The European market potential for dried grapes

In the long term, the European market for dried grapes is expected to grow 1%–2%. This growth is driven by the rising interest for healthy snacking and innovative bakery and confectionary products using dried grapes as an ingredient for sugar replacement. The United Kingdom is the world’s largest importer of dried grapes, offering opportunities for developing country suppliers. Other attractive markets are Germany, the Netherlands, France, Italy and Poland.

Contents of this page

1. Product description

Dried grapes are the dried, ripe fruit of the grapevine (Vitis Vinifera). After grapes reach the desired sugar content, they are harvested, washed, dried, sorted and packed. Before drying, grapes may be dipped into a chemical solution to remove natural wax from the skin of the fruit. This process shortens the drying time and enables a lighter skin colour. Traditionally, this solution is made of potassium carbonate and olive oil, but other substances are used too (such as ethyl esters). Grapes can be dried in the air (in the sun or in the shade) or in drying facilities. Sundried grapes have a darker skin colour compared to grapes dried in the shade.

Dried grapes can be treated by sulphuring with sulphur dioxide, which is the common production process for the golden yellow types. However, sulphur dioxide cannot be used in the production of organic dried grapes. In order to prevent the raisins from agglomerating (sticking together), they are often coated with vegetable oil.

Dried grapes are mostly used as an ingredient for bakery and other products. In the English language, the term ‘raisin’ is mostly used, instead of dried grapes, but the industry distinguishes three types of dried grapes, of which raisins is one (Figure 1). This report covers all three types of dried grapes and includes:

- Raisins: darker coloured, naturally dried grapes. Most used variety is light skin Thomson Seedless. Grape skin normally darkens during the drying process as grapes are not chemically treated.

- Sultanas: seedless, dried grapes of the yellow colour, originally named after the word ‘sultan’. Like raisins, sultanas are mostly produced from the Thompson Seedless variety. The light skin colour is preserved by dipping the grapes into a special solution and by a treatment with sulphur dioxide.

- Currants: purple-black dried grapes, originally produced from the seedless Greek Black Corinth variety. Their name derives from the Greek city of Corinth and should not be confused with berry fruit such as blackcurrants or redcurrants.

Please take into consideration that many countries have different classification for dried grapes, and there is no internationally accepted classification.

Picture 1: Three main types of dried grapes on the European market. Currants (left): small, reddish-blue; sultanas (middle): golden yellow; raisins (right): brownish-red to brown.

Source: Gesamtverband der Deutschen Versicherungswirtschaft e. V. (GDV)

World dried grapes production is slowly increasing, having reached a record of more than 1.33 million tonnes in the 2019/20 season. Turkey is the leading producer of dried grapes, with a 23% share of the world’s production. It is followed by the United States of America (17%), China (13%), Iran (12%), India (11%), Uzbekistan (6%) and South Africa (6%). European production of dried grapes is not self-sufficient. Greek is the leading European producer, mostly currants. Spain also produces dried grapes in the region of Malaga (Andalusia).

Table 1: Products in the product group of dried grapes

| Combined Nomenclature Number | Product |

| 08062010 | Currants (French: Raisins de Corinthe / German: Korinthen) |

| 08062030 | Sultanas (French: Sultanines / German: Sultaninen) |

| 08062090 | Other dried grapes (French: raisins secs/ German: Weinbeeren or Rosinen) |

2. What makes Europe an interesting market for dried grapes?

Europe is the largest market for dried grapes in the world, accounting for half of the world’s total imports. European imports of dried grapes have reached 379 thousand tonnes in 2019 or €778 million. More than 90% of all European imported dried grapes are produced in developing countries. Internal European trade consists mainly of re-exporting imported dried grapes. The only significant European producer is Greece with less than 5% of European supply. Small quantities of dried grapes are produced in Cyprus, Spain, Italy and Bulgaria.

In the next five years, the European market for dried grapes is likely to slowly increase by an average annual growth rate of 1%–2%, which is less than most other dried fruit, because dried grapes are mostly used as an ingredient and less as a snack. Dried grapes are a traditional ingredient in bakery and confectionery products. However, the number of innovative products with dried grapes in Europe is increasing. This includes fruit bars, fruit and nuts snack mixtures and breakfast cereals.

The European market for dried grapes is moderately concentrated with three leading importers that have nearly 60% of total import share. In 2019, the United Kingdom was the leading importer in Europe, with a 25% import share, followed by Germany (19%), the Netherlands (14%), France (7%) and Italy (6%). According to the International Nuts and Dried Fruit Council, the largest consumer of dried grapes in Europe is the United Kingdom, with an average consumption of over 90 thousand tonnes. The Netherlands has the largest per capita consumption in Europe, with an average consumption of 2.3 kg/year.

European demand for dried grapes is pretty stable. Retail sales and import values support this statement. If you see fluctuations in imports, they are the result of variable production in the main supplying countries (mainly Turkey). The European supply of dried grapes strongly depends on supply from Turkey. In years when Turkish production is smaller due to weather conditions or other external factors, total European imports are smaller too.

3. Which European countries offer most opportunities for dried grapes?

Within the European Union, the main importers of dried grapes (United Kingdom, Germany, Netherlands, France and Italy) are also the leading consumers. Figure 3 represents apparent consumption. These data also include industrial consumption. Belgium, although ranked sixth European importer, is actually the eighth European consumer. This is because Belgium is re-exporting nearly 30% of its imported dried grapes.

The United Kingdom, Germany and the Netherlands are the largest European markets for dried grapes, receiving more than 60% of the European market. The people in France, Italy and Poland are also big consumers of dried grapes. Over the last five years, imports into the Netherlands, Spain, and Italy rose strongly too. These six countries offer a lot of opportunities for emerging suppliers of dried grapes to Europe. Other countries showing increase in imports include Spain, Austria and Greece.

Table 2: Per capita consumption in 2019, kg/year

| Country | Consumption per capita |

| Netherlands | 2.33 |

| Ireland | 1.67 |

| UK | 1.45 |

| Iceland | 1.3 |

| Estonia | 1.2 |

| Luxembourg | 1.03 |

| Greece | 0.83 |

| Slovenia | 0.83 |

| Belgium | 0.81 |

| Norway | 0.8 |

Source: INC

The United Kingdom: the leading European market for dried grapes

The UK is the largest importer of dried grapes in Europe, representing around 25% of the European market. Imports of dried grapes in the United Kingdom were pretty stable over the last five years, reaching 96 thousand tonnes or €198 million in 2019. In the last two years, imports decreased because of the drastic fall in Turkish harvest in the 2018/19 season. For 2020, imports are expected to recover, because the Turkish harvest grew. Approximately 60%–70%) are sold to the food processing and food service industries.

In 2019, the United Kingdom imported 78% of its dried grapes from Turkey, followed by Greece (6%), Chile (5%), China (3%) and South Africa (3%). Emerging suppliers include the United States, Uzbekistan, Afghanistan and India. The most imported and consumed type of dried grapes in the United Kingdom are sultanas (56%), followed by other dried grapes (35%) and currants (9%). Turkey is the leading supplier of sultanas (81% share) and raisins (71%) while Greece leads the supply of currants with a 91% share.

The large market shares are captured by private labels of retail chains such as Tesco, Sainsbury’s, ASDA, and Morrisons. Independents brands include Whitworths and Sunny Raisins (both by Whitworths), Fudco, Crazy Jack (organic) and Sun Maid (United States). The company Maxwell Foods launched a very small package for children, branded with children’s cartoon characters such as Peppa Pig and Disney characters. Chocolate coated dried grapes are a very popular snack in the United Kingdom. They are produced by many different brands.

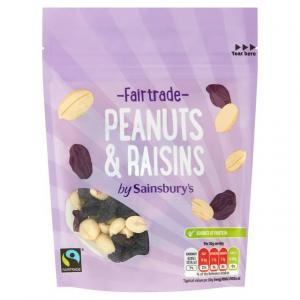

The market in the United Kingdom offers specific opportunities for suppliers of Fairtrade certified dried grapes, as the country is the largest Fairtrade product market in Europe. There are currently approximately 5,000 Fairtrade certified products for sale in the United Kingdom. Some retail chains, like Sainsburry’s, have launched snack mixes containing Fairtrade certified dried grapes.

Picture 2: Example of a dried grape brand in the United Kingdom (Whitworths brand)

Source: Tesco

Picture 3: Example of a Fairtrade peanuts and raisins package in the United Kingdom (Sainsbury’s private label)

Source: Sainsbury’s

Germany: a large market for sultanas

German dried grapes imports reached 71 thousand tonnes and a value of €154 million in 2019. Germany also re-exported more than 11 thousand tonnes, leaving around 60 thousand tonnes for domestic consumption. German per capita consumption of dried grapes is 0.76 kg/year. Most imported and consumed type of dried grapes in Germany are sultanas (95%), followed by other dried grapes (4%) and currants (1%). In 2019, Germany was the largest European market for sultanas, importing 68 thousand tonnes.

In 2019, Germany imported 43% of its dried grapes from Tunisia, followed by South Africa (23%), China (8%) and the United States of America (6%). Other emerging suppliers with increasing dried grape exports to Germany are Uzbekistan, Iran and Australia. Germany is the largest market for South African dried grapes, mostly sultanas. German imports of dried grapes from Australia have increased from 12 thousand tonnes in 2015 to more than 16 thousand tonnes in 2019.

Significant volumes of dried grapes in Germany are sold as private label, such as Belbake (by discounter chain Lidl), Trader Joe’s (by Aldi Süd and Aldi Nord), ja! (by REWE), Metro Chef and Fine Food by Metro and Edeka (by Edeka). Examples of independent brands include Seeberger, Farmer’s Snack, Meray and Kluth. Dried grapes in Germany are also used in mixtures with other nuts (Ultje), in bakery products (Harry), in breakfast cereals (Dr. Oetker), in chocolates (Ritter Sport) and in fruit-nuts bars (Corny).

Germany is a particularly attractive market for organic dried grapes, as the country is the largest European market for organic food. Organic dried grapes in Germany are sold as independent brands (for example, MorgenLand, Clasen Bio, Rapunzel, Reformhaus, Biofarm, Bioladen, Biozentrale and Rinatura), as private labels of mainstream retail chains (for example, bio by Aldi, Edeka Bio by Edeka, and REWE Bio by REWE) or as brands of specialised chains selling organic food (for example, dm, Alnatura, Denn’s, Rossmann and Keimling).

Picture 4: Example of an organic dried grapes product from Germany (dm)

Source: dm

Picture 5: Example of a bakery product with dried grapes in Germany (Harry)

Source: Harry-Brot

The Netherlands: the largest European per capita consumer

Imports of dried grapes in the Netherlands have been decreasing slightly since 2015. At an average annual rate of -1%, these imports reached 53.6 thousand tonnes and €109 million in 2019. In 2019, the Netherlands re-exported 17 thousand tonnes of dried grapes, leaving 36.7 thousand tonnes for domestic consumption. The Netherlands has the largest per capita consumption of 2.3 kg/year in Europe. Currants (krenten in Dutch) and raisins (rozijnen) are particularly popular dried grapes in the Netherlands, the second-largest importer of currants in Europe.

In 2019, 47% of the dried grapes the Netherlands imported came from Turkey, followed by China (12%), Greece (8%), Chile (7%) and South Africa (6%). The Netherlands is the largest importer of dried grapes from China. China has been gaining market share in the Netherlands, increasing their supply from 2.7 thousand tonnes in 2015, to 6.6 thousand tonnes in 2019. The leading market for dried grapes re-exported from the Netherlands is Germany, followed by Belgium and France.

Dried grapes are a particularly popular snack among children in the Netherlands. Parents often give dried grapes to children as a kind of healthy snack. Brands such as Sundrop and AH (Albert Heijn’s private label) developed special packaging of small snack portions which is specifically attractive for children.

Most dried grapes in the Netherlands are sold under a private label. The leading retail companies selling dried grapes under their own label in the Netherlands include Albert Heijn (AH label), Aldi, Jumbo (Jumbo), Lidl (Belbake label) and CIV Superunie (g’woon labels). The Netherlands has a very developed bakery industry, and dried grapes are largely used in bakery products. Some popular Dutch bakery products with dried grapes includes bread with dried grapes (rozijnenbrood and krentenbrood) and the popular New Year’s Eve donut oliebol.

France: stable growth

France is one of the rare European countries that shows a stable line of growing imports of dried grapes, even in the years when production in Turkey was low. Over the last five years, France increased imports of dried grapes by an annual growth rate of 2%. French imports of dried grapes reached 17.8 thousand tonnes or €66 million in 2019. The estimated total consumption of dried grapes in France is 26 thousand tonnes or 0.4 kg/year.

France imports 64% of its dried grapes from Turkey, followed by South Africa (10%), Chile (5%), Belgium (5% via re-exports) and Iran (5%). Sultanas are the most imported type of dried grapes in France, accounting for 83% of all imports, followed by other dried grapes (15%) and currants (2%). All supermarket brands (private labels) in France use Nutriscore to label dried grapes. The nutritional value of dried grapes is usually labelled with C, meaning it has an average health score.

Similar to other European countries, large volumes of dried grapes are sold as private labels (brands of the retail chains), such as Carrefour (Carrefour, Carrefour Bio and Pettit Prix), Leclerc (Couleurs Vives, Marque Repere and Bio Village), Super U (U), Intermarché (Paquito) and Auchan (Auchan and Bio).

Independent brands include La Patelière, Vahine Bio, Holy Fruits, Daco Bello, Profruit, Belle France, La Favorite and Sun or Maître Prunille.

Picture 6: Oliebol (the Netherlands)

Source: Marjon Besteman via Pixabay

Picture 7: Pain aux raisins (France)

Source: PxHere

Italy: stable market with dominant Turkish supply

In 2019, Italy imported 21.6 thousand tonnes of dried grapes with a value of €44 million. Italy uses all imported dried grapes for domestic consumption with no significant re-exports. This means that Italian consumption almost equals its import. In Italy, per capita consumption of dried grapes is 0.36 kg/year. Sultanas were the most imported dried grapes (94%) in 2019, followed by other dried grapes (4%) and currants (2%).

In 2019, Italy imported 83% of its dried grapes from Turkey, followed by Australia (5%), Chile (3%) and Iran (2%). Emerging suppliers of dried grapes to Italy are China, India and Uzbekistan. Almost 90% of sultanas are imported from Turkey, while the leading supplier of other dried grapes is Chile (56%) followed by South Africa and Iran. Currants are imported from Greece (66%) followed by India with (21%).

Sales are dominated by supermarket private labels, such as Coop, Conad and Carrefour. Independent brands include Fatina (Murano), Ventura, Noberasco and Life. Sales of organic dried grapes in Italy are increasing. A specific characteristic of the Italian retail segment is small snack packaging sold in shops for €0.99.

Poland: import growth

Polish imports of dried grapes increased at an annual growth rate of 4% over the last five years. Together with France, Poland has the largest market share in European imports and consumption of dried grapes. Poland increased import of dried grapes from 13.7 thousand tonnes in 2015, to 16 thousand tonnes in 2019, with a value of €29 million. Polish consumption of dried grapes is estimated to be around 15 thousand tonnes in 2019. Consumption per capita is around 0.4 kg/year.

In 2019, Poland imported 31% of its dried grapes from Turkey, followed by Iran (17%), Uzbekistan (8%), Chile (8%), Germany (7%) and China (7%). Sultanas are the most imported type of dried grapes in Poland, with a market share of 50%, followed by other dried grapes (47%) and currants (3%). Turkey is the leading supply of sultanas to Poland, while Iran is the main supplier of other dried grapes. Interestingly, Poland is the only European country where India leads the supply of currants.

Dried grapes are increasingly sold by the private labels of Polish retail chains such as Biedronka (Bakallino label), Lidl (Alesto label), Kaufland, Auchan and Carrefour. Examples of independent brands in Poland include Makar (by Makar Bakalie), Bakaland, Helio, Kresto (by VOG), Bio (by Natur Avena), Sante and Hebar. Also, some quantities are sold unbranded per weight. Dried grapes in Poland are also used in traditional baking products.

Tips:

- Stay up to date on the dried grapes market in the United Kingdom by regularly checking the website of the National Dried Fruit Trade Association UK.

- Find German traders of dried grapes on the websites of the specialised German Association Waren-Verein and in the German company directory Wer liefert was.

- Contact the French Association for Dried Fruit (SNFC) to learn about the French market for dried grapes.

4. Which trends offer opportunities in the European dried grapes market?

The increasing demand for fruit snack products together with developments bakery and confectionary products are main driving forces behind the huge consumption of dried grapes in Europe. Also, sustainable and ethical production is becoming an important aspect for European traders and consumers.

Healthy snacking

A major trend that is in line with increased consumption of dried fruit, including dried grapes, is healthy snacking. Consumers are searching for healthier alternatives for snacking between meals, or even for snacks that can replace meals in full. Younger consumers who are taking more care of their general health and wellness, no longer favour savoury snacks such as potato chips and other crisps. As a result, nuts, as well as dried fruit are becoming increasingly popular as a snack.

Consumers are increasingly looking for flexible, light and convenient snacking options that they can eat on the go. With their busy lifestyles, European consumers are replacing traditional lunch breaks with healthy snacking moments. One interesting healthy snacking example is the range of 25 g packs of nuts and dried fruit mixtures launched by Whitworths, the leading dried fruit brand in the United Kingdom, which are aimed for on-the-go snacking. Every pack in this line contains dried grapes and has less than 100 calories.

Clean label

Clean labels on dried fruit packs are especially important for consumers. ‘Clean’ means that there are no additives used during the production process. One important trend for dried grape exporters is additive-free dried grapes, as opposed to the regular use of sulphites, the main additive used to preserve the yellow colour of dried grapes. The problem with sulphur-free dried grapes is darkening the fruit, which makes it difficult to produce golden yellow dried grapes.

Dried grapes as an ingredient in so many ways

Bakery products, chocolate snacks, fruit snacks and many other products use dried grapes as an important ingredient. At the 2019 edition of leading food fair ANUGA in Cologne, producers introduced many new products with dried grapes as an ingredient, among which:

- Breakfast cereals with dried grapes – Many breakfast cereals already use dried grapes in flavour combinations. Recently launched products with dried grapes include Austrian Verival (several organic and sugar-free flavours containing dried grapes), organic granolas and bars by Lithuanian company Ekofrisa and apple quinoa parfait with toppings by Peruvian company Viru.

- Sweet snacks – Traditional Greek sweet snacks, such as Sykomaida by Voskopolua, borek sticks with raisins by Nestia, and cream bars by Estonian company Saaremaa Delifood.

- Bakery products – The bakery industry is a traditional user of dried grapes. Some recent product launches include crispy bread slices with raisins by Polish company Mamut, organic mini biscuits by Bulgarian company Natur, biscuits with raisins by Latvian company Dzukija, and panettone with raisins and orange peels by Bulgarian company Tims.

- Fruit snacks with dried fruit – The popularity of fruit bars in Europe has increased over the last years. The natural sweetener function of dried fruit allows the making of sweet products without adding sugar. Recent examples include Energy Balls by Greek company RHO, Raw-Bite by Danish company Raw Bite, fruit and nut chunks by Belgian company Chalo, and energy bars (by Italian company Vochem).

Sustainability and ethical production

Several sustainability initiatives are already present in dried grape production countries. Read more about these trends in the CBI processed fruit and vegetables trends study. In general, consumers and retailers are increasingly interested in sustainably produced fruit products, including dried grapes. Major sustainability issues related to the production of dried grapes include efficient use of water and renewable energy resources.

Tips:

- Promote dried grapes as healthy and nutritious in the European market. Explore creative ways of using dried grapes in home cooking and offer ideas through online promotion.

- Monitor industry trends and product innovations at the leading European food trade fairs, such Anuga, SIAL and Food Ingredients Europe.

- Read our study about trends in the European processed fruit and vegetables market to find out more about general trends.

This study was carried out on behalf of CBI by Autentika Global.

Please review our market information disclaimer.

Search

Enter search terms to find market research