The European market potential for dates

In the long term, the European market for dates is expected to show stable growth. This growth is likely to be driven by changes in the consumption patterns of European consumers. This includes a rising interest in healthy snacking and sugar replacement. Another driving force will be consumption by the large number of immigrants arriving in Europe. Many of them regularly consume dates. France, Germany, the United Kingdom, Spain, Italy and the Netherlands offer the most opportunities for developing country suppliers.

Contents of this page

1. Product description

Dates are the fruit of the date palm tree (Phoenix dactylifera). Depending on the fruit’s maturity, dates are referred to as fresh or dried. Fresh dates (usually with a moisture content of >50%) are rarely sold on the European market. The season for fresh dates is very short in producing countries and only a few varieties are appropriate for eating at this stage. Therefore, this study will only discuss the European market for dried dates (sometimes called ‘table dates’).

When left on the tree, dates will ripen, change colour, soften and reduce in size, weight and moisture content, but increase in sugar content. When picked early to avoid damage by rain, insects or other factors, dates may need to be additionally ripened after harvest. After harvesting and cleaning, conventional dates are protected from insects through fumigation, while organic dates are ideally treated by freezing (temp. -22°C). Often, they can be again rehydrated for better softness and pasteurised by being exposed to higher temperatures. They are sorted into grades by quality and size and stored in a cool place.

Very often pits are also removed either with machines or, more often, manually. Dates can be produced without any treatment after harvesting, and they are called natural dates. Dates can also undergo treatment after harvesting, including rehydration. Some – where the natural sugar content may be lower – use coating with glucose syrup or sorbitol for preservation. These dates are called conditioned dates.

Dates can be produced with a lower (<15%) moisture content or a higher (<30%) moisture content. Dates with a higher moisture content need to be stored at a temperature between 0 and 4°C. Even when dry, dates are often stored in frozen form to prolong shelf life. Generally, a frozen cold chain is then maintained during transport and further storage. For the retail shelves, processed dates will be offered at ambient or fridge temperature.

Dates are normally used as a final product (a fruit snack) by consumers, but they are also used as an ingredient in home cooking and in bakery products, confectionery and other food manufacturing industries. If dates are consumed as a snack, they are generally used whole, either with pits (stones) inside or pitted (destoned) or stuffed (with almonds, nuts or marzipan). They can also be chopped and used as an ingredient in, for example, mueslis or dried fruit mixtures. In addition, dates can be processed further into products, such as date paste, date juice (syrup) and liquid date sugar.

Most of the world’s date production is concentrated in the subtropical climate of North Africa and the Middle East. The harvesting season extends from July to late November, depending on the variety. However, the main harvest starts in September. World date production is increasing, reaching 1,15 million tonnes in 2022. Saudi Arabia is the leading producer of dates, with a 20% share of the world’s production. It is followed by Iran (14%), the United Arab Emirates (12%), Tunisia (11%), Egypt (11%) and Algeria (10%).

More than 3000 date cultivars are grown worldwide. They are generally classified into 2 categories: cane sugar varieties and invert sugar varieties. In most varieties, the sugar content is almost entirely of the inverted form (glucose or fructose), but a few varieties contain cane sugar (sucrose). The 2 cultivars are distinguished by their popularity on the world market: Medjool (invert sugar variety) and Deglet Nour (cane sugar variety). Medjool dates are particularly popular, representing around 25% of the total world exports.

Figure 1: Medjool dates

Source: Photo by Amy Bradstreet, (CC BY-NC-ND 2.0) via Flickr

Figure 2: Deglet Nour dates

Source: Photo by م ض, (CC BY-SA 3.0) via Wikimedia Commons

This study covers general information regarding the date market in Europe, which is of interest to producers in developing countries. For statistical analysis, the following combined nomenclature code is used: 08041000. Production statistics mentioned in the study cover date statistics for dried dates that have been packaged and presented for sale as such (approximately 15% of the global raw date production).

When the study refers to ‘Europe,’ it includes the 27 member states of the European Union (EU), plus the United Kingdom (UK), Switzerland, Norway, Iceland and Liechtenstein. Developing countries are defined as the countries that are listed as official development assistance recipients.

2. What makes Europe an interesting market for dates?

Although Europe is not the largest import market for dates, Europe is the fastest-growing importing region in the world. Europe increased its import global share in value from 25% in 2018 to more than 30% in 2022. Total European date imports reached 184 thousand tonnes in 2022; good for a value of €481 million. There is a temporary decline in imports, caused by the energy crisis and inflation due to the war in Ukraine. Despite this short-term decrease, the European date market is forecasted to continue growing in the long term.

Around 64% of imported dates in Europe come from developing countries. Internal European trade consists of simple re-exporting imported dates, but a significant part consists of added-value trade, including operations such as retail packing. European imports from developing countries increased over the last 5 years, from 112 thousand tonnes in 2018 to 118 thousand tonnes in 2022.

Table dates are not produced in Europe, so the demand fully depends on imports. Some small quantities are produced in Spain, but they are all sold as fresh in local markets. In the next 5 years, the European market for dates is likely to increase at an annual growth rate of 5%. A high import growth rate is forecasted because of the higher demand for natural sweeteners that can be alternatives for sugar. Together with the import of table dates, the import of date syrup and date paste is also likely to increase.

Source: Autentika Global and GTA

The European market for dates is moderately concentrated. 3 countries have a share of more than 50% of total imports. France was the leading importer in Europe, with a 25% import share in 2022, followed by Germany (15%), the United Kingdom (13%), the Netherlands (9%) and Spain (7%). According to the International Nut and Dried Fruit Council, the largest date-consuming country in Europe is France, with 9.8 thousand tonnes in 2022 (including industrial and foodservice consumption).

One of the important reasons for France’s large consumption is its large share of diaspora from North African date-producing countries. Per capita consumption in Europe is the largest in the Netherlands, with an average consumption of 300 grams/year per person. Consumption of dates in Europe as a snack has a strong seasonal character. There are usually 2 peaks in consumption. One is related to the Muslim population in Europe who consume the most dates during the month of Ramadan. Another peak is during the winter holidays, such as New Year’s Eve and Christmas.

Imports in 2022 decreased due to a combination of 2 factors. Firstly, global production in the 2022/23 season decreased by 12% from the previous years. Secondly, price inflation due to the war in Ukraine affected the European market, also affecting the demand. Although retail prices for packed dates in Europe have increased, import prices have not changed significantly over the last 2 years. The main reason for price increases is therefore the margins added by the traders and retail chains in Europe.

Source: ITC TradeMap

3. Which European countries offer most opportunities for dates?

The main importers of dates in Europe are also the leading consumers: France, the United Kingdom and Germany. The Netherlands is not on the list of leading importers in 2022, with Belgium taking its place. This does not, however, indicate a lower consumption but rather, larger unsold stocks of dates in Belgium. As the quantities produced vary from 1 year to another, there may be a wrong perception of constantly fluctuating demand. In reality, the demand is more stable, which is evident from the increased retail sales of dates.

France, Germany and the United Kingdom are the largest European markets for dates, representing more than 50% of European imports. Over the last 5 years, a high import growth rate was noted in Spain, Italy as well as in Belgium. Therefore, all 6 countries offer many opportunities for emerging suppliers of dates to Europe. Other countries with a high increase in imports include the Netherlands (a 7% annual growth rate since 2018), Poland (4%) and Greece (12%).

Source: Autentika Global (based on the TradeMap statistics and calculated as apparent consumption – the difference between imports and exports)

France: The leading European market for dates

France is the largest importer of dates in Europe, representing a quarter of the European market. French date imports have increased over the last 5 years, reaching more than 45 thousand tonnes and a value of €92 million in 2022. Of this quantity, France re-exports around 25%, leaving 33 thousand tonnes for domestic consumption. The main re-export destinations for France are other big trading countries: Spain, Germany, Belgium and the Netherlands.

In 2022, France imported 44% of its dates from Algeria, followed by Tunisia (38%) and Israel (7%). France is the only European country for which Algeria is the leading date supplier. This is explained by the well-established trade relationship and historical background between the 2 countries and their shared language (French). Apart from the 3 leading suppliers, no other country has a market share of more than 2% in France. Emerging suppliers with notable increases in exports to France are Palestine and Saudi Arabia. Over the last 5 years, Palestine more than doubled its exports to France; from 339 tonnes in 2018 to 748 tonnes in 2020.

Most dates in France (perhaps more than 70%) are sold through retail channels. The remaining 30% are sold to the industry and food service. The date variety that is imported and consumed the most in France is Deglet Nour, although the number of varieties is increasing. Dates are consumed throughout the year, but the highest consumption takes place during the winter months, especially at the end of the year. In addition, consumption is higher amongst the Muslim population during Ramadan.

Large quantities of dates are also sold under private labels (retail chain brands) such as Carrefour (Carrefour, Carrefour Bio and Petit Prix labels), Leclerc (Couleurs Vives label), Super U (U label), Intermarché (Paquito label) and Auchan (Auchan, Mmm and Bio). Independent brands include La Favorite and Sun (by Color Foods), Holy Fruits (by Mondial Fruits Secs), Brousse (by Brousse Vergez), Daco Bello (by Daco France) and Maître Prunille. Some producer brands are also present. In some shops, dates are sold unbranded by weight.

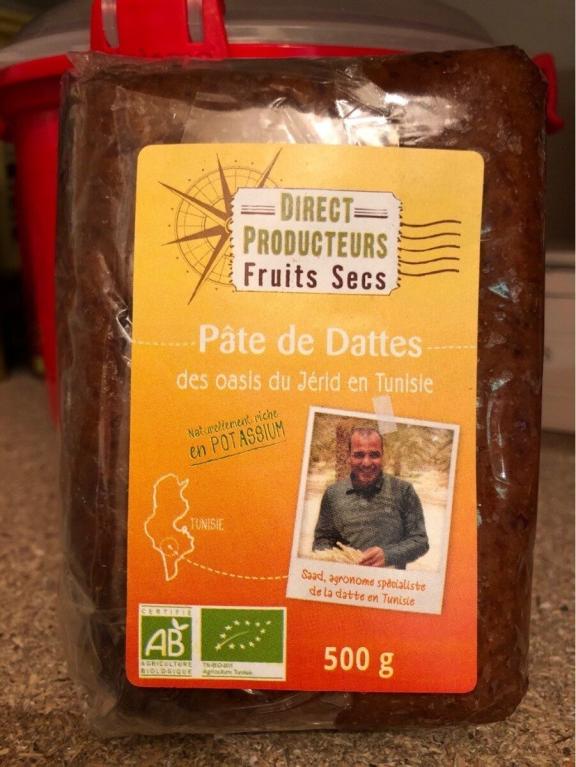

Ethical sourcing and sourcing of organic dates is also developing in France. Examples of companies and date importers sourcing ethically include Agro Sourcing, QES (Qualité-Équité-Solidarité), Biofruisec, Direct Producteurs Fruits Secs and Pronatura.

French brands usually promote a date cultivar (most commonly Deglet Nour or Medjool) and sometimes the origin (most often Algeria or Tunisia). Promoting the origin of the dates means that Tunisia and Algeria are recognised as quality suppliers to France, although some Iranian brands are also gaining market share. The most frequent size of retail packs is 500 g, but many other sizes are also available. Most supermarket brands (private labels) in France use Nutri-score to label dates. Dates are usually labelled ‘B’ or sometimes ‘A’, depending on the sugar content.

Figure 6: Medjool dates (brand by Brousse Vergez)

Source: Photo by kiliweb per Open Food Facts, (CC BY-SA 3.0)

Figure 7: Date paste (Direct Producteurs brand)

Source: Photo by kiliweb per Open Food Facts, (CC BY-SA 3.0)

The United Kingdom: Opportunities for emerging suppliers

In 2022, the United Kingdom imported 24 thousand tonnes of dates, with a value of €69 million. Most imported dates are consumed within the country and there is a relatively small percentage of re-export. The consumption of dates in the United Kingdom is estimated to have been around 23 thousand tonnes in 2022. Per capita consumption in 2021 was more than 500 g/year.

The import structure in the United Kingdom is quite different from other European markets. In 2022, the United Kingdom imported 18% of dates from the United Arab Emirates, Pakistan (17%), Israel (15%), Tunisia (12%) and Saudi Arabia (9%). The second-largest European supplier, Algeria, has a market share of only 3%. The United Kingdom is the only European country for which the United Arab Emirates is the leading date supplier. The United Arab Emirates has increased its export to the UK from 770 tonnes in 2016 to 4.2 thousand tonnes in 2022.

Another characteristic of date imports in the United Kingdom is the presence of a large number of importers bringing in smaller quantities. In 2022, more than 180 different companies were importing dates into the United Kingdom. Many suppliers specialise in the ethnic segment and sell dates to specialised ethnic shops. Examples of ethnic suppliers and importers include Fudco, Afak Trading, Al Harmain Dates, Golden Saffron, Organic UK, Sahara UK Foods, WG Buchanan and Damasgate.

The large market shares are held by the private labels of retail chains such as Tesco, Sainsbury’s, ASDA and Morrisons. A leading independent brand is Whitworths. The presence of other brands (aside from private labels) is relatively small and includes brands such as Crazy Jack and Wholefoods. Some exporters are successfully selling their own brands, such as Hadiklaim from Israel (Jordan River brand) and Siafa International from Saudi Arabia (Madina brand). The French cooperative Maître Prunille also sells the Eat Me brand in the UK. Some suppliers are focused on 1 origin of sourcing and promote the origin, such as Yaffa, which promotes dates from Palestine.

In the United Kingdom, dates are increasingly used as an ingredient in fruit snacks without added sugar. In these products, dates or date paste is used to provide sweetness. Many fruit bar snacks with dates were launched in the last few years. Some examples are Get Buzzing, Nakd, Trek, Good (brand by Western Commodities) and Deliciously Ella. The consumption of date syrup is also increasing and includes several brands, such as Biona, Groovy Food and Basra.

The market in the United Kingdom offers specific opportunities for suppliers of Fairtrade-certified dates, as the country is home to one of the largest Fairtrade product markets in Europe. Currently, there are over 6,000 Fairtrade-certified products on sale in the United Kingdom.

Figure 8: Date Syrup (Biona brand)

Source: Photo by arethe per Open Food Facts, (CC BY-SA 3.0)

Germany: the European importer with a large organic market

German imports of dates have increased over the last 5 years at an average annual growth rate of 3%. However, there was a decrease in imports in 2022 due to price inflation caused by the energy crisis following the outbreak of war in Ukraine. In 2022, German date imports reached 26 thousand tonnes and a value of €65 million. Germany also (re)exported 6.5 thousand tonnes, leaving around 19 thousand tonnes for domestic consumption. German per capita consumption of dates is estimated at 80 g/year, although it is more than 2 kg for the population regularly consuming dates.

In 2022, Germany imported 50% of its dates from Tunisia, followed by Pakistan (11%), Iran (8%) and Algeria (8%). Other suppliers with increasing exports to Germany are Israel, Saudi Arabia, the United Arab Emirates and Palestine. The highest increase in imports is noted for Palestine. German imports of dates from Palestine increased from 83 tonnes in 2018 to 474 tonnes in 2022. Other emerging suppliers include Turkey, Egypt, Jordan and Lebanon.

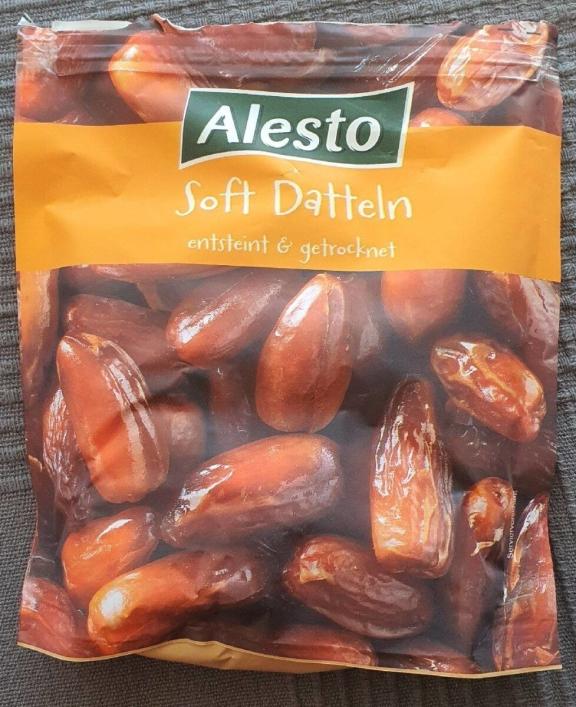

Significant quantities of dates in Germany are sold under private labels, including labels such as Alesto (by discounter chain Lidl), Trader Joe’s (by ALDI Süd and ALDI Nord), ja! (by REWE) and EDEKA and EDEKA Bio (by EDEKA). Some examples of independent brands are Seeberger, Farmer’s Snack and Kluth. A large share of organic dates is sold under private label brands of specialised organic retailers. There are also independent organic brands, such as Rapunzel, Clasen Bio and Morgenland.

Most suppliers to German mainstream supermarkets offer pitted dates despite the fact that some consumers prefer dates with pits. The reason behind this is easier quality control of pitted dates. During the pitting process, it is easier to notice and remove dates infested with insects. However, it is common for some origins and varieties to be with pits. Medjool dates are usually with pits while Deglet Nour are usually pitted.

Germany is a particularly attractive market for organic dates, as the country is the largest European market for organic food. In 2022, the organic market decreased temporarily but it seems that the market is recovering in 2023. Most organic dates sold in Germany are imported from Tunisia. Germany is famous for its large range of specialised retailers of organic food, such as BioMarkt, Alnatura, Basic, Bio Company, ebl-naturkost and SuperBioMarkt. Leading retail chains are also increasing their share of organic private labels.

The use of dates as an ingredient is also increasing in the organic segment. Some organic products containing dates in Germany include fruit bars (for example, Lubs, Hej, Alnatura and Lebepur), baby purees (for example, the Swiss brand Holle), fruit snacks (for example, DM and Bio-Zentrale) and breakfast porridge mixtures (for example, Stark, Hammermühle and the Austrian company Verival).

Figure 9: Example of a private date label in Germany (Alesto by Lidl)

Source: Photo by kiliweb per Open Food Facts, (CC BY-SA 3.0)

Figure 10: Example of a date syrup in Germany (Agava)

Source: Photo by kiliweb per Open Food Facts, (CC BY-SA 3.0)

Spain: A significant increase in imports

Spanish date imports show a significant increase, with an annual growth rate of 7%. There was no decrease in Spanish date imports even during the Covid-19 pandemic in 2020 and the war in Ukraine in 2022. Spain’s date imports increased from 10.7 thousand tonnes in 2019 to 13.1 thousand tonnes in 2022, or €33.5 million. Spanish date consumption is estimated to have been around 11.8 thousand tonnes in 2021. Per capita consumption is around 50 g/year.

In 2022, Spain imported 35% of its dates from Tunisia, followed by Algeria (27%) and Israel (15%). Large quantities (2.5 thousand tonnes) were imported from France through re-export. Some of those re-exported quantities were packed by France-based retailers and sold in Spain. Algeria was gaining market share at the fastest rate in Spain, increasing its supply from 2.3 tonnes in 2019 to 3.5 thousand tonnes in 2022.

Dates are mostly sold by private labels of Spanish retail chains such as Mercadona (Hacendado label), Carrefour, Lidl (Alesto label), Alcampo (Auchan label), Eroski, Dia and ALDI. Some examples of independent brands are El Monaguillo (by Bernabe Biosca Alimentacion, produced in Tunisia), Casa Pons (by Importaco, sold in Mercadona), Frumesa, Borges, Fernández and Campomar (organic). Also, some quantities are sold unbranded by weight.

Italy: Supply dominated by Tunisia

In 2022, Italy imported 12.8 thousand tonnes of dates with a value of €35.3 million. Around 1.3 thousand tonnes were re-exported, leaving around 11 thousand tonnes for domestic consumption. According to INC, per capita consumption of dates in Italy is estimated at 510 g/year. Imports of dates to Italy show a strong seasonal pattern. Italy imported more than 50% of its dates in the last quarter of the year, reaching a peak in November. This is explained by an increased use of dates during the winter holidays in Italy.

Italy imports most of its dates from Tunisia. Therefore, in 2022, Italy imported 73% of its dates from Tunisia, followed by Israel (12%) and Algeria (4%). Similarly to Spain, Italy imports some quantities via re-export from France, due to the presence of France-based retailers. French retailers pack dried fruits in France, including dates, and then export the products to Italy. Iran is present on the Italian market with a 1% share of direct exports. Other emerging suppliers include Palestine, Egypt and Jordan.

Sales are dominated by private supermarket labels, such as Coop, Conad and Carrefour. Independent brands include Fatina (by Murano), Ventura, Noberasco and Life. Sales of organic dates in Italy are increasing. The variety that is sold the most is Deglet Nour, with Tunisia as the main origin. Several retail brands present the name of the date cultivar on the retail label (Medjool or Deglet Nour).

The Netherlands: A re-exporter of dates

Date imports to the Netherlands have been increasing at an average annual rate of 7% since 2019. However, imports decreased in 2022 due to price inflation. Imports reached 15.6 thousand tonnes and a value of €60 million in 2022. Although the Netherlands imports more dates than Spain and Italy, consumption is relatively small, as the majority of dates are re-exported. In 2022, the Netherlands re-exported more than 13 thousand tonnes of dates, leaving only 2 to 3 thousand tonnes for domestic consumption together with unsold stocks from 2021.

The Netherlands is the only European country for which Israel is the leading supplier. In 2022, the Netherlands imported 23% of its dates from Israel, followed by Tunisia (14%), Germany (7%) and Saudi Arabia (6%). Saudi Arabia is gaining market share in the Netherlands at the quickest rate, from 472 tonnes in 2019 to 900 tonnes in 2022. The leading market for dates re-exported from the Netherlands is Germany, followed by Belgium.

The majority of dates in the Netherlands are sold under private labels. The leading retail chains selling dates under their own label in the Netherlands include Albert Heijn (AH label), ALDI (Trader Joe’s label), Jumbo (Jumbo label) and Lidl (Alesto label). Large Medjool dates are sometimes packed in more luxurious packaging. Several brands are sold under the labels of producers, especially in ethnic shops. One of the leading organic brands for dates is Smaakt Bio, but organic dates are also packed and sold under private labels.

Several Dutch producers use dates as a food for kids. One example is the company Truly Foods, which individually packs small dates under the brand de Kleine Keuken (the Little Kitchen). Another example is the food store and brand Okae for Kids, which produces sweet bars based on dates.

Tips:

- Contact the French Association for Dried Fruit (SNFC) to learn more about the French market for dates.

- Consider investing in French-speaking staff to more easily penetrate the French market if you are not from a French-speaking country.

- Find German date traders on the websites of the specialised German Association, Waren-Verein, and in the German company directory, Wer liefert was.

- Stay up to date with the date market in the United Kingdom through the National Dried Fruit Trade Association UK.

- Stay informed about the Italian market through the specialised portal Italiafruit (in Italian only).

4. Which trends offer opportunities on the European dates market?

The increasing demand for healthy snacking and sugar replacement alternatives, combined with product innovation, is the driving force behind the growing consumer interest in dates in Europe. In addition, sustainable and ethical production, including the preservation of our biodiversity and ecosystem, as well as the protection of our natural resources, are key factors. This is becoming an important aspect for European traders and consumers. In addition, there is an increased consciousness of the importance to protect water resources. For example, the Naturland certification pays particular attention to the use of sustainable water resources.

Sugar replacement

Sugar consumption is decreasing in Europe. Dates are one of the sweetest fruits, containing only naturally occurring sugars. Dates and date products are increasingly used as a sugar replacement. Innovative fruit snacks and other products containing dates very often use clean and clear label claims, such as the following: refined sugar free, no added sugar, reduced sugar and low sugar. Dates also add flavour and colour, replacing the need for artificial additives, thus creating a clear ingredient label.

Dates are used in home cooking, to give natural sweetness to products such as smoothies, shakes and healthy snacks. Industrial users increasingly use date products as a sugar replacement, including date paste and date syrup (concentrated date juice). Some companies use the popularity of vegan food as an opportunity to promote dates as a vegan sugar replacement. As honey is produced by bees, it is not vegan.

Producers and exporters of dates are also diversifying their offer by introducing new products, aside from date syrup and date paste. A good example of a producing company that offers several innovative products is the Tunisian company Boudjebel. It produces date crystal sugar, date powder, date paste, date syrup, date kernel oil and date bread. They have also started to produce date filling.

Sustainability and ethical production are becoming the main trends

Consumers and retailers are increasingly interested in sustainably produced fruit products, including dates. Read more about these trends in the CBI processed fruit and vegetables trends study.

A couple of ethical sourcing projects have been launched in Palestine. An example is the UNICOP project from Florence, Italy. This project is called “Jericho Dates" and involves exclusive marketing in Coop supermarkets under the "Terra Equa" brand. The project is the result of Coop’s collaboration with Palestinian producers and Israeli transporters. Another project supporting sales of Palestinian Medjool dates in the United Kingdom is the social enterprise Zaytoun.

Sustainable sourcing has become very important for European date importers. For example, the German organic food company Rapunzel has developed its own fair-trade programme and certification called HAND IN HAND. This certification guarantees fair prices, good working conditions, social security and transparency for suppliers. Centre de Conditionnement des Fruits (CCF), a dates processor from Tunisia, has benefited from this programme and has become a direct supplier to Rapunzel.

Another example of a sustainable approach to solve environmental problems is Beni Ghreb, a date cooperative and processor in Tunisia. The company is cooperating with GEPA (the biggest European Fairtrade company). The farmers of Beni Ghreb are suffering from climate change, as the increase in temperature and lack of water have led to the drying out of the fruits and reduced sizes. To support farmers, GEPA has developed a chocolate with dates, where small-sized dates are used as an ingredient – Choco4Change.

Healthy snacking for athletes

A major trend that is in line with the increased consumption of dried fruit, including dates, is healthy snacking. Consumers are searching for healthier alternatives to snack on between meals, or for snacks that can replace meals. Younger consumers who are taking more care of their health and wellness no longer favour sweets such as candies and chocolate snacks, but switch to protein bars and other low-sugar alternatives. As a result, dried fruit (together with nuts) is becoming increasingly popular as a snack.

However, dates are not considered light snacks, as they are rich in carbohydrates. Depending on the variety, they contain between 45% and 80% sugar. Sugar from dates has a low glycaemic index, which means it will be digested slowly, keeping energy levels even throughout the day. A slow release of energy ensures athletes have enough strength to perform well during their activities. They are also used as snacks after intensive training sessions to support glycogen replacement in muscles.

Innovative products based on dates

Innovative fruit snacks and other products increasingly use dates as an ingredient. During Anuga (a leading food exhibition) in 2021, many new products with dates as an ingredient (see table below) were presented.

Table 1: Innovative products presented at Anuga, 2019 and 2021

|

Category |

Description/Product examples |

|

Fruit snacks with dates |

The popularity of fruit bars in Europe has increased over the last few years. The natural sweetener function of dried fruit allows sweet products to be made without added sugar. Dates and date paste are often used in fruit bars because of their sweetness.

Some examples are RAWBITE (Denmark), Nakd (the United Kingdom), Veganz (Germany) and Hemp and Ginger Bites (Slovenia) |

|

Breakfast cereals with dates |

Many breakfast cereals use added sugar to give sweetness to muesli, granola and other products. As consumers are searching for no-added-sugar alternatives, some breakfast cereal producers have started to use dates in product compositions.

Examples include Dorset Cereals (the United Kingdom), Verival (Austria), Risenta (Sweden), Charles Vignon (France) and le Sillon (France). |

|

Traditional sweet snacks with dates as sweeteners |

Examples of products that use dates as a sweetener are sweet spreads, chocolate products, cookies and crisp products. These are used as an alternative to the traditional, sugar-rich jams and marmalades.

An example of an innovative company in this field is the company Soua Soua (France), which produces spreads from Algerian dates. Aside from spreads, Soua Soua produces other innovative products, such as fermented milk with dates. Another example is the Polish company Me Gusto, which produces organic chocolates and wafers sweetened with dates. |

Tips:

- Read CBI’s tips to go green and CBI’s tips to become a socially responsible supplier to learn about the increasing market requests on sustainability.

- Promote dates as healthy and nutritious on the European market. Explore creative ways of using dates in home cooking and offer ideas through online promotion. For inspiration, you can use examples of the California Dates Association, which offers a list of recipes using dates as an ingredient.

- Monitor industry trends and product innovations on leading European food trade fairs, such as Anuga, SIAL and Food Ingredients Europe.

- Read our study about trends on the European processed fruit and vegetables market to find out more about general trends.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research