![CBI_MI-productfoto_[Pickled Cucumbers and Gherkins]_2023](/sites/default/files/styles/hero_banner_1920_x_480_big/public/visuals/CBI_MI-productfoto_%5BPickled%20Cucumbers%20and%20Gherkins%5D_2023.jpg)

The European market potential for pickled cucumbers and gherkins

In the long term, the European market for pickled cucumbers and gherkins is expected to grow around 1–2% per year. These products face competition from similar products in the fresh market. However, the pickled versions offer some unique health benefits. Developing-country exporters can benefit from growing trends in using sustainable packaging like glass jars. As consumers search for alternatives to sugary products, pickled products also offer consumers a tangy taste with health benefits. Germany, the United Kingdom, France, the Netherlands, Belgium and the Czech Republic offer opportunities for exporters from developing countries.

Contents of this page

1. Product description

Pickled cucumbers and gherkins are popular preserved vegetable products on the European market. They are traded under Harmonized System (HS) codes, specifically HS Code 200110. This code covers cucumbers and gherkins prepared or preserved with vinegar or acetic acid. These products are staples in many European households and are widely used in various culinary applications.

Figure 1: Pickled cucumbers

Source: Image by Photo Mix from Pixabay, Pixabay content license

Cucumbers belong to the Cucumis sativus species. Botanically, the cucumber is an edible fruit. However, it is treated as a vegetable for trade and culinary purposes. It grows on annual vines of the gourd family. The species is widely grown, both commercially and in vegetable gardens. The plant is originally native to southern Asia.

Pickled cucumbers are cucumbers that have been pickled in a vinegar or brine solution, either sliced or whole. They are often flavoured with herbs and spices. A gherkin is a pickled baby cucumber that is harvested before maturity. They are commonly used in pickles because of their smaller size. The size helps them ferment quicker. Gherkins are typically between 3 and 8 cm long. Gherkins are best left to ferment for between two and three weeks. Gherkins often have a bumpier texture and are crunchier.

Figure 2: Pickled whole gherkins

Source: Image by SKYRADAR from Pixabay, Pixabay content license

In this study, the term ‘gherkin’ does not refer to the West Indian gherkin, which is also known as maroon cucumber. This is a smaller, specific variety of cucumber (Cucumis anguria) native to Africa. The West Indian gherkin fruit has slightly coarse prickles. Where this study refers to pickled cucumbers and gherkins, this refers to the products covered by HS code 200110.

In terms of taste, gherkins and pickles can be sweet or savoury. In the European market, pickled cucumbers and gherkins are also known by some other common trade names, depending on the national market. These other names include:

- Cornichons: extra-small gherkins popular in French cuisine.

- Dill pickles: cucumbers pickled with the herb dill, commonly found in Eastern European countries.

- Bread and butter pickles: sweet and sour pickled cucumbers, popular in the United Kingdom.

- Kosher dill pickles: a traditional Jewish preparation with garlic and dill, popular in various European Jewish communities.

Figure 3: Pickled sliced gherkins

Source: Image by Andreas Göllner from Pixabay, Pixabay content license

Pickled cucumbers and gherkins are versatile and widely used across various European cuisines. They are used as a culinary ingredient, condiment, appetiser and consumed as a healthy, low-calorie snack. Pickles in general have multiple health benefits. Pickled products have antioxidants that protect the human body from free radicals. They also contain probiotics, which assist digestion.

Keep in mind that the level of acidity in a pickled product is as important to safety as to taste and texture. Use canning or pickling salt. If noncaking materials are added to other salts, this can make the brine cloudy. The salt used in making brined pickles is important. It helps to provide the characteristic flavour and is vital to safety and texture. According to the University of Georgia, salt in fermented foods encourages the growth of desirable bacteria while inhibiting the growth of others.

After the cucumbers are washed, salt is added to a mixture of cucumbers and water. As soon as the brine is formed, fermentation starts. Salt concentration puts selective pressure on natural flora.

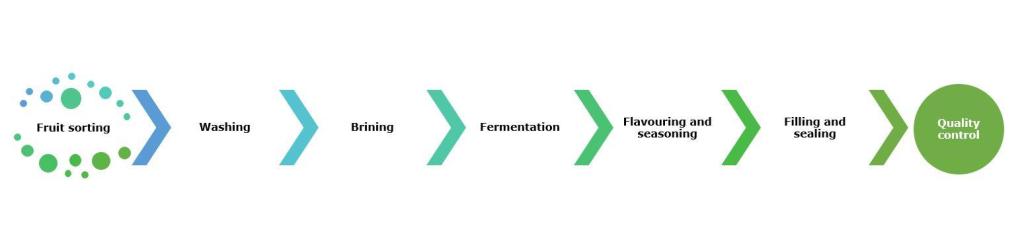

Figure 4: Pickled cucumber and gherkin manufacturing process

Source: Autentika Global, Seamerco

For a good overview of the pickled cucumber production process, watch a video of an industrial line from Noal Farm. For an alternative, watch another overview of how pickles are made in the factory.

This study covers general information regarding the overall market for pickled cucumbers and gherkins in Europe, which is of interest to producers in developing countries. In this study, the term ‘Europe’ refers to the 27 member states of the European Union (EU), plus the United Kingdom (UK) and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland). The term ‘developing countries’ is used to refer to countries listed on the OECD-DAC list of ODA recipients for 2024 and 2025 flows (PDF).

2. What makes Europe an interesting market for pickled cucumbers and gherkins?

The European market for pickled cucumbers and gherkins is substantial with steady growth. In the long-term, the market size is projected to increase at a constant pace. This growth is driven by consumer demand for healthy and convenient food options.

Over the next five years, the European market for pickled cucumbers and gherkins is likely to increase at an annual rate of 3–4% in value terms and 1–2% in volume terms. The annual growth rate is expressed as the cumulative annual growth rate, or CAGR. This increase in imported value is caused by a combination of factors. This includes inflation, the increasing popularity of less processed food products and healthy snacking trends.

European consumers are increasingly health conscious. This is driving the demand for pickled cucumbers and gherkins due to their health benefits. These products appeal to consumers looking for nutritious food options. Additionally, there is a trend of using pickled cucumbers and gherkins as snacks and ingredients in sandwiches and salads, which boosts their popularity.

Europe has a long history of pickle consumption. Many European countries have particular specialities and product variants. Germany is both the biggest consumer and supplier in the region.

In Europe, most pickled cucumber breeding companies focus on parthenocarpic varieties. Parthenocarpy is the naturally induced production of fruit without fertilisation, which makes the fruit seedless. Another advantage is the lack of seeds in the final pickled product. This is a valued trait in sliced pickled cucumbers, which are used in products like burgers and sandwiches.

Since cucumbers need a warm climate to grow, they can be grown more easily in southern Europe. Northern European countries are currently producing fewer cucumbers in winter because of high energy costs after the Russan invasion of Ukraine. This trend reversed in the Netherlands and Belgium in the winter of 2023. Growers in northern Europe increased supplemental lighting usage in greenhouses. Lower energy prices in late 2023 and early 2024 continued this trend.

In 2023, the value of imports in Europe totalled €482 million. This represents an average increase of 8.7% per year between 2018 and 2023. Intra-European trade accounts for 54% of the total import value, while 44% comes from developing countries. Imports from the latter group have increased by 12% in value over the past five years, reaching €214.1 million in 2023. Germany makes up the highest share of this market (19%), followed by the Netherlands (14%) and the UK (12%).

Source: Autentika Global, ITC Trademap, 2024

Tips:

- Consult the latest news and publications about the European market for processed fruit and vegetables, published by PROFEL, the European Association of Fruit and Vegetable Processing Industries. The PROFEL website has links to the websites of its members.

- Check out the CBI Export to Europe page to learn about exporting to Europe

3. Which European countries offer the most opportunities for pickled cucumbers and gherkins?

The largest importing and consuming countries are Germany, the Netherlands, the UK, France, Belgium and the Czech Republic. As Europe’s largest food market, Germany is an interesting focus market for exports.

Germany also provides specific opportunities for organically certified pickled cucumbers and gherkins, as it is the leading organic market in Europe. The Netherlands is a major market for pickled cucumbers and gherkins, although it is also a key re-exporter. Other large consumers include the UK, France, Belgium and the Czech Republic.

Source: Autentika Global, ITC Trademap, 2024

Germany: Leader in pickled cucumber and gherkin imports

Germany is Europe’s main importer of pickled cucumbers and gherkins. Germany’s import volume was 73,500 tonnes in 2023. Imports have increased consistently year on year, although there was a sharp dip in imports in 2023. The average volume growth was positive between 2019 and 2023, at 6.1%. In value terms, German imports increased by 8.2% on average, reaching €90.1 million in 2023. The perceived nutritional and health benefits of pickles in general have increased demand for good-quality, organic pickled vegetables in recent years.

Pickles made with vinegar can assist people with diabetes to regulate it. This helps to boost the consumption of pickled cucumbers and will continue to drive demand. Almost 7% of the German population suffers from diabetes, according to the IDF Diabetes Atlas. This is expected to increase to 7.9% in 2030 and 8.4% in 2045. Vegetables pickled in vinegar, when consumed in moderation, can help maintain haemoglobin and blood sugar levels.

The German import market is highly concentrated. Turkey, India and Poland together account for 84% of its total imports in value. In 2023, more than 85% of imports by value came from developing countries. The leading suppliers were Turkey with 53% and India with 24%. Other developing-country suppliers include Serbia, Egypt and Iran. The largest European suppliers were Poland with 7% and the Netherlands with 5%.

Germany is also the largest exporter of pickled cucumbers and gherkins in Europe. It exported 116,000 tonnes in 2023 (1.6 times its import volume). The largest export partners were the Netherlands (18%) and Russia (8%), followed by France (7%) and Austria (5%). The Netherlands acts as an entry point for imports into the region. As a result, Germany imports from and exports to the country.

The organic food market in Germany is the largest in Europe. According to the German Federation of the Organic Food Industry (BÖLW), sales of organic food in Germany rose by 5% (in German) to €16.1 billion in 2023.

The food retail sector increased its organic sales by 7.2% to €10.8 billion. German consumers are willing to pay a premium for organic pickled cucumbers and gherkins, which guarantees higher returns for producers.

Top suppliers of pickled cucumbers and gherkins on the German market include Carl Kühne, Spreewaldrabe, Spreewaldhof Golßen (part of Andros Deutschland since 2021), Hengstenberg, Hainich, Stollenwerk and Alfred Paulsen. Products include barrel pickles, crunchy gherkins, crunchy smaller gherkins, cornichons, sandwich gherkins and burger gherkin slices with a variety of added herbs and flavours. Carl Kühne KG (GmbH & Co.), one of the leading pickle manufacturers, has been launching new pickled gherkin varieties with different flavour characteristics (mild, hot, herbal) and has been selling them in more attractive packaging.

Tips:

- Explore all your opportunities to lower production costs to gain market share in the highly competitive German pickled cucumber and gherkin market.

- Explore possibilities for exporting niche market varieties of pickled cucumbers and gherkins, with unique seasonings and different flavours.

- Check out Germany’s 2024 organic industry report (PDF) in German. You can use Google Translate to read it.

- Browse through the 2023 Pickle Industry Directory (PDF) to learn more about international pickle associations and their members.

The Netherlands: major hub and import leader

The Netherlands is the second largest importer of pickled cucumbers and gherkins in Europe. It is an entry point for imports in Europe, which are then re-exported to other European countries. The Netherlands does not produce many cucumbers itself and relies on imports. In 2023, it was the second largest importer in terms of volume, importing 47,700 tonnes.

Over the past five years, Dutch imports have decreased by 10% in volume. This is due to lower imports in 2022 and 2023. This drop was mainly present because of significantly lower imports from Germany. The Netherlands imported around 40,000 tonnes per year from Germany between 2019 and 2021. These imports fell to below 10,000 tonnes in 2022 and to 23,000 tonnes in 2023.

Turkey was the second largest supplier to the Netherlands in 2023 with 13,200 tonnes, followed by India with 3,600 tonnes. Sri Lanka is the third largest developing-country supplier with 700 tonnes in 2023.

The Netherlands ranks second in exports of pickled cucumbers, after Germany, with an export volume of 48,000 tonnes in 2023. It is the fourth largest exporter globally, after Germany, India and the United States.

Top players in the Netherlands include Kesbeke Fijne Tafelzuren, Crop Alliance (a member of The Onion Group), Kuehne and Ahold Delhaize. Crop Alliance is an established Dutch company that grows, preserves, processes and exports silverskin onions, gherkins and other vegetables. The company specialises in vinegar and brine preservation. Another leading manufacturer is Van der Kroon Food Products. The company has its own brand, Kroon. It also produces a variety of private label products for large buyers. It offers customised private label pickled products to retail and wholesale/food service outlets, including custom packaging.

Several family-owned businesses have long traditions of pickling the best cucumbers and selling them at farmers’ markets. Some have been in the business for more than 150 years and dominate the Dutch market with their secret recipes.

Tip:

- Consult the Dutch government’s guide for exporting to the Netherlands to learn more about the market. Also read the Dutch Chamber of Commerce’s advice on necessary documents for exporting to the Netherlands.

France: A stable importer

Although they originate from southeast Asia, cucumbers have been grown in France since the ninth century. In France, pickled cucumbers go by the name of ‘cornichons’. They are made from mini gherkin cucumbers (2.5–5 cm in length). These are harvested before reaching full maturity for an extra tart crunch. Cucumbers are mainly cultivated in Pays du Loire, Provence-Alpes Côte-d'Azur and Centre de France.

Local cucumber production faces challenges. The cornichon cucumber is not a resilient crop, and it is expensive to grow because it only matures in France once a year. Farmers in southeast Asia can harvest it up to three times a year.

Around 80% of cucumbers in cornichons jars sold each year in France contain produce from India, while most of the rest are sourced from eastern Europe. Only a small part, destined for the speciality high-end market, contains cornichons grown in France.

France is the fourth largest importer of pickled cucumbers and gherkins in Europe. The value of French imports totalled €49.3 million in 2023. French import volumes have been stable and amounted to 32,110 tonnes in 2023. This is practically unchanged from 2019. Germany (33%) is the leading supplier, followed by India (19%), the Netherlands (18%) and Turkey (14%). Lebanon is the third largest developing-country supplier with just 0.4%.

A leading brand in France is Swiss-based Groupe Reitzel. The company’s goal is to source 100% of its pickles from sustainable and/or environmentally certified agriculture by 2030. Reitzel sells products that it markets under private labels and its own brands (HUGO, Jardin d'Orante, Hugo Reitzel, and organic brand Bravo Hugo!).

Reitzel has been supporting the revival of gherkin cultivation in France since 2016. Local farmers now produce 784 tonnes. Since 2023, Reitzel France has carried the PME+ label, for companies with ethical and responsible practices. The Reitzel group is relocating some production to France to serve consumers who want to eat locally grown and organic food.

Tips:

- Gain more insight into the ecological transition and pickle ethics in France by reading the 2022 Reitzel sustainability report (PDF).

- Consult the latest annual production and trade data (in French) for processed vegetables in France from Agrimer.

- Follow the latest news on the French processed vegetables market from Unilet and news about the French cornichon market from France Info (in French).

The United Kingdom: A traditional European market for gherkins

The UK offers significant opportunities for exporters of pickled cucumbers and gherkins, particularly in organic, Fairtrade and other sustainable niches. The UK’s strong consumer demand for health-conscious and environmentally friendly products drives the market for these pickled goods.

The UK is undergoing a canned and ambient food renaissance as British consumers seek to tackle the growing pressures of the cost of living crisis. Market research data shows that sales of canned goods have been outperforming the rest of the grocery market, according to a recent update from UK-based Princes Group. Their survey also revealed that 31% of British consumers intend to buy more canned products.

The reasons behind this revival are mainly lower costs and longer shelf lives. Some 20% of UK consumers expect to buy less chilled foods over the coming year. In the UK, pickled cucumbers and gherkins are used in various culinary applications. They are frequently added to sandwiches, burgers and hot dogs. They provide a tangy crunch that complements the flavours of meat and cheese. They are often featured in recipes on platforms like Great British Chefs and Jamie Oliver’s website.

Gherkins are also used as a garnish in cocktails like Bloody Mary’s, adding a unique flavour element. Chopped pickled cucumbers are a key ingredient in sauces and relishes.

Although food prices are still going up, inflation is gradually slowing in the UK. Year-on-year food prices rose by 7% in January 2024, whereas in December, food prices had increased by 8%. This was the smallest price increase since April 2022, according to cost of living data from the Office for National Statistics (ONS).

Over the last year, pickles saw the largest annual price increase, at 18%. For comparison, the annual increase in the price of other canned vegetables was 13% in January 2024. To get a better sense of the latest changes in inflation in the canned and pickled food market segment in the UK, take a look at the excerpt from the UK consumer prices basket in Table 1.

Table 1: Average prices of pickled and canned vegetables in the UK and their annual growth rate

| Name (weight or size) | Average price January 2024 | Average price January 2023 | Annual growth |

| Vegetable pickle 280–520g | £1.88 | £1.59 | 18% |

| Canned sweetcorn 198–340g | £1.04 | £0.91 | 14% |

| Baked beans 400–425g | £1.06 | £0.97 | 9% |

| Canned tomatoes 390–400g | £0.68 | £0.62 | 9% |

Source: ONS, 2024

Mrs Elswood is a leading pickled cucumber brand in the UK. The brand is a registered trademark of Empire Bespoke Foods. E.E. & Brian Smith is an importer and distributor of pickled vegetables, including pickled gherkins that are supplied by their factory in the Netherlands. Bennett Opie is a family-owned and operated company that produces pickled cucumbers and gherkins under its Opies brand.

Tip:

- Check out news from The Grocer to keep abreast of the latest developments and launches in the UK’s pickled cucumber and gherkin markets.

Belgium: A steadily growing market

Belgium is the fifth largest importer by value of pickled cucumbers and gherkins in Europe. In 2023, the total value of imports came to €21 million or 15,600 tonnes by volume. Over the past five years, the volume of pickled cucumber and gherkin imports has increased at an annual rate of 2.5%. The largest individual supplier is Turkey, which has a 29% market share. The Netherlands and Germany together account for 48% of total imports. Other developing countries account for a smaller share of imports. The list includes India (7%), Egypt (2%) and Syria (1%).

Belgium’s major export partners for pickled cucumbers and gherkins are France (46%), Germany (16%), the UK (13%) and the Netherlands (6%).

Devos&Lemmens is one of the leading manufacturers of pickled cucumbers and gherkins and sells its Belgian Pickles under its own brand name. Devos&Lemmens is now part of GBfoods.

Czech Republic: A major market for German suppliers

The Czech Republic is the sixth largest importer in Europe by volume. In 2023, the country imported 12,600 tonnes of pickled cucumbers, mainly for domestic consumption. Over the past five years, imports have increased each year by 0.7% in volume. Intra-European imports accounted for more than two-thirds of supply. Germany was the largest European supplier with 63%, followed by Slovakia (10%). Turkey (10%) was the largest developing-country supplier of pickled cucumbers and gherkins.

One of the most important players in the gherkin and cornichon market is Machland, owned by Austria’s Machland obst- und gemüsedelikatessen. Another major player is Norway-based Orkla Foods with its Czech brand of pickled cucumbers Hamé.

Tips:

- Read our study on demand for processed fruit and vegetables on the European market for more information about what makes Europe an interesting market for processed vegetables.

- Check trade statistics for products you are interested in through ITC TradeMap or Access2Markets.

4. Which trends offer opportunities or pose threats in the European pickled cucumber and gherkin market?

Growing demand for vegan and healthy food offers opportunities to exporters from developing countries. Consumers also increasingly prefer convenience and easy-to-prepare food. Pickled cucumbers and gherkins offer this convenience. In addition, European consumers are increasingly conscious of sustainability and ethical considerations in their purchasing decisions. There is a growing demand for products that are produced in an environmentally-friendly way and under fair working conditions.

Sustainably packed products like pickles have staying power

Recent surveys have shown that most European shoppers are displeased with the amount of plastic packaging used for products in supermarkets. This bodes well for suppliers in the pickled cucumber and gherkin industry. Glass is an inert material that is time tested as food packaging. It is also not affected by concerns about microplastic ingestion or endocrine-disrupting chemicals (EDCs) found in plastics.

Over 87% of 2,000 surveyed consumers in the largest European markets expressed concern regarding the wastefulness of packaging materials. Almost 60% of consumers are particularly concerned about plastic pollution and the role plastic plays in supermarkets. This is due to consumer awareness of the fact that supermarkets are instrumental in reducing plastic packaging, as supermarkets are a major source of plastic pollutants.

A survey conducted by Focaldata in November 2023 revealed that 57% of surveyed consumers across Europe were willing to pay more for products packaged in sustainable packaging. Glass is made from raw materials found in nature. These include sand, soda ash and limestone. Glass is also one of the only packaging materials that can be infinitely recycled in a closed bottle-to-bottle loop. A similar Eviosys-funded survey showed that more than seven people out of ten will not trade off on sustainability despite inflation concerns.

Figure 7: Pickled cucumbers in glass retail packaging in a supermarket

Source: Autentika Global

Pickled cucumbers and gherkins in glass packaging benefit from an eco-friendly image. In addition to being recyclable, glass can also be reused without losing quality. Today, 78% of all container glass put on the market in Europe is collected for recycling. Furthermore, 91% of Europeans would recommend glass as the best packaging material for environmental and health reasons, according to a FEVE report (PDF).

The glass packaging industry has made large strides in lowering transport costs and reducing the cost of packaging. The industry has strengthened glass with new surface treatments and improved designs, without sacrificing improvements made by reducing weight. The glass industry’s investments in lightweighting and decarbonisation have made glass packaging 30% lighter over the last 20 years.

Consumers are also increasingly aware of the danger of hidden plastics in food packaging and food products. Studies suggest these chemicals can contribute to an increased risk of diabetes, obesity, cardiovascular disease and certain cancers. This greater awareness of the dangers of plastic chemicals that are lurking in foods benefit sales of food products in glass containers.

Moving to sustainable packaging also makes good business sense. The UK government is committed to eliminating avoidable waste by 2050 and aims to recycle 65% of municipal waste by 2035. This will involve measures such as a tax on non-recycled plastic packaging. This could give food products packaged in sustainable, recyclable packaging a competitive edge, as similar trends are seen across Europe.

Koeleman India is a 100% export-oriented unit that sources premium cucumbers and gherkins for its private labelling services. The company offers 12 different glass jar sizes for its retail pickles and two different tin sizes for its food service pickles.

To find out more about general trends, read our study about trends in the European processed fruit and vegetables market.

Healthy snacking

Pickled cucumbers offer several health benefits that make them a nutritious addition to any diet. One significant benefit is their high probiotic content. Pickles are often made through a fermentation process that promotes the growth of beneficial microorganisms. Probiotics are live, beneficial bacteria and yeasts. These probiotics are essential for maintaining a healthy gut microbiome. This can improve digestion and boost the immune system.

European consumers are becoming increasingly aware of the importance of probiotics and their health benefits. This growing interest is driven by a desire to improve gut health, boost immunity, and enhance overall wellbeing.

A detailed report by IPA Europe highlighted that countries like Italy, Spain and Poland have particularly high levels of both consumer knowledge about and consumption of probiotics. This trend is supported by national guidelines that allow the use of the term ‘probiotic’ on food packaging. IPA’s online survey was carried out in eight European countries in 2023.

Pickle juice, a byproduct of pickled cucumbers, also offers a range of health benefits. It is rich in electrolytes such as sodium and potassium, which are crucial for hydration and muscle function. It also helps to regulate blood sugar and can even help with hangovers according to the Ohio State Wexner Medical Center.

The wider healthy eating trend is beneficial for exporters of pickled cucumbers. Many European workers choose to work from home if their workplace allows it. Food companies are trying to adapt to their needs and preferences.

For example, Mrs Elswood’s launched a campaign to help UK consumers ‘liven up their lunches’ at home with vegetable snacking. The company said that there are 6.8 billion sandwich occasions in the UK each year. Right now, less than half a percent of those contain a gherkin, indicating a great potential for growth. As a result, the company launched its ‘Put some PUNCH in your lunch’ advertising campaign with new ads in 2024.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research