Entering the European market for dried tropical fruit

Food safety certification combined with reliable and frequent laboratory testing helps create a positive image for dried tropical fruit suppliers wishing to export to Europe. Emerging suppliers can reap additional advantages through sustainable production methods and the implementation of corporate social responsibility measures. South Africa, Burkina Faso and Ghana are the leading suppliers of dried mango, while Ecuador is the main supplier of banana chips. Thailand is the leading supplier of sweetened dried tropical fruit.

Contents of this page

1. What requirements must dried tropical fruit comply with to be allowed on the European market?

What are the requirements?

All foods, including dried tropical fruit, sold in the European Union must be safe. Imported products are no exception. Additives must be approved. Limits are placed on levels of harmful contaminants, such as pesticide residues and mycotoxins.

Contaminant control in dried tropical fruit

The European Commission Regulation sets maximum levels for certain contaminants in food products. This regulation is frequently updated, and apart from the limits set for general foodstuffs, there are a number of specific limits that apply to contaminants in particular products including dried tropical fruit. The most common requirements regarding contaminants in dried tropical fruit relate to pesticide residues, micro-organisms, preservatives and food additives.

Contamination by foreign bodies

Insects are an important issue when importing dried tropical fruit to the European market. In order to prevent contamination with insects, suppliers from developing countries should implement preventive measures such as fumigation and temperature treatments. When using fumigation, you must apply only officially approved fumigants. For example, methyl bromide as a fumigant is banned in the European Union.

Pesticide residues

The European Union has set maximum residue levels (MRLs) for pesticides found in and on food products. Products containing levels of pesticide residues exceeding the prescribed limit are withdrawn from the European market. The majority of European importers request extensive testing for the presence of a wide range of pesticides (sometimes more than 500).

The European Union regularly publishes a list of pesticides that are approved for use in the European Union. This list is frequently updated. In 2019, the European Commission adopted 12 new laws prescribing changes with respect to nearly 80 different pesticides. One of the most important changes is the level of Chlorpyrifos, which is set to 0.01ppm from November 2020.

Microbiological contaminants

The presence of very low levels of salmonella and E. coli in ready-to-eat or processed foods, including dried tropical fruit, is an important cause of foodborne illness. Dried tropical fruit processors should consider salmonella and E. coli as major public health risks in their hazard analysis and critical control point (HACCP) plans.

Heavy metals

In 2020, the European Commission launched a review process for the maximum allowed levels of lead and cadmium. New limits for some products may be set in 2021. New regulations suggested a gradual decrease in the limit for lead. For dried tropical fruit produced in the 2019-2020 harvest, the maximum allowed level of lead will probably be 0.15 mg/kg. For dried tropical fruit produced in the 2020 harvest and beyond, the limit will be 0.10 mg/kg.

Food additives

European authorities can reject products if they contain undeclared or unauthorised extraneous materials or if the levels of these materials are too high. There is specific legislation governing additives (like colours, thickeners) and flavourings, that lists which E numbers and substances are allowed to be used. Additives that are authorised are listed in Annex II to the Food Additives Regulation. Other annexes of the regulation list food enzymes, flavourings and colorants.

Two examples of frequent problems related to dried tropical fruit is when preservatives (for example sulphites, sodium dioxide etc) or food colourings have either been used at levels which are too high or when their presence is not declared. The food dye E110 - Sunset Yellow, which is used in dried sweetened tropical fruit, is one typical example.

A problem related specifically to the production of banana chips is the presence of benzo(a)pyrene and polycyclic aromatic hydrocarbons (PAH). These toxic organic compounds may be formed when banana slices are fried in coconut oil. Levels of polycyclic aromatic hydrocarbons have been limited specifically for banana chips since 2015, due to an amendment of the European contaminants regulation. The level of benzo(a)pyrene in banana chips must not exceed 2 μg/kg and the total PAH content (B1, B2, G1 and G2) must not exceed 20 μg/kg.

Tips:

- Follow the Codex Alimentarius Code of Hygienic Practice for Dried Fruits. In dried tropical fruit, in particular, it is important to control the occurrence of insects and other parasites.

- Read more about MRLs on the European Commission website on maximum residue levels. To be prepared for any new changes in the MRLs, read the ongoing reviews of MRLs in the European Union.

What additional requirements do buyers often have?

Quality requirements

The quality of dried tropical fruit is determined by the percentage of defective produce, by number or by weight. The industry has defined several quality criteria, but some of them, such as taste and flavour, are subjective and cannot easily be determined on the basis of physical characteristics.

Specific quality standards for dried tropical fruit have not been officially established by the European Union. The standards most commonly used, are those published by the United Nations Economic Commission for Europe (UNECE). To date, UNECE has established specific standards for dried mango, dried pineapple and naturally dried bananas. A standard for banana chips has not yet been established. A new recommendation (undergoing assessment until the end of 2019) has been made for dried papayas.

The basic quality requirements for dried tropical fruit are:

- Fruit must be free of insects, mould, damage and blemishes.

- Moisture content: this varies depending on the type of dried tropical fruit. In general, the moisture content of natural dried fruit without added preservatives or sugars must be lower than that of fruit with added preservatives or sugar. The moisture content of natural dried mangoes must not exceed 15%, while that of pineapples and bananas must not exceed 20% and 18%, respectively. The moisture content of dried mangoes treated with preservatives must not exceed 20%, while that of treated pineapples and bananas must not exceed 44% and 18% to 25%, respectively. The recommended maximum moisture content for naturally dried papayas is 18%, and between 18% and 25% for treated dried papayas.

- Food additives: some types of food additives are allowed in the production of dried tropical fruit. Additives used in the production of dried tropical fruit include sodium chloride and calcium chloride. These additives are used to keep the moisture content from increasing. Sulphur dioxide is sometimes added to prevent rotting and discolouration and citric acid, which is an antioxidant, can also be added for this purpose. Sugar or fruit juice are also allowed and are often used in the production of dried tropical fruit infused with sweeteners.

- Quality classification: although European legislation does not classify dried tropical fruit as regards permissible defects, suppliers sometimes divide their products into three classes: Extra, Class I and Class II. This classification is determined based on the percentage of defective products by number or weight.

Food safety certification

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide some type of food safety certification.

The majority of European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). For dried tropical fruit the most popular certification programmes, all of which are recognised by GFSI, are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

Please note that this list is not exhaustive and food certification systems are constantly under development. The majority of food safety certification programmes are based on existing ISO standards like ISO 22000.

Although different food safety certification systems are based on similar principles, some buyers may prefer one management system in particular. For example, British buyers often require BRC, while IFS is more common for German retailers. It should also be noted that food safety certification is only a basis from which to start exporting to Europe. Serious buyers will usually visit/audit your production facilities within no more than a few years.

Corporate Social Responsibility

Companies have different requirements as regards social responsibility. Some companies will require adherence to their code of conduct or to common standards such as the Supplier Ethical Data Exchange (SEDEX), Ethical Trading Initiative (ETI) or amfori Business Social Compliance Initiative code of conduct (BSCI).

Packaging requirements

There is no general rule for the size of packaging for exported dried tropical fruit, but the most common type of export packaging is plastic bags or plastic liners placed in cardboard boxes of different sizes. Packaged products should be transported on Euro-pallets (80 x 120 cm) and transported onwards in containers. Twenty-foot containers may contain 1,600 cartons of 12.5 kg each or 2,000 cartons of 10 kg each.

The use of paper or stamps bearing trade specifications is allowed, provided the printing or labelling has been done with non-toxic ink or glue. The packaging is often formed in a cubic shape in order to efficiently use the pallet and container space. Dimensions can vary but all are compatible with standard pallet and container dimensions.

Dried tropical fruit does not need to be transported or stored at a particular temperature. However, extremely low or high temperatures should be avoided. If the product is stored at high temperatures, fruit sugar particles may form on the surface of the product, leading to hardening and discolouration.

Labelling requirements

The name of the product must appear on the label. Other trade names pertaining to form, can be used in addition to “dried tropical fruit name”. It is common for export package labelling to also include the name of the variety, crop year and drying method (such as “sun dried” or another method of drying). Information about bulk packaging has to be included either on the packaging or in accompanying documents. Bulk package labelling must contain the following information:

- Name of the product

- Lot identification number

- Name and address of the manufacturer, packer, distributor or importer;

- Storage instructions — storage and transport instructions are very important due to the high oil content and sensitivity to high levels of moisture, which can negatively influence the quality, if not dealt with properly.

The lot identification number and the name and address of the manufacturer, packer, distributor or importer may be replaced by an identification mark.

In the case of retail packaging, product labelling must be in compliance with the European Union Regulation on the provision of food information to consumers. This regulation specifies requirements for nutrition labelling, origin labelling, allergen labelling and clear legibility (minimum font size for mandatory information). Please note that this regulation lists dried tropical fruit as a product which can cause allergies or intolerances and therefore allergen information must be clearly visible on the retail packaging.

In addition to this regulation, from 1 April 2020, all food in retail packs in Europe must be labelled with an indication of origin. For example, if a product is packed in Germany, packaging still needs to indicate the origin. This can be done by indicating a country (for example Burkina Faso), by indicating “non-EU”, or by declaring “product does not originate from Germany".

Additional nutrition information, such as content of fibre, vitamins or minerals, can be placed on the retail products on a voluntary basis. In order to better inform consumers about healthier food choices, several nutritional labelling voluntary schemes were developed in Europe. The most famous and widely accepted by consumers is nutri-score, but there are other schemes such as Nutriform battery (Italy), Front of Pack Nutritional Labelling (also know as ‘traffic light’, the United Kingdom) or Keyhole (Sweden).

Dried tropical fruit is not included in the allergen list included in the regulation. However, sulphites must be indicated as potential allergens if they are used as preservatives. Retail packs must be labelled in a language which can easily be understood by consumers in the European target country. In general, that will be the official language in that country. This explains why multiple languages are often included on the label of European products.

Tips:

- Read our study about buyer requirements for processed fruits and vegetables for a general overview of buyer requirements in Europe.

- Read more about the transport and storage requirements for dried fruit on the website of Cargo Handbook.

- Do a self-assessment using the producer starter kit via the amfori BSCI website.

What are the requirements for niche markets?

Organic dried tropical fruit

To market dried tropical fruit as organic in Europe, it must be grown using organic production methods according to European legislation in this respect. Growing and processing facilities must be audited by an accredited certifier before you are allowed to use the European Union’s organic logo on your products. The same goes for the logo of the standard holder (for example, the Soil Association in the United Kingdom or Naturland in Germany).

Note that importing organic products to Europe is only possible if you are in possession of an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the European Union has to be accompanied by an electronic certificate of inspection, as defined in Annex V of the Regulation defining imports of organic products from third countries. This electronic certificate of inspection has to be generated via the Trade Control and Expert System (TRACES).

Sustainability certification

The two most commonly used sustainability certification schemes are Fairtrade and Rainforest Alliance. Fairtrade international has developed a specific standard for prepared and preserved fruit and vegetables intended for small-scale producer organisations. Among other criteria, this standard establishes a Fairtrade Minimum Price for dried mango from West Africa and for dried bananas.

In order to improve the sustainable production and sourcing of dried tropical fruit, a group of primarily European companies and organizations formed the Sustainability Initiative Fruit and Vegetables (SIFAV). The aim of SIFAV is for 100% of fruits and vegetables imported from Africa, Asia and South America to be sustainably sourced by 2020.

Sustainability certifications focus on different aspects such as environmental protection and ethical behaviour toward farmers, employees and animals. Some certificates deal with one aspect only while some cover broader range of aspects. There are new certification schemes based on CO2 emission including MyClimate or Carbon Footprint Certification. One certification scheme supporting several sustainability aspects is Planet Proof. Planet Proof includes several themes such as energy and climate, crop protection, biodiversity and landscape, soil fertility, clean water, packaging and waste.

Ethnic certification

The Islamic dietary laws (Halal) and the Jewish dietary laws (Kosher) impose specific dietary restrictions. If you want to focus on Jewish or Islamic ethnic niche markets, you should consider implementing Halal or Kosher certification schemes.

Tips:

- Consult the Sustainability Map database for sustainability labels and standards.

- Check the guidelines for imports of organic products into the European Union to familiarise yourself with the requirements of European organic traders.

- Read our study on Trends on the European processed fruit, vegetables and edible nuts markets for an overview of the developments in terms of the sustainability initiatives in the European market.

- Read SIFAV Basket of Standards to familiarise yourself with sustainability standards relevant for dried tropical fruit.

2. Through what channels can you get dried tropical fruit on the European market?

Dried tropical fruits are used as a snack and as ingredients in the food processing industry in Europe. Approximately 50% to 60% of the total imported dried tropical fruit in Europe is used as an ingredient for further processing, while some 40% to 50% is re-packed and sold by retailers, or used in the food service segment. It should be noted that this share reflects the continued leading role of sweetened tropical fruit used by the industry. However, when it comes to natural dried tropical fruit without added sugar, a much larger share is sold in the retail segment as a snack.

How is the end market segmented?

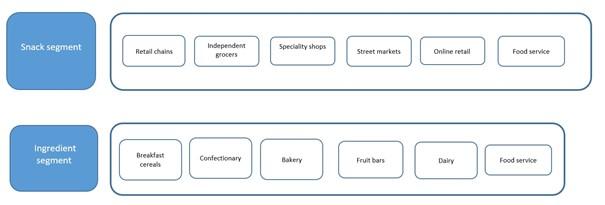

Figure 1: End market segments for dried tropical fruit in Europe

Source: Autentika Global

Snack segment

Approximately 40% of imported dried tropical fruit in Europe is sold as snacks. The consumption of natural dried tropical fruit (dried mango, in particular) is increasing, but the large market share is still mostly accounted for by sugar infused dried tropical fruit.

Consumer demand for healthier sweet snacking options, compared to chocolate and other sweet snacks, has boosted consumption of dried tropical fruit as a snack. According to PR Newswire, the size of the global healthy snack market is expected to reach USD 32.88 billion by 2025, expanding at a CAGR of 5.2% during the forecast period.

Currently, the most popular dried tropical fruit is dried mango, followed by dried pineapple. The snack segment is served by packing companies, which repack and brand imported bulk tropical fruit. Many of these companies pack dried tropical fruit under private labels for the European retail chains. Some companies have their own brands, but usually the market is concentrated and a relatively small number of companies in each of the European countries supply the snack segments. For examples of leading dried tropical fruit brands in Europe, please read our study on their market potential.

“No sugar added” and “preservatives-free”, are the main trends influencing the snacking segment. Dried tropical fruit (such as mango or pineapple) has an enticing exotic flavour, a good balance of sweetness and tartness(not too sweet) and provides minerals, vitamins, phytonutrients and fibre. Moreover, consumers wishing to satisfy their sugar craving, still perceive sugar infused tropical fruit as less “unhealthy” than chocolate and other sweet snacks.

Ingredient segment

The food processing segment accounts for roughly 60% of the European dried tropical fruit market. Several important product launches and developments are described in the trends chapter of the market potential study. The most common dried tropical fruit ingredient users include the following:

- The breakfast cereal industry is a major user of sugar infused dried tropical fruit. In order to meet consumer demand for products low in sugar, it is expected that breakfast cereal producers will increasingly use tropical dried fruit (which is infused with natural sweeteners such as concentrated fruit juice) instead of dried fruit that is sweetened with sugar syrup.

- The confectionary industry mainly uses cut tropical fruit to produce sweet snacks. New product formulations increasingly use dried tropical fruit coated with chocolate and other sweet glazing ingredients.

- The bakery industry uses pieces of raw dried tropical fruit in cookies, cakes and pastries. The bakery industry is still an important user of sweetened dried tropical fruit, such as cuts of dried mango, papaya and pineapple.

- Dried tropical fruit bars are available in an increasing number of varieties. Organic fruit bars are growing in popularity (especially in Germany). Naturally dried tropical fruit is used as the main fruit ingredient in some fruit bars, while others consist mainly of dehydrated fruit puree.

- The dairy industry uses dried tropical fruit as ingredient in fruit preparations for ice creams with tropical flavours, or in fruit yoghurts.

Tips:

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for your dried tropical fruit within the food ingredient segment.

- Visit or exhibit at ISM Cologne, the leading European trade fair for sweets and snacks, to explore opportunities in the dried fruit snack segment.

Through what channels does dried tropical fruit end up on the end-market?

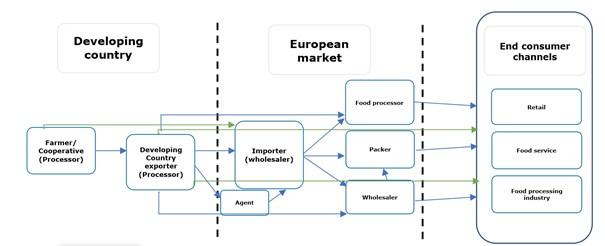

Specialised dried fruit importers represent the most important channel for dried tropical fruit in Europe. There are also several alternative channels, such as agents, food processors or food service companies.

Figure 2: European market channels for dried tropical fruit

Source: Autentika Global

Importers/wholesalers

In most cases, importers act as wholesalers. They very often sell dried tropical fruit to packing companies which package it for sale to consumers. Some importers also have their own processing and packing equipment, so they can also supply retail and food service channels directly. However, many important dried fruit brands import dried tropical fruit directly, instead of buying it through specialised importers.

Importers are usually quite knowledgeable when it comes to the European market and they closely monitor developments in dried tropical fruit producing countries. Therefore, they are your preferred contact, as they can inform you in good time about market developments and provide practical advice about exports. Dried tropical fruit importers often import other types of dried fruit and edible nuts as well, so offering other products in addition to dried tropical fruit can increase your competitiveness.

The position of the importers and food manufacturers are put under pressure by retailers. The higher demands imposed by the retail industry determine the supply chain dynamics from the top down. This pressure translates into lower prices, but also into added value in the form of “sustainable,” “natural,” “organic,” or “fairtrade” products. As a result, transparency in the supply chain is needed. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred developing country suppliers.

Dried fruit packer

Most of the leading European dried fruit brands import dried tropical fruit directly. For new suppliers, the challenge is to establish lasting relationships with well-known dried fruit companies, as they usually already work with selected suppliers. Established importers perform audits and visit producing countries on a regular basis. Many new contacts find they must offer the same quality at lower prices than their competitors, at the start of the relationship. Many dried fruit packers will request that you adhere to specific code of conduct, as they are under considerable pressure from the retail industry, as already mentioned.

Agents/brokers

Agents involved in the dried tropical fruit trade typically perform two types of activities. Agents normally act as independent companies that negotiate on behalf of their clients and as intermediaries between buyers and sellers. Typically, they charge commissions ranging from 2% to 4% of sales prices for their intermediary services.

Another activity performed by these parties is the supply of private labels for European retail chains. For most developing country suppliers, it is very challenging to participate in the demanding private label tendering procedures. For these services, some agents, in cooperation with their dried tropical fruit suppliers, participate in procurement procedures put out by the retail chains.

Dried tropical fruit agents in the leading European markets include the following: Kenkko (the United Kingdom) Hpm Warenhandelsagentur (Germany), MW Nuts (Germany) and QFN (Netherlands).

Retail channel

Retailers rarely buy directly from developing country exporters. Recently, the retail sector has become increasingly polarised, seeing a shift towards either the discount or the high-level segment. Until recently, naturally dried tropical fruit was offered mainly in the high-end retail segments. However, in the last two years, dried tropical fruit has also been offered by several large European discounters (for example ALDI’s “Simply Nature” dried mango or Lidl’s “Alesto” dried mango and dried pineapple).

The leading food retail companies in Europe differ per country. The companies with the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands).

Foodservice channel

The foodservice channel (hotels, restaurants and catering establishments) is usually supplied by specialised importers (wholesalers). The foodservice segment often requires specific packaging of dried tropical fruit in weights of 1kg to 5kg, which is different from the requirements for bulk or retail packaging.

World cuisines, healthy food and food enjoyment are the major driving forces in the foodservice channel in Europe. The fastest-growing business types tend to be new (healthier) fast food, street food and pop up restaurants, as well as restaurants serving international cuisines and sandwich bars.

Tips:

- Search the list of members of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM), to find buyers from different channels and segments.

- Understand the pressure from retailers for sustainable products and increase your competitiveness by investing in different certification schemes related to CSR, organic foods or food safety. Having food safety certification is the minimum requirement if you want to tap into the retail segment.

What is the most interesting channel for you?

Specialised importers seem to be the most useful contact if you aim to export dried tropical fruit to the European market. This is specifically relevant for new suppliers as supplying established brands, or the retail segment directly is very demanding and requires considerable investments in the area of quality and logistics.

However, packing for private labels may be an option for the well-equipped and price competitive producers. Still, private label packing is often done by importers that enter into contracts with retail chains in Europe. In addition, in order to have full control of the processing, it is easier to pack dried tropical fruit for the snack segment within Europe. As the cost of labour in Europe is increasing, dried tropical fruit importers sometimes search for more cost-effective packing operations, in developing countries, for instance.

3. What competition do you face on the European dried tropical fruit market?

Which countries are you competing with?

The leader in sweetened dried tropical fruit is Thailand. The leaders in dried mangoes are Burkina Faso, South Africa and Ghana. The leaders in dried pineapples are Costa Rica and Ghana. The leader banana chips is Ecuador. Many other countries are also emerging on the European dried tropical fruit market.

Ecuador, the leading banana chips supplier

Ecuador has been the leading banana exporter for decades. Ecuador is home to the most highly developed banana industry in the world. The country also processes bananas into products such as banana puree or banana chips. In Ecuador, green plantains are generally used for processing into chips, instead of bananas. Plantains are similar to bananas, they are locally popular and eaten cooked, steamed or fried. In Ecuador, the leading plantain variety used for processing and exporting is Barraganete. Both, green plantains and green bananas are cut and processed by frying them in coconut oil to produce banana chips.

Ecuadorian exports of banana and plantain chips totalled more than 18,000 tonnes in 2019, with Saudi Arabia as the main destination. In 2019, the European Union imported 2700 tonnes of banana and plantain chips from Ecuador. Ecuador accounts for more than 70% of Europe’s total banana chips supply, followed by the Philippines and Uganda. Uganda is Ecuador’s main competitor and developed the offer of exporting naturally sun-dried bananas to Europe, in addition tos banana chips. However, the majority of European consumers are still not familiar with naturally dried bananas and consumption in Europe is much lower than that of banana chips.

The largest market for banana and plantain chips within Europe is the Netherlands. It imports 80% of its supply from Ecuador, followed by France (8%), Germany (8%) and the United Kingdom (4%). France and Germany import most of their bananas and plantains chips from Ecuador, but the United Kingdom has a different structure of sourcing origins. The United Kingdom imports the majority of its dried bananas from Uganda (414 tonnes in 2019/Bogoya variety), followed by Philippines (300 tonnes/ Saba and Cardava variety). Ecuadorian banana chips are usually purchased by European consumers as snacks or as an ingredient in breakfast cereals.

Ecuadorian export companies receive considerable support from the governmental export promotion organisation Pro Ecuador. Pro Ecuador has more than 30 sales offices worldwide, helping companies form links with European companies. In addition, Pro Ecuador regularly arranges for Ecuadorian companies to participate in the major European trade events.

Thailand, the leading supplier of sweetened dried tropical fruit to Europe

Thailand is the leading Asian producer of dried tropical fruit. In the course of the development of the pineapple canning industry in Thailand, food processors have mastered other types of fruit preservation methods, including drying and sugar preserving. Most of the dried fruit produced in Thailand is sweetened, but over the last couple of years many processors have also increasingly begun producing naturally dried fruit without added sugar.

Exports of dried tropical fruit from Thailand totalled 180,000 tonnes in 2019. The majority of Thai dried fruits are exported to China. European consumers are not familiar with most of Thailand’s range of dried fruit. For example, the leading exported product is dried longans (165,000 tonnes exported in 2019), followed by dried tamarinds and dried durians. Those products are not well known among European consumers.

The most popular dried fruit products exported from Thailand to Europe are dried (mostly sweetened) mangoes and papayas. In 2019, exports of dried mangoes from Thailand totalled more than 3,000 tonnes, but the majority were exported to the United States, followed by China. The exact quantity of dried mangoes exported from Thailand to Europe is not known, but the quantity of dried papayas exported in 2019 was around 720 tonnes.

Apart from being the leader in naturally dried (and often sweetened) tropical fruit, Thailand is the world’s leading exporter of candied (sugar preserved) fruit. Exports of candied fruit totalled more than 66,000 tonnes in 2019. These types of products are often referred to as “dehydrated fruit” on the European market. The most popular candied products from Thailand sold on the European market are sugar preserved pineapples, followed by sugar preserved papayas and mangoes. Exports of sugar preserved pineapples from Thailand to Europe amounted to almost 6,000 tonnes in 2019.

Thai dried tropical fruit companies usually produce and offer products in three different ways: as fruit with a low sugar content (less than 10%), fruit with a normal sugar content (more than 10%) and fruit without added sugar. Although the addition of sugar is not perceived as “healthy”, by European consumers, it does make dried tropical fruit softer and sweeter compared to naturally dried fruit. The European breakfast cereal industry and producers of fruit snacks use significant quantities of sweetened dried tropical fruit from Thailand.

The promotional activities of Thai producers are supported by the Department of International Trade Promotion (DITP) of the Ministry of Commerce. DITP regularly organises national pavilions for Thailand’s exporters at all major European trade shows. The current strategy of DITP is to increase Thai companies’ online sales through online marketplaces such as Thaitrade and Alibaba. There are currently nine Thai fruit products for sale on these platforms, namely durian, mangosteen, lamyai, mango, coconut, jackfruit, rose apple, pineapple and longan.

Burkina Faso, supplier of organic dried mangoes

Burkina Faso has the most sophisticated mango processing industry. The country has been home to a large mango-drying sector since the late 1990s. The main production zone for mangoes is in Orodara, Banfora and Bobo-Dioulasso. Thanks to investments in mango cultivation and the establishment of new drying facilities, production in Burkina Faso continues to increase.. The key varieties used for drying are Amélie, Kent, Keitt and Brooks. Many farmers and processing facilities are certified for the organic production, making Burkina Faso the global leader in the production and export of organic dried mangoes.

In 2020, production of dried mangoes in Burkina Faso was estimated at 3,000 tonnes. Around 2,700 tonnes was exported, with the remaining 300 tonnes consumed locally. Around 80% of mangoes from Burkina Faso are exported to Europe. This means Burkina Faso supplies more than one third of the total dried mangoes destined for the European market.

Burkina Faso mainly uses tunnel drying technology, which is transferred from South Africa. There are constant efforts to improve drying technology and in one recent initiative, biogas was produced from mango processing waste (such as peels or pits). In addition, in order to have enough raw materials for drying, more and more is invested in new plantations and irrigation.

Burkina Faso’s mango production is supported by the Association of Mango Producers of Burkina Faso (known in French as APROMAB). In addition, several international funding projects have helped support the mango sector over the last several years. One of these projects, which received more than, €23.5 million in funding from the European Union, the French Development Agency, the Economic Community of States West Africa (ECOWAS) and governments of West African countries, involved fruit fly control.

Ghana, supplier of dried mangoes and dried pineapples

Ghana is the third-largest supplier of dried mangoes to Europe and probably the largest supplier of naturally dried pineapples. Exports of dried mangoes from Ghana to Europe are estimated at more than 1700 tonnes. The key varieties used for drying are Kent and Keitt. Although there are several fruit drying facilities in Ghana, the vast majority of the dried fruit, is exported by the Swiss-Ghanaian company HPW (read more about this company in the chapter below).

South Africa, pioneer of dried mangoes

South Africa has been the leading dried mango producer in Africa for many years. South African dried fruit processors were the first to develop a modern industry for the production of dried grapes, apricots and prunes. After years of experience in dried fruit production, processors transferred the knowledge to the production of dried mangoes and became the African leading producer of natural dried mangoes. Over the last several years, some processors started to invest in production facilities in other countries, especially in Burkina Faso.

South Africa’s mango producing regions are mainly situated in the North Eastern part of the country with Limpopo as the leading producing region, followed by Mpumalanga. There are several mango cultivars grown in South Africa but Kent, Keitt and Tommy Atkins are mainly used for drying. South African dried Keitt variety is perceived to be one of the best in Africa. Traditionally, Europe is the main export destination for South African dried mango, but increasing quantities are exported to other African countries, the United States of America and Australia.

South African dried mango exports are decreasing, as many processors switched to production in Burkina Faso in order to decrease production costs and become more competitive. In the last few years, the estimated export quantity of dried mangoes from South Africa was around 1,000 tonnes. The first estimations for the 2020 season show that South Africa produced only 50-60% of the normal volumes of dried mangoes. This means that the estimated production in 2020 would be around 500 tonnes.

India and the Philippines, emerging suppliers

It is not possible to list all countries that are increasing their exports of tropical dried fruits to Europe in this study. There are simply too many. However, India and the Philippines are two countries with different product profiles, which both seem to have high export potential. That is why we choose to discuss them here.

India supplies specific types of dried tropical fruit to niche segments of ethnic markets in Europe. Tamarind, for example, is one of the products that is not widely known among European consumers but is popular among Europe’s Asian population. India, like Thailand, also exports sweetened tropical fruit (such as sweetened papaya, mango or pineapple rings), but in smaller quantities. Some of the Indian companies have started producing naturally dried mango using the Kesar and of Alphonso varieties. Those types of mangoes are novel on the European market as their flavour is different from the varieties currently imported from Africa and other countries.

The Philippines is an important supplier of banana chips and dried mangoes to Europe and is growing in importance. A specific mango variety (Carabao) is exported to some European retailers as a high-end product, due to its specific flavour. It can therefore be sold at higher prices, on average, than other types of mangoes. Another emerging product is banana chips (made from Cardava and Saba varieties). There are more than 40 processors and exporters of banana chips in the Philippines.

Tips:

- Read the CBI value chain study for processed Fruits from Burkina Faso, Ivory Coast and Mali to better understand competition from Burkina Faso.

- Read the specialised study on the impact of COVID-19 on dried mango sourcing from West-African countries.

- Read the CBI dried mango study to keep up-to-date with the European dried mango market.

Which companies are you competing with?

There are many companies around the world that produce, process and export dried tropical fruit. Some of the large dried fruit processors in Africa come about as a result of investments by European companies. The same cannot be said of Asian companies, which are established mainly by local investors. A brief overview of some leading companies in each supplying country is given below.

Thai companies

There are many companies that process tropical fruit in Thailand. It is not easy to identify only one as a good practice example. However, GCF International, which has been active for more than 30 years, is one of the largest producers of dried tropical fruit in Thailand. Over the years, GCF International has become the largest Thai dried fruit exporter, supplying almost 50 export destinations around the world. GCF is constantly investing in innovations and creating new products. Established and new products are regularly promoted at the leading trade fairs in Europe.

Other examples of Thai dried fruit companies are: Unity Food, Phootawan, TanTan, Smile Fruit, Chinwong Food Company, Fruit House, Apple's Island, Fruittara, Thaweephol Samroiyod, Vita Food, Ampro Intertrade, Chin Huay, S.Ruamthai, Rama Siam, V & K Pineapple Canning and Fruit House Thailand.

Ecuadorian companies

The leading processor and exporter of banana chips in Ecuador is Exotic Blends, also known by the brand name Samai. Apart from developing processing capacities, Exotic Blends invests in sustainable and ethical production. The company is Rainforest Alliance certified and supports small-scale farmers and indigenous groups in Ecuador. Exotic Blends also produces banana chips in a sustainable way, for example by using banana peels as a fertilizer. Apart from banana chips, the company has developed a wide range of tropical fruit chips with different flavours.

Other examples of companies from Ecuador are: Rogai, TropicMax, Platayuc and Exporganic. In addition, the French international ethically focused company Ethiquable, sources and organises the production of banana chips in Ecuador.

Companies in Burkina Faso

In Burkina Faso, mangoes are processed by both local companies as well as by establishments of foreign investments. Locally-established dried mango processors and exporters include Sanle Sechage, Mango-So, NAFFA, Wouol Association (a cooperative) and Fruiteq. The largest foreign investment is Timini. Timini is currently the largest producer of dried mangoes in Burkina Faso. It is a joint venture company created in 2014 by Fruiteq SARL (Burkina Faso), MPAK Pty Ltd (South Africa) and Westfalia (South Africa).

Dutch company Tradin Organic cooperates closely with the drying facility in Banfora, while the German company EgeSun sources dried mangoes from Waka Group. Swiss company gebana Burkina Faso (formerly gebana Afrique) used to source organic and FairTrade-certified mangoes from local producers and process them in its own facility in Ghana. Gebana was active for twelve years in Burkina Faso but recently went bankrupt. However, in November 2019, gebana announced the company’s rehabilitation and a fresh start of operations.

Ghanaian companies

Most of the production and export of dried mangoes and pineapples in Ghana is arranged for with investments from Swiss company HPW. HPW is the largest mango and pineapple processer in Ghana and also one of the largest suppliers of dried mangoes in Europe. HPW cooperates closely with local farmers. HPW became a member of SIFAV and created the Special Initiative on Pineapple Production in Ghana. The aim of this project is to secure a supply of high-quality pineapple and to improve the standard of living of smallholder pineapple farmers.

Apart from exporting bulk-dried mangoes, HPW has created innovative dried tropical fruit snacks. A few years ago, HPW created 100% dried tropical fruit bars and recently developed 100% dried mango and pineapple fruit rolls. HPW won the innovation award at ISM 2019 for this product.

Another large processor in Ghana is the company Bomarts. Originally producing five tons of dried mangoes per year, today the company produces more than 500 tonnes of dried fruits annually, including mango, pineapple, papaya, coconut and banana. Bomarts has forged a partnership with Swiss company Varistor. Other dried tropical fruit suppliers from Ghana include Blavo mango and Integrated Tamale Fruit Company (part of the African Tiger group).

Examples of companies from South Africa, India and Philippines

- South Africa - Westfalia Fruit, Cape Dried Fruit Packers, Taste Africa Foods, Cecilia Farms, Baobab Value Adding (part of Blydevallei), Landman Dried Produce and Cape Mango

- India – Sresta, Krishnakath Foods, Jainys Cereals, Saraf Foods, and Yesraj Agro Exports

- Philippines – Gold Chips (a See International brand), El Coco Manufacturing, LTA Food Manufacturing, B-G Fruits, Prime Fruits, and Celebes.

Tips:

- Visit the website of the Southern African Mango Growers Association (SAMOA) for a list of mango processors in South Africa. SAMOA is the association of growers, processors and exporters of fresh and dried mangoes.

- Use the services of your national export promotion agency and actively participate in the development of export strategies.

- Visit leading European trade fairs regularly to meet competitors and potential customers. ANUGA, SIAL or Food Ingredients are just a few examples. For organic products visit Biofach, the world's largest trade fair for organic food and agriculture.

Which products are you competing with?

The main competing product is fresh tropical fruit. European consumers have become increasingly health-conscious and prefer a healthy diet, which includes increased consumption of fresh fruit and vegetables. This trend can influence the consumption of dried tropical fruit, especially if it is treated with artificial colouring, or has added sugars or preservatives. Considering such factors, the strong competition from fresh tropical fruits will likely be a major challenge for the European dried tropical fruit snacks market in the coming years.

Tip:

- Read CBI’s Fresh Fruit and Vegetables studies to better understand competition from fresh fruit.

4. What are the prices for dried tropical fruit?

Calculating margins according to final retail prices for dried tropical fruit is not very informative and will only give a very rough general idea of price developments. However, the CIF price is estimated to represent approximately 30% of the retail price of a pack of dried tropical fruit. If dried tropical fruit is used as an ingredient, estimating the added value is even more complicated, due to the number of different ingredients and the production process.

Prices also fluctuate due to differences in harvests, which change from year to year, and recently the strong influence of El Niño. In some cases, the prices of the materials used in the production process can also have an impact, such as the recent high price of coconut oil, which is used in the production of banana chips.

In the 2020 season, FOB (Free on Board) prices for natural dried mangoes were lower than in 2019. For example, the average FOB price from Burkina Faso was around €7.5/kg. This was lower than in 2019, when the average price was €8, while prices for South Africa and the Philippines were up to €10. After importing, bulk wholesalers re-sell the same product without any changes for €8.50, resulting in a margin of €1. The price of most sugar-infused dried fruit from Thailand was between US $3 and US $5 per kilo (€2.60-€4.30/kg).

The most common end-market price ranges in Europe for selected dried tropical fruit are as follows:

- Dried mango: €20/kg-€27/kg — prices of organic dried mangoes are higher;

- Dried pineapples: €15/kg-€20/kg;

- Dried banana (banana chips): €6/kg-€10/kg.

Table 1: Breakdown of retail prices for dried tropical fruit

| Steps in the export process | Type of price | Price breakdown |

| Production of fruit or vegetables | Raw material price (farmers’ price) | 5%-20% |

| Handling, processing and selling bulk product | FOB or FCA price | 20%-30% |

| Shipment | CIF price | 35%-50% |

| Import, handling and processing | Wholesale price (value added tax included) | 60% |

| Retail packing, handling and selling | Retail price (for average packaging of 250g) | 100% (retail price as seen in stores) |

Tips:

- Subscribe to the IHS Markit portal, which is one of the most respected market information services for food ingredients including dried tropical fruit. Subscribers have access to overviews of dried tropical fruit export prices, which are published regularly and updated frequently.

- See our product studies on dried mango to learn more about exporting this specific product to Europe.

This study was carried out on behalf of CBI by Autentika Global.

Please review our market information disclaimer.

Search

Enter search terms to find market research