The European market potential for dried pineapple

In the medium to long term, the European market for dried pineapple is expected to show a stable volume growth of 3-4% annually. This growth is likely to be driven by changes in the consumption patterns of European consumers, including the rising demand for healthier snacking options and a decrease in the consumption of snacks containing sugar. The United Kingdom, Germany, France, the Netherlands, Switzerland and Italy offer the best opportunities for developing country suppliers.

Contents of this page

1. Product description

Dried pineapple, a dehydrated form of the tropical fruit pineapple, has gained in popularity in the European market due to its sweet taste, long shelf life and versatile use in a variety of dishes and products.

Dried pineapple is obtained primarily from the Ananas comosus species. Native to South America, the pineapple plant is now grown in numerous tropical regions worldwide. The fruit is harvested, peeled and then dehydrated to produce dried pineapple. Thailand, the Philippines, Brazil and China are the main pineapple producers in the world, supplying nearly 50% of the total output. Other important producers include India, Nigeria, Kenya, Indonesia, Mexico and Costa Rica.

Dried pineapple, like all other dried tropical fruits, is a product prepared from ripe fruit, transformed by drying in the sun or by any other recognised dehydration method, with or without sweeteners (such as cane sugar) and food additives.

While most dried pineapple comes from the Ananas comosus species, there are multiple varieties within this classification. The most common ones include:

- Smooth Cayenne: Known for its smooth skin and sweet taste. This variety is the most common for dried pineapple production, as it has a consistent, sweet flavour which intensifies upon drying. Its firm flesh dries evenly without becoming overly tough or chewy. It also has a relatively low fibre content which ensures a pleasant mouthfeel when consumed dried. Being a larger variety, it also provides a good yield of dried product per fruit.

- Queen (or MacGregor): While not as commonly used as the Smooth Cayenne, it is recognised by its golden flesh and rich, sweet and slightly tart flavour that becomes richer upon drying. Its smaller size often results in titbits or chunks rather than rings when dried.

- Red Spanish: A smaller variety with a more robust and aromatic taste. Although it is cultivated extensively in certain regions, it is less preferred for drying. This is because its higher fibre content results in a tougher texture when dried and the yield of dried product per fruit is less compared to Smooth Cayenne.

- Baronne De Guinée: Also known simply as “Baronne”, this is a pineapple variety that originates from the French Antilles and has gained in popularity in certain regions, especially in parts of Africa. It has a sweet and aromatic flavour profile. The flesh of this variety is firm and less fibrous than certain other varieties, making it suitable for drying. Being a relatively large fruit, it can provide a good yield of dried product.

In addition to the variety-specific traits, 2 other characteristics are important for producing dried pineapple. While juiciness is generally a sought-after trait in fresh consumption, for drying purposes, overly juicy varieties might take longer to dehydrate and can result in a less consistent final product. Any pineapple variety that does not ripen uniformly can also pose challenges in achieving a consistent taste and texture in the dried product.

While certain varieties are more popular for commercial dried pineapple production, artisanal and smaller-scale producers can try a range of varieties to achieve unique flavours and textures in their products.

Dried pineapple is a product prepared from sound and mature ripe fruit of varieties of the Ananas comosus species, processed by drying. Pineapple is a perishable fruit that is harvested seasonally and as such it has a variable, year-round supply. Specifically, this means there is an oversupply of fresh pineapple during harvest seasons which leads to lower prices during harvest season.

As pineapples do not ripen much after harvesting, their flavour profile remains consistent from the point of harvest to the drying process. This also means that there is a narrow optimal window for drying to retain the best flavour and nutritional content. Growers often process the fruit soon after harvest to capture its peak ripeness.

While pineapples do not ripen after harvest, they can still deteriorate. Producers must ensure that post-harvest handling and storage are optimal to maintain fruit integrity until the drying process begins. Reducing post-harvest losses of agricultural products is a strategic method to increase farmer income.

In pineapple producing regions, a lack of fruit collecting or processing facilities, inadequate transportation and poor infrastructure can lead to high post-harvest losses. Even long distances between farms and buyers can cause product spoiling. Pineapple drying is a simple and effective method of food preservation that solves some of these problems. In tropical and sub-tropical countries, solar energy is often the most obvious and affordable way of drying fruit.

Pineapples have a high water content, typically around 86% or more. A general estimate is that it takes between 8 to 10kg of fresh pineapples to produce 1kg of dried pineapple, although this depends on the variety. There are many different types of dryers available. The tunnel dryer using heat exchangers in combination with a biomass boiler is seen as a good choice. Pineapple can be dried by the sun in combination with active indirect solar tunnel dryers (PDF) that protect the fruit from rain, insects and dust.

According to product specifications, dried pineapple can generally be produced in categories such as type of cut, use of preservatives and processing method.

1. Type of cut:

- Slices/Rings - Probably the most common form, where the pineapples are sliced across their width to form rings. Most often a hole is left in the middle where the core was.

- Chunks/Cubes - Pineapple flesh is cut into smaller, bite-sized pieces.

- Titbits - These are smaller than chunks and are typically irregular pieces.

- Strips - Sliced longitudinally, these are longer sections of pineapple.

2. Use of preservatives:

- Sulphites - They can be used in dried pineapple to preserve colour and extend shelf life. However, some consumers are sensitive or allergic to sulphites, and there is a strong demand in Europe for products without them.

- No Preservatives - Natural or organic dried pineapple products that do not use any chemical preservatives. These may have a shorter shelf life and may turn brown over time.

- Other Additives - Some dried pineapple is sweetened (with sugar or other sweeteners) to enhance flavour. Others might be treated with citric acid to retain a tangy flavour or with other natural preservatives such as ascorbic acid (vitamin C) to maintain colour.

3. Processing method:

- Sun dried - Although this air-drying method lasts longer and might result in a more varied product, it is energy efficient and cost efficient.

- Oven or dehydrator dried - Using controlled temperature and humidity, this air-drying method can produce a consistent product faster than sun drying. These are prevalent in the European market.

- Freeze dried - This method removes moisture from the pineapple by first freezing it. Then surrounding pressure is reduced to allow the frozen water in the fruit to sublime directly from the solid phase to the gas phase. Freeze-dried pineapple retains more nutrients and has a very different, often crisper texture than when traditionally dried. This is a more niche category that is better developed in the USA.

- Infused Drying - The pineapple can be infused with flavours (such as passion fruit or rum) before drying, offering a unique taste.

This study focuses its attention on natural dried (air-dried)pineapples.

Figure 1: Dried pineapple pieces

Source: Dried Pineapple by missbossy is licensed under CC BY 2.0.

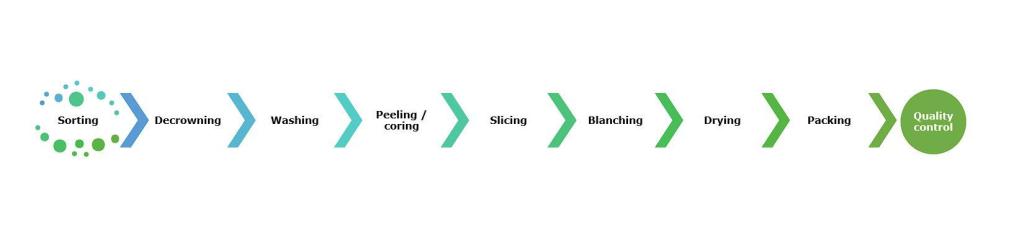

Dried pineapple processing can vary based on the region, the scale of production and the available equipment. The primary goal is to convert perishable pineapples into stable products with a longer shelf life while minimising qualitative and quantitative losses. A more detailed breakdown generally includes the operations described below. For a more in-depth understanding, consulting specialised resources such as the Handbook of Pineapple Technology: Production, Postharvest Science, Processing and Nutrition might be beneficial.

- Selection of fresh pineapples – the process begins with the selection of ripe, healthy and undamaged pineapples. The quality of the fresh fruit is crucial as it impacts the final product's quality. Fruit with higher dry matter content will give a better final product. Processing is easier if the pineapple is larger and has less fibre.

- Decrowning – the process of removing the crown (the leafy top part) of the pineapple. This is usually done with a sharp blade or a specialised machine. The crown is cut off to make the pineapple easier to handle in subsequent steps.

- Washing – after selection, the pineapples are thoroughly washed to remove any dirt, pesticides and other contaminants.

- Peeling and coring – peeling and slicing can be done manually on tables or by machine. Pineapples are peeled to remove the tough outer skin and then cored to eliminate the hard central core. Coring involves removing the hard central core of the pineapple, which is not usually eaten due to its tough texture. This step makes the fruit ready for slicing.

- Cutting/slicing – the peeled and cored pineapples are then sliced into uniform pieces. Uniform slicing ensures even drying and a consistent final product.

- Blanching (a process of brief scalding) – helps to sterilise and fix the pineapple slice colour. It can also improve the antioxidative activity. As a pretreatment, it affects the drying behaviour of pineapple slices, aiming at reducing the energy requirements for the drying process.

- Drying – blanched slices are placed onto drying trays that are placed on racks that can be moved to drying chambers or can be dried in a solar dryer. These chambers can be monitored for temperature and humidity. Hot air drying is a simple, low-cost method of drying. The slices can be flipped over during the process. Dried pineapple in the diced form can be produced in a 2-stage drying process. This is done by first placing the fruit in a concentrated sugar solution to draw out a proportion of the water by osmosis, followed by hot-air drying.

- Packing – once dried to the desired level, the pineapple slices are packaged in sealed containers to preserve their freshness and flavour, and extend their shelf life. Slices are packed in sealed plastic or aluminium packaging bags to preserve the ideal water content and soft texture.

Figure 2: Dried pineapple manufacturing process

Source: Autentika Global

For a good visualisation of the pineapple drying process, view a video of such an industrial line in operation in Africa.

Dried pineapple is used at home (for example, as a snack or cooking ingredient), out of the home (for example, in hotels, restaurants and other places) and in the food industry (for example, in bakery and confectionery products or in breakfast cereal mixtures).

Dried pineapple for snacking is usually sold in plastic bags or pouches and is eaten as a healthy substitute for sweets, chocolate or crisps. This market is still developing, as the habit of eating dried pineapple as a snack is still relatively minor in Europe. In addition, dried pineapple is relatively expensive in comparison to other dried fruit, even compared to some other dried tropical fruit.

Dried pineapple that is used as an ingredient in the food-processing industry is usually in the form of slices, chunks, titbits, strips or as powdered dried pineapple. It is used as a sugar substitute and as a healthy seasoning.

This study covers general information regarding the market for dried pineapple in Europe that is of interest to producers in developing countries. The term “Europe” in this study refers to the 27 member states of the European Union (EU), plus the United Kingdom (UK), and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland).

There is no specific statistical international trade code (HS code) available for dried pineapple. This means that there are no detailed statistics for the import of dried pineapple to Europe. Dried pineapple is statistically included in the same group with fresh tropical fruit products, under the code 08043000 (Fresh or dried pineapple). Therefore, all the quantitative data presented in this study are based on industry estimations, unless specified differently.

2. What makes Europe an interesting market for dried pineapple?

Precise data for European imports of dried pineapple and other minor dried tropical fruits cannot be satisfactorily quantified due to the lack of statistical data. The market situation can only be estimated based on information from industry participants, but this data needs to be taken with caution. A few countries, such as Thailand, statistically track dried pineapple exports under a specific tariff line code. Thailand’s tariff line code for dried pineapple is 08043000002. These exports can be consulted on Thailand’s official export statistics portal.

European imports of dried pineapple dropped by an estimated 5% (in volume) in 2022. According to industry estimates, the quantity of imported dried pineapple was below 1,000 tonnes in 2022. Virtually all imports from outside Europe come from developing countries. The term developing countries in this report is used to denote countries that are listed on the OECD-DAC list of ODA recipients for 2022 and 2023 flows PDF). The annual growth rate is expressed as the cumulative annual growth rate, or CAGR.

In the next 5 years, the European market for dried pineapple is likely to continue to increase, but at a rate of 2-3%. One of the main drivers behind the forecasted growth is health-conscious snacking, as consumers are shifting towards snacks that do not contain added sugars.

With the rapid pace of urbanisation and busy lifestyles, there is a growing preference for convenient and ready-to-eat products. This also bodes well for the dried pineapple market. Factors that are slowing the growth of dried pineapple demand include Russia’s ongoing war against Ukraine, slow economic growth in European countries and higher than average inflation in Europe.

It is estimated that conventional dried pineapple accounts for around 80% of imported volumes, organic dried pineapple for around 15%, and sweetened dried pineapple for the remaining 5%. While organic pineapple has seen impressive growth in the European market, the cost-of-living crisis in many parts of Europe has negatively affected sales of organic products.

Some of the internal European trade consists of the simple re-exporting of imported dried pineapple, but a significant part consists of added-value trade, including operations such as retail packing and the use of dried pineapple as an ingredient in products such as dried fruit mixtures, breakfast cereals, tea mixes, fruit bars and ice cream.

Dried mango remains by far the biggest market for dried tropical fruit. Dried pineapple is still quite new to European mainstream customers, according to Hans Peter Werder, who established the Swiss dried fruit company HPW in 1997. Nevertheless, the product has increasingly been expanding its reach from European specialty stores to supermarket shelves.

3. Which European countries offer most opportunities for dried pineapple?

The inadequacy of the trade statistics for dried pineapple makes it less straightforward to determine which destinations are the most important ones in Europe. Based on estimates, the 2 main importers are Germany and the UK. 2 other important buyers are France and the Netherlands, followed by Switzerland and Italy. These countries all have large importing companies such as Besana in Italy, HPW & Gebana in Switzerland, and Farmer’s Snack and Seeberger in Germany who themselves distribute dried fruits in multiple countries.

Retail sales of some dried tropical fruits such as pineapple reach a peak at Christmas when special packs are marketed. However, this does not mean that sales are generally higher during the winter months when taken as a whole. Switzerland and the Netherlands are important trade hubs for the re-export of dried pineapple to other European countries. The Scandinavian market is also showing growth in demand. Sugar-free products carry a price premium at retail level.

Source: Autentika Global estimate based on industry sources

Germany: Strong presence amongst private labels

Together with the United Kingdom, Germany represents almost half of the European market for dried pineapple. Germany is a fast-growing market. It is estimated that German imports in 2022 were larger than those of the UK, which used to be the largest market for dried pineapple in Europe. Until a few years ago, dried pineapple was mainly sold in specialised stores, but now they are also sold in mainstream supermarkets, including big discounters such as Aldi or Lidl. German dried pineapple sales are forecast to continue growing at a steady rate.

Although there is no exact data, market information suggests that most dried pineapple in Germany originates from Ghana, Costa Rica, Vietnam, Thailand, Uganda, Peru, Mexico, Sri Lanka, Burkina Faso, Myanmar, Tanzania and Brazil.

Germany is a particularly attractive market for organic dried pineapple as the country is the largest European market for organic food. Moreover, sales of sugar-free and preservative-free dried pineapple are increasing. There is an increasing number of launches of snacks that contain dried pineapple. Examples include Alnatura, and dm-drogerie markt.

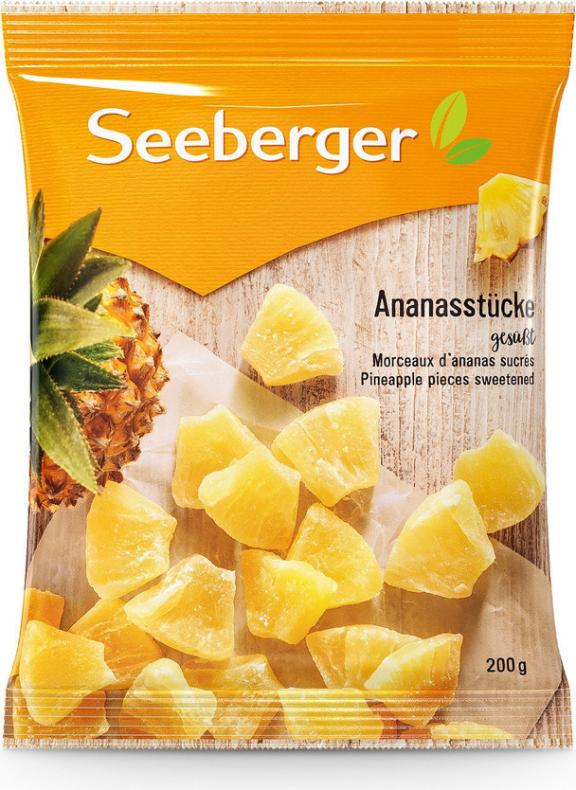

Figure 4: Sweetened dried pineapple pieces snack, from Seeberger

Source: WERTVOLLE SNACKS PINEAPPLE PIECES SWEETENED by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

Significant quantities of dried pineapple products in Germany are sold as private label. These include labels such as Alesto (owned by discounter chain Lidl), REWE Beste Wahl (by REWE), dmBio (by dm-drogerie markt) and EDEKA (by EDEKA). Some examples of independent German dried pineapple brands are Seeberger, Farmer’s Snack, Bremer Gewürzhandel and WeltPartner. Seeberger, Kluth and Farmer’s Snack import directly, but also buy from other traders in Germany and the Netherlands.

A large share of organic dried pineapple is sold as private label brands of specialised organic retailers, such as dm-drogerie markt and Alnatura. There are also smaller independent organic brands such as Rapunzel, Sunday Natural, Keimling, Morgenland and KoRo.

Sustainable sourcing has become very important for German dried pineapple importers. For example, German organic food company Rapunzel has developed its own fair-trade programme and certification called HAND IN HAND. Rapunzel sells many dried fruits, including dried pineapple.

Apart from snacks, dried pineapple is an ingredient of breakfast cereal mixtures. Nevertheless, the usage of sweetened pineapple in breakfast cereals is larger than that of natural dried pineapple. However, it is expected that no-added-sugar dried fruit in breakfast cereals will overtake sugar-infused fruit soon.

Figure 5: Premium muesli containing dried pineapple sold by German retailer Lidl

Source: Autentika Global

United Kingdom: Europe’s pioneering market for dried pineapple

The UK is another mature European market for dried pineapple. In fact, the country was amongst the first markets in Europe that developed a significant consumption of dried pineapple. This is no surprise, as Britain is a leading global importer of dried fruit. Bakers in the UK are important consumers and usually they build up large stocks of dried fruit and have agreed contracts with domestic and foreign suppliers. Annual imports are estimated to be slightly above 250 tonnes.

The largest share of imported dried pineapple is consumed within the country. In most cases, dried pineapple is imported in bulk into the UK and re-packaged within the country. Lines of distribution are relatively straightforward and mainly involve traditional style importers. Some of the largest importers are Whitworths, Urban Fruit and Voicevale. The lines of distribution after traders are more complex. One route is via large wholesalers and processors.

Hides Fine Foods is a supplier of specialty foods such as dried pineapple to the food service sector throughout the UK. There are also smaller independent organic brands such as Sentia Origins. Equal Exchange sells fair-trade sun-dried pineapple from Uganda. Suma, the largest equal-pay worker co-op in Europe, is an important wholesaler of dried pineapple. Natural snacks producer Wallaroo sells organic, fair-trade, dried pineapple from West Africa that does not contain preservatives or sulphites. Its products are sold in FSC-certified, 100% recyclable paper and shipped in boxes made from recyclable materials.

Like other packaged snack markets, focusing on UK consumer demand for healthy snacks with natural ingredients is where significant opportunity exists for small businesses producing dehydrated fruit in developing countries. The diced version of sweetened pineapple is popular for cereals, smoothies or adding to bakes and tropical fruit cakes. Diced pineapple is a popular format in the UK market as it works in both sweet and savoury dishes.

In August 2023, UK snack brand Bear (owned by Urban Fresh Foods) introduced a new line of dual-flavoured fruit snacks, called Fruit Splits, specifically designed for older children. Fruit Splits is available in 2 flavours: strawberry & apple and raspberry & pineapple. The snacks are made with real fruit and contain no added sugar or juice concentrates.

Some 70% of imported dried pineapple is sold in the form of retail snacks, such as the tangy, crunchy pineapple chips or pineapple pieces made from air-dried “wonky fruit” by Holland & Barrett. The remaining 30% is consumed either as part of a dried fruit mixture or as an ingredient for other products, such as baking products. The UK dried pineapple import market is quite concentrated with a relatively small number of regular importers.

The leading suppliers of dried pineapple to the United Kingdom are Ghana, Thailand, Peru, Uganda and the Philippines. The UK is also a relatively large consumer of sweetened or crystalised dried pineapple, mostly imported from Thailand.

Figure 6: Dried pineapple chips from Holland & Barrett

Source: Pineapple Chips - Holland and Barrett - 18g by manda for Open Food Facts is licensed under CC BY-SA 3.0

In the UK, not all retail chains offer their own private-label dried pineapple products. This contrasts with the dried mango sector, where major retailers such as Tesco, ASDA, Waitrose, Morrisons and Aldi predominantly feature their private labels. As of 2023, these chains largely sell branded dried pineapple offerings rather than their in-house label products. Notably, Sainsbury’s diverged from this trend by introducing its own Sainsbury's dried pineapple brand.

A leading independent brand is Whitworths. Other independent brands include Forest Feast (brand by Kestrel Foods), Urban Fruit, Wholefoods and Queenswood Natural Foods.

The market in the UK offers specific opportunities for suppliers of Fairtrade-certified dried pineapple, as the country is home to one of the largest fair-trade product markets in Europe. As shoppers strive to become more sustainable, they are increasingly demanding ethically-sourced products, according to the Fairtrade Foundation. Examples of UK fair-trade products made from dried pineapple include products from Tropical Wholefoods (recently purchased by Equal Exchange) and Forest Feast.

Dried pineapple is also used by confectionery makers such as Awesome Chocolate to manufacture premium chocolate delicacies or chocolate snack bars such as the Delicias milk chocolate with pineapple. Hallans also sells its Yaadgaar chocolate & pineapple slices cake.

France: Strong ties to suppliers in West Africa

France is a particularly attractive market for French-speaking suppliers of dried pineapple from West Africa (such as Togo, Cameroon, Benin and Côte d'Ivoire). Thailand is also an important supplier.

Leading independent private brands include Brousse Vergez and Maître Prunille. Dried pineapple brands from other European countries are competing with local brands. Brands that are strong in the organic segment include Bio Day (origin Togo), Juste Bio, Biogout (origin Cameroon) and Daco Bello (in dried tropical fruit mixtures).

Figure 7: Dried pineapple from Paquito

Source: Ananas en morceaux – Paquito by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

Most brands in France started to use the front of pack nutrition Nutri-Score labelling system to label dried pineapple. Dried pineapple that contains added sugar is usually labelled “C” meaning that it has average nutritional value, while the product without added sugar is often labelled “B” for a better nutritional profile.

Some dried pineapple is imported to France through the Netherlands or the United Kingdom, but there is an increasing number of companies that source directly from producing countries. These companies are investing in ethical sourcing and trying to help local communities in developing countries. Examples of such companies include Juste Bio (sells Ecocert-certified organic dried pineapple from Sri Lanka, Togo and Côte d'Ivoire), Graines d'ici (fair-trade dried pineapple from Benin), Biocoop, Agro Sourcing (from Rwanda) and Pepite (Rwanda).

Artisans du Monde is a French network of local fair-trade associations, currently the most important non-profit fair-trade movement in France. The network offers several products made with dried pineapple from small growers in Colombia.

The Netherlands: Europe’s dried pineapple trade hub

In terms of imported quantities, the Netherlands is estimated to be Europe’s third-largest importer of dried pineapple, although it re-exports large quantities to other European destinations. Current domestic consumption is estimated to be around 70 tonnes per year. This makes the Netherlands the fourth-largest consumer of dried pineapple in Europe, after Germany, the UK and France. The leading supplier to the Netherlands is Ghana, but Dutch importers source dried pineapple from many different destinations, including South Africa, Gambia, Mozambique, Thailand, the Philippines and other emerging suppliers.

In addition to snacking, dried pineapple is increasingly being used as an ingredient in fruit bars, bakery and confectionery products, and breakfast cereals. There are some original new products that include dried pineapple such as cream cheese with dried pineapple pieces that is sold by the Coop food retailer.

A large share of traded dried pineapple in the Netherlands is sold under the private labels of some supermarkets that carry the product. One of them is Lidl that sells dried pineapple under its Alesto Bio label. The product is also sold in health retail shops such as Holland & Barrett. The import volume of organic dried pineapple in the Netherlands is relatively high and led by one of the largest European specialised organic importers, Tradin Organic. This company sources organic dried pineapple from several origins, such as Vietnam, Togo, Costa Rica and India. The variety of pineapple it sources from Vietnam is of the Queen variety and the Costa Rican pineapple is of the MD2 variety.

Many online retailers offer their own branded dried pineapple products such as De Notenshop, while smaller brands – such as Mijn Natuurwinkel – are also expanding their presence in the dried pineapple market. Belgium’s Damhert also sells its dried pineapple cubes across the Benelux region.

Switzerland: Producing and trading country

Although small in terms of its consumption, Switzerland is home to a few very large trading and processing companies which together sell an important share of European dried pineapple. Switzerland is attractive for trading organic dried pineapple. The Swiss company HPW has several dried fruit processing facilities in West Africa, making the company one of the largest African dried fruit suppliers. The 2 BRC-certified plants are HPW Fresh & Dry Ghana and HPW Fresh & Dry Côte d'Ivoire.

After starting with the first block farm in 2016, HPW now supports ten block farms – 3 of which are organic – with 100 farmers on 100 acres of land. Each block corresponds to about half a hectare of land, which is farmed by 1 farmer. In addition, there are another 14 pineapple producer cooperatives, 4 of which are certified organic. All farms and cooperatives together provide HPW Fresh & Dry with over 4,100 tonnes of premium quality fresh pineapple annually.

HPW produces about 400 tonnes of dried pineapple (conventional, fair trade, organic) annually, using only fully ripened pineapples with a naturally high sugar content. The company sells only natural dried pineapple, all year round, without the addition of sugar or other sweeteners. It offers dried pineapple in different sizes from pieces smaller than 1 cm, to titbits and pineapple rings. The company produces innovative fruit snacks using some of the dried fruit, such as dried mango and pineapple. HPW has its headquarters in Switzerland, so some trade is performed through Switzerland, making the country an important trade hub.

Another important Swiss company is Gebana, which is also trading and producing dried pineapple from West Africa (Togo). Gebana has operated as a fair-trade company since 1998. Gebana fruit products are packaged in their country of origin and they are not repackaged afterwards. The fruit is sold in bulk packages directly from the country of origin to reduce waste, carbon emissions and costs. Dried pineapple is sold in the form of pineapple pieces and pineapple rings.

A significant share of dried pineapple in Switzerland is sold as private label, through leading retail chains such as Coop. Coop offers Organic fair trade dried pineapple from Ghana under its Naturaplan private label. The retailer also offers branded dried pineapple pieces made by Issro under its Morga brand. Issro has several dried pineapple products in its portfolio, including sweetened dried pineapple slices, pineapple pieces from Thailand, and dried pineapple in fruit mixtures.

Migros also sells sweetened, unsulphured dried pineapple under its Sun Queen private label, and also from the Stiftung Orte zum Leben foundation brand that is produced in the foundation’s facility in Oberentfelden for Migros. A smaller share is sold by independent brands, such as Germany’s Seeberger. HPW has developed and launched fruit bars and fruit rolls, based on dried pineapple, under its organic and fair-trade Tropicks brand.

Smaller players such as Gakomo also offer Fairtrade-certified dried pineapple products from small-scale farmers in Cameroon. Some innovative uses of dried pineapple include cream cheeses with dried pineapple and almonds by Castello.

Italy: Growing imports and re-exports

Dried pineapple is consumed in Italy mainly as a snack. Sales are dominated by supermarket private labels, such as Coop, Esselunga or Penny Italia (Amonatura brand). A popular way of dried fruit sales is in small discount packages of €1 per package (for 100 g of dried fruit). The leading independent brand is Noberasco that offers a range of dried pineapple products, including non-sweetened and sweetened conventional and organic snacks, as well as fruit bars with dried pineapple.

Euro Company, a major nut and dried fruit company, is also an important player in Italy’s dried pineapple market with a range of product brands. Some of its brands include Semplicemente frutta and Frutta e Bacche that sells both conventional and organic pieces, as well as dried pineapple rings (sourced from Côte d'Ivoire, Sri Lanka, Ghana, Costa Rica and South Africa). Other suppliers are Rome-based Castroni Coladirienzo and Life (pineapple sourced from Thailand). A leading Italian organic brand selling dried pineapple in mixtures with nuts is Econoce (owned by Euro Company).

Figure 8: Dried pineapple from Amonatura

Source: Ananas essiccato - Penny by kiliweb for Open Food Facts is licensed under CC BY-SA 3.0

Local Italian consumption of dried pineapple is estimated to be around 50 to 60 tonnes per year. Significant quantities of imported dried pineapple are exported to other European countries. This re-export is led by strong brands (such as Noberasco) in other European countries, as well as the presence of strong Italian traders (such as Besana). New brands, such as Sweet Africa, are also offering 100% traceable and sustainable dried pineapple products from Kenya.

Dried pineapple is also sold by the Italian premium private label brand Il Viaggiator Goloso, a top-of-the range brand for demanding customers developed by retailer Unes Supermercati.

Tips:

- Stay abreast of the market for dried pineapple in the United Kingdom through the National Dried Fruit Trade Association UK.

- Search for advice on possible buyers in the Federation of Bakers Limited (FoB), the trade association representing the UK Bread and Bakery industry.

- Find German traders of dried pineapple on the websites of the specialised German Association - Waren-Verein and in the German company directory – Wer liefert was.

- Learn more about the marketing of tropical fruits from the French association for research in the fruit and vegetable sector (CTIFL).

- Consider obtaining Fairtrade certification to enter the United Kingdom market or organic certification for easier penetration into the German market.

- Approach relevant associations, including the Nederlandse Zuidvruchten Vereniging in the Netherlands, to identify the most suitable importers for dried pineapple.

- Stay up-to-date by following news from the Swiss Federal Office of Agriculture.

- Identify the most suitable brokers or specialised traders who can help exporters from developing countries introduce dried pineapple to Italy.

4. Which trends offer opportunities or pose threats on the European dried pineapple market?

The increasing demand for healthy snacking and product innovations are the leading driving forces behind the growing consumer interest in dried pineapple in Europe. Moreover, sustainable and ethical production is becoming an important aspect for European traders and consumers. However, a short-term threat for small and medium exporters from developing countries is the high price point of dried tropical fruit at a time of slow economic growth in Europe and relatively high inflation. Consumer sentiment is further worsened by Russia’s war in Ukraine.

Economic slowdown and high inflation

The European region is grappling with the repercussions of slow economic growth, high inflation and financial instability, partly triggered by the energy crisis following Russia’s invasion of Ukraine. Inflation in the food, alcohol and tobacco sector rose to 15.4% and is expected to remain high throughout the year, making food items, including relatively expensive choices like dried pineapple, less affordable for average consumers. Consumers reacted by exercising restraint and this dampening of demand also affected the dried tropical fruit category.

Europe's economic growth is expected to be merely 0.3% in 2023 due to a myriad of factors including the ongoing war in Ukraine, which is a significant downgrade from the global economic growth projection of 2.2% for the same year. While there is a growing market for dried pineapple driven by health trends and consumer preferences, the ongoing economic challenges, worsened by the Russia-Ukraine war, pose significant hurdles for new exporters targeting the European market.

Many European countries have seen consumers reining in their expenses and becoming more frugal. Dried tropical fruit, especially dried pineapple, is generally seen as a luxury product. European consumers have been changing their shopping habits even during the high-spending Christmas season, which is traditionally a high point for sales of dried fruit. Inflation means the pricier products are certainly being more quickly overlooked and this certainly includes tropical fruit.

When inflation is high, consumers often cut back on discretionary spending or opt for cheaper alternatives. Given that dried pineapple is a premium dried tropical fruit product, consumers might find it less affordable and may avoid purchasing it in favour of lower-cost or locally sourced fruits and snacks. The economic slowdown can result in lower disposable income amongst consumers. As households may have less money to spend, they might also prioritise essential goods.

A lot of the world is now going through what is also termed a process of deglobalisation. This process is something that is relatively new and could negatively affect consumer demand for dried tropical fruit. With Europe’s Farm to Fork strategy and the disruptions caused by COVID, European fruit and vegetable consumers have got more used to consuming local products.

In August 2023, the FAO warned of several significant threats to global production, trade and consumption of major tropical fruits. In its Major Tropical Fruits Market Review (PDF), the FAO warns that high inflation rates, high interest rates and exchange rate fluctuations threaten to hinder demand, especially for higher-value tropical fruits. In this regard, particularly consumers in poorer economic areas, who spend a higher proportion of their income on food, may be affected by a reduced access to these commodities.

Healthy snacking

A major established trend that favours the consumption of dried pineapple is healthy snacking. Consumers want healthy options for snacking between meals or for snacks which can replace meals. Young consumers who are increasingly better informed about their general health and wellness are diversifying from savoury snacks such as potato chips and other crisps. As a result, nuts, as well as dried fruit, are becoming increasingly popular as a snack. The latest data shows 58% of European consumers wanting to improve their eating habits.

The sale of dried fruit products will benefit from increasing governmental pressure in many European countries towards regulating the promotion of unhealthy snacks. European governments are increasingly asserting their powers to improve the eating habits of consumers, with the pioneering High in Fat, Sugar and Salt (HFSS) regulation in England highlighting the power of public bodies to influence and disrupt the entire foods industry.

Sustainability surge and slowing demand for organic

Several sustainability initiatives are in implementation in dried pineapple production countries. In general, consumers and retailers are increasingly interested in sustainable and ethically produced fruit products, including dried pineapple.

Overall, demand for organic and sustainably grown tropical fruit has been on the rise in Europe in recent years. European consumers are increasingly aware of the positive environmental impacts and health benefits of organic food. This surge in organic food demand is tied to a growing concern for the environment, which is heavily influenced by climate change and a desire for healthier food choices. EU imports of organic tropical fruit, nuts and spices (PDF) increased by 7% in 2021, according to the European Commission.

More than half of surveyed Europeans confirmed they ate more sustainably since the COVID-19 pandemic, according to new market research. The research by the Kerry Group also showed that 51% of consumers in thefoodservice sector said they were happy to pay more for sustainable options. Keep in mind that this attitude may have changed due to the recent period of high inflation in Europe.

The COVID-19 pandemic was also an important driver that boosted organic sales. However, sales of organic products in 2022 may have been affected by surging inflation driven by energy costs and food prices. Recent estimates indicate that organic food sales in the EU may end up contracting by about 5% (PDF) in 2022. Sales in France and Germany, that together represent more than 60% of the total organic market in the EU, are forecasted to go down.

From Grandmas' Gardens is a socially responsible brand of dried pineapple developed as a charity project and sponsored by Reach the Children Uganda. As a local community organisation, it is managed by grandmothers and helps them provide for their families. This project enables them to feed their grandchildren and pay school fees. By purchasing 100% Ugandan dried pineapple, UK consumers get a tasty snack and support sustainable incomes for families and communities in need. The charity also has a YouTube channel that provides more information about the story and the grandmas behind the product.

Figure 9: Dried pineapple made by From Grandma’s Garden

Source: Dried pineapple by andslau for Open Food Facts is licensed under CC BY-SA 3.0

Pure and Just Company, a small-scale dried mango, pineapple and papaya processor in Accra, supported by the Ghana Climate Innovation Centre, turns about 2 tonnes of waste produce into biogas every week. The company sells its dried mango and pineapple under its ready-to-retail and wholesale brand Yvaya Farm.

Austrian company Twiga Sun Fruits recently launched a project to produce solar-dried pineapple in Uganda. The company aims to produce organic, fair-trade dried pineapple that meets European quality standards. Twiga Sun Fruits places value on leaving as much added value as possible in Uganda while also taking a sustainable approach. The dried fruit is packaged directly in Kangulumira in an inert gas atmosphere. Project partners aim to increase production volume from 8 to 150 tonnes of dried pineapple per year.

More information on sustainable and ethical production trends can be found in the CBI processed fruit and vegetables trends study.

Tips:

- Subscribe to the free newsletter of the International Nut & Dried Fruit Council (INC). Keep up to date on industry news, health and nutritional properties of dried pineapple. This will help you promote the applications and advantages of dried pineapple consumption.

- Read the CBI market statistics and outlook on processed fruit & vegetables study to learn more about general trade trends and the size of the specific market segments.

- Check the websites of trade shows and exhibitions to discover the newest trends. The most important trade fairs in Europe relevant to dried pineapple are SIAL (France, every even year in October), Anuga (Germany, every uneven year in October) and BIOFACH (Germany, organic products, every year in February).

- Label all dried pineapple products containing sulphites accordingly or do not use sulphites if possible. Some consumers avoid food products with sulphites. About 1 in 100 people (according to the FDA) are sensitive to these compounds. Sulphur dioxide and sulphites are amongst the 14 most common allergens, according to the European Centre for Allergy Research Foundation.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research