Entering the European market for macadamia nuts

Full control and risk prevention of pathogenic microorganisms and other contaminants helps to create a positive image for macadamia nut processors. Food safety certification is a must for entering the market, although often it is not enough by itself. Requests for quality and a more sustainable and transparent supply chain are increasing. The biggest competitors for new macadamia nut suppliers are South Africa, Kenya and Australia. A decrease in export prices is expected due to an increasing global supply.

Contents of this page

1. What requirements must macadamia nuts comply with to be allowed on the European market?

All foods sold in the European Union must be safe to consume. This includes macadamia nuts. Limits are placed on the levels of harmful contaminants, such as pathogenic microorganisms, pesticide residues and mycotoxins. It should also be clear from the labelling that macadamia nuts can cause allergies. However, meeting legal requirements is just the first step towards a successful export to Europe. Macadamia suppliers will also have to meet buyer requests related to quality, food safety certification and a more sustainable supply chain.

What are the mandatory requirements?

The European Commission Regulation sets maximum levels for certain contaminants in food products. This regulation is frequently updated. In addition to the limits for general foodstuffs, a number of specific limits apply for contaminants in specific products. This includes macadamia nuts. The most common requirements relate to the presence of mycotoxins, pesticide residues, microorganisms and heavy metals.

Contaminant control in macadamia nuts

The European Commission Regulation sets maximum levels for certain contaminants in food products. This regulation is frequently updated and, apart from the limits set for general foodstuffs, a number of specific limits apply for contaminants in specific products including macadamia nuts. The most common requirements regarding contaminants in macadamia nuts relate to the presence of mycotoxins, pesticide residues, micro-organisms, and heavy metals.

Control presence of foreign materials

Usually, the presence of foreign materials are not a reason for concern in macadamia nuts export. Experienced exporters usually remove any pieces of shell or dead insects that may be mixed in with healthy kernels. As current macadamia production includes a lot of equipment with metal parts, using metal detectors before packaging is strongly recommended.

Mycotoxins

The presence of mycotoxins is the main reason for concern in the nuts trade. The level of aflatoxin B1 in macadamia nuts must not exceed 2 μg/kg and the total aflatoxin content (B1, B2, G1 and G2) should not exceed 4 μg/kg. The presence of aflatoxins is much lower in macadamia nuts than in other nuts. However, it is important to de-husk nuts in less than 24 hours after falling onto the ground to prevent the nuts from going rancid. It is also important to dry in-shell nuts quickly after the harvest and to store the nuts in a cold room.

Pesticide residues

The European Union has set maximum residue levels (MRLs) for pesticides found in and on food products. Products containing a higher concentration of pesticide residues than allowed are withdrawn from the European market. However, it is fairly uncommon to encounter excessive levels of pesticides in the macadamia nut trade. This is because the shell, in which residues may accumulate, is removed before the nuts are sold.

Microbiological contaminants

Of all contaminants, salmonella is considered the highest risk for macadamia production. Therefore, it is important for macadamia processors to make sure the sanitary and hygienic practices inside their processing facilities are up to standard.

Chlorates and perchlorates

Chlorates are no longer approved as a pesticide, but they can come in contact with food when using chemicals for water disinfection. Another source may be detergents used for the cleaning of facilities and processing equipment. The level of chlorates is set to 0.1 for all edible nuts.

Mineral oil hydrocarbons

Mineral oil saturated hydrocarbons (MOSH) and mineral oil aromatic hydrocarbons (MOAH) can be found in lubricants for machinery, surface treatment agents and packaging materials. The European Food Safety Authority is currently working on an updated risk assessment for MOAH. The official opinion will be published in 2023. A German draft regulation suggests a limit of 0.5 mg/kg that can migrate from packaging to food. Macadamia nut processors should closely monitor this development and always check contamination risks.

Tips:

- Follow the Codex Alimentarius Code of Hygienic Practice for Tree Nuts. For macadamia nuts, it is important to control moisture levels during storage and transport to avoid damage due to mould and enzymatic changes. Also, frequent hand sanitation to prevent saliva contamination is strongly recommended.

- Be sure to perform laboratory tests in ISO/IEC 17025:2005 accredited laboratories only.

Labelling requirements

The bulk label should use coding for each lot. Labelling should indicate the product name, country of origin, style, lot code, net weight and shelf life. Also, allergen warnings need to be visible on bulk packaging. For bulk packaging, more details can be provided in the accompanying documents. It is also common to include the harvesting season. This information should include drying or processing time followed by month and year.

In the case of retail packaging, product labelling must comply with the European Union Regulation on the provision of food information to consumers. This regulation defines the nutrition labelling, origin labelling, allergen labelling and the minimum font size for mandatory information. Retail packaging must be labelled in a language easily understood by consumers in the European target country. This is generally the country’s official language. This explains why European products often have multiple languages on the label.

Comply with the legislative requirements on sustainability

Some of the most relevant European legislation related to environmental and social sustainability are incorporated in the European Green Deal (EGD). The EGD includes legislative changes, with a timetable outlining when they will come into action. The most relevant policies for the fruits, vegetables and nuts processing sectors are the Farm to Fork Strategy, the Biodiversity Strategy and the Circular Economy plan. Specific legislations relevant for macadamia nut suppliers are:

- Organic food regulation

- Sustainability labelling of food products

- Corporate Sustainability Due Diligence Directive

Tip:

- To be prepared for the legislative changes in line with the EGD and Farm to Fork Strategy, read the CBI’s Tips to go green and the CBI’s Tips to become a socially responsible supplier.

What additional requirements and certifications do buyers often have?

Private requests have become as important as mandatory requirements. These include compliance with food safety, quality and sustainability standards.

Quality requirements

The quality of macadamia nut kernels is determined by the percentage of whole nuts, size, colour, share of defective products and the presence of kernel dust. The industry has defined several quality criteria, but some of them are subjective and cannot easily be determined on the basis of physical characteristics. Quality features also depend on the variety, level of ripeness, implemented agricultural practices and postharvest handling.

Specific macadamia nut quality requirements are established in several standards. Until recently, the most widely applied standard in Europe was the United Nations Economic Commission for Europe (UNECE). Similar standards are also being developed by several producing countries. The World Macadamia Organisation (WMO) recently published its own standard in an attempt to determine a global standard for quality requirements. The most important criteria used to define the quality of macadamia nuts are:

- Class – In macadamia nut-producing countries, nuts are usually classified into 2 classes: First Grade (without visible defects) and Commercial Grade (with minor visual defects). Nuts with defects are treated differently depending on the type of defect. For example, they can be rejected, used for oil processing or the defective part can be cut away. The UNECE classification uses specific quantitative criteria to divide macadamia nuts into ‘Class I’ and ‘Class II’.

- Grading – Two main criteria for grading are the size of kernels and percentage of whole nuts, halves and pieces. Eleven different categories are defined, ranging from Style 0 (min 95% whole nuts of >20 mm) to fine pieces (<3 mm). However, buyer requirements may differ from the standard grading classification. For example, European roasting companies may request 70% of Style 1 (kernel sizes above 18 mm) and 30% of Style 2. Those two categories are then mixed before roasting.

- Chemical characteristics – The most important chemical parameters of macadamia nuts are moisture, free fatty acids content and peroxide value. Different standards suggest maximum moisture levels in the range of 1.8% to 2%, but industry practice is often to offer moisture levels of max 1.5%.

Although macadamia nut standards are very specific, there may still be differences between the perceived quality in the quality grade. For example, some processors wash kernels to fully remove dust from the kernel surface. This practice may provide shinier nuts, but at the same time decrease nutritional value and flavour. Therefore, it is very important to check with your buyers which quality characteristics are crucial for them.

Food safety certification

European buyers will commonly ask macadamia nut suppliers to provide proof of food safety. This requirement is fulfilled through the various food safety certification schemes. The most recognised private food safety certification schemes include International Featured Standards (IFS), British Retail Consortium Global Standards (BRCGS) and Food Safety System Certification (FSSC 22000).

Although the different certification schemes are based on similar principles, buyers may prefer one system over another. For example, British buyers often require BRC, while IFS is more common for German retailers. It should also be noted that food safety certification is only a basis from which to start exporting to Europe. Serious buyers will usually audit your production facilities before making a contractual agreement.

Requirements for pasteurisation

An emerging request is to use pasteurisation equipment before packing. This is a difficult request for many suppliers, as this equipment is expensive. Very strict buyers could also ask for an independent germ kill efficacy test, also called a ‘kill step validation’. The WMO suggests using a specific validation procedure (PDF) for counting pathogenic microorganisms before and after exposure to sterilisation.

It is important to check with your buyer if pasteurisation is necessary. Pasteurisation may be a good option when pieces are used for ice cream toppings, because milk is sensitive to pathogenic bacteria. However, nuts for roasting undergo a heating treatment that reduces the risk of contamination. Some buyers may prefer unpasteurised nuts, as pasteurisation influences the look and taste of the kernels, as well as cuts shelf-life. If the buyer insists on pasteurisation, offering pasteurisation services in Europe is an option.

Packaging requirements

Due to their high oil content, macadamia nuts are sensitive to rancidity when exposed to oxygen. In order to prolong their shelf life, a modified atmosphere is commonly used. In particular, most processors use vacuum aluminium bags to reduce the oxygen content. These vacuum bags are often flushed with nitrogen and sometimes with CO2. After the packages are closed, they are left for at least 24 hours to check stability and to make sure none of the gasses are released.

As the leading macadamia nut-producing countries use the imperial system, the most common weight for one packaging unit is 25 lbs (11.34 kg). European buyers commonly accept this size, although they prefer using the metric system. Some competitive advantages can be gained if packaging sizes are adjustable to regular sizes, such as 10 kg. However, packaging size is less important compared to other requirements.

The European Union is gradually decreasing the level of non-recyclable and non-renewable packaging waste. As aluminium is not a renewable material, some new solutions can be expected in the future. In the meantime, macadamia nut processors are advised to source packaging materials from suppliers who follow responsible sourcing programmes. An example of a responsible sourcing programme is the Chain of Custody Standard by the Aluminium Stewardship Initiative.

Figure 1: Export food-contact packaging for macadamia nuts

Source: Autentika Global

Sustainability requirements

There is an increasing demand for sustainably sourced food in Europe. To help consumers make more ecological choices, labelling systems such as Eco Score, Eco Impact, Planet Score, Enviro Score and Foundation Earth have been created. Along with requirements related to the environmental impact of the product, there is an increasing demand for a more transparent and fair supply chain.

One way to show that you take care of farmers and seasonal workers is to get certified. Examples are Fairtrade, Fair for Life and the Rainforest Alliance. Fairtrade international has developed a specific standard for nuts intended for small-scale organisations. This standard defines protective measures for workers in macadamia nut processing facilities. Fairtrade also defines the terms of payment and the Fairtrade Minimum Price for conventional and organic macadamia nut kernels.

Some companies require you to adhere to their own code of conduct, other companies require you to adhere to one or more common standards. Some examples include independent audits, such as the Supplier Ethical Data Exchange (SEDEX), the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative code of conduct (amfori BSCI). If macadamia nuts are meant for the retail segment, suppliers will have to follow a specific code of conduct developed by retailers.

Tip:

- Read our study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

What are the requirements for niche markets?

Organic macadamia nuts

To market macadamia nuts as organic in Europe, they must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can place the European Union’s organic logo on the packaging. This logo is placed in addition to the logo of the standard holder, for example, Soil Association in the United Kingdom and Naturland in Germany. A specific niche opportunity to sell organic macadamia nuts at a higher price can be found seeking out Demeter biodynamic certification.

If you are aiming to produce and export organic nuts to Europe, be aware of important new rules that may impact your business. The new EU organic regulation entered into force on 1 January 2022. This regulation is accompanied by more than 20 secondary acts that regulate the production, control and trade of organic products in more detail. Some of the important acts to be aware of are the detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Ethnic certification

The Islamic dietary laws (Halal) and the Jewish dietary laws (Kosher) impose specific dietary restrictions. If you want to focus on Jewish or Islamic ethnic niche markets, you should consider implementing Halal or Kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation by the Alliance for Product Quality in Africa project to prepare for the new rules.

- Read our study on trends on the European processed fruit and vegetables market for an overview of developments among the sustainability initiatives in the European market.

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through what channels can you get macadamia nuts on the European market?

In Europe, macadamia nuts are mostly used as a snack. They are also used as an ingredient in the food processing industry.

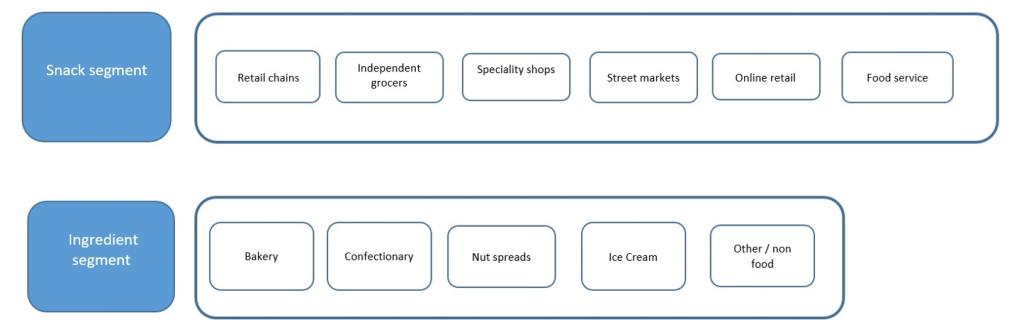

How is the end-market segmented?

The largest user of macadamia nuts in Europe is the snack segment, accounting for around 80% of consumption. The ingredient application market is much smaller, although it is growing faster than the snack macadamia market.

Figure 2: End-market segments for macadamia nuts in Europe

Source: Autentika Global

Snack segment

The most consumed salty snack in Europe is currently potato chips, but nuts are growing in popularity and are perceived to be a healthier option. Currently, the most common ways of consuming macadamia nuts as a snack is roasted and salted. The range of flavours for final consumers in Europe is still limited. One of the reasons is that the macadamia nut is still unknown to many European consumers. Thus, most roasting companies do not experiment with different flavours.

As macadamia nuts are more expensive than other nuts, they are sometimes sold in a mix with other nuts to keep the price down. Chocolate-coated macadamia nuts are an innovative snack product. They have just started to appear on the European market, but the number of new market launches remains modest.

Ingredient segment

The food processing segment is much smaller than the snack segment, approximately 20%. This food processing segment is expected to gain market share in the next several years. Currently, pieces used in ice cream toppings account for the largest share. A variety of important product launches and developments are described in the trends chapter of this study. The most common users include the following:

- The confectionary industry mainly uses macadamia nuts in chocolate snacks, similar to how hazelnuts. Smaller grades of macadamia nuts are used in chocolate products.

- The bakery industry uses chips, bits and diced macadamia nuts in cakes, biscuits and muffins.

- Macadamia nut butter is a new product in several European markets. The butter is produced either from macadamia nuts only or in the form of mixtures with other nuts. Some producers also add honey or chocolate and promote the spreads as premium products.

- Macadamia nuts are increasingly used as an ice cream topping. Usually, ice creams containing macadamia nuts are promoted as luxury products.

- Breakfast cereal producers are starting to use macadamia nuts in their product formulations. However, macadamia nuts are still used a lot less than other nuts.

- Macadamia oil is the most well-known macadamia nut product in the non-food sector. Macadamia oil can be used for cooking, but due to its price, it is rarely sold in Europe as a food product. Instead, macadamia oil is used in a variety of cosmetic formulations. Shampoos, conditioners and skin oils are some examples of the products that can contain macadamia oil.

Figure 3: Food grade macadamia oil

Source: Autentika Global

Tips:

- Monitor market developments within the European snack segment by visiting the news section of the European Snack Association website.

- Visit Snackex for networking opportunities with companies from the European snack segment. Another trade event worth visiting is the ISM in Cologne, Germany. This event is hosted every other year.

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for your macadamia nuts within the food ingredient segment.

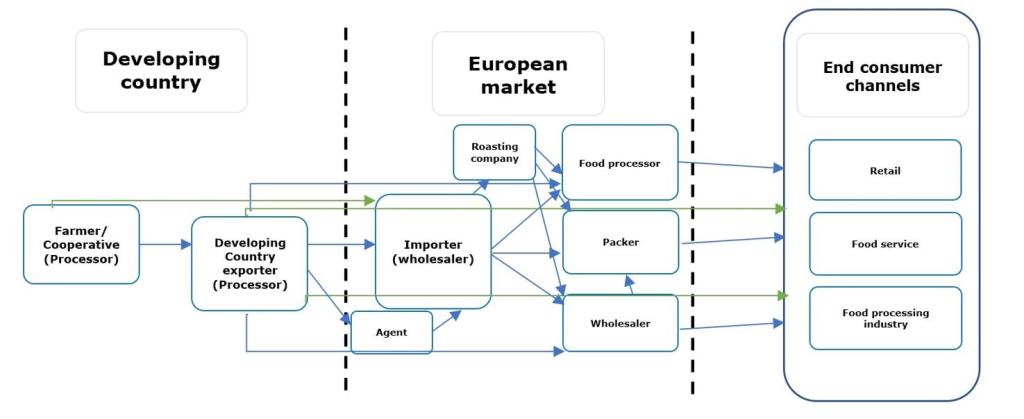

Through what channels do macadamia nuts end up on the end-market?

Specialised nut importers represent the most important channel for macadamia nuts in Europe. There are also several alternative channels, such as agents, food processors and foodservice companies.

Important players in the macadamia nuts segment include roasting and packing companies. Some roasting companies have specialised in selling roasted, salted and spiced macadamia nuts to packers in bulk. Some important roasting companies in Europe include Ireco (Luxembourg), Intersnack (Germany), Max Kiene (Germany) and Trigon (the United Kingdom). Many packing companies have roasting facilities in their factories and they are able to develop various products which they sell directly to consumer segments.

Figure 4: European market channels for macadamia nuts

Source: Autentika Global

Importers/wholesalers

In most cases, importers act as wholesalers. They often sell macadamia nuts to roasting companies, which process and package them for sale as consumer packages. Some importers also have their own processing and packing equipment, and they can supply the retail and foodservice channels directly.

Importers are usually quite knowledgeable when it comes to the European market, and they closely monitor developments in macadamia nut-producing countries. Therefore, they are your preferred contact. Macadamia nut importers normally import other types of edible nuts as well as dried fruit. Thus, offering other products in addition to macadamia nuts can increase your competitiveness.

For new suppliers, the challenge is to establish business relationships with well-known importers, as they usually already work with selected suppliers. Established importers perform audits and visit producing countries on a regular basis. Many new contacts find they must offer the same quality at lower prices than their competitors at the start of their business dealings.

Retailers put pressure on the position of importers and food manufacturers. The higher demands imposed by the retail industry determine the supply chain dynamics from the top down. The pressure translates into lower prices, but also added value in the form of ‘sustainable’, ‘natural’, ‘organic’, or ‘fair-trade’ products. As a result, transparency in the supply chain is needed. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred suppliers from developing countries.

Agents/brokers

Agents normally act as independent companies that negotiate on behalf of their clients and as intermediaries. Typically, they charge a commission ranging from 2% to 4% of the sales price for their services.

Other activities performed by these parties are the supply of private labels for European retail chains as well as the representation of specific brands as exclusive distributors. For most suppliers from developing countries, it is very challenging to participate in the demanding private label tendering procedures. It is also difficult to sell their own brands to retailers. Therefore, some agents participate in the procurement procedures put out by retail chains in cooperation with their macadamia nut suppliers.

Some examples of macadamia nut agents in leading European markets include: California Direct (Germany), Global Trading (the Netherlands), J.M. van de Sandt (the Netherlands), Secoex (Spain) and R.S. Tinsley (the United Kingdom).

Retail channel

Retailers rarely buy directly from developing-country exporters. However, certain exporters (processors) package their products directly for private labels, or even their own label brands. Recently, the retail sector has become increasingly polarised, shifting towards either the discount or the high-level segment. Consolidation, market saturation, fierce competition and low prices are the key characteristics of the European retail food market.

The leading food retail companies in Europe differ per country. The companies with the largest market shares are the Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands).

Foodservice channel

The foodservice channel (hotels, restaurants and catering establishments) is usually supplied by specialised importers, also called wholesalers. This segment often requires specific packaging of macadamia nuts in 1 kg to 5 kg quantities, which is different from the requirements for bulk or retail packaging.

World cuisines, healthy food and food enjoyment are the major driving forces in the European foodservice channel. The fastest-growing business types tend to be healthier fast food, plant-based food, pop-up restaurants, as well as restaurants serving international cuisines and sandwich bars. During the COVID-19 pandemic, the foodservice segment was negatively impacted due to travel restrictions, closures and fewer visits to restaurants and hotels. However, the foodservice segment recovered in 2022.

Tips:

- Search the members list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM) to find buyers from different channels and segments.

- Understand the pressure from retailers for sustainable products and increase your competitiveness by investing in various certification schemes related to CSR, organic foods or food safety. Having food safety certification is the minimum requirement if you want to tap into the retail segment.

What is the most interesting channel for you?

Specialised importers are the most useful contact if you aim to export macadamia nuts to the European market. This is specifically relevant for new suppliers, as supplying the retail segment directly is very demanding and requires considerable investments in the area of quality and logistics.

However, packing for private labels may be an option for well-equipped and price competitive producers. Private label packing is often carried out by importers that have contracts with retail chains in Europe. To have full control of processing, it is easier to roast and pack macadamia nuts for the European snack segment. As the cost of labour in Europe continues to increase, macadamia nut importers sometimes are searching for more cost-effective roasting operations in Eastern Europe or developing countries.

3. What competition do you face on the European macadamia nuts market?

New macadamia nut suppliers must carefully study the current offers from countries that dominate the market, namely South Africa, Kenya and Australia. As macadamia nuts are still perceived as a luxury product, it is a good idea to study the marketing strategies of other substitute nuts, such as almonds and cashew nuts. For example, the Almond Board of California is a good organisation to learn from about marketing tools.

Which countries are you competing with?

South Africa, Kenya and Australia are the main competitors for emerging suppliers of macadamia nuts to Europe. These three countries supply around 86% of all macadamia nuts to Europe. This leaves little room for emerging new suppliers. In the short term, it is likely that these three countries will remain the leading suppliers. However, in the long term, more supply and a bigger market share are expected from other emerging suppliers, such as Guatemala, Malawi, Vietnam, China and Zimbabwe.

New suppliers must be aware of an expected decrease in export prices over the next several years. In Table 1 below, it is clear that all leading macadamia exporting countries have estimated an increase in production. This estimation is based on the increase in areas planted with young macadamia trees. Based on the available data, the World Macadamia Organisation estimates that the global macadamia supply will triple by 2030.

The expected increase in supply will most probably lead to a decrease in export prices. However, it is still not easy to reliably estimate the future competition, as many countries are just starting with the production of macadamia nuts, including in Africa and South-East Asia. Also, it is still not easy to estimate China’s expected output. China has planted large areas in the Yunnan province with macadamia trees, but the expected yield and quality are still unknown.

Table 1: Estimated world macadamia kernels production, in tonnes

|

Producing country |

Crop 2022 |

Crop 2023 |

|

South Africa |

22,000 |

26,100 |

|

Australia |

16,400 |

18,600 |

|

China |

15,600 |

14,000 |

|

Kenya |

8,300 |

8,500 |

|

Guatemala |

3,180 |

3,400 |

|

Malawi |

2,200 |

3,135 |

|

USA |

3,100 |

3,100 |

|

Vietnam |

2,400 |

2,700 |

|

Brazil |

1,625 |

2,000 |

|

Colombia |

210 |

260 |

|

Others |

3,400 |

3,400 |

|

Total global production |

78,415 |

85,195 |

Source: Industry estimation

There are many initiatives to increase production capacities. China is planting the most macadamia trees, and it is likely that it will become the most important supplier in the near future. It is expected that global production and supply will double by 2030.

Source: Global Trade Atlas

South Africa, the leading global producer and exporter

South Africa is the world’s largest producer and exporter of macadamia nuts. For the 2023 season, its expected crop is more than 80,000 tonnes of in-shell macadamia nuts and around 26,000 tonnes of kernels.. In 2022, South Africa exported 27,000 tonnes of in-shell nuts and 12,900 tonnes of kernels.

In 2022, the top South African export destinations for macadamia kernels were the United States of America (44%), China and Hong Kong (14%), Germany (7%), the Netherlands (6%) and Japan (4%). The fastest-growing market for South African macadamia nuts is China, which is the largest consumer of in-shell nuts. Around 25% of the total South African kernel supply was exported to Europe, mainly to Germany (27%), followed by the Netherlands (23%), Spain (14%) and Belgium (13%).

The macadamia nut production is the fastest growing tree crop industry in South Africa. More than 9,000 new hectares were planted in 2022, compared to the 6,000 new hectares planted in 2021. The main growing areas are in the provinces of Limpopo, Mpumalanga and KwaZulu-Natal, in the Western Cape and George areas. Beaumont (695) is the most widely planted cultivar, followed by others such as A4, 816, 814, Nelmak 2, 695 and 842. The industry is export-based, with more than 97% of the annual production being exported abroad.

South African growers have established an industry body, the Southern African Macadamia Growers Association (SAMAC). SAMAC supports the sustainable development of the South African macadamia nut industry through various activities. Considerable effort is invested in research and development programmes. Activities promoting exports are also supported by the South African Department of Trade & Industry through participation in trade fairs and other marketing activities.

Kenya, the fast-growing supplier

Kenya is the third-largest producer of macadamia nuts in the world. It is responsible for around 13% of the total in-shell production and is the third-largest exporter of kernels. Kenyan processors estimate an in-shell crop of 42,500 tonnes and 8,500 tonnes of kernels for 2023. Since 2019, the Kenyan export of kernels increased at a stable rate of 12% annually. Kenyan kernel export doubled from 5,000 tonnes to 10,000 tonnes over the same period. Among the top suppliers, Kenya is the only country with a higher export to Europe in 2022.

The main export destination for Kenyan macadamia nuts is the United States of America, accounting for nearly half of the total export, followed by China, Germany, the Netherlands and Vietnam. In 2022, Kenyan exports to Europe reached 2,350 tonnes. Within Europe, the main destination for Kenyan macadamia nuts is Germany (46%), followed by the Netherlands (34%), Spain (7%), Slovakia (4%) and France (3%).

In contrast to production in Australia and South Africa, the production of macadamia nuts in Kenya relies on small-scale farmers. For most farmers, macadamia is not the main production crop, but it is mixed with other crops such as tea, coffee or avocado and produced without irrigation. As many small-scale farmers use no pesticides and mineral fertilisers, a large share of Kenyan production is similar to organic production. The major macadamia nut production region in Kenya is Mount Kenya, consisting of the counties of Meru, Embu, Nyeri Kirinyaga and Tharaka Nithi.

The Agriculture Food Authority (AFA) has banned the export of in-shell nuts from Kenya to support value addition, as well as to prevent the harvesting of immature nuts and smuggling to China and other processing countries. The Nuts and Oil Crop Directorate (NOCD) is officially responsible for the registration of macadamia nut processors in Kenya. There are now nearly 40 licensed macadamia nut processors in Kenya, with the number increasing every year. The Kenyan Agricultural Research Organisation has developed several quality varieties that are widely used by local producers.

The kernel recovery of Kenyan processors is small compared to Australia and South Africa due to insect damage, but many buyers find that the nuts taste better. In order to improve the quality and marketing of macadamia nuts and other nuts in Kenya, companies have established the Nut Processors Association of Kenya (NutPAK). This industry platform focuses specifically on macadamia nuts, cashew nuts and groundnuts.

Australia, a long tradition and the leading supplier of Asian markets

With an estimated crop of 60,000 in-shell nuts and 18,600 kernels for 2023, Australia is the world’s second-largest macadamia nut producer. In 2022, Australia exported 15,200 tonnes of in-shell nuts and 11,200 tonnes of kernels. Most in-shell nuts were exported to China (74%) for local consumption, while the remaining quantity was mostly exported to Vietnam for processing and re-export.

Australia is a strong supplier to China, where consumers favour in-shell products. This export is seasonal, with most of the quantities exported between July and September. For Chinese consumers, macadamia nuts are often flavoured and cut to allow hand cracking by using a key. This product is especially popular during the Chinese New Year celebration. A similar product was launched for the local market by a few Australian brands, such as Macadamia Twist and Nutworks.

Figure 6: Pre-cracked and flavoured macadamia nuts with an opening device

Source: Autentika Global

In 2022, Australia exported 11,200 tonnes of macadamia kernels. More than 80% of kernels were exported to Asia. The top destinations for Australian macadamia kernels were China (45%), Japan (19%), the Republic of Korea (10%) and the United States of America (9%). Around 1,048 tonnes of Australian macadamia nut kernels were exported to Europe. The main European markets for Australian macadamias in 2022 were Belgium (49%), followed by the Netherlands (31%) and Germany (15%).

Macadamia nuts are grown along the Eastern Coast of Australia. Approximately 46% of the Australian crop is produced in Bundaberg and 32% is produced in the Northern Rivers region. Production is constantly increasing, especially with new plantings in Bundaberg and Clarence Valley. In 2022, approximately 800 growers produced macadamia nuts in Australia. The production is concentrated in an area of 38,000 ha of land. An additional 46 ha will be under planting by 2025.

Macadamia nut production and marketing are strongly supported by the Australian Macadamia Society (AMS). AMS is a key platform for research, development and innovation in the Australian macadamia nut industry. AMS strongly promotes the consumption of macadamia nuts in Australia and worldwide. Within Europe, the promotion of Australian macadamia nuts is currently focused on the German market. Promotional activities include creating a specialised Australian Macadamias website in the German language.

Guatemala, an in-shell supplier with an increasing supply of kernels

Accounting for more than 60% of in-shell exports, Guatemala is increasing its exports of macadamia nuts worldwide. The Guatemalan export increased at a peak rate until 2021, but dropped in 2022. In 2022, Guatemala exported 2,500 tonnes of in shell-nuts and 1,500 tonnes of macadamia kernels. Nearly 90% of in-shell nuts were exported to China.

The main export destination for Guatemalan macadamia nut kernels in 2022 was the United States of America (49%), followed by the Netherlands (31%) and Germany (15%). Guatemala has significantly increased its macadamia export to Europe, from 189 tonnes in 2018 to 533 tonnes in 2022. However, the Central Bank of Guatemala statistics reports a much higher export to Europe, over 1,000 tonnes. The main export markets in Europe are the Netherlands, France and Germany.

Like Kenya, macadamia trees in Guatemala are often intercropped with coffee. Smallholder farmers use no intensive agricultural practices and the distance between the trees is far enough to allow shading for coffee bushes. Irrigation is not used, but water is sufficient for trees by way of rain. Most of the supply is organised by only three processing companies.

Malawi, a rapidly growing African supplier

With an estimated production of 12,500 tonnes of in-shell nuts and 3,100 tonnes of macadamia kernels in 2023, Malawi is the world’s sixth-largest producer of macadamia nuts. Macadamia production in Malawi is increasing rapidly. Although Malawi is increasing its export of kernels, it still exports significant quantities of in-shell nuts as a raw material for further processing. In 2022, Malawi exported 1,500 tonnes of in-shell nuts, mostly to South Africa and Vietnam.

Despite an international energy crisis and price inflation, Malawi managed to increase its macadamia kernel export to 1,860 tonnes in 2022. The leading export destination for Malawian macadamia kernels was South Africa with a 36% share, followed by the United States of America (35%), the Netherlands (19%) and Germany (3%). A significant share of kernels exported to South Africa is the result of activities of the Camelia group, which has processing facilities in both countries.

Other emerging suppliers are looking for opportunities in the European market

There are several emerging suppliers of macadamia nuts trying to increase their export share to Europe. These include Vietnam, China, Zimbabwe and the United States. Some other countries are increasing their own macadamia nut production, but still lack significant export to Europe. Examples are Tanzania, Rwanda and a few countries from Southeast Asia. Brazil and Colombia, although significant producers, do not export to Europe. Brazil exports most of its kernels to the United States, while Colombia consumes most of the produced nuts locally.

- Vietnam – As a leading processor of cashew nuts, Vietnam has focused some of its own processing capacities on macadamia nuts. Its own production of in-shell nuts increased to 9,000 tonnes in 2023. To utilise its processing capacities, Vietnam is also importing significant quantities of in-shell nuts, primarily from Australia. The Vietnamese export of macadamia nut kernels was 76 tonnes in 2023.

- China – Due to an intensive planning of young macadamia trees, especially in the Yunnan province, Chinese in-shell production is estimated at 56,000 tonnes. Despite this, China is a net importer of macadamia nuts, and the largest consumer of macadamia nuts globally. However, despite being an importer, China exported 45 tonnes to Europe in 2023.

- The United States – The centre for macadamia nuts in the United States is Hawaii, although these nuts are also grown in Florida, California and the southern regions of Texas. The leading macadamia organisation in the United States is the Hawaii Macadamia Nut Association. Local demand is satisfied through imports, but some quantities are also exported. In 2023, the European customs reported only 5 tonnes of import from the United States, which is a decrease from the more than 100 tonnes in 2022.

Tips:

- Participate in the International Macadamia Symposium to learn about global market developments.

- Visit the websites of national macadamia associations of leading suppliers, such as SAMAC (South Africa) and AMS (Australia), to get a better understanding of the supplying countries.

Which companies are you competing with?

The macadamia nut supply chain consists of hundreds of farming, processing and exporting companies all over the world. Therefore, the companies mentioned below are just a few examples of successful exporters to European and international macadamia markets. However, there are international companies that are not connected to production countries. Those companies specialise in sourcing macadamia nuts from various origins. The two most notable examples are Green & Gold Macadamias and Marquis.

Both companies are among the world’s leading marketers of processed macadamia nuts. Although they are headquartered in Australia, they sell worldwide from suppliers in different countries: Australia, South Africa, Brazil, Malawi and Kenya. This variety of sourcing is one of their strengths, as supply is not affected by seasonal variations, crop failure or weather events.

Another example of a company that operates internationally is Camelia PLC, a global agricultural company. Camelia produces macadamia nuts on farms in Kenya, South Africa and Malawi. Specialised parts of Camellia include Maclands, two producing companies called Eastern Produce (Malawi and South Africa) and Kakuzi (Kenya).

South African macadamia companies

Nearly 500 growers and 21 processing and export companies are members of SAMAC. A number of growers are Global GAP accredited and most of the cracking facilities are HACCP and/or ISO 9001 accredited. In addition to production and processing standards, many companies are certified by the Sustainable Initiative of South Africa (SIZA) for compliance with SIZA Social Standard.

Some of the notable companies in South Africa are:

- Green Farm Nuts – This is one of the leading processors of macadamia nuts in South Africa. The company sources macadamia nuts from a large network of growers that are supported by training and technical tools to improve production. With three large processing facilities, Green Farm Nuts is the largest processor in South Africa. In order to prepare for the expected increase of the macadamia crop in South Africa, Green Farm Nuts launched the world’s largest macadamia nut processing facility in Mpumalanga in 2018. The company plans to continuously increase its processing capacities to 25,000 tonnes. Green Farm Nuts is a partner of Green & Gold Macadamias.

- Other examples of South African macadamia companies include Empire State Trading, Mayo Macs, Valley Macadamia Group, Golden Macadamias and Amber Macs.

Kenyan macadamia companies

The Kenyan macadamia nut sector is characterised by a large number of small and medium-sized processors. One of the leaders is Kenya Nut Company. The main Kenya Nut processing facility is located in Thika. It is one of the largest processing facilities in the world. In addition to macadamia nuts, Kenya Nut processes, packs and trades a range of other products, such as cashew nuts, coffee, tea, chocolate product, meat and wine. They have created their own brand Out of Africa, targeted towards the high-end segment and tourists visiting Kenya.

- Other examples of larger Kenyan processors include Kakuzi, Jungle Nuts, Equatorial Nut Processors, Sasini, Privam and the Afrimac Group consortium (Afrimac, Village Nut, Batian Nuts, Jumbo Nuts and Sagana Nuts). There is also a variety of successful small and medium companies that are very active in export activities. Some examples include Limbua (a German-Kenyan partnership specialised in the supply of organic macadamia nuts), Exotic (a female-run company) and One Acre Fund (a social enterprise).

Australian macadamia companies

The Australian supply chain is very organised. More than 750 growers are united in cooperatives, selling in-shell nuts to processors. The farmer’s price is based on a quality assessment, the variety of the macadamia nut and the percentage of kernels inside the in-shell nuts. Many processing facilities are owned by grower cooperatives. The prices paid to farmers are transparent and are published regularly by AMS. Processors either sell nuts directly or via specialised marketing companies, such as Green & Gold Macadamias, mentioned above.

- The previously mentioned Marquis is the world’s largest single supplier of macadamia kernels. Some other examples of traders include Macadamias Direct, Nutworks and Stahmann Farms.

Macadamia companies from other supplying countries

- Malawi – Many companies in Malawi were formed through foreign investments. Eastern Produce (macadamia division of Camelia) is the largest grower, cracker and exporter of macadamia nuts in Malawi. Thyolo Nut is a subsidiary of the London-based PGI Group, while Tropha Estate (a part of Jacoma Estate) is a part of the British-based AgDevCo investment company.

- The United States – Mauna Loa (the largest in Hawaii), MacFarms (Hawaii), Olson Trust (Hawaii), Royal Hawaiian Orchards (Hawaii, a part of the Buderim Group).

- Guatemala – Alimentos Selectos, Mayan Gold (Industria Guatemalteca de Macadamia) and Alianza S.A.

Tips:

- Check the websites of macadamia companies on the SAMAC members list to learn about South African suppliers, and the AMS members list to learn about Australian suppliers.

- Use the services of your national export promotion agency and actively participate in creating export strategies.

- Visit major European trade fairs regularly to meet your competitors and potential customers. Examples are ANUGA, SIAL and Food Ingredients Europe.

Which products are you competing with?

Macadamia nuts are unique in terms of flavour. There are not many alternatives. Taking a broader view, other luxury tree nuts, such as almonds, pistachios and cashew nuts, can be considered competitive with macadamia nuts. The competitive advantage of all other ‘luxury’ nuts is that they are cheaper than macadamias.

Tip:

- Read the CBI’s almond and cashew studies to understand the almonds and cashew nuts industry, and learn about promotional tools used by almond and cashew suppliers.

4. What are the prices for macadamia nuts?

Depending on the country, the retail chain and brand, the prices of macadamia nuts sold to final consumers vary significantly across Europe. The retail prices of salted and roasted macadamia nuts can go over €50/kg. This price suggestion is not a real indicator to macadamia nuts suppliers, as the final price is very different from the export price due to the addition of many other costs, such as transport, roasting, packing, sales and profit margins. The approximate breakdown of macadamia nut prices is shown below.

Table 2: Breakdown of the retail price for macadamia nuts

|

Steps in the export process |

Retail price breakdown (margin addition) |

|

Farmers, traders and local shipping |

8% |

|

Shelling and processing |

40% |

|

Export, shipping and warehousing |

45% |

|

Roasting, packing and distribution |

50% |

|

Retailers price |

100% |

The export price of macadamia nut kernels varies, depending on the season. Prices depend on the form in which they are traded, the quality, the variety and the origin. The prices of macadamia nuts from South Africa and Australia are often higher than those from Kenya and Malawi. The average FOB price from leading supplying countries in the first quarter of 2023 ranged from €9/kg to €11/kg, which is a significant decrease compared to previous seasons.

Tip:

- Subscribe to the S&P Global Commodities portal, which is one of the most respected market information services for food ingredients. Subscribers have access to overviews of export prices for edible nuts, which are published regularly and updated frequently.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research