Entering the European market for citrus and tropical juices

New suppliers can be competitive by offering high-Brix juices with a good flavour profile at a competitive price. Food safety certification and laboratory tests are of critical importance in Europe. Sustainable production and corporate social responsibility standards provide additional advantages for emerging suppliers. The strongest citrus juice competitors are from Brazil (orange), Argentina (lemon), Israel (grapefruit) and Mexico (lime). The strongest tropical juice competitors are from Costa Rica and Thailand (pineapple), Peru (passion fruit) and India (mango purée).

Contents of this page

- What requirements and certifications must citrus and tropical juices comply with to be allowed on the European market?

- Through which channels can you get citrus and tropical juices on the European market?

- What competition do you face on the European citrus and tropical juices market?

- What are the prices of citrus and tropical juices on the European market?

1. What requirements and certifications must citrus and tropical juices comply with to be allowed on the European market?

Our study on buyer requirements in the European processed fruit and vegetable market provides general information. The section below covers specific details related to citrus and tropical juices.

What are mandatory requirements?

To be sold in the European Union (EU), in European Free Trade Association (EFTA) countries and in the United Kingdom (UK), juices must be safe. Only approved additives are allowed. Products may not exceed maximum levels for harmful contaminants.

Product composition is regulated by European Juice directive 2001/112/EC. This directive lists authorised ingredients, treatments and substances. Annex IV lists special provisions relating to fruit nectars, including minimum juice and/or purée content for different product types. Fruit juices may not contain added sugars, however fruit nectars may contain added sugars and honey.

The EU published a new Directive (EU) 2024/1438 in May 2024, creating a new category of fruit juices with reduced naturally occurring sugars. If manufacturers remove at least 30% of naturally occurring sugars, they are allowed to label them as ‘reduced-sugar fruit juice’, ‘reduced-sugar fruit juice from concentrate’ or ‘concentrated reduced-sugar fruit juice’.

Tariff barriers

Tariffs can reduce your competitiveness. The level of tariffs applied depends on trade agreements between the EU and the supplying country. For example, importers in the EU pay an ad valorem tariff (percentage of value) of 12.2% for not-from-concentrate (NFC) orange juice (OJ) imported from Brazil or South Africa. For NFCOJ from Mexico, the applied tariff is 4.2%. For NFCOJ from Costa Rica, no tariff applies.

Tariffs may also depend on export price. For example, if the price of passion fruit juice (Brix of 13.7+) imported from Brazil is above €30 per 100 kg, no tariff is applied. If the price is below €30 per 100 kg, then a 10.5% tariff applies. However, there are no tariffs on passion fruit juice from Peru, Ecuador, Colombia or Vietnam.

Combinations of ad valorem and fixed tariffs also exist. An example is imports of frozen concentrated orange juice (FCOJ) with a Brix of over 67° from Mexico. If the juice price is below €30 per 100 kg, a combined tariff of 15% + €10.30/100 kg applies. If the price is above €30 per 100 kg, only a preferential tariff of 14.20% applies.

The UK government suspended tariffs on citrus and tropical juice imports in 2023 and 2024. For more details, read the UK country section in our study on European market potential for citrus and tropical juices.

Tips:

- Use Access2Markets to find specific tariffs when exporting juices to the EU;

- Use the ITC Market Access Map to analyse competitive advantages based on tariffs applicable to your country and your competitors;

- Read our Organising Export tips to learn more about customs procedures, payments, logistics and documents used for exports;

- Track and manage information on juice product requirements with the help of free EPing notifications.

Contaminant control

The EU has strict controls on contaminants, with Regulation (EU) 2023/915 providing maximum levels for certain contaminants in food. There are also several specific contaminant limits for individual products.

Between 2019 and 2023, 21 juice-related notifications were reported in the European Rapid Alert System for Food and Feed (RASFF). Few were related to citrus and tropical juices. There were also four nectar-related notifications and two concentrated juice notifications in the same period.

The main requirements related to contaminants are on microbiological contamination, foreign bodies and food additives.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products. The EU regularly publishes a list of approved active substances that are authorised for use. In 2023, the European Commission approved 36 new regulations modifying this list.

The regulation on pesticide residues does not set MRLs for juices specifically. This means that MRLs for juices correspond to MRLs for fresh fruit, adjusted to account for dilution or concentration during processing. Pesticide residues are stored mostly in fruit skins and peels, so are not commonly found in juices.

Tip:

- Consider becoming a member of SGF. SGF has developed a Voluntary Control System covering the entire fruit juice supply chain, along with a fruit and region-specific pesticides database (FRAPP) and FRAPP early information system. SGF informs members in advance about expected changes in MRL limits.

Microbiological contaminants

Juices that are not properly pasteurised can be contaminated by microorganisms. Any microorganisms present must be below the limits specified in the European regulation on microbiological criteria for foodstuffs. Most European buyers require laboratory analyses for the presence of contaminants as part of product specifications.

Bacteria do not easily grow in juices, except for acid-tolerant bacteria such as Lactobacillus and Leuconostoc. European buyers may set even stricter limits than the legislation. Pathogenic bacteria, such as Salmonella and Listeria, must be completely absent.

Alicyclobacillus is a heat-resistant bacterium whose spores can survive the standard fruit juice industry pasteurisation process (92°C for ten seconds). Though not harmful to human health, it can spoil juice flavour. To prevent contamination, producers should follow good hygiene practices.

Tip:

- Refer to the Codex Alimentarius General Principles of Food Hygiene for good manufacturing practices.

Other contaminants

Contaminants are often the reason for border rejections or market withdrawals. Contamination can be caused by packaging corrosion, excessive content of preservatives or colourants, or materials migration (tin, cadmium or glass) from packaging into the product.

The EU has set restrictions for lead, cadmium, mercury and tin in its regulation on food contaminants. European buyers often require tests for the presence of heavy metals in juices. For fruit juices, the maximum allowed lead content is 0.03 mg/kg. The maximum allowed tin content is 100 mg/kg. For concentrated juices, the maximum level applies to the reconstituted juice.

An example of a metal-related incident is a November 2022 border rejection in Finland. The notification involved a shipment of sweetened canned pineapple juice from the Philippines that was contaminated with too much tin.

Chlorate and perchlorate

A regulation on chlorate levels entered into force in June 2020. Fruit can come into contact with chlorate through the use of chlorinated water when washing fruit or diluting concentrated juices. Another potential source is chlorinated detergents used to clean facilities and processing equipment. Chlorinated tap water should not be used to reconstitute concentrated juices without prior removal of chlorine, water hardness, salts and air.

Product composition

The European fruit juice directive defines types of fruit juices and nectars, authorised treatments and labelling. The addition of sugar and water to fruit juices is prohibited. Flavour, pulp and cells may be removed during processing and added back to the juice later. If sugar and water are added, the drink must be labelled ‘nectar’. The use of lemon and lime juice as acidity regulators is allowed up to 3 g per litre.

All juice additives must be compliant with Regulation (EU) No. 231/2012 and must be declared. The list of approved food additives can be found in Annex II of Regulation (EC) No. 1333/2008. Ascorbic acid and calcium ascorbate may be used as antioxidants to prevent colour change. Citric acid can be used as an acidity regulator in all juices. Malic acid is allowed only in pineapple juice. Pectin can be used as a stabiliser only in pineapple and passion fruit juice.

In December 2022, Portugal issued a notification after finding unauthorised additives (E 150d, E 110, E 102) in frozen concentrated juices from Brazil. The use of preservatives and colourants in juice is prohibited.

European Regulation 1925/2006 defines vitamins and minerals and other substances that may be added to foods. Annex III of the regulation lists substances whose use in foods is prohibited or restricted.

International laboratories (such as Eurofins), working in cooperation with Sure Global Fair (SGF), are collecting samples of fruit juices from around the world to build a large analytical database for the juice industry. This is making it possible to identify the origin, quality and authenticity of certain fruit juices, and therefore to detect fraud. Some common forms of attempted fraud in the fruit juice industry include:

- Adding water to juices. If the Brix level of NFC juices is naturally very high, water is added to keep Brix at an acceptable level. Another form of tampering is to add water to concentrated juice and sell them as NFC;

- Adding sugar to juice. This is done to increase the Brix level. Oligosaccharide profiling and isotopic analysis are used to detect sugar addition;

- Addition of acid to low-acidity juices. This involves the addition of undeclared acids to improve the Brix-to-acid ratio;

- Adding undeclared fruit juice. For example, the addition of a cheaper juice to a more expensive juice;

- Including undeclared additives. For example, ascorbic acid (to falsely claim a high natural vitamin C content), flavours or colours;

- Declaration of false origin. Some origins are recognised as more premium on the European market. Examples are declaring OJ as Italian or declaring passion fruit juice as Ecuadorian;

- Declaring a false fruit variety. For example, Alphonso mango purée is more expensive than Totapuri purée.

Tips:

- Follow the rules. Laboratory testing can easily detect the addition of prohibited sugars and other additives in fruit juices. A company’s reputation is quickly lost if it is caught offering adulterated or sub-standard products;

- Consult the EU Food Additives database and read the EU Fruit Juice Directive to be informed about authorised substances, as well as about processing aids.

Labelling

Depending on the type of juice exported, the bulk product must be labelled either ‘juice’ or ‘concentrated juice’. If lemon juice, lime juice, citric acid or malic acid are used, the quantity must be stated on the bulk packaging. There is no requirement to state this on retail packages.

The new Directive (EU) 2024/1438 has introduced a new nutrition claim that can be used on labelling: ‘fruit juices contain only naturally occurring sugars’.

European imports of retail-packed juices from outside Europe are relatively rare. Only retail-packed NFC juice exports may be labelled as ‘fruit juice’. If the juice is produced by reconstitution of a concentrated product, the correct label is ‘fruit juice from concentrate’.

Labels of juices made from a single type of fruit must match that fruit’s botanical classification. For example, juice can be labelled OJ only if it is produced from oranges of the species Citrus sinensis. If hybrid fruit is used, such as Ambersweet (4/8 orange, 2/8 clementine, 1/8 tangerine and 1/8 grapefruit), then the juice cannot be labelled OJ.

Retail product labelling must comply with the EU regulation on the provision of food information to consumers. If juice contains sulphites, this must be visible as a potential allergen on the retail label. The maximum allowed concentration of sulphites is 350 mg/l for lime and lemon juice. Sulphites are not allowed in other citrus and tropical juices intended for retail sales.

Tips:

- Control and test your juices using the analytical methods published by the International Fruit and Vegetable Juice Association;

- Perform laboratory tests only in ISO/IEC 17025:2017-accredited laboratories.

What additional requirements and certifications do buyers often have?

There is no official European standard governing citrus and tropical juices specifically. A useful general standard is the Codex Alimentarius General Standard for Fruit Juices and Nectars (PDF), amended in 2022.

Quality requirements

Detailed reference guidelines for juices are published by the European Fruit Juice Association (AIJN), which are available upon subscription to the AIJN. AIJN guidelines include acerola, banana, coconut, grapefruit, guava, kiwi, lemon, lime, mandarin, mango, orange, passion fruit, pineapple and pomegranate.

Several criteria are used to determine quality. Some, such as flavour, are subjective. These criteria cannot be determined using laboratory methods, so sensory testing is used instead. The main quality criteria are:

- Brix level – the sugar content of juice is expressed as Brix. Brix depends on the fruit variety, season and ripeness;

- Brix-to-acid ratio – the ratio of sugars to acid is the balance between sweet and sour. Where acidity is high, this number is low, and can only be corrected by mixing with other juices. Lemon and lime juice have naturally low Brix-to-acid ratios, but these juices are not consumed directly. For OJ, a harmonious Brix-to-acid ratio is around 15;

- Colour – citrus and tropical juice colours should be typical for the fruit. If oxidation occurs, the juice can turn brown;

- Turbidity (cloudiness) and cloud stability – some juices (orange and pineapple) are preferred cloudy. To keep juice cloudy, pasteurisation is used to inactivate the enzyme causing cloud loss;

- Vitamin C – the statement of vitamin C content is not obligatory, but is an important quality criterion for some types of citrus and tropical juices. It is typically stated in product specifications of fruit juices that have a naturally high vitamin C content, such as orange, grapefruit, papaya and guava;

- Flavour profile – flavour profile depends on the fruit variety, ripeness and processing method. A high presence of volatile components such as essential oils and aroma contributes to a good flavour profile. Bitterness is a negative characteristic, except in grapefruit juice. Bitterness caused by the presence of limonoid and naringin in citrus juices can be removed by using adsorption aids during processing.

Packaging and transport requirements

Many exported juices, especially OJ, are transported in specially designed road and ship tankers. The OJ export industry in Brazil has contributed to the development of juice logistics, with ships and port terminals. Brazil’s three leading OJ companies (Cutrale, Citrosuco and LDC) operate fleets of juice tankers, which can sometimes even be combined juice tankers for NFC and for FCOJ. These tankers’ trade routes can be tracked online in near real time.

Several European ports have terminals specialised in juice handling. They are equipped with pumps, tanks, pipes and other equipment to transfer juice from ships in a tightly controlled environment. Juice terminals are still mostly used for large shipments of OJ from Brazil.

For smaller juice processors, a practical form of bulk packaging is aseptic bag-in-drum. In this packaging, sterilised juice is poured into double-wall polyethylene bags that are placed in 200 kg steel drums. This packaging can be kept at room temperature. Another type of packaging, especially for the foodservice segment, is bag-in-box. In this packaging, juice is put in smaller, typically 25 litre bags that are placed in cardboard boxes.

Other packaging solutions used include frozen bag-in-drums and industrial size bag-in-boxes (1 tonne). Frozen juices must be transported at or below -10 °C. If transported in tanks, NFC juices are shipped at 0 °C. Aseptic packed juices can be transported at room temperature. The shelf life of concentrated juices is usually one year, while frozen concentrated juices can be stored at -10° C for three years.

Exporting juices in retail packaging is uncommon, as juices are usually blended and packed in Europe. Laminated cartons are the most popular type of retail juice packaging in Europe. Other options include glass bottles, plastic bottles and cans. Tetra Pak, Elopak and SIG are common packing solutions.

Food safety certification

Though European legislation does not mandate food safety certification for fruit juices, European food importers do expect it. Well-established importers will require you to provide such certification. Most European buyers ask for a certification recognised by the Global Food Safety Initiative (GFSI). GFSI recognises several certifications that meet its benchmarking requirements.

The main certification programmes for citrus and tropical juices are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000);

- SGF Voluntary Control System.

Make sure to check which certifications are currently recognised in the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications thanks to mutual recognition agreements. However, certain retailers may prefer one certification over another or demand additional certifications. Major buyers also usually visit and/or audit production facilities before starting a business relationship.

SA Veracruz, a family-owned company in Argentina’s Tucuman province, exports BRCGS and SGF-certified lemon juice.

SGF certifications are designed to improve fruit juice safety, quality and competition through industrial self-regulation. These schemes certify fruit-processing companies, packers, bottlers, traders, brokers, transport companies and cold stores. For bulk juices suppliers, an important part of the SGF certification system is International Raw Material Assurance (IRMA).

As an example, a good certification situation in the juice supply chain is one in which:

- Farmers are GlobalG.A.P.-certified;

- Fruit processors are IRMA-certified;

- Bottlers are IQCS (International Quality Control System for juices and nectars)-certified (also by SGF).

Corporate social responsibility (CSR) certification

Companies have different CSR requirements. Many importers ask fruit juice suppliers to follow a specific CSR code of conduct. Most European retailers have their own codes of conduct, including Lidl (PDF), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Other firms may insist on following common standards, such as the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone, without an audit, is not very complicated or expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), the amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Tips:

- Check your compliance with hygiene and good manufacturing practices using the SGF IRMA Audit Checklist (PDF) for juice processors;

- Read German retailer REWE’s guideline on juices to learn about sustainability requirements;

- Read the IFU Global Juice Sustainability Report 2024 to get a better understanding of juice sustainability issues.

What are the requirements for niche markets?

Companies with sustainable production and that supply niche markets can expect European importers and retailers to make additional demands.

Organic citrus and tropical juices

To market juices as organic, the fruit must be grown using organic production methods permitted by European legislation. Growing and processing facilities must be audited by an accredited certifier before being allowed to use the EU’s organic logo on products. This also applies to the logo of the standard holder (for example, Soil Association in the UK, Naturland in Germany or Agriculture biologique in France).

Figure 1: Organic lemon juice sold under the Lidl brand Solevita

Source: Autentika Global

You can import organic products to Europe using an electronic certificate of inspection (e‑COI). Each batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex to Commission Regulation No. 1235/2008.

For some countries (including Argentina, India and Tunisia) equivalent certificates are issued by control bodies designated by national authorities. You can find these countries in the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Sustainability certification

Two well-known sustainability certification schemes are Fairtrade and Rainforest Alliance. Fairtrade International has a standard for the purchase and sale of fruit. This standard (PDF) includes fresh fruit sold for further processing. The list includes açai, bananas, dragon fruit, grapefruit, langsats, lemons, limes, lychees, mangoes, mangosteens, nectarines, oranges, papayas, passion fruit, pineapples, pomegranates, prickly pears, rambutans, soft citrus (satsumas, clementines, mandarins, tangerines) and soursops.

The Sustainability Initiative Fruit and Vegetables (SIFAV) was formed by a group of mainly European companies and organisations some time ago with the aim to achieve 95% sustainable imports of fruit and vegetables from Africa, Asia and South America by 2025.

Ethnic certification

For the Jewish or Islamic ethnic niche markets, use Halal or Kosher certification schemes. Several organisations offer Kosher certification in Europe. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain Kosher certification. You can get Halal certification in Europe from certifying bodies such as Halal Certification Services (HCS).

Ecuador’s Quicornac is a leading South American supplier of passion fruit juice and mango purée. The company is an AIJN and IFU member and its products are Halal and Kosher-certified.

Tips:

- Consult the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH and control bodies and authorities for equivalence. For the Swiss market, you can also check approved inspection bodies at BIOSUISSE ORGANIC. For the UK market, see the list of approved UK control bodies;

- Keep up with important changes in organic regulations on the IFOAM Organics Europe news page;

- Follow the AIJN Code of Business Conduct (PDF) to meet minimum standards on human rights, labour and the environment in your juice supply chain;

- Consult the Standards Map database for sustainability labels and standards.

2. Through which channels can you get citrus and tropical juices on the European market?

Retail chains usually do not import juices from outside Europe directly. Instead, specialised bottling companies pack juices as private labels under subcontracting agreements or sell them as their own brands. Some of these companies import juices directly, others are supplied through specialised juice and ingredient importers.

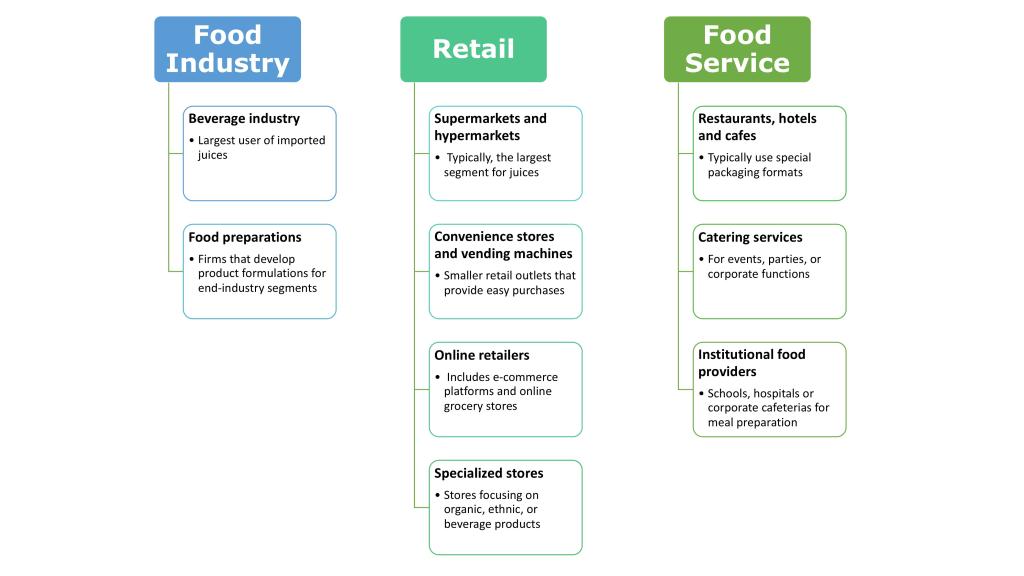

How is the end-market segmented?

In Europe, most citrus and tropical juices are sold through the retail channel. The food and beverage industry also uses citrus and tropical juices as ingredients in product formulations.

Figure 2: End-market segments for citrus and tropical juices in Europe

Source: Autentika Global

Retail

Many bottlers pack cheaper private label juices as well as more expensive commercial brands for sale to retailers. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market.

Around 60% of citrus and tropical juice brands sold in retail chains are independent brands and 40% are sold as private labels. The share of private labels is increasing.

Food industry

Beverage manufacturers are a key segment for exports of citrus and tropical juices. The food industry segment will continue to grow in line with growing demand for plant-based drinks and drinks with reduced sugar content. The main end users of citrus and tropical juices are:

- Beverage industry – juice ingredient suppliers and blending and bottling companies use citrus and tropical juices to create various flavours;

- Fruit preparations industry – develops products for manufacturers of fruit yogurts, ice creams, jellies and confectionery chocolate products. Fruit purées are used more than concentrated juices in fruit preparation formulations.

Foodservice

Most bottling companies supply both the foodservice and retail segments. Restaurants, cafés and bars buy juices in smaller packaging, usually 0.2 litre glass bottles. Pago (owned by Eckes-Grannini) specialises in supplying the foodservice segment. Hotels are also supplied with bag-in-box packaging designed to fit self-service juice dispensers.

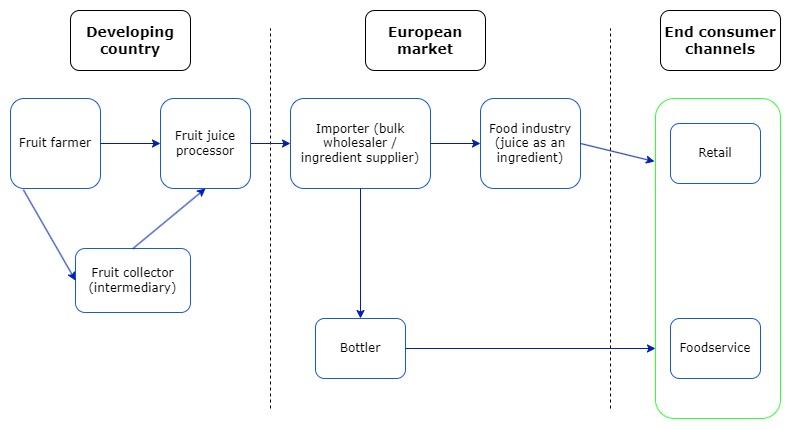

Through which channels does a product end up on the end market?

Beverage ingredient importers are the most important channel when supplying citrus and tropical juices to Europe. Some ingredient importers resell juices unchanged. Other firms have processing and blending facilities. Other channels include agents and ethnic food importers.

Figure 3: European market channels for citrus and tropical juices

Source: Autentika Global

Importer (wholesaler/ingredient supplier)

Importers specialised in supplying the beverage industry commonly import juices in bulk packaging. Some are purely trading companies. Blending houses have processing facilities and create customised solutions for bottling companies or food industry clients.

Importers are knowledgeable about the European market and closely monitor conditions in citrus and tropical juice-producing countries. Therefore, they are your preferred contact, as many bottlers in Europe do not import raw materials directly.

Bottlers

Many bottling companies have their own brands, but also produce and pack juices for retailers as private labels. Some bottlers are specialised only in private label supply. Large bottlers import raw materials directly, but many smaller bottlers are supplied through European importers. Large bottlers often prefer to have contracts for the whole season with selected suppliers.

Retail

Supplying the retail channel directly with packed juices requires bottling operations in Europe. Leading retail chains in Europe very rarely import packed juices from overseas. A few retail chains have their own bottling companies (such as Edeka in Germany). Supplying these companies gives you a better chance to get closer to retailers.

Specialised retailers such as ethnic or fair-trade shops are supplied by specific types of importers. Some ethnic shops sell juice and nectar brands packed in producing countries, but these brands are aimed mainly at a limited number of diaspora customers. Examples are Go Asia (Asian food chain in Germany), Eurogida (Turkish food chain in Germany), Brasil Latino (Latin American brands) and El Inti (Peruvian grocery shop in France).

Agent/broker

Agents are independent companies that negotiate on behalf of their clients and act as intermediaries between buyers and sellers. Agents do not play as significant a role in the citrus and tropical juices trade as in other processed fruit and vegetable sectors.

What is the most interesting channel for you?

Specialised beverage ingredient importers are your most useful contact to export citrus and tropical juices to the European market. Many are listed in our market analysis study for the six largest European markets. The Netherlands also has many important importers, including leading European processor and trader Döhler, which sells large quantities of juices through its Dutch office Doehler Holland. Other Dutch traders are SVZ, Ariza (specialised in organic products), Prodalim, Verbruggen Juice Trading and Santos Enterprise Food.

Tips:

- Watch the 2023 Deutsche Welle documentary for more insight into the strong competition between major suppliers and retail chains in Europe;

- Read this recent article on why European buying groups are becoming more important in European retail. By negotiating through alliances, retailers are increasing their bargaining power;

- Consult exhibitor lists from large trade fairs such as ANUGA, SIAL, PLMA (specialised private label fair) and Alimentaria to find potential buyers. If possible, attend these events.

3. What competition do you face on the European citrus and tropical juices market?

As a citrus and tropical juice supplier, your main competitors depend on the type of juice you supply. Europe’s OJ supply is dominated by Brazil, with a 95% share. Other juice types are dominated by other suppliers.

Source: Autentika Global, ITC Trade Map, 2024

Most grapefruit juice volume is supplied by Israel and South Africa.

Source: Autentika Global, ITC Trade Map, 2024

Europe’s leading lemon and single citrus juice suppliers are Argentina and Brazil (lemon) and Mexico (lime).

Source: Autentika Global, ITC Trade Map, 2024

Europe’s leading suppliers of pineapple juice are Costa Rica and Thailand. Peru is a large supplier of passion fruit juice.

Source: Autentika Global, ITC Trade Map, 2024

European-based suppliers of orange, mandarin and lemon juice include Spain, Italy, Portugal and Greece. Important global suppliers include South Africa (lemon, grapefruit, orange), Thailand (coconut water, pineapple), the Philippines (coconut water, pineapple), Indonesia (coconut water, pineapple), Vietnam (coconut water, passion fruit, pitaya, acerola, soursop), Ecuador (passion fruit, mango, banana) and India (mango, guava, lychee).

Which countries are you competing with?

Brazil is the leading global supplier of OJ and a key supplier to Europe. Events in the Brazilian market also tend to influence other citrus and tropical juice markets.

Brazil - the world’s orange juice powerhouse

Brazil owes its dominance to ideal climatic conditions, extensive citrus farming areas and advanced processing facilities. Brazil accounts for over 70% of global production and 75% of global OJ exports, according to a July 2024 USDA report (PDF). Regions like São Paulo and Minas Gerais offer perfect climates for orange cultivation and produce high-quality yields.

Brazil’s well-developed transportation networks facilitate swift export of juice to global markets. However, the country’s orange fruit production is suffering from the effects of climate change and spread of Huanglongbing (HLB) disease. Updated orange crop forecasts and crop disease reports for Brazil are published by the non-profit research group Fundecitrus.

Mexico – the lime juice leader

Mexico’s planted acreage of lemons and limes was 219,000 hectares in 2022-2023. Mexico is the world’s second-largest producer of limes, with a lime crop consisting of 52% Persian lime (used for juicing), 42% Key lime and 6% Italian lime varieties, according to a 2023 USDA market report (PDF). Limes are Mexico’s second-largest planted citrus crop, after oranges. Mexico is the world’s second-largest OJ producer, with production projected to increase by 11%, to 155,000 tonnes, in 2023-2024.

Mexican citrus and tropical juices are exported to only a few countries. The US is the largest market, with a share of almost 90%. Top tropical fruits processed in Mexico are mango, guava and soursop. Mexico is also the leading global supplier of aloe vera juice.

Argentina – the country of lemons

Argentina is the dominant lemon juice supplier to Europe, with exports rising steadily to reach almost 40,000 tonnes in 2023. This is more than triple the export volumes of Brazil and South Africa, the second and third-ranking suppliers, respectively. The USDA estimated Argentina’s lemon production (PDF) at 1.91 million tonnes in 2023-2024. Around 1.4 million tonnes go to the local juicing and essential oils industries for processing.

Costa Rica – delicious pineapple

Pineapple juice accounts for more than 85% of Costa Rican citrus and tropical juice exports, followed by orange juice (14%) and other tropical juices (1%). Costa Rica is the world’s leading exporter of pineapple juice, with two-thirds exported as NFC juice. Around half of its pineapple acreage is in the Huetar Norte region. Costa Rica also processes and exports other types of tropical fruit, mainly bananas, passion fruit, guava and soursop.

Tips:

- Follow the latest tropical fruit crop market reports from the Indian market, published by ABC Fruits;

- Keep an eye on the latest Abrafrutas news from Brazil’s fruit sector (in Portuguese) and news from CitrusBR about Brazil’s OJ market;

- Consult the free Fundecitrus PES online database (soon in English). It provides interactive online data about orange production, tree inventory and disease surveys.

Which companies are you competing with?

There are many citrus and tropical juice producing companies. The biggest players are in orange juice production, which is dominated by three large Brazilian companies: Citrosuco, Cutrale and LDC.

Brazilian companies

In Brazil, the common interests of the three major OJ players are collectively represented by CitrusBR. Their activities shape the OJ market. These three are also implementing novel sustainability practices that may become new industry standards.

Citrosuco produces 40% of Brazilian OJ. The company has five processing facilities in Brazil, orange groves in Florida and specialised land and ocean transport fleets. Citrosuco owns juice terminals at ports in Belgium (in Antwerp and Ghent) and has trade offices in Belgium and Germany.

Cutrale is the second-largest processor, sourcing around 40% of its oranges from its plantations in Brazil and Florida. Cutrale has offices in the Netherlands, the UK and Portugal.

LDC is the third-largest processor and exporter of Brazilian OJ. The company has a terminal in the Port of Ghent and trade offices in Europe.

Brazil is also the leading producer of acerola juice and guarana powder extract.

Other important citrus and tropical fruit juice producers are Britvic Ebba and Sergipe-based Tropfruit Nordeste and Maratá Sucos. Ducoco is the leading processor of coconut water, while Petruz, Amazon Polpas and Sambazon are leading producers of açaí berry pulp.

Mexican companies

Citrofrut is a major player in Mexico’s citrus juice industry. Citrofrut produces orange, lime, lemon, grapefruit, tangerine, guava and mango juice. The company operates five processing plants. Mexifrutas is a leader in tropical fruit concentrates and pulp with operations in Mexico and Costa Rica.

Other notable processors include Citricos de Colima, Indumesa and Regules Industrias. Suppliers of lime juice include Citrolim, Citrusper, Altex Citrex and Citrojugo. The leading aloe vera juice suppliers are Aloe Jaumave and Natural and Organic Farms Mexico.

Argentinean companies

There are two dozen citrus (mostly lemon) juice exporters in Argentina. San Miguel is a leading global producer of lemons. San Miguel controls a 16% market share (PDF) of worldwide lemon processing. The company recently opened new plants in South Africa and Uruguay.

Citromax processes around 210,000 tonnes of fruit per year into NFC and concentrated juices, dehydrated peel and essential oils. It is the world’s largest organic lemon processor. Citrusvil has the capacity to process around 350,000 tonnes of lemon per year and produces concentrated lemon juice.

Costa Rican companies

Exports of pineapple juice from Costa Rica are dominated by around ten companies. The leading exporters are Florida Products, Fruitlight (part of US-based ALCA Corp), Fructa (part of German riha WeserGold), Tropical Paradise Fruits, Del Oro and TicoFruit. Florida Products produces cloudy and clarified pineapple juice as well as banana juice.

Tip:

- Consider organising study visits to major producing and processing regions to learn from other producers.

Which products are you competing with?

Fresh citrus and tropical fruits, soft drinks and flavoured waters are key competitors. Large quantities of fresh orange juice are also produced by squeezing oranges at home, in restaurants or in specially-designed juice extractors in supermarkets.

Tip:

- Read the CBI studies on fresh fruit to understand the fresh citrus and tropical fruit competition for juices.

4. What are the prices of citrus and tropical juices on the European market?

Export prices of citrus and tropical juices vary significantly, depending on the fruit type, variety, season, Brix value, quality, origin and brand. Retail prices are an unreliable indicator of prices. The fruit harvest size, juice inventory size and industrial raw material prices in leading production countries give a much better indication of product price levels.

OJ and pineapple juice reached new price highs in Europe in 2024 as Brazil harvested five poor orange crops in a row. High OJ prices are also influencing other citrus and tropical juice segments as bottlers seek OJ substitutes.

In OJ production it usually takes around 260 boxes (of 40.8 kg each) of fruit to produce 1 tonne of FCOJ. In seasons with unfavourable conditions, such as 2015-2016, the number of boxes required can be more than 300.

The spot price of a box of industrial oranges in Brazil was BRL94.50 ($16.68) on 24 October 2024, according to CEPEA. The offering market price of Brazilian FCOJ was quoted as $6,500-7,000/t (CFR Rotterdam) in the same month. The cost of 260 boxes of fruit required for 1 tonne of FCOJ would equal $4,300 at spot market prices in Brazil. However, note that the three major Brazilian OJ companies have a lot of their own orange fruit production as well as long-term contracts with orange fruit suppliers. This makes it very difficult to calculate the orange fruit cost for the big OJ companies. These companies only purchase supplementary volumes in Brazil’s spot market at market price if necessary.

Source: Autentika Global, 2024

Tip:

- In-depth market pricing information is available from paid market information portals such as S&P Global Connect.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research