Entering the European market for adventure tourism

Selling adventure tourism products on the European market is very competitive. There are many specialist adventure tour operators, OTAs (Online Travel Agents) and travel agents offering a wide range of adventure activities. They are bound by strict regulations and expect their buyers to comply with those regulations. Increasing numbers of Fully Independent Travellers (FITs) are buying directly from OTAs, which is the fastest growing sales channel for adventure tourism experiences.

Contents of this page

- What requirements must adventure tourism travel products comply with to be allowed on the European market?

- Through what channels can you get adventure tourism travel products on the European market?

- What competition do you face on the European adventure tourism market?

- What are the prices for adventure tourism travel products on the European market?

1. What requirements must adventure tourism travel products comply with to be allowed on the European market?

European adventure tourism tour operators must comply with strict regulations to ensure the safety of their travellers while travelling overseas and to protect them financially. This means that they will expect their foreign suppliers to do business in line with their Code of Conduct and Terms and Conditions. As you will be selling your adventure travel product to them, you must understand what these requirements are.

What are the mandatory and additional requirements that buyers have?

The mandatory and other requirements for adventure tourism are common across the tourism sector.

- The European Package Travel Directive - since the UK left the European Union in January 2020, it has been reported that both the EU and the UK will make changes to the existing package travel rules. These changes are likely to focus on providing better protection for customers and may not have much impact on local suppliers. You should continue to monitor the latest developments.

- General Data Protection Regulation (GDPR) – European and UK data rules are complex and you should make sure that you understand your responsibility to protect customers’ personal details.

- Liability Insurance and Insolvency Protection – check and assess your liability insurance policy to make sure that it is suitable for your business and customers. You should also check that you are protected against insolvency and that your buyers’ funds are protected. Most European buyers will need specific details about your insurance policies.

- Sustainability and Responsible Tourism – integrating sustainability into your business operations is essential if you want to successfully attract European buyers. Learn about sustainability in tourism in this CBI study: How to be a sustainable tourism business.

As a first step, you should read the CBI guide What requirements must tourism services comply with to be allowed on the European market. This provides detailed information about the requirements, both legal and non-legal. Information about relevant Standards is detailed section 3 of the guide: ‘What are the requirements for niche markets?’

What are the requirements for niche markets?

Requirement to manage risk in the adventure tourism sector

Managing risk is a key requirement for adventure tourism providers. Ensuring the safety of adventure travellers is of paramount importance and as the adventure tourism sector is constantly evolving, managing risks can be challenging. You should ensure that your adventure travel products comply with international and local adventure tourism standards. These are not mandatory requirements but if your products comply, European buyers will be more likely to do business with you.

The International Organisation for Standardisation’s (ISO) international standard for adventure management was developed in 2014. It helps adventure tourism providers to manage adventure tourism activities professionally. Consider the following ISO standards:

- ISO 21101:2014 provides a basis for adventure tourism activity providers to plan, communicate about, and deliver adventure tourism activities as safely as possible.

- ISO 21103:2014 specifies the minimum requirements for information to be provided to participants before, during and after adventure tourism activities.

- ISO 20611:2018 outlines sustainability good practices related to adventure tourism that will help mitigate the negative environmental, economic or social impacts of tourism and enhance the positive ones.

- ISO 21102:2020 establishes requirements and expected skills for leaders in and providers of adventure tourism activities, with the exception of scuba diving.

- If your business is for scuba diving, look at these standards covering recreational diving services.

- A new standard to cover service requirements for hiking and trekking activities is currently under development. If your business provides hiking and/or trekking activities, you should keep an eye out for when the standard is published.

The United Kingdom (UK) is one of the largest markets for adventure travel from Europe. The British Standard for Adventure Tourism (BS8848:2014) was created to o minimise the risk of adventure travel outside the UK. It was developed by the BSI, the UK National Standards Body. Most, if not all, adventure tour companies that are based in the UK ensure that their adventure travel products comply with this standard.

If your services meet the BS8848 standard, you will exceed the requirements of buyers in any market, which will give you a competitive advantage.

Tips:

- Carry out a risk analysis and identify all the potential hazards and risks that could be associated with the adventure tourism travel product that you offer. For more advice, read the CBI study How to manage risks in tourism.

- Consider purchasing the ISO 21101, ISO 21103 and ISO 20611 standards, so you know what they are and are able to apply what you can to your adventure tourism travel product.

- Exceed your customers’ expectations and purchase the BSI’s BS8848:2014.

Requirement to provide quality experiences

Every element of your adventure travel product needs to meet the quality standards that you commit to. For instance, a one-day excursion to see wildlife in its natural habitat might include the services of a guide, a local transport business, and a food provider. You are responsible for ensuring that the quality of each element matches what you have agreed with your buyer.

Your buyer will be relying on you to establish that appropriate safety and legal standards are met, according to their Code of Conduct/Terms and Conditions, and the contract that you have agreed.

Tips:

- Make sure the guides you use are well trained, qualified as necessary, personable, and speak the language of the group well.

- Offer your guides additional training where possible.

- If you use vehicles, ensure that they are modern, well maintained and safe. You should insist on proper documentation from your providers, which can offer proof to your buyer that you have contracted a reputable company to transport their clients.

- If you supply equipment such as bicycles or Segways, or specialist equipment for activities such as mountaineering or diving, you must make sure there is a firm process in place to service the equipment to legal minimum standards.

- Ask for reviews from participants on your trips. Publicise the positive ones and make sure you act on any negative views and work on any suggestions.

Presenting your adventure tourism travel products

You should have a good website, as it is the public face of your business. While this is not a legal requirement, it is a vital business tool in the travel industry. Your trade buyers will use your website to decide whether your adventure tourism travel product will meet the standards and expectations of their customers. Customers in the Fully Independent Traveller (FIT) market also widely use the internet and will rely on the information you provide to make their travel purchasing decisions.

Establish levels of skill, activity and/or fitness for adventure tourism travel products

Be clear what sort of adventure tourism travel product you are offering. Is it a ‘hard adventure’ or ‘soft adventure’ activity? Perhaps it combines two or more elements? You can familiarise yourself with the difference between hard and soft adventure activities by reading the CBI’s European Market Potential for Adventure Tourism Report, so you are clear about what you are offering.

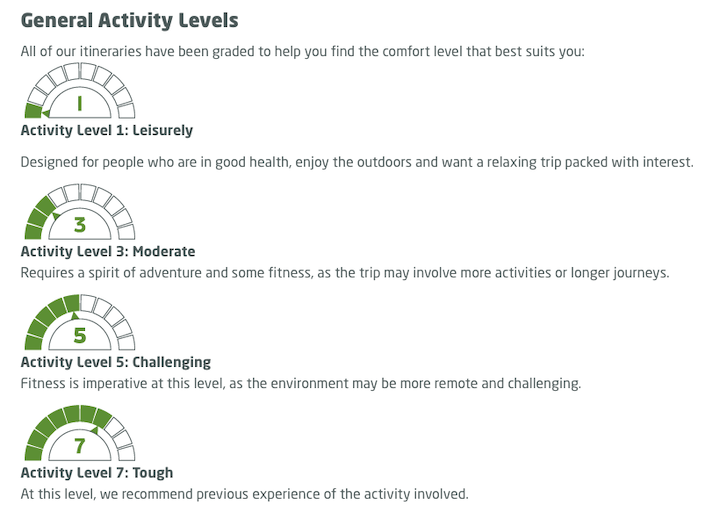

Some tour operators indicate the level of skill that is required to take part in their trips, along with the level of fitness recommended. You may wish to consider doing something similar and assign general activity levels, like the example below.

Figure 1: Example of Activity Levels for Adventure Tourism Trips

Source: Exodus Travels

Alternatively, you could assign more specific difficulty ratings and descriptions for your adventure tourism travel product, as per the examples below. The use of graphical images and diagrams are a good way of drawing the reader’s eye to important details you want to convey.

Chart 2: Example Difficulty Ratings

Source: Much Better Adventures

Payment terms

The contract you agree with your buyer should clearly state what your payment terms are. You must be sure that you are happy with the payment terms your buyer has offered. In Europe, businesses often expect payment terms of 30 days. If this does not suit you, try to negotiate a shorter term, but be aware that this may make you less competitive.

If you are selling directly to European adventure travellers, make sure that they can easily make payments. Credit card payments are convenient and common throughout Europe and offer both you and your customer peace of mind, as payments are protected by the credit card company.

Tips:

- Create or improve your website. For detailed tips, read the CBI study, How to be a successful tourism company online.

- Segment your activities by type and make it appealing to different types of traveller (see How is the end-market segmented section below.)

- Aim to partner with, and cross-market between, other local providers of similar or different adventure tourism travel products.

- Read more about negotiating contracts and payment terms in the CBI study, Tips for organising your tourism services export to Europe.

2. Through what channels can you get adventure tourism travel products on the European market?

To identify your ideal target market and the most appropriate sales channel, it is important to understand what motivates adventure travellers. The European adventure tourist market is diverse: there are many adventure activities to choose from and many activities can be combined during one excursion. High-quality, unique and inspiring experiences lie at the centre of adventure tourism trips. The chart below provides a visual of the three main segments: nature, culture, and physical activity. Traveller motivation influences the choice of adventure trip, and each ‘persona’ indicates a motivation for travel.

Figure 3: The Adventure Traveller and the Cross-over of Adventure Activities

Source: Visit Greenland

How is the end-market segmented?

In the European adventure traveller market, there is cross-over between the major consumer groups. These are Baby Boomers (born between 1946 and 1964), Gen X (born between 1965 and 1979), Gen Y or the Millennials (born between 1980 and 1995) and Gen Z (born from 1996 to 2015). Adventure travellers can also be segmented by the level of physical challenge (hard or soft adventure), how they travel (group or independent) and how much money and/or time they have to spend on travel.

In the table below, see how Baby Boomers (BB), Generation X (Gen X), Generation Y (Gen Y), Generation Z (Gen Z) are segmented by various markers.

Table 1: Adventure Traveller Market Segmented by Demographics, Hard vs Soft, Cash and Time

| Segment | Primary Demographic | Hard | Soft | Budget | Mid-Budget | Luxury | Time Rich | Time Poor |

| Backpackers | Gen Y, Gen Z | ✓ | ✓ | ✓ | ✓ | |||

| FITs | BB, Gen XY | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Small Group Travellers | BB, Gen XY | ✓ | ✓ | ✓ | ✓ | |||

| Tailor-made Group Travellers | BB, Gen XY | ✓ | ✓ | ✓ | ✓ |

Source: Acorn Tourism Consulting

Adventure traveller segments can be specified in more detail as follows:

- Soft adventurers: like to discover new things and activities during the day, such as hiking, canoeing/kayaking, surfing, food and rural tourism. They prefer a higher standard of accommodation and good food. Soft adventurers are the largest group of adventure tourists and cross over with all major traveller segments.

- Hard adventurers: take part in specialised activities that require skill and tend to favour higher-risk activities such as rock climbing, trekking in remote, isolated places, and kitesurfing. They are less interested in comfortable accommodation and prefer wild camping or basic hostels. Hard adventurers are a smaller group, and they share characteristics with the FIT market.

- Backpackers and budget adventure travellers: this market is dominated by younger travellers aged 18+ who have less money and more time to spend on travel. They often travel during a ‘gap year’, i.e. after leaving school and before starting university. Their budget is modest and they look for good-value travel experiences. They like to experience interesting and exciting adventures and they spend their money locally.

- Fully independent travellers (FIT): FITs do their own research and make their own travel plans online and by word of mouth. They book flights, transport and accommodation through OTAs or directly with providers, and adventure experiences directly with local operators. FITs are usually small groups of couples or friends/family, and retirees.

- Small group package travellers: this segment usually books pre-packaged trips through dedicated adventure tour operators. They like to travel in small groups, meeting like-minded people, and their trips are usually guided. The operator makes the bookings for the various elements of the trips (flights, local transport and accommodation, adventure experiences).

- Tailor-made group travellers: this traveller segment likes to work with a specialist tour operator to design a holiday that meets their specific needs. This type of traveller is more likely to be a high-end, wealthy consumer and to demand high quality throughout the trip.

Tip:

- Read more about these groups. The CBI has published several studies about promising traveller markets, including the FIT Market, the Gen Y Market, Multi-Generational Market, and Solo Tourism.

Through what channels do adventure tourism travel products end up on the end-market?

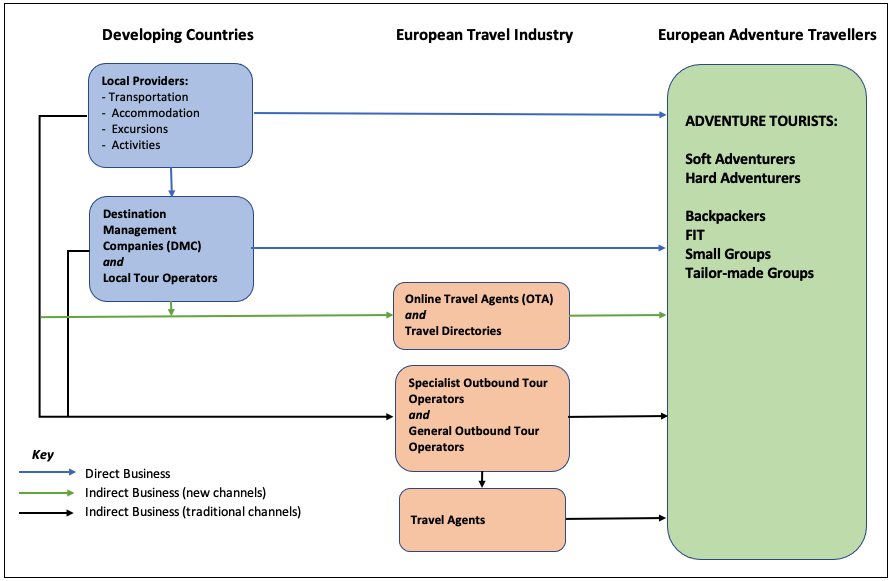

European tour operators, travel agents and online travel agents (OTAs) are the main sales channels for adventure travel tourism products. The European tour operator market for adventure tourism is very large and there are hundreds of tour operators selling adventure travel products to European travellers. The European Travel Agents’ and Tour Operators’ Associations (ECTAA) represents more than 70,000 tour operators and travel agents in Europe.

Figure 4: Flow of Adventure Tourism Sales via the European Travel Industry

Source: Acorn Tourism Consulting

To summarise the main European sales channels in the adventure tourism segment:

Specialist tour operators target adventure tourists with a broad range of holidays to destinations where they have expertise and knowledge. They also provide multiple activities and experiences. Some operators focus on the ‘gap year’ market, others on the small group and tailor-made market. The larger operators target several markets.

Examples include:

- Globetrotter Abenteuer, Diamir, World Insight (Germany)

- KE Adventure Travel, Wild Frontiers Travel, Rainbow Tours (UK)

- Adeo Voyages, Nomade Aventure, Terre d’Aventure (France)

- Sawadee, Battuta Reisen, Better Places (Netherlands)

General tour operators sell general package holidays as well as adventure holidays, often to beach or city destinations.

- German-owned TUI is Europe’s largest general tour operator, and its TUI Blue brand offers active adventures. DER Tour has several brands that cover many different holiday experiences. Kuoni is one of its adventure travel brands.

Online Travel Agents (OTAs) that specialise in selling excursions, guided tours and experiences are the fastest growing sales channel in day and multi-day tours. Some well-known platforms include:

- Viator, Airbnb Experiences (Global)

- Responsible Travel, TourHub, Much Better Adventures (UK)

- GetYourGuide (Germany)

- Musement (Italy)

- Bonogo (France)

Travel Directories and Metasearch sites are online marketplaces that offer comparisons of travel-related services from a wide range of companies. These are also referred to as OTAs. The main difference is that they do not process sales but transfer them to the Examples include:

- SafariBookings (Netherlands)

- TourHound (UK)

Tip:

- Find out more about working with OTA’s in these online blogs, How to work with OTAs and, Working with OTAs.

What is the most interesting channel for you?

As a local provider of an adventure tourism travel product, specialist tour operators and OTAs are the most interesting channels for you to work with.

Specialist Tour Operators usually create itineraries that feature a range of experiences during the trip. They look for local suppliers that can offer authentic experiences. These could include visits to a local community or heritage centre, activities like white-water rafting or game drives in safari parks. Other experiences could be gorilla trekking, bird watching trips, 4WD dune buggying or a cycle ride/hike on a marked trail.

To access the FIT market, OTAs offer a good opportunity. FITs are keen users of technology and are most likely to book an experience online. However, it is important that you weigh up the pros and cons of working with an OTA (see table above) and consider other routes to market as well. If FITs book directly with you, it will reduce the commission you have to pay third parties, but you will need to invest in a professional website with good SEO (search engine optimisation) and keep it up-to-date and well maintained. Consult the CBI report on How to be a successful tour ism company online for tips on building your own website.

Tips:

- Download the CBI study How to work with OTAs and investigate suitable businesses to work with.

- Download the CBI’s Tips for Finding Buyers in the European Tourism Sector. It provides useful tips on researching tour operators in the market and visiting trade and consumer fairs to make connections with specialist tour operators and other relevant organisations.

3. What competition do you face on the European adventure tourism market?

Which countries are you competing with?

India, Jordan, Kyrgyzstan, Morocco, Peru and Zambia are among the top competing destinations (see table below). Adventure travellers look for destinations that have a good reputation for adventure, accessibility and affordability.

There are many more adventure destinations and you should identify other key competitors in your region. For instance, neighbouring countries such as Nepal, Uzbekistan, Ecuador, Zimbabwe and Egypt also provide excellent adventures for the adventure tourist. You should keep up to date with blogs and listings like National Geographic's Seven Adventure Destinations for 2022 and beyond or Lonely Planet’s Best in Travel 2022.

Table 2: Top Competing Destinations in Developing Countries

| Developing Country | Region |

| India | South Asia |

| Jordan | Middle East |

| Kyrgyzstan | Central Asia |

| Morocco | North Africa |

| Peru | Latin America |

| Zambia | Sub-Saharan Africa |

Source: Acorn Tourism Consulting

India

The adventure travel market in India is large and highly diverse. The sector is expected to grow from US$ 0.3 billion in 2019 to US$ 2.0 billion in 2028, representing a compound annual growth rate (CAGR) of 20%. There are an estimated 25,000 adventure tour operators in India, and in 2018-2019 the tourism sector employed 12.75% of the total working population.

Most states offer numerous adventure travel activities. The Ministry of Tourism estimates that almost 500,000 foreign adventure tourists visit India every year. The most visited states for adventure tourism are Uttarakhand, Himachal Pradesh, Jammu & Kashmir, Goa and Rajasthan. The most popular activities, by type and in order of popularity, were:

- Land-based: Wildlife/Jeep Safaris, Trekking, Camping, Elephant/Camel/Horse/Yak Safaris, Cycling, Motorbike Tours, Rock Climbing, Artificial Wall Climbing

- Water-based: Water Rafting, Boat safaris, Houseboat Stays, Kayaking, Scuba Diving

- Air-based: Parasailing, Hot-Air Ballooning, Paragliding

But India faces challenges such as poor implementation of safety guidelines by state governments and growing numbers of unregistered and low-cost tour operators. In many remote regions, the lack of suitable infrastructure also causes problems.

In 2015 the Ministry of Tourism launched the Swadesh Darshan scheme to develop thematic tourist circuits. Adventure tourism was identified as a major theme. By 2022, 76 projects had been approved across 15 circuits, and the scheme was updated with the aim of developing sustainable infrastructure, Swadesh Darshan 2.0.

Jordan

Jordan has some of the best natural and cultural resources in the world and is well known as an adventure destination. Mountaineering, rock climbing, canyoneering, climbing, cycling, mountain biking, hiking and caving are all key adventure activities in Jordan.

The Ministry of Tourism and the Jordan Tourist Board (JTB) have identified adventure tourism as a key sector to focus on. The Jordan Trail and the Jordan Bike Trail are two major adventure tourism developments that have been developed successfully to support the sector.

The Mediterranean climate allows for year-round tourism, which offers a significant advantage. The country’s topography of mountains, wadis and deserts is excellent for adventure activities, and Jordan is within easy reach for European travellers. In addition, the country is compact, so that day trips from Amman and longer overnight trips are all easy to arrange.

Kyrgyzstan

Hiking, horse riding, CBT (community-based tourism) and homestays are the predominant forms of adventure tourism in Kyrgyzstan. The country’s nomadic tradition make this a popular destination for many tourists. Mountain villages have developed into tourism hubs with homestay guesthouses and yurts. They offer activities such as back country skiing and snowshoeing in the winter, and horse riding and hiking in the summer.

In 2012, Kyrgyzstan implemented a visa-free scheme for 45 countries, including Germany, France and the UK. This was expanded to an e-visa scheme for other countries in 2016 to speed up the application process. This helps to make Kyrgyzstan a good contender as a top destination for adventure tourism.

Morocco

The Atlas Mountains are an ideal destination for adventure tourism and hiking, trekking and homestays are typical activities. The Moroccan culture is strong in the cities of Marrakech, Fez and Casablanca and many trips start or end in one of them. Morocco’s climate gives it an advantage as a year-round destination for activities at varying times of the year. April to October is the best time for hiking in the mountains, while surfing is good during the summer on the coast. Morocco is another destination that offers easy access for Europeans.

Peru

Peru’s has strong cultural and heritage tourism products. Its nature segment is also good and usually involves hiking and trekking. In recent years, the tourism sector has worked to strengthen the partnership between tourism, culture and communities, building the CBT segment.

Hiking the Inca Trail is possibly the best-known adventure activity. The classic trail takes around four days, and there are many operators in the market. New regulations controlling tourist numbers in Machu Picchu to preserve the historic site have been put in place. Four circuits are now in place and tourists and official guides are obliged to comply with them.

Before the COVID-19 pandemic, Peru had ambitious plans to involve the less visited northern region more in tourism. Initiatives included improving infrastructure and tourist facilities, and better marketing for the region, in order to strengthen the country’s reputation as a leading adventure and nature destination. You can check whether there are similar initiatives in your destination.

Zambia

Soft and hard adventure activities are common pursuits for adventure travellers to Zambia. The Victoria Falls and the South Luangwa National Park are the major destinations for European travellers, and activities range from bungee jumping, white-water rafting, traditional safaris and walking safaris, which originated in Zambia. Zambia is also known for its water-based adventure activities on the Zambezi River, including river-based safaris, river boarding and hydrospeeding, a form of bodysurfing using an inflatable surfboard.

A new Destination Management Plan was developed for Livingstone for 2020-2025. This aims to improve the city’s competitiveness as a tourism destination and to ensure more socio-economic benefits for local people and tourism businesses.

Key Takeaways

- Identify the USP (unique selling point) of your destination, such as ‘nomadic travel’ or ‘trekking in the mountains’. Make sure your adventure travel product focuses on your USP to attract adventure travellers.

- Contact the tourist board and/or the Ministry of Tourism to find out what adventure tourism initiatives are being developed that you could get involved in.

- Avoid offering low-cost but poor-quality tours just to make a sale. Ensure that proper safety procedures are in place. Failure to do so will harm your reputation and you will lose buyers.

ADTI 2020 Index – ATTA’s analysis of the competition

The Adventure Travel Trade Association (ATTA) produces several market studies and is an important contributor to the global tourism sector’s understanding of the adventure tourism segment.

The Adventure Tourism Development Index (ATDI) ranks adventure destinations according to their potential and readiness to compete in the global adventure tourism market. It assesses countries against 10 benchmarks, or pillars, across three factors: Safe and Welcoming, Adventure, and Readiness.

The ATDI is a useful tool that destinations can use to measure their adventure competitiveness against competing nations and allows them to analyse their strengths and weaknesses. The pillars are:

- Government Policy that Supports Sustainable Development

- Safety and Security

- Health

- Natural Resources

- Cultural Resources

- Adventure Activity Resources

- Entrepreneurship

- Humanitarian

- Tourism Infrastructure

- Brand Image

The ranking is segmented by both Developed and Developing nations and in the 2020 Index, the highest ranked developing countries by region can be found in table 3.

Table 3: ADTI 2020 Index: Ranking of Most Competitive Adventure Destinations by Region

| Region | Developing Countries |

| Eastern Europe & Central Asia | Georgia Kyrgyzstan |

| East Asia & Pacific | Mongolia |

| Latin America & Caribbean | Costa Rica Uruguay Dominica Peru |

| Middle East & North Africa | Jordan Morocco |

| South Asia | Bhutan Nepal India Sri Lanka |

| Sub-Saharan Africa | Botswana Rwanda Zambia |

Source: ADTI 2020, ATTA

Tip:

- To find out more about the Index and pillars, consult the ATDI 2020 Report.

Which companies are you competing with?

The market for local tour operators offering adventures in developing countries is crowded, particularly in places like India, which has a long history of adventure tourism.

Companies in India

Snow Leopard Adventures offers many adventures including river rafting, trekking, mountain biking, sea kayaking and trans-Himalayan jeep safaris. It is an ISO9001:2015-certified organisation (which specifies requirements for a quality management system) and is BS8848 compliant. To drive development of tours and experiences, it focuses on four ‘S’ factors: Safety, Skilled, Sustainability and Service.

It is also a founder member of the Adventure Tour Operators’ Association of India, and a member of other internationally recognised adventure tourism associations including ATTA.

White Magic Adventure Travel appeals to mountain adventure travellers of all abilities in the Himalayas. Its products are categorised into treks and expeditions for experienced trekkers and ‘White Magic Lite’ activities for a ‘gentle way-in’ to mountain adventure. It also offers tailor-made adventures. As a result, the operator is capturing a wide range of potential customers while retaining a strong USP (Unique Selling Point) of mountain trips in India, Nepal and Bhutan.

Its website is clearly laid out and provides all the information that a potential customer needs to make a decision. Filters help to do this, including a difficulty grade, duration and maximum altitude for each trek. The website makes frequent references to safety, which is an important element of adventure tourism.

Encounters Asia is an established family-operated local tour operator that has been operating in India, Nepal, Bhutan and Sri Lanka for more than 30 years. Their primary motivation is creating exclusive and private journeys with a focus on experience-based travel, such as visiting lesser-known festivals and tracking the snow leopard. The company owns and operates camps and lodges in remote locations and wilderness areas.

Encounters Asia has worked hard to build relationships with its buyers and is a member of ATTA. It is also pro-active about marketing its travel experiences, and has been mentioned in several blogs of international publications including Forbes Life and Outside Magazine.

Its sustainability credentials are also good, and the company works closely with the Tiger Trust, an organisation actively involved in the conservation of the tiger and its natural habitat. It also supports the TOFT (Travel Operators for Tigers) campaign of training field guides, which contributes to improving the standards of field guides, in turn enriching the wildlife experience for clients.

Kalypso Adventures provides Active and Authentic Travel Experiences in India including birding, trekking and walking and youth travel. It was a nominee in the 2020 World Travel Awards. It has an immediate call to action through a pop-up window inviting customers to sign up for the latest updates and offers.

The website is notable for the large amount of content in the form of copy, images and videos, along with plenty of links, which gives it authority and suggests expertise. This offers reassurance to European Adventure travellers, particularly those customers in the youth adventure sector.

Companies in Jordan

Terhaal Adventures is a DMC that specialises in adventure travel. The company was established by a Jordanian couple in 2005. The name ‘Terhaal’ was an appealing choice, meaning ‘to be in a state of constant travel’ in Arabic and refers to the nomadic lives of Bedouin Arabs. This gives the company an authentic, evocative feel.

The activities it offers are hiking, biking, trekking, canyoning, tours of Petra and Wadi Rum. Trip duration range from day trips, weekend trips, multi-day tours and complete holiday packages. All trips are created under sustainable and responsible principles. Groups are small to minimise the impact on the environment. Customers are actively encouraged to adopt best practices to protect the environment. Its website also features a blog, information about travel to Jordan and booking conditions.

Jordan Direct Tours specialises in tailor-made tours of Jordan and clearly says why customers should choose the operator – local, convenient, excellent reputation, multi-lingual staff and peace of mind 24/7. These are all very appealing to the European FIT adventure traveller. Its ‘trip ideas’ provide useful guides on pricing, giving a basis upon which to plan.

Discover Jordan is based in Amman and specialises in inbound tourism and destination consultancy. The operator offers a wide variety of organised day trips, family tours, private tours, self-drive tours, hiking, camping and other adventure tours. Travellers can book trips online and it also features its tours on Tripadvisor, with reviews displayed prominently on their own website.

Companies in Kyrgyzstan

Ecotour is operated by two Kyrgyz sisters under three main principles: pride for the country and its heritage; the need to operate sustainably; and promoting community-based tourism so that local people benefit from tourism. These principles are a good USP for the operator, as they clearly set them apart as responsible providers of community-based tourism (CBT). Europe is an important target market and the website is translated in several languages (Dutch, English and German). Testimonials from European clients feature clearly on the site.

Its tours are aimed at small groups from four to eight people and are operated at a local level – renting yurts and horses from local communities, using locally sourced produce and encouraging the purchase of local handicrafts. The operator offers a wide range of tours over different timescales. A ‘Heritage section’ of the website offers interesting information and helps to enhance the operator’s reputation as a local, experienced provider.

CBT Kyrgyzstan is a local directory of CBT and adventure experiences that connects local communities with adventure tourists. The operator supports member organisations through business training, capacity building and tourism training. If you offer CBT, check whether there is an online platform or other CBT association that you could approach to work with.

As an emerging destination, there are opportunities for Kyrgyz nationals to get involved in their tourism sector. Several Kyrgyz guides promote their personal guiding services on OTAs such as Tours by Locals, a website that connects travellers with local guides. If you are a local guide, find out whether one of these OTAs would be suitable for you to join.

Companies in Morocco

Moroccan Active Adventures specialises in personalised, small group tours to provide authentic experiences. It covers a wide range of tour types including luxury camps, desert tours, mountain trips, camel rides, quad biking adventures in the Sahara, and various combinations of activities. It provides plenty of travel advice and important information about Morocco, as well as customer testimonials, which are an excellent inspiration for potential customers.

It publishes its most popular itineraries on the home page which helps to keep the operator current and up to date in the minds of potential customers.

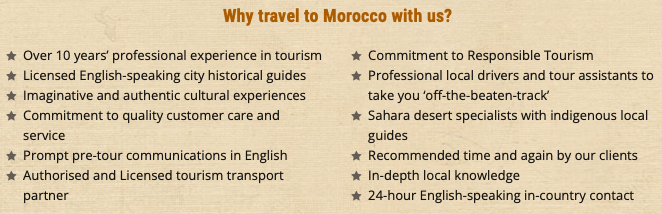

Sheherazad Ventures specialises in adventure holidays and tours throughout Morocco. Its trips are described as experiences and provide immersive insight into Moroccan culture and history. You can see how the operator is committed to quality and safety in the chart below. It is a good idea to reassure your clients in this way, as it conveys professionalism.

Figure 5: An Operator’s Commitment: Why travel to Morocco with us?

Source: Sheherazad Ventures

Additional features, like the weather in Marrakesh today and several ‘call to action’ buttons (including one to view customer reviews from Tripadvisor), encourage users to interact with the website.

Companies in Peru

Several companies promote themselves as operators for the Classic Inca Trail, which usually takes four days/three nights. It is hard to stand out in this crowded market.

Sam Travel Peru, a ‘100% Peruvian company’, has a five-star Tripadvisor rating and makes itself available to global markets via specific national contact telephone numbers. This is especially appealing to foreign buyers. The website has a broad choice of products. The operator provides good information about the regulations for visiting Machu Picchu to reassure their clients, and provides a packing checklist for treks.

It links to its social media platforms including TikTok, where it features a range of short, fun videos on customer treks. TikTok is one of the fastest growing social media platforms and is popular among younger Gen Z travellers (aged up to 26). Consider using TikTok if your adventure tourism product fits this user profile and you can commit to generating suitable content (videos).

Alpaca Expeditions website opens to promote more than 11,000 excellent reviews on Tripadvisor, and also collects customer reviews from Google and other platforms. It is an ‘official trail operator’ and features its many memberships and awards clearly. This includes the company’s commitment to reducing its carbon footprint through the national scheme, and ISO standards for sustainability and adventure tourism.

The operator makes good use of a prominent ‘call to action’, encouraging potential trekkers to book their Inca Trail trek for 2023. This links to several inspirational options to choose from.

Companies in Zambia

Based in Livingstone close to the Victoria Falls, Maano Adventures specialises in white water rafting safaris, wildlife safaris and cultural trips in Zambia. It also offers combination tours such as a game drive with kayaking or rafting, or a helicopter flight with a game drive. Many tours can be booked online, giving customers instant confirmation. The operator also offers tailor-made tours.

The company shows its credentials on the homepage along with customer reviews. Safety is a key element for its rafting tours and there is a page that outlines what customers need to know. Cancellation policies are generous – a 100% refund or date change is possible up to 24 hours in advance. This is a great idea if you can afford to do it. There are plenty of good photos on the website that give a good impression of the excursions, helping to inspire potential customers. Make sure that the images on your website are high resolution and give a good idea of what you do.

Nekacheya Travel & Tours promotes its safaris and adventures on sustainable and environmental principles. It offers day tours, multi-day tours and community activities in the best of Zambia’s national parks.

The founder’s personal story and elephant-based logo are interesting and emotive, helping to create a bond between operator and customer. Volunteers are also welcomed to help at Nekacheya School in Livingstone and accommodation can be provided. If you have a good story to tell, make sure you include it on your website.

Key Takeaways:

- Being a member of an adventure tourism association or other suitable organisation in your destination will enhance your reputation as a local adventure tour operator. Make sure you include any memberships you have clearly on your website as it shows that you are a professional business.

- Make sure you provide enough detail about your adventure product for potential customers to be able to make a booking. If you do not, they will find another provider. If you can include information about your destination and its history, it will make you an ‘expert’ and enhance your reputation. It will also improve your SEO and help your website rankings.

- It is important that you know what your USP is and make sure that it is clearly outlined on your website so that you are competing effectively in the marketplace.

- You should ensure you feature good customers quotes and/or testimonials on your homepage. This is known as ‘user generated content’ (UGC). UGC is more trusted by potential customers than content produced by businesses. Therefore it is very valuable.

- Make sure you are making the most of your social media platforms. If you do, you will drive more customers to your website.

What products are you competing with?

The adventure travel sector is one of the industry’s largest sectors. It has such a wide range of activities associated with it that they can all be considered competing products. The challenge for you as a local operator is to identify the competing products in your own region or area and target your own products appropriately.

It is important therefore that you study the niche activities, so that you are clear on what an adventure activity is. You will then be well positioned to identify your competition. You can decide whether your offer is best described as ‘adventure’, ‘hard’, ‘soft’, or create it as a more specific activity. This is important, so your potential customer has a clear understanding of what you are offering. You can find out more about soft and hard adventure in the CBI’s European Market Potential Report for Adventure Tourism.

Adventure activities fit into numerous categories, and many will cross over between one another. Categories may also be widened or reduced as appropriate for a visitor profile. In addition, adventure tourism travel products may also be segmented by Tour Type. The table below provides a guideline to the sort of competing adventure experiences that are commonly available in developing countries.

Table 5: Categories and Related Activities of Competing Adventure Tourism Travel Products

| Category | Example Activities |

| Land-based sports and outdoor activities | Hiking, cycling, mountain biking, skating, sledding, sandboarding, volcano boarding, rock climbing, mountaineering, caving, trekking |

| Water-based sports and outdoor activities | Paddle boarding, surfing, white-water rafting, kayaking/canoeing, sailing, scuba diving, coasteering |

| Air-based activities | Small aircraft, helicopter, hot-air ballooning, sky diving, paragliding, parasailing |

| Nature and wildlife | Animal encounters, safaris, horseback riding, fishing, beekeeping, hiking, trekking, dolphin/whale watching, hot springs, walking safari, animal tracking, bird watching, turtle watching |

| Day cruises | Island cruise, night cruise, dinner cruise, sunset cruise, snorkelling, shipwrecks, reefs, glass-bottom boat tours, submarine tours, sea caves, river cruise |

| Culture, history and heritage | Architecture, historical sites, street art, archaeology, ruins, art, sightseeing, literary, city tours, guided tours in museums/galleries/attractions, music |

| Community-based tourism | Visits to villages and communities, homestays, immersive experiences with community groups, farming, harvesting, cooking meals, volunteering, conservation |

| Culinary and wine | Tastings, local markets, eat with locals, chocolate making, wine trails, wine tastings, coffee/tea tours, street food, visits to distillers/brewers, visits to local producers |

| Learning | Cooking, handicrafts, dancing, painting, pottery, yoga, art, language, singing, heritage tours |

| Wellness | Mud baths, spas, fitness/boot camp, hot springs, Zen experiences, Tai Chi, yoga, meditation |

| Tour Types | City tours, classic car tours, full-day tours, half-day tours, tours by horse and carriage, motorcycle tours, train tours, photography tours, skip-the-line tours, sustainable tours, volunteer tours, walking/hiking tours, overnight tours, multi-day tours, eco-tours, 4WD/ATV tours |

| Festival themed tours | Christmas, National Holidays, New Year, Valentine's Day, Day of the Dead (Mexico), Chinese New Year, Diwali (India), festivals |

Source: Acorn Tourism Consulting

Understanding how to use categories so you can compete effectively is useful as a marketing tool, allowing you to target your trips to the most appropriate buyer or traveller. For instance:

- FITs in a city destination may choose to take a cultural and historical tour of the major attractions so they can be sure to see the top sights.

- Family groups may be interested in a water-based activity, such as a kayaking trip, or land-based safari, which suits all age groups and has an educational element.

- OTAs like to promote ‘experiences’ that are historical, cultural, sporting and nature-based, which all have wide appeal across many consumer groups.

- A wine tasting and culinary experience might be appealing to specialist operators in the luxury market.

- A street food tour may appeal to a specialist operator conducting small group trips, and FITs.

4. What are the prices for adventure tourism travel products on the European market?

Package holidays were created as a way of achieving high sales volumes and reducing unit costs by allowing tour operators to purchase different elements of a holiday in bulk, passing on some of the savings to their customers. They usually contract their suppliers and providers well in advance and set their prices 12-18 months before the holiday season, which helps them secure lower prices for services.

To be profitable, European tour operators operate at high levels of capacity, usually around 95% in terms of number of holidays sold. To help reach these sales, the travel industry in Europe typically adopts a dynamic pricing strategy. This means that prices increase when demand is high, such as during school holiday periods, and decrease during other periods, which helps to stimulate demand.

Essentially, a package holiday is a perishable product. This means it has no value unless it is sold, and the European operator takes the risk of any contracted service that remains unsold. So while the prices of their holidays may appear to be high, their margins are low. Specialist tour operators publish their holiday prices either with or without the airfare depending on the destination. They have little control over the airfare prices, which are also subject to dynamic pricing strategies. Where they travel to less-visited destinations, it may be more cost effective for the traveller to source their own flights.

The main components of a packaged adventure holiday usually include:

- Accommodation, this is the largest component and could account for as much as 60% of the overall cost, depending on the type of accommodation

- Excursions, which usually includes entry fees to attractions/national parks, guides/porters

- Local transportation

- Food and beverages (where included)

Table 5: Prices for Adventure Trips on the Market in 2022

| Adventure | Country | Duration | Price Per Person from € |

| Day/Part-Day Trips | |||

| Hiking Petra Back Trail | Jordan | 1 day | 69 |

| Ouarzazate Day Excursion | Morocco | 1 day | 70 |

| Jeep Safari, Gir National Park | India | 3 hours | 84 |

| Horse Riding in the High Atlas | Morocco | 1 day | 85 |

| Burana Tower and Konorchek Canyons | Kyrgyzstan | 1 day | 101 |

| Wadi Ibn Hammad and Karak Castle | Jordan | 1 day | 129 |

| Issyk Kul Lake | Kyrgyzstan | 1 day | 136 |

| Rainbow Mountain Hike | Peru | 1 day | 150 |

| Qeswachaka Inca Rope Bridge Tour | Peru | 1 day | 150 |

| White Water Rafting Tour | Zambia | 8 hours | 170 |

| Game Drive and Boat Ride, Chobe National Park | Zambia | 12 hours | 170 |

| Tadoba Tiger Reserve Tour | India | 3-5 hours | 301 |

| Multi-Day Trips | |||

| Wadi Rum Tour | Jordan | 2 days | 145 |

| Mount Toubkal Trek | Morocco | 3 days | 220 |

| Snowshoeing & Winter Hiking | India | 5 days | 437 |

| Hidden Meadows of Garhwal | India | 5 days | 500 |

| Atlas and Desert Tour | Morocco | 8 days | 500 |

| Cusco, Sacred Valley & Machu Picchu Tour | Peru | 3 days | 537 |

| Hike the Inca Trail to Machu Picchu | Peru | 5 days | 797 |

| Camping Safari Chobe | Zambia | 3 days | 1,000 |

| Nomadic Culture | Kyrgyzstan | 15 days | 1,295 |

| Spiritual Kyrgyzstan | Kyrgyzstan | 14 days | 1,350 |

| Dead 2 Red - Jordan Mountain Biking | Jordan | 9 days | 1,750 |

| Lower Zambezi & Victoria Falls | Zambia | 10 days | 2,950 |

Source: Acorn Tourism Consulting

Tips:

- When setting your prices, research what your competitors’ prices for similar products. Only set a higher price if you believe you are offering a better service than your competitor. Read CBI’s tips for organising your tourism services export to Europe for more information on setting prices, and this guide, Pricing your tourism product, published by Destination NSW.

- Do your own research to find out what your competitors are charging for adventure trips. Many are offering discounts and risk-free booking options with generous cancellation/rescheduling policies to attract adventure tourists. If you decide to do this, be sure that you can manage this and live up to your promises.

- Be upfront about your fees with your buyer. Be fair – remember, the margins are small and if you can offer a discount for bulk bookings, it could lead to a stronger relationship.

- You can do your own research into adventure experiences and trips that are currently on the market. Examples of OTAs and travel portals to research include Airbnb Experiences, Responsible Travel and Viator.

This study was carried out on behalf of CBI by Acorn Tourism Consulting Limited.

Please review our market information disclaimer.

Search

Enter search terms to find market research