The European market potential for accessible tourism

Accessible Tourism for people with disabilities is a large, valuable market. It does not focus on what tourists cannot do, but on what they can do. The European market offers many opportunities, as it is growing and still largely untapped. For this reason, competition is limited. France, the United Kingdom and Germany offer the main markets. Trends that offer opportunities include focussing on multi-generational travel and offering soft-adventure activities that are suitable for disabled travellers.

Contents of this page

1. Product description

Accessible tourism is the ongoing endeavour to ensure that tourist destinations, products and services are accessible to all people, regardless of their physical limitations, disabilities or age. It encompasses publicly and privately owned tourist locations. In addition to benefitting people with permanent physical disabilities, it also helps parents with small children, elderly travellers, people with temporary injuries (e.g. a broken leg) and their travel companions. Tourists with disabilities may travel individually, in groups, with family members or with caretakers.

Types of disability

Accessible tourism enables all people to participate in and enjoy tourism experiences globally. According to the World Health Organization, accessible tourism is an umbrella term that covers physical impairments, activity limitations and restrictions to participation. Although some disabilities are visible, many are not, as they can be caused by long-term physical, mental, intellectual or sensory impairments. The UN World Travel Organization (UNWTO) has developed a toolkit for tour operators and other related leisure businesses. In addition, ISO certification is available for quality assurance. The links are available under the heading ‘Tips’.

In addition to people with disabilities, accessible tourism applies to all other people who may benefit from accessible infrastructures, including elderly people, those carrying heavy luggage and parents with small children. Accessible tourism is thus relevant for anyone who needs special support when travelling, including senior citizens. Accessibility issues can arise for people of any age. Like everyone else, people with disabilities have the right to travel anywhere in the world. This is expressed in the global Sustainable Development Goal 10, which aims to ‘reduce inequality within and among countries’. The figure below shows that, of all disabled people (including senior citizens), one third experience mobility problems.

Needs of disabled travellers

Accessible tourism is a broad theme. It involves diversity and customized, specialized travel. According to the definition of the European Network for Accessible Tourism (ENAT), accessible tourism includes the set of ‘services and facilities’ (e.g. physical environment, transportation, information and communication) that enable people with special access needs (either temporary or permanent) to enjoy a holiday and leisure time without experiencing any particular barriers or problems. At the same time, however, people with disabilities often experience barriers that prevent them from full and effective participation in society on an equal basis with others, as many tourism and hospitality services do not cater to people with access needs. These obstacles may have to do with physical facilities, as well as with the digital, social and financial facilities that make travel possible.

Challenges for people with disabilities can include:

- Lack of information on accessible facilities, services, equipment rentals and tourist attractions;

- Inaccessible booking services and related websites;

- Untrained professional staff capable of informing and advising about accessibility issues;

- Lack of accessible airports and transfer facilities and services;

- Inaccessible streets and transport services;

- Lack of adapted and accessible hotel rooms, restaurants, shops, toilets and public places;

- Lack of barrier-free attractions and other destination-related services;

- Reviews of the tourist segment and stories to encourage travel.

Figure 2: Sustainable Development Goal 10

Source: adapted from the United Nations

Certified products

Businesses with customized offerings or that have received awards or certifications have a competitive advantage over others. Various national and international institutions help businesses and destinations achieve certification. Awards for holidays catering to people with disabilities (such as the awards presented by Zoover in the Netherlands) also create opportunities to diversify your products and services. In 2018, the Dutch tour operator TENDENS travel won this award. The company sells packages for small groups. Together with their clients, they create excursions for each day, depending on the capabilities and energy of the client. For more complicated packages, they draw on partnerships with specialized organizations. The key to success is knowing the customer’s journey.

Best practice: Tour operator Travaxy

The UNWTO selected the tour operator Travaxy as a best practice. In line with Sustainable Development Goal 10, the company enables offline/online travel agencies and travel application programme interfaces to locate the most accurate services for travellers with disabilities and senior travellers who need assistance. They do this according to disability type and needs, thereby ensuring a worry-free holiday. The tour operator controls the entire distribution process. For example, it provides airlines with accurate information about the passenger’s disability, the type of assistance needed and all associated equipment and documentation. In addition, the hotel offerings are drafted by disability type, with sub-filters for specific requirements.

Tips:

- If you would like to welcome visitors with special needs, you will need to arrange for all elements of the customer journey, like accessing information, long-distance travel of various sorts, local transportation, booking accommodations, shopping and dining.

- Closer cooperation with other local service providers, healthcare organizations and volunteers leads to greater the success. The provision of accessible services, packages, healthcare services and attractions is assured throughout the entire customer journey,

- Consult your customers. They are the ones with experience. Healthcare workers and family members of the target group can also provide valuable information.

- Inform yourself on how to provide accessible tourism. Consult these two helpful manuals:

- (1) REopening tourism for travellers with disabilities: How to provide safety without imposing unnecessary obstacles (published by UNWTO, ONCE and ENAT);

(2) ISO - ISO 21902:2021 - Tourism and related services — Accessible tourism for all — Requirements and recommendations. With guidelines for accessible tourism worldwide to help manufacturers, service providers, designers and policymakers create products and services that meet the accessibility needs of every person (published by International Standardization Organisation ISO).

2. What makes Europe an interesting market for accessible tourism?

Accessible tourism is a niche market that is growing gradually. The market for accessible tourism is expected to increase throughout the world in response to changes in society and increasing opportunities for access. Destinations in Southern and South-eastern Asia and Africa are increasingly popular with European tourists with accessibility needs.

According to a market study conducted by the Harris Interactive/Open Doors Organization in the United States, the expansion of accessible travel opportunities has now led disabled travellers to spend more than USD 13 billion a year on travel-related services. This includes more than 17 million hotel visits and 9.4 million airline flights. These figures are attracting the attention of the travel industry as never before.

The travel and tourism industries should view disabled travellers with specific access requirements as a business opportunity and possible competitive advantage. According to recent UNWTO estimates, the potential market of people with disabilities in the European Union (EU) comprises more than 80 million people, and even 130 million when including senior citizens and their travel companions. The overall number of people with disabilities is likely to grow, especially as baby boomers age. Most (70%) people with disabilities in the EU do are financially and physically able to travel.

Data from a report of the European Travel Commission (GFK) in 2014 provide a detailed overview of the features of accessible tourism in Europe (Table 1). The number of day trips in Europe indicates the need for travel within and outside the country. Particularly interesting for outbound travel are the number of overnight stays outside the European Union (EU27), which accounted for 12.5% of all travel in 2012, and 15.7% for people 65 years of age and older. Unfortunately, more recent data are not available. Nevertheless, these figures give a proper indication of the scope of tourism by Europeans with disabilities. Given the standstill in international tourism during the past three years, the data are more current than they may seem. This also applies to the other statistics reported in this section. Please note that, in 2012, the United Kingdom was still part of the European Union.

Table 1: Key statistics on the demand for accessible tourism in the European Union, 2012

| Day trips: | People with disabilities | People 65 years of age and older with disabilities |

| Number of day trips per year | 6.7 | 6.9 |

| Total number of day trips | 169.9 million | 225.6 million |

| Number of day trips to destinations outside the EU27 | 4.2 million (2.5%) | 1.1 million (0.5%) |

| Average total spending | € 74.4 | € 81.6 |

| Overnight stay trips: | ||

| Number of overnight stay trips per year | 6.7 | 5.5 |

| Total number of overnight stay trips | 169.7 million | 217.6 million |

| Number of overnight stay trips to destinations outside the EU27 | 21.2 million (12.5%) | 15.7 million (7.2%) |

| Average total spending | €798 | €852 |

Source: GfK, 2012 (United Kingdom still included in the European Union)

In 2012, France, Germany and the United Kingdom were the EU countries with the highest access needs. They constituted the three major source markets in Europe. France, Germany, the United Kingdom (and Italy) had the largest elderly population. Relative to population, France and the United Kingdom had the largest share of population with accessibility needs, with 10 million and 11 million people, respectively. In the Netherlands, younger travellers with disabilities are a significant group, as they are eager to travel. Spain and the Netherlands rank fourth and fifth as source markets for accessible tourism in the European Union.

In 2012, the favourite regions for people with specific accessibility needs were the Americas and Africa and the Middle East (Figure 3). At the country level, China (61 million), the United States (32 million) and Brazil (32 million) were the most important destinations. Please note that Egypt was the only individual country outside Europe/EU27 with a share of 5% or higher. Countries with smaller shares are not listed.

In 2012, the most frequently mentioned reason for people with disabilities in the EU to travel was ‘interest in local culture, nature or sightseeing opportunities’ (61%). Most of these travellers (59%) stayed in hotels/B&B (59%).

The most popular activities that European tourists with disabilities undertake during their holidays are as follows: shopping (65%); dining out at a local restaurant or café and trying local food and drink/going out (64%); sightseeing/walking around (63%); social activities and spending time with family or friends (59%); cultural visits (museums, monuments, arts, heritage) (49%); walking, hiking or running (45%); and swimming/sunbathing (45%).

When Europeans with disabilities consider a holiday, the five most important aspects are as follows: transport to and from the destination (53%), accessibility of booking services (53%), nature (48%), safety (48%) and the availability of information once at the destination (47%). The five most important accessibility aspects in buildings (e.g. hotels and museums) are the accessibility of restroom facilities; the accessibility of parking facilities; the ease of use of lifts; the ease of use of furniture, furnishings and lights; and mobility within the building.

Most (74%) customers with disabilities choose their holidays based on the advice of other people (e.g. family, friends, colleagues and their reviews).

Organizing tours for travellers with disabilities is a niche market with great potential to grow. It is complex, however, and not easily arranged. This is because barrier-free travel must be considered throughout the entire customer journey. It requires arrangements with providers of products and services in the economic, social and healthcare domains. It therefore involves a collaborative process amongst all stakeholders, governments, international agencies, tour operators and end-users, including people with disabilities and their organizations. The provision of successful tourism products requires effective partnerships and cooperation across many sectors at the national, regional and international levels, from idea to implementation

Accessible tourism experiences should take place in beautiful, welcoming environments that are designed for all kinds of tourists, both with and without disabilities. Accessibility and respect for diversity, whether visible or invisible, will create a hospitable environment for both visitors and staff. This creates a well-organized work environment, a competitive advantage, awards and, if desired and appropriate, certification, new revenue streams and customer loyalty. Inclusion drives innovation, service quality and business success. This kind of business and development of European destinations is based on the elements of ‘Universal Design’.

Tips:

- Offer excellent service to make your guests act as marketers for your business.

- Promote the accessibility of your business or offer help through your website, brochure or catalogue, or through the travel agent with whom you are cooperating. The majority (68%) of all people with disabilities prefer this type of assistance from the tourism industry.

3. Which European countries offer most opportunities for accessible tourism?

The niche market for accessible tourism is steadily growing. No recent data are available about the demand for accessible tourism in European countries. According to statistics from 2012, however, France, the United Kingdom, Germany, Spain, the Netherlands and Sweden are the European markets with the biggest potential. Table 2 presents a description of these markets.

Table 2: Top 6 source markets for accessible tourism in Europe, with key figures, 2012

| EU Country | Number of trips in millions (includes day trips and overnight stay trips) |

| France | 161.1 |

| United Kingdom | 156.0 |

| Germany | 121.4 |

| Spain | 54.8 |

| Netherlands | 39.5 |

| Sweden | 32.3 |

Source: GfK, 2012

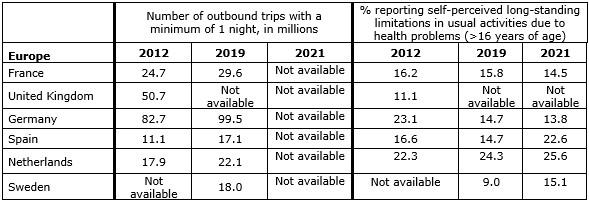

Statistics about outbound travel by people with disabilities are not retrievable. To provide an indication, Table 3 presents alternative statistics on outbound overnight-stay tourism and how people feel about any personal limitations they might have. These perceptions range from ‘some limitations’ to ‘severe limitations’, depending on the type and level of disability (e.g. functional or mental). These figures reveal an increase in outbound overnight-stay tourism (based on available data) from 2012 to 2019 (the year before the start of the COVID-19 pandemic, which severely affected international travel). In the same period, the percentage of Europeans reporting at least some limitations in their usual activities due to their health situation decreased in France, Germany and Spain, and increased in the Netherlands. Taken together, these developments suggest that, in the years before COVID-19, the market for people with disabilities became slightly larger in France, Spain and the Netherlands, whilst apparently declining slightly in Germany.

Table 3: Change in outbound tourism and self-reported disability in Europe

Source: Disability statistics - Statistics Explained (europa.eu)

The statistics above do not reflect the senior market, which is also growing in the European countries in which most people with disabilities travel.

The following sections present figures on people with disabilities living in the EU countries that generate the most tourism.

France

In France, 14% of all tourists with disabilities travelled outside the EU in 2012. They tended to travel in groups, with an average size of 3 people. Travellers with disabilities spent more than older travellers (65 years of age and older) on overnight stays. They spent less on day trips. French travellers were more likely to stay in rental houses or flats, or in spas or wellness resorts. They were less likely than average to stay in hotels or B&B. Relative to the European average, French tourists with access needs are more likely to go sightseeing but less likely to take part in local events. They are likely to experience more barriers to aspects they consider important when choosing a destination than do residents of other countries. This is especially the case with regard to transport to and from the destination.

Table 4: Country statistics on the French market for accessible tourism

| Average number of day trips per year, people with disabilities | 5.7 million |

| Average number of overnight-stay trips per year, people with disabilities | 6.3 million |

| Proportion of day trips with a destination outside the EU27 | 2.4% |

| Proportion of overnight-stay trips with a destination outside the EU27 | 14.0% |

| Average group size for people with access needs (i.e. people with disabilities aged 15–64 years + elderly people 65 years of age and older) | 3.1 |

| Average daily spending by people with disabilities, day trips | € 74 |

| Average daily spending by people with disabilities, overnight-stay trips | €99.50 |

| Average daily spending by people 65 years of age and older, day trips | €90.90 |

| Average daily spending by people 65 years of age and older, overnight-stay trips | €110.20 |

Source: GfK, 2012

The United Kingdom

In 2012, when the UK was still part of the EU, 15.2% of all residents with disabilities travelled to destinations outside the EU. On average, they travelled in groups of three. People with disabilities spent less than older travellers (65 years of age and older) did on day trips and overnight stays. According to statistics from 2016 (after the UK had left the EU), travel by people with disabilities increased. Compared to other tourists in the EU, those from the UK are more likely to stay in B&B facilities and less likely to stay in spas or wellness resorts. Travellers from the UK are more likely than those from other EU countries to spend time with family or friends. Residents of the UK are more likely than average to rely on their own experience when preparing for a trip. They are also more likely to search on the internet. They are less likely than travellers from other EU countries are to experience barriers during their holidays.

Table 5: Country statistics on the UK market for accessible tourism

| Average number of day trips per year, people with disabilities | 6.7 million |

| Average number of overnight-stay trips per year, people with disabilities | 6.9 million |

| Proportion of day trips with a destination outside the EU27 | 2.8% |

| Proportion of overnight-stay trips with a destination outside the EU27 | 15.2% |

| Average group size for people with access needs (i.e. people with disabilities aged 15–64 years + elderly people 65 years of age and older) | 3.4 |

| Average daily spending by people with disabilities, day trips | €75.80 |

| Average daily spending by people with disabilities, overnight stay trips | €103.30 |

| Average daily spending by people 65 years of age and older, day trips | €137.60 |

| Average daily spending by people 65 years of age and older, overnight-stay trips | €174.80 |

Source: GfK, 2012

Germany

In 2012, 11.8% of all Germans with disabilities travelled to destinations outside the EU. On average, they travelled in groups of three. People with disabilities spent more than those 65 years of age and older did on day trips and overnight stays.

Table 6: Country statistics on the German market for accessible tourism

| Average number of day trips per year, people with disabilities | 7.3 million |

| Average number of overnight-stay trips per year, people with disabilities | 6.3 million |

| Proportion of day trips with a destination outside the EU27 | 3.9% |

| Proportion of overnight-stay trips with a destination outside the EU27 | 11.8% |

| Average group size for people with access needs (i.e. people with disabilities aged 15–64 years + elderly people 65 years of age or older) | 3.3 |

| Average daily spending by people with disabilities, day trips | €84 |

| Average daily spending by people with disabilities, overnight-stay trips | €123.60 |

| Average daily spending by people 65 years of age and older, day trips | €74.30 |

| Average daily spending by people 65 years of age and older, overnight-stay trips | €112.70 |

Source: GfK, 2012

Spain

In 2012, 9.3% of all Spanish people with disabilities travelled to destinations outside the EU. On average, they travelled in groups of three. People with disabilities spent more than those 65 years of age and older did on day trips and overnight stays. Compared to those from other EU countries, Spanish people with disabilities are less likely to stay in tents, caravans or motor homes, and they are more likely to stay in hotels or B&B facilities. They are also more likely to prefer to include hiking and dining out in their programmes. Spanish tourists prefer to book in person more than those in other countries do. They are also less likely than other EU travellers to experience barriers with reference to nature and the way tourists are treated.

Table 7: Country statistics for the Spanish market for accessible tourism

| Average number of day trips per year, people with disabilities | 7.8 million |

| Average number of overnight-stay trips per year, people with disabilities | 8.0 million |

| Proportion of day trips with a destination outside the EU27 | 1.0% |

| Proportion of overnight-stay trips with a destination outside the EU27 | 9.3% |

| Average group size for people with access needs (i.e. people with disabilities aged 15–64 + elderly people 65 years of age and older) | 3.1 |

| Average daily spending by people with disabilities, day trips | €83.90 |

| Average daily spending by people with disabilities, overnight-stay trips | €116.10 |

| Average daily spending by people 65 years of age and older, day trips | €65.50 |

| Average daily spending by people 65 years of age and older, overnight-stay trips | €111.10 |

Source: GfK, 2012

The Netherlands

In 2012, 18.2% of all Dutch people with disabilities travelled to destinations outside the European Union. On average, they travelled in groups of three. People with disabilities spent more than those 65 years of age and older did on day trips and overnight stays. Compared to those in other EU countries, residents of the Netherlands are more likely to prefer to swim and sunbathe, and they are less likely to stay with family and friends and to go sightseeing. Dutch travellers with disabilities are less likely than those from other EU countries are to rely on other people and media when planning their holidays. They are more likely to use the internet (like those from the UK). They experience fewer barriers with the accessibility of booking services and various transport types than do tourists from other EU countries.

Table 8: Country statistics on the Dutch market for accessible tourism

| Average number of day trips per year, people with disabilities | 5.8 million |

| Average number of overnight-stay trips per year, people with disabilities | 6.0 million |

| Proportion of day trips with a destination outside the EU27 | 4.4% |

| Proportion of overnight-stay trips with a destination outside the EU27 | 18.2% |

| Average group size for people with access needs (i.e. people with disabilities aged 15–64 + elderly people 65 years of age and older) | 3.1 |

| Average daily spending by people with disabilities, day trips | €73.10 |

| Average daily spending by people with disabilities, overnight-stay trips | €95.50 |

| Average daily spending by people 65 years of age and older, day trips | €52.10 |

| Average daily spending by people 65 years of age and older, overnight-stay trips | €70.40 |

Source: GfK, 2012

Sweden

In 2012, 8.3% of all Swedish people with disabilities travelled to destinations outside the EU. On average, they travelled in groups of three. Compared to people 65 years of age and older, people with disabilities spend more on day trips and overnight-stay trips. Compared to the average EU tourist with disabilities, those from Sweden are more likely to travel in autumn. According to these figures, Swedish tourists with disabilities are more difficult to satisfy than those from other countries. They assigned lower scores on a wide range of aspects relating to accessibility.

Table 9: Country statistics for the Swedish market for accessible tourism

| Average number of day trips per year, people with disabilities | 7.7 million |

| Average number of overnight-stay trips per year, people with disabilities | 8.0 million |

| Proportion of day trips with a destination outside the EU27 | 1.3% |

| Proportion of overnight-stay trips with a destination outside the EU27 | 8.3% |

| Average group size for people with access needs (i.e. people with disabilities aged 15–64 + elderly people 65 years of age or older) | 3.3 |

| Average daily spending by people with disabilities, day trips | €84.70 |

| Average daily spending by people with disabilities, overnight-stay trips | €109.00 |

| Average daily spending by people 65 years of age and older, day trips | €56.50 |

| Average daily spending by people 65 years of age and older, overnight-stay trips | €93.60 |

Source: GfK, 2012

4. Which trends offer opportunities or pose threats on the European market for accessible tourism?

People with access needs are not a uniform group. Although some overall trends are consistent, results vary across groups (e.g. people travelling with children, people 65 years of age and older, and people with disabilities) and countries. Within countries, variation also occurs across types of disability. Nevertheless, available figures highlight two trends within the niche market for accessible tourism in Europe: the growing demand for multi-generational holidays and the growing interest in adventure travel (with options including diving, deep-sea fishing, kayaking and safaris).

Multi-generational travel

Multi-generational travel refers to holidays that multiple generations within one family spend together. These family groups usually consist of children, parents and grandparents, but they can also include aunts, uncles, cousins and adult siblings. These groups seek experiences that create closer bonds and that enable them to share lasting memories during a well-deserved break. Private guided tours appear to be becoming more popular with families wishing to re-unite. These tours include a private bus and travel director.

The trend is reinforced by the rise of blended or reconstituted families and the verticalization of families. Blended families are composed of two previously divorced persons with their single-parent families, children and, in principle, eight grandparents. The verticalization of families means that, because grandparents are living longer than was the case a few decades ago, they have more time to spend with their grandchildren. As a consequence, the care for the grandchildren is shifting from the siblings and cousins in traditional extended families to the grandparents in modern vertical families.

The business advantage of this niche is that multi-generational families tend to book earlier, and they prefer to take multiple holidays each year. In many cases, they end a family vacation by planning the next one. The key product for this market niche is an accommodation that allows the three generations to stay together comfortably and share quality time. Multi-generational travellers prefer to stay in accommodations that offer a measure of space and privacy to everyone; connecting rooms; and destinations that are colourful, off the beaten track and unique for the family to explore and discover together and, obviously, that feature plenty of chances to swim in pools or at the beach. Ancestral tourism could be a way to give more meaning to a multi-generational holiday and to explore the family’s common heritage.

Several African countries have apparently become top destinations for multi-generational trips, owing to their once-in-a-lifetime cachet for those who can afford it (for example, see NextAvenue). Myanmar is a new, emerging destination for multi-generational families. African safaris (e.g. to the Serengeti) are also popular. Because many lodges have a minimum age limit, they are suitable for adventurous families with older children. Other suggestions are listed on the Africa Endeavours website. One type of holiday that offers opportunities for this market is the heritage trip, which can include a visit to a family’s hometown or country.

Multi-generational travellers are increasingly returning to the new generation of travel agents (OTAS). They are becoming aware of the value of experienced travel agents who are able to customize trips to make them perfectly suited to their families. Experienced travel agents thus offer another opportunity for approaching this market.

According to expectations, multi-generational travel should increase again as tourism recovers following the COVID-19 pandemic. The most important reason is that, in many cases, family members have not been able to meet for a long time, and travel restrictions have forced them to skip a number of holidays. Multi-generational holidays have the added advantage of offering a kind of family reunion and a chance to reconnect once everyone in the family has been vaccinated.

The safety of destinations and hotels will continue to be an important factor. Travellers are therefore likely to favour accommodations that are perceived as cleaner (e.g. larger villas and private homes), away from busy resorts or popular destinations and more remote. This is especially the case for families that include members in more vulnerable age groups. Options to consider include contactless payment systems, automatic locks that can be opened without contact using a smartphone and frequent disinfection of facilities.

Tips:

- Have a large accommodation in prime condition that offers space for privacy. One example is the ‘reunion bungalow’ of Landal Green Parks in the Netherlands, which can accommodate up to 18 people and is equipped with nine bedrooms, nine bathrooms and multiple kitchens.

- Provide activities that family members can do together (e.g. private guided tours).

- Offer sufficient leisure facilities for all age groups, including kids’ clubs for young children, game and evening entertainment for tweens, sports and spa programmes for teenagers or babysitting services that allow parents to go out.

Adventure travel

Adventure travel refers to trips that include at least two of the following elements: physical activity, natural environment and cultural immersion. Such travel often involves risk and a certain level of skill on the part of the tourist. Adventure tourism is a very large segment, and it consists of many niche markets. One important distinction within the adventure-tourism segment is between ‘soft’ adventure' travel and ‘hard’ adventure travel. There are many different niches. Examples include wildlife watching, birdwatching, fishing, ecotourism, cycling, walking, community-based tourism, water sports, diving, sailing and scientific, volunteer and education tourism.

Adventure tourism contributes greatly to local economies. Approximately two-thirds of all money spent on adventure travel stays on site. On average, this amounts to approximately €350 per visitor, per day. For example, Green Safaris in Zambia offers high-end, sustainable safaris, and Tanzania Birding offers bird-watching experiences in Tanzania.

Accessible tourism will be the golden key of future, not only for making profit but also for achieving a sustainable environment. A fair and inclusive society is the basis for the implementation of the UN Sustainable Development Goals (SDGs) and sustainable business endeavours. ‘If it is not fair, it will not fly’.

Europe is the main source market for adventure tourism companies in Africa (43%) and Asia (30%). Soft adventure is relatively easy for small businesses to offer, for various reasons. For example, it requires less expertise than is the case for other markets. It also requires less investment in expensive materials, and it involves less risk, therefore requiring fewer precautionary measures. On the other hand, the easier access of small businesses to this market also translates into more competition.

During the COVID-19 pandemic, adventure travel outside Europe vanished almost completely, mainly due to border restrictions. According to expectations, adventure travel will recover more quickly than other segments. Safety is likely to become the most important issue—not only in the physical sense, but also in terms of the images that people have of safety in your country or at your destination.

Tips:

- Build a dedicated website or web page for people with disabilities.

- In your facilities and during trips, use demonstration CDs with subtitles for people with hearing impairments.

- Provide equipment for individuals with accessibility requirement (e.g. wheelchairs, strollers for families with children, and walking sticks).

- Train your personnel about how to communicate with and behave towards individuals having special requirements.

- Have special volunteers to accompany tourists in specific places and activities, if necessary.

This study was carried out on behalf of CBI by Molgo and ETFI.

Please review our market information disclaimer.

Search

Enter search terms to find market research