Entering the European market for dried grapes

Food safety certification, combined with reliable and frequent laboratory tests, creates a positive image for dried grapes exporters to Europe. Sustainable production and implementation of corporate social responsibility standards provide additional advantages for emerging suppliers. Tunisia is the leading supplier for sultanas, while Greece is the main supplier of currants. Emerging competitors in Europe are South Africa, Chile, China, and Iran.

Contents of this page

1. What are the requirements for dried grapes to enter on the European market?

What are the mandatory requirements?

All foods, including dried grapes, sold in the European Union must be safe. This applies to imported products as well. Additives must be approved. Levels of harmful contaminants, such as pesticide residues and mycotoxins, are limited.

Contaminant control in dried grapes

The European Commission Regulation sets maximum levels for certain contaminants in food products. This regulation is frequently updated to adjust limits in foodstuffs in general, but also for specific products, including dried grapes. The most common requirements regarding contaminants in dried grapes are related to ochratoxin A and high level of sulphites.

Border control

In the event of repeated non-compliance of specific products originating from particular countries, they can only be imported under stricter conditions, such as having to be accompanied by a health certificate and analytical test report. Products from countries that have shown repeated non-compliance are put on a list included in the Annex of Regulation (EU) 2020/625. As of May 2020, 10% of all shipments of dried grapes from Turkey to Europe must be officially controlled for the presence of ochratoxin A.

Mycotoxins

The presence of mycotoxins, and more specifically ochratoxin A, is the main reason for dried being banned grapes from the European market. The Rapid Alert System for Food and Feed (RASFF) recorded 42 notifications for the presence of ochratoxin A in dried grapes in 2019. Most border rejections were for raisins imported from Turkey. The maximum level of ochratoxin A in dried grapes intended for direct human consumption must be below 10 μg/kg.

The occurrence of ochratoxin A in dried grapes is a result of contamination by certain mould species (Aspergillus). The presence and spread of such fungi is influenced by humid weather during the production of grapes, lack of pruning and short-term humid weather during drying. Therefore, good agricultural practices, controlled drying and storage, under suitable conditions, are the most important prevention measures.

Pesticides Residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticide residues than allowed will be withdrawn from the European market. Most European importers will request a detailed test to check for the presence of a large number of pesticides, sometimes more than 500. The European Union regularly publishes a list of approved pesticides that are authorised for use in the European Union. This list is frequently updated.

Microbiological contaminants

The standard procedure before export includes laboratory testing of dried grapes for the presence of pathogenic microorganisms, such as yeasts, moulds, E.coli, salmonella, coliform and staphylococcus.

Product composition

European authorities can reject products if they have undeclared, unauthorised or too high levels of extraneous materials. Although European consumers prefer dried grapes without any additives, dried grapes are often packed with vegetable oil, preventing the fruit from sticking together. If a preservative is used, such as sulphites, it must be declared too, otherwise the product will be removed from the market.

Packaging requirements

Packaging used for dried grapes must protect the organoleptic and quality characteristics of the product, protect the product from bacteriological and other contamination, including contamination from the packaging material itself, and not pass on any odour, taste, colour or other foreign characteristics to the product. In January 2019, the European Union published a regulation listing allowed plastic materials that can be used for food packing.

Dried grapes are usually packaged in carton boxes with a plastic liner inside. Common bulk packing sizes range from 5 kg to 15 kg. When packaged in corrugated or millboard cartons, the product should be transported on Euro pallets (80 cm x 120 cm) and further transported in containers. 20 ft containers contain 1,600 cartons of 12,5 kg each or 2,000 cartons of 10 kg each. For retail, dried grapes are packed in various sizes, ranging from 25 g up to 1 kg. However, most sizes for retail packaging are between 200 g and 500 g.

The duration of storage is usually 12 months after the date of production, in the relative humidity of 60%–65%, at a temperature between 4ºC and 20°C.

Another packaging requirement is that the content must correspond to the indicated quantity in weight or volume on the label. Importers will check packaging size and weight to ensure that pre-packed products are within the limits of tolerable errors.

Labelling requirements

For bulk packaging, the name of the product must be placed on the container. ‘Raisins’, ‘sultanas’ and ‘currants’ (in different languages) are more often used than ‘dried grapes’. In varieties which are naturally not seedless, the label should declare the presence of the seeds with terms such as ‘Seeded’, ‘With Seeds Removed’, ‘Non-Seeded’, ‘Unseeded’ or ‘With Seeds’, except in cluster form and Malaga Muscatel type. If dried grapes intentionally do not have cap stems removed, the name of the product has to include the description ‘Unstemmed’ or a similar appropriate description, except in cluster form and Malaga Muscatel type.

International standards require mentioning on the label if dried grapes are treated or naturally processed. If dried grapes are bleached, part of the name has to include ‘Bleached’, ‘Golden’, or ‘Golden Bleached’. Dried grapes may be described as ‘Natural’ when they have not been subjected to dipping in an alkaline lye and oil solution as an aid to drying nor subjected to bleach treatment. However, this indication is not officially obligatory according to the European legislation rules.

The above mentioned description is not commonly used for retail packaging of dried grapes, but in product specifications in international and wholesale trade. Bulk packaging specifications also need to include:

- name of product, e.g. ‘dried raisins’

- lot identification number

- country of origin, name and address of the manufacturer, packer, distributor or importer

- shelf life of the product

- storage instructions

Lot identification and the name and address of the manufacturer, packer, distributor or importer may be replaced by an identification mark.

In case of retail packaging, product labelling must comply with the European Union Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information. Dried grapes are not declared as an allergen. However, sulphites must be indicated as potential allergens, if they are used as preservatives. Retail packs must be labelled in a language easily understood by the consumer in the European target country, so generally in the country’s official language. This explains why European products often carry multiple languages on the label.

In addition to this regulation, as of 1 April 1 2020, all food in retail packs in Europe must be labelled with the indication of origin. For example, if dried grapes are packed in the Netherlands, packaging still needs to indicate the origin of dried grapes. This can be done by indicating a country, for example, Turkey, or by indicating ‘non-EU’ or by declaring ‘raisins do not originate from the Netherlands’.

Tips:

- Be sure to perform laboratory tests in ISO/IEC 17025:2005 accredited laboratories only.

- Review your treatment practices to ensure your dried grapes will not contain pesticide residues above the current set limits.

- Store your dried grapes in proper conditions (low humidity, cool temperatures) during and after production to avoid appearance of moulds and mycotoxins.

- Refer to the Codex Alimentarius for practical guidelines to help you meet the requirements of European food safety legislation. For dried grapes, consult the Code of Hygienic Practice for Dried Fruits.

What additional requirements do buyers often have?

Together with the mandatory requirements, many private requests have become equally important. These include compliance with food safety, quality and sustainability standards.

Quality requirements

The quality of dried grapes is determined by the allowed percentage of defective produce, and by total number of defective fruits in 500 g. The industry defines several criteria for quality, but some of them, such as taste and flavour, are subjective and cannot be easily determined by physical characteristics.

The European Union has not officially defined quality standards for dried grapes. The most used standards, are standards published by the United Nations Economic Commission for Europe (UNECE) and the Codex Alimentarius. In addition to those international standards, Turkey (standard TS-3411) and the United States have national standards.

The basic quality requirements for dried grapes included the following aspects:

- Whole and sound fruit – Dried grapes must be free from insects, mould, pieces of stem and pedicels (except for the Malaga Muscatel type).

- Maximum moisture content – The allowed moisture content varies for different varieties. 31% for the Malaga Muscatel type, 19% for seed-bearing varieties and 18% for seedless varieties. UNECE additionally set a limit of 19% for the Monukka variety and 20% for currants.

- Allowed food additives – Dried grapes may include only sulphur dioxide, food grade oil and sorbitol.

- Quality class – Dried grapes can be classified into three classes: Extra Class, Class I and Class II.

- Size classification – The size classification is optional. Dried grapes can be sized by the actual size of the berry diameter, or by the number of fruit per 100 grams. Very often, the Turkish size classification is used by traders. According to Turkish standards, dried grapes are classified as Jumbo, Standard, Medium and Small.

- Colour classification – There is no colour classification in UNECE and Codex standards. However, colour classification is important in trade, especially for sultanas. Because of that, traders often use a colour chart developed by the Turkish standard. The colour chart defines 5 types of colour, from Number 7 (the darkest colour) to Number 11 (the lightest colour).

Picture 1: Colours of dried grapes according to the Turkish standard TS-3411

Source: OnayFood

Food safety certification

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide some type of food safety certification.

The majority of European buyers will ask for Global Food Safety Initiative (GFSI) recognised certification. For dried grapes, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

Please note that this list is not exhaustive and food certification systems are constantly developing.

Although all food safety certification systems are based on similar principles, some buyers may prefer one specific system. For example, British buyers often require BRCGS, while IFS is more common among German retailers. Also note that food safety certification is just a starting point. Serious buyers will usually visit and audit your production facilities during the sourcing selection process.

Corporate Social Responsibility

Companies have different requirements for corporate social responsibility. Some companies require adherence to their own codes of conduct, or a standard, such as the Supplier Ethical Data Exchange (SEDEX), Ethical Trading Initiative (ETI) or Business Social Compliance Initiative code of conduct (BSCI). If dried grapes are meant for the retail segment, suppliers will be asked to follow a specific code of conduct developed by the retailers. Many retailers have their own code of conduct, for example, Lidl, Rewe, Carrefour, Tesco and Ahold Delhaize.

Tips:

- Get food safety certification. Carefully select a certifying company and consult with your buyers about their certification preferences.

- Do a self-assessment through the producer starter kit from the Amfori BSCI website.

What are the requirements for niche markets?

Organic dried grapes

To market dried grapes as organic in Europe, grapes must be grown by organic production methods, according to European legislation. Growing and processing facilities must be audited by an accredited certifier before exporters can put the European Union’s organic logo on the packaging, as well as the logo of the standard holder, for example, Soil Association in the United Kingdom and Naturland in Germany. A specific niche opportunity to sell organic dried grapes at higher prices, is to follow the rules of the Demeter biodynamic certification.

Organically produced dried grapes cannot be treated with sulphites. However, they can be dipped in a solution of potassium carbonate and olive oil, to preserve the bright colour. If this is done, olive oil used in the solution must be organic too. If another vegetable oil is used, it must be sourced from organic farming too.

Importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the European Union has to be accompanied by an electronic certificate of inspection as defined in Annex V of Regulation defining imports of organic products from third countries. This electronic certificate of inspection has to be generated through the Trade Control and Expert System (TRACES).

Sustainability certification

Sustainability is a broad term with many aspects, and there is no globally recognised sustainability certification covering all of them. One increasingly used aspect is to publish CO2 emission rates on products, but it is difficult to have reliable measuring for those claims. In dried grapes production, the most important sustainability issue is economical, smart and clean usage of water and energy. Currently, the most famous certification schemes focus on environmental impact and ethical aspects.

Fairtrade is the most famous ethical certification worldwide. Fairtrade certification is currently used by several dried grape producers from Chile, India and Uzbekistan. Products carrying the Fairtrade label indicate that producers are paid a Fairtrade Minimum Price. Fairtrade International has a minimum price structure for dried grapes from South Africa, Central Asia, Southern Asia and South America. Fairtrade minimum prices are defined separately for organic and conventional dried grapes.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) propose specific restrictions in diets. If you want to focus on Jewish or Islamic ethnic niche markets, you should consider implementing Halal or Kosher certification schemes. Dried grapes are a particular popular product among both Jews and Muslims, so ethnic certification will positively influence your sales in Europe.

Tips:

- Read our study on trends in the European processed fruit and vegetables market for an overview of developments in the sustainability initiatives in the European market.

- Consult the Sustainability Map database for information on various sustainability labels and standards.

- Check the guidelines for imports of organic products into the European Union to familiarise yourself with the requirements of the European organic market.

2. Through what channels can you get dried grapes on the European market?

How is the end market segmented?

Dried grapes in Europe are mostly used as an ingredient in the bakery and confectionery industry, and much less as a snack. Without processing, they are mostly used as a part of snack mixtures with nuts and other dried fruit than alone. Still, dried grapes are sold in large volumes throughout the retail segment for home consumption and cooking. There is no exact data, but an estimated 60% of the dried grapes sold in Europe are sold through the retail segment, and the other 40% to industrial users. Within the retail segment, dried grapes are mostly sold in supermarkets.

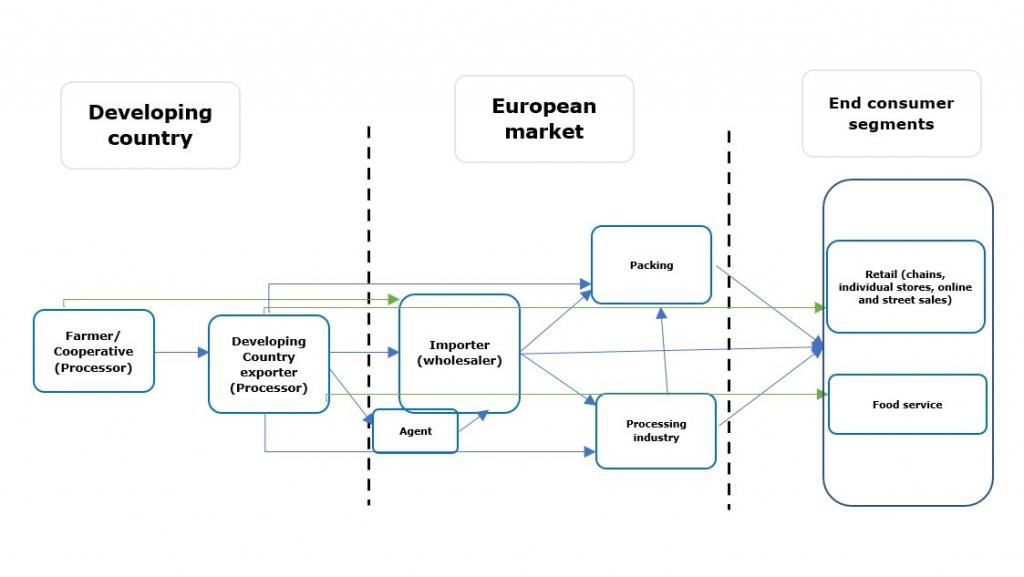

Figure 1: End-market segments for dried grapes in Europe

Source: Autentika Global

Retail (snack segment)

Retailers sometimes buy directly from developing country exporters, but in most cases, they are supplied via intermediaries, such as specialised distributors. A recent development is the polarisation of the retail sector into discounters and high-level segments. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market. Currently, online retail sales of dried grapes accounts for a small share of the market, but it is increasing, especially during and after the COVID-19 pandemic.

Several types of sub-segments (points of sale) of the dried grapes retail segment in Europe include the following:

- Retail chains – The main trends in retail chains are the increasing share of private label dried grapes, and the introduction of snacking packs, such as children’s sizes or chocolate coated. Retail chains with the largest market shares in Europe are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn).

- Specialised shops (including organic food and ethnic shops) – Some organic shops are part of specialised organic food retail chains, especially in Germany. Organic dried grapes products are also sold in drugstores, for example, dm and Rossmann, or variety shops, such as HEMA. Ethnic shops provide specific opportunities for entering the market without having to compete with the leading retail brands. There is a strong presence of shops selling Turkey-related food which do not sell dried grapes from other destinations.

- Ethical stores – This is a niche segment that provide opportunities for suppliers of dried grapes that are certified fair trade or have some other ethical or sustainable certification. Sales of Fairtrade certified products are particularly strong in the United Kingdom and Scandinavian countries.

- Online retail – Often part of the offer of existing retail traders or specialised shops, online retail has dramatically grown during March and April 2020 with the impact of the Covid-19 pandemic and the lockdown measures imposed in many countries in Europe. Online sales are expected to continue to grow in comparison with previous years.

Food industry (ingredient segment)

The food industry segment is the main user of dried grapes:

- Bakery – This is one of the largest users of dried grapes in Europe. A large number of companies use dried grapes in products such as breads, pastries, cookies, cakes, and buns. Some of the large bakery company groups present in the European market using dried grapes are Finsbury Food Group, Le Duff, Aryzta, Jab Holding, Kingsmill, Lantmännen Unibake, and Gruppo Bimbo.

- Chocolate and confectionery – These are the largest users of dried grapes. Dried grapes are a common ingredient in many homemade sweets, but also as a traditional ingredient in chocolate products. Aside from conventional chocolate products, confectionery products include chocolate coated dried grapes and energy balls with dried grapes. Leading chocolate producers in Europe include Mondelez, Nestlé, Mars, Hershey, Ferrero, and Lindt & Sprüngli.

- Breakfast cereals – Producers of cereal are increasingly switching from using sugar infused fruit to natural fruit, such as dried grapes. Examples of companies producing breakfast cereals with raisins include Nature’s Path, Kellog’s, Moma Foods and Jordans.

- Fruit snacks – Dried grapes are increasingly popular in products such as fruit snacks without added sugar. Examples of companies using dried grapes for fruit bars include Ella’s Kitchen, Pulsin, Benecol (all from the United Kingdom) and Oshee (Poland).

- Other users for dried grapes – These include producers of ice creams, fruit preparations and fillings for yogurt and bakery industry, and jams. A popular type of ice cream with raisins is Malaga ice cream.

Food service segment

The food service channel (hotels, restaurants and catering) is usually supplied by specialised importers and wholesalers. The food service segment often uses normal unbranded bulk packaging of 3kg–5kg. Some restaurants use 1kg packaging too. Consumer interest in trying new cuisines, healthy food and just simply enjoying food are the major driving forces in the food service channel in Europe. The fastest-growing business types are likely to be new, healthier fast food, street food, pop-up restaurants and international cuisines.

Through what channels do dried grapes reach the end market?

The most important channel for dried grapes in Europe are specialised dried fruit importers. After importing, dried grapes reach the different market segments described in Picture 11. In some cases, you can also supply different segments directly, without using an importer as an intermediary. However, for most exporters from developing countries, the first entry point into the European supply chain are specialised importers and wholesalers.

Figure 2: European market channels for dried grapes

Source: Autentika Global

Importers / Wholesalers

In most cases, importers act as wholesalers. They often sell dried grapes to packing companies who pack it into consumer packages. Some importers have processing and packing equipment, so they can also supply the retail and food service channels directly. However, many important dried fruit brands import dried grapes directly, instead of buying through specialised bulk importers.

Importers usually have good knowledge of the European market and they monitor the situation in dried grapes producing countries closely. Therefore, they are your preferred contact, as they can inform you timely about market developments and provide practical advice for your exports. Importers of dried grapes often import other types of dried fruit and edible nuts as well, so offering other products in addition to dried grapes can increase your competitiveness. There are also ethnic dried grape importers, specialised in supplying ethnic shops.

The higher requirements from retailers determine the supply chain’s dynamics from the top down, putting pressure on importers and food manufacturers. This pressure forces prices down, but also brings to the market more products that have added value qualities, such as sustainable, natural, organic, and fair trade. Transparency in the supply chain is also a requirement. To achieve this transparency, many importers develop their own codes of conduct and build long-lasting relationships with preferred developing country suppliers.

Importers / WholesalersAgent/broker

Agents involved in the dried grapes trade typically perform two types of activities. They act as independent companies that negotiate on behalf of their clients, and as intermediaries between buyers and sellers. For their intermediary services, they typically charge commissions between 2% and 4% of the sales price.

Another type of activity is the supply of private labels for retail chains in Europe. For most developing country suppliers, it is very challenging to participate in the demanding private label tender procedures. For these services, some agents work in cooperation with their dried grape suppliers to participate in procurement procedures put out by the retail chains.

Food processing industry

Food processing companies such as bakery and chocolate producers generally buy dried grapes from European wholesalers who act as intermediaries. There are two main reasons for intermediary sourcing. Despite the higher prices, they offer a broader range of products and easier sourcing control. However, some food processing companies import dried grapes without intermediaries, such as Mars (chocolate snacks), Mondelez (chocolate products) Haywood & Padgett (bakery) and Kinterton (confectionery).

Table 1: Examples of companies active in different channels for dried grapes in the leading European markets:

| Type of importer | Company example |

| General dried fruit importers and wholesalers | |

| Specialised organic food importers | |

| Importers specialised in supplying the food industry and food service | |

| Ethnic Food importers | Fudco |

| Food processors | Mars (chocolate snacks) Mondelez (chocolate products) Haywood & Padgett (bakery) Kinterton (confectionery) |

| Agents | |

| Packing companies |

What is the most interesting channel for you?

Specialised importers of dried fruit seem to be the best contact for exporting dried grapes to the European market. This is specifically relevant for new suppliers, as supplying the retail segment directly is very demanding and requires a lot of quality-related and logistical investments. However, for the well-equipped and price competitive producers, packing for private labels can be an option. As the cost of labour in Europe is increasing, importers of dried grapes sometimes search for more cost-effective packing operations, such as in developing countries.

Tips:

- Search the exhibitor lists of large trade fairs such as ANUGA and SIAL to find potential buyers. If you are aiming to supply to supermarkets’ private labels you can search for opportunities at PLMA.

- To reach the food service segment more easily, look for suppliers at specialised foodservice events like SIRHA and Internorga. For the United Kingdom market, look for opportunities within the Cater Force group.

- Search the exhibitor list of the specialised trade fair Fi Europe to find potential buyers for your dried grapes. Also, check out IBA, the world’s leading trade fair for the baking and confectionary industry.

- Stay informed about developments in the bakery and snacks industry segment by reading the specialised market information portal Bakery and Snack.

- Search through the member list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM), to find buyers from different channels and segments.

3. What competition do you face on the European dried grapes market?

Which countries are you competing with?

Turkey is the main supplier of dried grapes to Europe, responsible for more than 50% of all dried grapes imported into Europe. Four other important competing countries are South Africa, China, Chile, and Iran, which together supply an additional 20% of the market. Within Europe, Greece is the only serious competitor, supplying mainly currants. Other emerging suppliers include Uzbekistan, Afghanistan, Pakistan and Argentina.

Turkey, the leading European supplier of dried grapes

Turkey is the worlds’ leading producer of dried grapes. With a production of 305 thousand tonnes in the 2019/20 season, Turkey accounts for 23% of the world’s dried grape production. Turkey is also the leading dried grape exporting country, with 33% of the world’s exports. More than 80% of Turkish dried grapes are exported to Europe, followed by Japan. Sultanas are the most exported type of dried grapes from Turkey. The Turkish harvesting seasons starts in September and export is the highest in October.

Turkish export of dried grapes to Europe increased by an annual rate of 1% between 2015 and 2019. It reached 198 thousand tonnes in 2019, valued at €400 million. Within Europe, the major target market for Turkish dried grapes is the United Kingdom, where 37% of Turkey’s dried grape exports went to in 2019, followed by Germany (15%), the Netherlands (11%), Italy (10%) and France (8%). Poland is the fastest growing market for Turkish dried grapes. Turkish exports of dried grapes to Poland increased from 1.6 thousand tonnes in 2015 to 4.4 thousand tonnes in 2019.

Most dried grapes in Turkey are produced in Aegean (west). The most important production areas are Manisa, Izmir and Aydin. Around 35% of all grapes produced in Turkey are used for drying. The rest is sold as table grapes or used to produce alcoholic drinks, mainly raki. The sultana planted area in Turkey is increasing, having reached 74 thousand hectares in 2020. The Aegean Exporters Association, the affiliated member of the European Dried Fruits Trade Federation (FRUCOM), actively promotes exports of dried grapes from Turkey to Europe.

South Africa, increasing supplier to Europe

South Africa is the seventh-largest producer of dried grapes in the world. Their constantly increasing production reached 74 thousand tonnes in the 2019/20 season. In 2019, South Africa was the world’s fifth exporter of dried grapes, with 47 thousand tonnes. South Africa exports more than 60% of its dried grapes to Europe, with Germany as the main destination. After Europe, Algeria and the United States are the main markets importing South African dried grapes. Harvesting season usually starts in January, reaching its peak in mid-February, so dried grapes are delivered by the end of April.

South Africa’s dried grape exports to Europe are slightly increasing at an annual growth rate of 1%. In 2019, South Africa exported 29.7 thousand tonnes to Europe, worth €106 million. Sultanas are South Africa’s most exported type of dried grapes to Europe (66%), followed by other dried grapes (32%) and currants (2%). Germany is the main European destination for South African dried grapes (54%) in 2019, followed by the Netherlands (13%), France (9%), the United Kingdom (9%) and Denmark (4%).

More than 90% of dried grapes in South Africa are produced in the Northern Cape Province, near the Orange River, and the remaining 10% in Western Cape. The planting area is constantly increasing, reaching 18 thousand hectares in 2019. South African producers use around 15 grape cultivars for drying, but the Thompsons seedless is mostly used (more than 50%). Other important varieties include Merbein, Sultana, Selma Pete, Flames and Zante currants (limited to the Olifants River Valley).

Natural sun drying is the most common method used in South Africa. Other methods include dipping into alkaline solution and drying in the shade (Orange River raisins), dipping into alkaline solution and drying in the sun (WP sultanas), and ventilation in wooden trays (golden raisins). On average, export prices of South African dried grapes are higher than those of Turkish dried grapes, but lower than prices of American dried grapes. The most expensive types are golden raisins, whose production involves using ventilation facilities.

China, gaining market share in Europe

China is the third-largest producer of dried grapes in the world, accounting for 13% of the world’s total production in 2019. China produced 180 thousand tonnes of dried grapes in 2019, and consumed around 80%, leaving a remaining 20% for exports. Although China exported an average volume of approximately 25 thousand tonnes, in 2019, it significantly increased its exports to 40 thousand tonnes, more than half of which went to Europe.

Chinese exports of dried grapes to Europe increase at an annual rate of 12%, reaching 24 thousand tonnes in 2019, worth €32 million. The Netherlands is the main European market for Chinese dried grapes accounting for 31%, followed by Germany (26%), the United Kingdom (15%) and Belgium (10%). China exports several types of dried grapes, but it is specifically famous for exporting green raisins.

The city of Turpan, in the Xinjiang region, produces more than 80% of China’s dried grapes. Production of dried grapes is increasing, with new vineyards planted every year. Thompson Seedless varieties account for more than 90% of Chinese production. China is the leading producer of green raisins in the world. Green raisins are dried in the shade in special drying houses called chunche. However, intensive production of dark skin dried grapes produced by sun-drying is increasing, while green raisin production is decreasing.

Chile the leading South American supplier to Europe

Chile accounts for 5% of the world raisin production, with an average production of 60 thousand tonnes.

The main export destination for Chilean dried grapes is Mexico, with a 9% market share, followed by the United States and Peru. Europe accounts for nearly 30% of Chilean exports with the United Kingdom as the leading destination. In Chile, raisins are mainly produced from Thompson and Flame Seedless varieties. Other Chilean varieties are Autumn Royal, Black seedless, Crimson seedless, Superior and Red Globe.

Within Europe, the United Kingdom accounts for 25% of the Chilean export share, followed by the Netherlands (22%), Spain (11%), Denmark (9%) and Poland (8%). More than 75% of dried grapes exported from Chile to Europe, concern dark skin varieties. The Netherlands is the fastest growing import market for Chilean dried grapes. The Netherlands increased its import from 3 thousand tonnes in 2015 to 4 thousand tonnes in 2019.

Despite the significant production of dried grapes, until recently Chile did not have fresh grapes production specifically for drying. Chilean grapes that are not sold in fresh fruit or wine markets, are processed into dried grapes. In Chile, most grapes are produced in the northern regions of Atacama, Coquimbo and Valparasio. As their dried grapes are produced from grapes aimed at fresh consumption or wine, Chile mostly sells large-sized dried grapes.

Iran, the third world’s producer of dried grapes

With a 13% share of the global dried grapes production, Iran is the third-largest producer in the world. However, production was smaller in 2019, placing Iran in the fourth position after China. Production of dried grapes in Iran in 2019 was 160 thousand tonnes. Official export data is not available, but it is estimated that Iran exported more than 100 thousand tonnes of dried grapes in 2019. The major export markets for Iranian dried grapes are the United Arab Emirates and Iraq, followed by Turkey, Kazakhstan and the Russian Federation.

Iran exports around 10% of its dried grapes to Europe. In 2019, the European Union imported 16 thousand tonnes of dried grapes from Iran, worth €27 million. Poland was the main market for Iranian dried grapes (16%), followed by the Netherlands (15%), Romania (12%), Germany (12%) and Austria (10%). Sultanas are the most exported type of Iranian dried grapes, making up around 70% of total production, followed by Golden raisins.

Greece, the leading European producer

Although Greece does not belong to the world’s top dried grapes producers, it is the largest producer of currants. Greece produces an estimated 80% of the world’s currants, mostly on the west coast of the Peloponnese area of southern Greece, stretching from Corinth in the north to Calamata in the south. Aside from currants, Greece also produces sultana dried grapes. Greek currants are registered as protected designation of origin (PDO) by the Vostizza farmers union.

Greek exports of dried grapes reached 17.8 thousand tonnes, worth €48 million in 2019. Approximately 95% of all of Greece’s dried grape exports are currants, the remaining 5% are sultanas. More than 70% of these exports go to other European countries. The main market for Greek dried grapes is the United Kingdom, accounting for a 36% export share, followed by the Netherlands (18%), Australia (9%), Germany (4%) and India (4%).

Which companies are you competing with?

Most dried grapes exporters are processors and packers. Still, farmers in many countries supply exporters with grapes which are already dried and not only with fresh grapes as raw material. Some companies have their own plantations, but the majority buys dried grapes from farmers through specialised collectors. The examples listed below are illustrations of leading dried grapes exporters. Many other prospective companies are not mentioned in this study. Direct competitors are different for each exporter and they cannot be generalised.

Companies in Turkey

There are many dried grapes exporters in Turkey, but the leading 10 exporters have an estimated 80% share of the country’s exports. TARIS Sultana Raisins Cooperative is the largest exporter of dried grapes from Turkey. TARIS is a cooperative union purchasing 15%-20% of total sultana production in Turkey. There are around 65 thousand farmers producing sultanas in Turkey, and about half of them are members of TARIS. In Manisa province, TARIS invested in a dried grape processing facility which has yearly capacity of 45 thousand tonnes.

The leading private company exporting dried grapes from Turkey is Özgür Tarım. They produce dried grapes with pesticides far below the allowed limits by implementing integrated pest management. Ozgur is certified with BRCGS, FSSC 22000, IFS, Halal and Kosher certificates. They export to several European destinations, but especially to the United Kingdom, where they established their own subsidiary to better explore the market.

Other notable dried grapes exporters from Turkey include companies such as Osman Akça (part of Akça holding), Orka Tarim, Tugrul Tarim, Ertürk, Anatolia (also famous by its acquisition of Whitworths), Isik and Pagmat (which have a subsidiary in the United Kingdom).

Companies in South Africa

There are approximately one thousand dried grape producers in South Africa. They produce grapes and then transform them in processing facilities. Processors of dried grapes are at the same time exporters. There are seven processors of dried grapes in South Africa: Carpe Diem, Red Sun, The Raisin Company, Safari (owned by Pioneer Foods), Fruits du Sud (owned by BKB), Northern Cape Raisins and Prosperitas Foods. Below are some details about three of them.

- Carpe Diem – One of the largest exporters of dried grapes in South Africa. They account for nearly one quarter of all South African dried grape exports. Their processing facility has a capacity of approximately 12 thousand tonnes. Approximately 5% of Carpe Diem’s production is sold to the local market, and 95% are exported. They are constantly increasing their production of organic dried grapes, and have several certifications that enable them to reach different market segments.

- Red Sun – Red Sun’s modern facility processes around 13 thousand tonnes of dried grapes produced in a large network of around 250 farms. In 2017, they opened a pecan processing factory alongside their dried grape factory. They aim to export South African pecans to Europe and the United States.

- Safari - Owned by Pioneer Foods, Safari is a processor and packer of dried fruit. Aside from export of bulk dried grapes, the company offers innovative dried fruit snacking solutions. Innovative products include fruit rolls, which are shaped dried fruits in moulds that are attractive for children, and fruit bars.

Examples of dried grapes exporters from other supplying countries

- China – Many processors in China started to invest in dried grapes production in Turpan province. Some examples include Turpan Sun Raisins Processing, Turpan ShengDa Raisin Processing Factory and Turpan Green Ruby Fresh And Dried Fruit Limited Company.

- Chile – The leading exporters of dried grapes in Chile also export other types of dried fruit and nuts, especially prunes. There are more than 30 Chilean companies exporting raisins but many of them do not process grapes, but only sell them. Some leading exporters also process dried grapes in Chile, for example Group Natural Chile (largest producer with an output of 10 thousand tonnes), Frutexsa (with an export volume of more than 8 thousand tonnes), and Mi Fruta.

- Iran – Arat Company, Middle East Senate Exporting, Rasha Pistachio and Khoshbin Group.

- Greece – Farmers Union Vostizza is the leading producer of currants in Greece. They export dried grapes to more than 40 destinations around the world. Vostizza exports approximately 60% of the entire annual Greek production. Moreover, the union collects, packs and exports approximately 90% of the VOSTIZZA P.D.O., and significant quantities of Gulf and Provincial currant types.

Tips:

- Regularly visit leading European trade fairs such as ANUGA, SIAL and Biofach to meet your competitors.

- Learn more about Turkish competition from the Aegean Exporters Association.

- Visit the website of Raisins SA to learn more about the South African dried grapes industry.

- Check the website of the Iranian Dried Fruit Exporters Association to learn about Iranian competitors.

Which products are you competing with?

The main product competition for dried grapes are other types of dried fruit and fresh fruit, especially fresh grapes. European consumers have become increasingly health-conscious and prefer a healthy diet with more fresh fruit and vegetables. Consumption of fresh fruit is officially supported in Europe through national campaigns promoting five daily portions of fruit and vegetables. Strong competition from fresh fruits will likely be a major challenge in the European dried grapes market in the coming years.

Marketing competition from the fresh sector includes claims about sugar levels in dried fruit and the risk of dried fruit to dental health, since they stick to consumers’ teeth. However, the International Council for Nut and Dried Fruit counters the competition with information claiming there is unconvincing evidence of too high levels of sugar in dried fruit.

Tip:

- Read the CBI’s studies on fresh fruit and vegetables to better understand fresh fruit competition.

4. What are the prices for dried grapes on the European market?

Calculating margins according to final retail prices for dried grapes is not very reliable, as the entire sector has different prices for different varieties, origins and packaging. Usually currants are the most expensive, compared to other dried grapes, but it also depends on size, brand and other factors. Current retail prices in most European supermarkets vary between €2.56 and €5/kg for retail packs of 250g–500g. Retail prices of currants go up to €7/kg, but the same price level is reached by some leading brands or small packages for raisins or sultanas.

Cost, insurance and freight (CIF) represent approximately 50% of the retail price, of the average retail price for dried grapes. When the final retail product is sold directly to retail chains, that share is much higher.

In 2019, the export (CIF based) prices per kilogram of the main types are illustrated below. Keep in mind that the fluctuations were higher than shown, but the indicated export price, including transportation and insurance costs, is one used for most of the quantities.

Table 2: Export prices (CIF based) for different types and origin of dried grapes during 2019

| Dried grape type | Price (CIF)/kg |

| Sultanas – Turkey | Grade 10: €1.8 to €2 (reaching €2.5 in some periods) Grade 9: €1.6 to €1.9 |

| Currants – Greece | Vostizza: €3.1 to €3.3 Greek Provincial: €2.9 to €3 |

| Thompson seedless –United States | €2.2 to €2.7 |

| Iranian seedless – Iran | €1.5 to €1.9 |

| Thompson seedless – South Africa | €2.5 to 2.6 |

If you add value to your produce through differentiated quality, food safety, certification and processing steps, your prices will be higher. For example, organic and fair-trade certification may add value to your products.

The price breakdown given below is a very rough indication. There are many different factors contributing to the costs, such as quality, variety, origin, food safety certification costs, consultants, social security, taxes and sales network margins.

Table 3: Dried grapes retail price breakdown

| Steps in the export process | Type of price | Price breakdown | Example (Sultana larger sizes) |

| Processing and packing | FOB | 45% | €1.8 |

| Shipping and customs clearance | CIF price | 50% | €2 |

| Intra-European distribution | Wholesale price (including value-added tax) | 60% | €2.45 |

| Retail sales of the final packed product | Retail price (250 g–500 g pack) | 100% | €4 |

This study was carried out on behalf of CBI by Autentika Global.

Please review our market information disclaimer.

Search

Enter search terms to find market research