Entering the European market for pistachios

Food safety certification and frequent laboratory testing are necessary for pistachio suppliers who want to export to Europe. Emerging suppliers can attract buyers’ attention with sustainable production, good prices and corporate social responsibility measures. Pistachio suppliers have to pay special attention to mycotoxin control in their products. Pistachio nut shipments can be rejected at European border control if they contain too many aflatoxins.

Contents of this page

1. What requirements and certifications must pistachios meet to be allowed on the European market?

We provide general information on buyer requirements for processed fruit and vegetables in our study on buyer requirements on the European processed fruit and vegetable market. The sector level requirements for pistachios are analysed further at the product level here.

What are mandatory requirements?

Pistachios that are sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. Only approved additives are allowed, and products have to conform to maximum levels for harmful contaminants. The most common requirements for contaminants relate to pesticide residues and microbiological products.

Labels should make it clear if food products contain allergens, especially nuts. Research shows that pistachios are responsible for causing mild to severe reactions in people who are allergic. Pistachio nut allergy is related to cashew nut allergy. Pistachio nut allergy seems to be increasing globally according to recent research.

A phytosanitary certificate is necessary to import some forms of pistachio nuts into the EU from third countries other than Switzerland. This applies to whole and fresh pistachio nuts in the green husk intended for sowing, according to Regulation (EU) 2019/2072.

The European safety authorities must approve additives if there are any present. Additives should comply with Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008.

There were 285 pistachio-related notifications reported by the European Rapid Alert System for Food and Feed (RASFF) between 2019 and 2023. Most of them were classified as serious.

Contaminant control

Food contaminants are unwanted and harmful substances in food that can cause illness. The EU places strict controls on food contaminants. These controls are strict for aflatoxins, as per Regulation (EU) 2023/915 on maximum levels for certain contaminants in food. The most common requirements regarding contaminants in pistachios relate to mycotoxins, pesticide residues, insect infestation, micro-organisms (especially in pistachio paste) and undeclared allergens. If a product contains more contaminants than allowed, it will be withdrawn from the market.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products. The EU maintains a list of approved pesticides that are authorised for use. In 2023, the European Commission approved 36 new regulations that changed this list through new approvals, extensions and other changes.

One example of a pesticide-related incident is a May 2022 notification from Belgium. The notification concerned a shipment of pistachios with high residue content of the chlorpyrifos-methyl insecticide.

Regulation (EU) 2020/749 sets the maximum permissible level of chlorates to 0.1 for all tree nuts, including pistachios. Chlorates are not normal pistachio pesticides. However, they can contaminate pistachios with chlorinated water and detergents.

Heavy metals

Regulation (EU) 2023/915 sets the maximum level for cadmium in pistachios at 0.2 mg/kg of wet weight. The maximum levels do not apply to nuts for crushing and oil refining, provided that the remaining pressed tree nuts are not placed on the market as food.

Microbiological contaminants

Very low levels of Salmonella and E. coli in ready-to-eat or processed foods with pistachios can cause food poisoning. Tree nut processors should consider Salmonella and E. coli as major public health risks in their hazard analysis and critical control point (HACCP) plans. A shipment of American pistachio nuts from Germany was stopped in Finland in November 2023. This shipment of pistachios was recalled from the market because of contamination with Salmonella Anatum.

Other contaminants

Some European rejections of pistachio shipments are related to insect infestation. An Iranian shipment of pistachios was detained in Italy in January 2022. The shipment was returned because it was infested with insect larvae.

Mycotoxins

Fungi can produce aflatoxins on pistachios in the field or during storage. This is a particular problem in warm conditions with high humidity. Fungi can also spread in inappropriate storage conditions.

Aflatoxins are stable compounds that are not eliminated during the roasting or cooking of nuts. Another frequent mycotoxin found in pistachio shipments is ochratoxin.

Contamination of pistachio nut shipments with mycotoxins caused more than 200 border rejections in Europe between 2019 and 2023. In November 2022, a shipment of pistachios from Turkey was stopped in Germany because of its high aflatoxin content.

The level of aflatoxin B1 in pistachios must not exceed 8 μg/kg, and the total aflatoxin content (sum of B1, B2, G1 and G2 aflatoxins) must not exceed 10 μg/kg. The level of ochratoxin A must not be higher than 5 μg/kg. Slightly higher aflatoxin and ochratoxin A levels are allowed if the pistachios are not meant for direct human consumption. In these cases, the pistachios must be sorted or treated before they are placed on the market.

Tips:

- Read the Codex Alimentarius Code of Hygienic Practice for Tree Nuts (PDF).

- Consult the Codex Alimentarius Code of Practice for the Prevention and Reduction of Aflatoxin Contamination in Tree Nuts (PDF). Use appropriate farming methods to reduce the frequency of early hull splits and prevent orange worm infestation. Make sure not to delay the harvest. Remove damaged nuts.

- Read more about MRLs on the European Commission website on maximum residue levels. To be prepared for MRL changes, read the ongoing reviews of MRLs in the EU.

What additional requirements do buyers often have?

One basic requirement is to only include clean and healthy pistachios in your shipments. They should be free from any unrelated biological or inert matter.

Quality requirements

The quality of pistachios depends on the percentage of shells and kernels that do not meet the minimum requirements. The United Nations Economic Commission for Europe (UNECE) set out these requirements in their dry and dried produce standards. The UNECE has separate standards for pistachio kernels (PDF) and in-shell pistachios (PDF). Other quality criteria are also used, such as taste and flavour, which are subjective.

Codex Alimentarius has developed slightly different standards for pistachios, of which the United States and Iran are members. Codex Alimentarius has specific standards for unshelled pistachio nuts (PDF). The EU does not have its own official standards for pistachio classification.

Some of the most important criteria used to define pistachio quality are:

- Class: In-shell pistachios and pistachio kernels are divided into three main classes: Extra Class, Class I and Class II. To be classified as Extra Class, at least 98% of the pistachios must be open shelled with kernels inside. For Class I, this percentage should be at least 97%, and for Class II it should be at least 95%. Pistachio kernels are grouped into two classes: Extra and Class I.

- Grading: Grades for in-shell pistachios are defined by the number of pistachios per 100 grams in the UNECE standard. The US determines grades based on the number of pistachios per ounce (28.35 g). Sizing pistachio kernels and Class II pistachios is optional.

- Kernel colour: Peeled pistachio kernels can be classified into four groups according to colour: green, yellowish-green, yellow and mixed colour.

- Pistachios should have a moisture content up to 6.5%. The US pistachio standard considers pistachios ‘very well dried’ if the average moisture content does not exceed 7%.

For a more detailed look at the regional differences in pistachio sizes, consult the Guide to Global Pistachio Sizes developed by Germany’s Jupiter Pistachios. Iran’s Anata Nuts Company also has a very in-depth visual presentation (PDF) of pistachio products, categories and qualities.

Food safety certification

Most European food importers require food safety certification for pistachios. Well-established importers will not be interested in your products if you cannot provide the necessary certification. European buyers will often ask for certification recognised by the Global Food Safety Initiative (GFSI). For pistachios, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Make sure to check which certifications are currently recognised against the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, some retailers may prefer one certification over another or demand additional certifications. Major buyers will also usually visit or audit production facilities before starting a business relationship.

Tiryaki Agro is a major supplier of Turkish pistachios and holds BRCGS and FSSC 22000 certification.

Corporate social responsibility (CSR) certification

Companies may have different requirements for CSR. Many importers will ask pistachio suppliers to follow a specific CSR code of conduct. Some European retailers have their own codes of conduct, such as Lidl (PDF), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Other firms may ask for common standards like the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone, without an audit, is not very complicated or expensive. Alternatives include the Ethical Trading Initiative’s Base Code (ETI), amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Packaging requirements

There is no general rule for the packaging size of exported pistachios. The sizes commonly offered by the US exporters are 25lbs (for cartons) or 50lbs (for bags). Iranian and other exporters are more likely to offer pistachios in metric measurements. These commonly range from 10 to 50 kg.

In-shell pistachios are less sensitive to handling damage than pistachio kernels. Iranian suppliers often offer in-shell pistachios in both cartons and bags/bulk packaging. Shelled Iranian pistachios are mostly offered in cartons. Bagged pistachios are usually better priced than cartons. Cartons often come in 10 or 12 kg sizes, while bags come in 50 kg sizes.

Table 1: Example of pistachio packaging formats and relationship with shipping

| Product | Packaging | Unit net weight (kg) | Container | Quantity | Net weight (kg) |

| In-shell pistachio | Cartons | 10 | 20-foot | 1,100 cartons | 11,000 |

| 40-foot | 2,200 cartons | 22,000 | |||

| Bags | 50 | 20-foot | 240 bags | 12,000 | |

| 40-foot | 480 bags | 24,000 | |||

| Pistachio kernels | Cartons | 12 | 20-foot | 1,000 cartons | 12,000 |

| 40-foot | 2,000 cartons | 24,000 |

Source: Autentika Global, Rasha Pistachio, 2024

Labelling requirements

For bulk export packaging, the name of the product must appear on the label, Acceptable forms are either ‘pistachios’, ‘pistachio nuts’ or ‘pistachio kernels’. It is common for export labels to also include the crop year.

Bulk package labelling must include the following information:

- Name of the product.

- Lot identification number.

- Name and address of the manufacturer, packer, distributor or importer.

- Storage and transport instructions; moisture and high temperatures can negatively influence pistachio quality.

- Orchard location, harvest date and farm name can be included to improve traceability. This can help product tracing in case of contamination.

The lot identification number and name and address of the manufacturer, packer, distributor or importer can be replaced with an identification mark.

For retail packaging, product labels must comply with the EU Regulation on the provision of food information to consumers. This regulation lists requirements for nutrition labelling, origin labelling, allergen labelling and clear legibility. Pistachio allergen information must be clearly visible on the retail packaging.

A shipment of Bologna mortadella that contained pistachio that did not declare the allergen was recalled by Italy in July 2023. Similarly, an Iranian confectionery product that contained undeclared pistachio and almonds was recalled from the German market in November 2021.

Tips:

- Read about transport and storage requirements for pistachios on the Transport Information Services website.

- Consult the UNECE’s Poster on Marketing Quality of In-shell Pistachios (PDF) to see pictures of the 12 most common pistachio quality defects.

- Refer to industry examples of product technical sheets. For example, take a look at the technical sheet with pistachio kernel specifications (PDF) by the Italian agent Angelo Anaclerio. Also consult the technical sheet for shelled pistachios (PDF) from Greek producer Makin Nuts.

What are the requirements for niche markets?

Organic pistachios

European importers and retailers can demand extra effort from their suppliers. This is often the case for sustainable production and niche markets.

Sustainability certification

Fairtrade and Rainforest Alliance are two commonly-used sustainability certification schemes. Fairtrade International has developed a specific standard for nuts intended for small-scale producer organisations. This standard defines protective measures for workers in nut processing facilities.

To improve the sustainable production and sourcing of nuts, a group of mainly European companies and organisations founded the Sustainable Nuts Initiative in 2015. The main objective of this initiative is to improve the circumstances in nut-producing countries and to work toward sustainable supply chains.

Organic pistachios

Organic certification can set your product apart and allow for higher prices. To market pistachios as organic in Europe, they have to be grown using organic production methods allowed by European legislation. Growing and processing facilities have to be audited by an accredited certifier before you can put a European organic logo on your products. This also applies to the logo of the organic standard holder (e.g. Soil Association in the UK, Naturland in Germany, Agriculture biologique in France).

Importing organic products is only possible if you have an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Commission Regulation that defines imports of organic products from third countries.

Figure 1: Snack bar that contains organic pistachios and other nuts

Source: Autentika Global

For equivalent countries, including Argentina, India and Tunisia, certificates are issued by control bodies designated by national authorities. Consult the list of control bodies that operate in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Ethnic certification

To supply Jewish or Islamic ethnic niche markets, you need to implement Halal or Kosher certification schemes. Several organisations provide Kosher certification in Europe. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain certification. Halal certification in Europe can be obtained from certifying bodies that provide certification services, such as Halal Certification Services (HCS).

Nazario Pistachio is an Iranian producer and exporter of pistachios. The company has obtained Kosher and Halal certification for its products.

Tips:

- Consult the Standards Map database for sustainability labels and standards.

- Check Germany’s Bio-Siegel manual and decision aid (PDF) on labelling organic food to learn about the requirements. Consult the European Commission’s frequently asked questions on organic rules (PDF).

- Follow changes in Europe’s organic legislation on the legislation for the organics sector page.

- To read more about payment, delivery and other practical issues, read the CBI study on organising your exports to Europe.

2. Through which channels can you get pistachios on the European market?

Pistachios are mostly used as a snack in Europe. They are also used as an ingredient by the food processing industry. The ingredient market is smaller, but it is growing faster than the snack market.

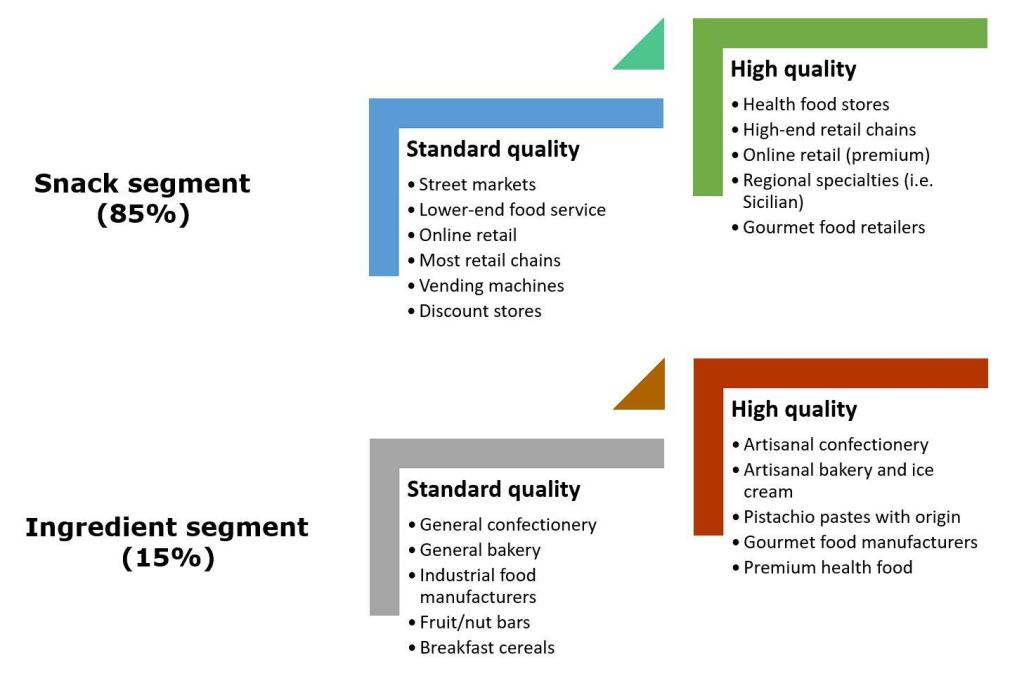

How is the end market segmented?

The European end market for pistachios can be broadly segmented based on quality (standard and high) and usage. Higher quality pistachios are larger in size, more uniform and have a better flavour and aroma. They also have an ideal moisture content and better purity, amongst other traits.

The snack segment is the largest user of pistachios in Europe. Around 85% of imported and produced pistachios in Europe are sold as snacks. They are sold as roasted, salted, unsalted, flavoured and in nut mixtures. The food processing industry also uses pistachio kernels as an ingredient.

Figure 2: End-market segments for pistachios in Europe

Source: Autentika Global

Snack segment

According to an IRI 2022 report, sales of salted snacks are on the rise (PDF) in key European markets such as Italy, Germany, UK, France and Spain. Health has become a much more important trend in daily nutrition, says the European Snacks Association (ESA). The ESA expects more growth in ‘free-from’ products and protein-packed snacks.

Figure 3: In-shell pistachios and other nuts sold without retail packaging (street markets and health food stores)

Source: 2022-11-14_16-20-51_JO_day2-4_Madaba_JH by Juhele_CZ is marked with CC0 1.0.

Sales of pistachio kernels packaged for retail sales are increasing. These products can be used either as snacks or as ingredients in home cooking and baking.

Ingredient segment (food processing segment)

The food processing segment accounts for roughly 15% of the European pistachio market. It is expected to gain market share. This growth is supported by greater consumer preference for healthier and less processed ingredients. Pistachio kernel users include:

- The ice cream and dairy industry: These industries mostly use pistachios in two ways. Pistachio bits are very often used as an ice cream topping. The ice cream industry also uses pistachio paste. The dairy industry uses pistachio paste as an ingredient in yoghurts and cream dessert products.

- The confectionary industry: Pistachio halves or pieces are mainly used to produce chocolate bars and other sweet snacks. Pistachio paste is also used in fillings and flavouring ingredients.

- The bakery industry: This industry uses whole kernels, halves, pieces and powder as an ingredient in cookies, pastries and Middle Eastern sweets (e.g. baklava, Turkish Delight). Food ingredient suppliers use pistachio paste in combination with sweeteners and other ingredients to produce pistachio fillings.

- Food manufacturers: Pistachio paste is mostly used here. Pistachio paste/butter is a newer product in European markets. Pistachio paste is often imported in bulk and then packaged as a retail product.

- Meat processors: Pistachio kernels are used as an ingredient in ‘mortadella’, a type of sausage.

Figure 4: Pistachio cream sold under the Billa private label by Austrian retailer Billa

Source: Autentika Global

Some of the segments mentioned are supplied by specialised food ingredient suppliers. Examples include Boxon Food (a Spanish-Turkish firm specialised in nut pastes), Petrou Nuts (a Greek company specialised in nut pastes and caramelised nuts) and Georg Lemke (German nut ingredient supplier). Iran’s Khoshbin Group, La Morella Nuts (owned by Barry Callebaut), the UK’s Kanegrade and Italy’s Euronut are also important paste suppliers.

Tips:

- Read the European Snack Association’s news section to follow developments in the snack industry.

- Visit Snackex, a European event that focuses on savoury snacks and snack nuts. Network with snack manufacturers during your visit.

- Search specialised trade fair Fi Europe’s list of exhibitors to find potential buyers from the food ingredient segment.

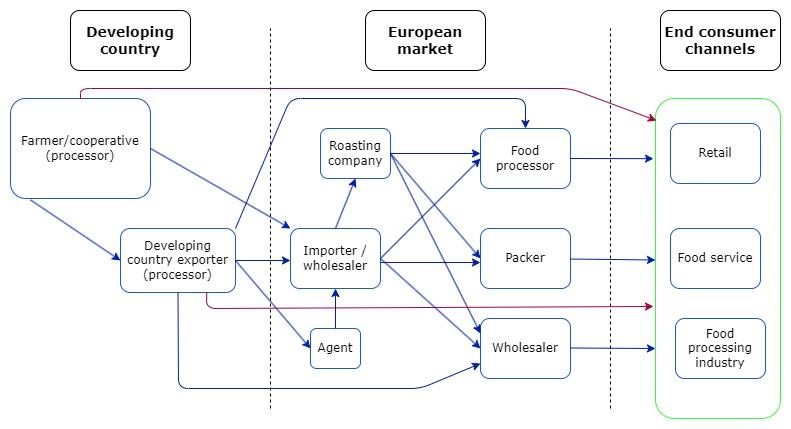

Through which channels does a product end up on the end market?

Specialised nut importers are the most important channel for pistachios in Europe. There are also alternative channels, such as agents, food processors and food service companies.

Important players in the pistachio segment include roasting and packing companies. Some firms specialise in selling roasted, salted and spiced pistachios to packers in bulk. Some important European roasting companies include Ireco (Luxembourg), Intersnack (Germany/International), Max Kiene (Germany) and Trigon (the UK).

US-based Wonderful Pistachios has roasting and packing operations in Europe. Many packing companies have roasting facilities in their factories.

Figure 5: European market channels for pistachios

Source: Autentika Global

Importers/wholesalers

Pistachio importers often act as wholesalers. Some pistachios are sold to roasting companies which process and package them for sale to end consumers. Importers may also have their own processing and packing equipment to supply retail and food service channels directly.

Hamburg-based Jupiter Pistachios specialises in importing and trading premium and organic pistachios. It also produces private label formats. California-based Wonderful Pistachios has logistic hubs in Belgium and European locations. This allows them to play a significant role in the European pistachio market.

Another major importer is olam food ingredients (ofi), which sources pistachios from Arizona, New Mexico and California. One leading Dutch importer and wholesaler is Aldebaran Commodities. Zieler & Co. is a German pistachio nut importer and wholesaler. HOWA is German firm that imports, exports and wholesales pistachios and other nuts.

Importers and food manufacturers are under pressure from retailers in terms of price. The retail industry demands are key in the pistachio supply chain. This can mean expectations of lower prices and new product requirements.

Agents/brokers

Agents involved in the pistachio trade act as independent firms that negotiate for their clients. They also act as intermediaries between buyers and sellers. Typically, their service commissions are between 2 and 4%.

Another activity that agents/brokers perform is supplying private label pistachios for retail chains in Europe. Developing country suppliers may find it difficult to participate in the demanding private label tendering procedures. Some agents can help with their services. Agents can participate in procurement procedures held by the retail chains together with their pistachio suppliers.

Pistachio agents in the leading European markets include: MW Nuts (Germany), Belfruduis and Nutfully (Belgium), Cardassilaris Family (Greece), and Global Trading & Agency and QFN Trading & Agency (the Netherlands). QFN was taken over by Blendwell Food Group and EastNut Holding in April 2024. Spain-based players include Hispania Nuts Agents (almonds and pistachios), Pangea Brokers (established in 2017) and Genial Nuts (founded in 2021). Anaclerio Angelo is a pistachio and nut agent based in Bari, Italy.

Retail channel

Large retail chains usually import pistachios from developing countries through intermediaries. These large-scale retail chains often sell pistachios under their private labels. The chain’s exact specifications and quality requirements must be met.

Leading food retail companies in Europe are usually very important for pistachio sales. Some of the companies that have the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold Delhaize.

Keep in mind that several retail alliances coordinate buying operations in Europe:

- Eurelec Trading (includes E.Leclerc, REWE Group and Ahold Delhaize from 2025).

- Carrefour World Trade or CWT (includes Carrefour, Système U, Match and Cora).

- AgeCore (Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland).

- European Marketing Distribution or EMD (Colruyt – cooperation only on private label, Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia).

- Epic Partners (EDEKA, Biedronka, Système U, Esselunga, Picnic, Migros, Jerónimo Martins, Jumbo and Ica).

Foodservice channel

Hotels, restaurants and catering establishments are part of the foodservice channel. Specialised importers and wholesalers usually supply this channel. Foodservice often needs pistachios packed in weights of 1–5kg. This is different from bulk and retail packaging sizes.

World cuisines, healthy food and snacking are the major driving forces in the foodservice channel in Europe. The fastest-growing business types tend to be healthy fast food, street food, pop-up restaurants, restaurants that serve international cuisines and sandwich bars.

What is the most interesting channel for you?

Specialised importers that work with pistachios and other nuts are the most useful contacts for exports to Europe. This is very important for new suppliers. Supplying the retail segment directly is very demanding and requires significant investment in quality and logistics. Importers usually have good knowledge of the European market and know the situation in pistachio-producing countries.

As a result, they are a preferred contact, as they can inform you about market developments and provide practical export advice. Pistachio importers often import other nuts and dried fruit as well. Thus, offering other products can increase your competitiveness.

New suppliers should try to establish lasting relationships with well-known importers. Many of these importers already work with selected suppliers. Importers often perform audits and visit producing countries on a regular basis. New suppliers often need to offer the same quality at lower prices than their competitors.

Packing for private labels may be an option for well-equipped and price-competitive suppliers. Be aware that private label packing is often done by importers that have contracts with retail chains.

Tips:

- Search the member list of the European Trade Federation for Dried Fruit and Edible Nuts (FRUCOM) to find buyers from different channels and segments.

- Consider joining forces with other producers from your country to offer sufficient volumes of pistachios, especially if you can offer products with uniform quality and certifications.

- Watch the 2023 Deutsche Welle documentary for more insight into the competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

3. What competition do you face on the European pistachio market?

The United States, Turkey and Iran are the key competitors for emerging suppliers of pistachios to Europe. These countries supply more than 92% of all pistachios to Europe.

Which countries are you competing with?

The United State and Iran used to compete for the position of largest pistachio exporter. However, Iran has been losing its market position in recent years. Iran was the second largest pistachio supplier to Europe between 2019 and 2021. Turkey overtook Iran in 2022 and 2023. Spain, Italy and Greece have a combined market share of around 5%, although some of their exports are re-exports. Argentina, Syria, the UAE, China and Vietnam export very small quantities to Europe.

Source: Autentika Global, ITC Trademap, 2024 *Spain, Italy and Greece

USA: the world’s dominant supplier of pistachios

American farmers’ pistachio production is increasing. The total number of US acres devoted to pistachios is nearly five times higher than two decades ago. The number of bearing acres has grown at a rate of more than 9% per year. California accounts for around 99% of the US pistachio production.

US pistachio growers harvested a record 1.49 billion pounds (675,853 tonnes) of pistachios in late 2023. This is expected to increase to nearly 2.08 billion pounds (943,472 tonnes) in 2031 according to a recent forecast (PDF) prepared for American Pistachio Growers (APG). Pistachios are enjoying a great moment in the US. They are the new darling of the country’s tree nut industry and are very popular among consumers according to a June 2022 Rabobank report.

In 2023, the United States exported 329,905 tonnes of pistachios, 100,000 tonnes more than in 2019. US pistachio exports represented 69.7% of world exports in 2023. However, this large share of global exports was mainly due to the very small crop in Iran, as the United States’ five-year average share is below 50%. The main markets for American pistachios were China, Turkey and Germany. In-shell pistachios make up about 95% of US exports.

US exports to Europe reached 88,700 tonnes in 2023. These exports are increasing at a rate of 3% per year. Germany is the main European destination with 27% of purchases, followed by Belgium (20%) and Spain (14%).

Iran: a pistachio exporter in gradual decline

Iran’s 2023 pistachio production was 180,000 tonnes, according to a market report (PDF) by Iran’s Pistachio Association (IPA). Kerman is the largest producing province. Kerman accounts for around 70% of Iran’s pistachio output. Other important production areas include Khorasan Razavi, South Khorasan, Yazd, Fars and Semnan. The largest producer areas can be seen here.

In Iran, popular cultivars include the local varieties Akbari, Ahmad Aghael, Ohadi, Fandoqhi (round) and Kaleh, according to the International Nut & Dried Fruit Council (INC) and IPA. Pistachio orchards in Iran are mostly hand-harvested. Production is limited by drought, water shortages, insufficient irrigation and problems in post-harvest operations.

Iranian pistachios are valued for their high kernel to in-shell ratio and high percentage of large kernels. Iran exports a large share of pistachio kernels. In 2023, Iran exported €65 million worth of natural pistachio kernels and €27 million worth of in-shell pistachios.

In 2023, the largest buyers of Iran’s pistachio exports were Russia (12%), India (12%) and Iraq (11%). Of the total exported quantity, 11% goes to Europe. Germany accounts for more than 75% of the European share. Spain is the second largest European importer with a 15% share. Exports to Europe have fallen by 14% per year since 2019.

Domestic pistachio consumption is estimated at around 15,000 tonnes (PDF), according to IPA. In recent years, exports have been limited by a wide range of factors. Government restrictions on the transfer and exchange of foreign currencies and price differences between domestic and international markets are the biggest problems. The sector also has to deal with high inflation rates and international trade restrictions. As a result, Iran’s share of the global pistachio market has fallen below 18%.

Turkey: an important pistachio producer and consumer

Most pistachios produced in Turkey are consumed locally. This leaves small quantities for export. Turkey is the second largest global consumer of pistachios after the United States. Turkish pistachio production and exports are increasing. The domestic Turkish pistachio market is also undergoing a significant surge in demand.

The major pistachio cultivars in Turkey include Kirmizi, Uzun, Halebi and Siirt, according to the INC. Most pistachios are sold as kernels for the food ingredient industry. Most pistachios are grown in south-east Turkey. Urfa and Gaziantep provinces are the main producing areas, followed by Siirt and Adıyaman.

Turkish pistachio exports increased from 16,000 tonnes in 2019 to almost 32,000 tonnes in 2023. Around 30% goes to Europe, with Italy being the main destination (43% of European imports in 2023), followed by Germany (39%) and Bulgaria (4%). Exports to Europe have increased by 13% per year on average since 2019.

European suppliers: an emerging source for European buyers

Spain, Italy and Greece are minor pistachio producers on the global stage. However, they still play a role in supplying buyers in Europe. Their exports to other European buyers increased by 13% on average between 2019 and 2023. Some of these exports were re-exports.

Spain has expanded pistachio production significantly. Some sources expect that it could become the fourth-largest producer in the world. The planted area has reached around 50,000 hectares. Most of it is expected to start production over the next three to four years. Spanish growers have formed the country’s pistachio growers’ association. The association is part of the of ASPPA, the Association of Pistachio Producers of Albacete.

Pistachio is a traditional crop in Italy’s Bronte region of Sicily, but it has also been expanding to other parts of Sicily and Basilicata. Pistachios grown in Bronte have the Protected Designation of Origin (PDO) status.

Greece is another important producer and consumer of pistachios. Some of the country’s culinary dishes and confectionery products use pistachios. One example is the Halva sweet snack, made from tahini, sugar, starch and pistachios. Aegina Island is famous for its pistachios. The EU declared Aegina pistachios (in Greek) a PDO product in 1996. Local pistachio farmers formed the Aegina Pistachio Growers association.

Tips:

- Visit the APG and IPA websites to learn about production in these leading supplying countries.

- Participate in APG’s annual conferences to meet American producers and learn about the competition.

- Follow news and developments from the US pistachio market by reading APG press releases.

Which companies are you competing with?

Many companies produce, process and export pistachios. Wonderful Pistachios & Almonds (WPA) is the world’s largest vertically integrated processor and marketer of pistachios. The company farms over 125,000 acres in California and supplies over 70 countries. Wonderful Pistachios processes 80 million pounds (36,287 tonnes) of pistachios every year.

American companies

Non-profit association APG represents over 800 grower members in California, Arizona and New Mexico. Many of them supply WPA with pistachios. Some independent growers have their own processing facilities and sell and export pistachios independently. Examples include: Setton Farms (a leading processor and exporter), Horizon Nut (a cooperative), Horizon Growers, Keenan Farms, Nichols Farms, Primex, Aro Pistachio, Summit and American Trading International (export service company).

Iranian companies

Around 80 exporters are members of IPA. Iran’s Hiva Nuts offers a wide range of pistachios from the Kerman, Damghan and Ghazvin regions. Khoshbin Group is one of the leading pistachio exporters and is certified by BRCGS. They focus on maintaining high standards of quality and safety in their production processes.

Other Iranian pistachio exporters include: IRNUTS, AHT Foods, illiya Pistachio, Rasha Pistachio, Sadaf Sabz, Nazari Pistachio, Dorchin, MEPE, Green Diamond Tree, Ostore Pistachio, Kian Chrysolite, Poopak, Arian Milan, Sirjan Zomorod and Anata Nuts.

Turkish companies

Tiryaki Agro is a Turkish company that processes and supplies pistachios and other agricultural products globally, with facilities in Gaziantep. Other important Turkish exporters include: Kahraman, Asim Samli, Karin Gida, Kılıç Kesmez Gıda and Aydın Kuruyemis.

European companies

European suppliers include Italian-based Anastasi, Marullo, Caudullo and New Factor, which represents the Wonderful Pistachios brand in Italy.

In Spain, important suppliers include Domo Pistachios, Pistamed, Pistachos del Sol, Pistagood, Pistachos Nazaríes and Pistachos de la Mancha. Family-run Grau Nuts offers pistachios and other nuts, seeds and snacks. Importaco Group is a large international company involved in importing, processing and selling pistachios and other nuts.

Investment group Atitlan bought 800 hectares of pistachio orchards in November 2023. Atitlan, Elaia and AGNBRO Capitalin are partnering to develop the largest pistachio processing plant in Spain.

Some important Greek players include Makin Nuts, Larinuts, Smart Nuts Group and Petrou Nuts.

Tips:

- Check out the APGember page to learn how US pistachio growers are organised. Check out the IPA member page to find more information about leading producers and exporters.

- Participate in the World Nut and Dried Fruit Congress, organised by the INC, to meet leading pistachio producers and traders.

- Visit major European trade fairs to meet competitors and potential customers. Examples include ANUGA, SIAL and FI Europe.

Which products are you competing with?

Pistachios have a unique flavour and form. The manual removal of shells from the kernels is part of their appeal as a snack. Almonds and cashew nuts are somewhat similar in terms of snacking use and price. However, they have a different taste profile and are visually different.

Tip:

- Read CBI’s studies on almonds and cashew nuts to learn about how they compare to pistachios in terms of similarities and differences.

4. What are the prices of pistachios on the European market?

Depending on the country, retail chain and brand, the prices of pistachios sold to final consumers can vary significantly. The prices of salted roasted in-shell pistachios usually range from €13/kg to €16/kg, but some brands can cost up to €30/kg. The retail price of pistachio kernels is closer to €50/kg. An approximate breakdown of pistachio prices is shown below.

Source: Autentika Global, 2024

The price of pistachios depends on the size of crops harvested in the United States and Iran. The US export price of in-shell pistachios increased from $8,000 per tonne in early 2019 to more than $9,000/t in June 2020. Prices then fell to around $7,000/t in July 2022. After a brief recovery to $7,500/t levels in mid-2023, the average monthly price dropped to a low of $6,660/t in February 2024. The price of shelled US pistachios has followed a similar pattern since 2019. The shelled price fell to a low of $6.66/kg in February 2024.

Tips:

- Subscribe to S&P Global Commodity Insights, a leading market information service for processed commodities, including pistachios.

- Subscribe to the ofi market price reports. These free reports provide information about nut prices and online nut purchasing activities.

- Monitor the latest nut market updates from the UK’s Chelmer Foods.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research