Entering the European market for dried mango

Quality is paramount for a smooth entry into the European market. The use of modern drying technologies can significantly improve quality and consistency. Food safety certification helps to establish trust with European buyers. Sustainable and responsible production provides additional advantages for emerging suppliers. South Africa, Burkina Faso and Ghana are the leading competitors for dried mango.

Contents of this page

1. What requirements and certifications must dried mango comply with to be allowed on the European market?

General information on buyer requirements for processed fruit and vegetables is given in our study about buyer requirements on the European processed fruit and vegetable market. The sector level requirements will be analysed further on the product level for dried mango.

What are mandatory requirements?

Dried mango sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. Only approved additives are allowed. Food products must conform to maximum levels for harmful contaminants, such as bacteria or viruses, pesticide residues and heavy metals.

A phytosanitary certificate is required for the import of fresh and frozen mango into the EU from third countries, other than Switzerland. However, this does not apply to dried mango, according to Regulation (EU) 2019/2072.

The common requirements regarding contaminants in dried mango relate to the presence of pesticide residues, sulphites and sulphur dioxide. If a product contains more contaminants than allowed, it will be withdrawn from the market. These cases are reported by the European Rapid Alert System for Food and Feed (RASFF).

An example of an incident related to dried mango is a market withdrawal notification from Denmark of a shipment of dried mango from Thailand. The notification was issued in March 2021 because of overly high sulphur dioxide (E220) content. The detected level was 140 mg/kg – ppm, while the permitted maximum was 100 mg/kg – ppm.

Contaminant control in dried mango

The EU places strict controls on contaminants in food, as per Regulation (EU) 2023/915 on maximum levels for certain contaminants in food. The most common requirements regarding contaminants in dried mango are related to the presence of pesticide residues, microbiological organisms, preservatives and food additives.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products and it publishes a list of approved pesticides that are authorised for use. In 2022, the European Commission approved 27 new implementing regulations that modified this list through new approvals, extensions and other changes.

An example of a pesticide-related incident related to dried mango is a border rejection notification by Finland. Finish authorities reported a shipment of dried mango from South Africa. The notification was issued in June 2022 because of the presence of the unauthorised pesticide residue Methamidophos. While fresh mango imports are affected by Commission Regulation (EU) 2020/749 that sets the maximum permissible level of chlorates to 0.3, dried mango imports are not covered by this regulation.

Microbiological contaminants

The presence of very low levels of salmonella and E. coli in ready-to-eat or processed foods, including dried mango, is an important cause of foodborne illness. Dried mango processors should consider salmonella and E. coli as major public health risks in their hazard analysis and critical control points (HACCP) plans. An outbreak of non-typhoid salmonellosis with severe clinical presentation in Norway in 2018 and 2019 was linked to microbiological contamination of exotic dried fruits.

Mycotoxins

Mycotoxins are toxic compounds produced by moulds and fungi, which can contaminate dried mango. The level of aflatoxin B1 in dried mango must not exceed 5 μg/kg and the total aflatoxin content must not exceed 10 μg/kg. These levels apply to dried mango subjected to sorting or other physical treatment. Stricter limits of 2 μg/kg (aflatoxin B1) and 4 μg/kg (total aflatoxins) apply if dried mango is used as only an ingredient, according to Annex 1 of Regulation (EU) 2023/915.

Product composition

European authorities can reject products if they have undeclared, unauthorised or too high levels of extraneous materials. There is specific legislation for additives and flavourings, that lists which E numbers and substances are allowed to be used. Authorised additives are listed in Annex II to the Food Additives Regulation.

Conventionally dried mangoes can be produced with a sulphite treatment. Sulphites are used as an antioxidant to prolong shelf life and retain the intense bright yellow colour of dried mangoes. Potato starch is also used as an additive to improve the drying process and keep dried mangoes soft. Sugar or concentrated fruit juice is also used in the production of dried mangoes infused with sweeteners.

Sulphur dioxide and sulphites are also considered allergens under Regulation (EU) No. 1169/2011. Therefore, for prepacked foods, their presence must be indicated on the label, by its full name, where the level exceeds 10 mg/kg or 10 mg/L (expressed as SO2). Danish authorities recalled from consumers a shipment of dried mango from Vietnam because of undeclared sulphites in March 2022.

A second frequent problem has to do with the excessive or undeclared content of food colours. Typical examples include the colouring E110 – Sunset Yellow, which is used to artificially improve the colour of dried mangoes.

Tips:

- Follow the Codex Alimentarius Code of Hygienic Practice for Dried Fruits (PDF). For dried mango, it is particularly important to control the occurrence of insects and other parasites.

- Read more about MRLs on the European Commission website on Maximum Residue Levels. To be prepared for changes in the MRLs, read the ongoing reviews of MRLs in the European Union.

What additional requirements do buyers often have?

Quality requirements

Dried mango quality is generally determined by the allowed percentage of defective produce, by number or by weight. The industry can use many criteria for quality, but some of them, such as taste and odour, are subjective. Good quality dried mango should have a uniformly soft and pliable texture without any hard or sticky parts. The exterior of the fruit should be smooth and not stick together in clumps.

The EU does not have specific quality standards for dried mango. The most common standard used, is the dried mango standard (PDF) published by the United Nations Economic Commission for Europe (UNECE). The basic quality criteria for dried mango can be found in Table 1.

Table 1: Common criteria defining dried mango quality

| Presentation |

|

| Sizing (optional) | Size is determined by the diameter of the widest part, or length of pieces |

| Variety | Kent / Keitt / Edward (or others) |

| Colour | Uniform golden yellow to orange, without spots or browning |

| Flavour | Naturally sweet, typical mango flavour, no bitterness |

| Odour | Aroma of fresh mangoes, free from off-flavours and odours |

| Texture | Chewable: firm but not hard |

| Moisture content | Water content is typically < 15.0% for untreated dried mangoes to allow for a long shelf life Between 15% and 35% for dried mangoes treated with preservatives or preserved by other means Products between 30% and 35% should be labelled as soft fruit/high moisture. |

| Quality classes (optional) | Determined by the allowed percentage of defects. Dried mango is classified into 3 classes: “Extra” Class, Class I and Class II. |

Source: Autentika Global, 2023

Although softness is not officially defined in the UNECE standard, it is an important quality trait. Many consumers find it more difficult to chew dried mangoes. Another differential in quality terms is the presence or absence of a sulphuring process that is used to preserve the colour of the fruit by preventing enzymatic browning. However, sulphuring leaves sulphite residues on and in the product, which are problematic because they are classified as an allergen. Sulphuring also influences water content and softness of dried fruit.

Table 2: Maximum water content in dried fruit products

| Maximum water content without sulphuring | Maximum water content with sulphuring | |

| Mangoes | 15% | 15-35% |

| Apricots | 20% | 25% |

| Papayas | 18% | 18-25% |

| Pineapples | 20% | 20-44% |

Source: Autentika Global, COLEACP (PDF), 2023

Food safety certification

Almost all European food importers require food safety certification for dried mango. Well-established European importers will not work with you if you cannot provide the type of food safety certification that they want. Most European buyers will ask for Global Food Safety Initiative (GFSI) recognised certification. For dried mango, the most popular certification programmes, all recognised by GFSI, are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Make sure to check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, certain retailers may prefer one certification over another. Major buyers will usually visit/audit production facilities before starting a business relationship.

Corporate social responsibility (CSR) certification

Companies have different requirements for corporate social responsibility. Many importers will ask you to follow their own specific CSR code of conduct. Most European retailers have their own codes of conduct, such as Lidl (PDF), REWE, Carrefour (PDF), Tesco and Ahold Delhaize.

Other companies will insist on following common standards such as the Sedex Members Ethical Trade Audit (SMETA) standard. Sedex membership alone (without an audit) is actually not very complicated and not very expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Sustainability certification

2 commonly used sustainability certification schemes are Fairtrade and Rainforest Alliance. Fairtrade international developed a specific standard for prepared and preserved fruit and vegetables for small-scale producer organisations. Amongst other criteria, this standard defines a Fairtrade Minimum Price (ex works) for certified mango for drying from Southern Asia ($0.28/kg), Central America, Mexico and the Caribbean ($0.20/kg) and Western Africa (€0.14/kg).

A group of mainly European companies and organisations formed the Sustainability Initiative Fruit and Vegetables (SIFAV). They aim to reach 95% sustainable imports of fruits and vegetables from Africa, Asia and South America in 2025. Sustainability certification in the dried mango trade was once used to target niche markets (such as Fairtrade), but sustainability claims and certification are now a strong trend in the mainstream market.

Packaging requirements

Dried mango is packaged in such a way that protects the produce properly. A common type of export packaging is plastic bags or plastic liners placed in carton boxes of different sizes. Packed products should be transported on EURO pallets (80x120 cm) and further transported in containers. Twenty-foot containers may contain 1,600 cartons of 12.5kg or 2,000 cartons of 10kg. For the retail market, dried mango is generally packaged in resealable pouches or simple transparent plastic containers.

Dried mango does not require a special temperature during transport or storage. However, extremely low or high temperatures should be avoided. At high storage temperatures, fruit sugar particles may form on the surface of the product, hardening and discolouring them.

Labelling requirements

The product name must be shown on the label. It is common for export package labels to include the name of the variety, crop year and type of drying (such as “sun dried” or “tunnel dried”). Information about bulk packaging has to be given either on the packaging or in accompanying documents. Bulk package labels must contain the product name, lot identification, name and address of the manufacturer, packer, distributor or importer, and storage instructions.

For retail packaging, product labelling must be in compliance with the EU Regulation on the provision of food information to consumers. Sulphur dioxide and sulphites must be indicated as potential allergens if they are used as preservatives and are present in concentrations of more than 10 mg/kg in terms of the total SO2. In addition to this regulation, all food in retail packs in Europe must be labelled with an indication of origin.

Tips:

- Consult an example of a technical sheet with dried mango specification (PDF) from Peru’s Chavin Dried.

- Read more about transport and storage requirements for dried fruit on the Cargo Handbook website.

- Follow news on sustainable trade from the Sustainable Trade Initiative (IDH) for new ideas.

- Consult the foodstuffs labelling and packaging advice from the European Union’s Access2Markets portal.

- Perform a self-assessment with the help of BSCI manuals from the BSCI website.

What are the requirements for niche markets?

Organic dried mango

To market dried mango as organic in Europe, the fruit must be grown using organic production methods that conform to European legislation. Growing and processing facilities must be audited by an accredited certifier before you may put the European Union’s organic logo on your products, as well as the logo of the standard holder (for example, Soil Association in the United Kingdom, Naturland in Germany or agriculture biologique in France).

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation defining imports of organic products from third countries.

Ethnic certification

If you want to focus on the Jewish or Islamic ethnic niche markets, consider implementing Halal or Kosher certification schemes. Several organisations provide Kosher certification in Europe, such as Kosher London Beth Din (KLBD) that provides guidelines on how to obtain the certification. Halal certification in Europe can be obtained via certifying bodies, such as Halal Certification Services (HCS) that provides certification services.

Profood International Corporation is the largest Philippine-based dried fruit producer. It offers a wide range of Halal-certified and Kosher-certified dried mango products and brands. Bangkok-based Doikham exports Halal-certified dried tropical fruit, including dried mango. The European Muslim community is predicted to grow from the current 4.9% of population to more than 7% by 2050, according to a recent report published in August 2023.

Tips:

- Consult the Standards Map database for information on a range of sustainability labels and standards.

- Read our study on trends on the European processed fruit, vegetables and edible nuts markets for an overview of the developments of the sustainability initiatives in the European market.

- Familiarise yourself with sustainability standards by reading the Basket of Standards (PDF, by SIFAV).

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH and control bodies and authorities for equivalence.

2. Through which channels can you get dried mangoes on the European market?

In Europe, dried mangoes are used as a snack and as ingredients in the food processing industry. Approximately 70-80% of the total imported dried mango in Europe is re-packed and sold as a snack through the retail channel. The remaining 20-30% is used as an ingredient in the food processing industry and in the food service segment.

How is the end market segmented?

Figure 1: End-market segments for dried mango in Europe

Source: Autentika Global

Snack segment

Almost four-fifths of imported dried mango in Europe is consumed as a snack. Consumption of dried mango as a snack is driven by consumer demand for healthier but tasty snacking options. According to Grand View Research, Europe is expected to witness an annual growth rate of 6.0% in 2023-2030. This growth is driven by the high prevalence of obesity and lifestyle diseases, prompting individuals to adopt healthier eating habits. There is a strong demand for snacks with lower calories, reduced sugar, healthier ingredients and functional benefits.

The snack segment is primarily served by packing companies, that repack and brand imported bulk dried mangoes. Many of those companies pack dried mango under private labels for the European retail chains. The market is concentrated and a relatively small number of companies in each European country supplies the snack segment. For examples of leading dried mango brands in Europe, consult the market analysis part of this study.

“No sugar added” and “free from preservatives”, are the main trends influencing the snacking segment. Dried mango is considered an attractive exotic flavour, it has a good sugar/acid ratio (not too sweet) and provides minerals, vitamins, phytonutrients and fibre. Consumers opting to satisfy their need for something sweet, perceive sugar infused tropical fruit as less “unhealthy”, compared to chocolate and other sweet snacks.

Ingredient segment (food processing segment)

The food processing segment is smaller. This is explained by the relatively high prices of dried mangoes compared to most other dried fruit. The biggest demand for dried mango in this segment comes from:

- The breakfast cereal industry is a large user of sugar infused and candied mango. Dried mango can be shredded or diced and added to cereal mixes in shredded, diced or sliced form.

- The confectionery industry mainly uses dried mango pieces to produce sweet snacks. New products increasingly use dried mango coated or half dipped into chocolate. Freeze-dried mango pieces are also used as crispy bits in some confectionery products.

- The bakery industry uses pieces of dried mango in muffins, pies, cookies and cakes. The industry is still an important user of candied mango cubes. Many European specialties that use dried fruit can be made in versions with dried mango, such as a tropical version of Italy’s Christmas specialty Panettone.

- Fruit bars are increasingly offered in many varieties. Organic fruit bars are on the increase (especially in Germany). In some fruit bars, naturally dried mango is used as the main fruit ingredient, while other bars consist mainly of dehydrated fruit puree.

- The dairy industry uses dried mango as an ingredient in fruit preparations for ice creams, smoothies and fruit yoghurts. It is used to flavour cheeses, such as Stilton with mango or Wensleydale with Mango.

Figure 2: Wensleydale cheese with dried mango

Source: Wensleydale with Mango and Ginger by nigelpentland for Open Food Facts licensed under CC BY-SA 3.0

Tips:

- Consult industry trade publications such as SF&WB, Confectionery News and Bakery & Snacks.

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for your dried mango within the food ingredient segment.

- Visit or exhibit at ISM Cologne, a leading European trade fair for sweets and snacks, to explore opportunities in the dried fruit snack segment.

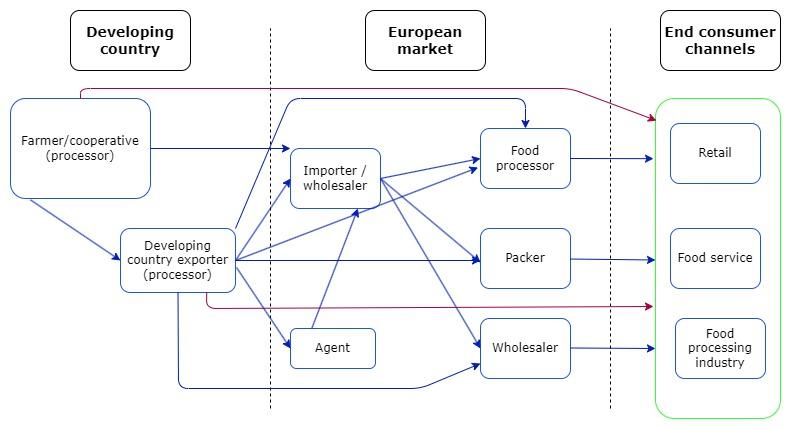

Through what channels does dried mango end up on the end-market?

The most important channel for dried mango in Europe is represented by specialised dried fruit importers. There are also several alternative channels, such as agents, food processors or food service companies.

Figure 3: European market channels for dried mango

Source: Autentika Global

Importer / Wholesaler

In most cases, importers act as wholesalers. They very often sell dried mango to packing companies who pack it into consumer packages. Some importers are also equipped with processing and packing equipment, so they can supply retail and food service channels directly. However, many dried fruit brands import dried mango directly. Importers usually have a good knowledge of the European market and they monitor the situation in dried mango producing countries closely. Therefore, they are your preferred contact, as they can give you timely information about market developments and provide practical advice for your exports.

The position of importers and food manufacturers is under pressure by retail. The higher requirements from the retail industry determine the supply chain dynamics from the top down. This pressure is translated into lower prices, but also into added value aspects such as “sustainable,” “natural,” “organic,” or “Fairtrade” products.

Notable German dried tropical fruit importers/wholesalers are Heinrich Brüning and Zieler & Co. J.O. Sims is a UK-based importer and distributor of dried mango. Danish Berrifine is a family-owned trader, processor and importer of dried mango. Italy’s Blife specialises in the trade and wholesale of dried mango from Burkina Faso. The Dutch Berrico Food Company is also a player in the dried mango market. Berrico representatives visited mango processors in Burkina Faso in April 2023 under the auspices of the CBI-backed West African Mango Processed project.

Packer

For new suppliers, the challenge is to establish long-term relationships with well-known dried fruit packers, as they usually already work with selected suppliers. As dried mango is still seen as a non-essential purchase by many European consumers, being price competitive will help establish new relationships.

Agent/broker

Agents act as independent companies that negotiate on behalf of their clients, and as intermediaries between buyers and sellers. Typically, they charge commissions of 2–4% of the sales price for their intermediary services. For most developing country suppliers, it is very challenging to participate in the demanding private label tender procedures. For these services, some agents, in cooperation with their dried mango suppliers, participate in procurement procedures put out by the retail chains.

Examples of dried mango agents in European markets include Kenkko (the United Kingdom), Belfrudis (Belgium), MW Nuts (Germany), Cardassilaris Family (Greece) and QFN Trading & Agency (the Netherlands).

Retail

Retailers rarely buy directly from developing country exporters. A new development is the polarisation of the retail sector into discounters and high-level segments. Until recently, naturally dried mango was mainly offered by high-end retail segments. However, dried mango is now also offered by several large European discounters (such as “Simply Nature” dried mango by ALDI or “Alesto” dried mango and dried pineapple by Lidl).

Foodservice

The foodservice channel (hotels, restaurants and catering) is usually supplied by specialised importers (wholesalers). The foodservice segment often requires specific packaging of 1-5kg of dried mango, which is different from bulk or retail packaging packs. Dried mango is not frequently sold through the foodservice channel.

What is the most interesting channel for you?

Specialised importers are the best contact for exporting dried mango to the European market. This is especially relevant for new suppliers, as supplying established brands or the retail segment directly is very demanding and requires a lot of quality-related and logistical investments. However, for the well-equipped and price competitive producers, packing for private labels can be an option. Moreover, in order to have full control of the process, it is easier to pack dried mango for the snack segment within Europe.

Tips:

- Search the members list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM), to find buyers from different channels and segments.

- Monitor snack market developments by visiting the news section of the European Snack Association.

- Watch a 2023 Deutsche Welle documentary for more insight into the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

3. What competition do you face on the European dried mango market?

Which countries are you competing with?

Trade in fresh mangoes is more regional in scope, while dried mango trade is more globally oriented. The main competing countries for the exportation of dried mango to Europe are Burkina Faso, South Africa, Ghana and Côte d'Ivoire. Burkina Faso and Ghana have become major hubs for processed dried mango, according to a recent ITC report (PDF). Other leading competitors include the Philippines, Thailand, Mexico and Peru. Emerging suppliers include Ecuador, Mali, Mozambique (represented by the company Afrifruta), Senegal, Kenya, India and Pakistan.

Source: Autentika Global, based on industry estimates

Burkina Faso: Supplier of organic dried mangoes

National dried mango production amounted to 3,316.57 tonnes, according to a recent report (PDF) from Burkina Faso’s export promotion agency Apex. Production was expected to reach 5,000 tonnes in 2021, but the crop faced pest issues in 2021/22. The centre of the industry is located in the Hauts-Bassins region, which produces more than 70% of mango and handles 70% of processing at the national level.

The country harvested around 300,000 tonnes of fresh mango (according to Le Monde) in 2021, or around 11% of the total West African production. Fresh mango production is closer to 150,000 tonnes, according to a recent ITC report (PDF) published in 2022. Some 29,000 tonnes are used as raw material for processing into dried mango. The main production zone for mangoes covers Orodara, Banfora and Bobo-Dioulasso. According to the Association of Mango Producers of Burkina Faso, the country has almost 75 mango-drying facilities.

Dried mango exports amounted to 2,716 tonnes in 2018, 2,716 tonnes in 2019 and 2,900 tonnes in 2020, according to a recent report (PDF) (in French) on the industry. It is estimated that Burkina Faso produces between 3,000 and 3,500 tonnes of dried mangoes each year. Most are exported to Germany and the Netherlands.

Mango growers are grouped within the Association Interprofessionnelle de la Mangue du Burkina (APROMA-B), which assembles organisations active in 3 links of the value chain: UNPM-B (production), PTRAMAB (processing) and APEMAB (marketing). The government authorised APROMA-B to import biopesticides to fight against fruit flies, in a decision adopted in March 2023. In the 2021/22 campaign, attacks by fruit flies caused the premature fall of mangoes in orchards and the loss of more than €0.6 million in exports.

Several international projects, some including CBI participation, have supported the mango sector. The ongoing Dry More project is to develop one or more alternative dried products that help dried mango processors to produce all year round. Yet, the country is currently in the midst of a political and economic crisis. In 2022, with at least 10,000 people killed and more than 2 million displaced, the army seized control in a bid to combat the jihadists. Civilians are increasingly being targeted by non-state armed groups in 2023. This may affect dried mango exports.

South Africa: Leader in African dried mango production

South Africa has been the leading dried mango producer in Africa for many years. South Africa’s mango growers are represented by South Africa’s Mango Growers’ Association (Samoa). Samoa maintains a current list of mango processors in the country. South Africa’s dried mango production totalled 14,744 tonnes in 2022/2023, up from 13,463 tonnes in 2021/2022, according to industry statistics (PDF).

South Africa’s mango producing regions are mainly situated in the Northeastern part of the country, with Limpopo as the leading producing region, followed by Mpumalanga. There are several mango cultivars grown in South Africa but Kent, Keitt and Tommy Atkins are mainly used for drying.

Ghana: Growing supplier of dried mangoes

Ghana is the third-largest supplier of dried mangoes to Europe and a large supplier of naturally dried pineapples. Export of dried mangoes from Ghana to Europe is estimated to be around 1,500 tonnes. The leading varieties used for drying are Kent and Keitt. The largest quantities are exported by the Swiss – Ghana company HPW (read more about this company in the chapter below).

Annual mango production is estimated at 99,000 tonnes, with an average yield of 12-15 tonnes per hectare. Commercially significant mango production is 68,000 tonnes, according to a recent ITC report (PDF). Some 25,000 tonnes of fruit are processed into around 2,500 tonnes of dried mango. The average fresh-mango-to-dried-fruit product conversion rate is 10% in Ghana, according to a value chain analysis of the Ghanaian fruit sector (PDF).

The Philippines: Emerging supplier

The Philippines produced 741,700 tonnes of mango in 2021, according to the Philippines Statistics Authority. It supplies about 10% of the world’s demand. The Philippines is home to 7 million mango trees. Most dried-mango processors are based in Cebu. Dried mangoes are the most valuable mango export of the Philippines.

Around 85% of the local total dried mango production is exported to key markets, such as the United States, China, Japan, South Korea and other Asia Pacific countries. Exports to the United States reached more than 3 thousand tonnes in 2020. The United States and Europe have switched positions as the most important dried mango export destination for Philippine-grown mangoes. The Philippines produces large quantities of sweetened dried mangoes which are mostly exported to other Asian countries.

Thailand: The leading supplier of sweetened dried mango to Europe

Thailand is the leading Asian producer of dried mango. Most Thai-produced dried or dehydrated mango is sweetened or candied, but over the last couple of years, many processors increased the production of naturally-dried mango without added sugar. In 2022, dried mango export from Thailand was around 5,000 tonnes and most was exported to the United States, followed by Europe. The leading mango variety used for drying in Thailand is Nam Dok Mai.

Thailand is the world’s second-largest exporter of candied (sugar preserved) fruit (HS code 200600), after China. Exports of candied fruit totalled more than 61,000 tonnes in 2022. These types of products are often referred to as “dehydrated fruit” on the European market. The European breakfast cereal industry and producers of fruit snacks use significant quantities of sweetened dried mango from Thailand.

Thai producers’ promotional activities are supported by the Department of International Trade Promotion (DITP) of the Ministry of Commerce. The Thai trade code for dried mango was 08045020002 until 2021 (08045022000 as of 2022). The biggest European importer of Thai dried mango in 2022 was Norway with 207.1 tonnes, according to the Tradereport portal of the Thai Ministry of Commerce.

Source: Autentika Global, Tradereport (Ministry of Commerce, Thailand)

Côte d'Ivoire: Producer of quality dried mango

Côte d'Ivoire is the largest exporter of fresh mangoes in West Africa. Commercial production is concentrated in the northern regions. Annual mango production is estimated at 150,000 tonnes. Commercially significant mango production is 55,000 tonnes, according to a recent ITC report (PDF) from 2022. Some 25,000 tonnes of fruit are processed into dried mango.

Between 2017 and 2021, dried mango processing in the country rose from 89 tonnes to 593 tonnes, representing an average annual growth of 66%. Dried mango is the main focus of the mango processing sector in Côte d'Ivoire, accounting for 67% of the total volume of mangoes processed. The country had 24 dried mango processing units in 2021 (PDF). The size of dried mango processing units varies, from the smallest with less than 1 tonne per year of dried mango production capacity to the largest with more than 100 tonnes per year.

Activities in the national mango sector are partially financed by the country’s Interbranch Fund for Funding and Agricultural Advice (FIRCA). The interests of mango growers are represented by the Federation of Mango Producers of the Côte d'Ivoire (FEPROMACI), by the growers’ organisation (OBAM-CI) and the central organisation of fruit growers and exporters (OCAB). Côte d'Ivoire is also attempting to improve the competitiveness through investments channelled to the mango and pineapple segments by the government’s PCCET project (in French).

Which companies are you competing with?

Some of the large, dried fruit processors in Africa are the result of investments by European companies or organisations. This is unlike the situation in Asia and South America, where dried fruit industries are mainly established by local investors. A quick overview of some leading companies per supplying country is given below.

Burkinabe companies

Timini is currently the largest producer of dried mangoes in Burkina Faso. Timini is a joint venture company created in 2014 by local company Fruiteq, and South African firms MPAK Pty and Westfalia. They have the capacity to produce 2000 tonnes of dried mangoes per year. They are BRCGS, organic and Fairtrade-certified.

Other notable locally-established dried mango processors and exporters include Fantic, Ranch Koba, Association Wouol, AgroBurkina, Sanle Sechage, Mango-So, Burkinature and Fruiteq. The Dutch company Tradin Organic closely cooperates with a drying facility in Banfora while the German company EgeSun sources dried mangoes from Groupe Waka. Rose Éclat is a dried fruit manufacturer that exports 90% of its production to Europe.

The Swiss-owned company Gebana Burkina Faso (formerly Gebana Afrique) sourced organic and Fairtrade-certified mangoes from local producers and processed them in their own facility in Ghana. Gebana was active for twelve years in Burkina Faso but the local firm went bankrupt. However, in October 2023, Gebana announced the successful collection of funds for the rehabilitation and fresh start of operations of Gebana Burkina Faso.

South African companies

Westfalia Fruit is the largest producer of dried mangoes in South Africa. Westfalia established its own network of subsidiaries around the world including in the UK, the Netherlands, Austria, Portugal and France. To increase and secure production, Westfalia also invested in processing facilities in West Africa, such as Timini in Burkina Faso. Westfalia dried mango processing facilities are BRCGS certified. They produce conventional dried mango, mostly packed and exported in bulk packaging.

Other South African dried mango producers include Cape Dried Fruit Packers, Taste Africa Foods, Cecilia’s Farm, Bavaria Fruit Estate, BAOBAB Value Adding (part of Blydevallei), Landman Dried Produce and Cape Mango.

Ghanaian companies

The largest share of production and export of dried mangoes in Ghana is organised by the Swiss company HPW. Its local subsidiary is the BRC-certified HPW Fresh & Dry Ghana plant, the largest mango and pineapple processor in Ghana, and a major supplier of dried mangoes to Europe. The HPW company joined SIFAV and created a Special Initiative on Pineapple Production in Ghana. During the 2 mango seasons, from January to February and from April to August, HPW produces 1,200 tonnes of dried Keitt and Kent mangoes.

In general, the company’s largest markets are in the largest countries in Europe: the UK, Germany and Italy. In addition to exporting dried mangoes in bulk, HPW has created innovative dried mango snacks. A few years ago, HPW created 100% dried mango bars, and they recently created 100% dried mango and pineapple fruit rolls.

Bomarts Farms today produces more than 500 tonnes of dried fruits. Bomarts established a partnership with the Swiss company Yourharvest. Other dried mango suppliers include Blavo mango, the European-Ghanaian organic fruit company Integrated Tamale Fruit Company (part of the African Tiger group) and Hendy Farms.

Wad African Foods exports organic and Fairtrade dried mango and other dried tropical fruits to Switzerland, Germany and Italy with the help of Wadco. Pure and Just Food offers organic dried mango from eastern Ghana under its Yvaya Farm brand. S’Fia Farms & Agro-Processing manufactures 100% natural dried mango slices.

Filipino companies

Several large firms lead the dried mango industry: Profood International Corporation, M. Lhuillier Food Products and FPD Food International. Profood exports some quantities under their own retail brand to Europe. Other processors include R&M Preserves and Celebes (also an important coconut processor). 3 more important firms are Amley Food Corporation, Martsons Food Corporation and Cebu Legacy Marketing Corporation.

Thai companies

GCF International is one of the largest and oldest producers of dried mango in Thailand. Over the years, GCF International developed into the largest Thai dried fruit exporter, reaching almost 50 export destinations around the world. Another major player in Thailand’s dried mango industry is Bangkok-based Siam Agro-Food Industry (SAICO), a subsidiary of the Thai Pineapple Canning Industry Corporation (TPC). Ace Star International is an important supplier of dried tropical fruit chips.

Other examples of Thai dried mango companies are Unity Food, TAN TAN, Smile Fruit, Chinwong Food Company, Fruit House, Apple's Island, Fruittara, Nanafruit, KP Fruits, Thaweephol Samroiyod, Ampro Intertrade, Chin Huay, S.Ruamthai and V & K Pineapple Canning.

Ivorian companies

In April 2021, HPW celebrated the official opening of a subsidiary production facility HPW Fresh & Dry in Côte d'Ivoire dedicated to the production of organic premium dried fruit. The plant can process 800 tonnes of premium mangoes, pineapples, coconuts and bananas. The factory has been successfully certified BRC. 2 more local players that export to Europe are Ivoire Organics and Les Jardins de Koba. Yao Tropico is setting up the country's first state-of-the-art mango drying facility.

Layaki Bio is an Ivorian agribusiness company specialised in the processing of mangoes, bananas and pineapples into natural dried fruits. Ivoire Bio Fruits offers certified organic fresh and dried fruits to Europe, including dried pineapple and mango. The company was set up in late 2021 with the help of an investment from Comoé Capital. Stepa and 2Saisons are 2 new dried mango processors that were due to start production in 2023.

Tips:

- Visit the website of the South African Mango Growers Association (SAMOA) to see mango processors.

- Read the CBI value chain study for processed fruits from Burkina Faso, Côte d'Ivoire and Mali to better understand competition from Burkina Faso.

- Consult WACOMP’s cost-margin analysis (PDF) of dried mango production in Ghana to understand the competition.

- Monitor events in the highly competitive Thai dried fruits industry through free market reports from the prominent local industry Ace Star International.

- Keep an eye on free tropical fruit market updates from UK-based Chelmer Foods and follow free news updates on exotic fruit markets published by Fruitnet.

- Keep in touch with the latest news from African fruit markets through a free news service in French from Commodafrica.

- Follow developments in the Peruvian and global frozen and fresh fruit markets by following commercial updates and market reports from ADEX (in Spanish).

4. What are the prices for dried mango?

Calculating margins based on final retail prices for dried mangoes provides only a very general overview of price structure. The CIF price is estimated to represent approximately 25–30% of the retail price of dried mangoes. The most common end-market prices in Europe range from €20/kg to €30/kg. If dried mangoes are used as an ingredient, it is even more complicated to estimate the added value, due to the number of different ingredients.

The price of Thai dehydrated mango (dice) ex works UK ranged between €4.6/kg and €5/kg for most of the period between late 2020 and early 2022. Spot prices gained momentum and topped €5.5/kg in July 2022. Since then, the price has been decreasing and averaged around €4.8/kg in October 2023. FOB prices for natural dried mangoes usually range between €7 and €9 per kilo, while the price for most sugar-infused dried fruit from Thailand was between USD 3/kg and USD 5/kg (€2.6–€4.3/kg).

Dried mangoes from the Philippines and South America (Mexico, Peru and Ecuador) usually bring higher prices, compared to African dried mangoes. Depending on origin and quality, prices for African dried mangoes differ widely. For example, South African dried mangoes are usually higher priced than those from Burkina Faso.

Table 3: Dried mango retail price breakdown

| Steps in the export process | Type of price | Price breakdown | Example (€/kg) |

| Production of fruit or vegetables | Raw material price (farmers’ price) | 5% | 1.6 |

| Handling, drying, packing and selling bulk product | FOB or FCA price | 27% | 8 |

| Shipment | CIF price | 28% | 8.5 |

| Import, handling, storing and bulk wholesale | Wholesale price (value added tax included) | 50% | 15 |

| Retail packing, handling and selling | Retail price (for average packaging of 250g) | 100% (retail price as seen in stores) | 30 |

Source: Autentika Global 2023

Autentika Global and updated by M-Brain carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research