The European market potential for cashew nuts

The popularity of nuts as a source of healthy fats, protein and fibre is driving the increase in demand for cashews on the European market. European cashew nut consumers still prefer cashew nuts as simple, roasted, salty snacks, but consumption of unsalted and less-processed cashew nuts is also increasing. Plain nuts without any additions are increasingly being offered, as well as various roasting flavours. Cashew nuts are used as ingredients in fruit and nut bars, breakfast cereals, nut spreads, nut drinks, ice cream toppings, cookies and other sweets.

Contents of this page

The popularity of nuts contributes to the increasing demand for cashews on the European market. European cashew nut consumers still prefer cashew nuts as simple, roasted, salty snacks, but consumption of unsalted cashew nuts is also increasing. Plain nuts without any additions are increasingly being offered, as well as different roasting flavours. In addition, cashew nuts are increasingly being used as ingredients in fruit and nut bars, breakfast cereals, nut spreads, nut drinks, ice cream toppings, cookies and other sweets.

1. Product description

Cashew nuts are the kidney-shaped seeds that develop on the bottom of the pseudocarp or ‘false fruit’. The false fruit is commonly called the cashew apple or the fruit of the cashew tree (Anacardium occidentale). The real fruit is a kidney-shaped drupe that grows at the end of the apple. Inside this true fruit (the raw cashew nut) is the soft white kernel. The cashew shell contains a caustic phenolic resin that is harmful to humans. The resin is known under the name cashew nut shell liquid, or CNSL, and has widespread industrial uses.

Figure 1: Red cashew nut pseudocarp (cashew apple) and drupe (nut)

Source: Cashew Fruit by bfishadow is licensed under CC BY-SA 2.0

The kernel itself is protected by a very strong shell, which needs to be roasted or steamed before it can be shelled. The edible part is the cashew nut kernel that is obtained after shelling. The kernel represents only around 20% of the whole cashew nut in weight. In most production countries, cashew trees have 2 or 3 flowering and harvesting cycles during the production season, depending on weather conditions.

The cashew tree is native to north-east Brazil, but today it is grown in many areas in the world. Cashew nuts are grown in at least 46 countries across Africa, Asia, Latin America and the Caribbean, 18 of which are amongst the least developed countries, according to UNCTAD (PDF). World cashew production (kernel basis) has been rising continuously since 2017/18 to reach 1.09 million tonnes in 2022-2023, according to the International Nut and Dried Fruit Council (INC) statistical yearbook (PDF).

Africa accounts for more than half of the global cashew harvest. West Africa accounted for 50% (548,190 tonnes) of global output in 2022-2023, followed by India with 15%, Cambodia with 14%, Vietnam with 9% and Eastern Africa with 6%. The production share of Brazil was 3%, followed by Indonesia with a 2% share of global production.

Production in East and West African countries has been increasing significantly, but due to the lack of processing (shelling) capacities, African producers still export most of their crop as in-shell cashew nuts to Vietnam and India. India and Vietnam are the 2 largest processors of cashew nuts. However, Côte d'Ivoire has significantly expanded its exports to the European market and overtook India in terms of exports to Europe in 2022.

Countries and regions north of the equator, including India, Vietnam and West Africa, harvest cashew nuts from early in the calendar year to approximately mid-year. Countries and regions south of the equator, including Brazil and East Africa, harvest from September or October to early on in the following year. Strong investments in processing capacity have helped Côte d'Ivoire expand its cashew exports. An example is the recent $10 million loan from Norfund to Valency CIV to build a cashew processing plant with a capacity of 45,000 tonnes per year near Abidjan.

The cashew value chain is largely divided between cashew-growing countries that produce raw cashew nuts (RCN) mainly for export and countries that have a processing industry. Countries that produce RCN but do not process them on a significant scale retain only a small share of the value that is generated in the cashew industry.

After harvesting, growers place the harvested inshell cashew nuts in the sun to dry. The nuts are continuously mixed in order to dry the nuts in their shells and achieve around 8 to 10% rest moisture. Inshell cashews and kernels are stored under dry (<65% relative humidity), dark, cool (<10 ºC/), and well-ventilated conditions.

Figure 2: Inshell cashew nuts

Source: Goa - Cashew Nuts by abcdz2000 is licensed under CC BY-SA 2.0

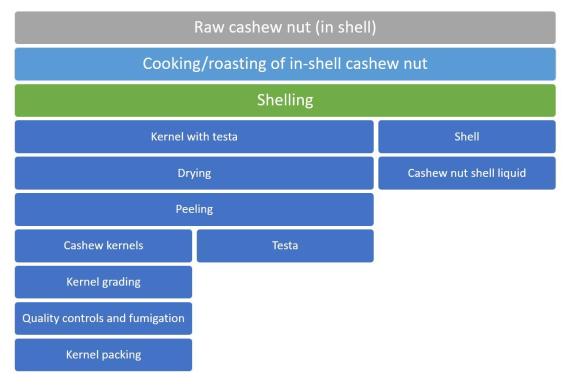

The production of raw cashew nut kernels is different in many production regions. After removing the inshell nuts from the cashew apple, processing typically includes the following 5 steps:

- Preparing the nuts for shelling (drying, sizing, cleaning, steam cooking or roasting);

- Shelling (with automatic, semi-automatic or manually operated machines);

- Peeling (drying shelled nuts, automatic or manual peeling);

- Grading (colour sorting, sizing, cleaning); and

- Packing (weighing, vacuum sealing).

Figure 3: Stages of processing raw cashew fruit (drupes) into kernels and byproducts

Source: Autentika Global, Global Cashew Council

Vietnam, as the leading cashew nut supplier to Europe, benefits from its large-scale production that is based on automatic processing equipment. The shelling capacity in Africa is much more limited because of a more prevailing usage of manual (hand- or pedal-operated) shelling machines. Usually, 1 worker can cut up to 40 kg in nuts per daily shift, while processing capacities of automatic machines can go over 100 kg per hour.

Figure 4: Workers processing cashew nuts

Source: Women preparing cashew, Burkina Faso by CIDSE - together for global justice is licensed under CC BY 2.0

On the European market, cashew nut kernels are mainly used as a roasted and salted snack. However, cashew nuts have also become popular as ingredients in confectionary and other food processing industries. It is used in cookies, fruit and nut snacks, breakfast cereals, as butter, as a topping on ice cream, as well as an ingredient in sauces and condiments.

Figure 5: Cashew nut kernels

Source: Cashew nuts in West Bengal of India by Billjones94 is licensed under CC BY-SA 4.0

This study covers general information regarding the market for shelled cashew nuts in Europe that is of interest to producers in developing countries. Cashew nuts are traded under 2 different Harmonised System (HS) codes. The HS code for inshell cashew nuts is 08013100, and the HS code for shelled cashew nuts (kernels) is 08013200. As European imports of inshell cashew nuts are of marginal importance (they amount to around 1,000 tonnes per year), this study only uses the code of cashew nut kernels for statistical analysis.

The term ‘Europe’ in this study refers to the 27 member states of the European Union (EU), plus the United Kingdom (UK), and the EFTA countries (Iceland, Liechtenstein, Norway and Switzerland).

2. What makes Europe an interesting market for cashew nuts?

According to Tridge, Europe is the largest importer of cashews nut kernels in the world, accounting for around 40% of global cashew import value in 2022. This is more than the 28.5% share controlled by the United States. European volume imports of cashew nuts increased at an annual average rate of 6.1% in the 2018-2022 time period. Virtually all imports from outside Europe come from developing countries. During 2022, European imports of cashew nuts contracted slightly after 3 consecutive strong increases.

In the next 5 years, the European market for cashew nuts is likely to increase at an annual growth rate of 5-6%. Demand for cashew nuts in Europe is strong, although import quantities sometimes fluctuate due to variable production in the main supplying countries. Regular fluctuations in imports will continue to be influenced by harvests and supply, as cashew nuts have a well-established market presence and strong demand.

Imports from developing countries are dominant and they account for around 74% of the overall imports by European countries. The term developing countries in this report is used to denote countries that are listed on the OECD-DAC list of ODA recipients for 2022 and 2023 flows PDF). The annual growth rate is expressed as the cumulative annual growth rate, or CAGR.

The price of cashew nuts is higher compared to many other nuts on the European market. Rising prices can influence consumer behaviour negatively, as buyers may find cheaper alternatives amongst other nut products. The high price can influence the demand for cashews by companies that use them as an ingredient for nut mixes, breakfast mixes, and so on. When cashews are expensive, food processors may reduce the share of cashew nuts in a mixture by increasing the share of cheaper nuts. This may also negatively affect new product launches.

Source: Autentika Global, GTA, 2023

Since 2018, European imports of cashew nuts have increased by 6.1% annually in quantity, while the value of imports contracted by less than 1%. This difference between growth rates in quantity and value indicates a slight weakening in import prices. In 2022, imports from outside Europe reached 172,000 tonnes. Intra-European trade in 2022 was 60,768 tonnes. The total European trade in cashew nuts (including imports and Intra-European trade) reached a value of €1.54 billion.

Intra-European trade accounts for 26% of all imports. Internal European trade consists of the simple re‑exporting of imported raw cashew nut kernels, but it also includes added-value processing, such as roasting, salting and retail packing. European imports from developing countries increased by 8.2% per year over the last 5 years, from 125,389 tonnes in 2018 to 171,584 tonnes in 2022.

Source: Autentika Global, GTA, 2023

Cashew nuts are imported to Europe throughout the whole year. However, there is a pattern, in which the first half sees a slightly lower import volume, with quantities increasing in the second half of the year. The peak period for deliveries is usually between September and November, as a result of increased consumption during the winter holiday season in Europe. Emerging cashew nut suppliers should therefore be able to have enough stocks for the larger deliveries during this peak season.

Source: Autentika Global, GTA, 2023

Note: The figure above represents apparent consumption, calculated as the difference between imports and exports.

When looking at European apparent consumption figures, it is worth remembering that the cashew import trade is concentrated with 2 significant importers, the Netherlands and Germany. Both countries are also important consumers of cashew nuts and transit countries for other European destinations. The general trend in the 2018-2022 period was towards increasing apparent consumption, with the exception of Belgium.

Over the last 5 years, a steady growth rate of apparent consumption can be seen in Germany (+2.8%), the United Kingdom (+3.1%), France (+8.5%), the Netherlands (+10.7%) and Italy (+13.6%), while the decrease of apparent consumption in Belgium might also be caused by inventory and trade variations, as the country is also a major re-exporter.

The latest INC statistical report (PDF) on estimated consumption in kernel equivalent for 2021 identifies Germany, the United Kingdom and France as the 3 largest consumer countries in 2021.

Sales are benefiting from increasing consumer awareness of health benefits associated with cashew nut consumption. Cashew nuts are promoted as specifically rich in iron (contributes to a strong immune system) and vitamin K (contributes to healthy blood and bones). Another driving force for the increased consumption of cashew nuts is their taste. Many European consumers find the taste of roasted cashew nuts more appealing compared to traditional European nuts such as hazelnuts or walnuts.

3. Which European countries offer most opportunities for cashew nuts?

As Europe’s main importer and consumer of cashew nuts, Germany is an interesting focus market. Germany also provides specific opportunities for organically certified cashew nuts. Germany and the Netherlands are also important trade hubs with significant re-export of imported cashew nuts. Other European countries that are large net importers and consume most of the imported cashews are the United Kingdom, France, Italy and Spain.

Germany: The largest European cashew market

Germany is Europe’s largest importer of cashew nuts. The total German import volume was almost 60,000 tonnes in 2022. German imports increased in volume by 5.9% annually between 2018 and 2022, while the average value of imports fell by 0.6% annually to €408.3 million in 2022.

Germany is also a large transit country for imported cashew nuts. Around 38% of all imported cashew nuts are re-exported from Germany every year, mostly (99%) to other European markets. Re-export activities are conducted by specialised traders and agents, many of them located in Hamburg (Germany’s main port). In 2022, the main target markets for German export and re-export were Luxembourg (14.7% share), France (12.2%) and the United Kingdom (8.4%).

The reason why Germany is re-exporting significant quantities of cashew nuts to Luxembourg, is the existence of processing (roasting and shelling) capacities for cashew nuts installed in Luxemburg. A lot of the cashew nuts are processed and packed for the German retail market in Luxembourg, and then shipped back to Germany. The estimated consumption per capita amounted to 0.643 kilograms per year (or 1.88 kilograms per year when factoring in the estimated percentage of population consuming cashews), according to the INC statistical report (PDF).

Currently, the German import market for cashew nuts is very concentrated, as Germany imports 58% of all its cashew nuts from Vietnam (35,314 tonnes in 2022) and a further 16.9% from the Netherlands (10,142 tonnes in 2022). Côte d'Ivoire has emerged as the third-largest supplier with an average annual growth of 98.8% between 2018 and 2022. The country shipped 5,329 tonnes of cashew nuts to Germany in 2022. In reality, developing countries have a much larger share (indirectly) because Germany imports some quantities from Belgium and the Netherlands, which act as transit countries for cashew nuts.

Belgium, which serves as a transit hub, and major cashew nut producer India have seen their market presence reduced in the German market. Belgian exports to Germany have fallen by 4.8% annually, while Indian exports to Germany contracted by 11.1% annually between 2018 and 2022.

The recent success of Côte d'Ivoire is likely to inspire companies in other African countries to invest in processing capacity. In the medium to long term (up to the next 10 years), African countries are likely to significantly increase their supply of cashew nut kernels to Germany and other European destinations. This expectation is based on the projected investment in larger-scale capacities for cashew nuts processing. Processing in several African countries is already supported by international and governmental funds.

German consumption of cashew nuts has been boosted by the healthy snacking trend. Recently, cashew nuts are also increasingly used as an ingredient in spreads, sauces and snack bars (especially organic), examples of which are presented in the photos below. Industry sources estimate that Germany is the largest consumer of organic cashew nuts in Europe.

Figure 9: A vegan and organic cashew nut spread sold by dm

Source: Autentika Global

Some 47% of German consumers were willing to pay more for brands that improve society or the environment in 2022. This is down from 54% in 2021, according to a new Healthy & Sustainable Living report (PDF) by GlobeScan.

Emerging developing-country suppliers of cashew nuts who want to export to Germany must be aware of the high standards required by German importers. Those standards include food safety certification, such as IFS Food, but also commitments to sustainable and reliable supply. The German governmental development agency (GIZ) has launched a comprehensive project called Competitive Cashew initiative (ComCashew) to enhance competitive and sustainable production of cashews in several African countries. The German market also provides good opportunities for organic cashew kernels.

Figure 10: Private label organic raw cashew nut and mango fruit bar sold by Lidl

Source: Autentika Global

Examples of German cashew importers include August Töpfer & Co. (ATCO), Märsch Importhandels (Märschimport), Intersnack and Nutwork. Leading retail brands in the conventional segment (also importers and packers) are Seeberger, Farmers Snack, Kluth and in the organic segment Alnatura and Rapunzel. Apart from independent brands, a lot of cashew nuts are sold under the brands of retailers (private labels). Leading private labels include Alesto (by Lidl), Trader Joe’s (by ALDI Nord), Farmer (by ALDI Süd), K-Classic (by Kaufland), ja! and REWE Bio (by REWE), and Gut & Günstig and EDEKA (by EDEKA).

Tips:

- Find German traders of cashew nuts on the websites of the specialised trade promotion organisation Waren-Verein der Hamburger Börse and the German B2B platform Wer liefert was (wlw).

- Subscribe to the German-backed ComCashew news bulletin to stay informed about the latest news and information on happenings in the cashew sector that are relevant for the German and other markets.

The Netherlands: Europe’s prominent trade hub

The Netherlands is the second-largest importer of cashew nuts in Europe, slightly behind Germany in 2022. Over the last 5 years, Dutch imports of cashew nuts have grown consistently, although they contracted by more than 5,000 tonnes to 57,587 tonnes in 2022. Imported volumes peaked at 63,000 tonnes in 2021, or €376 million. The Netherlands is ranked as the third-largest consumer market based on apparent consumption, following Germany and the United Kingdom.

The Netherlands plays an important role as a trade hub in Europe, as most of the imported cashew nut kernels are re-exported to other European countries. Germany is the leading destination of Dutch re-export of cashew nuts, as it absorbs around 15,000 tonnes per year. Another large destination for Dutch re-exports of cashew nuts is France, which imported more than 4,600 tonnes in 2022.

The Dutch market for cashew nuts is quite concentrated, and mainly depends on imports from Vietnam and India. In 2022, 77% of Dutch imports came from Vietnam, followed by India (10%). Imports from Africa, although relatively small, are increasing strongly. Between 2018 and 2022, imports from Burkina Faso increased at an average annual rate of 74% to 1,841 tonnes. In the same period, imports from Côte d'Ivoire increased by 28% per year to 1,217 tonnes.

Source: Autentika Global, GTA

The rising consumption of cashew nuts in the Netherlands is driven by the healthy snacking trend and usage of nuts as a substitute for animal proteins. Cashew nuts are used as an ingredient, especially in spreads such as cashew butter. Cashew butter in the Netherlands is produced as 100% from cashew nuts or in mixtures with other nuts. Dutch consumers are already accustomed to nut spreads, as the Netherlands is the largest European consumer of peanut butter.

Some Dutch consumers and traders of cashew nuts source sustainable and ethically produced cashew nuts. Sustainable sourcing of cashew nuts in the Netherlands is strongly supported by several initiatives, such as the Sustainable Nut Initiative (SNI), Woord en Daad and Fair Match Support. Implementing sustainable production schemes can therefore be beneficial for suppliers that want to enter the Dutch cashew market.

In 2022, around 38% of Dutch consumers were willing to pay more for brands that improve society or the environment. This is down from 42% in 2021, according to the Healthy & Sustainable Living report (PDF) by GlobeScan.

Some prominent market traders and agents are Alderaban Commodities, Rotterdam Commodity Trading B.V. (formerly Amberwood Rotterdam) and QFN Trading and Agency. Examples of Dutch cashew nut importers include Catz International, Nutland, Rhumveld, Global Trading & Agency (GTA), and Delinuts. Most cashew nuts in the Netherlands are sold to consumers as private label (retailer brands) products, for example Albert Heijn or Jumbo. The consumption of unbranded, freshly roasted nuts (such as those sold in paper bags) is also significant.

Tips:

- To learn more about the Dutch cashew nut industry contact the Dutch Southern Fruit Association (NZV) (website in Dutch, use Google Translate to read it).

- To stay informed about sustainability developments in the Dutch nut industry, follow the latest SNI news.

The United Kingdom: The second largest cashew consumer market

The United Kingdom is the third-largest importing country and the second-largest market for cashew nuts in Europe. In 2022, imports reached 23,000 tonnes and an estimated 21,640 tonnes was consumed. This means that the UK is a small exporter of cashew nuts, with the majority of imported nuts consumed within the country. Imports of cashew nuts to the UK are relatively stable without big fluctuations in the last 5 years.

The estimated consumption per capita in the UK amounted to 0.336 kilograms per year (or 1.02 kilograms per year when factoring in the estimated percentage of the population that consumes cashews), according to the INC statistical report (PDF).

The United Kingdom’s import of cashew nuts is very one-sided and has a large dependence on supply from Vietnam. Vietnam accounts for 91% of the market share and the country supplied almost 21,000 tonnes in 2022. In 2022, the UK imported 632 tonnes from the Netherlands, 511 tonnes from India and 276 tonnes from Côte d'Ivoire. Amongst developing countries, Côte d'Ivoire has seen rapid growth with exports increasing from zero in 2018 to 276 tonnes in 2022.

The United Kingdom is a very innovative market in terms of consumption of cashew nuts. If used as a salty roasted snack, cashew nuts are offered in a variety of different flavours. Food processors are also increasingly using cashew nuts in fruit and nut bars (such as Barebells and Primal Pantry), in nut butter spreads (such as those offered by Meridian Foods and Biona) and in dairy free drinks (offered by Rude Health or Plenish).

Figure 12: Caramel and cashew protein bar from Barebells

Source: Autentika Global

Sustainability and ethical sourcing are important aspects for the UK cashew importers. Examples of UK importers of cashew nuts include Barrow, Lane & Ballard, Community Foods, Freeworld Trading and Premier Fruit and Nut. In 2022, around 42% of UK consumers were willing to pay more for brands that improve society or the environment. This is down from 48% in 2021, according to the Healthy & Sustainable Living report (PDF) by GlobeScan.

Tip:

- Look for cashew nut importers in the member list of the UK Nut Association. Apart from the UK members, you will also find contacts of companies from France, the Netherlands and Germany.

France: Strong consumer demand for sustainable and ethical products

French imports of cashew nuts have increased by 1.4% in value and 8.9% in volume annually between 2018 and 2022. In 2022, the import of cashew nuts to France reached 16,121 tonnes and €114.7 million. In that same year, the leading supplier of cashew nuts to France was Vietnam, with a 45% share, followed by the Netherlands (25%) and Germany (13%). Overall, developing countries supply 58% of cashew nuts directly to France with the rest coming from transit countries.

Vietnam, already the largest supplier, continues to gain market share on the French market. Imports from Vietnam increased in volume by 14% per year, from 4,301 tonnes in 2018 to 7,225 tonnes in 2022. Imports from Germany (16.1% higher volume) and the Netherlands (25.3%) have also gained pace in the same period. The fastest growing supplier is Côte d'Ivoire that managed to increase exports by 195% per year in this period. Imports from Côte d'Ivoire have increased from 19 tonnes in 2018 to 1,452 tonnes in 2022.

Cashew nuts in France are a popular snack offered by a significant number of brands. The estimated consumption per capita amounted to 0.268 kilograms per year (or 1.06 kilograms per year when factoring in the estimated percentage of the population that consumes cashews), according to the INC statistical report (PDF). It is also increasingly being used as an ingredient in nut drinks, including sugar-free cashew milk and other innovative products such as chocolates and snacks. The presence of organic retail brands in France is also expanding. These include Jardin Bio, Ethiquable and Naturalia.

In 2022, around 49% of French consumers were willing to pay more for brands that improve society or the environment. This is down from 50% in 2021, according to the Healthy & Sustainable Living report (PDF) by GlobeScan.

Tips:

- Learn more about the French cashew nut market by contacting the French association for the research in fruit and vegetable sector (CTIFL).

- If you are not from a French-speaking country, consider investing in French-speaking staff for easier penetration into the French market for cashew nuts.

Italy: A price-competitive market

Italy is the fifth-largest European importing country and fifth-largest consumer of cashew nuts. Italy is characterised by the strongest annual growth of imports compared to other leading importing countries. Between 2018 and 2022, Italian imports increased annually by 4% in value and by 12% in quantity. In 2022, imports reached 13,428 tonnes worth €70.3 million. Italy’s largest supplier in volume is Vietnam, with a 54% share, followed by Côte d'Ivoire (20%), the Netherlands (6.6%) and Brazil (6%).

Côte d'Ivoire has seen a surge in exports to Italy. Exports increased by 92% annually from 198 tonnes in 2018 to 2,685 tonnes in 2022. Benin is an emerging developing country supplier to Italy. Italian imports from Benin increased from zero tonnes in 2018 to 527 tonnes in 2022.

A trend specifically for the Italian market is the increasing use of cashew nuts in pesto sauces. The traditional recipe of pesto includes pine nuts, but due to high prices and unstable supply, Italian manufacturers frequently substitute pine nuts with cashew nuts or almonds.

Tip:

- Learn about the ways to promote cashew nut consumption in the Italian market from the Italian Edible Nuts and Dried Fruit Promotion Organisation – Nucis Italia (website in Italian only, use Google Translate to read it).

Spain: Fastest growing importer

Spain is also an important and fast-growing importer of cashew nuts. Spain offers great potential for developing country exporters. Between 2018 and 2022, Spanish imports increased annually by 11.1% in value and 17.9% in quantity, reaching 13,130 tonnes and €92.3 million respectively. Spain’s largest supplier in volume is Vietnam, with a 68% share in 2022, followed by India (16%) and Germany (a transit country with a 9% share).

Emerging suppliers to the Spanish market are Nigeria, Côte d'Ivoire, Brazil, Guinea-Bissau and Togo. Some of the importing companies include Importaco, Pedros Frutos Secos, Importaciones RJ África and Mironous. Secoex is a leading brokerage for nuts and dried fruits.

Tips:

- See our study on demand for processed fruit and vegetables on the European market for more information on general developments of trade within the European nuts sector.

- Follow Spanish and global nut market updates from Secoex or news from the Spanish snacks market from the Spanish snacks association La Asociación de Snacks. Check out the member list for potential leads to buyers.

- Check relevant trade statistics using tools such as ITC TradeMap and Access2Markets. Use HS code 080132 to analyse the cashew nut trade.

4. What trends offer opportunities on the European cashew nuts market?

The increasing demand for healthy snacking combined with the need for stable and sustainable sourcing are the leading driving forces behind the growing consumer interest in cashew nuts in Europe. With rising interest in vegan diets, the consumption of salty and salt-free nuts (‘healthy snacking’), nut spreads (such as cashew nut butter) and the use of drinks produced from edible nuts (nut milk) is on the rise, because consumers must satisfy their protein needs and deal with lactose intolerances in the absence of animal proteins.

To find out more about general trends, read our study about trends on the European processed fruit and vegetables market.

Healthy snacking and less processed food

Nuts, including cashew nuts, enjoy a good reputation amongst European consumers. Consumption of nuts is expected to have the highest growth in the snack segment. In major consuming countries, cashew nuts are considered a healthier alternative to other savoury snacks, such as crisps and extruded snacks, and more beneficial to health than peanuts.

6 out of 10 European consumers wish to improve their eating habits, according to new findings from Euromonitor. In addition to the wish from the consumer side, healthy eating is now increasingly an issue that is being debated by European governments that wish to take further action. Cashew nut suppliers also stand to benefit from the rising popularity of fortified protein snacks that often rely on nuts, including cashew nuts.

Nuts are promoted as rich in phosphor, copper and magnesium, not commonly found in other foods. Cashews, along with pistachios, have the lowest fat content of all nuts. Almost 80% of the fat in cashews is unsaturated, which helps to maintain healthy cholesterol levels. They are also rich in tocopherols and phytosterols.

Sourcing of sustainably-produced cashew nuts

Sustainability claims and certification in the edible nuts trade are important and growing trends in the mainstream market. In 2020, the EU established an official policy called the European Green Deal, which includes the Farm to Fork Strategy and the Biodiversity Strategy. Both policies influence food production and trade. Aspects of the European Green Deal relevant for sourcing cashew nuts and other nuts from developing countries are: reducing the use of pesticides, increasing organic production and switching to sustainable packaging materials.

In the edible nuts sector, several large traders have joined the Sustainable Nut Initiative with the objective of stimulating traceability and sustainability. Among many tools to reach this goal, the initiative provides a management information system (3S — Sustainable Supply System). The aim of the system is to stimulate productivity and quality, and to create traceability and transparency in the supply chain.

By joining the sustainable nut initiative, developing country suppliers can become more competitive on the European market. The risk assessment helps companies focus on the most urgent sustainability risks. Companies can achieve crucial competitive advantages by taking care of farmers and improving their livelihood.

Sustainability of cashew nut production and processing is not divorced from normal investment and business operations. A supportive business environment and well-functioning physical and financial infrastructure are important enablers for the sustainable growth of cashew-processing industries, according to an UNCTAD special report (PDF) on cashew nuts.

The report highlights the potential for cashews to contribute to the UN Sustainable Development Goals, particularly the one on poverty reduction. Cashew nut production typically takes place on smallholdings in rural areas. This means that there is a direct link between value addition in the cashew sector and the achievement of poverty reduction. Cashews are a source of income for an estimated 3 million smallholder farmers in Africa, according to the report.

Cashew supplier Tolaro Global based in Benin has put sustainability at the forefront of its cashew production. The company states that its mission is to produce the world’s best cashews through a fair-trade, thriving and sustainable farming community. The company’s efforts to boost cashew trade sustainability captured the attention of the World Economic Forum. The firm trades with 7,000 cashew farmers and its processing plant handles 6,000 tonnes of raw cashews per year. Over half of its employees are women, as well as three-quarters of management.

In order to maintain constant supply and stable prices when sourcing cashew nuts, many European companies have started to invest in production sites in developing countries. These investments are likely to increase, especially in Africa. The aim of such investments is to develop the processing industry and to become less dependent on Asian supply, as it is more sustainable to buy African cashew nuts from Africa.

Some import and trading companies, such as Dutch-based Nuts2, even specialise in the sustainable trade of cashew and other nuts sourced directly from cashew farmers. nts2 tries to provide farmers in Africa with access to the world market at prices that the company states are fair. This production also aims to be environmentally friendly by focusing on local processing to avoid excessive shipping to other continents for processing. As a result, this opens new pathways to the European market for suppliers that invest in the sustainability of their production.

Other companies cooperating closely with farmers and processors in growing countries are Olam and Intersnack.

Tips:

- Promote the various applications and nutritional properties of cashew nuts. Check the news page of the INC to find news on relevant studies that have been published in scientific journals.

- Read the CBI demand for processed fruit and vegetables study to learn more about trade trends and size of specific market segments

- Follow the latest market updates and news on the cashew and other nut markets from Dutch GTA.

- Check the websites of trade shows to discover the newest trends. The most important trade fairs in Europe that are relevant for cashew nuts are SIAL, Anuga and BIOFACH. Monitor product reformulation trends and initiatives for developing healthier snacks on the European Snacks Association website.

- Use the online 3S Platform by ChainPoint to trace, analyse and improve cashew nut supply.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research