The European market potential for citrus and tropical juices

In the long term, European imports of citrus and tropical juices are expected to stagnate or decline by around 1% annually. In the short to mid-term these declines could be sharper, mainly due to problems in the production of oranges for juicing and higher juice prices. In addition, consumption of fruit juices and nectars is decreasing in Europe due to orange juice shortages and consumer concerns about calorie and sugar intake. The use of citrus and tropical fruit juices as ingredients in low-calorie drinks, smoothies and flavoured waters may help sustain demand. France, Germany, the United Kingdom, Spain, Italy and Poland offer opportunities for developing-country suppliers.

Contents of this page

1. Product description

Citrus and tropical juices are the liquid from inside citrus and tropical fruits. Tropical fruit refers to a number of different fruit species that grow in tropical regions. Citrus fruit is grown more widely and belongs to the genus Citrus. Tropical fruit cannot be grown in Europe, except on a few isolated islands that belong to European countries. Some citrus fruit is grown and processed into juice in Mediterranean Europe. However, the majority of citrus juice is imported.

Citrus and tropical juices are traded either as products that can be kept at room temperature in aseptic packaging or in frozen form. The four most important forms of juice for wholesale exports are:

- Frozen concentrated juice: water is removed to reduce volume for cost-effective transportation. For example, orange juice can be shipped in specialised orange juice bulk tankers.

- Concentrated juice: juice concentrate that is heat-sterilised and sealed in aseptic containers (barrels) and re-constituted with water on arrival.

- Not-from-concentrate (NFC) juice: juice that is pasteurised but not concentrated, preserving the natural flavours.

- Purées: thicker consistencies that are used in smoothies and culinary products.

Large quantities of tropical and citrus juices are exported in concentrated form. This helps exporters save on transport costs and packaging. After import, the concentrated juices are reconstituted by adding water, aroma and sometimes pulp cells. This type of juice is called reconstituted juice or juice from concentrate. However, demand for NFC juices is increasing in the European market.

Figure 1: Concentrated juice packaged in barrels for transport

Source: ‘barrels of juice concentrate’ by nbreazeale, licensed under CC BY-SA 2.0

Due to the nature of their fruit cells, some tropical fruits are processed mainly into purées instead of juices. Examples include banana and mango. Although these fruits can also be processed into juice (using centrifugation, microfiltration and enzymes), most quantities are processed into purée. Usually, these purées are mixed with other juices for end consumers. Unblended purées are too thick to drink.

The production process for bulk juices includes selecting whole, undamaged, ripe fruit for processing. Fruit is unloaded onto reception lines. The fruit can be cleaned using different methods, depending on the fruit and juice type. Fruit sizing is used in citrus juice production for optimal pressure in the presses.

Juice extraction is performed in different ways, depending on the fruit type and machine design. Extraction equipment is supplied by firms such as Bucher Unipektin, Alfa Laval, JBT and Brown. Citrus processing also includes extraction of oil from peels. After extraction, the juice is pulpy or cloudy. This juice is ready for the final processing stages for NFC juices: pasteurisation, concentration and packing.

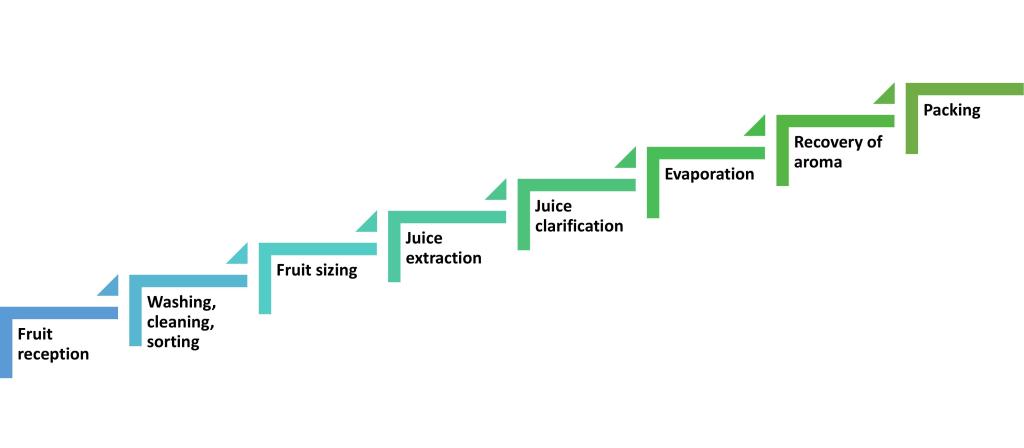

Figure 2: Production of concentrated juice

Source: ‘juice concentrate (in the tubes)’ by nbreazeale, licensed under CC BY-SA 2.0

When producing clear juice, it is clarified using centrifugal force and filtration. Individual batches of juice can be blended in big processing lines to achieve optimal Brix-to-acid ratios. When producing concentrated juice, evaporation equipment is used to remove water from the juice. No additional pasteurisation is needed. To preserve aroma, the first vapours that are rich in essence are taken from the evaporation tubes and condensed. This essence is commonly sold together with the concentrated juice.

Figure 3: Stages of the bulk juice production process

Source: Autentika Global, 2024

To get a clear picture of the NFC orange juice (OJ) factory extraction process, you can watch a video of a typical industrial line in the US. There is also a Citrosuco corporate video showing the size, scale and complexity of operations at Citrosuco. Citrosuco is one of Brazil’s three largest orange juice producers and exporters, along with Cutrale and Swiss trader Louis Dreyfus Company (LDC).

The largest share of the citrus juice trade is in orange juice, followed by grapefruit, lemon and lime. Other citrus fruit juices such as mandarin, tangerine, pomelo and yuzu are traded in relatively small quantities. The largest share of the tropical juice trade is in pineapple, followed by passion fruit.

Citrus and tropical juices are used mostly for direct consumption. The beverage industry also uses them as ingredients in juices, nectars, smoothies and soft drinks. Other ingredient uses include fruit preparations, fillings and toppings. High-acid citrus juices such as lime are consumed diluted with water, used as acidity regulators and as ingredients in drinks. Some juices, such as lemon, can be processed into powder and exported as concentrated powder.

Some key citrus juices in this wide category include:

- Orange juice: obtained mainly from Citrus sinensis. Valencia and navel are popular varieties.

- Lemon juice: obtained from Citrus limon and used extensively in culinary applications.

- Grapefruit juice: obtained from Citrus paradisi, available in white and pink varieties.

Table 1: Citrus juices product group

| HS Code | Brief description |

| 200911 (and corresponding 8-digit codes) | Frozen concentrated orange juice (FCOJ) |

| 200912 | NFC orange juice |

| 200919 (and corresponding 8-digit codes) | Concentrated orange juice (COJ) |

| 200921 | NFC grapefruit juice |

| 200929 (and corresponding 8-digit codes) | Concentrated and other grapefruit juices |

| 200931/200939 (and corresponding 8-digit codes below) | Other single citrus fruit juices |

| 20093151/20093159 | NFC lemon juices |

| 20093951/20093955/20093959 | Concentrated lemon juices |

| 20093111/20093119/20093191/20093199 | Other NFC single citrus fruit juices |

20093911/20093919/20093931/20093939 20093991/20093995/20093999 | Other concentrated single citrus fruit juices |

Source: Autentika Global, TARIC, 2024

Some of the main tropical juices include:

- Pineapple juice: obtained from Ananas comosus, particularly the Smooth Cayenne variety for concentrates.

- Guava juice: obtained from Psidium guajava, known for its rich vitamin C content.

- Passion fruit juice: obtained from Passiflora edulis, used in exotic blends.

Table 2: Tropical juices product group

| HS Code | Brief description |

| 200941 (and corresponding 8-digit codes) | NFC pineapple juice |

| 200949 (and corresponding 8-digit codes) | Pineapple juice concentrate (PJC) |

| 200989 (and corresponding 8-digit codes below) | Tropical fruit juices |

| 20098973, 20098997, 20098936, 20098934, 20098988, 20098985 | Juices of guavas, mangoes, mangosteens, papayas, tamarinds, cashew apples, lychees, jackfruit, sapodillo plums, passion fruit, pitahaya |

Source: Autentika Global, TARIC, 2024

Wherever this study refers to citrus and tropical juices, this includes all products listed in tables 1 and 2. The Harmonised System (HS) trade codes in these two tables cover juices traded in frozen, concentrate and NFC forms. Please note that fruit purées are not included in the statistical analysis as they have no globally agreed statistical codes.

This study provides general information about the overall market for citrus and tropical juices in Europe that is deemed to be of interest to producers in developing countries. The term ‘Europe’ in this study refers to the 27 member states of the European Union (EU), plus the United Kingdom (UK) and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland). The term ‘developing countries’ is defined as countries listed in the OECD-DAC list of ODA recipients for 2024 and 2025 flows (PDF).

Tip:

- Read our studies on coconut water, mango purée and pineapple juice to learn more about European markets for these specific juice industry products.

2. What makes Europe an interesting market for citrus and tropical juices?

Europe is an interesting market due to its well-developed and large juice market. European consumers are used to consuming fruit juices in all sorts of contexts. Europe accounts for 55% of the world’s citrus and tropical juice imports. On average, European imports of these juices increased by 3% in value per year in the 2019-2023 period.

During the same period, import volumes declined by around 4% per year. This is due to higher prices and lower supplies. In addition, European consumer concerns about sugar and calories are negatively affecting packed fruit juice consumption.

In 2023, European imports of tropical and citrus juices reached €5.6 billion. Roughly 49% of imports are intra-European trade in these juices. Europe imported €2.8 billion worth of tropical and citrus juices from non-European countries in 2023.

After import, concentrated juices are diluted. They can also be blended with other juices and packed. This explains the large share of intra-European trade. One litre of concentrated juice (depending on the Brix level) typically produces five to six litres of NFC juice. Some European countries (Spain and Italy) also produce citrus juices, but production is not enough to satisfy local demand.

In the next five years, the European market for citrus and tropical juices is likely to decrease, with an expected annual volume decline of around 3%. Drivers of this decline are weaker orange juice production in Brazil and the continuing spread of citrus greening, also called Huanglongbing (HLB) disease. HLB is a bacterial infection of citrus plants that has dramatically reduced orange production in Florida and Brazil. Another problem is the impact of climate change on orange production in Brazil’s citrus belt (São Paulo and the Triângulo Mineiro region) and Florida.

Bear in mind that analysing the overall volume of the juice trade is not simple. A lot of citrus and tropical juice is imported in concentrated form. Declines in concentrated juice imports may be masked by volume increases in NFC juice imports. For example, one tonne of frozen concentrated orange juice (65 Brix) equals 5.4 to 5.6 tonnes of NFC orange juice (11.6 Brix), according to the USDA (PDF). An accurate picture of market trends requires careful analysis of volume shifts in imports of every fruit juice type.

The decline of Brazil and the US as global orange juice producers led to record high prices for orange juice in 2024. This is creating welcome openings for alternative suppliers of orange and other juices.

Source: Autentika Global, ITC Trade Map, 2024

Orange juice accounts for 76% of all European citrus and tropical juice imports. Pineapple follows, with 9%, lemon (and other citrus) with 4% and grapefruit with 3%. Most orange juice (55%) imported from developing countries is concentrate. Around 39% is imported as low-Brix (<20°) or NFC juice, while 6% is imported as FCOJ. Grapefruit and other citrus juices are mainly imported as concentrate. Pineapple and other tropical juices are mainly imported as NFC.

Source: Autentika Global, ITC Trade Map, 2024

Imports of citrus and tropical juices from developing countries decreased at an average annual rate of 4% over the past five years. Imports of orange juice declined by 5% in volume but increased 6% in value. Among citrus juices, grapefruit and lemon showed the strongest average annual growth in import value (+6%). Imports of pineapple juice increased by 15% in value, though import volumes remained relatively stable.

Tips:

- Read our study What is the demand for processed fruit and vegetables on the European market? for more information on developments in the European processed fruit and vegetables sector.

- Check the latest trade statistics using tools such as ITC Trade Map or Access2Markets.

- Consult the latest news and publications published by PROFEL, the European Association of Fruit and Vegetable Processing Industries. The PROFEL website provides links to the websites of its members.

3. Which European countries offer the most opportunities for citrus and tropical juices?

As Europe’s largest markets for citrus and tropical juices, France, Germany and the UK are interesting markets. Spain and Italy are also attractive markets as they consume large quantities of tropical juices. The Netherlands, though the largest importer, re-exports most of its imported quantities and is a much smaller consumer. However, the Netherlands is home to some of the largest European traders. This provides distinct opportunities and makes it an entry point for the whole of Europe.

Source: Autentika Global, ITC Trade Map, Eurostat, UK Trade Info, 2024

The Netherlands is the largest importer of the category of citrus and tropical juices as a whole, accounting for 20% of all European imports. Next come France, Belgium, Germany, the United Kingdom and Spain. However, the type of juices they import differs.

For example, the Netherlands is the leading European importer of non-frozen concentrated orange, pineapple, grapefruit and some other tropical juices. Germany is the largest importer of FCOJ, while France is the leading European importer of NFC orange and lemon juices. Be aware of market preferences when targeting any market.

Another important factor is consumption. The Netherlands (largest importer) and Belgium (second to fourth-largest importer, depending on the year) are not among the top six consumers (table 3). This is because these countries are trade hubs for major orange juice processors, from where juice is then re-exported. Cutrale’s continental juice operations are based in Rotterdam, while Citrosuco and LDC both have terminals in Ghent. The scale and savings achieved by these investments makes it difficult for rivals to compete.

Table 3: Ranking of Europe’s largest fruit juice and nectar-consuming countries

| Country | Population in 2023* | Per capita consumption in litres in 2023*** | Estimated total consumption (litres) |

| Germany | 84,359,000 | 26.0 | 2,193,334,000 |

| UK | 68,682,962** | 16.6 | 1,140,137,169 |

| France | 68,173,000 | 15.9 | 1,083,950,700 |

| Poland | 36,754,000 | 20.4 | 749,781,600 |

| Italy | 48,085,000 | 13.2 | 634,722,000 |

| Spain | 58,997,000 | 9.2 | 542,772,400 |

| Netherlands | 17,811,000 | 15.4 | 274,289,400 |

| Sweden | 10,522,000 | 20.9 | 219,909,800 |

Source: Autentika Global, Eurostat*, Worldometers**, Verband der deutschen Fruchtsaft-Industrie e. V. (PDF)***, 2024

The quantities presented in table 3 are estimates of fruit juice consumption, including fruit nectars and fruit juice drinks. The fruit juice content of nectars is usually around 50%, while the juice content of fruit juice drinks ranges from 5% to 30%. Juices are also used as ingredients in soft drinks and other products.

Germany: the largest organic juice market in Europe

Germany is the largest juice market in Europe, with organic juices accounting for a very large share of the market. The country is the second-largest organic market in the world, after the USA, according to a 2023 USDA report (PDF). The market volume of organic food in Germany increased 5% year-on-year to €16.08 billion in 2023, which includes sales in food retail, natural food retail and other shopping outlets. This volume does not include chemist’s shops, health food shops, farm shops, craft businesses or out-of-home consumption.

In 2023, the main juice flavours in order of popularity were orange, apple, multivitamin, apple spritzer (chilled apple juice with carbonated water), grape and pineapple. Per capita consumption of fruit juices and nectars is decreasing. Consumption fell to 26.0 litres in 2023, down from 28.0 litres in 2022 and 30.0 litres in 2020, according to a 2024 report (PDF) published by the German federal association of fruit and nectar producers, VdF.

Germany has 305 fruit juice producers, together employing around 7,500 people. Juice and nectar industry imports are valued at €1.64 billion and exports at €1.33 billion. Most bottlers do not import raw materials directly, but are supplied through traders. The leading citrus and tropical juice importers and industry suppliers in Germany include Döhler and Austrian companies with facilities in Germany, namely Agrana (Agrana Fruit Germany) and Grünewald (Ernteband Fruchtsaft). Other industry suppliers are Carrière, Johs.Thoms, Saprex, STL and Juice Trade.

German imports of citrus and tropical juices have decreased at an average annual rate of 6.3% over the past five years, to 452,000 tonnes in 2023. Most imported juices are for domestic consumption, but large quantities are also exported to other European countries. Significant quantities are imported through Austria from large traders such as Agrana and through Citrosuco’s Austrian trade office.

Brazil is the leading supplier to Germany, accounting for almost 50% of imports. The Netherlands is the second-largest supplier, at 11%, with re-exported Brazilian juice as the main product. Orange juice of Brazilian origin represents more than 50% of all citrus and tropical juices in the German market. Other developing-country suppliers are Costa Rica (mostly pineapple), Argentina (lemon), Israel and South Africa (grapefruit) and Mexico (frozen orange and lime).

It is very difficult to gain access to the big four (Edeka/Netto, Rewe/Penny, Aldi Nord/Süd and Lidl/ Kaufland) German food retail trade chains. This can be an issue for exporters as a large share of juices and nectars are sold under these retailers’ private labels. These labels include Solevita (Lidl), Sooniger (Aldi Nord), rio d’oro (Aldi Süd), Rewe Beste Wahl and Ja (Rewe) and Edeka/Edeka Bio (Edeka).

Figure 7: Lemon and lime juices from concentrate sold under the Solevita private label

Source: Autentika Global

Private labels are often packed by specialised bottlers such as Refresco (large European bottler headquartered in the Netherlands), riha WeserGold, STUTE Nahrungsmittelwerke (filed for bankruptcy protection in April 2024) and Niederrhein-GOLD. Retail chain Edeka produces its own juices in the Albi and Sonnländer factories.

Many leading retailers also have their own organic private labels. A large share of organic juices is also sold through specialised organic retailers such as Biomarkt, Alnatura, dm, tegut, Bio Company, ebl-Naturkost and SuperBioMarkt. Note that a growing share of consumers view their buying decisions as a political or lifestyle statement (non-GMO, vegetarian, vegan). Many consumers also expect product traceability and information about production methods.

Tips:

- Participate in food trade fairs such as Anuga in Cologne and Biofach in Nuremberg. This will help you better understand the German organic market and meet important players.

- Find organic juice traders on the websites of the specialised German Association Waren-Verein and in the German company directory Wer Liefert Was.

- Stay updated about the German fruit juice industry via the website of the Association of German Fruit Juice Industry (in German only).

United Kingdom: cutting tariffs on citrus and tropical juices

The UK is the fifth-ranked importer of citrus and tropical juices in Europe. Imports have been declining in recent years, with average annual imports of this category of juices decreasing 3.6% over the past five years. Orange juice imports account for 74% of the entire category. Tropical and citrus fruit juice imports are expected to grow by 2-3% in the short term as the UK government has removed tariffs on these juices.

The UK saw an almost tenfold increase in direct fruit juice imports from Brazil in 2022-2023 relative to 2019-2021. Most of these imports from Brazil consist of NFC orange juice and COJ. This has made Brazil the leading supplier of citrus and tropical juices to the UK, with a 48% import share in 2023, followed by Spain (16%), Ireland (13%) and Costa Rica (4%).

Belgium, Germany and the Netherlands were larger suppliers of Brazilian orange juice between 2019 and 2021. Their roles declined dramatically in 2022 and 2023. Direct imports from Brazil are now large and go mostly through the offices of Brazilian companies such as Burlingtown UK (part of Brazil-based Cutrale).

The UK suspended import tariffs on many fruit juice and purée products on 1 January 2023 and 11 April 2024. The full list of agri-food tariff lines on which all tariffs have been suspended for a period of two years has been published by the UK government. Fruit juices and purées represent most of the tariff lines that had tariffs suspended.

The 2024 suspensions include non-frozen orange juice under tariff code 200912 as well as passionfruit concentrate and tropical fruit, grapefruit, lemon and pineapple juices. For specific trade codes for which tariff suspensions were approved, see the official list of implemented suspensions in 2024 (ODT). These suspensions will remain in place until 30 June 2026. A 12.2% import duty normally applies on Brazilian imports of these products. Some other suppliers (Mexico, South Africa) already benefit from zero-tariff access.

Previously, over 100 tariff suspension measures were implemented on 1 January 2023. These suspensions were in force until 31 December 2024. These tariff suspensions included FCOJ, COJ, PJC, lemon concentrate and lime concentrate. For the specific trade codes, see the official list of implemented suspensions in 2023 (ODT). The Brazilian Association of Citrus Juice Exporters (CitrusBR) reported that the removal of the 12.2% tariff would boost sales.

The temporary removal of tariffs was welcomed and supported by the British Soft Drinks Association (BSDA). The BSDA is the national trade association representing the interests of producers of soft drinks, including fruit juices.

Supplies from other developing countries are smaller. Examples include the Philippines (coconut water and pineapple concentrate), Thailand (pineapple) and Mexico (lime). García Carrión (Don Simon brand) is a leading Spanish supplier to the British market.

Private labels dominate the UK juice market, with a share of more than 50%. The leading retailers are Tesco, Sainsbury’s, Morrison, ASDA and Aldi. The largest quantities of juices, nectars and soft drinks for private labels in the United Kingdom are bottled by Refresco, which has six bottling and blending factories in the country. Refresco also bottles brands such as Innocent, Ocean Spray, Del Monte and Um Bongo. The leading UK brands are Tropicana and Innocent.

Tip:

- Learn more about the UK fruit juice market on the BSDA website.

France: a large consumer of NFC citrus and tropical juices

French imports of citrus and tropical juices decreased at an average annual rate of 5% between 2019 and 2023. Imports amounted to 635,000 tonnes in 2023. Most imported juices are for the domestic market, as France’s re-export market is small. NFC and low-Brix orange juices account for 60% of all imports in this category. The import decline is mainly due to a general decrease in consumption. France is the leading European consumer of pineapple juice.

Imports of lemon and mandarin juices remained relatively stable between 2019 and 2023. Most of these juices are sourced from Spain and Italy. In the short term, French imports of citrus and tropical juices are likely to continue decreasing at a rate of 3-4% per year due to the lower global availability of orange juice and high prices.

Brazil overtook Spain in 2023 to become France’s main direct supplier for the entire category, with a 31% share of imports. Spain’s main juice export product to France is NFC orange juice, followed by mandarin/clementine and lemon juices.

In 2023, France imported 208,133 tonnes of orange juice directly from Brazil and an additional 86,000 tonnes through Belgium via the Belgian trade offices of Brazilian companies. Other leading non-European suppliers are Costa Rica (NFC pineapple), Israel (grapefruit), Thailand (pineapple concentrate) and Morocco (orange and frozen orange).

Pineapple juice sales fell by 7.3% year-on-year in France in 2023. Orange juice sales dropped by 7.8%, according to the French Juice Association’s (UNIJUS) 2023 report (PDF) (in French). Sales of multifruit juices fell by 8.5% year-on-year. The overall drop in fruit juice and nectar sales was 6.7% by volume. However, sales rose 2.0% in value due to inflation, reported Unijus. The share of organic juice sales in the overall market dropped by 1.5% compared to 2022 and now represents 9% of all juice sales.

Around half of fruit juices and nectars are packed as private labels for retail chains. The leading chains include Carrefour (Carrefour, Carrefour Extra and Carrefour Bio labels), Leclerc (Jafaden and Bio Village labels), Intermarché (Paquito label), Auchan (Auchan and Auchan bio labels) and Super U (U label). Private labels are often packed by European bottlers such as Refresco, which has acquired Britvic. The leading independent juice brand in France is Tropicana (recently sold by Pepsico), followed by Joker (Eckes Granini).

Swiss-based commodities trader and Brazilian orange juice exporter LDC launched its own orange juice brand in France in 2024. Their new Montebelo Brasil brand offers orange juice made from fruit that is 100% traceable to orange groves in Brazil. The brand also offers other tropical and citrus fruit juice products including pineapple, passion fruit, coconut water, mango and lemon juice.

Demand for organic and low-calorie juices is strong in France. French producers are innovating to make juices ‘lighter’. A successful example is the leading nectar brand Pressade (owned by Britvic), which has launched several organic nectars with no added sugar. Thanks to this, some Pressade drinks can now be labelled ‘A’ under the Nutri-Score front-of-pack labelling system, making them more attractive compared to most other juices, which are labelled ‘C’ or ‘D’. Other innovations include adding coconut water (such as Joker with 30% less sugar) or blending with milk (such as Danao).

Tip:

- Find French juice processing, bottling and trading companies among the members of the French Juice Association (UNIJUS).

Spain: rising imports from developing countries

Spain has its own production of orange, mandarin and lemon juices and the largest citrus processing capacity in Europe. At the same time, Spain is an attractive market for tropical juices, being a major importer and consumer. Spanish imports of citrus and tropical juices have increased by 7.8% annually on average since 2019, reaching 143,900 tonnes in 2023. There has been a sharp increase in orange and pineapple juice imports.

COJ is the most imported juice in the entire category, accounting for a 24% share, followed by NFC orange juice with a 20% share and PJC with 13%. Brazilian orange juice is the most imported subcategory, but is imported mostly via Brazilian company trade offices in Belgium. However, direct imports are rising rapidly as well. A new trend is an increase in imports from Ireland, indicating a major OJ trading company may now be operating there.

Lemon juice is imported to supplement domestic processing. Domestic processing of lemons is much lower than that of orange and mandarins. The leading supplier of citrus and tropical juices to Spain is Belgium, with a 20% share, followed by Costa Rica (pineapple juice) with 17% and Brazil (orange juice) with 14%. After Costa Rica and Brazil, the leading developing-country suppliers are South Africa and Argentina (lemon juice), Mexico (lime juice), Thailand (pineapple juice), Kenya (pineapple juice) and Vietnam (passion fruit juice).

Private labels account for around 40% of Spanish retail sales of citrus and tropical juices. The leading private labels are Hacendado (by Mercadona), Carrefour/Carrefour BIO (by Carrefour), Dia (by Dia), Solevita (by Lidl) and Eroski (by Eroski). The two largest bottlers supplying private labels in Spain are J. García Carrión and AMC. The leading juice brands in Spain are Don Simon (J. García Carrión) and Juver (part of the Italian Conserve Italia group). Examples of ingredient traders are Universal Iberland, Altex and Quirante Fruits.

Tip:

- Learn more about the Spanish juice sector from the website of the Spanish Association of Juice Producers (AZOZUMOS) (Spanish only).

Italy: strong reliance on European suppliers

Italy’s imports of tropical and citrus juices have increased at an average rate of 4.2% per year between 2019 and 2023. The country imported 71,870 tonnes in 2023, down from a five-year high of 82,200 tonnes in 2022. Along with Spain, Italy is one of the two major European consumer countries to see imports increase in this period.

Italy has its own significant production of citrus juices. However, Italy does not produce enough for the domestic market and so imports citrus juices (especially lemon) from elsewhere. Italy is also a significant importer of pineapple and other tropical juices.

The leading supplier of citrus and tropical juices to Italy is the Netherlands, with a 25% share. The Netherlands mainly supplies Italy with PJC from Thailand and Indonesia. Other large European suppliers are Spain (mandarin and lemon juice) and Germany (mostly orange juice of Brazilian origin). Growing developing-country suppliers include Brazil and Türkiye (orange concentrate), South Africa (orange and lemon concentrates), Bolivia (lemon), Egypt (mango), Mexico (lime) and the Philippines (PJC).

In Italy, around 35% of juices and nectars are sold under private labels. The leading private labels belong to retail chains Conad, Coop, Selex Group, Esselunga, Carrefour and Eurospin. Coop has introduced Solidad as a Fairtrade label for Brazilian orange juice. A large share of private label juices are blended and bottled by the leading juice processor Conserve Italia, but also by La Doria Group, Fruttagel, Zuegg, Ortogel and Sterilgarda.

Leading juice brands are Santal (by Parmalat), Yoga (by Conserve Italia) and Skipper (by Zuegg).

Poland: large import and growing re-export market

Poland is the sixth-largest importer of orange juice in Europe. Between 2019 and 2023, Polish imports of citrus and tropical juices decreased by 2.1% per year in volume. In 2023, the volume of orange juice imports was 64,500 tonnes, valued at €117.5 million. Polish re-exports of orange juice are on the rise, reaching 41,000 tonnes in 2023.

Although the volume of Polish orange juice exports is relatively large compared to import volumes, Poland imports mostly concentrated orange juice. Meanwhile, its exports are almost wholly NFC orange juice, amounting to around 40,600 tonnes. Its main re-export destinations are the Czech Republic, Slovakia, Ukraine and Hungary.

A market report (in Polish) published by the Polish Association of Juices Producers (KUPS) in October shows that the most popular juice flavour in Poland remains orange, which was one of the top choices of 52% of Poles who participated in the KUPS survey. Apple ranked second at 40%, followed by multivitamin (34%) and multifruit (26%). Half of Polish consumers surveyed believe that fruit juices contain added sugar.

4. Which trends offer opportunities or pose threats in the European citrus and tropical juices market?

Consumer demand in Europe is being negatively affected by the rising prices of citrus and tropical juices, primarily orange juice from Brazil. This could represent a major opportunity for orange juice suppliers from other developing countries. Producers of other tropical and citrus juices can also benefit from buyer interest in alternatives to orange juice, especially in the citrus and tropical segments.

Sustainability concerns are shaping the juice category

European demand for sustainably grown tropical fruit is on the rise. Consumers are increasingly aware of the environmental impacts of foods they consume. There is growing consumer concern about the environment, awareness about the effects of climate change and a desire for overall healthier food choices.

According to a recent market survey, more than half of Europeans have been eating more sustainably since the Covid-19 pandemic. Research by Kerry Group in the foodservice segment also showed that 51% of consumers are happy to pay more for sustainable options. Bear in mind that attitudes may change due to the recent period of high inflation in Europe.

Juice exporters from developing countries can consider focusing more on sustainable sourcing and eco-friendly packaging. Exporters should also consider compatible dietary trends, for example towards plant-based and healthier lifestyle choices, by developing juice products aligned to all of these preferences.

Be aware of advances in sustainable packaging solutions. The food miles of tropical fruit juices, drinks and smoothies are a concern for 44% of category users in the UK. Some 38% of fruit juice/smoothie drinkers think that products made from concentrate have compromised nutritional credentials.

Concerns about ingredients’ food miles are likely to grow with increasing climate awareness. As food price inflation stabilises in Europe, consumers may continue to prioritise sustainability in their purchases. Be aware of the difference in the carbon footprint of transporting single-strength as compared to concentrated juice. Concentrated juice and purée are much cheaper to transport. This is because they contain less bulky water, also making them less carbon intensive to transport.

India’s NAVA Quality Foods offers Alphonso mango purée produced from fruit sourced from a group of contract farms. The fruit is grown under direct supervision to ensure compliance with sustainability standards, such as Rainforest Alliance standards. Nicaragua’s Sol Organica produces organic tropical fruit juices (passion fruit, pineapple and lime) and purées (passion fruit, pitahaya, banana, mango, pineapple and coconut). The company promotes sustainability in all areas of the business, from agricultural practices to processing.

New research shows that significant opportunities exist for tropical fruit producers to improve the sustainability of their produce by adopting a waste-to-value approach. Amongst other things, this can improve local employment, preserve natural resources, allow favourable use of side streams in local energy production, promote the use of environmentally-friendly packaging material for transport and add health functionalities to the end products.

Climate change and diseases are causing global orange juice shortages

The two largest global producers of orange juice, Brazil and Florida, are being severely impacted by climate change and Huanglongbing (HLB) disease. HLB is now a serious threat to the citrus industry worldwide. Brazil-based non-profit Fundecitrus recently reported on the continued spread of HLB, the incidence of which rose from 38.06% in 2023 to 44.35% in 2024 (report in Portuguese) throughout Brazil’s citrus belt. This was the seventh consecutive year of the disease’s growth, for which there is still no cure.

The presumed cause, the bacterial agent Candidatus Liberibacter spp., affects tree health as well as fruit development and ripening and quality of fruits and juice. Juice made from symptomatic fruit is described as distinctly bitter, sour, salty/umami, metallic, musty and lacking in sweetness and fruity/orange flavour, according to recent research.

Climatic problems and HLB’s spread over five consecutive harvests appear to be the main factors behind decreasing product supply and rising prices. “We are living in a period in which the supply of juice is below demand” (in Portuguese), said Brazil’s orange industry association (CitrusBR) executive director, Ibiapaba Netto. This situation is mostly affecting Europe as Brazil’s largest orange juice buyer. Brazil shipped 504,299 tonnes to Europe in 2023-2024, down 11.8% year-on-year.

Under the influence of the El Niño climate pattern, Brazil is likely to face continued peaks of extreme heat and significant reductions in rainfall in various regions. Meanwhile, in the US, the USDA announced in October 2024 that Florida growers are likely to harvest just 15 million boxes (40.8 kilos) in 2024-2025, which would be the lowest crop in more than 90 years.

These orange juice production shortages spell trouble for US and Brazilian suppliers. However, big market shifts like this ongoing one also offer new opportunities for developing-country suppliers of citrus and tropical juices.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research