Entering the European market for pickled cucumbers and gherkins

Food safety certification, combined with reliable and frequent laboratory testing, can help create a positive image for suppliers who want to export to Europe. Sustainable production and corporate social responsibility measures will help give emerging suppliers a competitive advantage. Strong competitors for new suppliers are pickled cucumber companies in EU member states, such as Germany and the Netherlands. Companies from Turkey and India are the toughest competitors outside Europe.

Contents of this page

- What requirements and certifications must pickled cucumbers and gherkins meet to be allowed on the European market?

- Through which channels can you get pickled cucumbers and gherkins on the European market?

- What competition do you face on the European pickled cucumbers and gherkins market?

- What are the prices of pickled cucumbers and gherkins on the European market?

1. What requirements and certifications must pickled cucumbers and gherkins meet to be allowed on the European market?

You can find general information about buyer requirements for processed fruit and vegetables in our study on buyer requirements on the European processed fruit and vegetable market. The sector-level requirements are analysed further on the product level for pickled cucumbers and gherkins here.

What are mandatory requirements?

Food safety is a critical part of EU food legislation. The European Commission has developed a food safety strategy covering every step, from farm to fork, as set out in the general food law.

Pickled cucumber and gherkin products sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. Only approved additives are allowed, and products must conform to maximum levels for harmful contaminants. The most common requirements regarding contaminants are related to pesticide residues, microbiological organisms, preservatives and food additives.

Due to the high optimisation of processing lines and sterilisation used in pickling, microbiological contamination is rare in the European market. However, physical and chemical contamination is more frequent. The European Rapid Alert System for Food and Feed (RASFF) reported one alert for pickled cucumber and two for gherkins between 2019 and 2023.

You need a phytosanitary certificate to import fresh and frozen fruits and vegetables into the EU. However, this does not apply to canned and pickled versions of these products, according to Regulation (EU) 2019/2072.

Contaminant control

The EU has strict controls on contaminants in food under Regulation (EU) 2023/915, which sets maximum levels for certain contaminants. This regulation is frequently updated, and it sets limits for general foodstuffs. It also has specific contaminant limits for specific products. For all products of the Cucurbitaceae family (the gourd family of flowering plants), there is an important limit on perchlorate (maximum 0.10 mg/kg). Cucumbers are part of the gourd family.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products and it publishes a list of approved pesticides that are authorised for use. In 2023, the European Commission approved 36 new implementing regulations that modified this list.

Pickling can affect pesticide residue levels in cucumbers and gherkins. The impact depends on the pesticides and the methods used in the pickling process. Research indicates that some pesticides can be partially removed during the pickling process. Other pesticides may concentrate.

A recent Chinese study discussed how pickling can partially remove certain pesticide residues like fluopyram and trifloxystrobin from cucumbers. However, some metabolites of these pesticides were found to concentrate in pickled cucumbers. This means pickling can reduce the residue levels of certain pesticides but it may increase the levels of other pesticides.

Other contaminants

There are few border rejections or market withdrawals of pickled foods from the European market. They are often caused by a high content of preservatives or colouring. One example of an incident is a January 2022 notification from Switzerland. The notification concerned a shipment of pickled cucumbers from Japan with unauthorised colours.

Other rejections are caused by materials moving from the packaging into the product. A serious incident with pickled gherkins in jars was reported by Belgium in September 2020. The shipment was recalled because of the presence of sharp pieces of glass in the jar with gherkins.

Heavy metals and metalloids

The use of lead, tin and cadmium in processed fruits and vegetables is restricted. These metals can accumulate in and on green vegetables. They can come from the soil or growing pots. Canned pickles have a risk of high inorganic tin concentrations depending on the type of can used.

Table 1: Maximum limits of contaminants in pickled cucumbers

| Heavy metals and metalloids | Contamination limit |

| Tin (chemical symbol: Sn) | 250 mg/kg, calculated as Sn |

| Lead (chemical symbol: Pb) | 1 mg/kg |

Source: Autentika Global, Codex Alimentarius (PDF), 2024

What additional requirements and certifications do buyers often have?

Preparing pickles using clean and sound cucumbers is a basic requirement. These cucumbers can be peeled and their seeds can be removed, but this is not necessary.

Quality requirements

The basic quality requirements for pickled cucumbers and gherkins are set out in the Codex Alimentarius (PDF). Some key quality criteria for pickled cucumbers include:

- Colour: Normal colour characteristics typical of the variety, type of packaging and style.

- Texture: Reasonably firm, crisp and practically free from shrivelled, soft and floppy parts, and reasonably free from very large seeds.

- Flavour: Good flavour typical of the type of pack and considering any flavouring or special ingredients.

- Size uniformity: There are different requirements for whole style (spears or sliced lengthwise) and ring cut (slices or cross cuts).

- Mineral impurities: No style or type of cucumber should contain more than 0.08% m/m except peeled.

- The code specifies allowable defects in cucumbers used.

There are many permitted optional ingredients in pickled cucumbers. The main ones are water, vinegar, salt (sodium chloride) and vegetable oils. Other accepted additions include nutritive carbohydrate sweeteners, paprika, herbs, spices, condiments and vegetables (usually not more than 5% of the total weight of the product).

There are many subtypes of pickled cucumbers and gherkins. These subtypes appear as product variants with different flavours and taste profiles. Codex Alimentarius Standards for acid and salt allowances for each pickle type are listed in Table 2 below.

Table 2: Acid and salt allowances per pickle type

| Sub-type | Total acidity (as acetic acid) | Salt (NaCl) | Salt-free soluble solids |

| (a) Dill | 0.4% to 2% | 1% to 4.5% | - |

| (b) “_____” (*Name of herb) | 0.4% to 2% | 1% to 4.5% | - |

| (c) Sour | 0.7% to 3.5% | 1% to 5% | - |

| (d) Sweet-Sour | 0.5% to 2% | 0.5% to 3% | 1.5% to less than 14% |

| (e) Sweet | 0.5% to 2% | 0.5% to 3% | 14% minimum |

| (f) Mustard | 0.5% to 3% | 1% to 3% | - |

| (g) Salt sour | 0.5% to 3.5% | 5% to 10% | - |

| (h) Mild | 0.4% to 0.7% | 1% to 3.5% | - |

| (i) Hot | 0.5% to 3% | 1% to 3% | - |

* Herb and oils there of other than dill herb and/or oil of dill

Source: Autentika Global, Codex Alimentarius (PDF), 2024

Food safety certification

Although European legislation does not explicitly require food safety certification for pickled cucumbers and gherkins, most European food importers require it. Well-established importers will not be interested in your products if you cannot provide the necessary certification. Most European buyers will ask for certifications recognised by the Global Food Safety Initiative (GFSI). GFSI recognises a few certifications that meet the GFSI benchmarking requirements. For canned fruits and vegetables, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Make sure to check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to mutual recognition agreements. However, certain retailers may prefer one certification to another. They may ask for other certifications based on their own internal policies. Major buyers will also usually visit or audit production facilities before starting a business relationship.

Koeleman India offers pickled cucumbers and gherkins in many formats from its BRCGS and IFS food safety certified unit.

Corporate social responsibility (CSR) certification

Companies have different requirements for CSR. Many importers will ask pickled cucumber and gherkin suppliers to follow a specific code of conduct for CSR. Most European retailers have their own codes of conduct, such as Lidl (PDF), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Other companies may insist on following common standards, such as the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone (without an audit) is not very complicated and not very expensive. Other CSR alternatives include the Ethical Trading Initiative’s Base Code (ETI), the amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Packaging requirements

Exporting pickled cucumbers and gherkins to Europe means adhering to specific packaging standards. These standards ensure product safety, quality and compliance with regulatory requirements. It is very important to ensure airtight sealing. This prevents contamination and spoilage. Common methods include vacuum and heat sealing.

Manufacturers must prevent unsafe levels of chemical substances moving from the packaging material to the food. Bisphenol A (BPA) is used to produce epoxy resins found in protective coatings and linings for food and beverage cans and vats. In April 2023, the EFSA published a re-evaluation of the safety of BPA, significantly reducing the BPA tolerable daily intake (TDI) in food contact materials from the standards set in its previous assessment in 2015. The TDI is around 20,000 times lower than before.

Packaging used for pickled cucumbers and gherkins must:

- Protect the taste, colour and other quality characteristics of the product.

- Protect the product from bacteriological and other contamination, including contamination from the packaging material itself.

- Not pass on any odour, taste, colour or other foreign characteristics to the product.

- Be corrosion-resistant, in case of tin cans.

Figure 1: Pickled cucumbers and gherkins on display in retail outlets

Source: Autentika Global

There are broadly three packaging types.

- Glass jars: Mostly for retail packaging. Preferred for their non-reactivity and recyclability. Ensure jars are sealed properly and are resistant to breakage during transport.

- Plastic containers: Must be BPA-free and suitable for food storage. Ensure containers are durable.

- Tin cans: Used for products with a longer shelf life. Ensure cans are internally coated with food-grade lacquer to prevent corrosion.

Labelling requirements

The name of the food must clarify the precise nature of the product and any special properties it might have. All ingredients contained in a prepackaged food must be listed on the packaging. The ingredients should be listed in descending order of weight.

There are specific rules for information that needs to be displayed on pickled cucumber and gherkin labels:

- Product name: Pickled Cucumbers, Cucumber Pickles, Pickles or Gherkins.

- Pack type: ‘Fresh Pack’ or ‘Cured Pack’.

- Pack style and sub-type, including names of herbs.

- Dill sub-type: ‘Natural Dill’ or ‘Genuine Dill’ for cucumbers naturally fermented in brine with low salt concentration.

- If in whole style, the approximate count range for containers larger than four litres.

In case of retail packaging, product labelling must comply with the EU Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and legibility (minimum font size for mandatory information) more clearly.

On 1 April 2020, new EU rules came into effect, requiring food businesses to label foods with the country of origin or place of provenance of primary ingredients. These requirements are set out in Regulation (EU) 2018/775 and apply in addition to existing rules laid out in the Food Information Regulation (EU) 1169/2011.

Tips:

- Keep an eye on the EFSA page on BPA and possible changes to regulations, safety measures and reductions in the tolerable daily intake.

- Consult the EU-wide uniform food labelling page provided by the German Ministry of Food and Agriculture and the latest updates on food labelling from the European Commission. If exporting to the UK, consult the official UK labelling guidance.

- Refer to industry examples of product technical sheets. See, for example, a product specification for pickled gherkins (PDF) produced in the UK from Indian gherkins by Bradley’s Food. Alternatively, consult the product technical sheet for whole pickled gherkins with dill (PDF) from Turkey created by Lefktro Fine Foods.

What are the requirements for niche markets?

You should expect European importers and retailers to demand extra effort from their suppliers in sustainable production and in niche markets.

Organic pickled cucumbers and gherkins

Organic certification can be an interesting way to set your product apart and market it at a higher value. To market pickled cucumbers and gherkins as organic in Europe, they have to be grown using organic production methods that conform to European legislation. Growing and processing facilities have to be audited by an accredited certifier before you can put the EU’s organic logo on your products, as well as the logo of the standard holder (e.g. the Soil Association in the UK, Naturland in Germany and Agriculture biologique in France).

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex to the Commission Regulation, which defines imports of organic products from third countries.

Certificates are issued by control bodies designated by national authorities for equivalent countries, including Argentina, India and Tunisia. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Sustainability certification

Two commonly used food sustainability certification schemes are the Fairtrade Standards and Rainforest Alliance. Fairtrade international certifies the production of a variety of Fairtrade vegetables, from artichokes to zucchini and palm hearts. The Fairtrade standards also cover cucumbers. The Rainforest Alliance’s online traceability platform has included vegetables since 1 January 2023. Cucumbers are also traceable, so it is possible to trace Rainforest Alliance-certified products through supply chains.

Ethnic certification

If you want to focus on the Jewish or Islamic ethnic niche markets, implement Halal or Kosher certification schemes. Several organisations provide Kosher certification in Europe. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain Kosher certification. Halal certification in Europe can be obtained from certifying bodies like Halal Certification Services (HCS).

Freshara Picklz is an Indian producer and exporter of high-quality preserved gherkins. The company has obtained Kosher certification for its products.

Tips:

- Strive for residue-free cucumbers and only certify your production as organic if this is possible. Organic certification can help your product in premium markets. Remember that certifying organic production can be expensive. You should be prepared to comply with the whole organic process.

- Find guidelines and the main changes of the new organic regulation on IFOAM Organics Europe.

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH, and control bodies and authorities for equivalence. For the Swiss market, you can also check the approved inspection bodies at BIOSUISSE ORGANIC.

2. Through which channels can you get pickled cucumbers and gherkins on the European market?

Manufacturers and processors often work with local cucumber and gherkin farmers in their respective countries or with farmers from supplier countries. These cucumbers are sourced and then processed for fermentation. Other suppliers import the end products and re-pack them for sale to retailers or the food service sector under private labels.

How is the end market segmented?

Statistics on the precise breakdown of pickled cucumbers and gherkins sold through the retail segment and the food processing industry are not easily available. The retail, food service and food industry segments are the largest users of pickled cucumbers and gherkins.

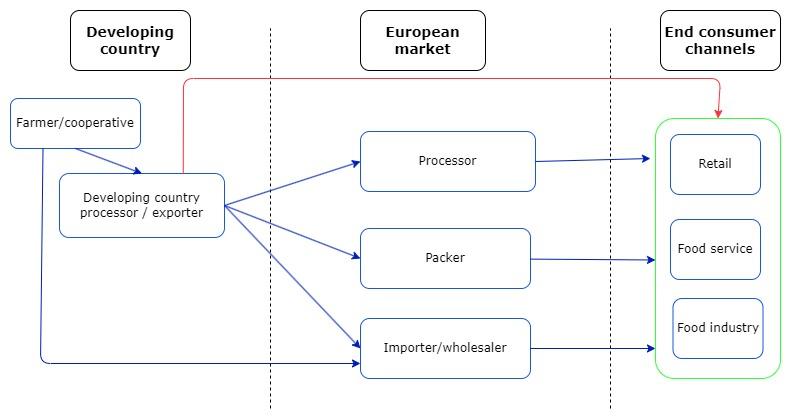

Figure 2: End market segments for pickled cucumbers and gherkins in Europe

Source: Autentika Global

Retail segment

Large retail chains tend to import pickled cucumbers and gherkins from developing countries through intermediaries or source them from nearby countries. Usually, large-scale retail chains sell pickled cucumbers under private labels. These are sourced from local farms and processed by the private label supplier. The chain’s specifications and quality requirements have to be met.

Leading food retail companies in Europe differ per country. These outlets are usually very important for sales of canned fruits and vegetables. The companies that have the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold Delhaize.

Keep in mind that several retail alliances coordinate buying operations in Europe:

- Coopernic (includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group).

- Carrefour World Trade or CWT (includes Carrefour, Système U, Match and Cora).

- AgeCore (Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland).

- European Marketing Distribution or EMD (Colruyt – cooperation only on private label, Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia).

- Epic Partners (Edeka, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica).

Food service segment

The food service segment, which consists of hotels, restaurants and catering businesses, has different requirements for pickled cucumbers and gherkins. These businesses usually source their supplies from large manufacturers or distributors. Food service often requires specific packaging in the range of 1–5 kg, which is different from bulk or retail packaging sizes.

Restaurants around the world have long used pickle-based sauces with different spice mixes and condiments, such as mustard seed paste and vinegar-based products, to enhance dishes. Pickles are also growing in popularity as a cocktail ingredient amongst consumers who want interesting and offbeat flavours, especially younger generations.

Wholesale companies that cater to the food service segment include Kesbeke and Van der Kroon Food Products (the Netherlands), SpreewaldRabe and Alfred Paulsen (Germany) and Hugo Reitzel (Switzerland/France). Hugo Reitzel is a company that has extensive experience supplying the food service sector and offers a wide range of convenient solutions for food service professionals.

Ingredient segment (food processing segment)

Demand for pickled cucumbers and gherkins is relatively low in the food processing industry. They are used mainly as ingredients in salad dressings, relishes, sauces and in the seasoning processing industry. Pickled olives and jalapenos are mainly used in frozen pizza, but the use of frozen gherkins is limited.

Tips:

- Search the specialised trade fair Fi Europe exhibitor list to find potential buyers for pickled cucumbers and gherkins or even pickle juice within the food ingredient segment.

- Build long-term relationships with large established European buyers to help you gain a stronger market position.

Through which channels does a product end up on the end market?

Large quantities of pickled cucumbers and gherkins are sold in the retail segment under importers’ brands and private label brands. Importers are the most important channel. In Europe, importers choose preferred channels based on their core strengths.

Figure 3: European market channels for pickled cucumbers and gherkins

Source: Autentika Global

Importer/Wholesaler

Some importers source cucumbers and gherkins from bulk producers based on special traits. These traits can be:

- Unique flavour

- Fewer seeds

- Higher water content

- Voluminous or slender product

- Organically farmed

- Specific varieties or trait combinations

These importers work with long-term contracts, maintain unique identities and follow Europe’s stringent food industry regulations.

Bulk suppliers of cucumbers and gherkins pickled in vinegar are the second category of importers. They import in large plastic drums or metal barrels suitable for food grade supplies. Major private label players that re-pack pickles in market-specific package sizes drive this category. It also includes food processors that use pickled cucumbers and gherkins in ready-to-eat preparations and gourmet cuisines.

The third category of importers directly imports straight-to-shelf pack sizes. They are primarily distributors and have cold storage warehouses and in-house packing/labelling facilities for bulk sales to retailers or re-exporters.

For new suppliers, the challenge is building lasting relationships with established importers. This is a traditional and established industry. Importers usually work with a select few suppliers. Established importers may perform audits on suppliers. These are done to verify quality and ensure that safety protocols and strict contract terms are followed. Due to stiff competition, offering discounts and lower prices may be challenging for new exporters from developing countries.

Direct supply to food retail or food service

Retailers that focus on specialty, gourmet and organic food may be more open to direct relationships with exporters. They often look for unique products that differentiate their offerings from mainstream supermarkets. Retailers that specialise in ethnic or international foods are also more likely to engage directly with exporters. Large retailers are expanding into this segment by offering products that cater to consumers who like international cuisines.

Examples of importers of pickled and preserved vegetables in European countries include EMN Europe (active in 18 European countries), OttoFranck (Germany), Clama (Germany), Henry Lamotte (Germany), Gama (UK), Goodies Foods (UK), Indo European Foods (UK), S.O.P International (UK), J.L. Machado (Portugal), Opa Distribution (France) and Agidra (France).

Tip:

- Watch the 2023 Deutsche Welle documentary for more insight into the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

What is the most interesting channel for you?

Collaborating with importers and wholesalers is often considered the most accessible and least risky channel for exporters from developing countries. However, this channel may offer lower margins compared to direct sales.

Specialised preserved vegetable importers are excellent contacts for exporting to Europe, especially for new suppliers. Supplying the retail segment directly is very demanding and requires a lot of quality and logistical investment. Importers usually have good knowledge of the European market. As a result, they are your preferred contact as they can tell you about market developments and provide practical advice.

Directly supplying the food retail or service and food manufacturers may appeal more to exporters that target niche markets or that have the capacity to meet specific quality or volume requirements. In this case, a strong online presence can be important.

Overall, the retail channel is becoming more powerful compared to the food service and food industry segments. Retailers have large offerings of pickled cucumbers and gherkins under private labels. These labels are no longer considered low quality. New players can focus on unique selling points, shifts in consumer demand and innovative launches. These activities should come in response to consumer trends that need to be monitored.

Tips:

- Read our tips about doing business with European buyers of processed fruit and vegetables and finding buyers on the European market for processed fruit and vegetables.

- Do extra market research on private labelling for specific products.

- Learn about fresh produce and pickled cucumber and gherkin traders in the region.

3. What competition do you face on the European pickled cucumbers and gherkins market?

The pickled cucumbers and gherkins market is dominated by European exporter and producer countries. Germany, the Netherlands, Poland, Hungary and the Czech Republic are your key competitors in the main markets, followed by Turkey, India and Serbia.

Source: Autentika Global, ITC Trademap, *Germany, the Netherlands, Poland, Hungary, Czech Republic, 2024

Which countries are you competing with?

As the pickled cucumbers market is a well-established one, competition is strong. There are many players with different roles. Some companies import pickled cucumbers and gherkins for re-exports. Germany is the leading supplier of pickled cucumbers in Europe. Among developing countries, Turkey is a major player. India and Serbia follow as important suppliers.

Big European suppliers: Germany and the Netherlands dominate the market

The largest European suppliers to European buyers are Germany, the Netherlands, the Czech Republic, Poland and Hungary. These five top suppliers exported 177,600 tonnes to Europe in 2023. Exports from these countries fell by 2% per year between 2019 and 2023.

Germany is the leading supplier of pickled cucumbers and gherkins to Europe, accounting for more than 90,000 tonnes of shipments to Europe. Four-fifths of German exports of pickled cucumbers and gherkins are destined for intra-European trade. Over the past five years, the country’s export volume to Europe has fallen by 1.5% per year on average.

Germany and India were the two largest global exporters of pickled cucumbers and gherkins in the 2019–2023 period. The Spreewald region in the state of Brandenburg (southeast of Berlin) is known for its pickles. Spreewald gherkins have a protected geographical indication (PGI) in the EU and are one of Brandenburg’s biggest exports.

Source: Autentika Global, ITC Trademap, 2024

In 2023, exports from Germany to other European countries fell by 6,000 tonnes compared to 2022. The Netherlands, France, Poland and Austria are the leading export destinations for German pickled cucumbers and gherkins. The primary export destinations outside Europe are Russia, China, the US and Belarus.

The Netherlands is the second largest intra-European supplier. The country does not produce many cucumbers itself, but it is a major trade hub for imports from different parts of the world, which it then re-exports. Over the past five years, Dutch exports of pickled cucumbers and gherkins to Europe have fallen 2.2%, from 50,600 tonnes in 2019 to 46,290 tonnes in 2023. The leading export destinations were France (21%), the UK (17%) and Belgium (16%).

Poland is the third largest supplier of pickled cucumbers and gherkins to European buyers. Over the past five years, the country’s exports to other European countries have fallen by 4.5%. Exports to Europe dropped from more than 19,500 tonnes in 2019 to 16,300 tonnes in 2023. The leading export destinations were the UK (28%), Germany (15%) and Mongolia (9%).

Turkey: the largest non-European supplier

Turkey’s processed vegetable exports are significant, with a strong emphasis on tomato paste and pickles. Turkey exported 118,700 tonnes of pickled cucumbers and gherkins to Europe in 2023. The average annual growth rate between 2019 and 2023 was 9.8%. The processing and preserving of fruits and vegetables is well developed and accounts for a 15.7% share of the food processing industry, according to a USDA 2023 country report on Turkey.

Türkiye exported €130 million worth of canned cucumbers and gherkins to Europe in 2023, in what is a rapidly growing sector. Almost 90% of its pickled cucumber exports are destined for the European market. Half of Turkey’s exports by value are exported to Germany (30.4%), the Netherlands (13.4%) and the UK (7.8%).

Turkey’s pickled cucumber and gherkin exporters are supported by the Turkey Exporters Assembly (TİM), which is the umbrella organisation of Turkish exports. The industry is also supported by the Federation of All Food and Drink Industry Associations of Turkey (TGDF).

India: a global powerhouse in pickled cucumbers and gherkins

India is one of the world's largest exporters of pickled cucumbers and gherkins. The country’s own consumption of pickled cucumbers and gherkins is negligible. India’s Agricultural and Processed Food Products Export Development Authority (APEDA) helps develop infrastructure, boost quality and promote processed gherkins in international markets. India supplies nearly 15% of the world’s gherkins, since many regions have ideal soils and temperatures.

States like Tamil Nadu, Karnataka and Andra Pradesh have become key cornichon-producing regions. India exports approximately 150,000 metric tons of gherkins annually, making it one of the top global gherkin exporters. European pickle producers often use these to make their processed product.

Many European manufacturers want small cucumbers for pickles. It is not easy for European processors to secure locally grown smaller cucumbers for pickles as they are not as competitive. South India is a dominant foreign supplier to Europe and the US. Around 90% of the gherkin output from Indian farms finds its way to international buyers according to a recent report by the CEO of Vignescware Exports, Pawan Kumar.

India’s monsoon season usually runs from June to September. It has an important influence on the country’s gherkin harvests. If there is particularly heavy rain and flooding, farmers may face problems harvesting their crops on time. Delayed harvesting can cause quality issues, such as the gherkins being overripe. This can lessen the crop’s suitability for pickling.

According to data from APEDA, India exported 227,700 tonnes of cucumbers and gherkins around the world in 2022–2022, valued at €201.5 million. Before 2001, processed gherkins were exported in bulk packaging, but now they are also exported in jars as ready-to-eat items.

Gherkin exports from India largely fall into two categories:

- Provisionally preserved in vinegar/acetic acid and brine. In this category, exporters ship gherkins in bulk form. These are packed in 220-litre food-grade drums. The drums are made of high-density polyethylene (HDPE). Importers later repack the preserved gherkins into smaller, ready-to-eat consumer packs.

- Preserved in vinegar. Exporters pack ready-to-eat gherkins in smaller jars and cans. The industry maintains quality standards to meet importing countries’ requirements. The majority of processing plants have implemented quality systems, such as HACCP, ISO and BRC, depending on what buyers need.

Serbia, the fastest growing supplier to Europe

Serbia has been an EU candidate country since 2012. The country has a well-developed vegetable processing industry. Around 33% of the Serbian food industry exports involve preserved fruit and vegetables, according to the Serbian chamber of commerce PKS (PDF). A sizeable part of this capacity is used to produce pickled cucumbers and gherkins.

Serbian exports amounted to 6,070 tonnes in 2023, with Germany (68%), Montenegro (12%), Bosnia and Herzegovina (6%), Croatia (5%) and Hungary (4%) being major export destinations. Over the past five years, Serbia’s export volumes to Europe have risen by 13.8%, from 3,619 tonnes in 2019 to 6,070 tonnes in 2023.

Tips:

- Identify the biggest importers of your product in selected large or fast-growing European markets. Explore their product offerings and variants.

- Study the performance and approaches of companies from developing countries that export to Europe. What are Turkey, India, and Serbia doing successfully?

- Get information about the export strategies of fast-growing exporters. Consult the news page of the Serbian chamber of commerce (PKS) for ideas that could benefit your exports to Europe.

Which companies are you competing with?

The supply of pickled cucumbers and gherkins is concentrated in Europe as big processing companies have production subsidiaries in multiple countries in the region.

European companies

The main German pickled cucumber suppliers include SpreewaldRabe, Carl Kühne KG, Hengstenberg, Hainich and Alfred Paulsen.

SpreewaldRabe is a family business in Lübbenau that dates back to 1898. The company offers a wide variety of pickled gherkins, including gherkins with added mustard, garlic and salted dill. Other offerings include premium cucumber onion dips, honey cucumbers and chili cucumbers. It also pickles Spreewald cucumbers from Brandenburg, which have a protected geographical indication (PGI) in the EU.

SpreewaldRabe supplies B2B customers with private label products in a range of packaging sizes. Prices can be higher than for conventional gherkins thanks to their specialities, diverse offering and brand name.

Carl Kühne KG is a 300-year-old company and a leader in the pickled cucumber and gherkin market. It was the first to launch pickled gherkins in Germany in 1903, and it currently offers more than 20 different varieties. Carl Kühne has a separate B2B department, called Kühne Food Partners. The B2B arm supplies buyers that use the product for burgers and sandwiches, in restaurant kitchens and in catering.

Hengstenberg is a 150-year-old family-owned company founded in Esslingen. The company has a range of products produced through sustainable farming, including sauerkraut, red cabbage and fine pickled vegetables. Most of its contract farmers grow their gherkins close to the factory. This means there is an average distance of around 20km between the field and the factory.

Indian companies

Large Indian pickle suppliers include Reitzel India and Raj International. Reitzel India is a subsidiary of the Swiss Reitzel Group. Established in 2004, it has its own farms in India and exports from its production facility in Kunigal. The company has Clean Label Project certification. It also produced its first fair-trade gherkin crop in 2019. In 2020, it started conducting organic trials for gherkins. The company has complete supply chain traceability, from seeds to final products.

Other important suppliers based in the Indian market include Blossom Showers Agro, Koeleman India (a subsidiary of OFB Tech Pvt), Freshara Agro Exports, Unicorn Pickles and Vigneshwar Exports.

Turkish companies

Turkey’s food manufacturing industry has been a major driver of growth for over a decade. The number of Turkish companies active in processing and preserving fruits and vegetables increased from 2,615 in 2018 to 3,553 in 2021.

The leading companies in the country’s pickled cucumber and gherkin segment are Tat, Tamker, Tukas Gida, Penguen Gida, Sera and Tat Gida. Anatolian Pickles was founded in the 1890s and has a factory in the Bursa district, which produces pickles without preservatives and colourants.

Serbian companies

Dijamant is a prominent Serbian producer of pickled cucumbers. The company is one of the largest processed food manufacturers in the country. Zdravo Organic is another important producer of preservative-free pickled cucumbers and gherkins. Other players include Jarmenovci, Polo Čačak and Fabrika Dobre Hrane.

Which products are you competing with?

Pickled cucumbers and gherkins compete with many products in the market. The main competitors are other pickled vegetables. These include beets, carrots, cauliflower and mixed pickles. Fermented vegetables are also important rivals. These include sauerkraut and kimchi. Both offer similar tangy flavour profiles and come with health benefits thanks to their probiotic content. Some consumers may also prefer fresh cucumbers over pickled ones.

Finally, both pickled cucumbers and olives are common in antipasto platters and as toppings for salads and sandwiches. They share a similar briny flavour, making them direct competitors.

Tip:

- Use the unique characteristics of pickled cucumbers and gherkins to position them against alternatives.

4. What are the prices of pickled cucumbers and gherkins on the European market?

In Europe, bulk packages of good quality pickled cucumbers and gherkins are sold in high volumes at lower profit margins, and usually range from €0.40 to €0.90. Prices for premium organic pickled cucumbers and gherkins range from €4.50 to €9 per kg. These are indicative prices and vary by country of origin and other factors.

A price breakdown is given below, which shows the margins each actor in the supply chain receives.

A rough indication of margins in the value chain is shown in Table 3. The table also shows what this means in absolute terms for a pot of sliced pickles sold in a European supermarket.

Table 3: Sample structure of the retail price of sliced pickles

| Steps in the export process | Type of price | Margin % | Sliced pickles in a 360 g jar | |

| Absolute margin in € | Price / kg in € (drained) | |||

| Production of vegetable | Raw material price (farmers’ price) | 5–15% | - | €0.60 |

| Handling, processing and selling of pickled product | FOB or FCA price | 30–40% | €1.20 | €1.80 |

| Shipment | CIF price | 5% | €0.20 | €2.00 |

| Import, handling and distribution | Wholesale price (value added tax included) | 10–15% | €0.40 | €2.40 |

| Retail sale | Shelf price | 40–50% | €1.60 | €4.00 |

Source: Autentika Global, 2024

Tips:

- Subscribe to S&P Global Commodity Insights, a leading market information service for processed commodities.

- Compare your offer with key competitors for your products in target markets. This is not a one-time operation. Price levels should be monitored over time, in different channels and countries.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research