The European market potential for Generation X tourism

Generation X (Gen X) are big travellers, often travelling to developing destinations to give their children authentic learning experiences and to take time to relax together as a family. Germany, the United Kingdom and France, in particular, offer a large market base from where these tourists originate, making Europe an interesting market to target when attracting Gen Xers.

Contents of this page

1. Product description

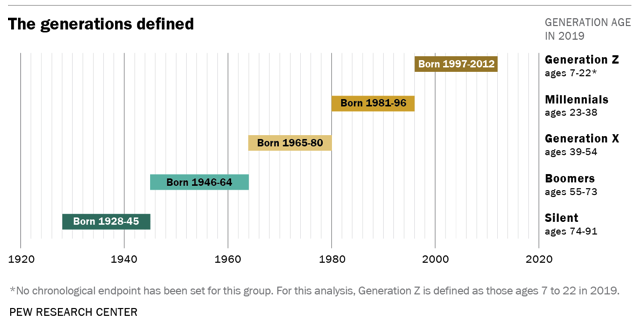

The definition of Gen X differs across sources, but is generally accepted as people born between 1965 and 1980, who are between the ages of 42 and 58 in 2023. Gen X is sometimes referred to as the ‘forgotten generation’ as there is not much research on them, particularly on their travel behaviours. Gen X grew up with a strong work ethic and ambition, likely something they learned from their parents. They have also experienced great technological evolution in their lifetimes and are adept at modern technologies.

Figure 1: Generations defined

Source: Pew Research Center

End market segmentation and consumer behaviour

Gen X are at an age where many have families. 63% of this generation live with a spouse or partner and 61% live with children. Travelling with children often means they need to travel during school holidays, and the cost is often higher than when travelling alone or as a couple. As the children of Gen X get older, families are trying to get in as much experiential travel as possible and fit in ‘one last big family trip’ before their children leave home.

Other Gen Xers have no children and may have established careers and more disposable income for travel. The older group of Gen Xers, those over 50, may already be empty nesters and will soon start to reach retirement age, so may have more financial freedom. These groups are not restricted by school holidays and have more freedom in when they can travel.

Gen X take an average of 26 vacation days a year, compared to 29 days for Gen Z and 35 days for millennials. However, recent research suggests that each trip this generation takes is longer on average than trips taken by younger generations. Almost half of Gen Xers take holidays of longer than seven days at a time. Gen X also spend more money when travelling than other generations, likely due to travelling in larger (often family) groups, which also makes them a valuable target group.

In terms of experiences, many Gen Xers are choosing to travel to developing destinations for authentic experiences and learning opportunities for their children and/or themselves. They like cultural activities that allow them to get involved, such as local cooking classes and trying local foods, staying on working farms and seeing and participating in local life. They were adventure travellers in their youth and want to continue this type of travel, but in a way that engages all members of the family.

Those with older children are finding that they tend to get bored sitting by the pool, and so want holidays with activities for all age groups that get the whole family away from the hotel. Good activities could include white water rafting and river tubing, jungle hikes, visiting ancient heritage sites, canopy tours, water sports and other adventure activities. Wildlife tourism is particularly popular with this group as it is very intergenerational.

Table 1: Gen X market segments

| Segment | Budget | Destinations | Activities | Accommodation |

| Families with young children | Low - medium | Close to Europe and safe | Swimming, beach, short walks, relaxation | High-value, many amenities, 3 to 4-star |

| Families with older children | Low - medium | Educational and safe | Adventure, educational tours, cultural immersion | High-value, some amenities, 3 to 4-star |

| Singles or couples without children | Medium - high | All destinations | Adventure, cultural immersion, relaxation and wellness | High-value, 3 to 5-star |

| Empty nesters and retirees | Medium - high | Bucket list | Historical and cultural, educational, hiking, bucket list, relaxation and wellness | High-value, 4 to 5-star |

Source: Acorn Tourism Consulting

Recent research by Expedia (PDF) and Publicis Sapient identifies the following key characteristics of Gen X travellers.

They are budget-conscious travellers and money is a very important aspect of selecting a destination. Therefore, developing and promoting products that offer value for money is essential to attract Gen X travellers.

- 64% agree budget is a key consideration when researching and booking trips.

- 86% look for deals and promotions when making reservations to be sure they are getting the best possible value.

- 81% voted getting value for money as critically important in travel planning, and another 64% said price was important.

Gen X prefer to use travel review websites and online travel agencies (OTAs) when planning trips.

- 85% of are influenced by review sites (such as TripAdvisor) when deciding on a destination. This is more than any other generation.

- When planning travel and making reservations, they are most likely to use OTAs (51%), compared to search engines (49%), travel review sites (41%) and metasearch sites (37%).

When Gen X use social media, they are most influenced by promotions. Therefore, when using social media to target Gen X, focus your calls to action on the promotions and discounts you offer.

- 52% said they were influenced by deals or promotions they see on social media. This is more than both millennials (46%) and Gen Z (42%).

- They are less risk averse, but still like to return to familiar destinations.

- Budget and cost are more important to them when selecting destinations than safety and security.

- Almost a quarter want to return to a familiar destination, compared to only 19% of millennials and 16% of Gen Z. These younger generations show more of a preference for new destinations.

Gen X want experiential travel, but also to take time to relax away from daily stresses.

- The three most influential factors for Gen Xers when choosing holiday experiences are: the activities available in the destination, the opportunity for once-in-a-lifetime experiences and the cultural component.

- Over the past year, 57% had taken a relaxing holiday, compared to 43% who took sightseeing holidays, 33% who visited family and 23% who went on a romantic getaway.

A recent report on millennial travellers (PDF) also offers insights into Gen X travellers and how they differ from other generations:

- Gen X value authentic, cultural experiences more than younger generations. Almost two thirds of Gen X care more about experiencing the local culture of the place they are visiting than getting likes and comments on their social media posts. The is true for only half of millennials.

- Gen X are depend less on smartphones than younger generations. While 43% of millennials say they manage their personal life on a smartphone at least once a day, this is true for only 32% of Gen Xers.

- Gen X are less influenced by social media than millennials are. 29% Gen Xers are influenced by their social media network when selecting a destination. This is less than for millennials (42%) but more than for baby boomers (16%).

- Gen X are happier to travel alone. Only 33% of Gen Xers feel taking a holiday alone is intimidating, compared to 43% of millennials.

Although Gen X can be categorised and analysed as a travel market in itself, travellers in this group are not all the same. Gen X travellers differ in their demographics, family make-up, booking methods and travel preferences. Bear in mind that Gen X will also fall into niche travel groups based on these differences.

Tips:

- Provide activities and facilities for all age groups, including kids’ clubs and babysitting options. Family-friendly holidays are essential.

- Make booking options easily accessible for Gen X. This can be through OTAs or by adding a payment gateway to your website. To learn more about how to effectively target the Gen X target group, read the CBI study on entering the European market for Gen X.

- Show promotions on your website, social media and destination management organisation websites. Gen X are very budget-conscious and hunt for discounts before travelling.

- Develop or advertise activities that engage all age groups, particularly older children, as Gen X want to ensure the whole family has an opportunity for authentic experiences and learning.

- Learn more about niche travel markets within the Gen X population by reading other CBI tourism studies.

Accessible tourism on the European market

Accessible tourism is the ongoing endeavour to ensure tourist destinations, products and services are accessible to all people, regardless of their physical limitations, disabilities or age. It encompasses publicly and privately-owned tourist locations. The improvements benefit not only those with permanent physical disabilities, but also parents with small children, elderly travellers, people with temporary injuries (for example broken bones) as well as their travel companions. Disabled tourists may travel individually, in groups, with their families or with caretakers.

Accessibility and Generation X

Gen X will start to reach retirement age over the next few years and, while this may allow them to travel more often, they may require more accessible activities as they age. Additionally, the trend towards multigenerational travel means Gen X is likely to be travelling with elderly parents, young children or pregnant women. Steps must be taken to ensure Gen X and their travel companions can participate in all activities.

Tips:

- Provide clear accessibility information on your website so travellers can prepare before their trip.

- Provide a dedicated contact number or email so travellers can discuss their specific needs before they travel.

- Provide equipment for individuals with accessibility requirements, such as wheelchairs, strollers, walking sticks etc.

- Read CBI's accessibility study for more tips on how to ensure accessible tourism for all visitors.

2. What makes Europe an interesting market for Generation X tourism?

In Europe, Gen X make up 22% of the total population. This is the largest population group, alongside baby boomers. Millennials make up 21% of the European population and Gen Z make up only 17%.

Source: UN Population Statistics

Gen X want to have experiential holidays that also offer time for relaxation. 71% of Gen X travellers like to participate in off-the-beaten-path activities, and 70% enjoy visiting museums and historic sites. This market is therefore a great opportunity for developing destinations with real high-quality, authentic local experiences and cultural offerings.

When booking travel and when they arrive, Gen X want things to be uncomplicated. That is, they want booking processes and travel logistics to be easy, accessible and fast. This generation often have stressful lives at home, balancing work and family life. They desire simplicity in the travel process and want to know everything will be organised and comfortable for their trip.

Gen X appear to have been more impacted by COVID-19 than other generations. A recent survey found that 55% of Gen X said COVID-19 was their top concern in travel planning in 2021. However, as the world has reopened over the last year or two, Gen X has been just as likely as other generations to travel overseas again. Having missed out on a couple of years of travelling with their children, they are excited to get back to having these experiences before their kids start to leave home.

In the past, European Gen Xers were the generation least likely to take international trips, most likely due to family commitments. However, the next five to ten years are likely to bring changes in the way they travel. While many still have children at home, Gen X are trying to get in at least one more exciting family trip. As their children grow up and leave home, many Gen Xers will have more freedom to travel more often as well as more flexibility in when they can travel, and so may choose to go outside peak times.

As some Gen Xers become empty nesters, they may have more financial freedom, especially if they are still working. The same applies to those who have never had children but developed their careers. As travelling without children reduces the expense of trips, Gen X may be more willing to travel further afield in the future and may even visit bucket-list destinations they could not in the past. This generation is likely to become a key travel market globally over the next decade and the opportunity to attract them should not be missed.

Tips:

- Create an offer of relaxing, uncomplicated holidays if you want to target Gen X travellers. Ensure easy access to booking systems and consistent communications and work to reduce the stress of trip planning as much as possible.

- Stay up to date about Gen Xers’ stage of life as the way they travel and destination choices are likely to change in the next few years. Destinations that are further afield and experiential should be ready to target this market.

3. Which European countries offer the most opportunities for Generation X tourism?

As Generation X is a demographically defined market segment, it is important to consider demographics in selecting source markets with high potential. In absolute numbers, Germany has the most Generation X travellers, with 18.1 million (22% of total population), followed by Italy (14.6 million), the United Kingdom (13.9 million) and France (13.3 million). Spain (12.2 million) and Poland (8.4 million) follow close behind. Spain (26%) and Italy (25%) have the largest proportions of Gen Xers as a share of their total population.

Source: UN Population Statistics

Germany

Germany has the largest Gen X population in Europe and has a highly valuable outbound tourism market (approximately US$95 billion in 2022), making it the highest priority source market for Gen X. Data from the 2019 German traveller profile survey ReiseAnalyse (PDF) indicated that 78% of the German population took a trip in 2019 and that 74% were international trips, highlighting the potential of this market.

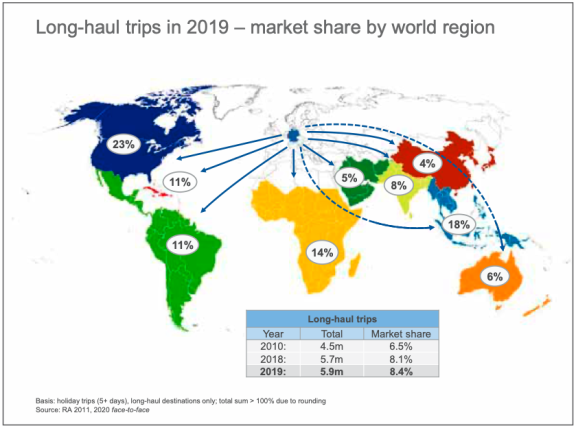

The most popular destinations for German travellers were short-haul, including Europe, Central Asia and North Africa. Only 8.4% of all trips were long-distance in 2019, however this has increased from only 6.5% in 2010, suggesting an upward trend. North America, Southeast Asia and Sub-Saharan Africa are the most popular long-haul destinations.

Figure 4: Long-haul trips taken by Germans in 2019 – market share by world region

Source: ReiseAnalyse

Germans are motivated to travel for relaxation and sightseeing, with sun and beach destinations being a preferred holiday type, specifically those offering sun, warmth and nice weather. Additionally, research suggests German travellers are more interested in participating in adventurous activities than other European markets, so they are a good target group for niche markets such as adventure and nature-based tourism.

German travellers tend to stay in hotels rather than other forms of accommodation, and to travel by air. They are budget-conscious (59% said budget was a key concern when planning travel) and their average stay during holidays is 9.8 days. During trips, 91% of Germans visit museums, suggesting an interest in learning about the culture of the destinations they visit. Additionally, Germans are keen to spread the economic benefit of their travel by spending money locally and buying regional products.

Table 2: Top holiday motivations for German travellers

| Top motivations | % respondents |

| Relax, rejuvenate and go to the beach | 76% |

| See natural scenery, landscapes and wildlife | 44% |

| Active and adventurous activities | 38% |

| Visit friends and relatives | 32% |

| Water sports adventure activities | 30% |

| Long or extended stay (e.g. digital nomads, retirees) | 29% |

| Short break or extended stopover | 22% |

| Ecotourism activities | 12% |

Source: World Bank

Research shows German travellers are moving away from package tourism towards individual travel and are looking to visit less crowded destinations in the future. This trend is also clear in booking behaviour, as 44% of Germans book their travel online. Unfortunately, although sustainability is top of mind for this market (61% want their holiday to be environmentally friendly), this is not currently reflected in their behaviour. Only 6% used tourism providers with sustainability credentials.

United Kingdom

The UK has fewer Gen Xers than Germany, with a total of 13.9 million in 2022. 88% of the total British population took a holiday in 2019, and 64% travelled internationally. This suggests up to 8.9 million British Gen Xers travel internationally every year. This market tends to travel to developing destinations more than German travellers, making them a good target market. In 2019, UK travellers took 2.7 trips on average, for an average of 7.9 days. The most popular types of holidays were sightseeing (53%) and relaxation (52%) (PDF).

Budget is a big concern for UK travellers, with 65% highlighting this as a primary factor in travel planning. When planning trips, UK travellers tend to use online travel agencies and personal recommendations to find activities. The most popular activities for this group include shopping, sightseeing, visiting national parks, fine dining and visiting museums.

Table 3: Top holiday motivations for UK travellers

| Top motivations | % respondents |

| Relax, rejuvenate and go to the beach | 75% |

| See natural scenery, landscapes and wildlife | 51% |

| Visit friends and relatives | 41% |

| Active and adventurous activities | 32% |

| Short break or extended stopover | 32% |

| Long or extended stay (e.g. digital nomads, retirees) | 32% |

| Water sports adventure activities | 27% |

| Ecotourism activities | 14% |

Source: World Bank

Most UK travellers choose to stay in hotels rather than other forms of accommodation such as short-term rentals. Accommodation is also the item they spend the most on during trips, followed by flights, suggesting that this group are more willing to travel a little further and spend more for the right destination. Only 10% of all travel spending was on attractions and tours, meaning UK travellers may look for resorts that have facilities and activities included.

UK travellers are interested in sustainability when travelling and want more visible communication about saving the planet across the industry. They also want to see businesses and destinations taking accountability for the impact of their actions and promoting sustainability measures.

France

France has a population of 64.5 million, 13.4 of whom are Gen Xers. In 2019, French people went on a total of 55.8 million international overnight visits and spent US$51.7 billion internationally (PDF). The average trip length for French travellers is 10.2 days (including domestic and international trips). This is the longest out of France, Germany and UK, suggesting the French market has more time to travel and may be more willing and able to travel further to the right destination.

The top type of trip taken by French travellers was relaxation holidays, with 51% of the population travelling for this reason. Surveys show that only 51% of French travellers stay in hotels, which is the smallest of the top three source markets. After hotels, the other top accommodation options were staying with family and friends (17%) or alternatives such as short-term rentals (17%). Likely because of this trend, French travellers spend the least on accommodation: only 22% of their trip budgets are used for this category. This frees up more money for flights, food, transport and attractions, suggesting French tourists may be able to travel further and are more interested in spending money on local activities than lodging.

The French outbound tourism market is projected to grow to a value of US$51.6 million by 2032, with much of this growth attributed to a rise in trekking and sightseeing tourists. This group tends to prefer using OTAs (online travel agents) over other methods of travel planning but will also use personal recommendations. Although they tend to book online, the French travel market is more likely than other markets to completely disconnect during travel, not using social media at all (PDF).

Table 4: Top activities the French market participates in

| Top motivations | % respondents |

| Shopping | 80% |

| Sightseeing | 59% |

| Visiting museums or art galleries | 40% |

| Visiting small towns | 32% |

| Fine dining | 29% |

| Visiting historic locations | 24% |

| Visiting amusement or theme parks (incl. water parks) | 21% |

| Attending concerts or theatre | 18% |

Source: US National Travel and Tourism Office

When choosing a destination, the French are most likely to use an official tourist organisation website or official social media site, followed by getting direct advice from a travel agent or tour operator, either over the phone or in person. Compared to other markets, the French are much less likely to decide on a destination based on online ads or images from their social media networks.

Italy

Italy has a population of 60 million. 25% are Gen X, providing a great potential market. Italians took 72 million overnight trips in 2019, though only 24% were international. The country ranks tenth globally in outbound tourism expenditure, spending more than US$30.3 billion in 2019. This means international trips are high value.

Before COVID-19, Italy’s outbound tourism market was expected to increase to 35.8 million trips by 2021. In terms of activities, active and cultural trips are driving growth in the market, but sun and sand tourism remains the most popular travel motivation. Developing destinations are popular with this market, particularly in Asia and Africa, and destinations such as Egypt, Turkey and Tunisia are seeing an increase in Italian tourists.

Italian travellers look for good food, high-quality accommodation and security when deciding on a destination. The top activities Italians do (PDF) when travelling include: restaurant dining, shopping, sightseeing, going to bars/pubs, visiting parks and gardens, visiting museums and art galleries and visiting historic sites.

Spain

Spain has a population of 47.6 million, but only approximately 10% go on international holidays. Gen X is one of the larger markets, numbering 12.2 million people. The median age of the Spanish population is 44 years.

In 2019, visitor spend in international destinations was approximately €111 per day and €798 per trip. When travelling, this market tends to prioritise the following activities (PDF): restaurant dining, shopping, sightseeing, visiting parks and gardens, socialising with locals and visiting museums and art galleries. The Spanish market tends to use public transportation over other forms of transport, with taxis in second place.

Poland

Poland has a population of 38 million, 8 million of whom are Gen Xers. In 2016, 57% of Polish residents took at least one trip, suggesting tourism is popular and that this market has high potential. This trend is equal across generations, meaning approximately 4.5 million Polish Gen Xers take trips every year. Polish travellers spent a total of US$8 billion on international tourism in 2016 (PDF), taking 15.9 million overnight trips.

Shopping is the most popular activity for this market when travelling. However, many also dine in restaurants, visit parks and gardens, visit museums and heritage sites and go sightseeing during trips. When planning travel, the Polish market is most likely to consult friends and family for ideas, followed by online information and personal experience. Polish travellers are also more likely to consider a destination’s sustainability when choosing where to travel.

Tips:

- Read the CBI Factsheets on adventure tourism, sun and beach tourism, cultural tourism and nature tourism to understand niche markets within the key Gen X source markets and more specifically target your marketing

- Keep track of trends in major source markets. Larger destinations often have similar inbound market profiles for some key target markets. You can read more about some of them on the US National Travel and Tourism Office website and Visit Britain.

4. Which trends offer opportunities or pose threats on the European Generation X tourism market?

As Gen X travel more, their travel preferences are changing. This group is following some trends in the European travel market and even leading others. These trends range from the desire for more sustainable travel, for road trip travel and travelling for wellness and relaxation to continuing to travel with wider family groups.

Sustainability is important to Gen Xers

Sustainable travel refers to travel that recognises both the positive and negative impacts tourism can have on the environment, people and the places tourists visit, while seeking to minimise the negative impacts and maximise the positive ones. Tourists around the world are becoming increasingly concerned about these impacts, and Gen X are no different.

The Gen X trend towards sustainability may be driven by their children, as younger generations are acutely aware of human impacts on the environment and social responsibility and are interested in making improvements. Booking.com releases an annual Sustainable Travel Report (PDF) and has tracked the growing trend towards sustainable travel. Up to 90% of consumers say they look for sustainable options when planning their travel, and 81% say that sustainability is vital in tourism.

Travellers are also looking for sustainable accommodation options. The number of travellers who stayed in sustainable accommodation grew by 11% between 2016 to 2022, from 35% to 46%, showing a clear trend towards sustainable operators. This is expected to continue as travellers become more aware of sustainable travel options. In fact, 70% of travellers have already avoided a destination or a travel company because they were not convinced by its commitment to sustainability.

In line with these trends, tourists may choose to change how they travel. For example by:

- Travelling with companies that have implemented sustainable practices in their operations

- Staying longer at long-haul destinations and selecting low-impact experiences to minimise their carbon emissions

- Engaging with local communities and spending money at local businesses, local markets and on community-based tourism

- Seeking small group experiences to engage more authentically with local communities and reduce harms to the environment

- Learning about new cultures through authentic experiences such as tasting new foods, visiting villages and doing homestays, attending cultural events and engaging with local people

See this best practice example:

Shinta Mani Wild eco-camp in Cambodia offers a luxury sustainable tourism experience. The property is single-use-plastics-free and bottles its own water in recycled containers. 70% of staff are employed from the local village. Shinta Mani Wild partners with the NGO Wildlife Alliance to give visitors opportunities to engage in conservation activities on the eco-camp grounds.

Tips:

- Communicate your sustainability commitments and actions you are taking to reduce your impact on the local environment.

- Advertise tours and opportunities for visitors to engage with local communities and contribute directly to the local economy.

- Learn more about sustainable travel by reading CBI’s report How to be a sustainable tourism business.

Multigenerational travel is common among Gen Xers

Multigenerational travel refers to multiple generations within a family going on holiday together, for example grandparents, parents and children, and even extended family such as aunts and uncles, cousins and siblings, as well as blended families, such as stepfamilies. This is a growing trend among European travellers, so bear this in mind when developing products for the European market.

Gen X are more likely than any other generation to travel with family members, including children, parents and grandchildren. As multigenerational trips share costs between more people, these travellers may be able to stay in more luxurious accommodations, participate in more activities, stay away longer or travel further from home.

Multigenerational travel requires accommodation that can comfortably house family members of all ages, with enough separate rooms for members to have their own space, but also areas where the family can spend time together. There should also be enough activities available on-site so families do not need to go out every day or eat out every evening, which can be complicated and expensive with larger groups. These groups will also want to engage in activities and tours that are interesting to all ages or that have specific activities targeted to different ages.

See this best practice example:

Saruni Mara is a small, luxury lodge in the Masai Mara in Kenya. The lodge consists of a few cottages and villas, providing enough room for multigenerational groups, as well as enough space to enjoy time apart and common areas such as the restaurant and pool to come together. The lodge offers many experiences and programmes including safaris, hiking and photography tours. Specifically for family groups is their ‘Warriors Academy’ experience, in which visitors of all ages learn bush skills, wildlife tracking and traditional handcrafts while spending time with Masai and Samburu warriors in their way of life.

Tips:

- Assess your company’s capacity to cater to multiple generations before aiming for this target group.

- Develop destinations and provide facilities allowing multigenerational families to enjoy themselves. Ensure enough opportunities for families to have fun together, such as pool or beach activities.

- Offer facilities for all age groups, for example kids clubs and babysitting for young children, several restaurant options, evening entertainment, spa programmes, etc.

- Develop balanced itineraries for tours with activities for all age groups to enjoy themselves.

- Check out CBI’s multigenerational tourism study for more details and recommendations.

Gen X likes wellness and relaxation

Wellness travel refers to activities to improve physical and mental wellbeing during a trip. This type of travel is growing rapidly in Europe. Even when it is not the primary motivation for a trip, travellers often do wellness activities. COVID-19 drew additional attention to health and wellness, and about half of all Europeans now consider this a key aspect of holidays.

Wellness activities include:

- Use of hotel facilities such as pools, hot tubs and saunas.

- Taking wellness classes such as yoga, meditation and fitness classes.

- Visiting a day spa for a massage, facial and other wellness treatments.

- Purchasing local wellness products such as shea butter, coconut oil and handmade soaps.

Gen X is likely to engage in wellness activities because they lead busy lives at home, juggling work commitments and family life. This generation likes to relax on their holidays and this is their top holiday preference.

As Gen X age, they are becoming more conscious of the need to look after themselves and taking opportunities to do so when they travel. In fact, a pre-COVID-19 survey found that the typical wellness traveller is a Gen X woman. They are motivated to invest in mental and physical wellness on trips to reduce stress and anxiety and enjoy rest and relaxation.

See this best practice example:

El Remanso Rainforest Lodge is located in remote southwest Costa Rica. The lodge has everything from hotel rooms for two to bungalows and deluxe villas for up to 6 guests. The lodge has several wellness activities to help guests relax and unwind during their stay, including massages, facial and skin care treatments, swimming in the pool and daily yoga sessions in a relaxing yoga studio.

Tips:

- Consider adding wellness facilities to your accommodation, for example a sauna, hot tub, ice pool, swimming pool or spa.

- Consider partnering with local businesses to provide your guests with discounts on using the fitness club or wellness classes such as yoga and meditation.

- Read CBI’s reports on wellness tourism to learn more.

Gen X travellers are keen road trippers

European travellers are more interested in road tripping now than ever. Over three quarters of European travellers said they wanted to travel by car in 2021, with the key motivation being freedom and flexibility. While Gen X most often arrive at their destination by air, they are also the most likely generation to drive once there. This suggests an opportunity to target Gen Xers from Europe for road trip travel.

Road trips give travellers the flexibility to do things on their own and tailor their trip to visit only the sights they really want to, while still providing the stress-free option of having their whole trip pre-planned and pre-booked by someone else. Additionally, road trips can be easier for families travelling with children as they avoid public transport. It can also be a cheaper form of transportation for larger groups. Road trips provide an authentic experience of a destination as visitors see and experience more than just the top sights.

See these best practice examples:

Safari Drive in Namibia plans itineraries for visitors to see the country in four-wheel-drive vehicles. They have been operating since 1993 and know the landmarks well enough to develop tailored itineraries for travellers.

Andean Trails develops self-drive tours across Chile and hire vehicles are included in the price. The company develops full ready-made itineraries and pre-books all accommodations and excursions for visitors, with some meals included and recommended restaurants for others.

Tips:

- Provide very detailed itineraries. Include directions, key places to visit and hotel and restaurant names. Also include direct links to businesses where you can.

- Create visitor guides and maps for each itinerary and make it clear to visitors what is and is not included in the cost.

- Learn more about trends that offer opportunities or pose threats on the European outbound tourism market. Read the CBI Trends Study.

Acorn Tourism Consulting Limited carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research