Entering the European market for table olives

New table olives exporters that want to enter the European market should test their olives regularly. You may have a competitive advantage if you can offer table olives with superior sensory characteristics. Other olive products may have an advantage because of their specific production area, certified organic status, or unique characteristics. The strongest competitors to new table olives suppliers are currently in Spain, Italy, Greece, Türkiye, Morocco and Egypt.

Contents of this page

- What requirements and certifications must table olives comply with to be allowed on the European market?

- Through which channels can you get table olives on the European market?

- What competition do you face on the European table olives market?

- What are the prices of table olives on the European market?

1. What requirements and certifications must table olives comply with to be allowed on the European market?

General information on buyer requirements for processed fruit and vegetables can be found in our study about buyer requirements on the European processed fruit and vegetable market.

What are mandatory requirements?

Food safety is a critical part of EU food legislation. The European Commission has developed a food safety strategy for every step of production, from farm to fork, set out in the general food law. Table olives sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. Only approved additives are allowed, and products must conform to maximum levels for harmful contaminants.

The most common requirements regarding contaminants are related to pesticide residues, heavy metals, microbiological organisms and food additives. Due to the high level of optimisation in processing lines and sterilisation in processing, microbiological contamination is rare in the European market. However, incidents do occur. Physical and chemical contamination are also possible. There were 15 alerts regarding table olives reported by the European Rapid Alert System for Food and Feed (RASFF) between 2019 and 2023.

A phytosanitary certificate is required for the import of fresh and frozen fruits and vegetables into the EU. However, this does not apply to table olives according to Regulation (EU) 2019/2072.

Tariff barriers

Table olive exporters to the EU from developing countries can be subject to various tariff barriers. This depends on the country of origin and the trade agreements in place. The EU has preferential trade agreements with many developing countries, which allow reduced or zero tariffs under specific conditions.

Many table olive producing countries are members of the Euro-Mediterranean partnership agreement. However, the EU also has free trade agreements with Albania, South Africa, Palestine and some South American countries. Trade relations between the EU and its Southern Neighbours are managed at the bilateral level. This is done through free trade areas established under the framework of the Euro-Mediterranean Association Agreements. Thanks to these arrangements, exporters like Morocco, Egypt, Algeria, Tunisia and Türkiye have 0% tariff preference rates.

The EU applies a common customs tariff on imported table olives from third countries. This usually amounts to 12.8% depending on the type and preparation of the olives. This higher rate applies to Argentina, Australia, Iran, Iraq, Libya, Saudi Arabia, Syria, Brazil and the United States of America (USA). When a tariff is calculated, it is applied to the value per kilogram of drained net weight.

These tariffs apply to countries that do not have preferential trade agreements with the EU. The EU’s tariff schedule for olives can be viewed on the EU TARIC system by searching for the goods code 200570.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products, and it maintains a list of active substances that are authorised for use, mostly as pesticides. In 2023, the European Commission approved 36 new regulations. Although high levels of pesticide residues are not very common for table olives, some European importers do request tests for the presence of pesticide residues.

According to the 2019 EU report on pesticide residues published in April 2021, olives have some of the lowest residue levels in Europe. Still, cases of excessive pesticide residues in table olives occur. In January 2020, the European Commission confirmed a decision not to renew the authorisation for the insecticides chlorpyrifos and chlorpyrifos-methyl. The MRLs for chlorpyrifos and chlorpyrifos-methyl were lowered to 0.01 mg/kg for food across the EU with effect from November 2020. These insecticides were used widely in the olive growing industry.

Nevertheless, at least four notifications involving chlorpyrifos in table olives were reported between 2019 and 2023. Spain issued an alert in September 2023 after finding chlorpyrifos in a shipment of table olives from Morocco. The detected residue was reported as amounting to 0.067+/- 0.034 mg/kg, while the MRL was 0.01 mg/kg.

Microbiological contaminants

The presence of microorganisms is regulated by the European regulation on microbiological criteria for foodstuffs and the legislation of individual European countries. Pathogenic bacteria, such as Salmonella or Listeria, must be completely absent. The presence of aerobic bacteria, Escherichia coli, yeasts and moulds can be tolerated in very small quantities. Between 2019 and 2023, there were several cases of RASFF notifications about table olive shipments where Listeria monocytogenes or mould were present.

One example of a serious incident is the detection of Listeria monocytogenes in pitted black olives with garlic from Germany, with raw materials from Spain. Germany issued the report in October 2023, and the product was recalled.

Microbiological contaminants are rare in table olives, as fermentation and the high salt content prevent the growth of many pathogenic and spoilage microorganisms. However, contamination can occur. Denmark recalled a shipment of olives from Türkiye in March 2020 because of mould.

Other contaminants

Border rejections or market withdrawals can be caused by contaminants. This includes packaging corrosion and excessive content of preservatives and colouring. Other reasons include migration of materials (tin, cadmium or glass) from the packaging onto the product.

If present, additives must be approved by the European safety authorities. Additives should comply with Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008.

One example of a contaminant-related incident is the March 2023 notification from Spain. The notification involved a shipment of olives from Spain that was contaminated with glass fragments. Spain and Denmark destroyed the shipment.

A notification was also issued for a shipment of olives from Morocco that contained undeclared sulphites. Sulphites are used for their antimicrobial and antioxidant properties. They stop fungi and bacteria from growing. The maximum permitted level of sulphites in final food except beverages is 2 mg/kg, according to Regulation (EC) No 1333/2008.

Product composition

Table olives have to meet requirements related to processing aids and additives used in brine. Allowed ingredients and additives in table olives and packing brine are determined by the International Olive Council (IOC) and its Trade Standard on Table Olives. The IOC standard defines all allowed additives groups. These include preservatives, acidifying agents, antioxidants, stabilisers, flavouring agents, flavouring enhancers, firming agents, thickeners and agglutinants, and processing aids.

The most commonly used additives in table olives are acidity regulators, such as lactic acid and citric acid. In olives that are darkened by oxidation, the producers use ferrous lactate and ferrous gluconate as stabilisers. The most popular preservative is potassium sorbate. Preservative use in Europe is decreasing due to the clean label trend. Sulphur dioxide is not allowed as a preservative in table olives.

For stuffed olives, bear in mind that foods of animal origin must be authorised by the EU authorities. Olives can be stuffed with a wide range of products, such as cheese, anchovies, fish pastes and ham. In order to export olives stuffed with food of animal origin, the supplying country and individual processing facilities must be authorised to export to the EU. The authorised non-EU countries and establishments are published on the Commission's website.

Adding colourings to table olives is forbidden. It is considered fraud. Several methods for fraud detection are described in research papers published by Spanish and Italian researchers. Fraud usually involves adding copper complexes of copper chlorophyllins and copper sulphate to green olives to maintain a stable green colour.

Packaging and labelling requirements

Packaging for table olives must protect the quality characteristics of the product. The content must correspond with the indicated quantity on the label. For olives packed in brine, the net drained weight should be declared in the metric system by weight.

For retail packaging, product labelling must comply with the EU regulation on the provision of food information to consumers. All food in retail packs in Europe must also indicate origin. Table olives are not on the list of allergens, however, in some cases, materials used for stuffing can be allergenic and must be indicated on the label.

Bulk-packed table olives labels should include lot identification, name and address of the producer, list of ingredients, country of origin, storage instructions, net weight and storage life.

Tips:

- Consult the Codex Alimentarius guidelines to prevent sanitary risks when producing table olives. Specifically look at the codes of hygienic practices for low and acidified low acid canned foods and canned fruit and vegetable products.

- Only perform laboratory tests in ISO/IEC 17025:2017 accredited laboratories.

- Read the latest reviews of MRLs in the EU to follow potential new changes in the MRLs.

What additional requirements and certifications do buyers often have?

In addition to the mandatory requirements, many other specific buyer requests have become equally important. These include compliance with specific food safety, quality and sustainability standards.

Packaging requirements

The packaging of table olives depends on the market segment covered by the importer. If olives are packed directly in retail packaging, producers will receive precise packaging specifications. These will include instructions about materials, the size and type of packaging, and labelling design. Glass jars, tin cans, vacuum bags and pouches are popular packaging formats. Bulk packaging usually involves barrels.

Food service suppliers need packaging sizes of 2–10 kg, which can include cans, jars and plastic buckets. Retail and foodservice containers are packed in cartons and then onto pallets. Using recyclable materials is an advantage as Europe is decreasing the use of non-recyclable packaging.

Food safety certification

Although European legislation does not explicitly require food safety certification for table olives, most European food importers do. Well-established importers will not be interested in your products if you cannot provide the necessary certification. Most European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). GFSI recognises a few certifications that meet the GFSI benchmarking requirements. For table olives, the certification programmes recognised by GFSI are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Make sure to check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, certain retailers may prefer one certification over another. Major buyers will also usually visit or audit production facilities before starting a business relationship.

Türkiye’s ekoFood offers Kalamata-style and black olives from its BRCGS food safety certified unit. The company also has a system that regulates its social responsibility. It uses the SMETA 4 Pillar (SEDEX Members Ethical Trade Audit) for social certification (see below).

Corporate social responsibility (CSR) certification

Companies have different requirements for CSR. Many importers will ask table olive suppliers to follow a specific CSR code of conduct. Most European retailers have their own codes of conduct, such as Lidl and Kaufland (part of Schwarz Group (PDF)), Rewe, Carrefour, Tesco and Ahold Delhaize.

Other companies may insist on following common standards. One of the most common is the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone, without an audit, is not very complicated and not very expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), the amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Tips:

- Train employees to perform in-company sensory and quality tests for table olives. Follow the International Olives Council Guidelines and methods for sensory assessors.

- Read our study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

- Refer to industry examples of product technical sheets. For example, read the product technical specification sheet for standard sliced black Hojiblanca olives published by Spain’s leading olive producer and exporter, AgroSevilla. Check out the full production flowchart for olives on page three of the technical sheet as a good example of disclosure. Consult a product technical sheet for pitted black olives, first quality (PDF), sold by Spain’s Aesekol under the Oh! Professional brand.

Companies should expect European importers and retailers to demand extra effort from their suppliers in sustainable production and niche markets.

Sustainability certification

Two commonly used sustainability certification schemes are Fairtrade Standards and Rainforest Alliance. Fairtrade International certifies the production of oilseeds and oleaginous fruits. Fairtrade has a small-scale producer standard that covers the purchase and sale of oilseeds and oleaginous fruit, including olives. The Rainforest Alliance’s online traceability platform has included fresh and processed fruits and vegetables since 1 January 2023, but not table olives.

Organic table olives

Organic certification can set your table olive products apart. Consider offering olive-in-oil product variants with higher quality oils, such as olive oil. For example, Italy’s Bio Orto offers its organic Peranzana olives as a premium product.

To market table olives as organic in Europe, they must be grown using organic production methods that conform to European legislation. Growing and processing facilities must be audited by an accredited certifier before you can put the EU’s organic logo on your products, as well as the logo of the standard holder (e.g. Soil Association in the UK, Naturland in Germany and Agriculture biologique in France).

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation, which defines imports of organic products from third countries.

For equivalent countries (e.g. Argentina, India and Tunisia), certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Ethnic certification

If you want to focus on the Jewish or Islamic ethnic niche markets, implement Halal or Kosher certification schemes. Several organisations provide Kosher certification in Europe. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain Kosher certification. Halal certification in Europe can be obtained from certifying bodies such as Halal Certification Services.

Morocco’s Olea Capital is the largest olive farmer in Morocco. The company is a Halal and Kosher certified producer of a wide range of table olive products.

Tips:

- Consult the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH, and control bodies and authorities for equivalence. For the Swiss market, you can also check the approved inspection bodies at BIOSUISSE ORGANIC. For the UK market, check out the list of approved UK control bodies.

- Follow the main changes of organic regulation on IFOAM Organics Europe.

2. Through which channels can you get table olives on the European market?

Manufacturers and processors often work with local olive farmers in their countries or in supplier countries. These olives are sourced then processed. Other suppliers import the end products and re-pack them for sale under private labels to retailers or the food service sector.

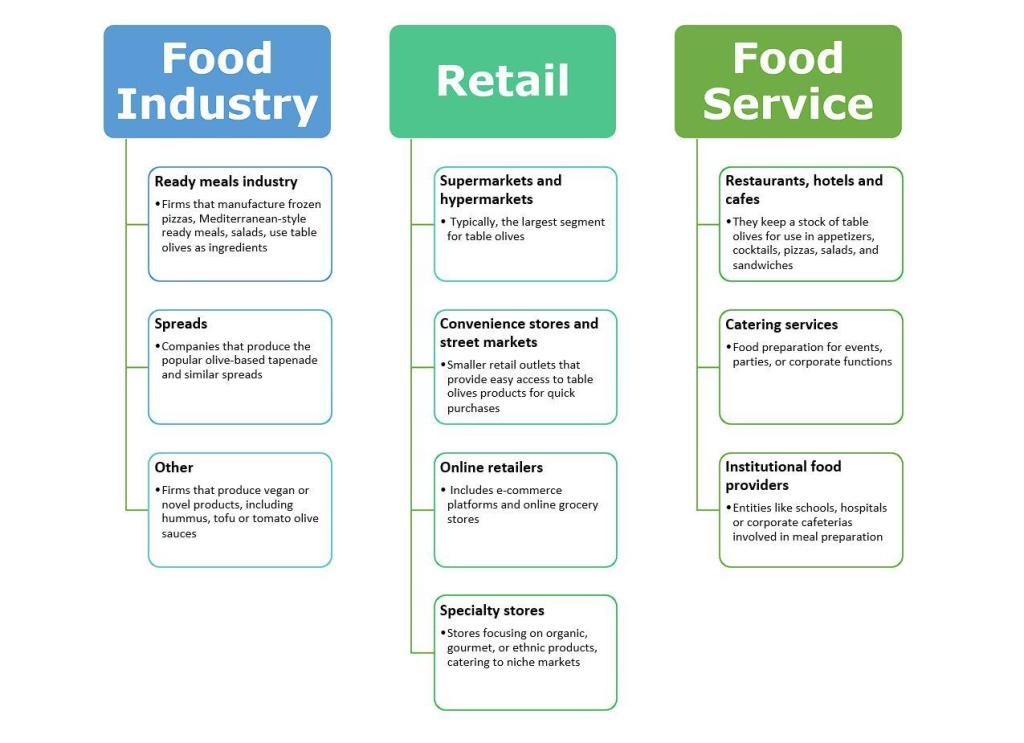

How is the end market segmented?

A recent report suggests that supermarkets and hypermarkets now hold the biggest market share in the table olive industry. In the retail segment, the share of private labels is growing. Many offer consumers a wider range of products. Table olives are used by the food service industry to make a variety of dishes and snacks.

Figure 1: End-market segments for table olives in Europe

Source: Autentika Global

Retail segment

Large retail chains tend to import table olives from developing countries through intermediaries. They also source directly from European suppliers, like Greece, Spain and Italy. Usually, large-scale retail chains sell table olives under their private labels. Suppliers produce them to meet retailer specifications and quality requirements. Retail chains also import branded products, usually through specialised distributors or bulk-packed olives for sale in fresh corners.

Leading food retail companies in Europe differ per country. These outlets are usually very important for sales of table olives. The companies with the largest market shares are: Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold Delhaize.

Several retail alliances coordinate buying operations in Europe:

- Coopernic: includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group

- Carrefour World Trade or CWT: includes Carrefour, Système U, Match and Cora

- AgeCore: Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland

- European Marketing Distribution or EMD: Colruyt – cooperation only on private label, Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia)

- Epic Partners: Edeka, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica

Other points of sale of table olives in Europe include:

- Specialised ethnic retail – The most relevant are those that sell food from Türkiye, the Middle East and North Africa. The Turkish retail segment is especially strong in Germany with ethnic supermarkets, such as Marmara, Eurogida, Özgida and Aima. Other retailers that sell table olives from different origins include Tema, Gima, Aytac (Turkish), AH Empire (Moroccan) and Lebanos (Lebanon).

- Specialised olive and olive oils shops – Specialised shops are often related to certain origins. They represent a very small share of the table olive market. Some olive oil shops offer table olives, such as Oil & Vinegar and Oliviers & Co.

- Specialised ‘fine food’ shops – These shops often sell premium table olives. Some specialised shops are part of luxury food department stores like Fortnum & Mason in the UK. Fine food stores are sometimes present as food corners in shopping malls or department stores, such as La Grande Épicerie in France and De Bijenkorf in the Netherlands.

- Specialised organic and health food shops – Specifically relevant for suppliers of organically certified table olives. Many organic shops are part of specialised organic food retail chains. Some of them import directly.

- Online retail – Online retail is dominated by large retail chains. Some specialised importers sell olives online. These are often connected to certain origins, such as the German company Lakudia (Greek olives) and the UK company The Olive Store (Spanish olives). One example of specialised online sales is the Italian project Oli e Olive. This platform allows restaurants to directly purchase table olives from Italian producers.

- Street markets – Although the market share of street markets has decreased significantly over the last decade, street markets are still a popular place for food shopping in Europe.

Food industry

Most food industry processors purchase table olives from local distributers but rarely import. The biggest use cases of table olives in the European food industry are given below.

- Ready meals – Frozen pizza makers are large users of table olives. Other products with olives include Mediterranean style products, such as pastas, paella and salads. Mediterranean style ready meals are also produced by specialised companies and sold as fresh in refrigerated corners of supermarkets. Some fresh salad producers also import table olives (e.g. Feinkost Dittmann in Germany).

- Spreads – The most famous spread made from olives is tapenade, which is produced in many European countries.

- Other – Olives are used in tomato olive sauces (e.g. Mutti and Potts). The popularity of the vegetarian diet has led to many new product launches. Some use table olives as ingredients (e.g. hummus or tofu).

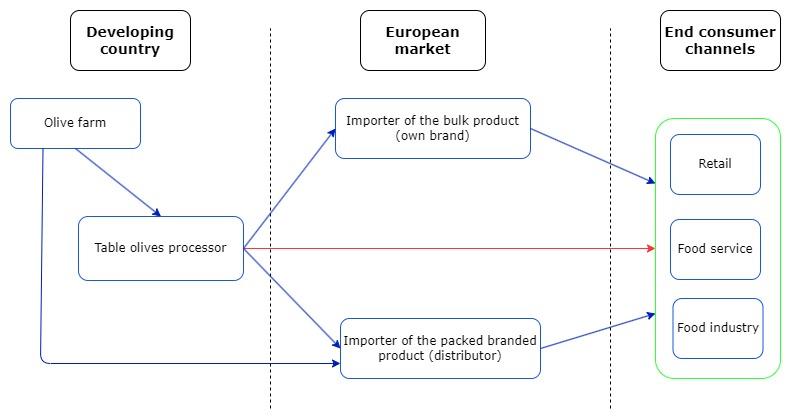

Through which channels does a product end up on the end market?

The most important channel for table olives in Europe are large producing and repacking companies. They import table olives in bulk for their own retail brands. Independent specialised table olives importers are also an important channel. This is true especially for higher-end segments in the European market.

Figure 2: European market channels for table olives

Source: Autentika Global

Importers of the bulk product

Many European companies have well-known brands of table olives. They often buy or import table olives in bulk packaging from selected suppliers. After importing, they can resell the olives without further processing or repack them. If they choose to repack, these olives can also be processed by adding stuffing and new marinades.

For new suppliers, the challenge is to establish long-term relationships with leading brands. At the start of the relationship, you may need to offer the same quality as your competitors but better prices. On the other hand, buyers may be interested in new varieties of table olives to broaden the range of their offer.

Importers of the packed retail product

Importers of packed table olives can be specialised traders or retailers who import directly. Large retail chains usually have centralised purchasing. They may choose suppliers in tenders or through purchasing alliances. Suppliers must be competitive in terms of price and quality and have the necessary production capacity.

Another opportunity is to sell packed products through ethnic supermarkets chains. Larger ethnic supermarkets can be supplied directly, but most individual stores buy from specialised ethnic goods importers.

Important table olive importers in Europe include EMN Europe (present in 18 European countries), OttoFranck, Victor-Konserven, Clama, Henry Lamotte (Germany), Gama, Goodies Foods, Indo European Foods, S.O.P International (UK), Opa Distribution and Agidra (France).

Tips:

- Watch the 2023 Deutsche Welle documentary for more insight into the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

- Read this recent article on why European buying groups are becoming more important in European retail. Bear in mind that retailers have greater bargaining power when negotiating through the alliances.

What is the most interesting channel for you?

Specialised importers are the best contacts for exporting table olives to the European market. This is particularly true for new suppliers who want to reach the retail segment. However, supplying table olives to supermarkets requires high production, distribution and logistical capacities.

Specialised importers usually know the European market well and monitor the situations in table olive producing countries closely. If your company is certified for socially responsible practices or produces organic table olives, look for opportunities with importers specialised in these products.

Tips:

- Read our tips about doing business with European buyers of processed fruit and vegetables and finding buyers on the European market for processed fruit and vegetables.

- Keep an eye on events and channels in the olive oil market as there might be potential for overlap. Read our report on exporting olive oil to Europe.

3. What competition do you face on the European table olives market?

The table olives market in Europe is dominated by European suppliers, mainly by Spain and Greece. Together with Italy, which has a much smaller share, these three countries supply around 70% of table olives to Europe. Fifth-ranked Italy imports more than it exports. The leading developing country suppliers to Europe are Türkiye, Morocco, Egypt, Albania and Argentina.

Source: Autentika Global, ITC Trademap, *Spain, Greece and Italy, 2024

Which countries are you competing with?

Table olives are a popular product across Europe. There are many regional consumer preferences for certain varieties, recipes and flavours. The table olive is emblematic of the Mediterranean region. It has been a staple in European cooking for centuries. There are more than 2000 olive cultivars in the Mediterranean basin. Spanish, Greek and Italian olives are popular in Europe. Suppliers in Egypt, Morocco, Algeria and Türkiye are also well established and appreciated by consumers.

Europe: The benchmark for table olive competitors

Spain, Greece and Italy are main players in the European table olive market. New suppliers need to monitor the competition in Europe as it influences product quality, presentation, trends, messaging and branding.

Europe is the largest table olive producer in the world. The EU-27 is projected to produce 600,500 tonnes of table olives in 2023/24, according to the IOC. This is a sharp decrease from 825,000 tonnes in 2022/23. Spain is Europe’s largest producer, producing 387,800 tonnes in 2023/24, down from 414,200 tonnes in 2022/23. Greek production is estimated at 110,000 tonnes, while Italian production is around 75,000 tonnes.

The USA is the largest market for Spanish table olives, with a 16% share in 2023, followed by Italy (11%), France (10%) and Russia (8%). The average export price of Spanish table olives is much higher (€2,465/t in 2023) in the USA than in other destinations. This is because stuffed and other value-added table olives make up the biggest share of exports to the USA. For comparison, the average export price to Italy was €1,719/t in 2023.

Over the past five years, Spanish exports of table olives to Europe have fallen by 4%, to 201,500 tonnes in 2023. This is down from 237,000 tonnes in 2019. The main varieties in Spain are Hojiblanca (50%) and Manzanilla (32%). Manzanilla is the most consumed variety domestically, while Hojiblanca is the most exported variety.

Spain has awarded a protected designation of origin (PDO) for Aloreña de Málaga and Aceituna de Mallorca table olives. Approval for geographical recognition is underway for Aceituna Gordal de Sevilla and Aceituna Manzanilla de Sevilla. Table olive exporters in Spain are supported by the Association of Exporters and Producers of Table Olives (ASEMESA). Table olive exports are promoted by the Interprofessional Organisation of Table Olives (Interaceituna).

Greece is Europe’s second-largest producer and exporter of table olives. Over the last five years, exports of table olives to Europe have increased at an annual rate of 6%, reaching 126,500 tonnes in 2023. Greece mostly processes locally produced olives, but it also imports 21,800 tonnes from other countries. More than half of these exports are from Albania. The USA is the main export market, accounting for a 19% share of Greek exports, followed by Italy (12%), Germany (9%) and the UK (5%).

The average export price of Greek olives is higher than Spanish olives. In 2023, the average export value of Spanish table olives was €1.98/kg while the price of Greek olives was €2.63/kg. This is because Greece exports a significant share of its naturally fermented kalamata olives, which command a higher selling price. Greece also exports more expensive organic olives and a larger share of retail-packed olives than Spain.

Figure 4: Pitted stuffed Greek Halkidiki olives sold under Lidl’s Chef Select private label

Source: Autentika Global

Greece processed 145,000 tonnes of green Halkidiki, 125,000 tonnes of black Kalamata and 85,000 tonnes of Konservolia (Amfissa) black and green table olives in 2023. The National Interprofessional Organization of Table Olives (DOEPEL) represents the interests of the domestic table olive industry. Greece has ten PDO table olives. Six of them are of the Konservolia variety (Amfisis, Artas, Atalantis, Piliou Volou, Rovion and Stylidas), three of the Throumpa variety (Ampadias Rethymnis Kritis, Chiou and Thassou) and one of the Kalamata variety (Elia Kalamatas).

Greek table olive exporters are united in the Panhellenic association of table olive processors, packers and exporters (PEMETE). The sector is supported by the Greek National Interprofessional Organization for Table Olives (DOEPEL).

Morocco: A major exporter to Europe in slight decline

Morocco is the third largest exporter of table olives in the world, after Spain and Greece. Production was predicted to reach 120,000 tonnes in 2023/4. In 2023, Morocco exported 77,700 tonnes of table olives. France was the largest destination market with a 40% share, followed by the USA (20%), Belgium (9%) and Spain (9%). French companies have invested heavily in the production of table olives in Morocco.

In Morocco, 90% of olive plantations consist of a single variety – Moroccan Picholine – followed by the Dahbia variety. To solve the problems caused by single-variety cultivation, the National Institute for Agricultural Research has selected several high-performing clones of Moroccan Picholine. Two of these (Haouzia and Menara) are now being grown more. New varieties are also being introduced, such as Beldi.

Over the past five years, Moroccan table olive exports to Europe have fallen by 3.8% per year. For the 2024 campaign, the outlook is worrying (in French) due to the effects of climate change. The EU and Morocco signed a deal worth €115 million in 2022 to support Morocco’s farming sector, which includes olive cultivation.

Türkiye: Strong market presence in the Balkans and Germany

Türkiye exported 44,400 tonnes of table olives to Europe and 60,800 tonnes to the rest of the world in 2023. Romania is the largest market for Turkish olives, accounting for a 30% share, followed by Germany (16%), Bulgaria (13%) and Belgium (9%). Germany is an already established market for Turkish olive suppliers as it has many ethnic Turkish shops and supermarkets. Today, an estimated 3 million people of Turkish heritage live in Germany.

Romania and Bulgaria are two of the most important markets for Turkish olives. Some Turkish companies opened subsidiaries in Romania to gain market share. An example of a Turkish company in Romania is Zayko Tarim (with its Loras brand). Türkiye now exports table olives to 116 countries (in Turkish).

Türkiye’s preserved food exporters are supported by the Türkiye Exporters Assembly (TİM), which is the umbrella organisation of Turkish exports. The industry is also supported by the Federation of All Food and Drink Industry Associations of Türkiye (TGDF).

Egypt: An emerging supplier

Egypt’s table olive production reached 600,000 tonnes in 2023/4. Most olives grown there are sold as table olives, but a smaller share is processed into oil. Most of Egypt’s production is consumed locally, while 50,000 tonnes are exported. The leading market is Brazil, which has a 19% export share, followed by Spain (18%), the USA (11%) and Iraq (9%).

In 2023, Egypt exported 16,470 tonnes to Europe. Spain was the largest destination market with 9,100 tonnes, followed by Italy (2,030 tonnes), Greece (1,900 tonnes) and Romania (1,350 tonnes).

Tips:

- Subscribe to a free email newsletter from Ambrosia, a Greek online platform dedicated to specialty food from Greece.

- Follow news from DOEPEL and ASEMESA to stay up to date about events in Europe’s largest supplier countries.

Which companies are you competing with?

Europe’s supply of table olives is mainly met by Europe-based companies concentrated in the major producing countries. Some European companies have production subsidiaries in supplying countries in North Africa. Some trade relationships involve related parties.

European companies

Spanish companies are very export oriented. Agrosevilla is one of the largest table olive exporters and a leading global exporter of table olives. It produces around 80,000 tonnes of olives per year. Other important players include Dcoop and Angel Camacho Alimentación (ACA). ACA sells table olives under private labels and its own brands: Fragata, Mario and Loreto.

Other important Spanish players include Agolives (brand owned by Aceitunas Guadalquivir), Borges International Group, Serpis, Goya, Interoliva (with a patented ball stuffing process), Manzanilla Olive, Olive Line, Industrias Alimentarias de Navarra, Acetiunas Cazorla and Eurolive (with its Crespo brand).

Intercomm Foods is the largest export and processing company of table olives in Greece. It exports olives under its own brand Delphi, and it produces olives as private labels for leading retail chains. Other important players include Konstantopoulos, Trofico, Mani Foods, DEAS, Amalthia, Medbest, Kalogiros, Elbak, GAEA and Agrovim.

Moroccan companies

Table olive producer Société Marocaine d'Industries Alimentaires (SOMIA), a subsidiary of the French company Comolive Crespo, was reportedly placed under bankruptcy protection in February 2024. The company has reportedly been in receivership since July 2024. Crespo invested in table olive processing in Morocco over 50 years ago. Framaco is another Franco-Moroccan cooperative venture. It is partnered with Spain’s Borges Group, which sells table olives under the brand Tramier.

French company Delieuze sources olives from Morocco with Cartier Saada being a top supplier. Other suppliers include Conserves Nora, Siof, Olea Capital, Bled Conserves, Agrucapers and Sicopa.

Turkish companies

The main important Turkish companies are: Sera Foods (with a distribution centre in Germany), Önal Zeytin (with an annual production capacity of 8,000 tonnes), the Zer Group (one of the top 100 exporters in Türkiye), Tukas (processing tomato and other products in addition to olives), Maroli (with a long trade history with Germany and the establisher of ethnic food retail chain Marmara), Artem Oliva, Aydoğmuş and Ark Foods (with a wide range of preserved vegetables).

Egyptian companies

Nile Garden is a leading Egyptian table olive exporter. Other important players include Wadi Food, Wadi Alnile, Plantform Agriculture (with exports to various markets), Egypt Olive and Special Food Industry International (with a variety of preparations). Olive Bloom Egypt is an alliance of eight table olive companies with a storage capacity of around 25,000 tonnes.

Which products are you competing with?

Due to their unique characteristics, it is not easy to find a direct substitute for table olives. Table olives are often sold on the shelves with other canned, preserved and pickled vegetables. Regarding the health benefits, olive oil can be considered a substitute product for table olives to some extent. This is because consumers are generally more aware of olive oil’s health benefits. However, there are limits to this interchangeability as the two products are used in very different ways.

Tip:

- Read CBI’s study on exporting olive oil to Europe to get an understanding of the possible synergies and competition from olive oil.

4. What are the prices of table olives on the European market?

Calculating average margins based on final retail prices for table olives is difficult. Table olive products vary greatly in terms of packaging, brand, variety, presentation and other factors. For example, Greek Kalamata olives usually fetch higher prices than other types of olives.

The average retail price of packed table olives in Europe for a package of 80–200 g now fluctuates between €1.50 and €4 for one unit. The retail price per kilogram is usually €12–30. Products with added value (quality, food safety, certification and processing), fetch higher prices.

Figure 5 provides a rough breakdown of table olive prices based on a model scenario. The share of the retail price paid to farmers varies a lot between producing countries and the type of product. It also varies year to year depending on market conditions. Retailers tend to maintain stable prices for end consumers even in case of import price fluctuations.

The example illustrates a case that involves the export of bulk products in drums. These are then repackaged for retail sales. Direct exports of retail packaged products have a different pricing structure.

Source: Autentika Global based on industry sources, 2024

Tips:

- Subscribe to S&P Global Commodity Insights, a leading market information service for processed commodities.

- Compare your offer with key competitors for your products in target markets. This is not a one-time operation. Price levels should be monitored over time, in different channels and countries.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research