Colour |

White, light yellow, pale ivory or light ash-grey |

|

Grade |

ww320 |

|

Nut Count |

300-320 nuts per pound 660-706 nuts per kg |

|

Moisture |

Max 5% |

|

Broken |

Max 10% |

|

Lower size grade |

Max 10% |

|

Defects |

Max 8% in total |

|

Quality class (optional) |

Determined by the permitted percentage of defects. Cashew kernels can be classified as “Extra”, “Class I” and “Class II” |

Source: Autentika Global, 2023

Food safety certification

Although European legislation does not explicitly require food safety certification for cashew nuts, be aware that almost all European food importers require it. Well-established European importers will not work with you if you cannot provide the type of food safety certification that they want.

Most European buyers will ask for Global Food Safety Initiative (GFSI) recognised certification. GFSI does not provide food safety certification, rather it recognises a number of certification programmes that meet the GFSI benchmarking requirements. For cashew nuts, the most popular certification programmes, all recognised by GFSI, are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000); and

- Safe Quality Food Certification (SQF).

Make sure to check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. Food certification systems are constantly developing. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements, so there are no major discrepancies in their requirements. However, certain retailers may prefer 1 certification over another, or demand additional certifications based on their own internal policies.

For example, British buyers often require BRCGS, while IFS is more common for German retailers. These preferences are sometimes historical. For example, IFS was initially developed as a joint venture of the French retail association FCD and the German retail association HDE. Note also that food safety certification is only a basis for exports. Major buyers will usually visit/audit production facilities before starting a business relationship.

Packaging requirements

There is no general rule for the size of packaging for exported cashew nuts, but the most common type of export packaging is 10 kg to 25 kg polybags or flexi packs. A 25 kg flexi pouch can be packed in a carton and 700-750 such cartons make a full container load. In order to prolong the shelf life, bags are often vacuum sealed by extracting the air and injecting carbon dioxide and nitrogen.

Cashew nuts are also packaged in airtight tins. For example, Nuragro packs cashew nuts in 10 kg tins, in which case 2 such tins are packed in a carton for a total of 20 kg. 750 such cartons make a full container load, which is preferred for shipping as it results in huge saving in ocean freight.

The use of paper or stamps bearing trade specifications is allowed, provided the printing or labelling has been done with non-toxic ink or glue. The packaging is often formed in a cubic shape in order to efficiently use the pallet and container space. Dimensions can vary but all are compatible with standard pallet and container dimensions.

Labelling requirements

For bulk export packaging, the product name is “cashew nut kernels” or “cashew nuts”, accompanied by the name under which the product is sold in the country of retail sale. When applicable, the name may indicate the quality and grade of the product and crop year. More detailed information can be given in accompanying documents, but the product name and storage instructions must appear on the packaging. Other information (lot, producer name and address, and so on) may be replaced by an identification mark.

As cashew nuts have a high oil content, including storage and transport instructions is very important. This is also important because of the product’s sensitivity to high levels of moisture, which can negatively influence quality, if not dealt with properly.

European rules require you to label the origin of the product. For example, if cashew nuts are packed in Belgium, the origin of the product must also be indicated. This can be done by indicating a specific country (such as Vietnam), by indicating ‘non-EU’, or by declaring ‘cashew nuts do not originate from Belgium.

In the case of retail packaging, product labelling must be in compliance with the European Union Regulation on the provision of food information to consumers. This regulation specifies requirements for nutrition labelling, origin labelling, allergen labelling and clear legibility (minimum font size for mandatory information). Please note that this regulation lists cashew nuts as a product that can cause allergies or intolerances and therefore allergen information must be clearly visible on the retail packaging.

If a product containing cashew nuts is not labelled for allergens, it will be withdrawn from the market. These cases are reported by the European Rapid Alert System for Food and Feed (RASFF). A shipment of non/incorrectly labelled allergen (cashew and almond) in organic peanut butter from Greece was recalled in August 2023. Similarly, a product containing undeclared cashew nuts in pasta salad with pesto was withdrawn from the market in July 2023.

Tips:

- Read our study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

- Read more about the transport and storage requirements for cashew nuts on the website of Transport Information Services.

- Consult the UNCTAD special report (PDF) on cashew nuts for a wider overview of global issues affecting the cashew nut trade.

- Read advice from Vietnam’s Kimmy Organic Farm on how to check the quality of cashew nut kernels.

What are the requirements for niche markets?

Organic cashew nuts

To market cashew nuts as organic in Europe, they must be grown using organic production methods that meet European legislation in this respect. Growing and processing facilities must be audited by an accredited certifier before you are allowed to use the European Union’s organic logo on your products, as well as the logo of the standard holder (for example, the Soil Association in the United Kingdom or Naturland in Germany).

Organic farming in the EU is expanding quickly, thanks to rising consumer interest in organic goods. To address this, the EU implemented new organic legislation as of January 2022. It strengthens the control system, boosting consumer trust in EU organic products and setting the same standard for local and imported organic products. Moreover, a wider range of products can now be marketed as organic under these guidelines.

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic cashew nuts imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation defining imports of organic products from third countries.

For equivalent countries (including India and Vietnam), certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Sustainability and Corporate Social Responsibility (CSR) certification

The 2 most commonly used sustainability certification schemes are Fairtrade and Rainforest Alliance. Fair Trade international has developed a specific standard for nuts intended for small-scale producer organisations. This standard defines protective measures for workers in cashew nut processing facilities. In addition, the standard defines the terms of payment and Fairtrade Minimum Price for conventional and organic raw cashew nut kernels from Africa.

To improve the sustainable production and sourcing of cashew nuts, a group of primarily European companies and organisations formed the Sustainable Nuts Initiative in 2015. The main objective of this initiative is to improve the circumstances in nut-producing countries and work towards sustainable supply chains.

Firms have different requirements for social responsibility. Some companies will insist on their code of conduct or the following of common standards such as the Sedex Members Ethical Trade Audit (SMETA) standard. It provides a globally recognised way to assess responsible supply chain activities, including labour rights, health & safety, the environment and business ethics. Sedex membership alone (without an audit) is actually not very complicated and not very expensive. Other alternatives include Ethical Trading Initiative’s Base Code (ETI), amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and B Corp certification.

Many importers will ask you to follow their own specific code of conduct. Most European retailers have their own codes of conduct, such as Lidl (PDF), REWE, Carrefour (PDF), Tesco and Ahold Delhaize.

Tip:

- For the overview of the developments of the sustainability initiatives in the European market, read our study on trends on the European processed fruit and vegetables market.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) propose specific restrictions on diets. If you want to focus on the Jewish or Islamic ethnic niche markets, consider implementing Halal or Kosher certification schemes. There are several organisations that provide Kosher certification in Europe, such as Kosher London Beth Din (KLBD), which provides guidelines on how to obtain the certification. Halal certification in Europe can be obtained via certifying bodies, such as Halal Certification Services (HCS), which provide certification services.

India’s Alphonsa Cashew Industries received its Halal certification from Halal India in 2021. The company confirmed that there is an increasing demand for Halal-certified cashew nuts across the globe, more prominently in Muslim-dominated countries. India’s cashew nut processing and exporting company Tasty Nut Industries also offers Halal-certified cashew kernels to buyers, as does Vietnam’s raw cashew exporter Lafoco.

The European Muslim community is predicted to grow from the current 4.9% of population to more than 7% by 2050, according to a recent report published in August 2023.

Tips:

- Consult the Standards Map database for sustainability labels and standards.

- Check Germany’s Bio-Siegel manual and decision aid (PDF) that is used to label organic food to familiarise yourself with the requirements.

- Read our study on trends on the European processed fruit, vegetables and edible nuts markets for an overview of the developments in terms of the sustainability initiatives in the European market.

- Keep up to date on evolving changes in the European Union’s organic legislation on the European Commission’s legislation for the organics sector page.

- To read more about payment, delivery and other practical issues, read the CBI study on organising your export to Europe.

2. Through what channels can you get cashew nuts on the European market?

The European end-market for cashew nuts can be broadly segmented based on quality (standard and high) and usage. Cashew nuts are mostly used for snacks that are directly consumed by the consumer, but they are also used as ingredients for processing by the food industry. These segments require different cashew nuts quality. Higher quality cashew kernels are characterised by a larger size, uniformity, better flavour and aroma, ideal moisture content, purity and certifications, amongst other traits.

The largest user of cashew kernels in Europe is the snacking segment. Approximately 90% of imported cashew kernels in Europe are sold as snacks, predominantly as roasted salty snacks. Cashew kernels are also increasingly used by food processing industries as ingredients.

How is the end-market segmented?

The largest user of cashew nuts in Europe is the snack segment. Approximately 90% of imported cashew nut kernels in Europe are sold as snacks, predominantly as roasted salty snacks. Cashew nut kernels are also increasingly used by food processing industries as ingredients.

Figure 1: End market segments for cashew nuts in Europe

Source: Autentika Global

Snack segment

European savoury snack sales are still impacted by the aftermath of the COVID-19 pandemic, supply chain issues, the Ukraine war and high inflation. With food prices on the rise, sales could see a slowdown in volume growth and a more pronounced focus on value. Expectations are that consumer spending should remain resilient thanks to hybrid working models and an increased number of at-home occasions.

According to an IRI 2022 report, sales of salted snacks are on the rise (PDF) in key European markets such as Italy, Germany, UK, France and Spain. Snacks with groundnuts could benefit further as protein and energy claims, as well as healthy ingredients, are becoming increasingly popular amongst snack consumers. Health has become a much more important trend in daily nutrition, according to the European Snacks Association (ESA). The association expects more growth in free-from products and protein-packed snacks.

The snacking industry is also actively developing various roasting flavours in order to diversify offerings and match consumer taste preferences. Aside from roasting flavours, various types of salty and sweet coatings are used to produce innovative snacks. Another trend is the increasing offer of unsalted, slow-roasted, dry-roasted and unroasted cashew nuts as a healthier option compared to salted snacks.

Figure 2: Cashew kernels and other nuts sold without retail packaging (street markets and health food stores)

Source: 2022-11-14_16-20-51_JO_day2-4_Madaba_JH by Juhele_CZ is marked with CC0 1.0.

Within the snack segment, 2 different trends are influencing consumption. The first is the development of various roasting flavours to diversify offerings and match them with varying taste preferences. The kernels are available natural, roasted, salted and spiced, as well as in mixtures with other nuts. The second trend is the increasing range of unsalted and unroasted cashews as a healthier alternative to salted snacks.

Ingredient segment

The food processing segment accounts for roughly 10% of the European cashew nut market. It is expected that this food processing segment will gain market share over the next few years. Several important product trends are described in the market potential chapter of this study. The most common cashew ingredient users include the following:

- The confectionery industry mainly uses pieces of cashew nuts to produce chocolate snacks. Chocolate and caramel-coated whole cashew kernels are also increasingly offered as a new product following successful sales of chocolate-coated almonds in several European markets.

- The bakery industry uses split and whole raw cashew nuts as spreads in cookies and pastries.

- Cashew nut spreads are an innovative product in several European markets and are promoted as a healthier alternative to peanut butter. In addition, cashew nut butter is mixed with other ingredients to offer a wider range of flavours to consumers.

- The breakfast cereals industry is launching new nut-rich granola products that frequently use cashew nuts.

- Protein and fruit-nut bars are increasingly offered as an alternative to sugary and chocolate snacks. Cashew nuts are often used as an ingredient in those products as a source of plant protein.

- Other segments cashew nuts are used in include ready meals and sauces, such as pesto, where it is used as an alternative to the more expensive pine nuts.

Tips:

- Monitor market developments within the European snack segment by visiting the news section of the website of the European Snack Association.

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for your cashew nuts within the food ingredient segment.

- Explore the possibility of offering European processors high-quality pieces, in addition to whole kernels.

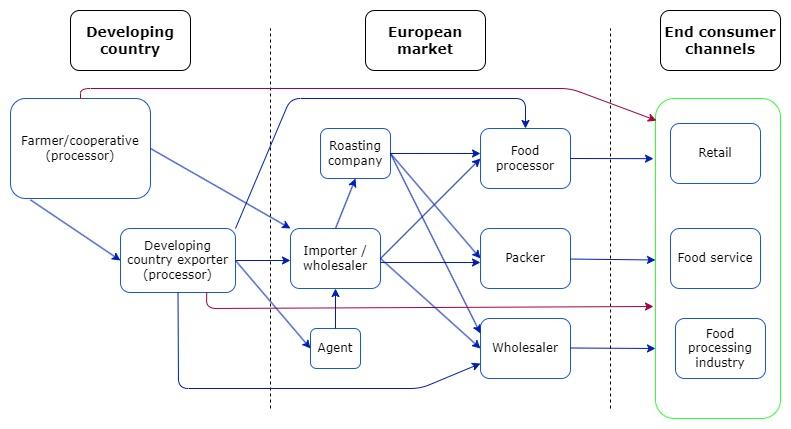

Through what channels do cashew nuts end up on the end market?

Specialised nut importers represent the most important channel for cashew nuts in Europe. There are also several alternative channels, such as agents, food processors and food service companies.

Important players in the cashew nut segment include roasting and packing companies. Some roasting companies have specialised in selling roasted, salted and spiced cashew nuts to packers in bulk. Some important roasting companies in Europe are Ireco (Luxembourg), Intersnack (Germany/International), Max Kiene (Germany) and Trigon (the UK). Many packing companies have roasting facilities in their factories, enabling them to develop different products that they can sell directly to consumers.

Figure 3: European market channels for cashew nuts

Source: Autentika Global

Importers/wholesalers

In most cases, importers act as wholesalers. Some volumes of cashew nuts are sold to roasting companies that process cashew nuts and package them for sale to consumers. Some importers also have their own processing and packing equipment, so they can supply retail and food service channels directly.

A leading nut trading and distribution company in Europe is August Töpfer & Co. (ATCO), which also operates its own cashew factory in Vietnam. The firm is also a leading importer of cashew kernels from Africa. Another major importer is Olam International that has a cashew plant in Côte d'Ivoire and in other parts of the world. A leading Dutch importer and wholesaler is Aldebaran Commodities. Zieler & Co. is a German cashew nut importer and wholesaler.

The positions of the importer and food manufacturers are put under pressure by retailers. The higher demands imposed by the retail industry determine the supply chain dynamics from the top down in the chain. The pressure translates into lower prices but also leads to new requirements for added value. These demands are for “sustainable,” “natural,” “organic,” or “fair trade” products. Many importers develop their own codes of conduct and build long-lasting relationships with preferred developing-country suppliers.

Agents/brokers

Agents involved in the cashew nut trade typically perform 2 types of activities. Agents normally act as independent companies that negotiate on behalf of their clients and as intermediaries between buyers and sellers. Typically, they charge commissions ranging from 2% to 4% for their intermediary services.

Another activity performed by these parties is the supply of private labels for retail chains in Europe. For most developing country suppliers, it is very challenging to participate in the demanding private label tendering procedures. For these services, some agents, in cooperation with their cashew nut suppliers, participate in procurement procedures put out by the retail chains.

Cashew nut agents in the leading European markets include MW Nuts (Germany), Belfrudis (Belgium), Global Trading & Agency (the Netherlands), Rotterdam Commodity Trading (the Netherlands), Cardassilaris Family (Greece) and QFN Trading & Agency (the Netherlands).

Retail channel

Retailers rarely buy directly from developing-country exporters. However, certain developing-country exporters (processors) package their products directly for private label or even their own label brands. Recently, the retail sector has become increasingly polarised, seeing a shift towards either the discount or the high-level segment. Consolidation, market saturation, fierce competition and low prices are key characteristics of the European retail food market.

The leading food retail companies in Europe differ per country. The companies with the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, ALDI, EDEKA, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands). Keep in mind that several retail alliances coordinate buying operations in Europe:

- Coopernic (includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group);

- Carrefour World Trade or CWT (includes Carrefour, Système U, Match and Cora);

- AgeCore (Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland);

- European Marketing Distribution or EMD (Colruyt – cooperation only on private label, Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia); and

- Epic Partners (EDEKA, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica).

Foodservice channel

The foodservice channel (hotels, restaurants and catering establishments) is usually supplied by specialised importers (wholesalers). The foodservice segment often requires specific packaging of cashew nuts in weights of 1kg to 5kg, which is different from the requirements for bulk or retail packaging.

World cuisines, healthy food and food enjoyment are the major driving forces in the foodservice channel in Europe. The fastest-growing business types tend to be new (healthier) fast food, street food and pop-up restaurants, as well as restaurants serving international cuisines and sandwich bars.

What is the most interesting channel for you?

Specialised importers experienced with cashews and other nuts represent the most useful contact if you aim to export cashew nuts to the European market. This is specifically relevant for new suppliers as supplying the retail segment directly is very demanding and requires considerable investments in quality and logistics. Importers usually have a good knowledge of the European market and they monitor the situation in the cashew-producing countries closely.

They are therefore your preferred contact, as they can inform you in good time about market developments and provide practical advice about exports. Cashew nut importers normally import other types of edible nuts and dried fruit as well, so offering other products in addition to cashew nuts can increase your competitiveness.

For new suppliers, the challenge is to establish lasting relationships with well-known importers, as they usually already work with selected suppliers. Established importers perform audits and visit producing countries on a regular basis. Many new contacts find they must offer the same quality at lower prices than their competitors, at the start of the relationship.

However, packing for private labels may be an option for well-equipped and price-competitive suppliers. Nevertheless, private label packing is often done by importers that have contracts with retail chains in Europe. In addition, to have full control of processing, it is easier to roast and pack cashew nuts for the snack segment within Europe. As the cost of labour in Europe increases, cashew nut importers sometimes search for more cost-effective roasting operations, in Eastern Europe or developing countries, for instance.

Tips:

- Search through the members' list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM) to find buyers from different channels and segments.

- Understand the pressure from retailers for sustainable products and increase your competitiveness by investing in different certification schemes related to CSR, organic foods or food safety. Having food safety certification is the minimum requirement if you want to tap into the retail segment.

- Consider joining forces with other producers from your country to offer sufficient volumes of cashew nuts with a unified quality and certification profile.

- Watch a 2023 Deutsche Welle documentary for more insight into the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

- Subscribe to the QFN Trading & Agency newsletter for free market reports and news.

3. What competition do you face on the European cashew nut market?

Which countries are you competing with?

Vietnam is the key competitor for all emerging suppliers of cashew nuts to Europe. This country alone supplies 78% of all cashew kernels to Europe, followed by Côte d'Ivoire, which has a market share of approximately 8%. India, which used to be the second-largest supplier until 2022, is a major processor, along with Vietnam. The 2 countries process more than 80% of the world’s total cashew crops.

Côte d'Ivoire is rapidly gaining market share in Europe. The West African country managed to increase its exports to Europe almost tenfold between 2018 and 2022. Other African countries, although still very small suppliers to Europe, are gaining market share. Burkina Faso and Nigeria are the 2 fastest-growing exporters to Europe, following Côte d'Ivoire. This trend in West Africa is expected to continue.

Source: Autentika Global, GTA, 2023

Vietnam: The undisputed supplier of cashew nut kernels to Europe

Vietnam is the leading exporter of cashew nuts to Europe and the rest of the world. The country was the leading exporter of cashew kernels in 2022, accounting for around two-thirds of global exports. The USA, the European Union, the UK and China were its top markets. In terms of production, Vietnam produces less than Côte d'Ivoire, India and Cambodia. The large Vietnamese exports can be attributed to the large installed shelling capacity in Vietnam.

The Vietnamese cashew crop in 2022-2023 was reported to be 103,500 tonnes, according to the latest INC statistical report (PDF). In order to utilise its many shelling facilities, Vietnam imports in-shell cashew nuts mostly from Cambodia, Côte d'Ivoire, Ghana, Nigeria, Tanzania, Senegal, Indonesia and Ghana. With the expansion of domestic processing capacity in Côte d'Ivoire, Vietnamese imports of in-shell nuts from Côte d'Ivoire fell for the first time in 2022. However, imports from Cambodia are expected to rise. Vietnamese processors are increasingly investing in Cambodian production of in-shell nuts.

Imports from West African origins are serviced by major shipping companies. For example, French sea shipping company CMA CGM has dedicated fortnightly shuttle services for West Africa’s raw cashew nut exports to India and Vietnam. This shuttle service is in operation from mid-June to the end of the cashew season every year.

Most shelled cashew nuts (kernels) produced by Vietnam are exported, only around 5% is consumed locally. In 2021, Vietnam exported around 456,000 tonnes of cashew nut kernels, with the United States (26%) as the leading export destination, followed by Europe (30%) and China (6%). Vietnamese cashew nut exports to Europe grew by 9.2% annually to 134,000 tonnes in 2022. Mid-term and long-term export prospects to Europe remain strong and growth percentages are likely to remain in the high single digits.

Vietnam’s Binh Phuoc province is also known as the "cashew nut capital" of Vietnam with the largest area and output in the country. Binh Phuoc has 141,595 hectares under the crop, while the output of raw cashew nuts is over 200,000 tonnes per year. The province has almost 300 companies involved in cashew processing and dozens of companies are involved in exports.

The practice of manual cracking has almost been eliminated in Vietnam due to the lack of availability of workers. Instead, the in-shell cashews are cooked and then cracked by machines.

Investments in new cashew plantations and productivity are supported by the Vietnamese Ministry of Agriculture and Rural Development (MARD). In addition to the development of domestic production, MARD also cooperates with Cambodia to develop reliable sourcing for the domestic processing industry. The Vietnam Cashew Association (VINACAS) supports the development of technology and promotional activities, while the Vietnam Trade Promotion Agency supports export activities.

Tips:

- Visit VINACAS’ Golden Cashews Rendezvous event to meet producers and learn more about the development of the cashew industry in Vietnam.

- Monitor developments in Vietnam’s successful and growing cashew nut industry through regular news updates published by the country’s agriculture ministry.

Côte d'Ivoire: The world’s largest in-shell producer

Côte d'Ivoire is the world’s number 1 producer of in-shell, raw cashew nuts. The country produced 247,000 tonnes of cashew kernels or 1.2 million tonnes of raw cashew nuts in the 2022/2023 season. Côte d'Ivoire does not have sufficient processing capacity for the shelling of raw nuts, so the country exports most of its cashews, like other African countries, as in-shell nuts to Vietnam and India.

Exports of shelled cashew nuts from Côte d'Ivoire increased from 9,736 tonnes in 2018 to more than 35,000 tonnes in 2022. Europe is, however, not the main target market for cashew nuts, as Côte d'Ivoire exports most of its shelled kernels to the United States, followed by the Netherlands and Vietnam. In 2022, Côte d'Ivoire exported 13,697 tonnes to Europe, with the Netherlands, Germany, Italy and Belgium being the main target markets.

The country was the fastest-growing exporter to Europe with an average annual growth rate of 75% between 2018 and 2022. Exports to Europe are likely to remain very dynamic and are expected to grow at a slower 20-30% per year in the next 3 years, while double-digit growth is also likely to be present in the longer term (5 years or more). The Ivorian market share in Europe rose from just 1.2% in 2018 to 8.0% in 2022.

The Cotton and Cashew Board (Conseil du Coton et de l’Anacarde) regulates cashew production and marketing and promotes processing in Côte d'Ivoire. The government supports investments in processing through various subsidies. The interests of the country’s cashew nut processing sector are represented by the Association of Ivoirian cashew processing companies (GIC-CI).

Tips:

- For more information about the Côte d'Ivoire cashew nut market, read a recent CBI news story on the world’s largest cashew nut producer.

- For deeper insight into the West African cashew nut sector, read CBI’s value chain analysis cashew nut processing in West Africa (PDF). CBI’s cashew project in Côte d'Ivoire and Benin offers good opportunities to local cashew processors.

- Follow the latest market news and communiques (in French) from the Ivorian Cotton and Cashew Board.

- Follow regular news updates on the Ivorian cashew sector from the GIC-CI.

India: The world’s largest cashew nut consumer

With a crop of 162,000 tonnes of kernels, India was the second-largest producer in the 2022/2023 season, followed by Cambodia, Vietnam, Eastern African origins, Brazil and Indonesia. In contrast to Vietnam, India consumes large quantities of cashew nuts locally. According to the International Nuts and Dried Fruit Council, India is the world’s largest cashew nut kernel consumer. Domestic consumption in 2021 was estimated at 322,160 tonnes, which is almost 140,000 tonnes more than the second-largest market worldwide, the United States.

Production facilities are mainly located in coastal regions, with Maharashtra as the leading producing region. Harvesting usually takes place in March, April and May. Although Indian cashew production continues to increase, productivity is still lower than in Vietnam because of the frequent use of manual processing.

India’s share of the European market is falling. The country’s cashew kernel exports to Europe fell by 14.9% annually between 2018 and 2022 to settle at 10,785 tonnes in 2022. India’s market share in Europe fell from 16.3% in 2018 to 6.3% in 2022.

The production and export of Indian cashews are supported by the Cashew Export Promotion Council of India (CEPCI). The country’s nut processing capacities are larger than needed to handle domestic production: large quantities of in-shell nuts are therefore imported from Africa. India’s largest suppliers of raw cashew nuts in 2022 were Côte d'Ivoire (273,000 tonnes), Ghana (225,000 tonnes), Benin (186,000 tonnes), Guinea-Bissau, Tanzania, Nigeria and Guinea. The main export markets for Indian cashew nuts in 2022 were the United Arab Emirates, followed by the Netherlands, Saudi Arabia and Japan.

Brazil

Brazil with its production of 29,440 tonnes accounted for 3% of global cashew kernel production in 2022/23 and 2% of global exports. Cashew nut production in Brazil is concentrated in the northeast of the country with around 95% of cashew nuts produced in the states of Ceará, Piauí and Rio Grande do Norte. Like Vietnam and India, Brazil imports in-shell cashew nuts from Africa in order to better utilise processing capacities.

The Northeast is responsible for all imports of cashew nuts into Brazil. In 2020 and 2021, the processing industry did not need raw cashew nuts for processing. A specific characteristic of Brazil is that it imports in-shell cashew nuts only from Côte d'Ivoire. Imports from Côte d'Ivoire amounted to 6,497 tonnes in 2018, 5,000 tonnes in 2019 and 14,913 tonnes in 2022.

Brazilian cashew nut kernel exports to Europe grew by 1.2% annually between 2018 and 2022. Exports mostly hovered around 3,000 tonnes per year, with an unusual peak of 6,300 tonnes in 2020. Brazil’s share of the European market is gradually falling, from 2.5% in 2018 to 1.9% in 2022. Due to its geographic location, Brazil exports significant quantities to the United States – around 30% in 2022. The top European destinations were the Netherlands (13%) and Italy (7%).

Export promotional activities are undertaken by the Brazilian Trade and Investment Promotion Agency (APEX Brazil). APEX Brazil facilitates the organisation of national stands at European trade fairs and other trade events. The interests of the nut industry are represented by the country’s nut association ABNC. Instituto Caju Brasil (ICB) is an NGO focused on the sustainable development of the cashew value chain.

Burkina Faso

In Burkina Faso, the production and processing of cashew nuts had been increasing until recently. Burkina Faso is a secondary cashew origin in West Africa, processing less than a fifth of its domestic crop. Cashew production is organised on more than 255,000 hectares according to Burkina Faso Cashew Council (CBA). Raw cashew nut production amounted to 106,044 tonnes in 2021, which was slightly below the 5-year average of 108,867 tonnes. Some 99% of the crop is produced in the Cascades, South-west, High Basins and Centre-west regions.

Exports from the country could suffer a hit due to the current political instability and poor safety situation. Following 2 military coups d’état in 2022, militant Islamist violence has spread throughout the country. Roughly half of Burkina Faso’s territory is effectively outside of government control. The country is now suffering from an unprecedented food crisis.

The country has 21 cashew nut processing plants and four-fifths of the processing capacity is located in the High Basins region, while 14% is in the Cascades. The country processed 18.15% of its crop in 2020 and 16.11% in 2021. Most of the cashew processing in Burkina Faso is done manually. Almost 50% of the processing plants do not have calibration equipment, while 97% of the shelling equipment is manual and only 2.5% is automatic or semi-automatic. Two-thirds have manual peeling equipment, while one-third of peeling is done automatically.

Burkina Faso exported 88,958 tonnes of raw cashew nuts and 3,200 tonnes of cashew kernels in 2021. The raw nuts were mostly exported to re-exporting and processing countries, such as Ghana and Vietnam. The commodity is the second-most important export crop for the country after cotton. In 2022, Burkina Faso exported 2,734 tonnes of cashew kernels to Europe. Annual exports to Europe grew at an annual pace of 28.5% between 2018 and 2022. The country’s market share in Europe doubled from 0.8% to 1.6% in the same period.

Cashew production in Burkina Faso is supported by the Cashew Committee of Burkina Faso (CIAB), the National Union of Cashew Producers (UNPA-BF), the Burkina Faso Cashew Council (CBA), the National Association of Processors (ANTA-BF) and the National Union of Cashew Nut Exporters (UNCEA-BF). Cashew growers are assembled in the FENAPA-B federation. In addition, Burkina Faso is included in the activities of the African Cashew Alliance (ACA) and ComCashew.

A deeper look at the cashew sector in Burkina Faso is available from the latest cashew sector annual report (PDF) published (in French) by CBA.

Nigeria: Emerging developing-country supplier

Nigeria harvests around 300,000 tonnes of raw cashew nuts every year, thereby making the country the second-largest producer in Africa after Côte d'Ivoire. The Nigerian harvest season starts in late January. In 2022, Nigeria exported over 170,000 tonnes of raw cashew nuts. Around 88,000 tonnes were shipped to India and almost 80,000 tonnes to Vietnam for further processing.

However, Nigeria has managed to increase its own processing capacity as well. This has led to a significant increase in exports of cashew kernels. In 2022, Nigeria exported 69,492 tonnes of cashew kernels, including 59,678 tonnes to Vietnam and 6,700 tonnes to India. Exports to Europe amounted to 1,500 tonnes in 2022. However, exports to Europe are rising fast. Annual shipments rose by 62.5% on average between 2018 and 2022. Nigeria’s share of the European market increased from 0.2% in 2018 to 0.9% in 2022.

Within Europe, most of Nigeria’s cashew nuts go to the Netherlands (30%), followed by Belgium (25%) and Germany (15%). Nigeria is expected to have a good crop in 2023, following good weather conditions in key production zones such as Kogi, Kwara, Ogbomosho and some parts of the eastern region. Several value chain projects by development partners are currently on-going to increase cashew nut production and processing in Nigeria.

Nigeria has 15 active processing plants with an estimated capacity of 55,750 tonnes and eight inactive plants with an estimated capacity of 8,500 tonnes. The main organisations that support the development of the cashew sector in Nigeria are the National Cashew Association of Nigeria (NCAN), the Association of Cashew Farmers, Aggregators and Processors of Nigeria (ACFAP) and the Nigerian Export Promotion Council (NEPC). Only 10% of exported cashew nuts were processed in Nigeria in 2022.

Tips:

- Participate in the World Cashew Convention to gain insight into the global cashew industry.

- Visit the website of the African Cashew Alliance to gain a better understanding of African cashew-supplying countries.

Which companies are you competing with?

There are thousands of companies around the world that produce, process and export cashew nuts. One company stands out as one of the most important influencers in the cashew community. That company is Olam International, one of the largest cashew nut processors and exporters in the world. Olam states that it is the only fully-integrated cashew supplier in most major producing and processing origins. As a result, the company’s actions have significant influence on market events and trends.

Olam runs more than 15 cashew processing facilities in Asia and Africa. These are located in India, Vietnam, Côte d'Ivoire, Mozambique and Nigeria. In India and Vietnam, Olam uses fully mechanised shelling facilities. In the supply of cashew nuts, Olam pays considerable attention to food safety. Olam’s sustainability focused Cashew Trail (PDF) published in 2022 sets 2030 targets across its cashew business.

A quick overview of some leading companies per supplying country is given below.

Vietnamese companies

According to VINACAS, Vietnam is home to nearly 400 companies that export in-shell cashews and around 150 processing companies. The top exporter of Vietnam’s cashew kernels is Olam International, with around 10% of the total export share. However, Olam is a multinational (headquartered in Singapore) with cashew nut processing operations in several countries. German-based ATCO also has its own local cashew processing company, ATCO Vietnam.

Three Olam branches in Vietnam (Quy Nhon, Bien Hoa II Industrial Zone and Olam Vietnam Food Processing) were the 3 largest exporters in 2022. The 3 branches had combined exports worth around $375 million. After OLAM, the largest Vietnamese cashew nut processor and exporter is the company Long Son with its 2 subsidiaries (Long Son Joint Stock Company and Long Son Inter Foods). Long Son is Vietnam’s largest processor with ten processing facilities across the country. Moreover, Long Son owns several companies outside of Vietnam.

Other large exporters include Hoang Son 1, Hai Viet, Dakao Agricultural Produce, Cao Phat and Vietnam Intersnack Cashew (part of Germany’s Intersnack Group). Other companies that are thought to be amongst the top exporters and/or processors in Vietnam are Rals Vietnam (a subsidiary of the Indian company Rajkumar Impex), Minh Loan, Lafooco (part of PAN Food), Haprosimex and Hapro.

My An Co, Tan Lon Group and Dan On Foods are also important processors. The remaining companies are much smaller as compared to the top exporters.

There is a trend towards a concentration of the cashew industry in Vietnam. This means that the number of processors is decreasing and large processors are increasing their power. This is a trend that many small and medium-sized companies as should be aware of.

Indian companies

India is home to many cashew nut processing and exporting companies. Many of these used to be located in Kollam, in the state of Kerala. Of the more than 800 cashew factories operational in Kollam till a decade ago, less than 100 cashew factories are operational now. Even those that are operational often do not work at full capacity. The Kerala State Cashew Development Corporation runs 30 cashew factories across Kerala state with an annual production capacity of 30,000 tonnes.

Maharashtra is India’s largest cashew nut producer state with a production of 199,700 tonnes in 2021/22, followed by Andhra Pradesh (127,200 tonnes) and Orissa (121,300 tonnes). India’s cashew nut growers and processors are represented by CEPCI. On its website, CEPCI lists as many as 187 exporters of cashew nuts. Cashew nut processing, once very limited to Kerala and other southern states, has now spread to the entire country, with domestic consumption rising. The cashew harvesting season in India is normally from late February to early June.

Cashew nut exports are supported by India’s Agricultural and Processed Food Products Export Development Authority (APEDA). APEDA publishes a list of the top 20 exporters for many agricultural commodities. The top 20 cashew exporters in 2022-2023 include Intersnack Cashew India (a member of Germany’s Intersnack Group), India Food Exports, Tasty Nut Industries, Pratipa Cashews and Kerala Nut Food Co.

Like in Vietnam, Olam International is an important cashew processor and exporter in India. Other notable Indian exporters include Bismi Cashew Company (with 7 factories and 2 packing centres), Fernandes Brothers (a leading exporter active for several decades), Bolas (a large exporter that also imports almonds and pistachios to India), Prasad Trading Company and Paranjape Agro Products.

The Indian processing industry is very fragmented. Rough estimates from Olam show Kerala state topping the processing ranking with a 20% market share, closely followed by Maharashtra (18%), Karnataka (16%) and Tamil Nadu (12%).

A major trend in India is the investment in fully automatic processing facilities. Nevertheless, most cashew nuts in India are shelled by pedal-operated machines. India’s leading grape exporter Sahyadri Farms has recently opened Maharashtra’s biggest cashew processing plant.

Cashew companies from Brazil

In order to utilise their existing domestic processing capacity, Brazilian companies also started investing in production in Africa, similar to Vietnam and Indian companies. The largest processor is Usibras, with business units in Brazil, Ghana and the United States (Nutsco). Usibras processes around 100,000 tonnes of cashews annually. Examples of other Brazilian cashew companies are Amendoas, Marambaia, Cione and Carino.

African cashew suppliers

Olam International is the largest cashew nut processor in Africa. Aside from Olam, there are many other cashew companies that are increasing their exports to Europe.

- Côte d'Ivoire – Olam is the largest processor with a processing capacity of more than 40,000 tonnes per year. Other large processors include CILAGRI, SITA, Nord Cajou and Ivory Cashew Nuts, followed by several other companies. Some prominent players, such as FMA and Cajou des Savanes (CASA), were recently forced to shut down operations due to strong competition from Asian countries.

- Burkina Faso – As in other African countries, OLAM is an important processor in Burkina Faso. The largest local processor is Anatrans, followed by several others. Organic importer and wholesaler Gebana, which is headquartered in Switzerland, was active in Burkina Faso for 12 years, but recently went bankrupt. However, in September 2023, Gebana announced the restart of the company’s operations.

- Nigeria – Enkay Indo Nigerian Industries is an important cashew nut exporter, as is Lagos-based FoodPro Group.

Tips:

- Monitor activities of the Global Cashew Council to stay informed about the activities of the largest cashew-producing, processing and trading companies.

- Use the services of your national export promotion agency and actively participate in the creation of export strategies.

- Regularly visit major European trade fairs to meet competitors and potential customers. Anuga, SIAL and Food Ingredients Europe are just a few examples.

Which products are you competing with?

Cashew nuts have a unique flavour. They are, however, also part of a wider group of tree nuts. It is therefore unusual for buyers to consider alternative products, although when prices are very high, consumers may also opt to replace some tree nuts (such as cashew) with cheaper groundnuts.

Cashews are often consumed as part of a salted nuts mix. In such a mix, the proportions of the various types of nuts may vary and will in part determine the price of the mix. The nuts that are most similar to cashews in terms of flavour are probably peanuts, while in terms of popularity, almonds and pistachios are important competitors. Almonds, like walnuts and hazelnuts, are traditionally used as an ingredient in confectionery and breakfast products, and as a topping, more so than cashews.

One of the advantages of almonds is that they cost less than cashews. The FOB price of almonds is, on average, 60% lower than that of cashews. Additionally, the consumption of almonds is promoted more aggressively by the US, the leading supplier of almonds to Europe, than the consumption of cashew nuts is promoted by the leading cashew suppliers (India and Vietnam).

Tip:

- Read CBI’s study on almonds and the study on groundnuts to understand the 2 industries and learn about promotional tools used by the almond and groundnut suppliers.

4. What are the prices for cashew nuts?

Depending on the country, retail chain, package size and brand, the prices of the cashew nuts sold to end- consumers vary significantly across Europe. The prices of salty roasted cashew nuts usually range from €20/kg to €30/kg, while prices of natural unsalted kernels commonly vary between €15 and €18/kg.

These price ranges do not tell cashew nuts suppliers a lot, as the final price is very different from the export price due to the addition of many other costs, such as transport, roasting, packing and sales, as well as profit margins. The approximate breakdown of retail cashew prices is shown below, however keep in mind this is a generalisation that does not reflect the specifics of individual supply chains and markets.

Source: Autentika Global

Global cashew prices are currently subdued. In many nut commodities, including cashew, high production has been part of the reason behind this trend. For the 2023-2024 period, the worldwide raw cashew kernel production is projected at 4.97 million tonnes, marking a 1% decline from the previous year. This is attributed to decreased yields in India and Vietnam.

During 2017-2018, prices soared. This was followed by an extended era of depressed prices. Initially, this was attributed to a decline in demand from India. However, the low cashew nut prices persisted. Overproduction in Africa and a surge in Cambodian yields were identified as influential elements. Presently, weaker demand from Europe, the US and China, along with Côte d'Ivoire emerging as a major supplier of processed cashews, are key factors setting prices. In Europe, this is exacerbated by the Russian war against Ukraine and high energy prices.

The UK ex-works price of Vietnamese 240 cashew kernels peaked at €11.55/kg in March 2017 and since then has been gradually dropping. Prices of Vietnamese 320 and 450 grades have followed an identical pattern. Prices reached a sharp low in August 2020 when the price of 240s fell to €6.24/kg and then held above that level until the end of 2022. In 2023, the UK ex-works price of Vietnamese 240s fell below €6/kg and were trading around €5.82/kg in August 2023. Vietnamese 320s were trading for €5.37/kg and 420s for €5.27/kg.

Industry voices maintain that cashews are also facing competition from other nuts such as almonds, walnuts and pistachios. As inflation impacts purchasing choices, consumers are gravitating towards products that merge the attraction of being traditional snacks and beneficial for health. Aggressive marketing is key to favourable consumer perception. Major producers and exporters, such as Vietnam and India, have long enjoyed robust sales but have overlooked wider campaigns emphasising the health benefits of cashews.

Cashew kernel prices in 2022 and 2023 were so low that leading traders have warned that current prices are causing volatility and uncertainty. Should these trends continue unchanged in the next few years this could potentially lead to an unsustainable value chain. Recent reports indicate that the price slump is so bad that some segments of the cashew nut industry in Côte d'Ivoire are close to collapse. Essentially, farmers, buyers and processors face major problems when they try to sell their inventory.

Some bearish trends remain present. Nearby demand both in in-shell and kernel seems sluggish. Additionally, consumers remain less interested in luxury items. This is mainly attributed to consumer uncertainty, especially in the slower growing European economies. On the other hand, with the current favourable pricing, main destination markets are showing higher interest. There is a desire from buyers to cover supply going into 2024 at these favourable price levels.

While raw cashew nut and cashew kernel prices are now at historic lows, industry sources see $3.00-3.50/kg as a healthy average price range for cashew kernels (including lower grades) from supplier countries in Africa. These price levels are likely to be achieved again when the conditions on the supply and demand sides normalise, for example after an end to the Russian war in Ukraine.

There is a likelihood that demand in Europe will pick up further thanks to promotions that improved consumption levels in 2023. Retailers across main destination markets have adjusted their shelf prices, which has supported a rise in consumption. Be aware that the demand for raw cashew nuts and cashew kernels may vary depending on inventories and processing trends.

Tips:

- Subscribe to S&P Global Commodity Insights, a leading market information service for food ingredients, including cashew nuts. Subscribers have access to overviews of cashew nut export prices that are updated frequently.

- Read and subscribe to the Nuts by ofi market price reports published by Olam Nuts. These free reports provide information about nut prices and nuts online purchasing activities.

- Monitor the latest nut market updates from the UK’s Chelmer Foods.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research