The European market potential for pistachios

The European market for pistachios is expected to grow stably in the long term. This growth is likely to be driven by changes in the consumption patterns of European consumers, including the rising demand for healthier snacking options and interest in Eastern Mediterranean cuisine. Germany, Italy, Spain, France, Belgium and the Netherlands offer opportunities for developing country suppliers.

Contents of this page

1. Product description

The pistachio tree (Pistacia vera) is a drought-resistant tree that grows in arid and semi-arid climates. It needs hot summers and cool winters. The tree can grow up to ten metres tall and has a deep root system that allows it to withstand drought conditions. Pistachio trees are dioecious, meaning there are separate male and female trees. Typically, one male tree can pollinate up to 15 female trees. The pistachio tree is native to Western Asia and Asia Minor.

Pistachio trees are primarily grown in Iran, the United States (especially California), Turkey, Syria, Afghanistan, China, Italy, Australia, Spain and Greece. Fruit begins appearing on the trees after four to five years, reaching full production after around 15 years. Although it is known as a nut, botanically the fruit is a drupe. The edible part is an elongated seed. The outer, hard, cream-coloured shell is removed and only the inner seed kernel is edible. The nut splits open because humans bred it to have this trait. Varieties may differ in terms of how often their nuts split open.

The harvesting period varies by region, but it generally occurs between late August and early October. Pistachios are often harvested with mechanical tree shakers that knock the nuts to the ground. The nuts are then collected and processed. Late removal of the hull often leads to stained shells. Mechanical harvesting is most common in the USA, while manual harvesting is more common in Iran, Turkey and Syria. The pistachio industry uses the term ‘processor’ (PDF) for companies that remove the hull, dry in the shell, sort, shell and package pistachios.

Figure 1: Pistachio tree with pistachios

Source: Image by NoName_13 from Pixabay, Pixabay content license

Within this species, there are numerous varieties, including:

- Kerman: Predominantly grown in the United States and recognised for its large size and high quality.

- Kalehghouchi: Known for its large kernel and high yield, commonly grown in Iran.

- Uzun: A variety primarily cultivated in Turkey, recognised for its distinct flavour and texture.

- Fandoghi: The most widely grown variety in Iran, valued for its small, round kernels and robust flavour.

Pistachios from Bronte, Sicily, are known as ‘Bronte Pistachios’ or ‘green gold’. They have a Protected Designation of Origin (PDO) status. Their special taste and fragrance are key to making unique ice creams, sauces, creams and sweets. They have always been the primary element used in Sicilian confectionery products and cuisine in general. This example also indicates how pistachio suppliers from developing countries can try to protect their own unique pistachio cultivars and origins. Higher quality, well-known products can often command higher prices.

World pistachio production (in-shell basis) reached 1.08 million tonnes in 2023–2024 according to the March 2024 edition of NutFruit Magazine (available to subscribers). The magazine is published by the International Nut and Dried Fruit Council (INC). The 2023–2024 crop is 47% higher than the previous year. The US crop reached a record of 677,830 tonnes, 69% higher than the previous year, setting a new record.

Pistachios are widely recognised and traded under several common names, most notably ‘pistachio nuts’ or simply ‘pistachios’. In international trade, they fall under two Harmonized System (HS) codes. The 080251 code refers to in-shell pistachios (fresh or dried). The code 080252 is used for shelled pistachios (fresh or dried).

Figure 2: Shelled pistachio nuts

Source: Image by Engin Akyurt from Pixabay, Pixabay content license

Shelled pistachios are pistachio nuts that have had their hard outer shell removed. This makes them more convenient for consumption and use. They are usually available as:

- Raw: Natural and unroasted, often used in cooking and baking. They are a popular ingredient in salads, granolas and desserts.

- Roasted: These have been roasted to enhance their flavour. They are often consumed as snacks or used in recipes that benefit from their roasted taste.

- Flavoured: Shelled pistachios are sometimes seasoned with a variety of flavours, such as salt, chili and garlic.

Figure 3: In-shell pistachio nuts

Source: Image by Alexa from Pixabay, Pixabay content license

In-shell pistachios are sold in their shells for several reasons:

- Snacking: They are enjoyed as a healthy and satisfying snack. The act of cracking the shells is part of the appeal for many consumers.

- Gifting: Pistachios are often sold in decorative packaging, usually during holidays and special occasions.

The time of harvesting pistachio nuts is critical. A good indicator to determine the best time to harvest is when the hull slips from the shell. Earlier or later harvesting results in inferior nut quality.

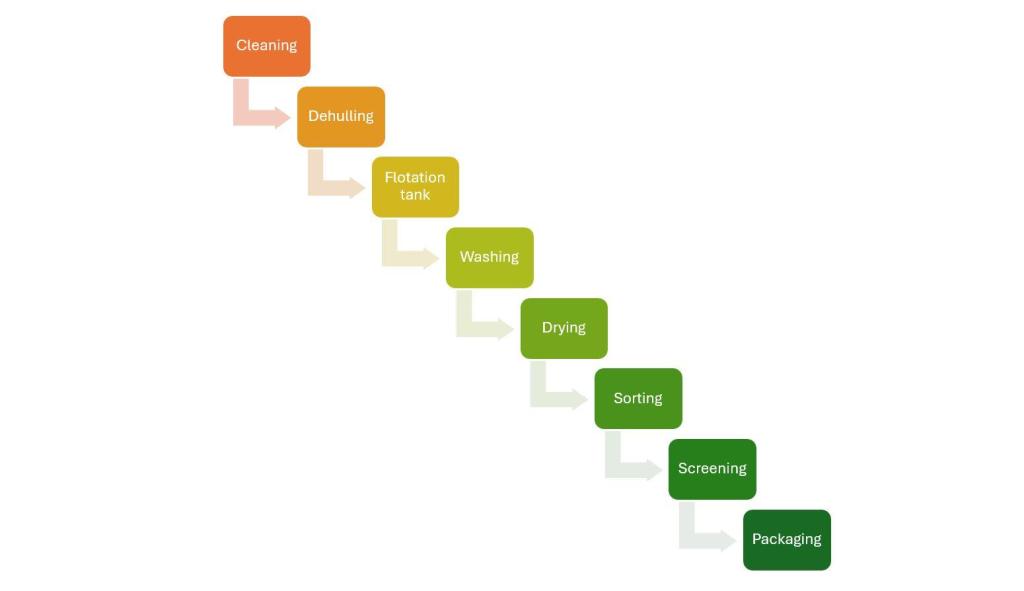

Production of pistachios typically includes these processes that can be organised in several ways:

- Harvesting: mechanical or by hand.

- Dehulling: removing the hulls from the nuts.

- Water sorting: unripe nuts float in water.

- Drying: sun drying or machine drying.

- Separation: separating open-shell nuts from closed-shell nuts.

- Sorting: into two or three grades.

- Packaging.

The processing of raw pistachio nuts may differ in different production regions and may depend on variety. After removing the in-shell nuts from the tree, processing typically includes the steps shown in Figure 4. Read more about pistachio nut processing in descriptions provided by pistachio processors like Desert Green Nuts, Top Nut, Kia Herbs and Biodels.

Figure 4: Stages of processing raw pistachio drupes into kernels

Source: Autentika Global

2. What makes Europe an interesting market for pistachios?

Pistachios are widely used in the European food industry and are popular among European consumers. They are used for snacking, usually in roasted and salted form. Pistachios are also an ingredient in numerous baked goods and confections, including Italian cannoli, French macarons and Turkish baklava. Pistachios are also used in Middle Eastern and Mediterranean cuisines. They can be found in dishes such as rice-based pilaf, salads and pesto.

Europe’s ice cream and dessert industries also frequently use pistachio flavours. Italy is particularly renowned for its pistachio gelato (ice cream) and torrone (nougat).

Europe is the second largest market for pistachios after the United States, but the largest importing region in the world. European imports of pistachios increased at an average of 3.4% in volume in the 2019–2023 period. The annual growth rate is expressed as the cumulative annual growth rate, or CAGR. Due to Europe’s very limited production and high demand, the EU pistachio trade balance remains negative, resulting in significant imports from the United States and Iran.

In 2023, 10% of all imports from outside Europe came from developing countries. Over the next five years, the European market for pistachios is likely to grow at an annual rate of 2–3%. Fluctuations in imports will be influenced more by crop harvests and price levels rather than changes in demand.

In this study, the term ‘Europe’ refers to the 27 member states of the European Union (EU), plus the United Kingdom (UK) and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland). The term ‘developing countries’ is used for countries that are listed on the OECD-DAC list of ODA recipients for 2024 and 2025 flows (PDF).

The largest quantities of pistachios in international trade are packed in bulk and exported as raw in-shell split nuts. Quality categories are described in more detail in the market entry part of this study. Processing operations, such as roasting and salting, usually take place in Europe, but some exporters can also perform processing to meet requests from European buyers.

The European market for pistachios is very concentrated. The three largest suppliers (USA, Turkey and Iran) supply more than 92% of the total market. The largest supplier of pistachios to Europe is the United States, which accounts for 78% of total supply, followed by Turkey (8%) and Iran (6%). Iran’s exports to Europe have been falling at an annual rate of 14%. Turkey’s exports to Europe have been rising at a rate of 13% per year.

Pistachio trees exhibit an alternating bearing pattern. This means that they tend to produce a large crop one year followed by a much smaller crop the next year. This cycle can significantly affect overall yields and market supply. Leading producers are always stocking some portion of the production to stabilise supply.

Source: Autentika Global, ITC Trademap, 2024

Tips:

- Consult the latest news from the European Pistachio Council (EPC). The EPC is a non-profit association committed to serving the interests of the European pistachio value chain. Members include American Pistachio Growers and the Iran Pistachio Association.

- Check out the CBI Export to Europe page to learn about exporting to Europe.

3. Which European countries offer most opportunities for pistachios?

Europe is and will remain a significant market for pistachios. This is because of the rising health and wellness trends and growing demand for on-the-go nutritious snacks. European consumers are also receptive to plant-based and premium products. Pistachios are also increasingly being added to baked goods.

Germany is a good market to focus on. Italy, Spain and Greece are also markets with constant demand. The three countries produce pistachios, but production, although increasing, is not sufficient to satisfy domestic demand. Belgium and the Netherlands are consumer and transit countries with specialised traders. France is an interesting consumer market.

Source: Autentika Global, ITC Trademap, 2024.

Over the next five years, the European market for pistachios is likely to increase at an annual rate of 2–3% in volume terms. This increase is driven by a range of factors. These factors include healthy snacking trends, the launch of new pistachio products and the popularity of vegan diets. Food manufacturers also introduce new pistachio-flavoured products to attract consumers.

Pistachio nuts are also used to produce pistachio oil. Pistacia vera seed oil is extracted from the nuts. It is used in cosmetic products for its antioxidant and anti-inflammatory properties and as an edible oil.

Keep in mind that tree nut consumption has been affected by financial instability and inflation in recent years. This has mostly been caused by high inflation provoked by the twin crises of Covid-19 and the Russian war against Ukraine. If the economic situation in Europe continues to improve, this could lead to greater pistachio sales.

Source: Autentika Global, ITC Trademap, USDA, MAPA, ISTAT, ELSTAT, 2024

Figure 7 shows apparent pistachio consumption volumes for each country. The general trend in the 2019–2023 period was rising apparent consumption, especially in Italy, Spain and the Netherlands. Apparent consumption is a rough tool as pistachio products can be exported in many processed forms. These may include pistachio paste and confectionery products.

Apparent consumption in Figure 7 is calculated as the difference between imports and exports for Germany, France and the Netherlands. For Spain, Italy and Greece, it is calculated as the difference between imports and production on one side and exports on the other. These three south European countries are also pistachio producers. Estimated production for Greece in 2023 is based on a predicted 30% drop in pistachio production in 2023. The Hellenic Statistical Authority (ELSTAT) has not released the final pistachio production figures for 2023 yet.

Germany: the largest European importer

Germany is Europe’s largest and the world’s second-largest importer of pistachios after China. Germany’s import value of pistachios amounted to €428 million in 2023. This is 53% higher than the second largest importer, Italy. German imports have mostly been stagnant over the past five years. They decreased in volume by 0.1% annually between 2019 and 2023, reaching 45,000 tonnes. Germany imported 33,800 tonnes of in-shell pistachios and 1,100 tonnes of shelled pistachios in 2023.

Germany is also an important re-exporter of imported pistachios. Almost 40% of all imported pistachios are re‑exported to other European markets from Germany. Exports increased at a rate of 15% per year between 2019 and 2023. Specialised traders and agents perform re-export activities. Many of these firms are located in Hamburg, which is home to Germany’s largest seaport. The main target markets for German export of pistachios are Italy (with a 24% share in 2023), followed by the Netherlands (13%), France (13%) and Spain (12%).

The German import market for pistachios is very concentrated. Germany imports 82% of all its pistachios from the United States. Iran supplies 9% of the German market. Iran’s pistachio exports to Germany have fallen by 4.3% per year since 2019. Turkey’s exports to Germany have fallen by 2% per year over the past five years.

Three quarters of German imports are raw, unprocessed pistachios. After import, specialised companies commonly process pistachios before they reach the final user. The most common type of processing is roasting, but pistachio kernels are also cut into smaller pieces for use in various products. German roasters and processors include Intersnack (with five production facilities across Germany), Omnitrade, Max Kiene, A.M.A. and Moll Marzipan. Jupiter Pistachios specialises in the import and export of pistachios, with a focus on premium quality and organic products.

Leading pistachio snack brands in Germany include ültje (owned by Intersnack), Max (owned by Max Kiene), Seeberger and Kluth. Apart from independent brands, a lot of pistachios are sold under the brands of retailers. Leading private labels include Alesto (by Lidl), Trader Joe’s (by Aldi Nord), Farmer (by Aldi Süd), K-Classic (by Kaufland), ja and REWE Bio (by REWE) and Gut & Günstig and EDEKA (by EDEKA). Examples of German retail pistachio brands in the organic segment include Alnatura and Rapunzel, which are also fair trade.

Figure 8: Roasted and salted in-shell pistachio nuts sold by Lidl under its Alesto private label

Source: Autentika Global

Pistachio is also used as an ingredient in ice creams, chocolates, cakes, yoghurts and other products. They are used in many foods and beverages, ranging from pistachio creams to pistachio lattes. Natural food brand KoRo launched a pistachio-packed organic wafer in collaboration with professional footballer Mario Götze in 2024.

German consumption of pistachios is helped by a healthy snacking trend and their use by the food industry for confectionery and ice cream products. Pistachios are promoted as being high in mono-unsaturated fat, fibre and minerals. They also have a high antioxidant content.

Pistachios are a top ten snack for consumers during the festive season leading up to Lent, known as ‘Karneval’ in Germany. This is an important season for sales according to the German Confectionery Industry Association (BDSI).

Tips:

- Find German traders of pistachios on the specialised trade promotion organisation Waren-Verein der Hamburger Börse and the German B2B platform Wer liefert was (wlw) websites.

- Contact the Association of the German Confectionery Industry Association (BDSI) for more information about the gourmet and pistachio nuts market in Germany.

- Inform yourself about trends and the production of tree nuts in the EU by reading the USDA Tree Nuts Annual.

Italy: a traditional ingredient pistachio market

Italy is a very promising market for pistachios. Consumers are traditionally aware of pistachios, and new demand is driven by consumer awareness of health benefits. The country's culinary culture, combined with a growing interest in high-quality food products, provides significant opportunities for pistachio suppliers.

Italy has seen the highest pistachio import growth rate among the six most important European consumer markets. Italy’s annual imports increased at a rate of 10.5% by volume between 2018 and 2023. In value terms imports rose by 12% in the same period. The country imported almost 27,000 tonnes of pistachios in 2023, which is almost 9,000 tonnes more than 2019. The apparent consumption of pistachios in Italy grew at the highest annual rate of almost 10% between 2019 and 2023.

Most of the imported pistachios in Italy are consumed within the country, and less than 10% of the total imports are re-exported. In 2023, Italy imported most of its pistachios from the United States (48%) and Germany, which acted as a transit country (15%). Spain and Belgium supplied around 8%, or 2,000 tonnes, each. The two largest developing-country suppliers were Turkey (5%) and Iran (4%).

Pistachios are also produced in Italy, with more than 90% of the production being concentrated in the Bronte area.

Bronte, a village in Sicily, is renowned for its premium pistachios, often referred to as ‘green gold.’ Growers in Bronte practice sustainable and traditional farming methods. This makes pistachios from Bronte highly sought after, both domestically and internationally. Domestic production is stable, at around 4,000 tonnes per year, according to the country’s statistics body ISTAT.

Bronte pistachios obtained a protected designation of origin (PDO) in 2010. The nut fruit is cultivated at the foot of Mount Etna between 400 and 900 m above sea level. The volcanic soil provides fertile ground for pistachio trees that flourish in this area. The local community promotes this product by organising an annual speciality pistachio event: Sagra Del Pistacchio Bronte. The production area is located within the municipal areas of Bronte, Adrano and Biancavilla in Catania. Bronte pistachios are pricier and sell at higher prices than imported or other Italian pistachios.

Bronte pistachios are sold as whole, chopped, roasted and salted, or as pistachio paste by many Italian suppliers, such as Pariani. They are also processed into organic and conventional pistachio oil and pistachio spreads of different concentrations for ice creams. These pistachio product forms are popular amongst Italian consumers and lovers of Italian cuisine in Europe.

Figure 9: Soft serve ice cream with pistachio bits

Source: Image by ran dana from Pixabay, Pixabay content license

The Italian food retail industry is highly diversified and there are many retail channels. Hypermarkets, supermarkets, major discount stores and specialised stores coexist with family-owned grocery stores and open-air food markets. There is a large market for artisanal products in the packaged food market.

Leading retail brands include Noberasco, Ventura, Cameo, Life and Milani. A large amount of roasted pistachios in Italy are sold by private label brands of supermarkets like Coop, Conad and Carrefour. American brands are also promoted in Italy. Significant quantities are sold as unbranded snacks, measured and sold by weight. Italy’s Ekoterra Food offers pistachios that are cultivated organically in southeast Turkey.

Pistachio kernels are traditionally used in Italian cuisine as an ingredient. Italian ice cream producers use significant quantities of green pistachio kernels or paste. Other products that contain pistachio as an ingredient include pasta sauces, traditional desserts and sweet brittles. Some quantities are processed into paste for fillings in bakery products. Mortadella, a traditional Italian pork sausage, contains pistachios.

Spain: a strong growth market

Spain is the third largest importer and second largest consumer of pistachios in Europe. In 2023, imports reached 15,700 tonnes. Apparent consumption has increased at a rate of more than 6% over the past five years. High domestic and international demand make the crop very attractive to Spanish growers.

Most pistachios in Spain are consumed as a salty snack. They are also a popular side snack that is often served with drinks in bars. The Spanish market is open to innovative pistachio-based products, such as pistachio butter, flavoured pistachios and pistachio-infused beverages. These products cater to the trend towards premium and healthy snacking options. Pistachio ice cream is a beloved flavour in Spanish gelaterias. Pistachio turron is also a traditional Spanish nougat, particularly enjoyed during the Christmas season.

The United States is the leading supplier of pistachios to Spain (85% share in 2023), followed by Iran (11% share), and Germany (2%) and Belgium (1%), which act as transit countries. Vietnam (21 tonnes) and Jordan (13 tonnes) started exporting to Spain in 2023 with small volumes.

Spain is Europe’s largest pistachio producer, with around 23,000 tonnes of pistachios harvested in 2023 according to the country’s agriculture ministry (MAPA). Production in Spain shows steady growth. The crop size has increased by 15% on average between 2019 and 2023. The production and consumption of pistachio in Spain is being popularised through the Spanish Pistachio Association (ASPPA). Most Spanish pistachios are produced in the Castile-La Mancha region.

Pistachios are predominantly sold by the private labels of Spanish supermarkets (e.g. Mercadona, Carrefour, Alcampo), discounters (e.g. Lidl, Aldi, Dia) and department stores (e.g. El Corte Ingles). Examples of independent brands include Borges, Frit Ravich, Wonderful and Campomar Nature (organic). There are also brands of regional pistachio products, such as Nazaries and Maná Pistachos Ecológicos (organic pistachio products that use pistachio paste).

Tips:

- Follow Spanish and global nut market updates from Secoex or news from the Spanish snacks market from the Spanish snacks association La Asociación de Snacks. Check out the member list for potential leads to buyers.

- Check relevant trade statistics using tools such as ITC TradeMap and Access2Markets.

Belgium: a major transit country for pistachios

Belgium is the fourth largest European importer of pistachios. Although large in import volume, Belgian consumption is rather small. The bulk of imported pistachios are re-exported to other European markets. Belgium has many brokers that source and supply a wide range of nuts and nut-based products.

Belgian imports of pistachios increased by 0.7% in value and 0.2% in volume annually between 2019 and 2023. Pistachio imports reached 11,000 tonnes and €92 million in 2023. Belgium is a very concentrated market for pistachios. The country imports 89% of pistachios from the United States. Very small quantities are imported from developing countries. Imports from Iran amounted to 104 tonnes, while imports from Turkey totalled 70 tonnes in 2023.

In 2023, France was the second largest pistachio supplier to Belgium, with a supply of more than 200 tonnes. Belgium exports pistachios to Luxembourg for processing. After processing, retail-ready products are returned to Belgium for further trade. In 2022, Belgium imported more than 2,300 tonnes of pistachios from Luxembourg.

Most pistachios are sold under the private label brands of big retailers, such as Delhaize. Independent pistachio brands have a small market share. The USA brand Wonderful is gaining market share in Belgium. This company is running a campaign to increase sales in several European countries, and their main European office is located in Ghent.

Some of the leading importers and distributors of pistachios in Belgium include Dutch wholesaler Nutland. Nutland is known for its extensive range of conventional and organic nuts. Belgian company ABC Nuts is an important conventional and organic pistachio roaster and supplier. Brussels-based Nutfully is an established trading and brokerage company that deals in pistachios.

Tips:

- Find out more about the Belgian pistachio market. Contact Belgium’s specialised food industry association (Fevia) for further information.

- Browse over 1,400 Belgian food companies on the Fevia’s Food.be portal to find potential buyers for pistachios from different segments of the Belgian food industry.

France: a stable pistachio market

France is an important and relatively stable importer of pistachios. French imports fluctuated between 7,000 and 8,600 tonnes between 2019 and 2023. French imports reached 7,200 tonnes and €70 million in 2023. In 2023, France imported most of its pistachios from the United States (81%), followed by Iran (6%) and Spain (5%). Turkey and China only export around 20 tonnes of pistachios to France.

The largest quantities of salted, roasted pistachios are sold under private label brands by retail chains, such as Carrefour, Intermarché, Auchan and Lidl. Examples of retail snack brands include Daco Bello, Vico (a brand owned by Intersnack), Wonderful (American brand), Menguy’s, Pronatura (organic) and Juste Bio (organic). The French food processing industry uses pistachios in a range of ways. They are very popular as an ingredient in sausages, chocolate products, ice creams and bakery products.

In 2022, around 49% of French consumers were willing to pay more for brands that improve society or the environment. This is down from 50% in 2021 according to the Healthy & Sustainable Living report (PDF) by GlobeScan.

Tips:

- Learn more about the French pistachio market by contacting the French association for research in the fruit and vegetable sector (CTIFL).

- If you are not from a French-speaking country, consider investing in French-speaking staff for easier penetration into the French market for pistachios.

The Netherlands: a large re-exporter of pistachios

The Netherlands is usually the fourth or fifth-largest importer of pistachios in Europe, often slightly behind France. In 2023, the Netherlands imported 90 tonnes more pistachios than France. Over the last five years, Dutch imports of pistachios fell by 2.5% on average per year. Imports amounted to 7,300 tonnes worth €72 million in 2023. Imported volumes peaked at 8,100 tonnes in 2019, worth €68 million.

The Netherlands plays an important role as a trade hub in Europe, as approximately 80% of the imported pistachios are often re-exported to other European countries. Germany is the leading destination for Dutch pistachio re-exports, accounting for around 2,200 tonnes per year. Two other large destinations for Dutch re-exports are Poland and France, which imported around 1,000 tonnes each in 2023.

The Dutch market for pistachios is dominated by the United States, which supplies two-thirds of the imports. In 2023, 19% of Dutch imports came from Germany, followed by Turkey (3%). Imports from Vietnam amounted to 70 tonnes and 45 tonnes came from China. There were no pistachio imports from these two countries between 2019 and 2022.

The growing consumption of pistachios nuts in the Netherlands is driven by the healthy snacking trend. Pistachios are also used as a substitute for animal proteins. Pistachios are used as an ingredient, often in spreads like pistachio butter and sauces. Dutch consumers are already used to nut spreads as the Netherlands is the largest European consumer of peanut butter.

Some Dutch consumers and traders of pistachios source sustainable and ethically produced pistachios. The sustainable sourcing of pistachios in the Netherlands is strongly supported by initiatives like the Sustainable Nut Initiative (SNI). As such, implementing sustainable production schemes can be beneficial for suppliers that want to enter the Dutch pistachio market.

In 2022, around 38% of Dutch consumers were willing to pay more for brands that improve society or the environment. This is down from 42% in 2021, according to the Healthy & Sustainable Living report (PDF) by GlobeScan.

One prominent pistachio trader and agent is QFN Trading and Agency. Other examples of Dutch pistachio importers and traders include Catz International, Nutland, Rhumveld, Global Trading and Agency (GTA) and Delinuts. In the Netherlands, most pistachios are sold to consumers as private label products like Albert Heijn and Jumbo. The consumption of unbranded, freshly roasted nuts (e.g. sold in paper bags) is also significant.

Tips:

- To learn more about the Dutch pistachio industry, contact the Dutch Southern Fruit Association (NZV). The website is in Dutch, but you can use Google Translate to read it.

- To keep informed about sustainability developments in the Dutch nut industry, follow the latest SNI news.

- Consult the USDA’s free exporter annual guide to the Netherlands. It describes three market sectors (food retail, food service and food processing) and looks at market entry strategies.

4. Which trends offer opportunities or pose threats in the European pistachio market?

Rising demand for healthy snacking and the sustainable sourcing of plant-based food are the leading driving forces behind the growing consumption of pistachios in Europe. With growing interest in vegan diets, the consumption of salty and salt-free nuts (‘healthy snacking’), nut spreads (such as pistachio butter) and the drinks produced from edible nuts (nut milk) is on the rise, because consumers need to satisfy their protein needs and cope with lactose intolerance in the absence of animal proteins.

To find out more about general trends, read our study about trends on the European processed fruit and vegetables market.

Healthy snacking and less processed food

Nuts like pistachios have a good reputation amongst European consumers. The consumption of nuts is expected to grow in the snack segment. Many consumers enjoy less processed snacks, and pistachios can be consumed in this less processed form. In major consuming countries, pistachios are considered a healthier alternative to other savoury snacks, such as crisps and extruded snacks. They are also perceived as more beneficial to the health than peanuts, which are a legume.

Pistachios contain important vitamins, fibre and essential minerals. These minerals include copper, manganese, potassium, calcium, iron, magnesium, zinc and selenium. Pistachios, along with cashew nuts, have the lowest fat content among nuts. Pistachio nuts are also rich in heart-healthy monounsaturated fats. Pistachios are also a source of poly-unsaturated fats, including the essential Omega-3 fatty acids, which are important for the health of the brain and heart.

Nuts mainly contain the healthy mono and poly-unsaturated (Omega-3 and Omega-6) fats. They also usually contain a much lower proportion of the ‘bad’ saturated fats (<15% total fat). The type of fat you eat is more important than the total amount, according to research cited by the Nuts for Life platform using contributions from the Australian government.

Six out of ten European consumers want to improve their eating habits according to recent Euromonitor findings. In addition to the demand from the consumer side, healthy eating is now increasingly being debated by European governments that want to take further action. Pistachio suppliers also stand to benefit from the growing popularity of fortified protein snacks, which often use nuts.

Sourcing of sustainably-produced pistachios

Sustainability claims and certification in the edible nut trade are important and growing trends in the mainstream market. In 2020, the EU established an official policy called the European Green Deal, which includes the Farm to Fork Strategy and the Biodiversity Strategy. Both policies affect food production and trade.

In the edible nuts sector, several large traders have joined the Sustainable Nut Initiative with the aim of stimulating traceability and sustainability. Among the many tools to reach this goal, the initiative provides a management information system (3S: Sustainable Supply System). The aim of the system is to stimulate productivity and quality, and to create traceability and transparency in the supply chain.

By joining the sustainable nut initiative, developing country suppliers can become more competitive in the European market. The risk assessment helps companies focus on the most urgent sustainability risks. Companies can achieve crucial competitive advantages by treating farmers fairly and improving their livelihoods.

The pistachio tree is, by nature, a drought-resistant plant, but the precise application of water at certain times in its growth cycle is critical to produce perfect pistachios. While some areas are no longer in use due to water management issues, new areas are being planted with pistachios. Recent research has shown that pistachio production is environmentally and economically sustainable in Mediterranean areas. This is true even for areas with 500 mm of annual precipitation with the addition of as little as 100 mm of irrigation water per year.

There are new options for pistachio growers who wish to avoid the use of rodenticides. For example, American pistachio growers use predatory birds to protect orchards from rodents and nut-eating birds who destroy pistachio crops. Growers place nesting boxes in and around orchards as homes for owls and hawks that keep pests at bay.

Iran’s Hiva Nuts offers a wide range of pistachios from different areas of Iran, including Kerman, Damghan and Ghazvin. The company states that it uses sustainable farming practices to ensure the health and vitality of its orchards.

Tips:

- Promote the various applications and nutritional properties of pistachios. Take a look at the INC news page to find news on studies published in scientific journals.

- Read the CBI’s study on demand for processed fruit and vegetables to learn more about trade trends and the size of specific market segments

- Check the websites of trade shows to discover the newest trends. The most important trade fairs in Europe that are relevant for pistachios are SIAL, Anuga and BioFach. Monitor product reformulation trends and initiatives for developing healthier snacks on the European Snacks Association website.

- Read more about sustainable pistachio production from the American Pistachio Growers association.

- Watch this recording of a round table on the sustainability of pistachio production. The round table, which features leading industry players, was recorded by the INC in London in May 2023.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research