Entering the European market for olive oil

New olive oil exporters that want to enter the European market need to put their products through regular laboratory and sensory tests. You may have a competitive advantage if you can offer olive oil with superior sensory characteristics, related to specific production areas, certified organic or backed by good storytelling marketing. The strongest competitors to new olive oil suppliers are currently in Spain, Italy, Portugal, Greece and Tunisia.

Contents of this page

1. What requirements must olive oil comply with to be allowed on the European market?

New olive oil exporters that want to enter the European market need to put their products through regular laboratory and sensory tests. Virgin olive oils are the only food sold in Europe where sensory testing is obligatory by law to define quality.

What are mandatory requirements?

All food products sold in the European Union (EU) must be tested for safety, including olive oil. Testing for safety includes, for example, complying with established maximum levels for harmful contaminants, such as mineral oil hydrocarbons. In the case of olive oil, product composition is also of utmost importance, because olive oil must meet specific requirements related to acidity, content of specific chemicals and sensory characteristics. The product label should also make it obvious to consumers what type of olive oil it is.

Tariff barriers

Under certain free-trade agreements, most olive oil exporters from developing countries can export olive oil to Europe without paying duties. To achieve zero duty status, exporters must submit a certificate of origin that complies with specific rules defined in the specific free-trade agreements. A certificate of origin is used as proof that olive oil is fully produced within the exporting country and from locally grown olives.

Most olive oil producing countries are members of the Euro-Mediterranean partnership agreement, but the EU also has free-trade agreements with Albania, South Africa, Palestine and some South American countries. A specific tariff quota is used for Tunisian olive oil. After the exported volume reaches 56,700 tonnes, a regular tariff of €124.50 per 100 kg applies. Also, a quota of 7,453 tonnes is used in imports of Tunisian olive oil to the United Kingdom.

Please note that for Tunisia, European importers must also have an import license to benefit from reduced tariff rates under the tariff quotas. Currently, most olive oil importers with licenses to import within given quota are big olive oil blending companies from Spain, Italy, France and Belgium. Traders from other large markets, such as Germany, the United Kingdom (UK) and the Netherlands, rarely apply for these import quotas.

Contaminants control in olive oil

A specific and frequently updated European Commission Regulation sets the maximum levels for certain contaminants in food products. In addition to the general contaminant limits set for foodstuffs, it also provides a number of precise contaminant limits for specific products, including olive oil.

Mineral oil hydrocarbons

Mineral Oil Saturated Hydrocarbons (MOSH) and Mineral Oil Aromatic Hydrocarbons (MOAH) are olive oil contaminants that have raised public concern several times. For example, French consumer organisations tested 24 olive oils in 2023 and MOSH and MOAH in amounts above 2 mg/kg. Although official limits are not set yet, they are expected soon. The most probable source of contamination with MOSH and MOAH in olive oil are lubricants used for the processing machinery.

Pesticide Residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticide residues than allowed will be withdrawn from the European market. The European Union regularly publishes a list of approved pesticides that are authorised for use. Although high levels of pesticide residues are not very common in olive oil, some European importers do request a detailed test for the presence of pesticide residues.

The number of incidents regarding too high levels of pesticide residues in olive oil is decreasing, but they do occur. Every 3 years, the European Union control programme samples 12 of the most consumed food products, including virgin olive oil. In the latest official test report from 2021, 0.3% of the tested olive oils on the European market contained pesticide residues above the allowed limits. Some pesticides are banned in the EU but some of them, such as Chlorpyrifos and Dimethoate, were found in quantities exceeding the legal limit in imported olive oil samples.

Microbiological contaminants

The presence of microbiological contaminants is rare in olive oil, as the chance of microorganisms growing is extremely low without the presence of water. Nevertheless, freshly produced olive oil naturally contains small amounts of water, allowing some microorganisms to develop. Some studies show that coliform bacteria can survive and reproduce in olive oil containing low level of phenolic compounds. Therefore, some importers may require standard microbiological tests for imported olive oil, although it is not very critical.

Processing contaminants

No processing contaminants are allowed in the production of extra virgin olive oil. However, lampante olive oil must be refined to remove its defects so processing aids are used in the refining process. The European regulation maximum levels for certain contaminants sets maximum levels for 3-monochloropropanediol, 3 fatty acid esters and Glycidyl fatty acid esters.

Other contaminants

Other commonly requested contaminant controls for olive oil are related to the presence of heavy metals, irradiation and polycyclic aromatic hydrocarbons (PAHs). Commonly tested heavy metals include cadmium, lead and mercury. The presence of PAHs can be connected to the production of olive pomace and smoked oils.

Tips:

- Be sure to perform laboratory tests only in ISO/IEC 17025:2017 accredited laboratories.

- To be prepared for potential new changes in the MRLs, read the ongoing reviews of MRLs in the European Union.

Olive oil composition

EU olive oil legislation defines 8 different categories of olive oil, as well as the relevant methods of analyses to be used by Member States’ control authorities. Legislation includes marketing standards that must be followed to label different categories of olive oil. European legislation is slightly different compared to the standards of the International Olive Council (PDF).

The sales of fake or falsely declared olive oil in Europe is prevented through regular controls. Each European country must perform a certain number of controls to ensure that marketing standards for olive oils are respected. Despite frequent controls, irregularities are often found. In the official test report from 2021, more than 14% of tested olive oils were not labelled correctly. Moreover, a reason for public concern is that nearly 40% of tested EVOO did not fulfil official quality requirements.

Authenticity tests on olive oil are performed to avoid fraud. Common frauds include adding cheaper vegetable oil, false quality grading, false organic certification and false geographical origin. Authenticity tests include detecting the amount of waxes (revealing the presence of pomace oil), 2-glyceril-monopalmitate (the presence of re-esterified oils), stigmastadienes (the addition of refined oil), ECN42 (the addition of seed oil) and fatty acid composition (to find out if olive oil is a blend). There are also several other tests for authenticity.

Quality requirements

The different categories of olive oils are graded according to quality parameters relating to the physical and chemical features, as well as and the organoleptic (sensory) aspects. High-quality olive oil is commonly defined as the oil with low acidity, high content of polyphenols and good flavour. It is not easy to have all parameters well balanced. For example, olive oils with a high content of polyphenols sometimes have a too bitter and pungent flavour.

The main chemical features related to quality are the acidity level, peroxide index, level of oxidation, fatty acid content and sterols composition. Olive oil chemical composition depends mainly on olive cultivars, production region, olive health condition, freshness and production process. Low acidity levels indicate higher quality olive oil. Acidity increases when olives are too mature (fermentation starts), when temperature during crushing is too high, and when the time between harvesting and pressing is too long. Storage time also increases acidity.

Chemical tests alone are not enough to establish the quality category in olive oil. Additional sensory testing is necessary to define characteristics such as fruitiness and the absence of organoleptic defects. Sensory tests are required only for virgin olive oils, and they are performed by a team (panel group) of 8–12 qualified assessors. Officially recognised assessors must participate every year in proficiency tests to prove their competence.

Sensory tests are performed by smelling and tasting. A bitter taste is frequently related to olive oils produced from green olives or olives turning coloured, while unripe olives are a source of pungency in olive oil. Fruitiness, bitterness and pungency are perceived to be positive characteristics. EVOO must not have any sensory defects and must have an average sensory fruity attribute above zero. Virgin olive oil can have sensory defects between 0 and 3.5.

EVOO of protected origin can have unique sensory properties. For these oils and for premium olive oils, additional sensory attributes are evaluated, such as artichoke, citrus, flowers, grass, green and herbs. As a result of the standards in place, fermentation of olive oils is not allowed. Nevertheless, some speciality oils in France are produced using short fermentation of mature olives.

Tips:

- Strongly invest in relationships with farmers and support them in good agricultural practices to improve the quality of olives. For example, investing in mechanical harvesters can prevent the picking up of olives from the ground. In addition, to avoid olive fermentation, you can rent breathable crates for farmers.

- Do not store olives in big piles for a long time to avoid fermentation.

- Separate unfiltered oil from any sediment and water after extraction as soon as possible to avoid the appearance of sensory defects. Repeat this process a few times before bottling.

- Train employees in your company to perform in-company sensory tests for the regular monitoring of olive oil quality. Follow the ISO 8586:2023 training guidelines for sensory assessors.

Packaging requirements

There is no official regulation for bulk-packed olive oil. For retail sales of olive oil, the maximum container capacity cannot exceed 5 litres, according to the European olive oil marketing regulation. Packaging can be larger if the oil is sold to food service (restaurants, hotels) or public segments (hospitals, governments).

According to the EU olive oil marketing regulation, EVOO can be sold only in single-use sealable containers for retail sale. In retail sales, refilled dispensers should only be used for flavour-infused olive oil, but not for EVOO. This rule has been criticised by specialised shops, because it does not allow the reuse of packaging.

Packaging contaminants

Phthalates are chemicals frequently found in samples of olive oil. They can migrate from the plastic packaging to the oil but also from processing equipment, such as pipes, or from tanks during transport. In the above-mentioned French consumer research, 23 out of 24 samples of olive oil were contaminated with phthalates. It is therefore important to also test olive oil samples for the presence of packaging contaminants. Limits are set in the European regulation for plastic materials and articles intended to come into contact with food.

The presence of bisphenol A (BPA) is controlled in plastic packaging, but also in inner lid coatings. The use of BPA is still allowed, but its use is under review. Official stricter limits are likely be set soon.

Labelling requirements

The European olive oil marketing regulation regulates the information that must be placed on the retail label and what optional information can be included. Mandatory information is the following:

- Category of olive oils according to the official classification (either EVOO, virgin, olive oil composed of refined olive oils and virgin olive oils or olive-pomace oil)

- Storage conditions – must be stored away from light and heat

- Place of origin – obligatory for EVOO and virgin olive oil. If olives are harvested in one country but processed in another this must be also indicated on the label. For example, ‘extra virgin olive oil obtained in Italy from olives harvested in Greece’.

- Packaging plant number

Optional labelling on EVOO can include special quality characteristics such as “first cold pressing”, “cold extraction” and special sensory characteristics. EVOO labelling can also include maximum acidity expected by expiry date and harvesting year.

European health claims regulations prohibit claims that foods can cure illnesses. Currently allowed health claims labelling for olive oil include only polyphenols, oleic acid, vitamin E and monounsaturated and polyunsaturated fatty acids. Beneficial effects of polyphenols can only be used on the label for olive oil that contains at least 5 mg of hydroxytyrosol and derivates per 20 g of olive oil. In that case the following claim can be used: “Olive oil polyphenols contribute to the protection of blood lipids from oxidative stress”.

Tips:

- Read more about the transport and storage conditions for olive oil on the websites of Transport Information Service and Cargo Handbook. Packaging materials and storage conditions can impact the outcome of sensory tests and phenol levels.

- Read the CBI study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

Comply with the legislative requirements on sustainability

Some of the most relevant European laws and legislation related to environmental and social sustainability are incorporated in the European Green Deal (EGD). The EGD includes legislative changes, with a timetable outlining when they will come into action. The most relevant policies for the fruit, vegetable and nut processing sector are the Farm to Fork Strategy, the Biodiversity Strategy and the Circular Economy plan. Specific legislations relevant for olive oil suppliers are:

- Organic food regulation;

- Sustainability labelling of food products;

- Corporate Sustainability Due Diligence Directive (PDF);

- Packaging and packaging waste.

What additional requirements do buyers often have?

In addition to the mandatory requirements, many other specific buyer requests have become equally important. These include compliance with food safety, quality and sustainability standards.

Specific quality characteristics

Some buyers may have special quality preferences for olive oils in terms of intensity and olive ripeness. Regarding intensity, all olive oils can be classified as intense (robust), medium or light (delicate). Intensity is defined by the main attributes (fruitiness, bitterness and pungency). Depending on the harvest time, olive oil can be produced from unripe olives (green), from ripe olives or from a combination of both. Other types include infused, organic, monovarietal and olive oils from specific regions.

Some buyers specialise in premium olive oils. Although there is no official European categorisation of premium olive oil, it is commonly understood as olive oil that has an extremely low acidity level, if possible, less than 0.3g per 100g. Premium olive oils are also promoted with remarkably high positive sensory attributes. The most common marketing method for premium olive oil is through international olive oil competitions. When olive oil wins competition awards, it is then commonly promoted as ‘premium’, ‘high-end’ or ‘superior quality’.

Trading packaging requirements

A large amount of olive oil is exported as bulk. Bulk packaging includes various sizes and containers, such as steel drums, reusable (intermediate) bulk plastic containers, flexi tanks and truck cisterns. Bulk packaging can vary in size and range from 200 kg (drums) to over 20 tonnes (flexi tanks). For the food service sector, most pack sizes vary between 5 kg and 25 kg and very often tin cans are used. For specialised olive oil stores and the food service sector, olive oil is also packed into special dispensers between 5 L and 15 L, or in bag-in-box packaging.

The most common sizes of retail olive oil bottles in Europe are between 0.5 and 1 litre. Premium olive oils are mostly packed in sizes of 0.5 L and 0.75 L and sometimes even in smaller bottles of 100 ml, 250 ml, and even in 20 ml single-use bottles for restaurants and catering.

Glass is the preferred type of retail packaging, mostly due to consumer preferences and image of quality olive oil. Still, olive oil is packed in many other materials for retail sales, including plastic bottles (such as PET and PVC), aluminium cans, tinplate cans and coated paperboard. Even ceramics is used for some premium olive oils.

Food safety certification

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide some type of food safety certification.

Most European buyers will ask for Global Food Safety Initiative (GFSI) recognised certification. For olive oil, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS); and

- Food Safety System Certification (FSSC 22000).

Please note that this list is not exhaustive and food certification systems are constantly developing.

Although the various food safety certification systems are based on similar principles, some buyers prefer 1 specific standard over the other. For example, British buyers often require BRC, while IFS is more common for German retailers. Also note that food safety certification is only a basis to start exporting to Europe. Serious buyers will usually visit or audit your production facilities before buying.

Sustainability requirements

There is an increasing demand for sustainably-sourced food in Europe. To help consumers make more ecological choices, there is an increasing development of labelling systems such as Eco-Score, Eco Impact, Planet Score, Enviro Score and Foundation Earth. For example, the Italian producer Monini has started to promote its brands ‘Classico’ and ‘Delicato’ as CO2 neutral. Along with requirements related to environmental impact, there is an increasing demand for a more transparent and fair supply chain.

One way to show that you take care of farmers and workers is to get certified with standards such as Fairtrade, Fair for Life and Rainforest Alliance. Fairtrade is the most used ethical certification for olive oil, especially for olive oil from Palestine and Syria. Products carrying the Fairtrade label indicate that producers are paid a Fairtrade Minimum Price. Fairtrade International has a complete minimum price structure for olive oil classified by origin, as well as by category (organic or conventional, and extra virgin or virgin).

Some companies require an adherence to their own code of conduct, other companies require an adherence to 1 or more common standards. Examples include independent audits such as SMETA (by Sedex), the Ethical Trading Initiative (ETI) and BSCI (by amfori). If olive oil is intended for direct retail sales, suppliers will have to follow a specific Code of Conduct developed by retailers.

Important environmental aspects relevant for olive oil production are related to wastewater generation and disposal. Wastewater generated by olive mills contains high concentrations of phenols, which can contaminate water if they are disposed of in rivers, lakes or seas.

Tips:

- Read CBI tips to go green and CBI tips to become a socially responsible supplier to get familiar with increasing market requests on sustainability.

- Read the CBI study on trends in the European processed fruit and vegetables market for an overview of developments regarding sustainability initiatives in the European market.

What are the requirements for niche markets?

Organic olive oil

To market olive oil as organic in Europe, processed olives must be grown using organic production methods. Growing and processing facilities must be audited by an accredited certifier before exporters can place the European Union’s organic logo on the packaging, as well as the logo of the standard holder, for example, Soil Association in the United Kingdom and Naturland in Germany. A specific niche opportunity to sell organic olive oil at a higher price is to follow the rules of the biodynamic certification of Demeter.

If you are aiming to produce and export organic olive oil to Europe, be aware of important new rules that may impact your business. The New EU organic regulation entered into force on 1 January 2022. This regulation is accompanied by more than 20 secondary acts that regulate in more detail the production, control and trade of organic products. Some of the important acts to be aware of are detailed organic production rules, the list of authorised substances for plant protection and the rules on documentation requirements for imports.

Ethnic certification

The Islamic dietary laws (Halal) and the Jewish dietary laws (Kosher) impose specific dietary restrictions. If you want to focus on Jewish or Islamic ethnic niche markets, you should consider implementing Halal or Kosher certification schemes.

Tips:

- Read the training materials on the new organic regulation (by Alliance for Product Quality in Africa project) to prepare for the new rules.

- Read our study on trends on the European processed fruit and vegetables market for an overview of developments amongst the sustainability initiatives in the European market.

- Consult the Sustainability Map database for information on a wide range of sustainability labels and standards.

2. Through what channels can you get olive oil on the European market?

If you want to offer olive oil of standard quality in big volumes, good entry points are European olive oil producing, blending and bottling companies. However, independent specialised olive oil importers are also an important channel, especially if you are willing to enter the foodservice or high-end segments in the European market.

How is the end-market segmented?

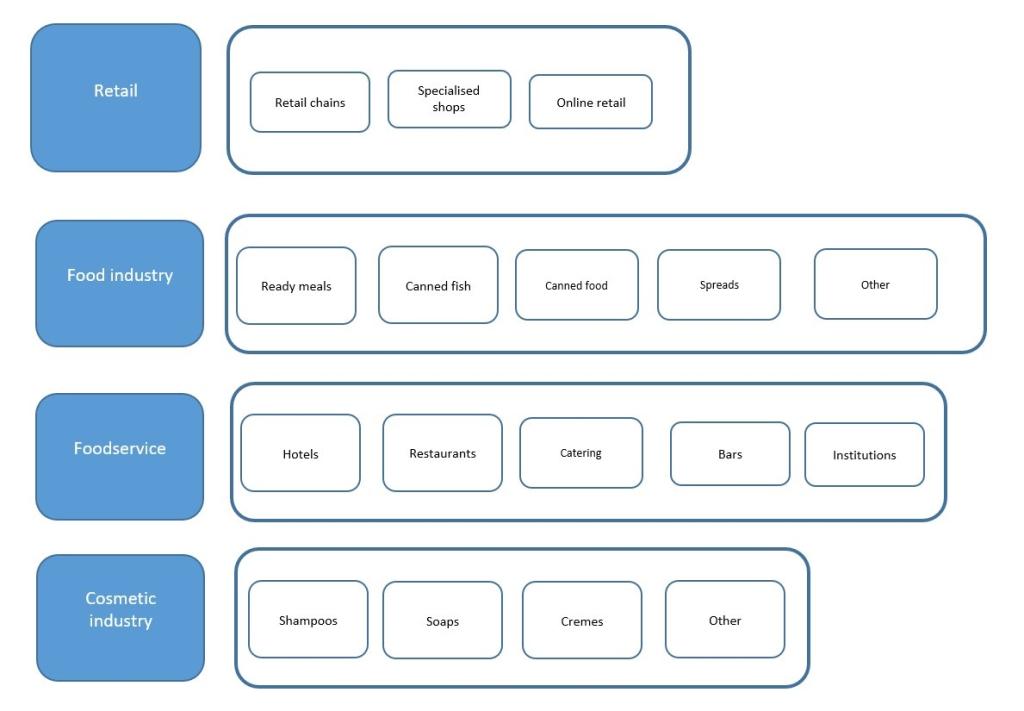

Olive oil in Europe is mostly used for home consumption – as a result, retail sales have the largest share. Olive oil is also used by the food processing industry and by food services. There is no exact data, but the retail segment is roughly estimated at approximately 60% of the European olive oil market. Within the retail segment, the largest volumes are sold through supermarkets, where the share of private labels is growing.

Figure 1: End-market segments for olive oil in Europe

Source: Autentika Global

Retail

Retailers sometimes buy directly from developing-country exporters, but in most cases, they use intermediaries, such as specialised distributors. A recent development is the polarisation of the retail sector into discounters and high-level segments. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market. Online retail sales of olive oil currently account for a small share of the market, but they are growing.

Types of sub-segments (points of sale) of the olive oil retail segment in Europe include the following:

- Retail chains – the main development for the leading mainstream retailers is the increasing share of private label olive oils, including organic and higher quality (such as single-origin) varieties. Companies holding the largest market shares in Europe include Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, ALDI, EDEKA, Leclerc, Metro Group, REWE Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands).

- Specialised olive oil shops – Relevant for high-quality and single-origin EVOO sales. Some single shops were so successful they opened stores in different locations. Oil & Vinegar from the Netherlands is a good example of a shop that started in the Netherlands and now has stores in several European countries. There are also national chains that specialise in olive oil, such as Oliviers&Co in France. In most specialised shops, customers can taste oils before buying and fill their own bottles from the glass barrels.

- Specialised ‘fine food’ stores – These shops sell a wider range of food and premium olive oils. Some specialised stores are present in the form of luxury food department stores such as Fortnum & Mason in the United Kingdom. Fine food stores are sometimes present not as individually branded shops, but as food corners in shopping malls or in luxury department stores, such as La Grande Épicerie in France and de Bijenkorf in the Netherlands.

- Specialised organic and health food shops – Specifically relevant for suppliers of certified organic olive oils. Many organic shops are part of specialised organic food retail chains, especially in Germany. Some of them import directly. Some European shops selling organic olive oil are also drugstores (for example, dm and Rossmann), variety shops (such as HEMA) or food supplement stores (such as Holland & Barrett).

- Specialised ethnic shops – These shops provide specific opportunities for entering the market without competing with the leading retail brands. The most relevant types of ethnic shops for olive oils sales are shops selling food from the Middle East and North Africa.

- Specialised ethical shops – This is a niche segment that provides opportunities for Fairtrade and ethical certified suppliers. Sales of Fairtrade-certified products are strong in the United Kingdom and Scandinavian countries.

- Online retailers – Online retailers usually sell premium olive oils, often from specific origins or from single producers. Online olive oil shops are often part of the business of regular traders.

Food industry

Most food industry processors rarely use EVOO olive oil as an ingredient. However, the number of products with EVOO as an ingredient, is on the rise. Adding olive oil to food products improves the consumer’s image of the product. This means the price can be increased for the final retail product. Most food industry companies are supplied through wholesalers and do not import olive oil directly. The biggest users of olive oil in the European food industry include:

- Ready meals – Producers of chilled, canned or frozen ready meals use olive oil as an ingredient. The majority of those products include Italian style products, such as pizzas, pastas and pesto sauce, or Spanish style products, such as frozen paella. Mediterranean style ready meals also using olive oil as an ingredient are appearing on the market, such as Greek style salads and pita breads, and Middle Eastern tabbouleh salads.

- Canned fish – Producers of canned tuna, mackerel, sardines and anchovies use oil in most of their products. Many canned fish producers are replacing other vegetable oils with olive oil to increase quality and improve the product image (such as the famous Rio Mare brand).

- Canned food – Apart from fish, this item includes processed and canned vegetables, such as grilled artichokes, grilled peppers, chopped garlic and canned pasta sauces.

- Spreads – Several producers of margarines are introducing new options to improve the image of the product, including adding olive oil to decrease the content of unhealthy fats in the final product.

- Other food industry products – These include other products where olive oil is used as an ingredient, such as dips, sauces, condiments (for example, mayonnaise), table olives, dressings and bakery snacks.

Food service

The food service segment (hotels, restaurants, catering and public organisations) is usually supplied by specialised wholesalers and distributors. The food service segment usually does not import directly, except in a few cases of fast-food chains that are served by exclusive distributors. Increasing consumption is specifically relevant for Mediterranean types of restaurants and fast-food chains, such as pizza and tapas bars. In addition, some high-end or luxury restaurants serve premium olive oil.

The food service segment is quite significant in Europe, in terms of olive oil use. For example, the Netherlands alone has approximately 40 thousand players in the food service segment. In order to reach end buyers in this segment, it is necessary to use specialised distributors and specific packaging, such as 5 L tin cans.

Most olive oil used for food preparation in restaurants is not virgin. However, olive oil served together with dishes is mostly EVOO. Until recently, in many European countries, olive oil served with dishes was of inferior quality from refillable containers. However, some countries introduced rules for restaurants to serve EVOO from original bottles. For example, in Greece, since 2018, EVOO must be served in non-refillable bottles of up to 500 ml. However, this rule is not easy to adopt by many restaurants due to the added cost.

Through what channels does olive oil end up on the end-market?

In terms of volume, the most important channels for olive oil in Europe are large producing and bottling companies. They import bulk olive oil for blending and production of their own retail brands. However, independent, specialised olive oil importers are also an important channel, especially for companies willing to enter high-end segments in the European market.

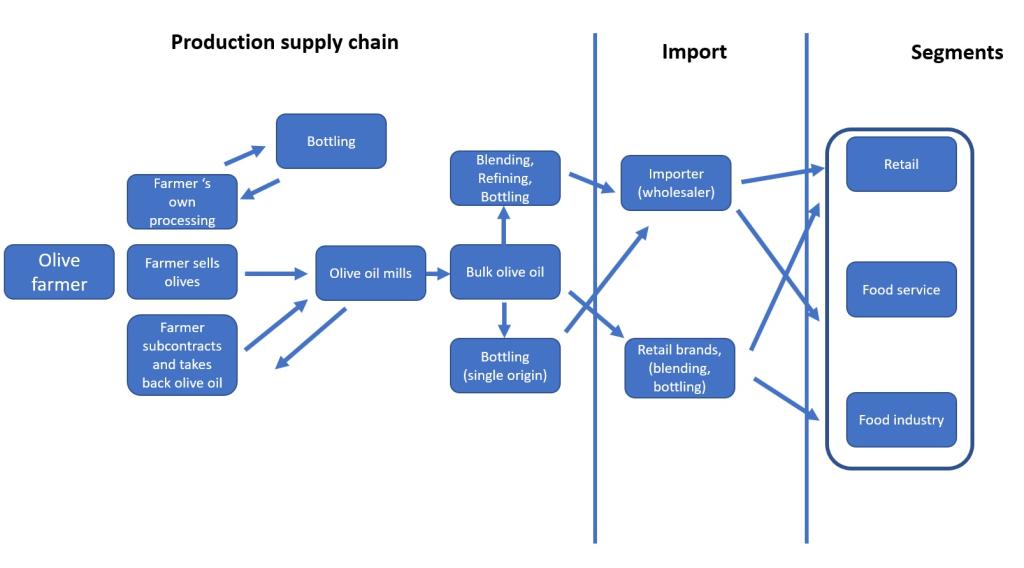

Figure 2: European market channels for olive oil

Source: Autentika Global

Importers (Wholesalers)

Unlike many other food sectors in Europe, in the olive oil sector the largest importers are not traditional wholesalers, but companies selling olive oil under famous retail brands. These companies import bulk olive oil from their own production locations to different destinations in Europe. Specialised importers, in turn, import either bulk or bottled olive oil and sell it to the food service segment or to specialised shops.

Some specialised importers are also exclusive distributors for certain olive oil brands. In many cases, these importers also import other products, not just olive oil. However, exclusive distributors usually do not sell more than 1 olive oil brand.

For new suppliers, the challenge is to establish long-term relationships with leading brands that usually already work with selected suppliers. Well-known importers perform regular audits and visits to producing countries. As a new contact, at the start of the relationship, you often need to offer the same quality, but at better prices than your competitors. On the other hand, specialised importers of premium olive oil offer better prices, but ask for exceptional quality, new flavour profiles and interesting stories behind your product or brand.

Many different types of importers specialise in importing olive oil. Some import a wide range of products, others import different types of oils and other condiments, such as vinegars. There are still importers that specialise in importing only olive oil. The most important types of olive oil importers are the following:

- Leading retail brand producing companies – These are companies that buy most of the olive oil in the world. They are relevant for bulk exporters, but less relevant for suppliers of bottled oils. They have strict quality assessment procedures before selecting new suppliers. For new suppliers willing to export bottled olive oil, these companies can even be considered competitors. Examples of the largest companies include Deoleo, SOVENA, Migasa, Salov and Acesur.

- Retail bottling companies and brand distributors – These companies are often bottlers of different types of edible oils, but some are multinational companies selling many different products and international brands. They can be interesting for bulk olive oil exporters that often blend olive oil from different origins. Some examples are Avril Group, Unilever, Princes Group, MH Foods and Di Luca & Di Luca.

- Specialised olive oil importers – The different types of specialist olive oil importers range from those importing oil only from specific origins, to importers importing bulk and different types of oil. Some of them act as bulk wholesalers, while some are specialised in trading premium olive oil and supplying olive oil shops. Examples include Peter Kölln, The Oil Merchant, Artisanal Olive Oil Company, Assisi (Oil & Vinegar brand), Or Andaluz, Henry Lamotte Oils, the gift of oil, Meyer & Co and Imex Delikatessen.

- Specialised natural and organic food importers – Amongst these specialist importers providing opportunities for suppliers of organic olive oil are Le Temps des Oliviers, Bio Planète, Naturata, Raw Living, Oliva Oil (Biologisch Pakhuis) and Gebana.

- Other importers – Some importers provide opportunities for niche markets. They include single-origin olive oil importers, fair-trade and sustainable product importers, and ethnic food importers.

What is the most interesting channel for you?

Specialised olive oil and vegetable oil importers are the best contacts for exporting olive oil to the European market, particularly for new suppliers willing to reach the retail segment more easily. However, selling olive oil in mainstream supermarkets can be very difficult and requires high distribution and logistics capacities.

Specialised importers usually have a good knowledge of the European market and monitor the situation in olive oil producing countries closely. On the other hand, large-scale producers willing to provide standard quality and competitive prices can also consider working with the larger producing and bottling companies. If your company is certified for socially responsible practices or produces certified organic olive oil, you can look for opportunities with specialised importers of these products.

Tips:

- Study the exhibitor lists of large trade fairs, such as Anuga, SIAL and Alimentaria, to find potential buyers for your olive oil. If you aim to supply to supermarket private labels, search for opportunities at PLMA.

- In order to more easily reach the food service segment, look for suppliers at specialised food service events, such as SIRHA and Internorga.

- If you are producing premium olive oil, enter your product in international competitions to attract potential buyers. Also consider exhibiting at specialised fine food exhibitions, such as the International Food & Drink Event and Speciality & Fine Food Fair.

- Understand the retailers’ demand for sustainable products and make yourself more competitive by investing in various certification schemes, such as those involving corporate social responsibility (CSR) practices. Food safety certification is a minimum requirement if you want to reach the retail segment.

3. What competition do you face on the European olive oil market

As most of the olive oil in the world is produced in Europe, you can expect fierce competition, especially from the large suppliers from Spain, Italy and Greece. Suppliers from Tunisia, Morocco and Turkey are also gaining share on the European market.

Which countries are you competing with?

The main competitors for emerging olive oil suppliers are in Europe, namely in Spain and Italy. Exports from those 2 countries supply more than 70% of all European olive oil imports. Greece and Portugal are 2 other important supplying countries within Europe. Tunisia is the main non-European supply country, followed by Morocco. Spain is characterised by large-scale production and a price-competitive assortment. In Italy and Greece, a large number of small-scale producers produce high-quality olive oil, while Tunisia has the strongest organic product range.

Source: Global Trade Atlas

Spain: The leading world supplier of olive oil

Spain is the leading olive oil producing country in the world, and the largest supplier to other European countries. In 2022, Spain exported 1.16 million tonnes of olive oil, at a value of €4.56 billion. Most of the olive oil exported from Spain is EVOO (60%), followed by refined and blended oils (25%), refined pomace oil and pomace oil (10%), virgin olive oil (3%), lampante olive oil (2%) and crude olive pomace oil (1%). Due to lower production and price inflation, Spanish exports are expected to decline in 2023.

In 2022, the leading export destination for Spanish olive oil was Italy (29% of all olive oil exports), followed by the United States (14%), Portugal (11%), France (8%) and China (4%). A significant part of the olive oil exports from Spain to Italy belong to large European companies that have facilities in both countries. China was the fastest growing export destination for Spanish olive oil. Spanish exports to China increased from 30 thousand tonnes in 2018 to 45 thousand tonnes in 2022.

Spain is the world’s largest producer of olive oil. Having the largest olive tree planted area in the world, Spain accounts for 50% of the total olive area in Europe. The largest share of olive oil production is located in Andalusia (80%) followed by Castilla-La Mancha (8%), Extremadura (5%) and Catalonia (3%). With 35 protected designations of origin for olive oil, Spain is fully export oriented and has a growing production but stagnating domestic consumption.

Spain grows 260 different olive cultivars, but the most important is Picual, which makes up 50% of Spain’s olive trees. Olive oil produced from the Picual variety is favoured because of its high level of polyphenols and long shelf life. Other important Spanish varieties include Hojiblanca, Cornicabra, Arbequina, Lechín of Seville, Verdial, Empeltre and Picudo. More than 1,800 olive mills process Spanish olives into olive oil, but an estimated 40% of Spanish olive oil is produced by large oil groups.

Greece: A long production history and unique varieties

In 2022, Greece was the second-largest European olive oil producer and exporter. However, on average, Greece produces less olive oil than Italy. In 2022, Greece exported 205 thousand tonnes of olive oil at a value of €867 million. Although the exported quantity in 2022 is not significantly higher compared to previous years, the export value dramatically increased due to price inflation in Europe.

Approximately 72% of Greek olive oil exports were EVOO, followed by crude pomace oil (11%), refined oil and blends (8%), virgin olive oil (4%), olive pomace oil and refined olive pomace oil (3%) and lampante oil (1%). Greek production is focused on high quality olive oil and EVOO represents a large share of the produced output compared to other producing countries. Greece is also the leading world exporter of crude olive pomace oil, which is mostly exported to Italy and Spain for further refining.

Italy is the leading market importing Greek olive oil, taking 65% of all Greek olive oil exports, followed by Spain (9%), Germany (8%) and the United States (5%). In recent years, the biggest increase in Greece’s olive oil exports was to Poland. Greek olive oil exports to Poland have increased almost fourfold, from 555 tonnes in 2018 to 2.1 thousand tonnes in 2022.

Most olive oil production in Greece is concentrated in Peloponnese (Messenia and Ilia), Crete (Iraklion and Chania), Mitilíni and on the Ionian Islands (Corfu). The leading olive variety in Greece is Koroneiki followed by Mastoidis and Adramitini. Approximately 9% of Greece’s olive trees dedicated to olive oil production are organically certified.

Italy: Increasing exports to the United States of America

Italy is the second-largest olive oil exporter in the world. In 2022, Italy exported 395 thousand tonnes of olive oil, valued at €1.9 billion. Italian domestic production is not sufficient for that volume of exports, so the country imports more than it exports: 617 thousand tonnes in 2022. Consumption of Italian olive oil is supported by Italy’s famous retail brands, a significant organic assortment and the well-established reputation of Italian cuisine. More than 75% of Italian olive exports is EVOO.

In 2022, the leading export destination for Italian olive oil exports was the United States (28%), followed by Germany (11%), France (8%), Japan (5%), Spain (5%) and Canada (5%). The United States of America was the fastest growing export destination for Italian olive oil exports over the last 5 years. Italian olive oil exports to the United States have increased from 94 thousand tonnes in 2018 to 109 thousand tonnes in 2022. Another fast-growing market is South Korea where Italy has increased exports at an annual rate of 21% since 2018.

Italian production is concentrated in the south, with Puglia as the leading producing area, followed by Calabria and Sicily. More than 400 olive cultivars are grown in Italy. The most common one is Coratina (especially in Puglia), famous for its high oleic acid content and oxidative stability. Other popular varieties are Ogliarola Salentina, Cellina di Nardò, Carolea, Frantoio and Leccino. Olive farms in Italy are relatively small compared to Spain; there are more than 800 thousand olive farms currently operating in Italy.

Portugal: Continuous export growth

Portugal shows continuous olive oil export growth at an annual average growth rate of 8% over the past 5 years. In 2022, Portugal’s olive oil exports reached 265 thousand tonnes, valued at €985 million. More than 60% of Portuguese olive oil exports are destined for other European countries. Around 69% of Portuguese olive oil exports is EVOO, followed by refined and blended olive oil (13%), crude olive pomace oil (8%), lampante olive oil (7%), virgin olive oil (2%) and refined olive pomace oil and pomace oil (2%).

The main target market for Portuguese olive oil is Spain, where 53% of Portugal’s exports went to in 2022, followed by Brazil (24%), Italy (15%) and the United States (2%). Since 2018, Portuguese olive oil exports to the United States increased threefold, from 1.7 thousand tonnes in 2018, to 5.6 thousand tonnes in 2022. Other growing destination countries for Portuguese olive oil, albeit in smaller volumes, are Germany, Mozambique, Japan and Colombia.

Approximately half of the olive oil production in Portugal is concentrated in Alentejo, followed by Trás-Os-Montes and Beira Interior. The 2 leading olive varieties used in oil production are Galega Vulgar and Cobrançosa. Other important varieties include Carrasquenha, Cordovil, Maçanilha Algarvia, Verdeal and Madural. The number of olive trees is significantly growing and production is being modernised in Alentejo. This intensive growth is partially connected to the construction of the nearby Alqueva dam, enabling water for regular irrigation.

Tunisia: The leading exporter of organic olive oil to Europe

Tunisia is the leading olive oil producing country outside of Europe. In the 2022/2023 season, Tunisian olive oil production was estimated at 180 thousand tonnes. This production is significantly lower than the 5-year average of 240 thousand tonnes because of the unfavourable weather conditions during the past season. Tunisia is already the largest exporter of organic olive oil in the world. Europe is Tunisia’s main export target for olive oil, accounting for around 65% of total exports, followed by North America (30%) and North Africa and the Middle East (3%).

European countries imported 134 thousand tonnes of olive oil from Tunisia in 2022 at a value of €465 million. This was a strong decrease compared to 2020 (247 thousand tonnes) and 2021 (145 thousand tonnes). Of this quantity, more than 72% was EVOO, 22% was lampante olive oil, 4% was crude pomace oil, 1% was virgin olive oil and 1% were other oils. 95% of the olive oil from Tunisia is exported as bulk and 5% as bottled. Export is also influenced by the already mentioned tariff quota of 56,700 tonnes.

Tunisian olive oil is of good quality, which is shown by the large share of EVOO. However, a large share of lampante olive oil is exported too, especially to Spain, for further refining and blending. In 2022, Spain was the largest importer of Tunisian EVOO olive oil in Europe, with a 54% share (72 thousand tonnes), followed by Italy (51 thousand tonnes), France (7.2 thousand tonnes) and Belgium (2 thousand tonnes). Tunisian olive oil exports to Europe are fluctuating, mainly because of variable production.

Morocco: Supplier of processors in Europe

Morocco is the third-largest olive oil producing country outside Europe, after Tunisia and Turkey. Moroccan exports are fluctuating, reaching a peak of 40 thousand tonnes in 2019. In 2022, Morocco exported 33 thousand tonnes of olive oil at a value of €79 million. Compared to Tunisia, Morocco exports a larger share of lower quality oils. A 54% share of Morocco’s exported olive oil in 2022 was crude pomace olive oil, followed by lampante olive oil (19%), EVOO (14%), virgin olive oil (6%), refined olive oils and blends (5%) and other oils (2%).

In 2022, approximately 80% of Moroccan olive oil exports went to Europe. Moroccan olive oil exports are quite concentrated. More than 90% is exported to only 2 countries: Spain and the United States. In 2022, the leading export destination for Moroccan olive oil was Spain (76%), followed by the United States (17%), Italy (2%), the Netherlands (1%) and Canada (1%).

Morocco still has a large presence of traditional oil mills. The leading olive variety in Morocco is Picholine Marocaine, used in more than 96% of the country’s olive oil production. Other popular varieties are Picholine du Languedoc, Dahbia and Meslala. The largest quantity of exported olive oils from Morocco is used for further processing by European refining, blending and bottling companies. However, Morocco is increasing its quality and a few Moroccan companies have won awards in international olive oil competitions.

Which companies are you competing with?

Many olive growers, grower cooperatives, olive oil mills, refineries, blending and bottling companies supply European markets, each of them with their own export strategies. The sector is showing polarisation in terms of size due to price competition. The number of small farmers and oil mills is decreasing while large-scale production and processing is increasing. An estimated 50% of olive oil retail sales in the world is bottled by only 5 or 6 large companies.

Some of the leading exporters are listed in the examples below, but many other potential competitors are not mentioned in this study. Direct competitors are different for each olive oil exporter and they can be better analysed in terms of individual export marketing strategies. For example, direct competition for producers of premium olive oils are not the leading massive-scale producers, but producers selling oils in the high-end segment.

Spain

More than 1,800 olive mills, 1,600 packing companies, 6,000 pomace mills and more than 20 refineries process olive oil in Spain. More than 840 of these businesses are located in Andalusia, especially in Jaén province. Andalusia has the largest number of olive oil processors, and the largest olive mills in terms of capacity, some of which can process 2.5 thousand tonnes per month. Most Spanish mills use 2-phase decanter centrifuges and do not operate independently, but are related to packing facilities.

Despite the large number of olive mills, up to 50% of Spain’s producing cooperatives belong to large cooperatives that gather operations such as growing, processing, packing and exporting. Some of the largest Spanish olive oil cooperatives are Dcoop, Olivar de Segura, Jaencoop, Almazaras de la Subbética, Oleoestepa, Interoleo, Cooperalia, Oleotoledo, Montes Norte and Unió. The largest individual olive oil processor in Spain, and in the world, is La Cooperativa Nuestra Señora del Pilar with 14 production lines (member of Jaencoop).

Other larger individual processors in Spain include Nuestra Señora de los Remedios, San Isidro de Loja, Fertinez and Bravoleum. The largest olive oil bottling and blending companies in Spain are Deoleo, Sovena, Migasa, Acesur, BAIEO (Borges) and Maeva.

Amongst the leading players in Spain, the following 2 stand out:

- Dcoop – The largest olive oil producer in the world, Dcoop currently produces approximately 7% of the world’s olive oil, and exports to almost 70 countries. Dcoop consists of a group of 180 cooperatives (the largest in Europe), of which 113 produce olive oil. In addition to producing bulk olive oil, Dcoop runs 4 modern bottling facilities operated by the subsidiary Mercaóleo, which packs and blends olive oil for several brands, including Pompeian, one of the leading brands in the United States.

- Deoleo – The world’s largest olive oil bottler, with factories in Spain and Italy and subsidiaries in 15 other countries, Deoleo produces olive oil under the brands Bertolli, Carbonell, Carapelli, Sasso, Hojiblanca and Koipe, as well as other edible oils, vinegars and sauces, which are sold in more than 80 countries.

Spanish Olive Oil Interprofessional is the Spanish olive oil sector industry organisation, which works as an umbrella association of growers, cooperatives, factories, bottlers and exporters. ASOLIVA, the Spanish Olive Oil & Pomace Olive Oil Exporters Association is an association of 50 Spanish olive oil exporting companies.

Italy

Compared to Spain, Italian production is characterised by the presence of a larger number of small-scale olive mills. Italy had 4,448 active olive mills in 2022 (2.5 times more than in Spain) and more than 200 industrial olive oil processors. It is estimated that more than 60% of these mills are run by small family companies. Approximately 17% of Italy’s olive mills are in Puglia, 17% are in Calabria and 14% are in Sicily. Most of these olive mils belong to individuals and only roughly 20% of them are operated by cooperatives, mostly in Puglia and Toscana.

Although 76% of olive mills in Italy use less than 500 tonnes of olives for crushing, most of the olive oil is produced by medium-scale mills crushing between 1,000 and 5,000 tonnes of olives. The large number of small processors can negatively influence competitiveness, but Italian producers and blenders are specialised in exporting retail-packed oils. An estimated 40% of quality retail brands in Europe are Italian brands. Italy also has 50 PDO olive oils, the largest of which in production volume is Terra di Bari, from Puglia.

In spite of the large number of olive oil mills in the country and their many production types and capacities, some examples of large bulk olive oil producers, storage companies and refining companies in Italy are Castel del Chianti, Oleificio Zucchi and Valpesana. Large storage and processing companies in Italy include Casa Olearia Italiana, Fiorentini Firenze and Montalbano Agricola Alimentare Toscana.

Several large Italian bottling companies also own oil mills, such as Salov (Filippo Berio and Sagra brands), Monini, Fratelli Carli (Olio Carli), Olio Dante (Dante), de Cecco, Farchioni, Pietro Coricelli, Olitalia, Basso, Desantis and Rubino. Spanish olive oil giant Deoleo runs 2 facilities in Italy. Amongst the many players in Italy’s olive oil scene, the 2 largest players are:

- Salov – Salov distributes its range of oil products under the Sagra brand in Italy and under the Filippo Berio brand worldwide. The company’s main facility is situated in Massarosa, Italy, and it also has 3 subsidiaries in the United Kingdom, the United States and in the Russian Federation. They also have an office in Singapore and a strategic partnership in Japan. The company’s products reach 75 countries.

- Monini – Monini S.p.A. is the Italian joint-stock company specialised in the production of extra virgin olive oil, headquartered in Spoleto. Monini products are present in almost all European countries. The company has subsidiaries in Poland and the United States. In addition to olive oils, Monini also produces balsamic vinegars and cosmetic products.

Greece

Some of the most notable Greek producers, traders and exporters include Terra Creta, Nutria, Olicobrokers, ABEA and Cretanthos. There are more than 450 different olive oil brands in Greece; the most known are Elanthy, Altis (by Upfield), Minerva, (by investment fund Diorama), Gaea and Iliada (by company AGROVIM). Many small mills produce PDO olive oils. Currently, Greece has 17 PDOs. Approximately 90% of Greece’s olive oil exports are in bulk and 10% under branded names of many different companies.

Although most olive mills in Greece are smaller and less technologically advanced than those in Spain and Italy, Greek olive oil is generally characterised by low acidity and therefore high quality. An 80% share of Greek olive oil mills use 3-phase technology, and 70% are owned by cooperatives controlled by farm owners. The leading exporters are Nutria, Gaea, Minerva and Upfield.(Altis brand)

Tunisia

Olives are grown in many areas in Tunisia, but mainly in the warm coastal areas and the Low Steppes. Tunisia’s 2 leading olive varieties are Chemlali and Chetoui. Other important varieties include Oueslati, Zalmati, Zarrazi, Gerboui and Sayali. A modernisation of olive mills in Tunisia is under way, but a large share of processing is still done by traditional presses and mills. The largest number of mills is located in Sfax and Sahel. There are more than 40 olive oil packing facilities in Tunisia.

Although the number of olive oil producers in Tunisia is much larger, some interesting export-oriented companies to mention include CHO Group, Sadira, Huilerie Loued, Sara Huiles, Agromed, Barhoumi, Fermes Ali Sfar and Hovea Oleum. Some Tunisian exporters (for example CHO) established companies in the European Union in order to get access to the quota.

- CHO Group controls 20% of Tunisia’s production and has subsidiaries in several countries. The company is an exporter of bulk olive oil and organic olive oil but also produces the brand Terra Delyssa. It has subsidiaries in Europe and the United States.

Portugal

Many Portuguese olive producers work together in cooperatives. Producers from Alentejo, for example, formed the Centre for the Study and Promotion of Alentejo Olive Oil (CEPAAL) with 28 producers who grow, crush and bottle olive oils. The largest Portuguese independent player is SOVENA group.

- SOVENA is a Portuguese company owned by Nutrinveste, producing brands such as Andorinha, Olivari, Fontoliva, Soleada and Flor de Olivo. SOVENA organises production through their own company Oliveira da Serra, on more than 10 thousand ha, which is considered the largest olive growing investment in the world. Olive crushing is done in the largest Portuguese olive mill, in Ferreira do Alentejo, and at a newer mill in Avis.

Morocco

One of Morocco’s leading olive oil producers is Lesieur Cristal, but there are many olive oil producers and exporters in Morocco (PDF). One of Morocco’s leading companies is Atlas Olive Oils, which cultivates more than 1 million olive trees on 3 estates at the foot of the Atlas mountains. The company has a modern olive mill and several olive oil brands. 2 of their premium brands — Les Terroirs de Marrakech and Desert Miracle — have won awards in international competitions. The company is also producing olive oil-based food supplements.

- Lesieur Cristal is part of France’s Avril Group. In addition to olive oil under its leading brands Jawhara and Mabrouka, Lesieur Cristal also produces other vegetable oils, as well as oilcakes and soaps.

Tips:

- To learn more about the Spanish olive oil industry, check the websites of Spanish Olive Oil Interprofessional, Spanish Olive Oil & Pomace Olive Oil Exporters Association (ASOLIVA), Spanish Federation of Industrial Producers of Olive Oil (Infaoliva) and National Association of Industrial Packagers and Refiners of Edible Oils (ANEIRAC).

- Learn more about the Italian olive oil industry from the websites (Italian only) of the Association of Italian olive oil producers (ASSITOL), Italian Olive Consortium (UNAPROL) and Institute for Agricultural Market Services (ISMEA).

- Find the contacts of Tunisian olive oil companies on the Tunisian Olive Oil website and learn more about the Tunisian olive oil sector on the National Office of Olive Oil (in French).

- To learn more about the Greek olive oil industry, visit the website of the Federation of Greek Olive Oil Industries (SEVITEL AMKEPE) – in Greek only, use Google Translate.

- Regularly visit leading European trade fairs, such as Anuga, SIAL and BIOFACH (for organic) to meet your competitors and potential clients.

Which products are you competing with?

The main substitute products for olive oil are other types of vegetable oil. The most produced oil in Europe is rapeseed oil, followed by sunflower and soybean oil. Sunflower oil is also the most imported type of vegetable oil in Europe. Above all, butter is still very popular and the most traded product of all fats in European countries. Consumption of olive oil is increasing in Europe, but it is largely influenced by price.

Olive oil is considered a high-value product and it is important to offer high-quality olive oil to final consumers. Incidents involving fake olive oil and low-quality olive oil passing for EVOO could negatively influence the reputation of olive oil amongst European consumers. A possible threat is that if olive oil does not offer more health and quality benefits than other oils, consumers may switch to cheaper alternatives, such as sunflower, rapeseed and other oils. The popularity of coconut oil has increased in Europe in the last few years, although online negative information has since affected coconut oil consumption.

Several other types of oils belong in the premium segment, but they are more used as cosmetic ingredients. These include argan oil, avocado oil, jojoba oil and macadamia oil. Some of these oils, especially oils produced from nuts (like hazelnut, walnut and almond) and pumpkin seed oil belong in the high-end segment, fetching higher prices than olive oil. Chia oil and sacha inchi oil, mostly used in cosmetics, are also increasingly sold as food.

Tip:

- Visit the websites of the Federation of European Vegetable Oils Industry (FEDIOL), European Association of Dairy Trade (Eucolait) and the European Dairy Association (EDA) to better understand the competition to your product.

4. What are the prices for olive oil on the European market?

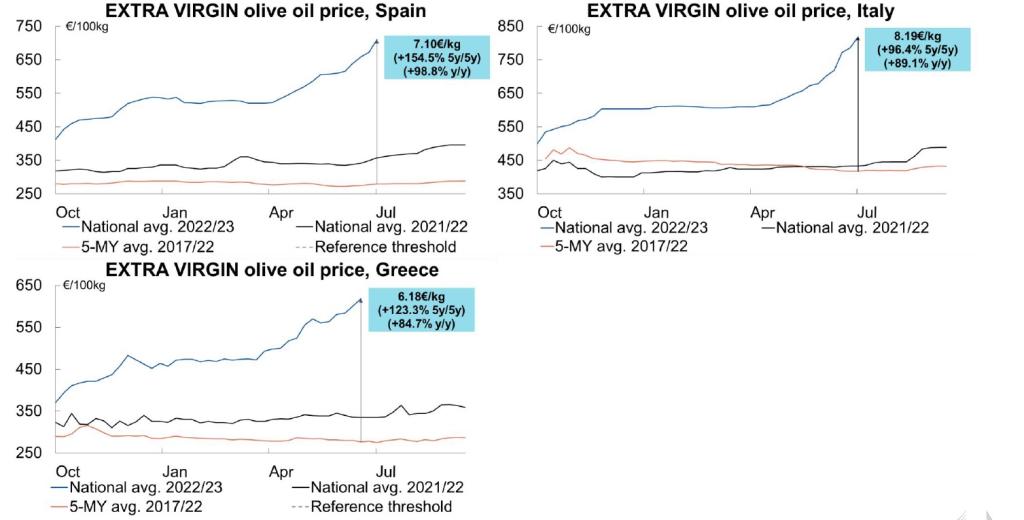

Prices of olive oil vary according to the type of olive oil. The cheapest olive oils are lampante and olive pomace oil, and the most expensive are EVOO premium oils. Bottled olive oils reach the highest export prices, but most of the European trade consists of bulk olive oil, which normally fetches lower prices. The prices of olive oil also depend on the oil quality, and there are several different price segments.

Italian olive oil fetches significantly higher prices than Spanish, Portuguese and Greek oils. Due to price inflation in 2022 and 2023, farmers could not use sufficient quantities of agricultural inputs. Additionally, bad weather conditions negatively influenced harvests, which resulted in historically low quantities and very high prices. To complement low domestic production, imports from emerging origins in Europe increased too.

FOB Prices of premium bottled olive oil usually reach more than €5/kg and some can even go over €10/kg. Prices for some PDO olive oils can be higher than €12/kg. For example, the estimated production price for PDO Italian olive oil Brisighella is estimated at €22/kg for 2019. In final retail sales, a litre of this oil can reach almost €100. Another example is PDO Garda olive oil. In 2019, the producer price was €17 and the retail price was over €30/l.

Figure 4: Average weekly prices of EVOO from Spain, Italy and Greece in season 2022/2023:

Source: European Commission

The price breakdown below is a very rough indication, considering that many different factors affect production costs, such as quality, variety, origin, food safety certification costs, consultants, social security, taxes and sales network margins. Keep in mind that that example below is based on the average yearly prices and does not indicate price increases in 2022 and 2023.

Table 1: Olive oil retail price breakdown

|

Export process steps |

Type of price |

Price breakdown |

EVOO price per litre (example) |

|

Production of olives |

Raw material price |

5%–6% |

€0.33/kg for olives, based on the assumption that the price of 100 kg of olives is €60 and that producing 1 L of oil requires 5 kg of olives. |

|

Crushing and production of bulk oil |

FOB or EXW price |

50% |

€3 |

|

Import, shipping, handling and storing |

CIF price |

58% |

€3.5 |

|

Bottling |

Wholesale price (value-added tax included) |

60%-70% |

€4 |

|

Retail sales of the final packed product |

Retail price |

100% |

€6 |

Tip:

- Check prices in the leading producing countries on the websites of Precio Aceite de Oliva and ISMEA.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research