Entering the European market for dates

Food safety certification, combined with reliable and frequent laboratory tests, creates a positive image for date exporters to Europe. Sustainable production and implementation of corporate social responsibility standards will provide additional advantages for emerging suppliers. Tunisia and Algeria are the leading suppliers to Europe. Although Medjool and Deglet Nour dates have the strongest presence in Europe, emerging suppliers such as Iran, Pakistan and Saudi Arabia are offering new, tasty varieties and are gaining share on the European market.

Contents of this page

1. What requirements must dates comply with to be allowed on the European market?

All foods, including dates, sold in the European Union (EU) must be safe. Limits are placed on the levels of harmful contaminants, such as pathogen microorganisms, pesticide residues and mycotoxins. Producers should ensure that dates are free from any dead or living insects through permitted fumigation practices and strict quality control. However, meeting legal requirements is just the first step toward a successful export to Europe. Date suppliers also have to meet buyer requests related to quality, certification and sustainable supply chains.

What are mandatory requirements?

All foods, including dates, sold in the European Union must be safe. This also applies to imported products. Additives must be approved. Levels of harmful contaminants, such as pesticide residues and mycotoxins, must be limited. Producers of organic dates must also follow new organic production rules and use only approved substances and methods for pest protection, fertilising and fumigation.

Contaminant control in dates

The European Commission Regulation sets maximum levels for certain contaminants in food products. This regulation is frequently updated and, apart from the limits set for general foodstuffs, there are a number of specific contaminant limits for specific products, including dates. The most common requirements regarding contaminants in dates are related to pesticide residues, microbiological organisms, foreign bodies (such as insects), preservatives and food additives.

Contamination caused by insects

Contamination caused by insects seems to be one of the biggest issues for dates on the European market. The main pests affecting dates are the carob moth (Ectomyelois ceratoniae), the lesser date moth (Batrachedra amydraula) and the raisin moth (Cadra figulilella). They can develop inside the fruit and continue their growth upon arrival at the packaging plant and during storage. The development of these insects is timed with the seasonal occurrence of the date fruit. Due to a high risk of infestation with insects, some buyers accept only pitted dates.

Preventive measures after harvesting are recommended. Currently, fumigation with phosphine or CO2 is the preferred way to control insect development in stored conventional dates. For organic dates, temporary freezing (minus 22°C) is used as desinsectisation treatment. Methyl bromide as a fumigant is banned in the European Union. Temperature treatments are also used to prevent insect development. Adult insects and eggs die if exposed to temperatures above 50°C for a longer period. Cold storage can also be used to prevent infestation in places where insects are likely to be present in ordinary storage.

Mycotoxins

The presence of mycotoxins is the one of the most frequent reasons for removing dates from the European market. Dates are grown in areas where temperatures and humidity are relatively high, so they are exposed to mycotoxin contamination, especially during their later stages of maturation. Insects, birds or harvest-related damage can also expose dates to mycotoxins. The limit for Aflatoxin B1 and Ochratoxin A in dates is set at 2 µg/kg, while the limit of Ochratoxin A in date syrup is set at 15 µg/kg.

Tips:

- Train farmers to protect date branches with nets to prevent insect and bird damage.

- Use cold and dried storage for dates to prevent the occurrence of mycotoxins.

Pesticide residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticide residues than allowed will be withdrawn from the European market. The majority of European importers will request a detailed test on the presence of a large number of pesticides (sometimes more than 500).

The European Union regularly publishes a list of approved pesticides that are authorised for use in the European Union. This list is frequently updated. Controlling the application of the insecticide chlorpyrifos is very important for date producers. Chlorpyrifos is widely used in date production to control fruit worms, caterpillars, mites and aphids. However, chlorpyrifos is banned in Europe. The limit in Europe is set to 0.01ppm.

The European Union is currently implementing a set of policies and actions called the European Green Deal, with the aim to make the European economy more sustainable and climate neutral by 2050. The action plan also includes a 50% reduction in the use of pesticides and an increase in the share of agricultural land used for organic farming to 25% by 2030. This means that many pesticides will be banned and residue levels will decrease gradually over the coming years. Any producer that sells their products in Europe will also have to meet these conditions, even if they are not based in Europe.

Microbiological contaminants

The presence of aerobic bacteria and/or yeasts and moulds is an important cause of the microbiological contamination of dates. The standard procedure before exporting includes laboratory testing of dates for the presence of pathogenic microorganisms such as yeasts, moulds, E. coli, Salmonella, coliforms and Staphylococcus.

Chlorates and perchlorates

Chlorates are no longer approved as a pesticide but they can come in contact with food by using chemicals for water disinfection. Water used to rehydrate dates should be controlled for the level of chlorates and perchlorates. Another source may be the use of detergents used for the cleaning of facilities and processing equipment. The level of chlorates is set to 0.3 mg/kg for dates.

Mineral oil hydrocarbons

Mineral oil saturated hydrocarbons (MOSH) and mineral oil aromatic hydrocarbons (MOAH) can be found in lubricants for machinery, surface treatment agents and packaging materials. The European Food Safety Authority is currently working on an updated risk assessment for MOAH. The official opinion will be published in 2023. A draft German regulation suggests a limit of 0.5 mg/kg for MOAH and 0.2 mg/kg for MOSH that can migrate from packaging to food.

Product composition

European authorities can reject products if they have undeclared or unauthorised extraneous materials or if the levels of these materials are too high. Although European consumers prefer dates without any additives, glucose syrup, sugars, flour (usually in chopped dates) and vegetable oils can be optional ingredients in date production. If any of those ingredients are used, this must be declared in the ingredients list, as well as in the product description. If a preservative is used (such as potassium sorbate), the quantity used must also be declared.

Packaging and labelling requirements

The label should indicate the name of the product (‘dates’ or ’dates coated with glucose syrup’), the name and physical address of the packer, the date style (cluster, stems, pitted where appropriate), the country of origin and the class. It is common practice to put the name of the variety, the crop year and the best-before date on the label. When dates undergo thermal treatment (hydration and drying), they are commonly declared as processed or conditioned dates. Without these treatments, dates are declared as natural dates.

In the case of retail packaging, product labelling must meet the European Union Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information. Dates are not declared as an allergen. However, sulphites must be indicated as potential allergens if used as preservatives. Retail packs must be labelled in a language that can easily be understood by consumers in the European target country.

Specifically related to sourcing of products from Israel, there was a decision in 2019 by the European Court of Justice that European Union countries must identify products made in Israeli settlements on their labels. In the statement by the court, it is explained that indicating that goods originate in the state of Israel, as opposed to the occupied territory, could mislead consumers about the fact that Israel "is present in the territories concerned as an occupying power and not as a sovereign entity".

Tips:

- Be sure to perform laboratory tests only in ISO/IEC 17025:2017-accredited laboratories.

- Review your treatment practices to ensure your dates contain no pesticide residues above the set limits.

- Refer to the Codex Alimentarius for practical guidelines on how to meet the requirements of European food safety legislation. For dates, consult the Code of Hygienic Practice for Dried Fruits.

Comply with the legislative requirements on sustainability

Some of the most relevant European laws and legislation related to environmental and social sustainability are incorporated in the European Green Deal (EGD). The EGD includes legislative changes, with a timetable outlining when they will come into action. The most relevant policies for the fruit, vegetable and nut processing sector are the Farm to Fork Strategy, the Biodiversity Strategy and the Circular Economy plan. Specific legislations relevant for date suppliers are:

- Organic food regulation;

- Sustainability labelling of food products;

- Corporate Sustainability Due Diligence Directive (PDF); and

- Packaging and packaging waste.

Tip:

- To be prepared for the legislative changes in line with the EGD and Farm to Fork Strategy, read CBI’s tips to go green and CBI’s tips to become a socially responsible supplier.

What additional requirements and certifications do buyers often have?

Together with the mandatory requirements, many private requests have become equally important. These include compliance with food safety, quality and sustainability standards.

Quality requirements

The quality of dates is determined by the allowed percentage of defective produce, per the total number of fruits. The industry has defined several criteria for quality, but some of them, such as taste and flavour, are subjective and cannot be easily determined by physical characteristics. Some retail chains in Europe have very strict rules related to the rejection of dates containing insects, so they accept only pitted dates.

Specific quality standards for dates have not been officially defined by the European Union. The most common standards used are the standards published by the United Nations Economic Commission for Europe (UNECE) and by the Codex Alimentarius.

The basic quality requirements for dates are:

- Absence of: insects, damages, mould, fermentation and foreign smell or taste; if dates are pitted, specification should also include a maximum number of dates with pits.

- Moisture content: maximum of 26% for cane sugar varieties and 30% for invert sugar varieties. However, for Deglet Nour dates in their natural state, the maximum moisture content is 30%; rehydration of dates is a common process to meet the specific moisture requirements of the buyers.

- Presentation: separated into individual fruits (pitted or unpitted), clusters (dates with the main stem attached) and stems (stems that are separated from the rachis, with the fruit attached naturally). Dates can also be chopped; Medjool dates are usually sold with pits while Deglet Nour can be unpitted or with pits, depending on customer requests.

- Additional ingredients: must be clearly indicated. Dates are often produced without any additions, but some producers use preservatives, usually potassium sorbate, or coatings such as glycose syrup or vegetable oil.

Specific marketing requirements include:

- Classification: dates are classified into 3 classes: Extra Class, Class I and Class II.

- Sizing: Dates can be classified into 3 categories, according to the number of dates per 500 grams or per 1 kg.

- Colour and shape of the fruit: The colour and shape of dates are biological characteristics, and they vary per date variety. Colours can vary from a light (yellow) colour to a dark, almost black colour. Most dates sold in Europe are of the light colour variety, although this indicates no difference in quality. The light-coloured dates on the market are a result of the cultivars grown in the main supplying countries (Tunisia and Algeria).

Packaging requirements

In bulk packaging, dates are typically packed into carton boxes with a polythene liner inside. Bulk packages usually weigh 5 kg, or sometimes 10 kg. For retail packaging, smaller carton boxes or plastic trays are most common. Dates can be packed pressed (to better fit into containers), unpressed (without mechanical force) and in clusters (with the main bunch stem attached). Some producers pack dates in retail packaging, together with a plastic stick that resembles a central stem.

Dried dates are best stored refrigerated at 4-10°C, especially if they have a high moisture content. At temperatures higher than 25°C, the syrup or date honey may seep out of the packaging. The shelf life of dates varies per cultivar. For example, the Medjool variety has a shorter shelf life than the Deglet Nour variety. As mentioned, wholesalers often store dates in frozen form. Shelf life can also be prolonged if dates are vacuum packed in an inert atmosphere.

Food safety certification

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will decline to work with you if you cannot provide some type of food safety certification.

The majority of European buyers will ask for certification that is recognised by the Global Food Safety Initiative (GFSI). For dates, the most popular certification programmes (all recognised by GFSI) are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000).

Please note that this list is not exhaustive and that food certification systems are constantly developing.

Although different food safety certification systems are based on similar principles, some buyers may prefer one specific management system. For example, British buyers often require BRC, while IFS is more common for German and French retailers. In addition, note that food safety certification is only a basis to start exporting to Europe. Serious buyers will usually visit/audit your production facilities within 1 or a few years.

Tips:

- Be aware that some retail chains in Europe will request to visit your company as part of an unannounced audit. Therefore, it is important to be ready for those audits and comply with the retail chain requests.

- If you have insufficient capacity to fully implement the food safety standard, you can do it in steps. There are special gradual certification schemes for SMEs, such as IFS Global Markets, FSSC 22000 Development Program and BRCGS START!

Sustainability requirements

There is an increasing demand for sustainably sourced food in Europe. To help consumers make more ecological choices, there is an increasing development of labelling systems such as Eco-Score, Eco Impact, Planet Score, Enviro Score and Foundation Earth. Along with requirements related to the environmental impact, there is an increasing demand for a more transparent and fair supply chain.

One way to show that you look out for farmers and seasonal workers is to get certified with standards such as Fairtrade, Fair for Life and Rainforest Alliance. Fairtrade international has developed a specific standard for fruit (including dates) intended for small-scale producer organisations. This standard defines protective measures for workers in macadamia nut processing facilities. Fairtrade also defines the terms of payment and the Fairtrade Minimum Price for organic and conventional dates from Algeria, Egypt and Tunisia.

Some companies require an adherence to their own code of conduct and other companies require an adherence to 1 or more common standards. Examples include independent audits such as the Supplier Ethical Data Exchange (Sedex), the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative code of conduct (amfori BSCI). If dates are meant for the retail segment, suppliers will have to follow a specific Code of Conduct developed by retailers. Adherence to the retailer standards also includes unannounced audits.

Tip:

- Stay up to date on new sustainable initiatives and innovations through participation in the Khalifa International Award for Date Palm and Agricultural Innovation in the United Arab Emirates.

What are the requirements for niche markets?

Specific opportunities can be found in the Demeter certification that requires date producers to follow rules of biodynamic growing. In addition, ethnic markets provide good opportunities for suppliers from specific destinations. Ethnic markets are also less demanding compared to mainstream retail chains.

Organic dates

To market dates as organic in Europe, they must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can place the European Union’s organic logo on the packaging, as well as the logo of the standard holder, for example, Soil Association in the United Kingdom (UK) and Naturland in Germany. A specific niche opportunity to sell organic dates at a higher price is to follow the rules of the biodynamic certification of Demeter.

If you are aiming to produce and export organic dates to Europe, be aware of important new rules that may impact your business. The New EU organic regulation entered into force on 1 January 2022. This regulation is accompanied by more than 20 secondary acts that regulate in more detail the production, control and trade of organic products. Some of the important acts to be aware of are detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

In conventional date production, pesticides are used to protect the fruit from insects (such as fruit fly and moth larvae). As using synthetic pesticides is not allowed in the production of organic dates, producers must use biological methods. One method to protect fruit branches from insects is to use plastic bags to cover the seed heads.

Tip:

- Read the training materials on the new organic regulation (by Alliance for Product Quality in Africa project) to prepare for the new rules.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) propose specific restrictions in diets. If you want to focus on Jewish or Islamic ethnic niche markets, you should consider the implementation of Halal or Kosher certification schemes. Dates are an especially popular product for the ethnic populations mentioned above, so ethnic certification will positively influence your sales in Europe.

Tips:

- Read the CBI study on trends on the European processed fruit and vegetables market for an overview of developments amongst the sustainability initiatives in the European market.

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

- Read the CBI study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

2. Through what channels can you get dates on the European market?

Dates are mostly used as a snack in Europe. Therefore, the most important channel to sell dates are specialised suppliers with experience in supplying the retail segment. Dates are also increasingly used as an ingredient in the food processing industry, as a natural sweetener. The ingredient segment with the most significant growth rate are dried fruit and nut bars.

How is the end-market segmented?

In Europe, dates are mostly used for home consumption, and retail sales have the largest share. They are increasingly used by the food processing industry and by the food service. The food processing industry is also increasingly using date products such as date paste, date sugar and date syrup. There are no exact data, but the retail segment is roughly estimated to make up a 60% share of the European date market. Within the retail segment, dates are mostly sold in supermarkets but also in specialised shops such as ethnic and organic shops.

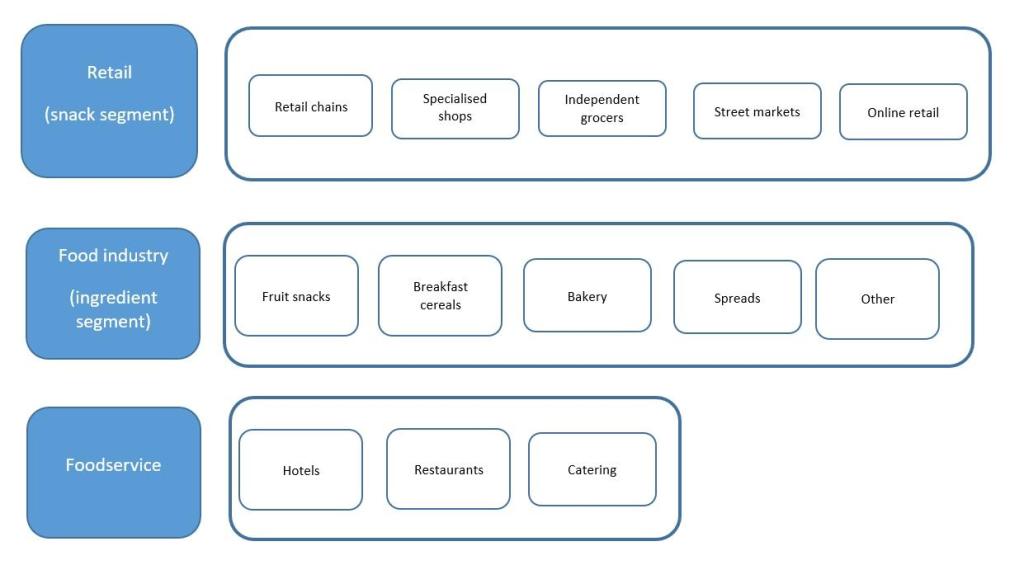

Figure 1: End-market segments for dates and date products in Europe

Source: Autentika Global

Retail (snack segment)

Retailers sometimes buy directly from developing country exporters, although, in the majority of cases, dates are supplied via intermediaries such as specialised distributors. A recent development is the polarisation of the retail sector into discounters and high-level segments. Consolidation, market saturation, strong competition and low prices are the key characteristics of the European retail food market.

Types of subsegments (points of sale) of the European date retail segment include:

- Retail chains – an increasing share of private label dates and the introduction of own organic and more luxury brands (such as small packs with large Medjool dates) are the main developments for leading mainstream retailers. The companies that hold the largest market shares in Europe are the Schwartz Gruppe (the Lidl and Kaufland brands), Carrefour, Tesco, ALDI, EDEKA, Leclerc, the Metro Group, the REWE Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands);

- Specialised shops – including organic food and ethnic shops. Some organic shops are part of specialised organic food retail chains, especially in Germany. Organic dates and date products are also sold in drugstores (for example, dm and Rossmann) and variety shops (such as HEMA). Ethnic shops selling food from the Middle East and North Africa provide specific opportunities for entering the market, without competing with the leading retail brands;

- Ethical stores – a niche segment. They provide opportunities for Fairtrade and ethically certified suppliers. Sales of Fairtrade-certified products are strong in the United Kingdom and the Scandinavian countries;

- Online retail – often part of the offer of existing retail traders or specialised shops. Since the start of the Covid-19 pandemic and lockdown measures imposed in many countries in Europe, online retail orders have increased dramatically. Most leading retail chains in Europe offer online purchasing and some are online-only stores. The most notable example is the British online-only retailer Ocado.

Food industry (ingredient segment)

Food industry processors are increasing the usage of dates as an ingredient at a fast rate. Some of them are supplied by European wholesalers but a few also purchase dates and date products directly. For example, date pieces are attractive for breakfast cereal producers, while date paste is a popular ingredient in fruit bars. It is expected that the food industry will increase its use of dates, as they can be used as a sugar alternative in many products. The biggest users of dates in the European food industry include:

- Fruit snacks – dates and date paste, as already explained above, are becoming increasingly popular in products such as fruit bars, as they can provide sweetness and the desired consistency to products without the addition of sugar. Organic dates and date paste are increasingly used by fruit bar producers, as fruit bars are perceived as healthy food;

- Breakfast cereals – breakfast cereal producers are increasingly switching from using sugar-infused fruit to natural fruit, such as dates. Chopped dates are used for breakfast cereals, sometimes coated with flour in order to avoid sticking;

- Bakery industry – date paste is used to produce various sweets. Date paste is also used as a filling. However, the baking industry is not yet a significant consumer of dates;

- Date spreads, pastes and syrups – these still lack a large presence on the European market, although they are increasingly emerging. Date syrup and date paste are used in combination with other fruit to produce sugar-free jams and spreads;

- Other users – other users of date products include confectionery producers (for example, chocolate-coated and nut-stuffed dates or energy balls with dates) and producers of innovative products such as date butter. Date products are also packed as sugar replacements for home use, such as date powder and date syrup.

Foodservice

The food service channel (hotels, restaurants and catering) is usually supplied by specialised importers (wholesalers). The food service segment often requires specific packaging of 5 kg of dates, which is different from retail packaging. World cuisines, healthy food and food enjoyment are the major driving forces in the food service channel in Europe. The fastest-growing business types are likely to be new (healthier) fast food, street food, pop-up restaurants and international cuisines.

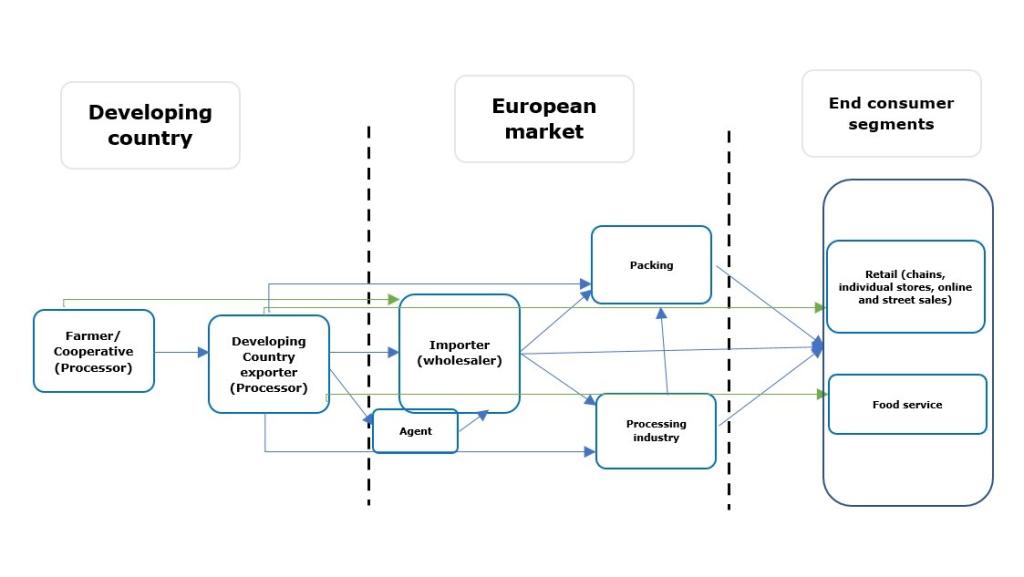

Through what channels do dates end up on the end-market?

The most important market channel for dates in Europe is represented by specialised dried fruit importers. After importing, dates reach the market segments, as described in Figure 2. In some cases, you can also supply the segments directly, without an importer as the intermediary. However, specialised importers or wholesalers are usually the first entry point into the European supply chain for exporters of dates from developing countries.

Figure 2: European market channels for dates

Source: Autentika Global

Importers / Wholesalers

In most cases, importers act as wholesalers. They sell dates to packing companies who pack them into consumer packages. Some importers also have processing and packing equipment so they can supply retail and food service channels directly. However, many important dried fruit brands import dates directly, instead of buying them through specialised bulk importers.

The position of importers and food manufacturers is put under pressure by retail. The higher requirements from the retail industry determine the supply chain dynamics from the top down. This pressure translates into lower prices but also into added-value aspects such as ‘sustainable’, ’natural’, ’organic’ and ’fair trade’ products. As a result, transparency is needed in the supply chain. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred developing-country suppliers.

Agent/broker

Agents involved in the date trade typically perform 2 types of activities. They act as independent companies that negotiate on behalf of their clients and as intermediaries between buyers and sellers. For their intermediary services, they typically charge a commission of 2-4% of the sales price. Another type of activity is the supply of private labels for retail chains in Europe. For most developing-country suppliers, it is very challenging to participate in the demanding private label tender procedures. For these services, some agents, in cooperation with their date suppliers, participate in procurement procedures put out by the retail chains.

Some examples of companies active in different channels for dates in the leading European markets of France, the United Kingdom and Germany include the following:

- Importers and wholesalers: Soua Soua (France), Brousse Vergez (France), Midi Sec (France), Die Frischebox (Germany), Richard Janssen (Germany), Chelmer Foods (United Kingdom), Evolution Foods (United Kingdom), OrganicUK (United Kingdom) and Petrow Food (United Kingdom);

- Agents: Eurobroker (France), PALM Nuts & More (Germany) and Kenkko (United Kingdom);

- Packing companies: Maître Prunille (France), Color Foods (France), Seeberger (Germany), Maryland (Germany), Whitworths (United Kingdom) and The Forest Feast (United Kingdom);

- Companies selling processed dates: Alnatura (organic date syrup, breakfast cereals, Germany), Rapunzel (date syrup, fruit bars, Germany), Windmill Organics (organic date syrup, breakfast cereals, United Kingdom) and Meridian Foods (date syrup, United Kingdom).

There are also partnerships between European companies and date exporters. These partnerships include investments from European partners that enable direct sales to Europe without intermediaries. Some examples are Soua Soua (French partnership with Algerian producer Amadhagh), Le Comptoir des Dattes (Tunisian company with a French partnership), Eden Fruits (the German partner of Algerian company Ziban Garden) and Médi Fruit (a Tunisian partnership for organic dates with the German company Tilouche Fruchtimport).

What is the most interesting channel for you?

Specialised importers of dried fruit are your best bet for exporting dates to the European market. This is specifically relevant for new suppliers, as supplying the retail segment directly is very demanding and requires a lot of quality-related and logistical investments. However, for well-equipped and price-competitive producers, packing for private labels can be an option. As the cost of labour in Europe increases, importers of dates sometimes search for more cost-effective packing operations, such as those in developing countries.

Importers usually have a good knowledge of the European market, closely monitoring the situation in date-producing countries. Therefore, they are your preferred contact, as they can inform you in good time about market developments and provide practical advice for your exports. Importers of dates commonly import other types of dried fruit and edible nuts as well, so offering other products in addition to dates can increase your competitiveness. There are also specific types of ethnic date importers specialised in the supply of ethnic shops.

Dates are often pressed before packing, and many European packers fail to use pressing equipment that is available in date-producing countries. This can be used as an opportunity to add value in supply.

Tips:

- Study the lists of exhibitors for large trade fairs, such as Anuga, SIAL and Alimentaria, to find potential buyers for your dates. If you aim to supply private labels of supermarkets, search for opportunities at PLMA.

- To reach the food service segment, look for suppliers at specialised food service events such as SIRHA and Internorga.

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for date products such as date paste and syrup.

- Retailers need sustainable products. Make yourself more competitive by investing in different certification schemes related to corporate social responsibility (CSR) or organic or food safety, for example. Food safety certification is the minimum requirement if you wish to reach the retail segment.

- Search the members' list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM) to find buyers from different channels and segments.

3. What competition do you face on the European dates market?

New date suppliers must carefully study the current offers from Tunisia, Algeria and other suppliers to Europe. The date market is a very competitive market with many players and an increasing range of date varieties. Until recently, Deglet Nour and Medjool dates were the only 2 cultivars on the market. However, the range of attractive cultivars is increasing at a fast rate and attracting the attention of European consumers.

Which countries are you competing with?

The main competitors for emerging date suppliers in Europe are Tunisia and Algeria. These 2 countries supply 55% of all dates to Europe. Israel, Iran and Pakistan are 3 other important competitors, supplying the other 30% of the market. Tunisia is also very strong in the organic segment. However, Algeria is currently the only country that can provide Naturland certified organic dates. Emerging suppliers include the United Arab Emirates, Saudi Arabia, Turkey, Palestine, Jordan, the USA, South Africa and Egypt. Morocco can be a competitor in the future in the Medjool variety, as the country is planting a lot of Medjool palm trees.

Source: Autentika Global and GTA

Tunisia: Leading European supplier of dates

Tunisia is the world’s fifth-largest producer of dates. With a production of 120 thousand tonnes, Tunisia produces 10% of the world’s dates. The Tunisian export of dates is also ranked fifth in the world, after Iraq, the United Arab Emirates, Saudi Arabia and Iran. Although Tunisia has a 10% share in the world’s exports, it has a 38% share of the European market. Nearly 20% of Tunisian dates are exported as organic.

Morocco is the largest destination market for Tunisian dates, followed by Italy and Germany. Tunisian exports to Europe increased at an annual rate of 2% and reached 58 thousand tonnes in 2022, or €111 million. Within Europe, the major target market for Tunisian dates is France with a 29% import share, followed by Germany (22%), Italy (16%), Spain (8%) and the United Kingdom (5%). Germany is the fastest-growing market for Tunisian dates. German imports of dates from Tunisia increased by 3 thousand tonnes between 2018 and 2022.

Tunisia is home to 6 million date palm trees. They are concentrated in 4 oases in the south of Tunisia – in Kébili (a 67% production share), Tozeur (16%), Gabes (13%) and Gafsa (5%). The harvesting period in Tunisia lasts from the beginning of October until the end of December. Although there are more than 150 date varieties in Tunisia, only 4 varieties are of economic interest: Deglet Nour (with more than two-thirds of all production), Allig, Khouat Allig and Kenta. Deglet Nour is the main exported variety, accounting for more than 80% of all exports.

Algeria: Growing supplier to Europe

Algeria is the world’s sixth-largest producer of dates. On average, Algeria produces around 130 thousand tonnes of dates. It is forecasted that Algeria will increase its production to 145 thousand tonnes in the 2023/2024 season. Algeria is the world’s eighth-largest exporter of dates, with exports of more than 70 thousand tonnes. Algeria exports most of its dates to France (a 28% share in 2022), followed by Morocco (21%), the Russian Federation (7%), the United States of America (5%) and Mauritania (5%). Deglet Nour represents more than 84% of Algerian date exports.

Algeria is significantly increasing its exports to Europe, although quantities fluctuate due to variable production levels. Algerian exports to Europe reached a peak of 34 thousand tonnes in 2021. However, due to unfavourable weather conditions combined with price increases, exports dropped down to 27 thousand tonnes in 2022. France is the main European destination for Algerian dates, accounting for a 75% European export share in 2022, followed by Spain (13%), Germany (7%) and Belgium (5%).

Algeria has more than 18 million date palms and is continuously increasing production. Date production in Algeria is concentrated in the south-eastern part of the country. The province of Biskra ranks first in Algerian date production (31%), followed by El Oued (27%) and Ouargla (18%). Around 50% of Algerian dates are of the Deglet Nour variety, followed by Degla Beida and Ghars. Together, they represent almost 90% of Algerian dates.

Israel: A leading Medjool supplier

Israel produces around 30 thousand tonnes of dates per year and exports around 50% of its production to Europe. The leading date variety is Medjool, with an 80% production share. Other date cultivars grown in Israel include Deglet Nour, Halawi, Hayani, Deri, Ameri, Khadrawi, Barhi and Zahidi. It is estimated that Israel produces 50% of the world’s Medjool dates. Almost half of Israeli dates are grown in the Jordan Rift Valley and Arava.

The European import of dates from Israel has increased at an annual rate of 10%, reaching 18.7 thousand tonnes in 2022, worth €107 million. In terms of value, Israel is the second-largest supplier to Europe, which is explained by the higher prices of Medjool dates compared to Deglet Nour. The leading European importer of dates from Israel is the Netherlands, accounting for 30% of European imports, followed by the United Kingdom (21%), France (15%), Spain (11%) and Italy (9%).

Iran: The leading supplier of North Europe

With an average production of 151 thousand tonnes, Iran is the second-largest producer and exporter of dates in the world. Still, less than 5% of the exported quantities reach Europe. The main export destinations for Iranian dates are Asian countries: India, Pakistan, Kazakhstan, Afghanistan and Turkey. The European import of dates from Iran was stable until 2021, but slightly decreased in 2022 due to price inflation. In 2022, it reached a quantity of 11.4 thousand tonnes and a value of €18.9 million. The most exported variety to Europe is Mazafati.

In 2022, Poland account0ed for 14.9% of European imports from Iran, followed by Denmark (14.6%), the United Kingdom (13.4%), Germany (12.7%) and Sweden (11.5%). Iran is the leading supplier to North European and several Central/East European countries. Iranian dates are price competitive and average prices are usually lower than those from other origins. Most Iranian dates are exported as soft with a high moisture content so they must be kept refrigerated during transport and storage.

Most dates are cultivated in southern Iran. There are more than 400 date varieties in Iran, but the one that is produced the most is Sayer (40%). Sayer is also frequently used for cutting or further processing. The very sweet Mazafati date is the leading exported snack variety, followed by Zahedy, Shahany, Kabkab, Estameran and Piarome. Although Iran is famous for its price competitiveness, the Iranian variety ‘Piarom’, known as the ‘chocolate date’, is one of the most expensive varieties in the world.

Pakistan: The leading supplier for the United Kingdom

Pakistan is ranked as the sixth-largest exporter of dates in the world. In 2022 Pakistan exported 107 thousand tonnes of dates at a value of €41 million. Most Pakistani dates are exported to the United Arab Emirates (84%), followed by Germany (3%), Turkey (3%) and the United Kingdom (2%). More than 90% of the dates are produced in the Sindh and Balochistan provinces.

Pakistan’s export of dates to Europe accounts for less than 10% of total exports. In 2022, Pakistan’s date exports to Europe reached 8 thousand tonnes, or €12.4 million. Exports to Europe are highly concentrated, with 3 main importers having a share of more than 90%. In 2022, the leading European importer of dates from Pakistan was Germany with a 43% share, followed by the United Kingdom (35%), Denmark (12%) and Poland (3%). Other European importers of Pakistani dates include the Netherlands, Latvia, Lithuania, Bulgaria and Finland.

There are more than 160 date cultivars in Pakistan. The leading Pakistani cultivars are Aseel, Dhakki, Begum Jangi, Rabai and Muzawati. In the European market, Pakistan has a significant supply of Aseel dates. This variety is rarely sold as a snack inside mainstream supermarkets. Instead, it is often used as an ingredient in the food processing industry. In Germany, Aseel dates are imported by the food industry with a high moisture content and are often called “fresh dates”. However, in ethnic shops, especially in the UK, Aseel dates are also sold as a snack.

Saudi Arabia and the United Arab Emirates are increasing their supply to Europe

Saudi Arabia and the United Arab Emirates export similar quantities of dates to Europe. Saudi Arabia is the leading world producer of dates, with an average production of 224 thousand tonnes. The United Arab Emirates is the third leading global producer of dates, with an average production of 138 thousand tonnes. Both countries consume most of the produced dates within the country. Both countries are estimated to be the largest consumers of dates in the world per capita.

The export of dates from the United Arab Emirates in 2022 was estimated at 250 thousand tonnes, while exports from Saudi Arabia were approximately 230 tonnes. Although the United Arab Emirates exports more dates compared to Saudi Arabia, it is estimated that some of those exports also consist of re-exported dates of Saudi Arabian origin. Each year the United Arab Emirates import between 40 and 70 thousand tonnes from Saudi Arabia. India is the main market for dates from the United Arab Emirates. Yemen is the primary target market for dates from Saudi Arabia.

Both countries are increasing their export to Europe. Germany and the United Kingdom are the main markets for both countries. However, the Netherlands is also an important importer and re-exporter of dates from Saudia Arabia. Both countries are recognised as reliable suppliers in terms of food safety.

There are more than 400 date palm varieties in Saudi Arabia. Riyadh, Qassim, the Eastern Province and Medina are the largest date-producing areas. Alwain, Khudry, Sukkary, Sagei, Albrni, Kholas and Al-Safawi are the most important cultivars. The United Arab Emirates cultivates around 70 varieties. The Emirate of Abu Dhabi alone is the leading producer, with an 80% production share. Date palms are primarily concentrated in the region surrounding Al Ain in the east, and along the Liwa Oases in the west.

Which companies are you competing with?

Most date exporters are processors and packers. Some companies have their own plantations, although the majority buy dates from farmers through specialised collectors. The examples listed below are illustrations of the leading date exporters. Direct competitors are different for each exporter and cannot be generalised. For example, exporters of Deglet Nour, Medjool or Sayer varieties target different market segments and therefore do not compete directly.

Companies in Tunisia

Producers of dates in Tunisia are switching from traditional oases, where several different varieties are grown, to modern ones with Deglet Nour as the only variety. The current supply chain of dates is organised by approximately 60 thousand (mostly small) farmers, 400 collectors and around 70 packers and exporters. Most collectors purchase 50-300 tonnes of dates and transfer them to packers. Most storage capacities are located in the south of Tunisia, with Kébili and Tozeur as the leading centres with a total capacity of around 100 thousand tonnes.

- Boudjebel S.A. VACPA (VAlorisation et Conditionnement du Produit Agricole) is the leading exporter of dates in Tunisia. It is the world’s leading exporter of Deglet Nour dates, with annual exports of 13 thousand tonnes (of which 6 thousand tonnes are organic). It has included more than 600 farmers in its vertical integration programme and over 100 farmers have Fairtrade (Max Havelaar) certification. Besides its several food safety certificates, Boudjebel has its own ISO 17025-accredited laboratory for quality control.

- Nouri&Cie is a date packing and exporting company with over 800 employees. The company exports around 6 thousand tonnes annually and has 2 conditioning facilities and a large storage facility with the capacity of 13 thousand tonnes. Nouri owns its own palm farms in the south of Tunisia. The company exports dates to many different markets, but exports are focused on Asia, especially India and South East Asian countries with large Muslim populations.

- Horchani Dates is a part of the Horchani Group. It has 750 employees and a long tradition in date production. It produces 1.3 thousand tonnes of dates and exports 3.5 thousand tonnes every year. One half of the exported dates are Deglet Nour and the other half is Alig, Kouat and Alig Kenta. It has the largest processing facility in Tozeur, which can process 10 thousand tonnes per year. Horchani is one of the pioneers in organic date production in Tunisia, currently exporting more than 400 organic dates.

These 3 companies are notable examples of exporters in Tunisia. Due to the limitations of this study, it is not possible to describe all exporting companies (over 70). Examples of other exporters include Cap Bon Frigorifique Plus, Beni Ghreb, Rose de Sable, Golden Agriproduct, House of Dates, Datcha Dates and Biosca Tamara.

In order to promote the export of Tunisian fruit, including dates, Tunisian companies have formed the association Groupement Interprofessionnel des Fruits (GiFruits). In addition, to improve the competitiveness of the date sector in Tunisia, Pole of Djérid (private public partnership) has established the Dates and Palms Cluster.

Companies in Algeria

In Algeria, there are almost 40 private date processing factories with different capacities. The majority of these facilities are concentrated in the Biskra province, and especially in the Tolga municipality. Biskra has around 30 private conditioning and packaging factories. In addition to this, there are more than 150 storage facilities for dates in Algeria. The conditioning of dates in Algeria usually does not include coating in glycose syrup, as Algerian dates are prized for their high sweetness.

- Haddoud Salim – one of the largest date processors in Algeria, established 30 years ago. The company processes around 6000 tonnes of dates per year. It exports dates to several countries but aims to increase its presence in the United Kingdom and become the leading supplier there. The company sells dates through the Barari Group, a company that trades dates from several different origins;

- EURL Boukellal Mohammed Tahar – annually processes 5000 tonnes of dates. It has formed its own brand – Prestige Dates. It is ISO 22000, BRC and IFS certified, which enables it to reach markets and clients with different demands, including European retailers such as Tesco and Carrefour. Apart from the European Union, Boukellal supplies some of the leading retail chains in the Russian Federation.

Other examples of date exporters in Algeria include Ziban Garden, Tolga Agrofood, Agrodat, Biodattes and Sed Oasis. Several important date processors in Algeria still have no websites (nor do they use Facebook for promotion). Some examples are Afridat, Lakhder Hlimet ETS, Kisrane Import Export EURL, Sud Datte, Ouadah Toumour, Datol Export and Sodapal.

Companies in Israel

The largest export of dates in Israel is organised by the Israel Date Growers' Cooperative, also known as Hadiklaim. Hadiklaim is responsible for 50% of the dates exported from Israel. Hadiklaim operates 16 packing stations. The company exports dates to over 30 countries, albeit mostly to Europe. Hadiklaim sells dates under its own brands (such as ’Jordan River’), as well as under private labels of retail chains such as Tesco, Waitrose, Migros and Albert Heijn. In 2018, Hadiklaim established a subsidiary in the Netherlands – Palm Fruits BV.

Other important date producers and exporters in Israel include Carmel Agrexco, Mehadrin, Agrifood Marketing, Galilee Export and Kibbutz Samar.

Examples of date exporters from other supplying countries

- Iran – Iran is home to many date-exporting companies. Some notable exporters are Crystal Dates, Sun Export, Sajad Dates, Hassas Export, Nakhl Sabz Sobhi, Parsun Day, Pariz Nuts, Aban Arya, AHT, Arat Company, Ario, Global Shokraneh Salamat, Tropical Sunshine Green Palm, Middle East Product Export,;

- Pakistan – the leading date exporter in Pakistan is Gilano Dates. Other important exporters include Wisdom Industries, New Lal Shahbaz Traders, Taj Foods and Asia Foods International;

- Saudi Arabia and the United Arab Emirates – the largest individual date palm farm in the world is the Saudi Arabia-based Alaseel, with more than 250 thousand palm trees. Other exporters include Al Mohamaida Dates, Aneesah, Rayana Dates, Kingdom Dates, Date Room, Onaizah Dates, Al Khammash Dates Factory, Amal Al Khair and Barakath Al Medinah.

Tip:

- Visit leading European trade fairs, such as Anuga, SIAL, Fruit Logistica and BIOFACH, to meet your competitors.

Which products are you competing with?

The main product competition for dried fruit, including dates, is fresh fruit. European consumers have become increasingly health-conscious and prefer a healthy diet with an increased consumption of fresh fruit and vegetables. This trend can influence the consumption of all dried fruit, especially if it is coated with glucose syrup or sorbitol. The strong competition of fresh fruits will remain a major challenge for the European date market in the coming years.

Marketing competition from the fresh sector includes claims about sugar levels in dried fruit and the risk of dried fruit for dental health, as they stick to consumers’ teeth. However, the International Council for Nut and Dried Fruit counters the competition with information claiming there is unconvincing evidence of extreme levels of sugar in dried fruit.

Tip:

- Read CBI’s Fresh Fruit and Vegetables studies to better understand the competition from fresh fruit.

4. What are the prices for dates on the European market?

Calculating margins according to final retail prices for dates is not very reliable, as the entire sector has varying prices for different varieties, origins and packaging. For example, Medjool dates normally reach higher prices than Deglet Nour or Sayer. Current price inflation makes price forecasting more difficult. For example, the ex-Works price of Sayer dates has reached €1.3/kg at the end of 2022, which is significantly higher than the average price over the last 5 years. Over the last 5 year this price was rarely over €1/kg.

Retail prices in most European supermarkets vary between €6 and €10/kg for small packs of 100 g of pitted Deglet Noir dates. The price of retail packed Medjool dates can reach €15/kg. Cost, insurance and freight (CIF) prices of dates represent approximately 20% of the retail price of a small retail package. In cases where a final retail product is sold directly to retail chains, that share is much higher.

If you add value to your product through differentiated quality, food safety, certification and processing steps, your prices will be higher. For example, organic and fair-trade certification may add value to your products.

The price breakdown given below is a very rough indication. There are many factors contributing to the price, such as quality, variety, origin, food safety certification costs, consultants, social security, taxes, sales and network margins.

Table 1: Dates retail price breakdown, price per kg

|

Steps in the export process |

Type of price |

Price breakdown |

Example (Deglet Nour) |

|

Production of dates |

Farmer price |

15% |

€0.60 |

|

Collectors’ price |

Collectors’ fee |

16% |

€0.65 |

|

Processing and packing of dates |

Factory price |

25% |

€1 |

|

Storing, handling and shipping |

CIF price |

50% |

€2 |

|

Selling to retail |

Wholesale price (incl. value-added tax) |

75% |

€3 |

|

Retail sales of the final packed product |

Retail price |

100% |

€4 |

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research