The European market potential for community-based tourism

CBT is all about sustainable community empowerment. Local people are directly and collectively involved in preparing and providing the tourism experience. They benefit through skills development and improved economic self-sufficiency, and the community can proudly preserve their culture, heritage and local environment. Current travel trends are closely aligned with CBT. European tourists are very motivated by authentic and immersive experiences, want to avoid the negative impacts of travel and want to know that their money directly benefits the communities they visit.

Contents of this page

1. Product description

What is community-based tourism?

Community-based tourism (CBT) refers to tourism experiences that are owned, hosted and managed by local communities. Well-managed CBT creates jobs, generates income and safeguards the local environment. CBT also inspires CBT travellers and promotes cross-cultural understanding. To be effective, CBT projects must be:

- Authentic and hands-on: experiences must be real and give authentic insight into the daily life of the community. They must not be ‘staged’ or ‘fake’ and should have a hands-on element. Activities for CBT travellers give a more immersive experience and help them bond with the community.

- Sustainable: managed according to sustainable principles, with actions that are visible, measurable and transparent. Many CBT projects are in rural destinations and activities that protect the local landscape are important for environmentally-conscious European CBT travellers.

- Community-led: owned and managed directly by the local community. This way, the community enjoys direct financial benefits and is empowered to strengthen its self-governance and long-term economic development. It is important that the community takes responsibility for the project in a collective way to avoid benefits going to only a few individuals, and so creating distrust and rivalry.

- Provided by staff/members trained in tourism: communities offering CBT must have suitable tourism training so they know how to offer the appropriate services to European CBT travellers.

Figure 1: CBT – a great experience

Source: Fresh from the Field, Myanmar Ministry of Commerce and the Ministry of Hotels and Tourism (PDF)

Empowering local communities is a very important goal for many European tour operators as a way to ensure their trips are sustainable. Exodus, a UK-based adventure tour operator, measures the impact of its trips to ensure that most support local economies.

Figure 2: Economic empowerment of local communities

Source: Exodus

Tips:

- Look at organisations or networks that promote CBT and at how they work with local communities and other organisations. For instance, the North Andaman Network Foundation (Thailand), founded after a tsunami devastated the region in 2004.

- Research what CBT networks exist in your region/country. Search online and/or talk to your local tourist board to see if they have any information.

Benefits and challenges of CBT

Well-managed CBT creates opportunities for communities and is very empowering. CBT is also very rewarding for visitors and fosters bonds between hosts and visitors. However, it is important that the whole community is committed to organising CBT, so the benefits are spread evenly and negative impacts are addressed. The table below lists benefits and challenges communities must address.

Table 1: Benefits and challenges of CBT for communities

| Benefits of CBT | Challenges of CBT |

|

|

Source: Acorn Tourism Consulting

Tips:

- Promote open and honest communication between all community members to get everyone on board. Getting the whole community engaged with CBT development is one of the most important factors of CBT.

- Carefully consider the best type of legal entity for the community and how benefits will be equally distributed among members. Benefits include income, training, employment, resources, staffing and so on.

- Make sure community members get the right training to provide tourism services to international travellers. For instance, guiding, administration and communication.

- Invest in developing language skills, particularly among youngers community members who can then pass these skills on.

Examples of CBT experiences

There are many examples of CBT experiences that can easily be adapted to suit a community’s needs. The table below gives some useful examples.

Table 2: Segmentation of CBT experiences

| CBT experiences | CBT with accommodation |

Duration: 2-3 hours; half or full day | Duration: 1-3 nights or longer |

Experience providers: Communities, villages, collectives, associations, NGOs, families, individuals | Experience providers: Communities, villages, collectives, associations, NGOs, families, individuals, networks of homes in community or region |

Examples:

| Examples:

|

Source: Acorn Tourism Consulting

End-market segmentation and consumer behaviour

CBT travellers share many characteristics of the adventure tourist. A key motivation for CBT travel is the ‘feel good factor’ of an immersive cultural experience, along with ‘making a difference’ in local lives. CBT travellers include the major consumer groups of baby boomers (born between 1946 and 1964), Gen X (born between 1965 and 1980) and millennials/Gen Y (born between 1981 and 2000). They can be further categorised by how much money and time they have to spend on travel.

Table 3: Demographics and travel motivations of the CBT traveller

| Age group | Personal situation | Travel motivation | Travel style |

| Baby boomers (aged 59-77 in 2023) | Time rich, cash rich | Seek a unique experience | Largest group. Well-educated, wealthy, moving into retirement, like to combine authenticity with comfort. Prepared to pay for a genuine or personalised experience. |

| Gen X (aged 43-58) | Cash rich, time poor | Desire for authenticity and to give back to communities | Well-educated, well-travelled, family groups and couples, variable disposable income. Authenticity and pricing are key. |

| Millennials/ Gen Y (aged 23-42) | Time rich, cash poor | Desire for personal fulfilment, to support communities, volunteer | Younger people taking time out to travel and/or volunteer, pre-family groups. Limited budget to travel, keen to learn new things. |

Source: Acorn Tourism Consulting

CBT travellers often travel independently (fully independent travellers, or FIT) or as part of a small group on package trips. FITs do a lot of internet research before deciding where to travel. If you have a website, make sure to keep it up to date. Use inspirational blogs, images and videos about your CBT experience. If you have an Instagram account, post images regularly, as Instagram is a major travel resource for FITs.

You can also tailor CBT to different types of travellers, for instance:

- Families value opportunities for their children to learn in the ‘classroom of life’ and do activities or crafts with local artisans.

- Students and teachers value the chance to learn about local life from other local students/teachers.

- Volunteers value doing something useful with community members.

- Clubs and associations value learning about and developing their own interest, for example, gastronomy, art and heritage, languages, textiles, local beliefs, the role of women.

Accessible tourism on the European market

Accessible tourism is the ongoing endeavour to ensure tourist destinations, products and services are accessible to all people, regardless of their physical limitations, disabilities or age. It covers both publicly and privately owned tourist locations. Improvements seek to benefit not only those with permanent physical disabilities, but also parents with small children, elderly travellers, people with temporary injuries such as a broken leg, as well as their travel companions. Disabled tourists may travel individually, in groups, with their family or with carers.

Accessibility and CBT

To attract CBT travellers with accessibility needs, the most important thing is to be very clear about what you can offer. Disabled people do a lot of research before travelling to be sure their needs will be fully met. Some simple requirements include:

- If you provide accommodation, state the size of the room and whether it has facilities such as handrails. Make sure the bathroom facilities are equipped for disabilities.

- If your experience is a walking tour, state if the terrain is suitable for wheelchairs and/or people with mobility difficulties.

- Offer the use of walking sticks or walking frames if you can.

- Be inclusive: treat disabled guests the same as non-disabled guests.

Tip:

- Read the CBI study What are the opportunities in the European market for accessible tourism? for practical and useful advice on how to make your tours accessible.

2. What makes Europe an interesting market for community-based tourism?

Europe is a major source market for outbound tourism. Although domestic and European destinations accounted for 92% of overnight tourism trips by EU residents (excluding UK nationals), 88 million tourism trips were taken outside the EU. By 2021, outbound travel had recovered to 30% of 2019 levels and 26.4 million tourism trips were taken outside the EU.

Germany and the UK are the largest outbound source markets from Europe. As tourism recovers post-Covid, they continue to be the leading markets, with German outbound tourism reported to be at 49% of 2019 levels. While outbound tourism from the UK appears to be recovering slower (21%) there was a reported inconsistency in data collection and the figures should not be compared in the same way. Recovery rates from the other major markets of France and the Netherlands were 43% and 52%, respectively.

Source: Eurostat; ONS

International tourism is on the road to recovery. The United Nations World Tourism Organisation (UNWTO) stated that the sector was on track to reach 65% of pre-pandemic levels by the end of 2022. Europe was the leading destination for international arrivals, especially from July to September 2022, when arrivals reached 90% of 2019 levels. Arrivals to all other regions also saw growth:

- Middle East – arrivals increased by 225% between January and September 2022 (77% of pre-pandemic levels)

- Africa – arrivals increased by 116% (63% of pre-pandemic levels)

- Americas – arrivals increased by 106% (66% of pre-pandemic levels)

- Asia and the Pacific – arrivals increased by 230%, though they were still 83% below 2019 levels. Many Asian destinations were late to reopen and China remained closed until January 2023.

Europeans’ intention to travel is very high. Research conducted by CBI in 2022 in key source markets (Germany, the UK, France, Spain, Italy and the Netherlands) found that, on average, 96.2% of respondents planned to travel abroad and 21.6% planned to travel to developing countries. Respondents from the UK showed the greatest intention to visit developing countries (24.7%), followed by Spain (23.2%) and France and Italy (21.7% each).

It is useful to continue monitoring trends and patterns of tourism recovery in your target markets. Google Trends and Looker Studio have a range of free online tools to help do this. Google Trends shows the popularity of top search queries in Google search. Looker Studio creates graphs, charts and tables to help visualise this data. CBI has created several Data Studio Dashboards to help you understand demand and recovery in the biggest outbound markets.

Read the study How to forecast tourism demand with Google Trends & Data Studio? for more information. You can also watch the video on how to use the dashboard for additional support.

Europeans like to explore other cultures and destinations. In line with current trends (see the section Which trends offer opportunities on the European market? below), authentic and unique experiences are of great value to European travellers who are interested in immersive experiences. European tour operators are selling more and more CBT experiences to clients. In its interactive infographic, CBI estimates that more than one fifth (21.1%) of European tour operators sell CBT.

Sustainability is a crucial element of successful CBT in terms of ensuring the long-term independence and stability of the community and local environment. This is important to the European market, which is keen to minimise the negative impacts of travel. European nationals are well-informed about the need to live more sustainably and recent research indicates they are willing to make changes to their travel and tourism habits to be more sustainable.

Figure 4: European attitudes towards travel and sustainability, 2021

Source: Flash Eurobarometer 499 (PDF), October 2021

The war in Ukraine has created challenging cost of living crises throughout Europe. All Europeans are looking at ways to manage their income and pay their bills. It is likely that many European economies will face ongoing challenges in 2023 because of high inflation, high energy costs and rising interest rates. This uncertainty is affecting consumer confidence, meaning consumers will be more careful about how they spend their income. Travel is often considered a luxury, so they may spend less on travel or travel closer to home.

Local operators of tourism experiences of all kinds need to offer good value for money to continue attracting tourists.

3. Which European countries offer the most opportunities?

The European countries that offer the most opportunities for CBT in developing destinations are Germany, the UK, France, the Netherlands and Spain. In 2019, nationals from these countries took the most outbound trips, and the chart below shows that, as tourism recovers, they will remain the major source markets.

In addition, Sweden offers good opportunities as an emerging source market of travellers keen to try new experiences that are immersive. Swedish travellers are willing to travel and like new, diverse destinations that offer good value for money.

Germany

Germany has Europe’s largest population, numbering 83.7 million people. It also has the largest economy in Europe and Germans enjoy a high standard of living. Like most of Europe, at the beginning of 2023 Germany was affected by high energy costs due to the war in Ukraine, and rising inflation. These factors led to low consumer confidence, which impacted consumer spending. The outlook for the German economy (PDF) is positive. The German economy is expected to recover in the second half of 2023 as energy prices and inflation rates fall.

Germany is Europe’s largest outbound travel market and German nationals travel a lot. The market is predicted to grow over the next 10 years. The outbound tourism market was estimated at US$95.3 billion in 2022 and is projected to reach US$241.4 billion by 2032. This represents a CAGR (compound annual growth rate) of 9.7% during the forecast period.

German outbound tourism will be among the first European countries to recover fully from the pandemic. This forecast estimates that outbound travel from Germany will recover to pre-pandemic levels by 2024.

More than three quarters of the German population (76.5%) take tourism trips for personal reasons, and in 2019 Germans took 99.5 million outbound trips. 77% of all trips were for 4 or more nights, which is a good indication that they enjoy travelling to places that may be far from home. Germans are also high-spending tourists, spending an average of €589.29 per trip.

Germans like travelling to a variety of destinations, both domestically and internationally. Turkey is the most popular developing destination for German travellers, accounting for 6.3% of all outbound trips. Turkey is close to Germany and well served by low-cost carriers (LCCs). By 2021, German travellers started returning to Turkey in large numbers, suggesting they are once more eager to travel to long-haul destinations.

Morocco, Tunisia and Egypt in North Africa are other convenient and popular destinations for German travellers, as are Thailand and India in Asia. The chart below shows the numbers of German visitors to developing destinations between 2019 and 2021. Note that 2021 data is not available for all destinations.

Source: UNWTO

Most Germans (74%) use the internet to research their holidays. This percentage has increased steadily over the past 20 years. Online trip bookings now outnumber in-person bookings and this trend is likely to continue. German travellers also prefer to book package tours rather than separate components. EU research in 2021 found that Germans are also motivated by culture as the primary reason for choosing a destination. In addition, they are price-sensitive.

Table 4: Germany – European attitudes towards tourism

| Motivation | % of respondents |

| Top 3 preferred methods for organising travel and tourism activities | |

| Online platforms for professional accommodation services, e.g. Booking.com | 35% |

| Online listings of private housing offerings (rooms, apartments), e.g. Airbnb | 31% |

| Through someone you know | 28% |

| Top 3 preferred sources of information | |

| Personal experience | 52% |

| Recommendations from friends, colleagues or relatives | 47% |

| Website/social media page of service provider | 24% |

| Top 3 reasons to select a destination | |

| Cultural offerings at the destination | 54% |

| Overall price of trip | 54% |

| Natural environment at the destination | 47% |

Source: Flash Eurobarometer 499, October 2021

UK

The UK has a large population of 67.8 million and is the second largest economy in Europe. Because its economy is largely service-driven, the pandemic had a bigger negative impact. Growth has been slow since then and it is possible the UK economy will fall into recession in 2023. In line with the rest of Europe, inflation and interest rates are high and contributing to the current cost-of-living crisis.

However, the future for outbound tourism is expected to be strong. The outbound travel market was estimated to be worth US$76.7 billion in 2022 and is projected to reach US$175.2 billion by 2032, growing at a CAGR of 8.6% during the forecast period. Despite economic concerns, there is pent-up demand from the second-largest outbound market in Europe, and it is forecast that outbound travel will exceed 2019 levels in 2024.

British travellers made more than 93 million outbound trips in 2019. Of 19.1 million outbound trips in 2021, 8.9 million were holiday trips. Demand for outbound travel was very high in 2022. Between January and August 2022, outbound tourism had rebounded to 71% of 2019 levels during the same months.

Turkey was the most popular long-haul destination for British travellers in 2019, followed by India, which has been a favoured destination for Britons for many decades. India is a popular destination for SAVE tourism (scientific, academic, volunteer and education), which shares many characteristics with CBT. The chart below shows the numbers of UK visitors to developing destinations between 2019 and 2021. Note that 2021 data is not available for all destinations.

Source: UNWTO

In normal times, travel is important to UK nationals and they are experienced overseas travellers. It enables them to recharge and escape their daily routine and discover new things. While they like immersive experiences at destinations, hygiene, accessibility, convenience and safety are still important to them. British travellers like to take part in activities. This ranks among the top factors influencing their final choice. Visiting natural attractions and watching wildlife are common activities.

In research conducted in 2022, OTAs were the preferred booking channels for British travellers (39%), followed by separate bookings for accommodation and flights (26%). Tour operator bookings accounted for 16%.

France

With 65.2 million people, France has the third largest population in Europe. French nationals enjoy a high standard of living and above-average wages in the European region. Its economy is the third largest in Europe, after Germany and the UK. Despite the cost-of-living crisis and high energy prices, the economy is expected to experience slow growth in 2023.

French people are keen to travel and made 29.7 million outbound trips in 2019. The outbound travel market is estimated at US$33.9 million and projected to reach US$51.6 million by 2032. This represents a CAGR of 4.3% during this period.

Outside Europe, Africa is the most popular continent for travel among French nationals. In 2019, Morocco was the most popular destination, followed by Tunisia and Turkey. The table below shows that French tourism to most developing destinations has some way to go to return to 2019 levels. Other countries with a French-speaking history, such as Senegal and Madagascar, are also popular choices for French travellers. The following chart shows the numbers of French visitors to developing destinations between 2019 and 2021. Note that 2021 data is not available for all destinations.

Source: UNWTO

French people are known for their independent nature. This also applies to French travellers, who like to make their own decisions and prefer to travel individually rather than as part of a group. Growth in outbound travel is being driven by demand for hiking and cultural trips around the world, which aligns well with CBT.

French travellers are particularly interested in food, nature and scenery and experiencing local culture. They like authenticity and immersive experiences. As an ageing nation, the 55+ age group is set to be an important consumer group. EU research indicates that they prefer to book directly with airlines and hotels and value word-of-mouth recommendations.

Table 5: France – European attitudes towards tourism

| Motivation | % of respondents |

| Top 3 preferred methods for organising travel and tourism activities | |

| Website of a hotel, airline | 28% |

| Through someone you know | 26% |

| Online platforms for professional accommodation services, e.g. Booking.com | 22% |

| Top 3 preferred sources of information | |

| Recommendations from friends, colleagues or relatives | 54% |

| Personal experience | 31% |

| Website collecting reviews and ratings from travellers, e.g. TripAdvisor | 29% |

| Top 3 reasons to select a destination | |

| Natural environment at the destination | 47% |

| Cultural offerings at the destination | 39% |

| Overall price of trip | 36% |

Source: Flash Eurobarometer 499, October 2021

Netherlands

The Netherlands is a small but densely populated country with 17.1 million people. It is also a wealthy, highly-developed nation and its population well educated. The Dutch economy is set for moderate growth in 2023. The value of outbound tourism was €17.6 billion in 2019 and €7.5 billion in 2021. This was 60.4% below 2019 levels.

Travel is extremely important to Dutch nationals: 85% of the population take trips for personal reasons. In 2019 they took 22.1 million outbound trips, which is an average of 1.3 trips per person and higher than the European average. The average length of stay per trip was 10.2 nights and the average trip spend was €790.

Turkey was the most popular destination for Dutch travellers in 2019, and by 2021 demand for Turkey was growing well. Thailand, Malaysia and India were also popular in 2019 but growth in travel to Asia is likely to be slower as tourism was slower to reopen after the pandemic. The chart below shows the numbers of Dutch visitors to developing destinations between 2019 and 2021. Note that 2021 data is not available for all destinations.

Source: UNWTO

Many Dutch people speak multiple languages fairly well, particularly English. They are interested in other cultures and are careful with their money. They look for good value. They are well organised when it comes to planning their holidays, often researching trips up to six months in advance. They are very comfortable using the internet to book trips. These day, few Dutch travellers use traditional travel agents to book trips.

Table 6: Netherlands – European attitudes towards tourism

| Motivation | % of respondents |

| Top 3 preferred methods for organising travel and tourism activities | |

| Website of a hotel, airline | 32% |

| Online platforms for professional accommodation services, e.g. Booking.com | 31% |

| Online platforms combining travel services, e.g. Expedia, Kayak | 25% |

| Top 3 preferred sources of information | |

| Recommendations from friends, colleagues or relatives | 53% |

| Personal experience | 40% |

| Websites collecting reviews and ratings from travellers, e.g. TripAdvisor | 39% |

| Top 3 reasons to select a destination | |

| Overall price of trip | 54% |

| Natural environment in the destination | 45% |

| Cultural offerings at the destination | 33% |

Source: Flash Eurobarometer 499, October 2021

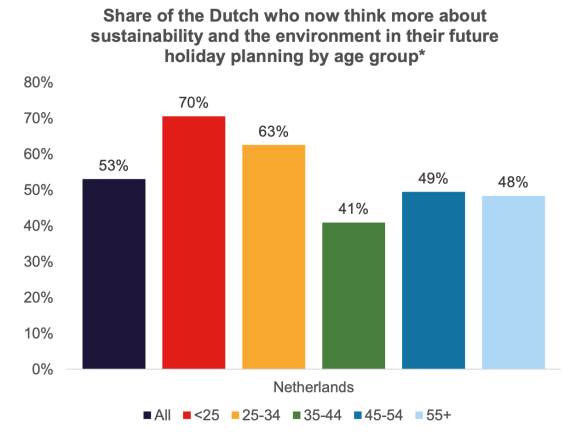

Dutch people are very concerned about the environment and want to adopt sustainable habits when travelling. Younger age groups show the strongest intention to change their travel behaviour. Examples include using other forms of transport than flying and minimising their use of plastic to protect the environment.

Figure 9: Importance of sustainability to Dutch travellers

Source: Visit Britain

Spain

Spain has a large population (46.7 million people) and a well-diversified and resilient economy. It has the fourteenth largest economy in the world and the fourth largest in the EU. The economy grew by 5.5% in 2022, driven by public spending, but has yet to recover to 2019 levels. Growth is expected to slow in 2023. This means that, as in most European countries, cost of living will continue to determine spending and Spanish travellers will be looking for good value experiences.

Spain was the EU’s fifth largest outbound tourism market in 2019, with 17.1 million outbound trips. The majority of destinations were in Europe, the most popular being France, Portugal and Italy. In 2021, Spanish travellers on outbound trips had an average spend of €111 per day and €798 per trip, and stayed an average of 9.6 nights at their destination.

Before the pandemic, Morocco was the most popular developing country for Spanish travellers, followed by Spanish-speaking Mexico. In 2021 there was a notable increase in departures to Mexico and Costa Rica from Spain. Both countries are also Spanish-speaking and Latin America opened up more quickly to tourism than Asia.

Source: UNWTO

Beach destinations are the most popular among Spanish outbound travellers (37%) followed by rural/nature destinations (17%). Post-pandemic trends include big trips and nomadic travel. Value for money and authentic experiences, with opportunities to interact with local people and cultures, are also important factors in the choice of destination. Research conducted by CBI found that, compared to other major source markets, Spanish travellers are particularly interested in CBT and ecotourism.

Security and reliable health and safety protocols remain important concerns for Spanish travellers.

When choosing a destination, cultural offerings at the destination are the deciding factor for Spanish travellers (44%), along with trip price (43%) and the natural environment (43%).

EU research found that Spanish travellers value recommendations from friends and relatives and use a variety of online websites to book trips, including OTAs (online travel agents). Cultural offerings are the most important factor for them, closely followed by price and nature.

Table 7: Spain – European attitudes towards tourism

| Motivation | % of respondents |

| Top 3 preferred methods for organising travel and tourism activities | |

| Online platforms combining travel services, e.g. Expedia, Kayak | 30% |

| Website of a hotel, airline company | 29% |

| Online platforms for professional accommodation services, e.g. Booking.com | 26% |

| Top 3 preferred sources of information | |

| Recommendations from friends, colleagues or relatives | 63% |

| Websites collecting reviews and ratings from travellers, e.g. TripAdvisor | 41% |

| Personal experience | 32% |

| Top 3 reasons to select a destination | |

| Cultural offerings at the destination | 51% |

| Natural environment at the destination | 49% |

| Overall price of trip | 49% |

Source: Flash Eurobarometer 499, October 2021

Sweden

Sweden has the largest population of the Scandinavian nations, with 10.1 million people, and the highest GDP of the region. Its economy is diverse, innovative and competitive, with growth in several sectors including information and communication technology (ICT). While nationals pay high income tax, they enjoy good state-funded healthcare and education.

Swedes enjoy high levels of income and were among the highest-spending European tourists in 2019, spending an average of €642.41 on per outbound tourism trip. The value of outbound tourism from Sweden was estimated to be US$14.3 billion in 2019 and has grown by a CAGR of 3.73% since 2000. Swedish travellers made 18 million outbound trips in 2019.

Turkey and Thailand are the top long-haul destinations for Swedish travellers. Demand for Turkey has grown since the pandemic eased and is a popular destination because of its good weather and beaches, culture and convenience. The chart below shows the numbers of Swedish visitors to developing destinations between 2019 and 2021. Note that 2021 data is not available for all destinations.

Swedish travellers are well educated and interested in cultural experiences. They are also adventure travellers and the natural environment is important to them. They are very adaptable and keen to immerse themselves in local cultures, learn the local language and try local foods. Like Dutch tourists, they tend to speak English fairly well.

Swedes receive large annual holiday allowances from their employers and tend to travel more than other Europeans. Their harsh winters make them more likely to travel throughout the year, giving local operators opportunities to attract them outside high season.

EU research in 2021 found that Swedish travellers use the internet extensively to book trips, are price-conscious and rely on friends, family and colleagues for travel recommendations.

Table 8: Sweden – European attitudes towards tourism

| Motivation | % of respondents |

| Top 3 preferred methods for organising travel and tourism activities | |

| Online platforms for professional accommodation services, e.g. Booking.com | 47% |

| Online platforms combining travel services, e.g. Expedia, Kayak | 45% |

| Website of a hotel, airline | 37% |

| Top 3 preferred sources of information | |

| Recommendations from friends, colleagues or relatives | 78% |

| Personal experience | 46% |

| Websites collecting reviews and ratings from travellers, e.g. TripAdvisor | 42% |

| Top 3 reasons to select a destination | |

| Overall price of trip | 52% |

| Cultural offerings at the destination | 45% |

| Natural environment at the destination | 44% |

Source: Flash Eurobarometer 499, October 2021

Tips:

- Consider other European markets, such as Italy and Poland. Both countries have large outbound tourist markets and pent-up demand for travel is high across Europe.

- Do your own research into relevant markets. European national tourism boards are good places to find information about source markets. For example, Visit Britain publishes several insight guides about inbound markets to the UK. You can explore them here.

- Find out how to do business with these markets. Read the CBI study 10 tips for doing business with European tourism buyers.

- You must embed sustainability in your tourism business to attract the European market. To find out how, consult the CBI study How to be a sustainable tourism business.

4. Which trends offer opportunities or pose threats on the European market for CBT?

The key travel trends significantly aligned to CBT growth are authentic and immersive experiences, sustainability and ensuring that communities benefit directly from tourism activities. More and more travellers want to travel in ways that are more sustainable and less harmful to the planet. CBT lets them do this while having more meaningful interactions with the people, communities and places they visit.

Ecotourism, sustainable and responsible travel becoming an industry standard

Global travel industry leaders believe that ecotourism – along with sustainable and responsible travel – is fast developing from ‘trend’ into industry standard. Travellers from Europe and all over the world are looking for authentic connections with local people and communities. There is increasing demand for assurances that travel is making positive contributions to local communities.

Travel research conducted in 2022 by two leading global companies, American Express and Booking.com, revealed strong sentiments in major source markets, including Europe.

Table 9: Sentiments towards future travel, 2022

| Sentiment | % agree |

| Preservation of cultural heritage is crucial | 84% |

| Respondents want to travel to destinations where they can immerse themselves in the local culture | 81% |

| Respondents want money they spend during travel to go to local communities | 81% |

| Travellers want to know their economic impact is spread equally throughout society | 76% |

| Travellers want authentic experiences that are representative of the local culture | 73% |

| Respondents are interested in cultural immersion and taking tours on future trips | 70% |

Source: American Express 2022 Global Travel Trends Report and Booking.com Sustainable Travel Report 2022 (PDF)

More and more tourists want immersive and authentic experiences that are meaningful. For example, making their own ceramic pot instead of just buying one, or learning to cook a local dish from a local. A personal interaction with someone from a different culture is a mutually beneficial exchange for both hosts and tourists. Tourists want unique experiences that are one-of-a-kind and exclusive to that destination, and they are prepared to pay more for a ‘premium experience’.

An example of a successful CBT project is the Rota da Liberdade (Freedom Route).This is a collaborative initiative in a historic district of Santiago de Iguape in northeast Brazil. The project is now led by Quilombos women in six Quilombos communities. Tourists can choose from three tours to experience daily life, learn about the culture, visit villages and help harvest local produce.

Travelling in a way that is sustainable and responsible allows European CBT travellers to minimise harmful impacts on local communities and to help conserve the environment for the future health of the planet.

Tips:

- Make sure the experience you offer is authentic and shows real daily life in the community. It must not be staged or fake in any way.

- Involve visitors in a hands-on activity if you can. This will make the experience better for both the community and host.

- Read the CBI study Entering the European market for CBT tourism to learn more about setting up your own CBT project.

Demand for local food experiences offers good CBT potential for local communities

Food tourism is a significant global tourism niche strongly linked to CBT. It is growing around the world and offers good opportunities for local families, individuals and communities. Culinary experiences are in high demand and becoming an increasingly popular part of tourism trips because they offer an immersive cultural experience. Food-based experiences are also a good way to create revenue for local farmers, cooks and other suppliers.

Food festivals, wine trails, plantation visits and hands-on farming/fishing experiences are all examples of food and CBT activities that are on the rise. This tour of a coffee plantation in Cusco, Peru, is a good example of a CBT tour marketed to CBT travellers. It emphasises learning about how coffee beans are grown and harvested, enjoying locally-produced food and getting to know the local farming community.

Tip:

- Read the CBI studies on European market potential and market entry opportunities for food tourism for more information about this niche and practical tips for setting up your own food experience.

Indigenous-led experiences are a growing CBT trend

More and more indigenous communities around the world are entering the CBT market. They are introducing experiences that allow visitors to learn about the origins of that destination, its history, culture and also future. This is a very positive development for indigenous communities that have been negatively exploited for generations. Today, tourism is a powerful tool for preserving their unique cultures and educating travellers, and directly benefits various groups.

There are many and very diverse indigenous communities worldwide that can benefit from the demand for authentic, immersive experiences. Indigenous people account for around 5% of the world’s population, but manage up to 25% of the land. This land is often located in areas of high biodiversity, protected areas and ecologically important places. These communities are therefore well-placed to offer some of the most immersive experiences in remote, lesser-visited places.

Leading global tour operator Intrepid Travel now sells more than 100 indigenous-led experiences, including a homestay experience with a Mayan family in Mexico, a six-day trek in Guyana led by tribespeople from the village of Pairuma, and an experience with the Terraba River Indigenous Community in Costa Rica. Intrepid Travel has B Corp Certification, which means it is committed to responsible and sustainable tourism that directly benefits local people and communities, and the planet.

Another UK operator promoting indigenous-led experiences is the online travel agency Much Better Adventures, which offers trips led by the Guna and Embera communities in Panama.

Trip planning and booking goes mobile

As more tourists plan and book their holidays and experiences online, it is also becoming more common to use mobile devices to make bookings. Mobiles are also increasingly being used to store important documents such as Covid-19 vaccine certificates, air and other transportation tickets, booking confirmations for hotels and experiences, and much more.

Recent research has shown that 63% of consumers feel it is important to use a smartphone when planning or booking trips. Being able to plan and book activities while in a destination is also important. 70% use their smartphone while travelling to find things to do in a destination, 66% use it to research places to visit and 58% to plan places to stay.

55% of customers who have poor experiences on mobile websites or apps would not use them again. Therefore, the tourism industry absolutely must meet this need to remain competitive. Issues that stop consumers from returning to a site or app include slow loading times, dead links and buttons that do not work.

Tips:

- Ensure your website is mobile-friendly and works well. Check for all the issues mentioned above. If your site needs work, talk to your web developer to find out what can be done to make it more mobile-friendly.

- If you do not have a website, consider building one. Online website builders offer a good, quick and easy way to develop a site that also conforms to the latest mobile technologies. Read the CBI study How to be a successful tourism company online? to learn more.

- Read the CBI Trends Study to learn more about trends that offer opportunities or pose threats on the European outbound tourism market.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research