The European market potential for dried mango

In the medium to long term, the European market for dried mango is expected to show a stable volume growth of 3-4% annually. This growth is likely to be driven by changes in the consumption patterns of European consumers, including the rising demand for healthier snacking options and a decrease in the consumption of snacks containing sugar. The United Kingdom, Germany, France, the Netherlands, Switzerland and Italy offer the best opportunities for developing country suppliers.

Contents of this page

1. Product description

Dried mango is a product prepared from the sound and mature ripe fruit of varieties of the Mangifera indica species, processed by drying. Mango is a highly perishable fruit that is harvested seasonally and as such it has a variable year-round supply. Specifically, this means there is an oversupply of fresh mango during harvest seasons and that results in lower prices during harvest season.

In mango producing regions, a lack of fruit collecting or processing facilities, inadequate transportation and poor infrastructure can lead to high post-harvest losses. Even long distances between farms and buyers can cause product spoiling. Mango drying is a simple and effective method of food preservation that solves some of these problems. In tropical and sub-tropical countries, solar energy is often the most obvious and affordable way of drying mango fruit.

It takes between 12 to 15 kg of fresh mangoes to produce 1 kg of dried fruit, although some estimates put the conversion rate closer to 10%. There are many different types of dryers available. The tunnel dryer using heat exchangers in combination with a biomass boiler is seen as a good choice. Mango can be dried by the sun, but is mostly produced by other methods of dehydration, such as tunnel drying. For a good overview of the advantages and disadvantages of different types of mango dryers consult a 2023 COLEAD report on the technical and economic feasibility of dried mango production.

According to product specifications, dried mango can generally be produced as natural or sweetened. These categories contain additional subcategories such as type of cut (cubes, slices, cheeks, etc.), use of preservatives (sulphites) and processing method.

- Natural dried (air-dried) mangoes – are produced without additional sugar. This type is the most popular format in Europe. Air-dried mango is often produced with the addition of sulphites. Sulphites are used as a preservative to prolong shelf life and to retain the intense bright yellow colour. If dried mangoes are produced as organic, sulphites cannot be used. Nowadays, more consumers increasingly want to avoid sulphites. This study focuses its attention on natural dried mangoes.

- Sweetened dried mangoes – are produced with sugar addition. They are not sold in Europe in high quantities. In Asia, it is the other way around, with sweetened dried mangoes accounting for most retail sales. The typical amount of sugar in dried mangoes is around 10%. This product should not be confused with candied mangoes where fruit cuts are preserved by sugar. This is a different type of product (candied fruit) with a 50-70% sugar content.

- Freeze-dried mangoes – are obtained by freezing mango fruit at very low temperatures, dehydrating the mango pieces and creating a very crisp product with a distinctive flavour. This is a more niche category that is more present in the USA and is primarily supplied by China. Freeze-dried mangoes are more expensive to produce.

Figure 1: Dried mango pieces

Source: Mangue séchée by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0.

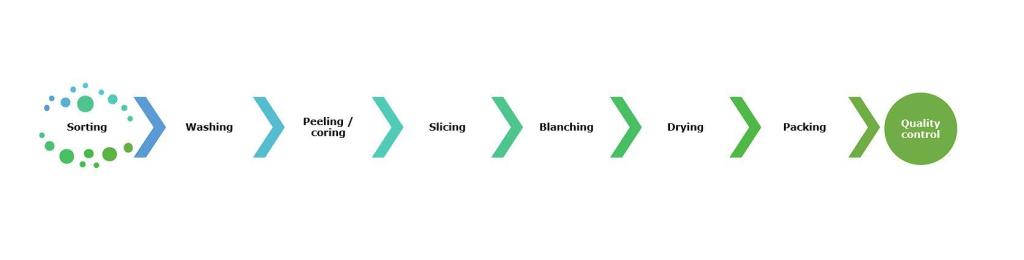

Dried mango processing can vary according to the country and processor, but a more detailed breakdown generally includes the operations described below. For a more in-depth understanding, consulting specialised resources such as the Handbook of Mango Fruit: Production, Postharvest Science, Processing Technology and Nutrition might be beneficial.

- Selection of fresh mangoes – the quality of dried mango depends on the quality of the harvested fruit. Choose whole, plump mango fruit without mechanical damage, free of pests and fresh in appearance. Fruit with a higher dry matter content will give a better final product. Processing is easier if the mango has a small and flat core and less fibre.

- Washing – practices vary by region. After both ends of the mango are trimmed, the fruit is washed manually in water or put on the conveyor belt that leads to a washing machine. Fruit is soaked and washed to remove any dirt and pesticide residue.

- Peeling and coring – peeling and slicing can be done manually on tables or by machine. Mango is peeled because its skin contains tannin which causes mango browning and affects product quality. Machines can be equipped with a stoning device which can complete fruit peeling and de-stoning in 1 machine.

- Cutting/slicing – mango fruit is cut into uniform slices to prepare them for drying. To get a more uniform quality, mango is often cut lengthways into 8 to 10mm-thick slices.

- Blanching (a process of brief scalding) – helps to sterilise and fix the mango slice colour. After blanching at 70-80˚C hot water for 15 seconds, enzyme activity is inhibited.

- Drying – Blanched slices are placed onto drying trays that are placed on racks that can be moved to drying chambers or can be dried in a solar dryer. The trays should preferably be made of plastic mesh (metal trays cause food products, especially fruit, to discolour quickly) and coated with glycerine to prevent sticking. The chambers can be monitored for temperature and humidity. Hot air drying is a simple, low-cost method of drying. The slices can be flipped over during the process. To maintain the dry mango’s original colour without discolouration or darkening, a temperature of 80° is seen as the optimal drying temperature.

- Packing – dried mango slices are packed in sealed plastic or aluminium packaging bags to preserve ideal water content and soft texture.

Figure 2: Dried mango manufacturing process

Source: Autentika Global

For a good visualisation of the mango drying process, view a video of one such industrial line in operation in Asia and another video of a dried mango production line in Africa. The varieties Ameli and Kent are particularly good for drying.

Dried mangoes are used at home (for example, as a snack or cooking ingredient), out of the home (for example, in hotels, restaurants and other places) and in the food industry (for example, in bakery and confectionery products or in breakfast cereal mixtures).

Dried mangoes for snacking are usually sold in plastic bags or pouches and they are eaten as a healthy substitute for sweets, chocolate or crisps. This market is still developing, as the habit of eating dried mangoes as a snack is still relatively minor in Europe. In addition, dried mangoes are relatively expensive in comparison to other dried fruits.

Dried mangoes that are used as an ingredient in the food-processing industry are usually in the form of slices, chunks, diced pieces or granules. They are used as a sugar substitute and as a healthy seasoning.

This study covers general information regarding the market for dried mangoes in Europe that is of interest to producers in developing countries. The term “Europe” in this study refers to the 27 member states of the European Union (EU), plus the United Kingdom (UK), and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland).

There is no specific statistical international trade code (HS code) available for dried mangoes. This means there are no detailed statistics for the import of dried mangoes to Europe. Dried mango is statistically included in the same group as fresh tropical fruit products, under the code 08045000 (Fresh or dried guavas, mangoes and mangosteens). Therefore, all the quantitative data presented in this study is based on industry estimations, unless specified differently.

2. What makes Europe an interesting market for dried mango?

European imports of dried mango increased by an estimated 4-6% (in volume) in the 2019-2022 period. According to industry estimates, the quantity of imported dried mangoes was around 6,000–7,000 tonnes in 2022. Virtually all imports from outside Europe come from developing countries. The term developing countries in this report is used to denote countries that are listed on the OECD-DAC list of ODA recipients for 2022 and 2023 flows PDF). The annual growth rate is expressed as the cumulative annual growth rate, or CAGR.

In the next 5 years, the European market for dried mango is likely to continue to increase, but at a somewhat lower rate of 3-4%. One of the main drivers behind the forecasted growth is health-conscious snacking, as consumers are shifting towards snacks that do not contain added sugars.

With the rapid pace of urbanisation and busy lifestyles, there is a growing preference for convenient and ready-to-eat products. This also bodes well for the dried mango market. Factors that are slowing the growth of dried mango demand include slow economic growth in European countries and higher than average inflation in Europe.

In 2022, according to industry estimates, the imported quantity of dried mango reached 9,000 tonnes. It is estimated that conventional dried mangoes account for around 70%, organic dried mangoes for around 25%, and sweetened dried mango for the remaining 5%. While organic mango has seen impressive growth in the European market, the cost-of-living crisis in many parts of Europe has negatively affected sales of organic products.

Internal European trade consists of simple re-exporting of imported dried mangoes, but a significant part consists of added-value trade, including operations such as retail packing and the use of dried mango as an ingredient in products, such as dried fruit mixtures, breakfast cereals, tea mixes, fruit bars and ice cream.

3. Which European countries offer most opportunities for dried mango?

The 2 main importers are Germany and the UK. 2 other important buyers are France and the Netherlands, followed by Switzerland and Italy. These countries all have large importing companies such as Besana in Italy, HPW & Gebana in Switzerland, and Farmers Snack and Seeberger in Germany who themselves distribute dried fruits in multiple countries.

Switzerland and the Netherlands are also important trade hubs for the re-export of dried mango to other European countries. The Scandinavian market is also showing growth in demand.

Source: Autentika Global estimate based on industry sources

Germany: A well-developed, mainstream market

Together with the United Kingdom, Germany represents roughly half of the European market for dried mango. Germany is a fast-growing market. It is estimated that German imports in 2022 were larger than those of the UK which used to be the largest market for dried mangoes in Europe. Until a few years ago, dried mangoes were mainly sold in specialised stores, but now they are also sold in mainstream supermarkets, including big discounters such as Aldi or Lidl. German dried mango sales are forecast to continue growing at a steady rate.

Annual imports are estimated to be close to 2,000 tonnes. Although precise data is not readily available, it is estimated that more than half of dried mangoes sold in Germany are of Burkinabe origin, followed by dried mangoes from other origins such as South Africa. Other suppliers include Ghana, India and Thailand, with relatively small quantities coming from South America.

Germany is a particularly attractive market for organic dried mango as the country is the largest European market for organic food. Moreover, sales of sugar-free and preservative-free dried mango are increasing. One of the market segments providing specific opportunities for suppliers of dried mango is the fruit bar segment. There is an increasing number of launches of fruit bars and similar snacks that contain dried mango. Examples include Yammbits, Alnatura and dm-drogerie markt. However, note that some fruit bars containing mango are produced from mango purees and not from dried mango.

Figure 4: Dried mango fruit bar with no added sugar, sold by German discounter Lidl

Source: Autentika Global

Recent consumer testing in Germany has shown that dried mango attributes, such as organic production, fair trade, cooperative and sustainable labelled flakes may offer new opportunities for farmers who aim for the export market. These testing results suggest that the organic and fair trade labels are a good marketing strategy to apply for dried mango exporters to Germany. However, these findings were based on a non-representative sample of consumers.

Significant quantities of dried mangoes in Germany are sold as private label. Those include labels such as Alesto (owned by discounter chain Lidl), REWE Beste Wahl (by REWE), dmBio (by dm-drogerie markt) and EDEKA (by EDEKA). Some examples of independent German dried mango brands are Seeberger, Farmer’s Snack, Kluth, Märsch and WeltPartner. Seeberger, Kluth and Farmer’s Snack import directly, but also buy from other traders in Germany and the Netherlands.

Figure 5: Dried mango pieces sold by German discounter Lidl

Source: Autentika Global

A large share of organic dried mango is sold under private label brands of specialised organic retailers, such as dm-drogerie markt and Alnatura. There are also smaller independent organic brands such as Rapunzel, Clasen Bio, Sunday Natural, Keimling, Morgenland and KoRo.

Figure 6: Dried mango pieces sold by German dm-drogerie markt

Source: Autentika Global

Sustainable sourcing has become very important for German dried mango importers. For example, German organic food company Rapunzel has developed its own fair trade programme and certification called HAND IN HAND. Burkinature, a dried mango processor from Burkina Faso, has benefited from this programme and has become a direct supplier to Rapunzel. The company offers workers employed in mango processing units better salaries and supports some community projects.

In addition to snacks and the already mentioned fruit bars, dried mango is an important ingredient of breakfast cereal mixtures. Although candied mango used to be the preferred usage form in breakfast cereals, natural dried mango is becoming more attractive because of its lower sugar content.

Figure 7: Premium muesli containing dried mango sold by German retailer Lidl

Source: Autentika Global

United Kingdom: Europe’s pioneering market for dried mangoes

The UK is another mature European market for dried mango. In fact, the country was the first market in Europe that developed a significant consumption of dried mangoes. This is no surprise, as Britain is the world's biggest importer of dried fruit. Bakers in the UK are important consumers and they usually build up large stocks of dried fruit and have supply contracts with domestic and foreign suppliers. Annual demand is estimated to be around 1,200 tonnes.

The largest share of imported dried mango is consumed within the country, as less than 10% is re-exported. In most cases, dried fruit is imported in bulk into the UK and re-packaged within the country. Lines of distribution are relatively straightforward and mainly involve traditional style importers. Some of the largest importers are Whitworths, Urban Fruit and Voicevale. The lines of distribution after traders are more complex. One route is via large wholesalers and processors.

Natural snacks producer Wallaroo sells organic, fair trade, dried mango slices from West Africa that does not contain preservatives or sulphites. Its products are sold in FSC certified 100% recyclable paper and shipped in boxes made from recyclable materials.

Like other packaged snack markets, focusing on UK consumer demand for healthy snacks with natural ingredients is where significant opportunities exist for small businesses producing dehydrated fruit in developing countries.

Some four-fifths of imported dried mangoes are sold in the form of retail snacks, while the remaining 20% is consumed either as part of a dried fruit mixture or as an ingredient in other products. The UK dried mango import market is quite concentrated with a relatively small number of regular importers.

The leading suppliers of dried mango to the United Kingdom are Burkina Faso, South Africa, Ghana and the Philippines. The UK is also a relatively large consumer of sweetened or candied dried mangoes, which are mostly imported from Thailand.

Figure 8: Dried mango slices from Waitrose

Source: Dried mango – Waitrose by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

A specific characteristic of the market in the United Kingdom is the popularity of the sweet carabao mango variety from the Philippines. While other European markets predominantly use other varieties of dried mangoes (such as Kent, Keitt, Tommy Atkins), some companies in the UK may have a preference for the chewy carabao variety.

The UK market is dominated by private labels of retail chains such as Tesco, Sainsbury’s, ASDA, Waitrose (Good Health brand), Morrisons and Aldi's own healthy snacking brand The Foodie Market. A leading independent brand is Whitworths. Other independent brands include Forest Feast (brand by Kestrel Foods), Urban Fruit, Wholefoods, Queenswood Natural Foods and the organic Crazy Jack line. Dried mango is increasingly used as an ingredient in fruit and cereal bars, for example Bear (by Urban Fresh Foods).

The market in the UK offers specific opportunities for suppliers of Fairtrade-certified dried mangoes, as the country is home to one of the largest Fairtrade product markets in Europe. As shoppers strive to become more sustainable, they are increasingly demanding ethically sourced products, according to the Fairtrade Foundation. Examples of UK Fairtrade products made from dried mango include products from Cocoa Loco (a chocolate producer), Tropical Wholefoods (recently purchased by Equal Exchange) and Forest Feast.

Figure 9: Dried mango from Tesco

Source: Mango - Dried - Tesco by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

France: Strong ties to suppliers in West Africa

France is one of the faster-growing markets for dried mango, which is partially helped by the strong ties with Francophone supplier countries in West Africa. France is a particularly attractive market for French-speaking suppliers of dried mango from West Africa, such as Burkina Faso and Côte d'Ivoire).

Leading independent private brands include Brousse Vergez and Maître Prunille. Dried mango brands from other European countries are competing with local brands. Brands that are strong in the organic segment include Bioday, Juste Bio, Optimys and Daco Bello. Dried organic mango is increasingly used as a breakfast cereal component. However, some producers may use tropical fruit from freeze-dried purees instead of dried mango.

Figure 10: Organic dried mango from Pronatura

Source: Mangues séchées sans sucre ajouté - Pronatura by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

Dried mangoes are also sold in French supermarkets as non-branded, per weight or in the simple transparent packaging of retailers.Dried mango is also often sold in mixtures with other dried fruit and nuts. Supermarket-owned private label brands in France mostly use the front of pack nutrition Nutri-Score labelling system to label dried mangoes. Dried mangoes that contain added sugar may be labelled “C” meaning that they have the average nutritional value, while the product without added sugar is often labelled “A” for best nutritional profile.

Some dried mango is imported to France through the Netherlands or the United Kingdom, but there are an increasing number of companies that source directly from producing countries. Those companies are investing in ethical sourcing and trying to help local communities in developing countries. Examples of such companies include Agro Sourcing, Ethiquable, Pepite and Ethik Essence.

Figure 11: Organic dried mango from Optimys

Source: Mangue séchée - Optimys by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

Artisans du Monde is a French network of local fair trade associations, currently the most important non-profit fair trade movement in France. The network offers several products made with dried mango.

The Netherlands: Europe’s dried mango trade hub

In terms of imported quantities, the Netherlands is estimated to be Europe’s third-largest importer of dried mangoes, although it re-exports large quantities to other European destinations. Current domestic consumption is estimated to be around 400 tonnes per year. Burkina Faso is a leading supplier to the Netherlands, but Dutch importers source dried mangoes from many different destinations, including South Africa, Gambia, Mozambique, Thailand and the Philippines, as well as from other emerging suppliers.

The growing consumption of dried mangoes in the Netherlands is driven by several trends, such as healthy snacking, the popularity of plant-based diets and the attractiveness of exotic flavours. The most important attribute for Dutch dried mango consumers is “free from extra ingredients”, according to a recently published study. Surveyed consumers preferred a purer mango product and demonstrated a negative perception of “crispy” dried mango, instead preferring “chewy” over other textures. Concerning taste, Dutch respondents preferred a “more sweet than sour” taste.

Figure 12: Dried mango from Albert Heijn

Source: Gedroogde mango by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

In addition to snacking, dried mangoes are increasingly being used as an ingredient in fruit bars, bakery and confectionery products, and breakfast cereals. The Netherlands has been characterised by a notable import share of sugar-infused dried mangoes, especially from Thailand. This share is expected to decrease, while the share of products with no added sugar can be expected to increase.

A large share of traded dried mango in the Netherlands is sold under the private labels of supermarkets, such as Albert Heijn (AH and AH Bio labels) and Jumbo (Jumbo label), or of discounters such as Lidl (Alesto Bio label), as well as in health retail shops such as Holland & Barrett. The import volume of organic dried mango in the Netherlands has been relatively high. This is partly due to the efforts of one of the largest European specialised organic importers, Tradin Organic. This company sources organic dried mango from several origins, such as Mexico, Gambia and Burkina Faso. In Burkina Faso, Tradin Organic has its own mango drying project.

A notable independent importer of dried mango from Africa is Eindhoven-based Mango Impact. Many online retailers offer their own branded dried mango products such as De Notenshop, while smaller brands – such as Mijn Natuurwinkel – are also expanding their presence in the dried mango market. Wisselwaar sells 100% organic produced dried mango from a small-scale project in Burkina Faso, packaged in zero waste packaging.

Switzerland: Producing and trading country

Although small in terms of its consumption, Switzerland is home to a few very large trading and processing companies which together trade and sell a significant portion of European dried mango. Switzerland is particularly attractive for trading organic dried mangoes. Swiss company HPW has 2 mango processing facilities in West Africa, making the company one of the largest African dried mango suppliers. The 2 BRC-certified plants are HPW Fresh & Dry Ghana and HPW Fresh & Dry Côte d'Ivoire.

During the 2 mango seasons from January to February and April to August, HPW produces 1200 tons of Keitt and Kent dried mangoes through its African subsidiaries. HPW manufactures its sweet, dried mango and fruit snacks without added sugar or concentrates. The company produces these innovative fruit snacks using some of the dried fruit, such as dried mango and pineapple. HPW has its headquarters in Switzerland, so some trade is performed through Switzerland, making the country an important trade hub.

Another important Swiss company is Gebana, which is also trading and producing dried mangoes in Africa (Burkina Faso). Gebana has operated as a fair trade company since 1998. Gebana fruit products are packaged in their country of origin and are not repackaged afterwards. The fruit is sold in bulk packages directly from the country of origin to reduce waste, carbon emissions and costs. Gebana has been active in Burkina Faso since 2006 processing mangoes in the Bobo-Dioulasso plant. A second plant is being built.

A significant share of dried mango in Switzerland is sold as private label, through leading retail chains such as Coop (that offers Fairtrade and Organic Fairtrade dried mango under its Naturaplan private label) and Migros (Sun Queen, Migros Sélection and Migros Bio labels). A smaller share is sold by independent brands, such as the German Seeberger. HPW has developed and launched fruit bars and fruit rolls based on dried mango.

Italy: Growing imports and re-exports

Italy is increasing its import of dried mango. Dried mango is consumed in Italy mainly as a snack. Sales are dominated by supermarket private labels such as Coop, Conad or Carrefour. A very popular way of dried fruit sales is in small discount packages of €1 per package (for 100 g of dried fruit). The leading independent brand is Noberasco, but there are more brands such as Semplicemente frutta (by Euro Company), Castroni Coladirienzo and Life. The leading Italian organic brands selling dried mangoes are Almaverde Bio and Econoce (owned by Euro Company).

Local Italian consumption of dried mango is estimated to be around 300 tonnes. Significant quantities of imported dried mango are exported to other European countries. This re-export is led by strong brands (such as Noberasco) in other European countries as well as the presence of strong Italian traders (such as Besana). Imports come from different origins including Togo, Brazil and Thailand. Euro Company sources its dried mango products from Swiss supplier HPW that produces them in Ghana.

Some companies in Italy have been participating in the Postmango Project to experiment with the best method for dehydrating Sicilian mangoes. These companies are aiming to retain the high nutritional value, appearance, smell and pleasant taste of these mangoes. Because of these efforts, companies like AlPassoFood are already offering naturally dried Sicilian mango to consumers.

Tips:

- Stay abreast of the market for dried mangoes in the United Kingdom at the National Dried Fruit Trade Association UK.

- Search for advice on possible buyers in the Federation of Bakers Limited (FoB), the trade association representing the UK Bread and Bakery industry.

- Find German traders of dried mango on the websites of the specialised German Association – Waren-Verein and in the German company directory – Wer liefert was.

- Learn more about the marketing of tropical fruits from the French association for research in the fruit and vegetable sector (CTIFL) to learn more about the French market.

- Consider obtaining Fairtrade certification to enter the United Kingdom market or organic certification for easier penetration into the German market.

- Approach relevant associations, including Nederlandse Zuidvruchten Vereniging in the Netherlands to identify the most suitable importers for dried mangoes.

- Stay current by following news from the Swiss Federal Office of Agriculture.

- Identify the most suitable brokers or specialised traders who can help exporters from developing countries introduce dried mangoes to Italy.

4. Which trends offer opportunities or pose threats on the European dried mango market?

The increasing demand for healthy snacking and product innovations are the leading driving forces behind the growing consumer interest in dried mango in Europe. Moreover, sustainable and ethical production is becoming an important aspect for European traders and consumers. However, a short-term threat for small and medium exporters from developing countries is the high price point of dried tropical fruit at a time of slow economic growth in Europe and relatively high inflation.

Economic slowdown and high inflation

The European region is grappling with the repercussions of slow economic growth, high inflation and financial instability, partly triggered by the energy crisis following Russia’s invasion of Ukraine. Inflation in the food, alcohol and tobacco sector rose to 15.4% and is expected to remain high throughout the year, making food items, including relatively expensive choices such as dried mango, less affordable for average consumers. Consumers reacted by exercising restraint, and this dampening of demand affected the dried tropical fruit category.

Europe's economic growth is expected to be only 0.3% in 2023 due to a myriad of factors including the ongoing war in Ukraine. This is a significant downgrade from the global economic growth projection of 2.2% for the same year. While there's a growing market for dried mangoes driven by health trends and consumer preferences, the ongoing economic challenges, pose significant hurdles for new exporters targeting the European market.

Many European countries have seen consumers reigning in their expenses and becoming more frugal. Dried tropical fruit, including dried mango, is generally seen as a luxury product. European consumers have been changing their shopping habits even during the high-spending Christmas season, which is traditionally a high point for sales of dried fruit. Inflation means the pricier products are being more quickly overlooked and this certainly includes tropical fruit.

A lot of the world is now going through what is also termed as a process of deglobalisation. This process is something that is relatively new and could negatively affect consumer demand for dried tropical fruit. With Europe’s Farm to Fork strategy and the disruptions caused by COVID, European fruit and vegetable consumers have gotten more used to consuming local products.

In August 2023, the FAO warned of several significant threats to global production, trade and consumption of major tropical fruits. In its Major Tropical Fruits Market Review (PDF), the FAO warns that high inflation rates, high interest rates and exchange rate fluctuations threaten to hinder demand, especially for higher value tropical fruits. In this regard, particularly consumers in poorer economic strata, who spend a higher proportion of their income on food, may be affected by a reduced access to these commodities.

Healthy snacking

A major established trend that favours the consumption of dried mango is healthy snacking. Consumers want healthy options for snacking between meals or for snacks which can replace meals. Young consumers who are increasingly better informed about their general health and wellness are diversifying from savoury snacks, such as potato crisps. As a result, nuts, as well as dried fruit, are becoming increasingly popular as a snack. The latest data shows 58% of European consumers wanting to improve their eating habits.

The sale of dried fruit products will stand to benefit from increasing governmental pressure in many European countries towards regulating the promotion of unhealthy snacks. European governments are increasingly asserting their powers to improve the eating habits of consumers, with the pioneering high in fat, sugar and salt (HFSS) regulation in England highlighting the power of public bodies to influence and disrupt the entire food industry.

Sustainability surge and slowing demand for organic

Several sustainability initiatives are in implementation in dried mango production countries. In general, consumers and retailers are increasingly interested in sustainable and ethically produced fruit products, including dried mango.

Overall, demand for organic and sustainably-grown tropical fruit has been on the rise in Europe in recent years. European consumers are increasingly aware of the positive environmental impacts and health benefits of organic food. This surge in organic food demand is tied to a growing concern for the environment, which is heavily influenced by climate change, and a desire for healthier food choices. EU imports of organic tropical fruit, nuts and spices (PDF) increased by 7% in 2021, according to the European Commission.

More than half of surveyed Europeans confirmed they ate more sustainably since the COVID-19 pandemic, according to new market research. The research by Kerry Group also showed that 51% of consumers in the foodservice segment said they were happy to pay more for sustainable options. Keep in mind that this attitude may have changed due to the recent period of high inflation in Europe.

The COVID-19 pandemic was also an important driver that boosted organic sales. However, sales of organic products in 2022 may be affected by surging inflation driven by energy costs and food prices. Recent estimates indicate that organic food sales in the EU may end up contracting by about 5% (PDF) in 2022. Sales in France and Germany, that together represent more than 60% of the total organic market in the EU, are forecasted to go down.

The UPROMABIO cooperative, which produces organic and fairtrade dried mangoes in the Bobo-Dioulasso region of Burkina Faso, has been supplying fairtrade dried mango to German company Kipepeo Bio & Fair since 2015. Kipepeo sells the certified dried mangoes of the Brooks variety from the cooperative that buys organically grown and certified fruits, dries them in-house and packs them for export.

All the links in the Kipepeo dried mango chain are connected to fair trade (Flocert or FairForLife). Consumers are aware that the purchase of such products can help contribute to preventing emigration and rural exodus. These certified products also help support small farmers and their families in a remote and economically disadvantaged region.

Pure and Just Company, a small-scale dried mango, pineapple and papaya processor in Accra, supported by the Ghana Climate Innovation Centre, turns about 2 tonnes of waste produce into biogas every week. The company sells its dried mango and pineapple under its ready-to-retail and wholesale brand Yvaya Farm.

More information on sustainable and ethical production trends can be found in the CBI processed fruit and vegetables trends study.

Tips:

- Subscribe to the free newsletter of the International Nut & Dried Fruit Council (INC). Keep up to date on industry news, health and nutritional properties of dried mango. This will help you promote the applications and advantages of dried mango consumption.

- Read the CBI market statistics and outlook on processed fruit & vegetables study to learn more about general trade trends and the size of the specific market segments.

- Check the websites of trade shows and exhibitions to discover the newest trends. The most important trade fairs in Europe, relevant to dried mangoes, are SIAL (France, every even year in October), Anuga (Germany, every uneven year in October) and BIOFACH (Germany, organic products, every year in February).

- Label all dried mango products containing sulphites accordingly or do not use sulphites if possible. Some consumers avoid food products with sulphites. About 1 in 100 people (according to the FDA) are sensitive to these compounds. Sulphur dioxide and sulphites are amongst the 14 most common allergens, according to the European Centre for Allergy Research Foundation.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research