Entering the European market for frozen vegetables

Food safety certification, combined with reliable and frequent laboratory testing, can help create a positive image for frozen vegetable suppliers wishing to export to Europe. Sustainable production and corporate social responsibility measures will help give emerging suppliers a competitive advantage. Some of the toughest existing competitors for new suppliers are EU member states such as Belgium and Spain. Outside this region, China and Turkey pose challenges for new entrants.

Contents of this page

- What requirements and certifications must frozen vegetables meet to be allowed on the European market?

- Through which channels can you get frozen vegetables on the European market?

- What competition do you face on the European frozen vegetables market?

- What are the prices for frozen vegetables on the European market?

1. What requirements and certifications must frozen vegetables meet to be allowed on the European market?

In addition to the quality requirements mentioned in the section below, read the CBI study about buyer requirements for processed fruit, vegetables and edible nuts for a general overview of buyer requirements in Europe.

What are mandatory requirements?

All foods products in Europe are required to comply with EU Commission regulations. Additives must be approved and used within the permitted ranges. Harmful contaminants, such as bacteria, viruses, pesticide residues and excessive levels of heavy metals, are prohibited. Food labels must also provide information about, among other things, allergens, nutritional value and preservatives used.

Border control

If specific products from particular countries repeatedly fail to comply, they can then only be imported under stricter conditions. Products from countries that have shown repeated non-compliance are put on a list included in the Regulation on the increased level of official controls on imports. At the moment of writing (February 2024) the following frozen vegetables are on the stricter inspection list for the presence of pesticide residues:

- Frozen chillies: 50% of all imports from the Dominican Republic, Uganda and Vietnam, 30% from Egypt and Thailand, and 20% from Pakistan, Rwanda and Turkey

- Frozen sweet peppers: 50% of all imports from the Dominican Republic, 30% from Egypt

- Frozen okra: 20% of all imports from India

- Frozen Yardlong beans: 30 of all imports from India and 20% of all imports from Sri Lanka

- Frozen moringa: 20% of all imports from India

- Frozen chillies: 20% of all imports from Kenya

Contaminant control in frozen vegetables

Contaminants are unwanted substances in or on food products that impact food constitution, purity and nutrition. The European Commission Regulation has set maximum levels for certain contaminants in food products. This regulation is frequently updated. Products that exceed the limits will be banned from European markets. The most common requirements regarding contaminants in frozen vegetables relate to the presence of nitrate, pesticide residues, heavy metals, microorganisms and mycotoxins.

A maximum level of 2,000 mg NO-3/kg applies for frozen spinach (see Section 1 of the Annex to Regulation (EC) No 1881/2006).

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in food products. Products containing pesticide residues beyond the prescribed limit are withdrawn from European markets. However, the number of border rejections of frozen vegetables has decreased thanks more laboratory testing. For information about border rejections, see the annual reports of the European Rapid Alert System for Food and Feed (RASFF). The EU publishes a list of pesticides approved for use, which is frequently updated.

Microbiological contaminants

One of the reasons for border rejections and withdrawals of frozen vegetables from the European market is the presence of microorganisms such as Listeria, Salmonella and Hepatitis A. In 2023 and 2024, the RASFF recorded two cases of market withdrawals due to large amounts of bacteria, Listeria monocytogenes, in products from Poland (frozen broccoli and frozen cut green beans), Salmonella (frozen lime leaves from Thailand) and Norovirus (frozen seaweed salad from China and Japanese, frozen seaweed appetizer from Taiwan).

Heavy metals and metalloids

Restrictions are in place for lead and cadmium content in fruits and vegetables. Spinach has the greatest sensitivity to heavy metals, particularly cadmium, which accumulates in leaves. Cadmium can come from the natural environment, such as soil or growing pots (see Section 3 of the Annex to Regulation (EC) No 1881/2006).

Unwanted foreign matter

The presence of any foreign matter such as insects, plastic pieces, stones, metal or glass make food products unsuitable for clearance and subject to thorough checks and careful reviews.

Packaging requirements

Packaging and labelling requirements are crucial for entering the European market:

Primary packaging (direct contact with food) may include moisture and vapour-resistant wraps, such as heavyweight aluminium foil, plastic-coated freezer paper and other plastic films. The primary package may be covered in a carton wrap or box.

Secondary packaging is a form of multiple packaging used to process and display primary packs together for sale. Cardboard freezer boxes are frequently used as an outer covering for plastic bags to protect them against tearing, and for easy stacking in the freezer.

Tertiary packaging is used for bulk transportation of products that are not displayed on the shelf (for example, carton boxes, pallets, sea containers).

Labelling requirements

General EU labelling regulations for food also apply to frozen vegetables, and cover:

- Name under which the product is sold;

- Net weight of pre-packaged products;

- Minimum shelf life;

- Special conditions for storage or use;

- Business name and address of manufacturer, packager or seller based in the EU;

- Lot marking on pre-packaged products, with the marking preceded by the letter 'L';

- Nutrition information (the European Commission is working on various proposals, including harmonised regulations for the display of nutrient content on the front of product packaging, as part of the Green Deal’s Farm to Fork Strategy);

- Information about the origin of primary ingredients, if different from the stated place of origin (mandatory requirement as from 1 April 2020).

Refer to Regulation (EU) 1169/2011 for detailed rules about food labelling requirements in the European market.

Specific labelling regulations for frozen vegetables

The label should state the name of the vegetable and the words ‘quick-frozen’ or ‘frozen’ and any additional ingredients used (salt, spices, etc.). It should also state the style, as appropriate (for example: IQF-whole, block, sized/unsized). If the frozen vegetables are cut, the cutting style should be on the label as well (diced, halved, julienne, trimmed, rings, chopped, etc.).

For bulk export packaging, the above information can be provided in the accompanying documents instead of on the packaging itself. However, frozen or quick-frozen + [name of the vegetable] and the name and address of the manufacturer or packer must appear on the packaging. In addition to the type of vegetable, product specifications often include the variety.

Specifications for nutrition labelling, net quantity, use-by date, date of freezing, process undergone, origin, allergens and legibility (minimum font size for mandatory information) apply to frozen vegetables. Celery is the sole vegetable in the regulation’s allergen list.

EU Law provides labelling guidance for quick frozen foods.

Tip:

- Read more about MRLs on the European Commission website on maximum residue levels. To be prepared for any new changes in MRLs, read the ongoing reviews of MRLs in the European Union..

What additional requirements and certifications do buyers often have?

Aside from basic food safety requirements, buyers will frequently ask for specific quality grades and food safety certificates, such as FSSC22000, BRCGC and IFS. There are growing numbers of requests for sustainability compliance and transparency throughout the whole supply chain.

Product authenticity

Product specifications that are intentionally misleading are illegal in Europe. As undeclared preservatives, food ingredients, concentration levels or artificial colours in products may cause allergies, strict action is taken against offenders. Many laboratories in Europe have increased food testing to uncover this type of fraud.

Quality requirements

Frozen vegetables must meet the following quality requirements:

- Reasonably uniform colour, texture and crispness;

- Fresh, clean and free of foreign matter;

- Virtually free of pests and associated damage;

- Free of artificial or peculiar flavours and odours, with specification of other added ingredients.

Optional ingredients permitted in specific frozen vegetables are salt (sodium chloride), sugar, edible oils, aromatic herbs, stock or vegetable juices and vegetable garnishes, up to a maximum of 10% m/m of the total drained vegetable ingredient.

General quality requirements for processing, cutting, handling, labelling, defects and allowances are set out in the Codex Alimentarius standards for Quick Frozen Vegetables (carrots, corn on the cob, leeks and whole kernel corn). In addition, separate standards exist for frozen peas, spinach, broccoli, cauliflower, Brussels sprouts, green and wax beans and French-fried potatoes.

Food safety certification

Although food safety certification is not obligatory under European legislation, it is required by almost all European food importers. Most established importers will not work with potential suppliers without proof of food safety certification.

The majority of buyers in Europe ask for certification recognised by the Global Food Safety Initiative (GFSI). For frozen vegetables, the most popular certifications are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

Although different food safety certification systems are based on similar principles, some buyers prefer a particular system. For example, British buyers often require BRC, while IFS is more common for German retailers. Also note that food safety certification is only a basis from which to start exporting to Europe, and serious buyers usually also visit the production facilities.

A common certification for fresh vegetables farming is GlobalG.A.P. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards. In the coming years, the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced.

Tips:

- Get food safety certification. Consult with preferred buyers about their certification preferences and carefully select a certifying company.

- Do a self-assessment using the producer starter kit available on the amfori BSCI website (paid membership required).

Green Deal

In 2019, the European Commission presented the Green Deal, containing measures for sustainable agriculture, consumption and the economy. This is expected to bring major changes to the European fruit and vegetable industry, impacting suppliers in Europe and worldwide. Overall, the aim is a climate-neutral society by 2050. As an intermediate step, by 2030 CO2 emissions must be lowered 55% (compared to 1990), the use of pesticides reduced by 50%, and 25% of farming must be organic. The Green Deal’s Farm to Fork Strategy sets out specific measures for the food industry, including to encourage vegetable consumption.

Payment terms

Before any international transaction, it is important to sign a contract of sale. This defines the terms and method of payment, which may vary in how much security they give you. When exporting your first shipment, ask for an advanced payment by bank transfer (safest option) or letter of credit (second best, but may come with added costs). Some European importers may pressure you to accept deferred payment. This is fine if you have export insurance.

You are advised to insure your payments and goods, especially for higher volumes, to offset risks such as an importer’s failure to pay, product damage or theft and currency fluctuations, among others. Export credit insurance is the most common type of insurance for processed fruit and vegetable exports. This is offered by export credit agencies, which can be private or government-owned.

Tip:

- Read more about payment, delivery and other practical issues in the CBI study on Organising Your Export to Europe.

What are the requirements for niche markets?

Sustainability has become one of the most important topics in the food trade in Europe. Most retail chains and suppliers ask for proof of compliance with ecological and social standards. Specific sustainability certification can improve emerging suppliers’ competitiveness.

Organic frozen vegetables

To market frozen vegetables as organic in Europe, they must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can use the European Union’s organic logo and the logo of the standard holder (e.g. the UK’s Soil Association and Germany’s Naturland) on the packaging. One specific niche opportunity to sell organic frozen vegetables at a higher price is to follow the rules of the biodynamic certification of Demeter.

If you want to produce and export organic frozen vegetables to Europe, be aware of important new rules that may affect your business. New EU organic regulations entered into force on 1 January 2022. These regulations are accompanied by more than 20 secondary acts that regulate the production, control and trade of organic products in more detail. Some of the important acts to be aware of are the detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Sustainability requirements

There is increasing demand for sustainably sourced food in Europe. To help consumers make more ecological choices, there is a growing development of labelling systems, including Eco Score, Eco Impact, Planet Score and Enviro Score. Along with requirements related to the environmental impact, there is increasing demand for more transparent and fair supply chains.

One way to show that you look out for farmers and seasonal workers is to become certified with standards like Fairtrade, Fair for Life and Rainforest Alliance. Fairtrade international has developed specific standards for vegetables intended for small-scale producer organisations. These standards define protective measures for workers in vegetable processing facilities. Fairtrade also defines the terms of payment and the Fairtrade Minimum Price for a range of organic vegetables.

Some companies require adherence to their own code of conduct, while other companies require adherence to one or more common standards. Examples include independent audits, such as the Supplier Ethical Data Exchange (SEDEX), the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative code of conduct (amfori BSCI). If frozen vegetables are meant to end up in the retail segment, suppliers will have to follow a specific code of conduct developed by retailers. Adherence to retailer standards also includes unannounced audits.

Tips:

- Read the training materials on the new organic regulation by the Alliance for Product Quality in Africa project to prepare for the new rules.

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through which channels can you get frozen vegetables on the European market?

Manufacturers and processors have been working with local farmers in countries where vegetables are sourced and processed/frozen to export to other EU countries. Other suppliers import end products and re-pack them for sale under private labels to retailers or the food service sector.

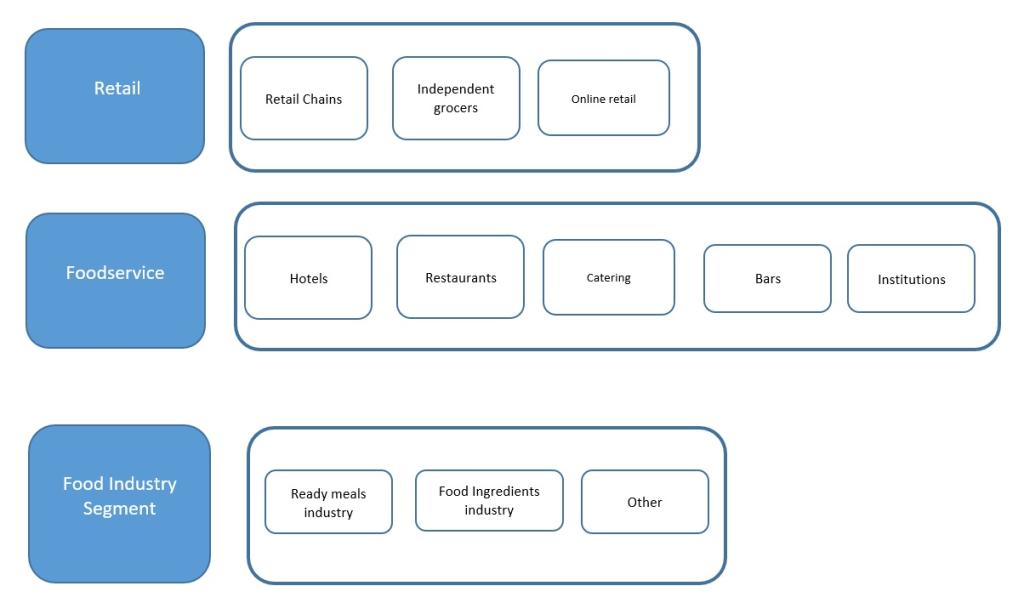

How is the end market segmented?

The retail, food service and food industries are the largest users of frozen vegetables. Business buyers such as hotels, caterers, restaurants and fast-food chains are among the major users of frozen fruit and vegetables.

Figure 1: End market segments for frozen vegetables in Europe

Source: Autentika Global

Retail segment

Retailers occasionally buy from developing country exporters directly. However, in most cases, they are supplied via intermediaries, such as packing companies, which place products in their final packaging. In case of frozen vegetable mixtures, products can be either prepared in the supplying country or mixed by a packing company after import.

One recent development is the polarisation of the retail sector into discounters and high-level segments. The European retail food market’s key characteristics are consolidation, market saturation, strong competition and low prices. Currently, online retail of frozen vegetables accounts for a small share of the market, but it is increasing, especially after the Covid-19 pandemic. Online sales are forecasted to increase in the near future.

The leading food retail companies differ per country. The companies with the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands). There are also several retail chains in Europe that specialise in the supply of frozen food, such as Iceland (United Kingdom) and Picard Surgelés (France).

Food service segment

The food service segment (hotels, restaurants and catering establishments) has different requirements for frozen vegetables than retailers. The food service segment often requires specific packaging for frozen vegetables, which is different from bulk and retail packaging (e.g. 1 to 5 kg packs). Frozen vegetables supplied to the food service sector are also often further prepared, for example, they are roasted or grilled, or spices or other ingredients are added.

Some wholesale companies that cater to the food service segment are Ardo and Oerlemans (the Netherlands), Frosta Food Service (Germany), Aronde (Belgium) and Kiril Mischeff (the United Kingdom).

Food processing segment (food ingredient industry)

Compared to the retail and food service industries, demand for frozen vegetables is low in the food processing industry. Food processing sub-segments such as canned vegetables, baby food, processed juice and vegetable powders tend to use fresh vegetables, not frozen. The frozen pizza industry is the main user of frozen mushrooms and olives. Food processing companies need supplies to be regular and mostly high-quality. These companies work closely with importers, often under long-term contracts or in partnerships.

The wide variety of frozen prepared foods in Europe creates added opportunities for frozen vegetable suppliers. The food ingredient industry also uses smaller quantities of frozen vegetables to make food additives. Vegetable snacks such as kale crisps and sweet potato chips are examples of innovative products made from frozen vegetables. Frozen vegetables are also increasingly sold as frozen purees for smoothies, baby food and soups.

Tips:

- See Food and Drink Europe for more information about the European food processing industry.

- See the SIAL Paris website to learn about the latest trends in the frozen food processing industry.

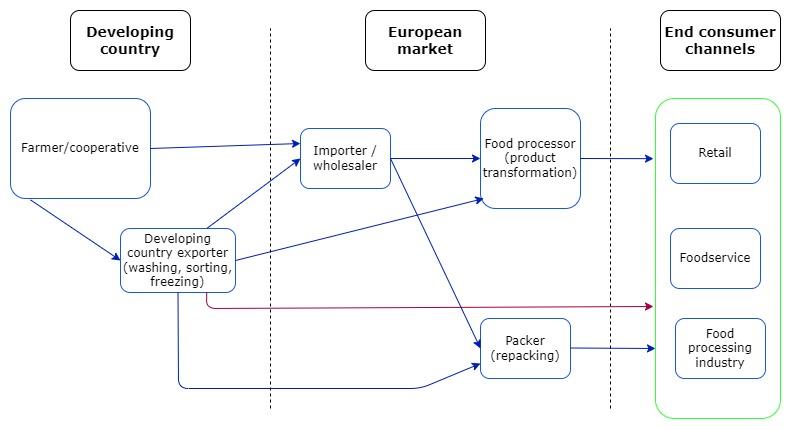

Through which channels does a product end up on the end market?

Importers (wholesalers) specialised in frozen vegetables, including some food ingredient suppliers, are the most important channel in Europe. Many large frozen vegetable producing companies also import frozen vegetables. Retail chains rarely source frozen vegetables from developing countries. European trading companies more often act as intermediaries and take part in retail chain procurement procedures.

Figure 2: European market channels for frozen vegetables

Source: Autentika Global

Importers/wholesalers

In Europe, importers may also be distributors or wholesalers. They sell frozen vegetables to food processors/manufacturers. Some importers have cold storage warehouses and do in-house packaging/labelling and sell products in bulk to retailers or re-export them. Many European countries are intermediary import and export hubs.

For new suppliers, the challenge is to establish long-term relationships with well-known importers, as they usually already work with selected suppliers. Well-known importers perform regular audits and visit producing countries. As a new contact, you often need to offer the same quality while also providing better prices than your competitors at the start of the working relationship.

There are many importers of frozen vegetables and other frozen products. Some of the leading companies importing frozen vegetables in Europe include Nomad Foods (Iglo, Birds Eye and Findus brands), ARDO, Crops and Greenyard Frozen.

Retailers

Retailers often work with farmers/cooperatives directly, eliminating the need for middlemen and keeping prices down. This can put a higher burden on other suppliers (intermediaries). Offering organic, ‘free from’ or natural products as part of their range gives suppliers a better chance of attracting health-conscious European consumers.

Food processors

Importers usually sell frozen vegetables to food processing companies in bulk for processing, based on the needs of the specific end market (retailers, food service, food industry). Many importers are also food processors, which eliminates the middleman.

Examples of frozen meal processing companies in Europe are Nestle (Wagner frozen pizza brand), Dr Oetker (frozen pizzas and frozen ready meals), Nomad Foods brands, Picard, Amy’s Kitchen and Chef Martin.

What is the most interesting channel for you?

Specialised importers/wholesalers of frozen fruits and vegetables continue to be the most useful contact for marketing frozen vegetables in Europe. Most importers are knowledgeable about the European market and closely watch developments in frozen vegetable production countries. This makes them especially well informed about market developments and able to provide practical advice about exports. Importers normally import frozen fruit as well, so diversifying your product range can give a competitive edge.

As an end user of the frozen food industry, the retail channel is becoming more powerful compared to the food service and food industry segments. Retailers have benefitted from private labels, which are no longer seen as lower quality, but fresh and natural. Although the retail segment is extremely demanding for new suppliers, by identifying their unique selling points and focusing on quality, competitive pricing, sustainability and trends, they may be able to carve out a niche for themselves.

Tips:

- Identify your export market and do extra market research on private labelling for specific products.

- Learn about the food and drink manufacturing industry in Europe on the Food and Drink Europe website.

- Learn about frozen vegetable traders in Europe on the European Association of Fruit and Vegetable Processing Industries (PROFEL) website.

3. What competition do you face on the European frozen vegetables market?

Which countries are you competing with?

Competition is high in European countries. Many import frozen vegetables purely for re-export. Belgium is the leading frozen vegetable supplier and a large share of this supply is in the hands of local suppliers.

Source: ITC TradeMap

Among non-European countries, China supplies a major share, followed by Turkey, Egypt and several other countries, each of which specialise in specific types of frozen vegetables.

Source: ITC TradeMap

Strong internal European competition

Most of the frozen vegetables consumed in Europe is produced within Europe. Belgium is the leading supplier of frozen vegetables in Europe with 31% market share followed by Spain, Poland and France.

Belgium

Belgium is the second-largest exporter of frozen vegetables globally, after China. The production of frozen vegetables in Belgium accounts for more than a quarter of the total European production. Belgium also exports more than 90% of its total production. Belgian frozen vegetable producers are concentrated in East and West Flanders. The Belgian vegetable industry has a trade union for frozen vegetable wholesalers and processors, Vegebe, which has a list of member companies and initiatives to improve the sector.

Exports of frozen vegetables from Belgium to other European countries gradually increased in the run-up to 2023 but decreased to 1.28 million tonnes in 2023. The leading export destinations for Belgian frozen vegetables in Europe are Germany with a 19% export share, followed by France (18%), the United Kingdom (13%) and the Netherlands (7%). Belgium is a very strong exporter of frozen vegetable mixtures (the largest in the world). These mixtures are sold as own-brand products or tailored to the retail and food service industries across Europe.

Spain

Spain was the second-largest exporter of frozen vegetables in Europe in 2023, exporting 608,000 tonnes. It accounted for 12% of total European exports in 2023. A large share goes to other European countries, with France as the leading export destination. Its leading export products are frozen broccoli, sweet peppers and mixed vegetables. The Spanish Association of Frozen Vegetable Manufacturers (ASEVEC) brings together major frozen vegetable manufacturers in Spain. The Association is currently made up of eight companies that are active nationwide and account for 95% of total production.

In 2023, 834,000 tonnes of frozen produce was processed in Spain. Frozen vegetables are produced in several regions, led by Navarra (northern Spain) and followed by Murcia (southeast Spain) and Andalusia (southern Spain). Spanish producers also increased the production of frozen green beans, eggplants, corn and zucchini but decreased the production of frozen leeks, artichokes, broccoli and peppers in 2023.

Poland

Poland was the third-largest exporter of frozen vegetables in Europe in 2023. Exports of frozen vegetables fell from 475,000 tonnes in 2019 to 425,000 tonnes in 2023. Exports of frozen peas saw the fastest growth, over a period of five years, followed by frozen sweetcorn and prepared vegetable mixtures. The main export destination in 2023 was Germany (23%), followed by Belgium (11%), France (9%) and the United Kingdom (7%).

China, the leading frozen vegetable exporter in the world

China is one of the world’s largest producers of frozen vegetables. This is mainly because the Chinese vegetable market is immense, and production areas are distributed all over China. China exports various frozen vegetables to Europe. Frozen mushrooms are very important items. China is the largest producer of frozen mushrooms in the world. This product is largely imported from China by the European foodservice sector. Other exported products to Europe are frozen broccoli, frozen diced onions, frozen boiled soybeans and frozen garlic.

Over the last five years, the Chinese exports of frozen vegetables have grown at an annual rate of 4%, reaching 1.48 million tonnes in 2023. Most Chinese frozen vegetables are exported to Asian countries, with Japan accounting for a 32% export share, followed by South Korea (24%). In 2023, exports to Europe reached 263,000 tonnes, with most quantities exported to the United Kingdom, followed by Belgium, Germany and Spain.

Egypt, the frozen artichokes specialist

Egypt is the leading supplier of frozen artichokes to Europe, with Italy being the main export destination. Egyptian frozen artichokes are used by the European food service segment, particularly pizza restaurants. However, Egypt exports a wide range of other frozen vegetables in addition to artichokes. The most important of these are frozen broccoli, frozen grape leaves and frozen okra.

In 2023, Egypt exported 167,000 tonnes of frozen vegetables at a value of €228 million. The main export destination for Egyptian frozen vegetables was Saudi Arabia, which had a 15% market share, followed by the United States of America (11%), Italy (8%) and the Russian Federation (6%). Within Europe, the major target markets are Italy, France and Spain.

Turkey, a variety of exported products to Europe

Turkey’s exports are fluctuating owing to changes in produced quantities. In 2023, Turkey exported 67,000 tonnes of frozen vegetables at a value of €120 million. Germany is traditionally a major export market for Turkish frozen vegetables with a 13% market share, followed by the United Kingdom (12%), the United States of America (10%), Iraq (9%) and Greece (7%). Turkey is significantly increasing its market share in Belgium, with exports rising threefold from 1.5 thousand tonnes in 2019 to 4.6 thousand tonnes in 2023.

Turkey exports a wide range of frozen vegetables as it has a well-developed vegetable production and processing industry. The main exported frozen vegetable is frozen tomato, with a 26% export share, followed by frozen peppers (24% share), frozen broccoli (10%) and frozen onions (9%). The Turkish processing industry is increasing its export of prepared frozen products, such as frozen ready-to-fry breaded onion rings, frozen sun-dried tomatoes in brine and frozen falafel.

Which companies are you competing with?

The supply of frozen vegetables is very concentrated in Europe as big processing companies have production subsidiaries in multiple countries in the region.

European companies

Belgian vegetable processors are the European leaders, with freezing operations in many countries outside Belgium. They compete mainly with Spanish, Polish and Dutch companies. The biggest European competitors include Belgium’s The Greenyard Foods Group, ARDO, D’Arta and Crop’s, and Spain’s Virto Group and Congelados De Navarra.

The Greenyard Foods Group is a global market leader in fresh and frozen foods. It caters to the top-20 retailers in Europe and has a turnover of €4.4 billion. Freezing plants are strategically located in the main vegetable producing areas for quick transport and freezing after harvesting. Greenyard is dedicated to sustainability and working towards a 50% reduction in CO2 emissions and 100% recyclable packaging by 2025.

ARDO is a leading frozen vegetable supplier in Europe, with a revenue of €1.9 billion. It has operations in nine countries including Belgium, France, Spain, Italy and Portugal and exports to more than 100 countries. Its customers are in retail (own brands and private labels), the food service sector and the food industry. ARDO emphasises sustainability and recently switched to sustainable packaging. Its Minimum Impact, Maximum Output Sustainable Agriculture (MIMOSA) programme aims to minimise climate impact and make crops more resilient to climate change.

D’Arta is a global player in the development, processing and commercialisation of fresh frozen products including vegetables, fruit and ready-made dishes. Based in West Flanders, which is a European production hub for frozen vegetables, it has production plants in Portugal and the UK. It produces for private label customers and mainly supplies the food service, retail and food industries.

Virto Group is one of the largest frozen vegetable companies in Spain and one of the most important in Europe. The company operates eight specialty centres in Spain and has an international presence in the UK, France, Germany, the US, Portugal and Brazil. The group offers a wide product range that extends beyond frozen vegetables to include pulses, fruits, vegetable mixes, rice, pasta, cereals and vegetable-based dishes.

Non-European companies

The main non-European competitors are based in China, Turkey, Egypt and Ecuador. Although they specialise in a wide range of products, some countries have narrower specialisations, as described in the chapter above.

Chinese companies

These include many processors and traders such as Tomco Produce Group, Wssf Corporation, S.F.I Asia, Fortune Foods, Baixing, Longhai Yide Industry and Trade, Frostar, Beswor Foods and Three People (Xiamen) International.

Fortune Foods produces a range of IQF frozen vegetables, fruit and mushrooms. It is located in China’s Hebei province and has a production capacity of 10,000 tonnes per year and an own lab to guarantee microbial control. The EU is the largest export market for Fortune Foods, with Germany, Italy, France and Spain being the biggest importers. S.F.I Asia is a Chinese processor and trader of frozen vegetables, fruit and fish. It was established in 2003 as a joint venture of Superior Foods and Foodimpex.

Egyptian companies

Egypt is another non-European hub for frozen vegetable production. Its main companies include ICAPP, Orouba for Food Industry (BASMA - AJWA), Deluxe, AlfaFrost, Frosty Foods and GIVREX. Deluxe is a young Egyptian company specialised in high-quality IQF fruit and vegetables. Its frozen vegetables offering includes almost 20 different products. AlfaFrost is one of the biggest producers of IQF fruit and vegetables in Egypt. It exports to almost all parts of the world, with a special focus on Europe.

Turkish companies

The Turkish supply of frozen vegetables is characterised by a large number of processors and international traders. There are over 100 exporters of frozen vegetables in Turkey. Some of the notable names are EkoFood, Martas, Avod, Mapeks Organics, Seven Foods and Ulubay. Some Turkish companies also produce tomato paste and sun-dried tomatoes alongside frozen vegetables.

Ecuadorian companies

Companies from Ecuador mostly specialise in the export of frozen broccoli. Although frozen broccoli dominates exports, with more than 90% of the frozen vegetable production, Ecuador also exports a few other products, such as frozen cauliflower and spinach. The leading exporter of frozen vegetables in Ecuador is Provefruit, which has been operating for over 30 years. Other notable exporters include Ecofroz, Nova Alimentos and Ecualim Food.

Tips:

- Find information about trading in the frozen vegetable industry on the websites of leading producers such as the Belgian vegetable processing sector union (Vegebe) or the Spanish Association of Manufacturers of Frozen Vegetables (Asevec).

- Present your offering on B2B frozen food websites such as FrozenB2B.

Which products are you competing with?

Convenience and year-round availability are major drivers of frozen vegetable consumption. While frozen vegetables have unique selling points in terms of availability with added seasonings, pre-portioned and/or pre-roasted, they compete with fresh vegetables, which consumers see as unprocessed and rich in nutrients. Fresh vegetable prices have increased by on average 2% per year over the past decade and are expected to go up even more due to the war in Ukraine.

Canned and fermented vegetables generally have similar nutritional profiles to fresh vegetables, particularly in terms of mineral and fibre content. Fermented vegetables also have a range of health benefits thanks to their probiotic qualities. One disadvantage of fermented foods is that they have a completely different flavour profile from fresh and frozen vegetables.

Tip:

- Use the unique characteristics of frozen vegetables to position them against fresh options. For example: year-round availability, range of seasonings, lower food waste, sustainable production and harvesting, table-ready, GMO-free, no added preservatives, no defrosting or thawing needed.

4. What are the prices for frozen vegetables on the European market?

The prices of frozen vegetables vary depending on the country of origin, type of vegetable, grade and quality, retail chain brand, production cost, climatic factors and other global economic factors. Generally, the prices of fresh vegetables produced specifically for freezing are more stable compared to the fresh vegetable market. The prices of frozen vegetables produced in Europe are also typically higher compared to the prices of imported frozen vegetables.

The price breakdown below is a very rough indication for frozen broccoli. Many factors affect the price, such as quality, variety, origin, food safety certification costs, consultants, social security, taxes, sales and network margins. In this example, the price of frozen broccoli is also affected by the size of the florets, as smaller florets (20–40 mm) normally have a better price compared to larger florets (40–60 mm)

Table 1: Frozen broccoli retail price breakdown, price per kg

| Steps in the export process | Type of price | Price breakdown | Example (Deglet Nour) |

| Production of fresh broccoli | Farmer price | 15% | €0.60 |

| Collectors’ price | Collectors’ fee | 16% | €0.65 |

| Freezing and packing of broccoli | Factory price (Exorks) | 25% | €1.3 |

| Transport to and loading onto the ship | FOB price | €1.35 | |

| Storing, handling and shipping | CIF price | 50% | €1.4 |

| Selling to retail | Wholesale price (incl. value-added tax) | 75% | €1.9 |

| Retail sales of the final packed product | Retail price | 100% | €2.2 |

Please note that the prices presented above are only illustrative to give emerging frozen vegetables suppliers rough margins. The presented retail price is for 1kg of private label frozen broccoli in major European discounters, sold in large 1kg packaging. However, the prices of organic packed frozen broccoli in smaller packaging (commonly 300g) can go over €6/kg.

Actual prices may vary due to other added costs such as logistics between European countries, specific freezing process, packaging, marketing and profit margins. Efficiency savings in operating, transportation or distribution costs can give suppliers a competitive advantage. Government support and partnerships can also boost productivity and reduce costs.

Tip:

- Subscribe to S&P Global, one of the most respected market information service providers for the processed fruit and vegetables sector. Subscribers have access to frozen vegetable price overviews, which are published and updated regularly.

M-Brain carried out this study and updated by Autentika Global on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research