Entering the European market for dried pineapple

Quality is paramount for a smooth entry into the European market. The use of modern drying technologies can significantly improve product quality and ensure consistency. Food safety certification and frequent laboratory tests help to establish trust with European buyers. Sustainable and responsible production provides additional advantages for emerging suppliers.

Contents of this page

1. What requirements and certifications must dried pineapple comply with to be allowed on the European market?

General information on buyer requirements is given in our study about buyer requirements on the European processed fruit and vegetable market. The section below deals with specific requirements applying to dried pineapple fruit in Europe.

What are mandatory requirements?

All food products, including dried pineapple, sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. This also applies to all imported food products. Only approved additives are allowed. Food products must conform to maximum levels for harmful contaminants.

Fresh and dried pineapple are on a list of plants for which a phytosanitary certificate is not required for their introduction into Union territory, according to Regulation (EU) 2019/2072. There were no specific dried pineapple notifications reported by the European Rapid Alert System for Food and Feed (RASFF) between 2018 and October 2023. Nevertheless, the most common requirements regarding contaminants in pineapple relate to the presence of pesticide residues and additives in fresh pineapple shipments.

Contaminant control in dried pineapple

The EU places strict controls on contaminants in food, as per Regulation (EU) 2023/915. The most common requirements regarding contaminants in dried pineapple are related to the presence of pesticide residues, microbiological organisms, preservatives and food additives.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products and it publishes a list of approved pesticides that are authorised for use. In 2022, the European Commission approved 27 new implementing regulations that modified this list through new approvals, extensions or other changes.

The most frequent examples of pesticide-related incidents related to pineapple imports are border rejection notifications because of the presence of Ethephon. Ethephon is a plant growth regulator widely used to speed up ripening. While fresh pineapple imports are affected by Commission Regulation (EU) 2020/749 that sets the maximum permissible level of chlorates to 0.3, dried pineapple imports are not covered by this regulation.

Microbiological contaminants

The presence of very low levels of salmonella and E. coli in ready-to-eat or processed foods, including dried pineapple, is an important cause of foodborne illness. Processors should consider salmonella and E. coli as major public health risks in their hazard analysis and critical control points (HACCP) plans. An outbreak of non-typhoid salmonellosis with severe clinical presentation in Norway in 2018 and 2019 was linked to the microbiological contamination of exotic dried fruits and dried pineapple.

Mycotoxins

Mycotoxins are toxic compounds produced by moulds and fungi. Their presence can arise from pre-harvest or post-harvest contamination, and inadequate drying and storage. The level of aflatoxin B1 in dried pineapple must not exceed 5 μg/kg and the total aflatoxin content must not exceed 10 μg/kg. These levels apply to dried pineapple subjected to sorting or other physical treatments. Stricter limits of 2 μg/kg (aflatoxin B1) and 4 μg/kg (total aflatoxin content) apply if dried pineapple is used as an ingredient, according to Regulation (EU) 2023/915.

Product composition

European authorities can reject products if they have undeclared, unauthorised or too high levels of extraneous materials. There is specific legislation for additives (like colours, thickeners) and flavourings, that lists which E numbers and substances are allowed. Authorised additives are listed in Annex II to the Food Additives Regulation. Other annexes of the regulation list food enzymes, flavourings and colourants.

Conventionally dried pineapple can be produced with a sulphite treatment. Sulphites are used as an antioxidant to prolong shelf life and retain the intense bright yellow colour in dried pineapple. Sulphur dioxide and sulphites are considered allergens under Regulation (EU) No. 1169/2011. Therefore, for prepacked foods, their presence must be indicated on the label, where the level exceeds 10 mg/kg or 10 mg/L (expressed as SO2).

Tips:

- Follow the Codex Alimentarius Code of Hygienic Practice for Dried Fruits (PDF). For dried pineapple, it is particularly important to control the occurrence of insects and other parasites.

- Read more about MRLs on the European Commission website on Maximum Residue Levels. To be prepared for potential changes in the MRLs, read the ongoing reviews of MRLs in the EU.

What additional requirements do buyers often have?

Quality requirements

Dried pineapple quality is determined by the allowed percentage of defective produce, by number or by weight. The industry uses many criteria for quality, but some of them, such as taste and odour, are subjective and cannot be easily determined by physical and chemical characteristics. The basic quality criteria for dried pineapple can be found in Table 1. Good quality dried pineapple should have a uniformly soft and pliable texture without any hard or sticky parts. The exterior of the fruit should be smooth and not stick together in clumps.

The EU has not defined quality standards for dried pineapple. The most common standard used, is the dried pineapple standard (PDF) published by the United Nations Economic Commission for Europe (UNECE).

Table 1: Common criteria defining dried pineapple quality

|

Presentation |

|

|

Sizing (optional) |

Size (if sized) |

|

Variety |

Name of variety |

|

Colour |

Uniform natural yellow or amber colour typical of dried pineapple, without spots or browning |

|

Flavour |

Distinct pineapple flavour |

|

Odour |

Aroma of pineapples, free from off-flavours and odours |

|

Texture |

Chewable: firm but not hard |

|

Moisture content: |

|

|

Quality classes (optional) |

Determined by the allowed percentage of defects. Dried pineapple is classified into 3 classes: “Extra” Class, Class I and Class II. |

Source: Autentika Global, 2023

Softness is an important quality trait. Consumers avoid dried pineapple that is dry and hard to chew. Another way to differentiate dried pineapple products in quality terms is based on the presence or absence of a sulphuring process. Sulphuring also influences water content and softness of dried fruit.

Table 2: Maximum water content in dried fruit products

|

|

Maximum water content without sulphuring |

Maximum water content with sulphuring |

|

Pineapples |

20% |

20-44% |

|

Mangoes |

15% |

15-35% |

|

Apricots |

20% |

25% |

|

Papayas |

18% |

18-25% |

Source: Autentika Global, COLEACP (PDF), 2023

Food safety certification

Although European legislation does not explicitly require food safety certification for dried pineapple, be aware that most European food importers require it. Well-established importers will not work with you if you cannot provide the food safety certification that they want. Most European buyers will ask for Global Food Safety Initiative (GFSI) recognised certification. GFSI recognises a few certification programmes that meet the GFSI benchmarking requirements. For dried pineapple, the most popular certification programmes, all recognised by GFSI, are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Make sure to check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, certain retailers may prefer one certification over another, or demand additional certifications based on their own internal policies. Major buyers will also usually visit/audit production facilities before starting a business relationship.

For example, UK natural snacks producer Wallaroo sells BRCGS-certified dried pineapple from West Africa. Switzerland’s HPW also sells dried pineapple and dried fruit snacks that are BRCGS-certified.

Corporate social responsibility (CSR) certification

Companies have different requirements for corporate social responsibility. Many importers will ask you to follow their own specific CSR code of conduct. Most European retailers have their own codes of conduct, such as Lidl (PDF), REWE, Carrefour (PDF), Tesco and Ahold Delhaize.

Other companies will insist on following common standards such as the Sedex Members Ethical Trade Audit (SMETA) standard. Sedex membership alone (without an audit) is actually not very complicated and not very expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Sustainability certification

2 commonly-used sustainability certification schemes are Fairtrade and Rainforest Alliance. Fairtrade international developed a specific standard for prepared and preserved fruit and vegetables for small-scale producer organisations. This standard sets a Fairtrade Minimum Price (ex-works) for certified pineapple for drying from South-Eastern Asia ($0.18/kg), Southern Asia (€0.19/kg) and Western Africa ($0.19/kg).

A group of mainly European organisations formed the Sustainability Initiative Fruit and Vegetables (SIFAV). They aim to reach 90% sustainable imports of fruits and vegetables from Africa, Asia and South America in 2025.

Packaging requirements

Mechanical injuries are one of the major problems for damage to and losses of dried pineapple products, which can be brittle and can be damaged through compression during shipping and handling. The most common type of export packaging is plastic bags or plastic liners placed in carton boxes of different sizes. Dried pineapple can be preserved for a longer period because of the reduced moisture content, but it is important to keep the pineapple from absorbing moisture. Moisture absorption will make the product soft and soggy and can lead to fungal growth.

Special plastic films that block air and moisture are often used and packaging types that include layers of different plastics to keep the colour of dried and dehydrated pineapples fresh. For large amounts of dried pineapple, strong plastic like HDPE is used for packaging. For retail packaging, dried pineapple is usually packed in pouches or plastic containers. These packages are then formed in a cube shape to effectively use pallet and container space.

In Europe, the Euro pallet is 1200mm × 800mm. These Euro pallets are then loaded and transported in containers. Twenty-foot containers may contain 1,600 cartons of 12.5kg or 2,000 cartons of 10kg. Extremely low or high temperatures should be avoided during transport or storage. At high storage temperatures, fruit sugar particles may form on the surface of the product, hardening and discolouring them.

Labelling requirements

The name of the product must be on the label. Export package labels should include the variety name, crop year and type of drying (such as “sun-dried” or “tunnel-dried”). Information about bulk packaging has to be given on the packaging or in accompanying documents. Bulk package labels must contain the name of the product, lot identification, name and address of the manufacturer, packer, distributor or importer, and storage instructions.

For retail packaging, product labelling must be in compliance with the EU Regulation on the provision of food information to consumers. Sulphur dioxide and sulphites must be indicated as potential allergens if they are present at concentrations of more than 10 mg/kg in terms of the total SO2. All food in retail packs in Europe must be labelled with an indication of origin.

Tips:

- Consult industry examples of technical sheets. For example, a technical sheet with dried pineapple specification (PDF) from US company Traina and a technical sheet for dried pineapple rings (PDF) from Peru’s Chavin Dried.

- Read more about transport and storage requirements for dried fruit on the Cargo Handbook website and consult the foodstuffs labelling and packaging advice from the EU’s Access2Markets portal.

- Follow news and resources on sustainable trade from the Sustainable Trade Initiative (IDH) for inspiration and new ideas.

- Perform a self-assessment with the help of BSCI manuals from the BSCI website.

What are the requirements for niche markets?

Organic dried pineapple

To market dried pineapple as organic in Europe, the fruit must be grown using organic production methods that conform to European legislation. Growing and processing facilities must be audited by an accredited certifier before you may put the EU’s organic logo on your products, as well as the logo of the standard holder (for example, Soil Association in the United Kingdom, Naturland in Germany or Agriculture biologique in France).

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation defining imports of organic products from third countries.

Figure 1: Organic dried pineapple pieces sold by German dm-drogerie markt

Source: Autentika Global

For equivalent countries (including Argentina, India and Tunisia) certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Ethnic certification

If you want to focus on the Jewish or Islamic ethnic niche markets, implement Halal or Kosher certification schemes. There are several organisations that provide Kosher certification in Europe, such as the Kosher London Beth Din (KLBD) that provides guidelines on how to obtain the certification. Halal certification in Europe can be obtained via certifying bodies, such as Halal Certification Services (HCS) that provides certification services.

Costa Rican company Natural Sins exports crispy dried pineapple chips that are Kosher certified by the Orthodox Union. Profood International Corporation is the largest Philippine-based dried fruit producer. It offers a wide range of Halal-certified and Kosher-certified dried pineapple products and brands.

Tips:

- Consult the Standards Map database for information on a range of sustainability labels and standards.

- Familiarise yourself with sustainability standards by reading the Basket of Standards (PDF) (by SIFAV).

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH and control bodies and authorities for equivalence.

2. Through what channels can you get dried pineapple on the European market?

In Europe, dried pineapple is used as a snack and as ingredients in the food processing industry. Approximately 70-80% of the total imports of dried pineapple in Europe is re-packed and sold as a snack through the retail channel. The remaining 20-30% is used as an ingredient in the food processing industry and in food service.

How is the end-market segmented?

Figure 2: End-market segments for dried pineapple in Europe

Source: Autentika Global

Snack segment

Almost four-fifths of imported dried pineapple in Europe is sold and consumed as a snack. The demand is propelled by healthier lifestyles and the popularity of pineapple as a favoured tropical fruit. According to Grand View Research, Europe’s snack segment will witness an annual growth rate of 6.0% in 2023-2030. This growth is driven by the high obesity rates and lifestyle diseases, prompting individuals to adopt healthier eating habits. “No sugar added” and “free from preservatives”, are the main trends influencing the snacking segment.

The snack segment is primarily served by packing companies, which are repacking and branding imported bulk dried pineapple. Many of these companies pack dried pineapple under private labels for the European retail chains. For examples of leading dried pineapple brands in Europe, read about the European market potential for dried pineapple.

Ingredient segment (food processing segment)

The food processing segment accounts for roughly 20-30% of the European dried pineapple market. This small percentage is explained by the relatively high prices of dried pineapple compared to most other dried fruit. The biggest demand for dried pineapple in this segment comes from:

- The breakfast cereal industry is a user of sweetened pineapple. It can be used in a variety of ways. Dried pineapple can be shredded or diced and added to cereal mixes.

- The confectionery industry mainly uses dried pineapple pieces to produce sweet snacks. New products use dried pineapple coated or half dipped into chocolate. Freeze dried pineapple pieces are also used as crispy bits in some confectionery products.

- The bakery industry uses pieces of dried pineapple in muffins, pies, cookies and cakes. Many European specialties that use dried fruit can be made in versions with dried pineapple, such as a tropical version of Italy’s Christmas specialty Panettone, but with exotic fruit.

- Fruit bars are increasingly offered in many varieties. Organic fruit bars are on the increase (especially in Germany). In some fruit bars, naturally dried pineapple is used as a fruit ingredient.

- The dairy industry uses dried pineapple as an ingredient in fruit preparations for ice creams with tropical taste, or in fruit yoghurts and smoothies. Dried pineapple is also used to flavour and decorate cheeses, such as Wensleydale with Pineapple or Pineapple cottage cheese.

Figure 3: Holiday season confectionery product with dried pineapple sold by German retailer Lidl

Source: Autentika Global

Tips:

- Consult trade magazines and publications, such as SF&WB, ConfectioneryNews and Bakery & Snacks, that publish articles on the snacking and ingredients industries, including trends and new products.

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for dried pineapple within the food ingredient segment.

- Visit or exhibit at ISM Cologne, the leading European trade fair for sweets and snacks, to explore opportunities in the dried fruit snack segment.

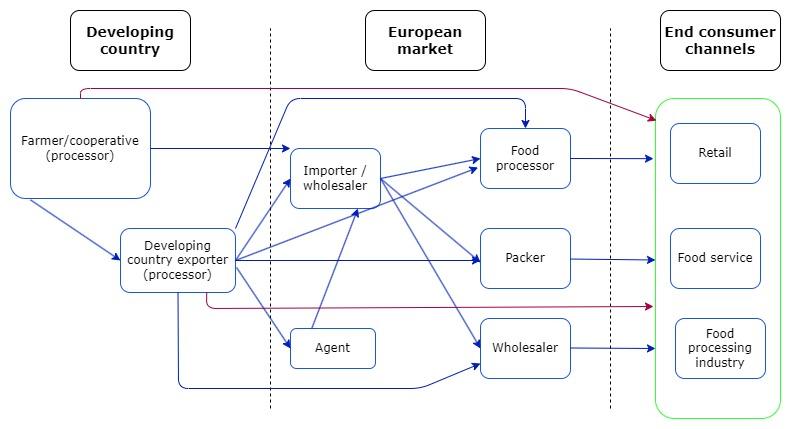

Through what channels does dried pineapple end up on the end-market?

The most important channel for dried pineapple in Europe is represented by specialised dried fruit importers. There are also several alternative channels, such as agents, food processors or food service companies.

Figure 4: European market channels for dried pineapple

Source: Autentika Global

Importer / Wholesaler

In most cases, importers act as wholesalers. They very often sell dried pineapple to packing companies who pack it into consumer packages. Some importers are also equipped with processing and packing equipment, so they can supply retail and food service channels directly. However, many important dried fruit brands import dried pineapple directly, instead of buying it through specialised importers.

Importers usually have good knowledge of the European market and monitor the situation in dried pineapple producing countries closely. They are therefore your preferred contact, as they can inform you about market developments and provide practical advice for your exports.

The position of importers and food manufacturers is put under pressure by retail. The higher requirements from the retail industry determine the supply chain dynamics from the top down. This pressure is translated into lower prices, but also into added value aspects such as “sustainable”, “natural”, “organic” or “fair trade” products. Many importers develop their own codes of conduct and build relationships with preferred developing country suppliers.

2 notable German-based importers and traders are Horst Walberg Trockenfrucht Import (HOWA) and Zieler & Co.. J.O. Sims is a UK-based importer and distributor of dried pineapple for snacks and ingredients, while Kiril Mischeff imports candied dried pineapple. Catz International is one of Europe’s leading wholesalers of dried fruits, including dried pineapple. The Dutch Berrico Food Company is also a player with interest in the dried pineapple market. Italy’s Blife is active in the trade and wholesale of organic dried pineapple, as is Agro Dry Fruits.

Packer

For new suppliers, the challenge is to establish long-term relationships with well-known dried fruit companies, as they usually already work with selected suppliers. Established importers perform regular audits and visits to producing countries. As dried pineapple is still seen as a non-essential purchase by many European consumers, being price competitive will help establish new relationships.

Agent/broker

Agents involved in the dried pineapple trade typically act as independent companies that negotiate on behalf of their clients, and as intermediaries between buyers and sellers. They usually charge commissions of 2–4% of the sales price for their intermediary services. For most developing country suppliers, it is very challenging to participate in the demanding private label tender procedures. For these services, some agents, in cooperation with their dried pineapple suppliers, participate in procurement procedures put out by the retail chains.

Examples of dried pineapple agents in the leading European markets include Kenkko (the United Kingdom), Belfrudis (Belgium), Cardassilaris Family (Greece) and QFN Trading & Agency (the Netherlands).

Retail

Retailers rarely buy directly from developing country exporters. A new development is the polarisation of the retail sector into discounters and high-level segments. Until recently, naturally dried pineapple was mainly offered by high-end retail segments. However, dried pineapple is now also offered by several large European discounters (such as “Simply Nature” dried pineapple by ALDI or “Alesto” dried mango and dried pineapple by Lidl).

Foodservice

The foodservice channel is usually supplied by specialised importers (wholesalers). The foodservice segment often requires specific packaging of 1-5kg of dried pineapple. Dried pineapple is not frequently sold through the foodservice channel. World cuisines, healthy food and food enjoyment are the major driving forces in the foodservice channel in Europe. The fastest-growing business types are likely to be new (healthier) fast food, street food, pop-up restaurants and international cuisines.

What is the most interesting channel for you?

Specialised importers are the best contact for exporting dried pineapple to the European market. This is especially relevant for new suppliers, as supplying established brands, or the retail segment directly, is very demanding and requires a lot of quality-related and logistical investments. There are also several alternative channels, such as agents, food processors or food service companies. However, for well-equipped and price-competitive producers, packing for private labels can be an option.

Tips:

- Search through the members' list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM), to find buyers from different channels and segments.

- Monitor market developments within the European snack segment by visiting the news section of the website of the European Snack Association.

- Watch a 2023 Deutsche Welle documentary for more insight into the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

3. What competition do you face on the European dried pineapple market?

Which countries are you competing with?

Trade in fresh pineapple is more regional in scope, while dried pineapple trade is more globally oriented. Dried pineapple in producing countries is also in strong competition with the affordable fresh product, meaning that dried pineapple is most often exported. In the Harmonized System (HS) statistics, dried pineapple is in the same category as fresh pineapples (HS 080430), so it is generally difficult to distinguish between them.

The main competing countries for dried pineapple export to Europe are Ghana, Togo, Costa Rica, Thailand, Benin and Côte d'Ivoire. The leading competitors from Asia are the Philippines and Vietnam. Emerging competitors include Sri Lanka, South Africa, Rwanda, Cameroon, Mozambique (represented by Afrifruta), Kenya and Gambia.

Source: Autentika Global, based on industry estimates

Costa Rica: Leader in pineapple production

In Costa Rica, 40,000 hectares are planted with pineapple. The Huetar Norte region leads with 19,600 hectares, followed by the Atlantic region with 11,600 hectares. The US and Mexico are important export markets, as is Europe. The interests of the industry are represented by the National Chamber of Pineapple Exporters (CANAPEP). The industry is also supported by Costa Rica’s export promotion agency Procomer.

Costa Rica was positioned as the first exporter of pineapple in the world in 2021, according to the latest annual report from the Ministry of Foreign Trade. Costa Rica uses 080430000020 as the national trade code for dried pineapple. This is based on the nomenclature from the Central American Tariff System (Sistema Arancelario Centroamericano - “SAC”) that allocates the 080430 code to fresh, dried and organic pineapple exports.

Source: Autentika Global, Procomer

Costa Rica exported 891.33 tonnes of dried pineapple in 2021, an increase of 36.3% from the 654.13 tonnes the country exported in 2020, according to national trade data collected by Procomer.

Table 3: Costa Rica’s dried pineapple (080430000020) exports to Europe (tonnes)

|

|

2019 |

2020 |

2021 |

|

Germany |

98.26 |

69.49 |

106.68 |

|

Belgium |

- |

26.23 |

- |

|

Spain |

116.76 |

112.89 |

137.57 |

|

Netherlands |

7.67 |

- |

21.14 |

|

Italy |

90.97 |

149.26 |

140.93 |

|

Poland |

- |

6.77 |

32.98 |

Source: Autentika Global, Procomer, 2023

Ghana: A rising supplier of dried pineapple

Export of dried pineapple from Ghana to Europe is estimated to be around 400 tonnes. The largest quantities are exported by the Swiss – Ghanaian company HPW (read more about this company in the chapter below). In the ten years leading up to 2017, Ghana experienced an almost tenfold increase in pineapple production. Pineapple harvests increased from around 70,000 tonnes to 677,113 tonnes.

However, overall pineapple exports have effectively collapsed in recent years. Fresh or dried pineapple exports have fallen from 20,000 tonnes in 2018 to 1,558 tonnes in 2022. Trade data by destination for 2022 shows that some 74% of exports from Ghana were destined for France. Exports from Ghana continued to struggle to keep up with the lower prices of pineapples from competing origins in global value chains, according to the FAO (PDF).

Pineapple production is located in the Coastal areas, Accra plains, Eastern region, Central region and in the Volta region, while processing activities mostly take place in the Central and Eastern regions. The Ghana Export Promotion Authority (GEPA) supports exporters in the country. In the pineapple subsector, exports receive organisational support from the Sea-Freight Exporters Association of Ghana (SPEG). Dried fruits account for 9% of exported fruit products from Ghana, according to a value chain analysis of the Ghanaian fruit sector (PDF).

Togo: A rising supplier of conventional and organic dried pineapple

Togolese pineapple production was estimated at 44,391 tonnes in 2022. This represents a significant increase from the 30,149 tonnes produced in 2019, when around thirty companies also produced over a million litres of pineapple juice and 476 tonnes of dried pineapple. Dried pineapple production is now estimated at around 530 tonnes with roughly around 400 tonnes going to Europe.

Most processed pineapple products are exported to Europe (95%) and to neighbouring countries (2%), while the remaining 3% is sold in Togo, according to a GIZ report (PDF). A major revival of the sector commenced with development aid from Germany in 2016. Today, pineapple is grown in the Maritime, Plateaux Est, Plateaux Ouest and Centrale regions. The number of pineapple processing companies has increased rapidly from around 30 to around 50 between 2017 and 2022, according to a new agriculture ministry action plan (PDF) (in French).

The ministry’s new plan envisages a total investment of FCFA9.5 billion into the pineapple sector over the 5-year period ending 2028. The plan mainly aims to double pineapple production, from 44,391 tonnes to 88,782 tonnes by 2028. It also calls for increasing local pineapple processing from 35% to at least 75% by 2028.

Benin: An emerging supplier of dried pineapple

Growers in Benin harvested more than 400,000 tonnes of the crop in 2021, with an average yield of 63.5 tonnes per hectare, according to a report from the country’s agriculture ministry (PDF), in French. The ministry forecast for 2022 was for a 427,457-tonne harvest. Pineapple is primarily produced in the southern departments in communes such as Zè, Abomey-Calavi, Allada and Tori-Bossito. Pineapple production in Benin is expected to reach 511,000 tonnes by 2025, according to a ministry forecast (PDF).

The crop is produced on an area of roughly 6,400 hectares. Benin sugar loaf variety remains by far (75%) the most widely grown variety, ahead of smooth Cayenne, according to a report on the pineapple sector (PDF).

Compared to pineapple juice, dried pineapple is produced in smaller volumes due to the limited capacity of units. Dried pineapple is mainly exported. Certified units sell to wholesalers in Europe (France, Belgium, Switzerland and Germany) and Asia (Japan). Exporters act individually, but are federated by the National Association of Pineapple Exporters (ANEAB), according to the VCA4D Benin Pineapple report.

Côte d'Ivoire: Smaller producer of quality dried pineapple

Côte d'Ivoire exported 32,000 tonnes of fresh and dried pineapple in 2022. Trade data by destination suggests that France and Belgium continued to be the 2 key recipients of fresh and dried pineapple from Côte d'Ivoire in 2022, jointly procuring some 77% of the country’s total shipments.

Activities in the national pineapple sector are co-financed by the Interbranch Fund for Funding and Agricultural Advice (FIRCA). The interests of the sector are represented by the organisation of banana, pineapple and mango growers (OBAM-CI) and the central organisation of banana, pineapple and mango growers and exporters (OCAB). Côte d'Ivoire is attempting to improve the competitiveness of its fruit sector through investments channelled to the mango and pineapple segments by the government’s PCCET project (in French).

Thailand: The leading supplier of sweetened dried pineapple to Europe

Thailand is the leading exporter of processed products derived from pineapple fruit, particularly canned pineapple and pineapple juice. The main pineapple growing province is Prachuap Khiri Khan, followed by Ratchaburi and Phetchaburi. Most Thai-produced dried pineapple, is sweetened or candied, but over the last couple of years, processors have increased the production of naturally dried pineapple.

Thailand is the world’s second-largest exporter of candied fruit (HS code 200600). Exports of candied fruit totalled more than 61,000 tonnes in 2022. The most popular candied products from Thailand in Europe are sugar-preserved pineapples (code 20060000002) and sugar-preserved papayas. Thai exports of sugared pineapple to Europe fell from 6,400 tonnes in 2018 to 4,700 tonnes in 2022. The Thai trade code for dried pineapple is 08043000002. Europe’s biggest importer of Thai dried pineapple in 2022 was Germany with 32 tonnes, according to the Tradereport portal of the Thai Ministry of Commerce.

Source: Autentika Global, Tradereport (Ministry of Commerce, Thailand)

Which companies are you competing with?

There are many producing, processing and exporting companies of dried pineapple around the world. Some of the large dried fruit processors in Africa are the result of investments by European companies or organisations. In Asia and South America, dried fruit industries are mainly established by local investors.

Costa Rican companies

One of the largest exporters of dried pineapple in Costa Rica is Fruta Sana. The company is focused on producing and exporting 100% natural dried pineapple free of preservatives, dyes and sugar. The product manufactured from the MD2 pineapple variety is also free of SO2 and Kosher certified.

Productos Agropecuarios VISA is a large player in the processed pineapple market. Instantia Costa Rica, a subsidiary of the Mexican company Instantia, opened a new plant to produce dehydrated pineapple in Pococí, Limón. Todo Natural, part of Grupo Pelon, exports to Europe and states it is the largest vertically integrated dehydrated pineapple manufacturer in the Americas.

Ghanaian companies

The largest share of production and export of dried pineapple in Ghana is through an investment of the Swiss company HPW. Its local subsidiary is the BRC-certified HPW Fresh & Dry Ghana plant, the largest mango and pineapple processor in Ghana. It cooperates closely with local farmers. The HPW company joined SIFAV and created a Special Initiative on Pineapple Production in Ghana. All farms and cooperatives together provide HPW Fresh & Dry with over 4,100 tonnes of premium quality fresh pineapple annually.

HPW produces about 400 tonnes of dried pineapple (conventional, fair trade, organic) annually. The company sells only natural dried pineapple, without the addition of sugar or other sweeteners. In general, the company’s largest markets are in the largest countries in Europe: the UK, Germany and Italy. In addition to exporting dried pineapple in bulk, HPW has created innovative dried snacks such as 100% dried mango and pineapple fruit rolls.

Another large processor in Ghana is Bomarts Farm that has a partnership with the Swiss company Yourharvest. Another growing processor is Jodacy Plus that produces Jozy Snacks (watch an interview with Jodacy Plus CEO). Pure and Just Food offers organic dried pineapple from eastern Ghana under its Yvaya Farm brand. Wad African Foods exports organic and fair trade dried pineapple to Switzerland, Germany and Italy with the help of Wadco. S’Fia Farms & Agro-Processing sells Fairtrade-certified natural dried pineapple slices.

Togolese companies

Gebana Togo, a subsidiary of Zurich-based Gebana, produces organic fresh and dried pineapple in Togo for exports to Europe. ProNatura West Africa (PNWA), a subsidiary of French Pronatura, manufactures Fair for Life certified processed pineapple products. Pronatura sells Togolese fair trade dried pineapple. Tropic Bio Production is a producer of organic dried pineapple based in Lomé that has Fair for Life social and Fairtrade certification. Other exporters include Alliance Bio, Setrapal, Junabio, Agro-Food, Julado and Rimouski.

Beninese companies

Le Centre de Séchage des Fruits Tropicaux (CSFT) produces and exports dried pineapple. Most of CSFT's production has so far been exported to France, Switzerland and Belgium. CSFT’s production capacity is currently estimated at 15 tonnes of Fairtrade-certified dried pineapple per year. Other exporters include the Union of Pineapple Producers' Groups in Toffo (UGPAT) and the Cooperative of Pineapple Growers in Togoudo (COPRATO).

Rose Éclat is a dried fruit manufacturer that exports dried pineapple from Benin. In 2018, Les Fruits Tillou added dried pineapple to its range and acquired a unit with a drying capacity of 500 tonnes per year. The firm has GLOBALG.A.P. and HACCP certifications (PDF), and its products (fresh, dehydrated and juice) are certified organic.

Ivorian companies

Dried pineapple production in Côte d'Ivoire is still mostly done by companies that process mango. These include Ivoire Organics, Rescan Industrie, La & Jab Côte d’Ivoire, Les Jardins de Koba and Swiss HPW. Les Jardins de Koba and Ivoire Organics offer organic products, as is the case with HPW. In April 2021, HPW opened the production facility HPW Fresh & Dry in Bonoua.

Layaki Bio is an Ivorian agribusiness company specialised in the processing of mangoes, bananas and pineapples into natural dried fruits. Ivoire Bio Fruits offers certified organic fresh and dried fruits to Europe, including dried pineapple and mango. The company was set up in late 2021 with the help of an investment from Comoé Capital.

Thai companies

GCF International is one of the largest producers of dried pineapple in Thailand. Over the years, GCF International developed into the largest Thai dried fruit exporter. Another major player is Bangkok-based Siam Agro-Food Industry (SAICO), a subsidiary of the Thai Pineapple Canning Industry Corporation (TPC). Ace Star International is a major supplier of dried tropical fruit chips.

Other firms include Unity Food, Nana Fruit, KP Fruits, TAN TAN, Smile Fruit, Chinwong Food Company, Fruit House, Fruittara, Thaweephol Samroiyod, Ampro Intertrade, Chin Huay, S.Ruamthai and V & K Pineapple Canning.

Tips:

- Read the CBI value chain study (PDF) for processed Fruits from Burkina Faso, Côte d'Ivoire and Mali.

- Follow the latest news and events on tropical fruit markets from the International Tropical Fruits Network and keep an eye on free tropical fruit market updates from UK-based Chelmer Foods.

- Monitor events in the highly competitive Thai dried fruits industry through free market reports from the prominent local industry player Ace Star International.

- Follow free news updates on exotic fruit markets published by Fruitnet.

- Keep in touch with news from African markets through a free news service in French from CommodAfrica.

- Follow developments in the Peruvian and global frozen and fresh fruit markets by following commercial updates and market reports from ADEX (in Spanish).

Which products are you competing with?

The main competitors for dried pineapple are other dried fruits and fresh pineapple. European consumers have become increasingly health-conscious and prefer a healthy diet with an increased consumption of fresh fruit and vegetables. This trend can influence consumption of dried pineapple, especially if it is treated with artificial colouring, or has added sugars or preservatives.

Dried pineapple has a higher price, compared to most other dried fruits on the European market, but it is not easy to decrease production prices. The average fresh-mango-to-dried-fruit product conversion rate is 10%, while the corresponding conversion rate for pineapple is 4% because pineapples have a higher water content (PDF).

Tip:

- Read CBI’s Fresh Fruit and Vegetables studies to better understand competition from fresh fruit.

4. What are the prices for dried pineapple?

Calculating margins based on final retail prices for dried pineapple provides only a rough overview of price structure. The CIF price represents approximately 25–30% of the price of a retail package of dried pineapple. Retail product prices are highly varied in Europe, ranging from €30 to €43 per kilogram on the European market.

The price of Thai dehydrated pineapple core (8-10mm dice) ex works UK ranged between €3.1/kg and €4.7/kg between late 2020 and October 2023. Spot prices gained momentum and topped €4.7/kg in March 2022. Since then, the price has dropped to around €3/kg in late 2023. FOB prices for natural dried pineapple ranged between €7.5 and €12.0 per kilo, while the price for Thai sugar-infused dried fruit was between €5.58kg and €7.5/kg.

Table 4: Dried pineapple retail price breakdown

|

Steps in the export process |

Type of price |

Price breakdown |

Example (€/kg) |

|

Production of fruit or vegetables |

Raw material price (farmers’ price) |

5% |

2 |

|

Handling, drying, packing and selling bulk product |

FOB or FCA price |

27% |

10.8 |

|

Shipment |

CIF price |

28% |

11.2 |

|

Import, handling, storing and bulk wholesale |

Wholesale price (value added tax included) |

50% |

20 |

|

Retail packing, handling and selling |

Retail price (for packaging of 250g) |

100% (retail price as seen in stores) |

40 |

Source: Autentika Global 2023

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research