Entering the European market for MICE tourism products

The MICE market is very complex and there are many interlinked services provided by a wide range of suppliers. The MICE customer has high expectations for high-quality services and personalised customer service. To work with the European market, MICE suppliers must be knowledgeable, professional and prepared. The increase in demand for bleisure experiences (defined as leisure mixed with business) offers local tour operators significant opportunities to develop suitable products for the market.

Contents of this page

- What requirements must MICE tourism products comply with to be allowed on the European market?

- Through what channels can you get MICE tourism products on the European market?

- What competition will you face in the MICE tourism market?

- What are the prices for MICE tourism products on the European market?

1. What requirements must MICE tourism products comply with to be allowed on the European market?

European tour operators that sell MICE products to European business tourists are bound by strict regulations to ensure the safety of their travellers and to protect them financially. You should understand what these regulations are.

What are the mandatory and additional requirements that buyers have?

The requirements that European tour operators have for MICE travel products in developing countries cover the following:

- The European Package Travel Directive

- General Data Protection Regulation (GDPR)

- Liability Insurance and Insolvency Protection

As a first step, you should read the CBI’s What requirements must tourism services comply with to be allowed on the European market and familiarise yourself with the comprehensive details of legal, non-legal and common requirements.

MICE travel post-COVID-19

MICE travel has been badly affected by the COVID-19 pandemic. Companies around the world turned to technology to continue doing business, which saved time and money on business travel. Video conferencing platforms like Microsoft Teams and Zoom were widely used to conduct meetings. Large events including the major tourism fairs at ITB Berlin and WTM London were hosted virtually in 2020 and 2021, and many other international, regional and local conferences were also moved online.

The Global Business Travel Association (GBTA), the world’s leading and largest business travel and meetings association, has forecast an acceleration of MICE and business travel activity between 2022 and 2024. A full recovery to pre-pandemic levels is expected by 2025 and the value of the sector is projected to reach US$1,439.3 billion in the same year.

Considerable market research has been conducted in 2021 to anticipate how the MICE and business travel market might evolve post-pandemic, and most findings are broadly optimistic about the future of the sector.

Research by American Express in the 2021 Global Meetings and Events Forecast identified pent-up demand for the resumption of face-to-face business tourism in a safe environment. Trust between professionals, suppliers, clients and participants is more important than ever, with a focus on duty of care requirements. Europeans are more likely to travel to small meetings, with in-person events accounting for 50% of all events. This means that hybrid events (a mix between virtual and in-person events) are likely to increase.

A European poll found that changing habits during the pandemic and concern over climate change led to four in 10 business travellers planning to fly less. However, the Global Business Traveler Report 2021 found that 96% of business travellers consulted stated they were willing to travel in 2021, but 68% want to make their own travel decisions and 72% rank flexibility as key to business travel in the future.

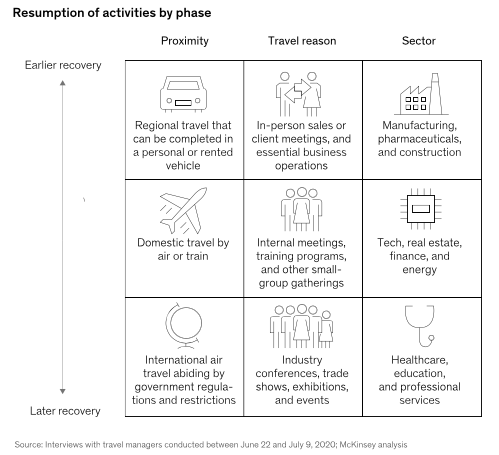

Distance to travel will have the largest impact on time to recover. Therefore, local and regional travel for smaller meetings/events is likely to resume more quickly than large conferences and exhibitions in long haul destinations. The infographic below provides a useful indication of the factors that will impact the resumption of travel for business.

Figure 1: Resumption of Business Travel

Source: Exhibit from “For corporate travel, a long recovery ahead”, August 2020, McKinsey & Company, www.mckinsey.com. Copyright (c) 2021 McKinsey & Company. All rights reserved. Reprinted by permission.

In the short to medium term, local operators in the MICE sector should focus on local and regional markets, as there will be more opportunities for them. This will give you plenty of time to prepare for the safe return of European MICE travellers.

In summer of 2021, the COVID-19 pandemic continued to have a considerable impact on the tourism industry worldwide. The rules for travelling to and from Europe are complex and every country has imposed different regulations for outbound and inbound travellers. Most European countries identify other countries as green, amber or red list destinations, with red list countries subject to the strictest regulations, such as compulsory quarantine in government facilities and travel for leisure being forbidden.

This includes returning residents from countries such as India, South Africa and Brazil where new virus variants pose a significant threat. Neighbouring countries tend to be under similar restrictions, such as Bangladesh, countries in southern Africa, and other South American countries.

To speed up the resumption of business tourism for European business travellers, the introduction of COVID passports or vaccine health certifications were being assessed. In June 2021, the GBTA was calling for action and coordination to safely re-open travel across Europe. The EU Digital COVID Certificate issued to vaccinated people would restore confidence and the ability to travel freely.

You must keep abreast of current restrictions and how they are changing. Every European country has different rules and you should do your own research to find out what they are.

- Re-open EU is an interactive tool developed by the European Union (EU) to provide information about the current COVID-19 situation in each country. It is regularly updated and provides the latest information about the health situation, coronavirus measures and travel information.

- Consult IATA’s interactive travel restrictions map for travel restrictions in most other countries. You should also be aware of the restrictions placed on inbound travellers to your own country and keep checking in the event of any developments. Visit your own country’s government website to find out more.

- The United Kingdom (UK) government has categorised all countries by red, amber and green list rules that affect travelling into and out of the UK. UK nationals travelling to red or amber list countries are subject to quarantine regulations upon return, which means they are unlikely to travel to them for business reasons unless there is no alternative.

You should use this ‘down time’ to prepare your MICE travel product for a health and safety-conscious European business traveller. You must also establish new booking terms and conditions and clearly state what cancellation and waivers you will offer to your buyers during the pandemic. Flexibility is an important factor that business planners will be looking for from their suppliers.

Consult the CBI study, How to respond to COVID-19 in the tourism sector for tips on preparing for the future recovery of the tourism sector. The study includes detailed information about revising terms and conditions to help you amend yours.

The World Travel & Tourism Council (WTTC) has launched a new set of measures to rebuild consumer confidence, reduce risk and encourage travel to resume. You can download WTTC’s Tour Operators - Global Protocols for the New Normal for more details about the protocols for the MICE segment and decide whether to apply for the ‘Safe Travels’ Stamp Application.

For the remainder of this report, all discussion, insight and advice has been provided on the basis of travel in normal circumstances.

What are the requirements for niche markets?

Characteristics of MICE travel

The structure of the MICE (Meetings, Incentives, Conferences and Events) travel industry is very complex. It involves not only the planning of large or smaller scale business events/fairs/exhibitions by venues and specialist conference organisers, but also the planning of trips for business professionals for meetings or a series of meetings, often by specialist travel management companies. Coordinating complex trip itineraries are important parts of business travel planning.

A wide range of people, services and skills are involved in the MICE industry such as sponsors, planners, convention and visitor bureaus, meeting venues, accommodation, suppliers, planners, event management and participants themselves. The Meetings segment is the largest of the four.

Examples of MICE include:

- Meetings and business events such as Annual General Meetings (AGM), board meetings, sales meetings, presentations, product launches, supplier meetings, team building events, business training courses/events.

- Incentive travel trips as perks to motivate employees.

- Conferences and Congresses involving large numbers of delegates, members of associations, institutes or organisations, often hosted annually or bi-annually.

- Exhibitions and B2B fairs to network, find new business suppliers/providers.

Table 1: Characteristics of the MICE Segment

| Decision-making Priorities for Meetings/Conferences | MICE Trip Services | Motivators for MICE Travel |

|

|

|

Source: Acorn Tourism Consulting

There are significant advantages for destinations that have a strong MICE offering:

- MICE events boost the local economy.

- High profile and/or well-marketed international, regional and local events can enhance the destination’s reputation as recognisable and reputable.

- Creates employment opportunities in multiple associated sectors such as meeting planners, hospitality, venues, catering, logistics, transportation operators/providers, professional trade organisations, tourism board, tour operators and travel agents.

- MICE is a year-round travel product, so it does not necessarily suffer from seasonality issues.

- Generates increased tourism expenditure as business travellers usually spend more than leisure tourists.

- Facilities/amenities at destination may be improved to attract businesses, for example, infrastructure, technology, accommodation.

- The growing trend for including leisure activities whilst on a business trip (bleisure) offers numerous opportunities for local tour operators to enter the market and develop leisure tourism experiences for business travellers.

Quality Services and Safety Protocols

The MICE sector has very high expectations of service and quality and travel management companies commit to a high duty of care for their business travellers. Individual business travellers also expect a high level of customer service, safe and comfortable transportation, clean and comfortable accommodations, whether facilities are luxury or more basic, and high-quality catering. As a supplier, you will need to be professional and offer high-quality services to them.

Therefore, to work successfully in the MICE sector, you must ensure that you:

- Are knowledgeable, professional, and prepared. Business planners want to be especially reassured when dealing with their suppliers.

- Do your research. Find out more about the company you want to do business with so you have a solid understanding of their needs.

- Are flexible. If changes are required or issues or problems arise, meet that challenge with a ‘can do’ attitude to meet their needs. However, never promise what you can’t deliver. Honesty and integrity are equally important.

- Make your buyers feel they are unique and your most important client. Take time to really find out what their needs are so you can effectively tailor your services to them.

Post-COVID, health and safety protocols are paramount, especially when big groups of people come together for events or large meetings. Research has shown that health and safety while on a business trip is more than twice as important for business travellers than meeting their corporate goal. Companies are prioritising the need to protect their employees when they travel and will expect their suppliers to do the same. You must be clear about the protocols and standards that you have in place to protect visitors.

Tips:

- Find out more about the importance of health and safety in business tourism in a post-COVID world.

- For tips on doing business with European buyers, consult CBI’s study, 10 tips for doing business with European tourism buyers

Commitment to Sustainability

The MICE industry is working to improve its sustainability credentials to meet the needs of a traveller base that seeks to minimise its impact on the destination. More than one quarter of business travellers are prioritising alternative modes of transport such as car and train, over air travel, and travel managers have a stronger focus on offering products that are sustainable.

The ISO (International Organization for Standardization) publishes a range of international standards for use by companies. The ISO 20121 is the Standard for Sustainable Events offering guidance and best practice to help manage events and control social, economic and environmental impact. You should consider purchasing the ISO 20121 if it is suitable for your business.

Businesses, including tour operators, often have a Sustainability Policy or Corporate Social Responsibility (CSR) guidelines they make public on their website. European buyers are very keen to work with suppliers who have one or both and you should consider how to promote your sustainability actions as a tour operator. This blog, How can tour operators contribute to sustainable tourism offers some practical advice.

Tips:

- Download Visit Britain’s guide to using sustainability to promote your business, Market and communicate your green credentials, for more ideas.

- Join the Business Travel Association (BTA) to download industry papers including the BTA Planet Plan Conference on Sustainability held in February 2020; it is free to register.

Attract the bleisure traveller market

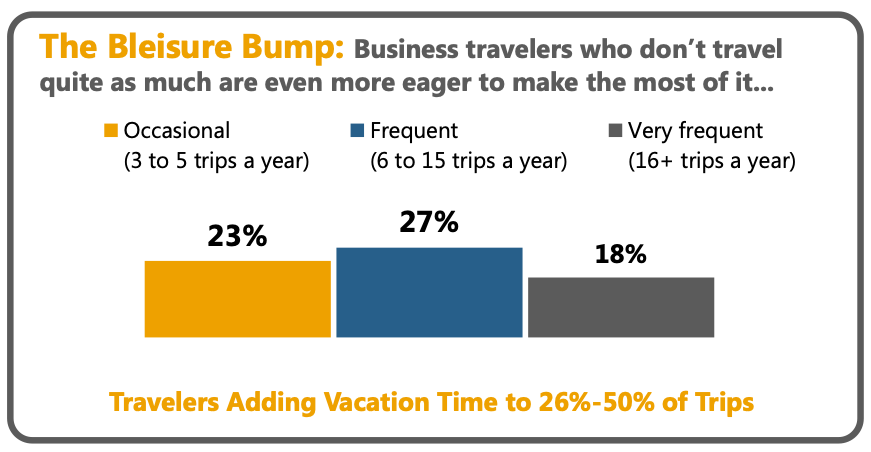

Increasingly, business travellers are choosing to include an element of leisure travel within a business trip, often referred to as ‘bleisure’ or ‘bizcation’. According to Expedia, 60% of business trips are extended for leisure purposes and participants are often prepared to travel beyond the business destination to do it.

Business travellers from Germany and the UK are keen on bleisure, spending, on average, 3.2 days and 2.8 days respectively on bleisure trips in 2018. In addition, almost 60% of companies encourage their employees to extend their business trips on account of the added benefits that a satisfied employee can bring to the productivity of the business.

Figure 2: Popularity of Bleisure is Increasing

Source: Global Business Traveler 2021 Report, SAP Concur/Wakefield Research

Developing and supplying travel products for bleisure offers particularly strong opportunities to local tour operators and there are clear benefits:

- As part of MICE, bleisure travel is also less seasonal than general leisure travel, which makes it a good year-round travel product.

- Travellers are willing to travel beyond the business destination for leisure.

- Conference organisers, accommodation providers and corporate travel management companies are keen to offer businesses added value to their customers through the provision of leisure opportunities.

- Bleisure travellers do not necessarily plan or book their experiences in advance, giving good opportunities to market activities at the destination.

- Bleisure travellers often bring family members with them on a trip, which means that operators can also promote their products to a wider audience.

Table 2: What Makes a Great Bleisure Destination?

| Bleisure Activity | % Popularity |

| Food/restaurants | 56% |

| Beaches | 52% |

| Natural sightseeing locations | 51% |

| Weather | 50% |

| Historical monuments/sightseeing | 49% |

| Museums/art/culture | 41% |

| Iconic/bucket list/must visit | 39% |

| Outdoor Recreation | 34% |

Source: Expedia Group Media Solutions, Unpacking Bleisure Traveller Trends

Tips:

- Audit your current trips to identify those that might be suitable to adapt for business travellers.

- Put together a range of two- to four-day post-conference/event programmes that include a variety of activities such as culinary, sightseeing, outdoor activities.

- Collaborate with service providers including accommodation, conference organisers, venues and corporate travel management companies to ensure your packages are included in information or offers they provide to business travellers.

- For more information about developing suitable travel products for a variety of tourism niches, consult CBI’s Tourism Market Information studies. Studies such as those about Bird Watching, Cultural, Wildlife and Community-based Tourism will give you some good ideas.

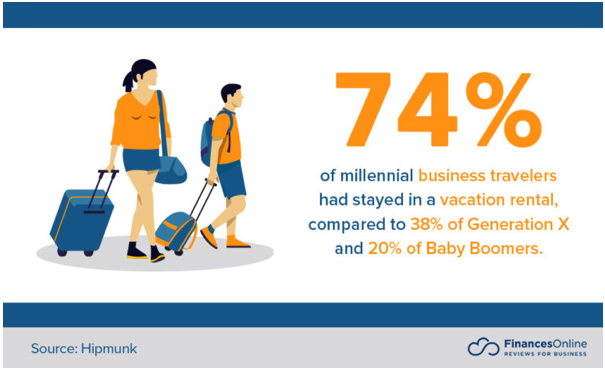

Accommodation providers to the MICE market

Many business travellers like to choose and book their own accommodations and opt to stay in locally run boutique hotels, private homes, bed and breakfasts (B&Bs) or guesthouses instead of large chain hotels. A trend that is particularly popular among younger business travellers, online travel operator (OTA) Airbnb states that 15% of customers are booking for business travel.

Figure 3: Changing Face of Business Travel Accommodation

Source: Hipmunk/Finances Online

Non-traditional accommodations in locations that are further away from business districts provide guests with more opportunities to discover the destination they are visiting in new ways, interact with local people and communities and enjoy a more authentic experience. However, while they will not necessarily expect the level of service they would get in a luxury hotel, it is important that the quality of the accommodation is good, clean, and safe.

Tips:

- Ensure that you can provide reliable Wi-Fi and Internet access.

- Be on hand to offer other services to this type of guest, such as taxis or other advice for getting around.

- Collaborate with local operators to offer bleisure experiences. Download these 7 tips for hotels looking to attract more bleisure travellers for more ideas.

Providing technology services to the MICE market

If your business is involved in providing the MICE industry with technology services, you will need to be up to date with knowledge of the IT market and what technological services are required to service the event/meeting. The types of technology most commonly used by the MICE industry are:

- QR Codes – often used by delegates to register at an event or check in quickly. They save a lot of time and have the added benefit of being touchless technology, which has become increasingly important during the pandemic times. The blog, How to make a QR Code in 8 easy steps, is helpful reading. QR code generators to research include QR Code Generator and QR Code Monkey.

- Event apps – customised event apps are also very common and enable delegates to download all the information they require such as itineraries, presentations, participant biographies and connect with other guests.

- Video conferencing – is very commonly used in meetings and at conferences and events. Options to research include GoToMeeting and Click Meeting.

Virtual and/or hybrid events look set to remain an important part of MICE in the future. Technologies that support these will be highly sought after. You should research what virtual or hybrid events are happening in your region to see what opportunities there may be.

2. Through what channels can you get MICE tourism products on the European market?

How is the end-market segmented?

There are two major end-markets for MICE:

- Companies and associations

- Individual business travellers

Companies and associations vary in size and there is no typical type. For-profit companies organise a wide range of events, incentives and meetings, and often have reasonable budgets with a higher per head cost. Team-building events are common in the corporate sector, and industry events, tourism for example, are often high-profile and costly to implement.

By contrast, associations are often not-for profit, host large conferences and events for their members, which are complex and take a long time to plan.

Individual business travellers cross all the major consumer groups of Baby Boomers, Gen X, GenY/Millennials and the newest generation to enter the workforce, Gen Z. Millennials travel most for business, and are very keen to do so. However, although still young, Gen Z make up more than 32% of the global population and are already keen travellers for leisure.

Millennials are the key market currently for MICE. There are limited statistics for MICE amongst Gen Z, as they are new to the workplace. In the future however, it is highly anticipated that both Millennials and Gen Z will be important growth markets for the sector, and also for bleisure.

Table 3: Demographics of the Travelling Consumer

| Consumer Group | Demographics (in 2021) | *% Travel for Business |

| Baby Boomers | born 1946 and 1964; age 57-75 | 8% |

| Gen X | born 1965 and 1980; age 41-56 | 23% |

| Gen Y/Millennials | born 1981-1995; age 26-40 | 38% |

| Gen Z | born from 1996; age up to 25 | n/a |

Source: Acorn Tourism Consulting; *Hipmunk

Both markets are important depending upon your product. Smaller events and individual business travellers are the easiest and most convenient to target.

Tips:

- Familiarise yourself with MICE publications, resources and online directories to keep abreast of trends and events. Examples include MICE, an online community; MICE Magazine; MICE Central & Eastern Europe, Europe Congress and Business Traveller to keep abreast of developments and trends. Consider advertising if appropriate.

- Research events venues in your destination and make contact to see how you can add your business to the supplier listings.

- Make sure your website is appealing to businesses and individuals. Download the CBI study How to be a successful tourism business online to help develop or improve your website.

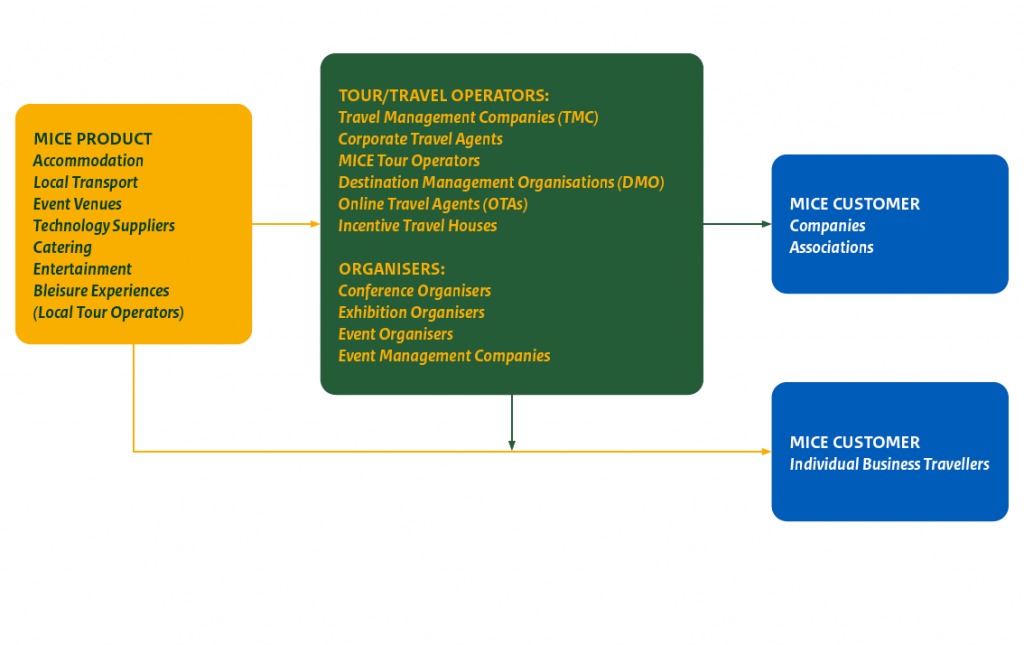

Through what channels do MICE tourism products end up on the end-market?

Business travel is usually organised on behalf of companies and associations through specialist tour operators and travel agents, such as travel management companies (TMCs), corporate travel agents, MICE tour operators, destination management organisations (DMOs), incentive travel houses or organisations.

OTAs are also often used by individual business travellers who make their own direct arrangements for their leisure time.

Figure 4: Sales Channels for MICE

Source: Acorn Tourism Consulting

There are numerous specialist operators on the European market. Examples include:

- Corporate Travel Management (UK),

- Travel Perk (UK),

- AirPlus International (Germany),

- DER Business Travel (Germany),

- Egencia (France),

- Patterson Travel (Spain)

The main OTAs that serve the MICE market are Expedia and Booking.com for booking flights, hotels and car hire. Both platforms also offer listings of attractions and things to do. However, as younger business travellers are seeking authentic travel experiences to enjoy while away from home on business, Airbnb is also an important channel and the OTA has created a unique page on its website for business travellers: Feel at home, wherever the job takes you.

Tips:

- Download the CBI study 10 tips for finding buyers on the European tourism market for an extensive list of European tourism industry fairs and events and explore the conference market.

- Research what tourism and hospitality events are being hosted in your area and identify suitable contacts.

What is the most interesting channel for you?

Both specialist operators and OTAs offer good opportunities.

It is important to focus on the local and regional markets in the short to medium term while the long-haul business travel market begins to recover. This will help you build up knowledge and experience of the sector and the needs of the customer.

Tips:

- Read this article by Airdna, the business research department of Airbnb, about how business travel-ready Airbnb listings can generate more revenue.

- Consider listing your property or host a travel experience on Airbnb if it is suitable for the MICE market.

3. What competition will you face in the MICE tourism market?

Which countries are you competing with?

The MICE industry is dominated by Europe and the Asia Pacific regions, which together account for a 70% share of the value of the market for both domestic and international travellers. The Asia Pacific region is predicted to witness the highest growth rate until 2025, driven by China, India and Singapore.

Brazil

Rio de Janeiro and Sao Paulo are leading cities for MICE and the country is South America’s most popular business destination. According to the Brazilian Association of Events Companies (ABEOC Brazil), there are around 10,000 venues available for hire, and the MICE industry generates more than R$ 67 billion (€11 billion) annually. Both cities have a wide range of tourism activities and attractions that would appeal to bleisure tourists.

MICE tourism is an important part of the tourism industry in the South American region. In September 2020, five South American countries, Brazil, Colombia, Ecuador, Argentina and Peru, joined forces to create the South American MICE Alliance. The purpose of the alliance was to strengthen inter-institutional cooperation and promote major cities as leading MICE destinations, including Sao Paulo. The strategic agreements covered exchange of best practice, joint promotional campaigns and sharing of key information for mutual benefit.

China

China is the world’s leading destination for business and MICE travel; the business travel sector was estimated to reach US$420 billion in 2019. Before the pandemic, rapid growth of the MICE segment was forecast to reach US$31 billion by 2026. Shanghai and Beijing are the leading destinations for MICE trips, followed by Guangzhou, Hong Kong and Macau. Reported challenges faced by the MICE sector in China include improving sustainability and meeting the increased need for professionals in business travel, events and hospitality.

China’s MICE industry looks set to benefit from the development of new technologies developed in China to support the industry. WeChat, the communications and retail platform, has been optimised to include features such as event registration and payment, real-time customer service and feedback, and onsite social engagement. There is also potential for Artificial Intelligence recognition and Virtual Reality interaction.

India

Pre-pandemic, India’s business travel market was highly tipped for growth and it was expected that India would be one of the top five business travel markets by 2022/23. At the beginning of 2021, social events were expected to begin the recovery of the MICE industry, followed by the entertainment events sector. Technology innovation to support hosting virtual and hybrid events were being developed by venues and accommodation providers to support activities such as online registrations, live streaming and virtual reality booths.

For the future, India is well-placed to increase bleisure offers – its exceptionally rich culture and heritage gives multiple opportunities to provide the business traveller a wide range of unique experiences.

Indonesia

As an emerging market, the value of Indonesia’s MICE industry is set to exceed US$3.5 billion by 2025. In October and November 2020, the Ministry of Tourism and Creative Economy (MoTCE) organised the Indonesia Corporate Travel and MICE B2B tradeshow in five cities: Jakarta, Bali, Yogyakarta, Malang (East Java) and Bogo (West Java). The event brought together suppliers and buyers and it was hoped to stimulate continued business so the industry will be ready to compete internationally when borders reopen.

Mexico

Mexico is an emerging market in the business travel sector. Pre-pandemic, the MICE industry hosted more than 266,000 annual events and 29 million participants, generating revenue of US$24.97 billion. This represented a contribution of 1.5% of the national GDP. Mexico City and Cancun in the Mexico Caribbean region are MICE hotspots on account of excellent facilities including numerous 4 and 5 star hotels and venues.

In recent years, industry experts Meetings Alliance and the Mexico Meetings Industry Council formed an alliance, representing 12 associations and organisations to promote the segment and implement subject matter and language standards to appeal to an international market. The alliance also works to improve the professionalism and sustainability of the sector.

Thailand

The MICE industry is an important tourism segment in Thailand and is a good destination for bleisure, particularly among British and German business travellers. There are several important companies and organisations that support the sector.

The Thai Incentive and Convention Association (TICA) was established in 1984 as a non-profit organisation and includes hotels, DMOs, tour operators, professional convention and exhibition organisers, contractors, venues, local attractions and other travel industry suppliers among its members. The Thailand Convention and Exhibition Bureau (TCEB) promotes, develops, regulates and facilitates MICE to an international market.

In 2019, the TCEB signed a Memorandum of Understanding with four overseas MICE markets, Australia, the UK, USA and Germany, to create a framework for developing the MICE sector for mutual benefit through sharing of information, business development, market promotion, business research and personnel development.

Which companies are you competing with?

Brazil

Nattrip is a local tour operator offering a range of travel experiences including MICE travel products of incentive travel, team building and corporate travel. Its website features FAQs for corporate planners and brochure downloads for MICE and Team Building (both in Spanish only). The website is available in Portuguese, Spanish and English and the operator makes good use of inspiring images for its corporate pages. Corporate partners and customers are prominently listed, which is a good idea to foster trust among new customers.

China

CBN Travel & MICE is an experienced travel management company that serves the UK market – it is a member of the European Tourism Association (ETOA) and UK Inbound. It specialises in all aspects of MICE as well as shopping tours and classic sightseeing tours. It has established partnerships with several suppliers such as transport, attractions such as museums and art galleries, and conference and events venues. The operator attends a range of tourism industry events in both China and the UK, including WTM London and the World Travel Fair in Shanghai. The website is translated into Chinese and English.

India

Luxxury MICE is a business travel management company with offices in several locations including Mumbai and New Delhi, which designs bespoke corporate travel itineraries for the domestic and international market. The operator also offers a wide range of personalised bleisure and incentive experiences for inbound business tourists. The operator has embedded sustainability into its business events and tools, through initiatives such as eco-friendly products for all MICE events, recycling/reusing where possible, offering local and in-season food produce, restricting use of plastic bottles, using digital/mobile platforms instead of paper and reducing waste.

The operator also founded MICE Indiaa, an award-winning specialist digital MICE magazine that offers a range of executive MICE development training and management programmes for the sector, as well as publishing expertise and insights. The platform can be used to promote upcoming MICE events for tradeshows, hotels, conventions bureaus and other business events.

Indonesia

Based in Jakarta in Java, Panorama Destination is a destination management company that provides logistical support for the MICE industry. Its portfolio includes luxury resorts, destinations throughout Indonesia and a range of suppliers and partners. Sustainability is embedded throughout its services and the operator is a Travelife Partner, meaning the operator is committed to sustainability and ready to work towards becoming fully certified. It publishes a range of industry news items including a COVID-19 Situation Report, last updated in early June 2021. This is good to engender customer confidence when considering travel.

The operator is a member of several associations including the Association of the Indonesia Inbound Tour Operators Association (INTOA) and Pacific Asia Travel Association (PATA). An online magazine that users are encouraged to sign up to and selection of inspirational videos are also available online.

Mexico

Arminas Travel is a destination management company in Mexico that offers a range of services for the MICE market including ground services and tours, gala dinners and theme parties, and team building experiences. It has provided services for a range of corporate clients, many of which are featured on its website, and features a range of gallery images to showcase its products.

It specialises in the Eastern European and Russian markets and takes part in a number of international fairs in its key regions each year. The website is published in English and Russian. The operator has been awarded the “M” badge, issued to companies that have implemented the quality programme “Moderniza” for tourism best practice.

Thailand

Magi Holidays offers services to plan, book and facilitate conferences, seminars and other business events for the MICE market. The operator works with a range of different suppliers including hotels and conference centres, corporate meeting planners, catering suppliers, accommodation providers, incentive houses and trade organisations. It also offers bespoke tours to leisure travellers.

Which products are you competing with?

The MICE industry is a unique, stand-alone industry for the purpose of doing business. Your main competition is other providers selling similar products.

Tip:

- Undertake some competitive research regarding other suppliers to the MICE industry in your region or area and familiarise yourself with what they provide. You can then assess where the gaps in the market are and how you can add value to your product to generate more sales.

4. What are the prices for MICE tourism products on the European market?

MICE tourism is competitive and there are many destinations, venues and other MICE services that European buyers can choose from. MICE products are usually tailor-made as no two meetings or events are the same.

Bleisure experiences may be included and costed within a whole business travel package for the delegate(s). Individual business customers may book a bleisure experience through an OTA or directly with a tour operator, covering the cost themselves or within a budget set by the business.

Therefore, MICE products are highly price-sensitive and buyers will be looking to get the best value possible. You should be prepared to negotiate.

Tip:

- To sell your MICE travel product to European business travel operators, consult the CBI study 10 tips for doing business with European tourism buyers.

This study was carried out on behalf of CBI by Acorn Tourism Consulting Limited.

Please review our market information disclaimer.

Search

Enter search terms to find market research