Entering the European market for frozen berries

Food safety certification and frequent laboratory testing help create a positive image for frozen berries suppliers who wish to export to Europe. Emerging suppliers can reap additional advantages through sustainable production methods and the implementation of social responsibility measures. The toughest existing competitors for new suppliers of frozen berries are Serbia and North African suppliers, although they are active in different berry markets. As most frozen berries are used as ingredients, characteristics like a high Brix value, colour intensity and flavour are important to European buyers.

Contents of this page

- What requirements and certifications must frozen berries meet to be allowed on the European market?

- Through what channels can you get frozen berries on the European market?

- What competition do you face on the European frozen berry market?

- What are the prices of frozen berries on the European market?

1. What requirements and certifications must frozen berries meet to be allowed on the European market?

We give general information on buyer requirements for processed fruit and vegetables in our study about buyer requirements on the European processed fruit and vegetable market. The sector level requirements are analysed further on the product level. The section below deals with the requirements that apply to frozen berries in Europe.

What are the mandatory requirements?

Frozen berries sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. All food products have to conform to maximum levels for harmful contaminants, such as pesticide residues, microbiological organisms, preservatives and food additives.

Certain plants and plant products entering the EU need phytosanitary certificates, including fresh or chilled berries. However, these restrictions to not apply to frozen berries, according to Regulation (EU) 2019/2072.

The European safety authorities must approve additives if any are present. Additives should comply with the specifications outlined in Regulation (EU) No 231/2012. The list of approved food additives can be found in Annex II of Regulation (EC) No 1333/2008. Labels should make it obvious to consumers if frozen berries contain any allergens.

Contaminant control in frozen berries

The most common requirements regarding contaminants in frozen berries relate to the presence of pesticide residues and micro-organisms. If a product contains more contaminants than allowed, it will be withdrawn from the market. These cases are reported via the European Rapid Alert System for Food and Feed (RASFF). Dozens of incidents involving imported frozen berries were reported between 2018 and 2023 by EU nations through the RASFF system.

Contamination by foreign bodies

Frozen berries may be contaminated by foreign bodies, such as metal parts (for example, from agricultural machinery and tools), earth, stones and insects. Consider investing in metal detectors to prevent contamination with metal parts. However, to prevent contamination from other foreign bodies, you should implement eye/hand control before processing and packing.

In July 2023, the Finnish Food Authority warned that pieces of plastic from boxes used to harvest strawberries had been found in frozen berry packages. Norway found pieces of glass in frozen raspberries from Serbia in 2020.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in food products, and it publishes a list of approved pesticides. In 2023, the European Commission approved 36 new implementing regulations that modified this list through new approvals, extensions and other changes.

Some examples of pesticide contaminations in recent years include Serbian wild strawberries (chlorpyrifos, ametoctradin), Chinese organic strawberries (bromadiolone) and Egyptian frozen strawberries (carbofuran).

Microbiological contaminants

One common reason for border rejections of frozen berries is the presence of microorganisms, such as norovirus, salmonella, mould and hepatitis A. For example, Slovakia found norovirus RNA in a shipment of frozen strawberries from Egypt in 2022.

The main reason for the microbiological contamination of frozen berries is a lack of hygiene control during harvest and transport. Many small berries are very soft and cannot be washed after harvesting. As such, suppliers should educate pickers to practice good hygiene and clean transport vehicles.

Bear in mind that most viruses and bacteria found in frozen berries can survive freezing. They also can survive freeze-drying, and heat treatments of less than 85°C.

Control of chlorate and perchlorate

The EU modified the MRLs for chlorate on certain products several years ago. The maximum chlorate levels were set to 0.05 mg/kg for fresh or frozen berries. The Commission Regulation (EU) 2020/749 on chlorate levels entered into force in June 2020.

Chlorate can come into contact with food if chlorinated water is used during fruit washing. Another source can be chlorinated detergents used in the cleaning of facilities and processing equipment. Poland reported high levels of chlorate in a shipment of frozen strawberries from Morocco in 2022.

Heavy metals

In 2023, the European Commission set the maximum level for contaminants in food products through Commission Regulation (EU) 2023/915. The maximum level of cadmium for raspberries was reduced from 0.05 mg/kg to 0.04 mg/kg wet weight. The level for other berries was reduced from 0.04 mg/kg to 0.03 mg/kg wet weight.

The maximum level of lead for cranberries, currants, elderberries and strawberries was set at 0.20 mg/kg wet weight. This limit is 0.10 mg/kg for other berries. The maximum level applies after washing and separating edible parts. In 2023, Belgium withdrew a shipment of frozen raspberries from Serbia that contained 0.08 mg/kg of cadmium from the market.

Product composition

European authorities can reject products if they have undeclared, unauthorised or excessive levels of extraneous materials. There is specific legislation for additives (for example, colours, thickeners) and flavourings, that lists which E numbers and substances are allowed. Authorised additives are listed in Annex II of the Food Additives Regulation. Other annexes of the regulation list food enzymes, flavourings and colourants.

For most imported volumes of frozen berry products, product composition requests are not very relevant as most frozen berries are exported as clean and clear products without additives.

Tips:

- Reduce the amount of pesticides by applying Integrated Pest Management (IPM) during production.

- Search for information on the active substances used in plant protection products and MRLs in frozen berry products by consulting the EU Pesticides Database.

- Follow the guidelines published by the European Association of Fruit and Vegetable Processors (PROFEL) to prevent the transmission of microorganisms via frozen fruit.

- Consult a guide on how to make berries safe to eat and the associated Hepatitis A (PDF) and Norovirus fact sheets from the New Zealand government to better understand the diseases caused by these pathogens.

What additional requirements do buyers often have?

Quality requirements

Raw materials used in the manufacture of quick-frozen berries must be of sound and sellable quality and be fresh enough. Furthermore, preparing and quick-freezing frozen berries must be carried out promptly in order to limit chemical, biochemical and microbiological changes.

Suppliers must be aware of Council Directive 89/108/EEC, which lays down EU-wide rules governing quick freezing, packaging, labelling and inspecting quick-frozen foodstuffs. The temperature of quick-frozen berries must be stable and maintained, at all times, at -18°C or lower, with possibly brief upward fluctuations of no more than 3°C during transport.

Commission Regulation (EC) No 37/2005 outlines the requirements for monitoring temperature during transport, warehousing and storing for quick-frozen foodstuffs.

There are no official quality standards for frozen berries in Europe. Some traders use Codex Alimentarius Standards for frozen strawberries (PDF), frozen raspberries (PDF), bilberries/wild blueberries (PDF) and cultivated blueberries (PDF). One important related handling standard is the Code of Practice for the Processing and Handling of Quick Frozen Foods (PDF).

Frozen berries can be presented as:

- Whole and free-flowing (individually quick frozen – IQF);

- Non-free flowing (in the form of blocks);

- Crumbled (in the form of crushed berries);

- Sliced (in the case of strawberries);

- A combination of crumbled and whole.

Crumbled raspberries can be further classified into 2 quality categories: ‘standard’ or ‘yogurt’.

Some processors have additional quality categories. Examples include ‘original’, if the contents of the container after picking are frozen without any sorting. Another example is the ‘confiture’ class of blackberries where the ratio between red and black berries is higher than the IQF class. For IQF blackberries, up to 10% of berries’ colour can turn from black to red during freezing. This ratio of red berries in the ‘confiture’ class can be 20% or even more.

Some general quality requirements for frozen berries are the following:

- Good, reasonably uniform colour, characteristic of the type of fruit and variety;

- Clean, sound and free from foreign matter;

- Free from foreign flavours or odours;

- When presented as IQF: practically free from adhering berries;

- Free from completely uncoloured berries and reasonably free from uncoloured berries. Blackberries are allowed to have a small number of red-coloured berries;

- For aggregate types of berries: reasonably free from disintegrated berries or berries that are not intact;

- After thawing, berries should not lose more than 5% of their juice.

Different market segments also value different quality parameters. For example, the jam and juice industries value a high Brix level and flavour over other characteristics. On the other hand, packers of retail products value the shape of free-flowing, non-sticking frozen berries. Retailers and the baking industry prefer berries that keep their shape after defrosting.

Some varieties usually fetch higher prices on the European market. For example, the frozen Willamette raspberry variety (typical of Serbia) may be sold at higher prices. The frozen Senga Sengana strawberry variety can also fetch higher prices than early Italian varieties. Wild-picked frozen blueberries (also called ‘bilberries’) are exported at a higher price than frozen high bush blueberries.

Food safety certification

Although European legislation does not explicitly require food safety certification for frozen berries, most European food importers do. Most European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). The GFSI recognises a few certifications that meet the GFSI benchmarks. For frozen berries, some of the popular certification programmes recognised by the GFSI are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000);

- Safe Quality Food Certification (SQF).

Check which certifications are currently recognised by the latest version of the GFSI benchmarking requirements. The EU, UK, and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, certain retailers may prefer one certification over another, or demand additional certifications. Major buyers will also usually visit or audit production facilities before starting a business relationship.

For example, Fruits Congel du Nord exports BRCGS and Halal-certified frozen strawberries from Morocco. ZA Fruits from Serbia exports BRCGS and IFS-certified frozen raspberries, blackberries and strawberries.

Corporate social responsibility (CSR) certification

Companies have different requirements for CSR. Many importers may ask frozen berry suppliers to follow a specific CSR code of conduct. Most European retailers have their own codes of conduct, such as Lidl (PDF), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Other companies may insist on following common standards, such as the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone, without an audit, is not very complicated or expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), the amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Packaging requirements

Bulk frozen berries are often packaged in polyethylene bags and cardboard boxes lined with plastic foil. Usually, more valuable first-class IQF berries are transported in smaller packages while second-class berries, crumbles and frozen blocks have larger packages. Cardboard packaging is usually smaller in size (commonly up to 15 kg) while bags are larger in size (usually up to 25 kg). Retail packaging of frozen berries may vary greatly depending on the buyers’ requests, but usually it consists of plastic bags or cartons.

Figure 1: Frozen berries sold in a frozen fruit mix in plastic bags

Source: Autentika Global

The cardboard boxes are packed on Euro-pallets (80 x 120 cm) and protected with polyethylene foil. The cardboard must be durable enough to keep its shape under the weight on the pallet during prolonged storage. Cardboard boxes are sealed with tape.

Labelling requirements

Council Directive 89/108/EEC sets rules for quick-frozen foodstuffs and for their packaging and labelling. Quick-frozen foodstuffs sold to the final consumer should carry the following labelling indications: the product name with the indication ‘quick-frozen’, the minimum shelf life, the period during which the purchaser may store the product, the storage temperature and/or type of storage equipment required, batch identification and a clear indication ‘do not re-freeze after defrosting’.

Due to their high value, berries and berry-based products can be subject to adulteration. This can occur either for financial reasons or as a simple consequence of improper identification of a berry species or variety, according to recently published research.

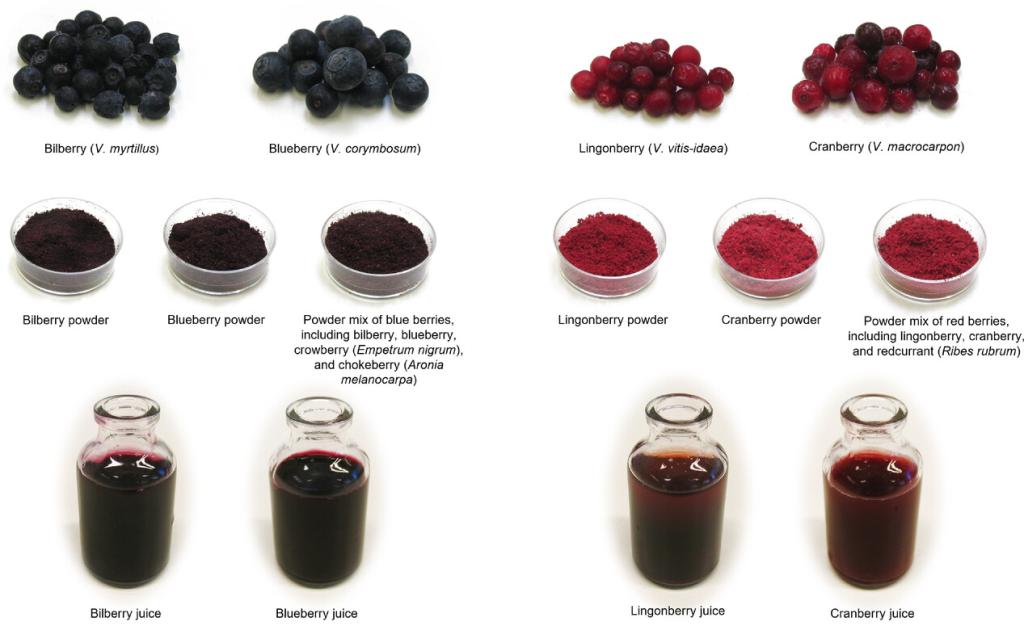

Figure 2: Comparison of Vaccinium berries of similar colour and appearance

Source: Salo, H.M.; Nguyen, N.; Alakärppä, E.; Klavins, L.; Hykkerud, A.L.; Karppinen, K.; Jaakola, L.; Klavins, M.; Häggman, H. Authentication of Berries and Berry-Based Food Products. Compr. Rev. Food Sci. Food Saf. 2021, 20, 5197–5225, public license: CC BY 4.0 license, © 2021 The Authors. Comprehensive Reviews in Food Science and Food Safety published by Wiley Periodicals LLC on behalf of Institute of Food Technologists

Some examples of authenticity problems with frozen berries include:

- Declaring an incorrect variety when selling frozen berries. One example is mixing early Italian strawberry varieties (low brix and weak flavour types) with the Senga Sengana variety (high brix and strong flavour type). Product specifications may allow for a very small percentage of other varieties.

- The ratio of frozen berries in retail berry mixes is different than declared. For example, increasing the share of cheaper strawberries and decreasing the share of pricier raspberries or blueberries.

- Adding water in bulk-frozen berry products, such as frozen berry blocks. Sugar is the only optional ingredient allowed for frozen berries. If glazing is used for some ingredient products, such as blocks, the product weight must be measured without glaze/water.

Tips:

- Always discuss the specific requirements for size and packaging with your buyer.

- Consult the USDA’s free Food and Agricultural Import Regulations and Standards report for the EU to obtain an independent overview of the EU food import legislation.

- Consult industry product technical sheets. For example, a technical sheet with an IQF strawberry specification (PDF) from Chilean company Latam Product and a technical sheet for IQF raspberries (PDF) from Bosnia and Herzegovina’s Frozen Berries.

What are the requirements for niche markets?

Organic frozen berries

To market frozen berries as organic, the fruit must be grown using organic production methods that conform to European legislation. Growing and processing facilities have to be audited by an accredited certifier before you can put the EU’s organic logo on your products or the logo of the standard holder (for example, the Soil Association in the UK, Naturland in Germany and Agriculture biologique in France).

Note that importing organic frozen berries to Europe is only possible with an electronic certificate of inspection (e‑COI). Every batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Commission Regulation defining imports of organic products from third countries.

Sustainability certification

Although widely recognised, the Fairtrade and Rainforest Alliance sustainability certification schemes are not frequently used for the certification of frozen berries. Fairtrade International has developed a specific standard for the purchase and sale of fresh fruit, which includes fresh fruit sold for further processing, for small-scale producer organisations. This standard (PDF), which has been in effect since 2018, covers seasonal fresh fruit used for further processing, but frozen berries are rarely certified as Fair Trade products.

A group of mainly European companies and organisations formed the Sustainability Initiative Fruit and Vegetables (SIFAV). They aim to achieve 95% sustainable imports of fruits and vegetables from Africa, Asia and South America by 2025.

Ethnic certification

If you want to expand to include the Jewish or Islamic ethnic niche markets, implement Halal or Kosher certification schemes. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain the Kosher certification. Halal certification in Europe can be obtained from certifying bodies, like Halal Certification Services (HCS), which provides certification services. Canada’s Fruit d’Or exports Halal-certified IQF blueberries and cranberries (PDF).

Tips:

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH and control bodies and authorities for equivalence.

- Consult the Standards Map database for information on sustainability labels and standards.

2. Through what channels can you get frozen berries on the European market?

Most of the frozen berries in Europe are used by the food processing industry but the share of retail sales is increasing due to the increasing consumption of smoothies and the popularity of frozen berries as a snack.

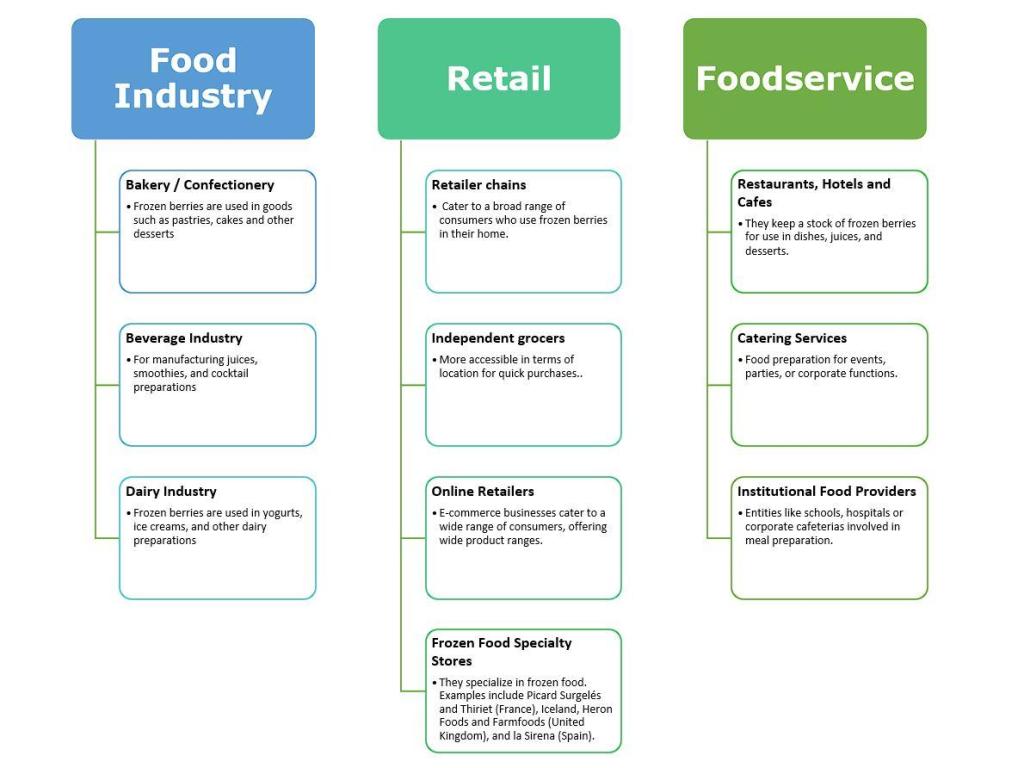

How is the end market segmented?

The food processing industry is Europe’s largest user of frozen berries, followed by the retail and foodservice sectors. The food processing segment is estimated to account for 65% of the European frozen berry market. The use of frozen berries by the jams and fruit spreads industry is shrinking due to the decreasing consumption of sugary products. Retail and foodservice sales are increasing due to the widespread popularity of smoothies.

Figure 3: End market segments for frozen berries

Source: Autentika Global

Food processing segment

In the European food sector, frozen berries are used by:

- The jams and spreads industry: The largest user of frozen strawberries and raspberries. In jam production, 40% to 50% of the final product weight consists of frozen berries. However, the proportion of fruit used in jams is increasing as producers want to increase the fruit content and reduce sugar content.

- The beverages industry: Which uses frozen berries to make juices and smoothies. Industrial smoothie producers more commonly use frozen berry purees. Frozen berry purees are often mixed with banana puree for the thicker consistency and with different types of fruit and vegetable juices to achieve specific flavours. Berry seeds are usually removed during the puree production process, but they are preferred in smoothies.

- The bakery and confectionery industries: Which use frozen berries to produce cakes, tartlets and other desserts. The bakery industry uses significant quantities of fruit fillings for pies, pastries and similar products. Fruit fillings made from frozen berries are commonly supplied by specialised food ingredient firms.

- The dairy industry: Uses berries for fruit yoghurts and ice creams. Frozen berries are not usually used directly but as an ingredient in fruit preparations. Berry crumbles are occasionally used as ingredients in ice creams with natural flavours.

Figure 4: Frozen berries in frozen pastry products

Source: Autentika Global

Another important segmentation of the frozen berry market is based on their physical form.

- IQF berries represent the premium segment. They are valued for retaining individual berries’ shape, colour, flavour and nutritional value. They are preferred for direct consumption, high-end culinary applications and any use where berry integrity is paramount.

- Block Frozen and Crumbled berries make up the economical segment. They are best suited for industrial applications where berry appearance is less critical. These berries are typically used as ingredients in processed food products like jams, smoothies and baked goods.

- Sliced and Mixed-Form berries target niche markets that require specific berry presentations. This can be either sliced strawberries for desserts or a mix of whole and crumbled berries for cooking and baking.

Retail segment

Retail chains sometimes buy directly from developing-country exporters, but they are mostly supplied by importing companies. Consolidation, market saturation, strong competition and low prices are key characteristics of the European retail food market.

Leading food retail companies in Europe differ per country. The companies holding the largest market shares are Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands). Several retail chains in Europe specialise in frozen food, such as Iceland, Farmfoods and Heron Foods (United Kingdom), Picard Surgelés and Thiriet (France), and La Sirena (Spain).

Keep in mind that several retail alliances coordinate buying operations in Europe:

- Coopernic (includes E.Leclerc, REWE Group, Ahold Delhaize, Coop Italia and Colruyt Group);

- Carrefour World Trade or CWT (includes Carrefour, Système U, Match and Cora);

- AgeCore (Colruyt – cooperation on national brands and private label, Conad, Eroski and Coop Switzerland);

- European Marketing Distribution or EMD (Colruyt – cooperation only on private label, Pfäffikon, Countdown, Dagab/Axfood, Kaufland, MARKANT, Euromadi and ESD Italia);

- Epic Partners (Edeka, Système U, Esselunga, Picnic, Migros, Jerónimo Martins and Ica).

Foodservice segment

Hotels, restaurants and catering are usually supplied by specialised importers (wholesalers). The foodservice segment often requires specific packaging sizes (1–5 kg), which differ from bulk or retail packaging packs. Some catering companies specialise in the supply of frozen fruit mixtures for smoothie bars and restaurants, such as Projuice (UK), ACAI (Germany) and Juice Factory (Austria). Smoothies and frozen fruit mixtures have also benefited from the strong growth in the home delivery market.

Tips:

- Read CBI’s study on jams, jellies, purées and marmalades to gain more insight into this important frozen berry segment.

- Search the list of exhibitors of the specialised trade fair Fi Europe to find potential buyers for your frozen berries within the food ingredient segment.

- Watch the 2023 Deutsche Welle documentary for more insight into the stiff competition between major suppliers and retail chains in Europe. Learn about the purchasing power of cross-border retail alliances.

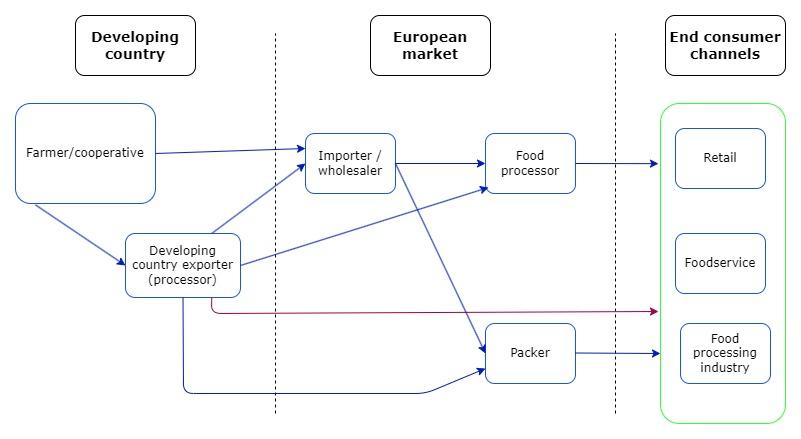

Through which channels does a product end up on the end market?

The most important channel for frozen berries is specialised frozen fruit importers/wholesalers, some of which are also referred to as ‘food ingredient suppliers’. Although the fruit processing industry is the largest user of frozen berries, these players often do not import directly but use specialised importers. Sometimes, frozen packaged berries are sold directly to European retail chains. However, in most cases, trading companies act as intermediaries.

Figure 5: European market channels for frozen berries

Source: Autentika Global

Importers/Wholesalers

Importers/wholesalers re-sell frozen berries to either food processors or packers. Some importers also own packing equipment to repack the produce for direct supply to end-market segments. For new suppliers, the challenge is to establish long-term relationships with well-known importers. Well-known importers perform regular audits and visit producing countries. As a new contact, you would need to offer the same quality but better prices than your competitors.

Importers and food manufacturers’ position is under pressure from the retail industry, which dictates the supply chain dynamics from the top. Pressure translates into lower prices but also added-value aspects, such as transparency and thus sustainable, natural, organic or fair-trade products.

There are many importers that specialise in frozen products. Some examples of large importers in the European frozen fruit market include Crop’s (Belgium) Greenyard Frozen (Belgium), Dirafrost (member of the Austrian AGRANA group), Lamex Food Group (UK), Binder International (Germany), Descours (France), ARDO (Belgium) and Grunewald (Austria).

Food processors

Food processors are a specific segment within the frozen fruit market. Some companies are specialised as intermediaries between frozen berry suppliers and industrial users. They often manufacture fruit fillings and preparations for the bakery, confectionary, dairy or ice cream industry. Those fruit preparations can be made from frozen fruit as a main ingredient. Ingredients are typically customised for each client and can include sugar, gelling agents, thickeners, concentrated juice, and so on.

Fruit preparation producers often act as food ingredient suppliers for food industries. Examples of food ingredient suppliers that offer fruit preparations include Kerry (Ireland), ADM WILD (multiple countries), Döhler (Germany), FDL (the United Kingdom) and AGRANA (Austria). Several famous producers of jams and fruit spreads also offer fruit preparations. Examples include Zentis (Germany), Zuegg (Italy) and Andros (France).

Packers

Frozen fruit packing companies usually import and re-pack imported tropical fruit under their own brands or private labels. Some importers that supply their own brand to the retail segment are Crop’s and Ardo. In some cases, suppliers from developing countries directly pack for retailers in Europe.

What is the most interesting channel for you?

Specialised frozen fruit importers are the best contacts for exporting frozen berries to Europe. They have good knowledge of the European market, and they closely monitor the situation in the frozen berry producing countries. They can also inform you about market developments and provide practical advice for your exports. Normally, they also import multiple types of frozen fruit, so offering several fruits can increase your competitiveness.

Food ingredients suppliers are also an interesting channel for market entry in this sector. In some cases, developing country-exporters can supply other segments directly as well. However, supplying directly to the retail segment is demanding as it requires a lot of investment in quality and logistics.

Compared to the general frozen fruit and vegetable sector, for frozen tropical fruit, the food industry is a relatively large segment, leaving less size and opportunities for food retail or food service, for example.

3. What competition do you face on the European frozen berry market?

Which countries are you competing with?

EU member states are the leading suppliers of frozen berries to the European market. The 4 leading frozen berry suppliers to the EU, EFTA countries and the UK are Poland, Belgium, Spain and Germany. These 4 countries supply almost 300,000 tonnes of frozen berries to Europe. Poland specialises in the production of a wide range of frozen berries and is a large supplier of frozen strawberries and frozen black and red currants. Serbia, which is not an EU or EFTA member, is the largest third-party supplier. Serbia is a major supplier of frozen raspberries and blackberries. Frozen berry supplies from Morocco and Egypt are also on the rise, while supplies from Ukraine are falling.

Chile and Mexico, large players in the global frozen berry trade, do not export significant quantities to Europe. Both countries export most of their frozen fruit to the United States, Canada and Japan. Chile is famous for its exports of frozen raspberries, while Mexico’s exports of frozen blackberries are increasing.

Source: Autentika Global, * Top 4 European suppliers (Poland, Belgium, Spain and Germany), 2024

Big European suppliers: Poland dominates the market

Poland is by far the largest supplier, exporting more than 174,000 tonnes to Europe in 2022. However, frozen berry exports from Poland fell by 3.2% per year on average between 2018 and 2022. The country is a large exporter of most major types of frozen berries to Europe, including strawberries and black and red currants.

The bulk of Polish frozen strawberries are exported to Germany, the Netherlands and France, which jointly accounted for more than half of imports. However, annual Polish frozen strawberry exports to Europe fell by 6.6% on average between 2018 and 2022. Shipments to Germany, the biggest buyer, underwent the largest drop of 12% per year.

Polish growers produced over 55,000 tonnes of blueberries in 2022; for 2023, production was estimated at over 65,000 tonnes. Of all berries, only blueberry production is increasing. Declines have been seen in the production of strawberries, raspberries, currants and gooseberries in recent years.

The frozen blueberry market is more complex than the fresh blueberry market, as the global blueberry industry uses different varieties by region. Wild blueberries, which are mostly all processed, are popular in Europe.

Serbia: A large European raspberry producer

Serbia decreased its exports of frozen berries from 123,000 tonnes in 2018 to just below 100,000 tonnes in 2022. The annual rate of frozen raspberry exports to Europe fell by 10% between 2018 and 2022, mostly due to a sharp drop in frozen raspberry demand after an increase in frozen raspberry prices in the past 2 years.

The leading European destination for Serbian frozen raspberries is Germany (30% export share), followed by France (20%) and Belgium (10%). The United Kingdom saw the biggest decline in raspberry imports from Serbia, from 8,390 tonnes in 2018 to 4,200 tonnes in 2022.

Around 75% of the Serbian production and export of frozen berries consists of frozen raspberries, 20% of frozen blackberries and 5% of other frozen berries. The leading raspberry variety for freezing is Willamette, which is prized by the fruit processing industry for its intense flavour and high Brix level. The second-ranked variety is Meeker. The leading blackberry variety is Cacak (without thorns), followed by Thornfree.

In Serbia, frozen berry production mainly takes place in the western part of the country, which has the highest concentration of facilities around the Municipality of Arilje. Willamette raspberries from the Arilje area are particularly valued by processors. Those raspberries have a protected designation of origin in Serbia. Serbia’s organic frozen raspberry production has increased in recent years.

Morocco: A steady European supplier of frozen strawberries

Morocco is a significant producer of both fresh and frozen berries. Only the country’s greenhouse tomatoes are now yielding more earnings from overseas buyers than their frozen berries. Frozen strawberry exports have traditionally been Morocco’s strongest suit. However, in recent years, frozen raspberry exports to Europe have been booming. The country’s frozen raspberry exports increased by 112% per year on average reaching 24,000 tonnes in 2022, up from just 1,200 tonnes in 2018. Most are destined for Germany (42%), Italy (16%) and Spain (16%).

Due to Morocco’s favourable climate, the country can produce and export strawberries during Europe’s winter season when prices are higher. Most strawberries are used for freezing. In 2023, Morocco exported more than 56,000 tonnes of frozen strawberries to Europe, with Spain being the leading export destination with a 27% share, followed by the Netherlands (27%), France (22%) and Belgium (10%).

Egypt: Leader in frozen strawberries

Egypt has seen the largest growth in frozen berry exports to Europe among the developing countries. European imports of frozen berries from Egypt have increased by 21% per year on average, reaching 68,500 tonnes in 2022, up from 32,000 tonnes in 2018. This is driven by frozen strawberry exports, which account for more than 95% of frozen berry exports. Egypt has been the primary exporter of frozen strawberries to the EU market since 2019, a title previously belonging to Morocco.

Tip:

- Participate in meetings organised by the International Raspberry Organization and the International Blueberry Organization to monitor the development of international competition.

Which companies are you competing with?

Many companies around the globe supply the European market with frozen berries, including large multinational ones and smaller firms. Each company has its own strategy for exporting to Europe. The examples given below illustrate just a few of the leading exporters.

European companies

Poland is still the primary exporter of frozen berries and the world leader in the export of bilberries. The number of cold store facilities in Poland that process frozen berries is estimated to be more than 100. These companies are spread throughout the country, but most are located in eastern Poland in the Lublin and Masovian Voivodeships. One important example of a successful Polish company is Real. Real’s freezing capacity is 600 tonnes per day, while the freezing warehouses’ storage capacity is 75,000 tonnes of frozen products.

Other important players in Poland include Uren Novaberry, based in Lublin, and Quadrum Foods. Other players include Kabako, Pinguin Foods, Polarica and Global Fruit.

Serbian companies

It is estimated that Serbia has more than 150 frozen berry exporters thanks to its many small processing facilities. Most berry freezing facilities are located in western Serbia. Some large European frozen fruit traders are present with cold storage facilities in Serbia. Some examples include Crops & Partners (part of the Belgian company Crop’s), Mondi Lamex (part of the UK-based Lamex) and the company Yube (part of Belgian company Dirafrost, itself part of the Austrian company Agrana).

Sirogojno is the largest frozen berry producer and exporter in Serbia, and it relies on a large network of fruit suppliers. Other frozen berry exporters include Zadrugar, Elixir, ZA Fruit, Agropartner and Frikos.

Moroccan companies

Spain and the Netherlands have some investment deals and partnerships with Moroccan processors. For example, the company Frigodar is a Spanish-Moroccan partnership that produces more than 5,000 tonnes of frozen strawberries per year. Other examples include Dutch processor SVZ, which started freezing strawberries in the late 1990s, and Dutch company Messem, which produces frozen strawberries in Morocco.

Other examples include Raimy, Frozen Fruits International and Fruits Congel.

Egyptian companies

Some of the leading Egyptian frozen berry exporters include EFM Frozen, Kenzy Group, Alfafrost, Mima Foods, Verde and Frosty Foods. A full list of licensed IQF exporters for the 2024 season is available here.

Which products are you competing with?

Fresh berries are the main competitor to frozen berries. Some consumers falsely think that freezing can affect the nutritional value of fruits and that it reduces the quantities of certain nutrients. Fresh fruit consumption is officially supported by European authorities, such as the European Fresh Produce Association (Freshfel). The largest European fresh berry suppliers are Spain, Portugal, the Netherlands and Belgium.

Tip:

- Read the CBI study on fresh berries to understand more about the competition from fresh products.

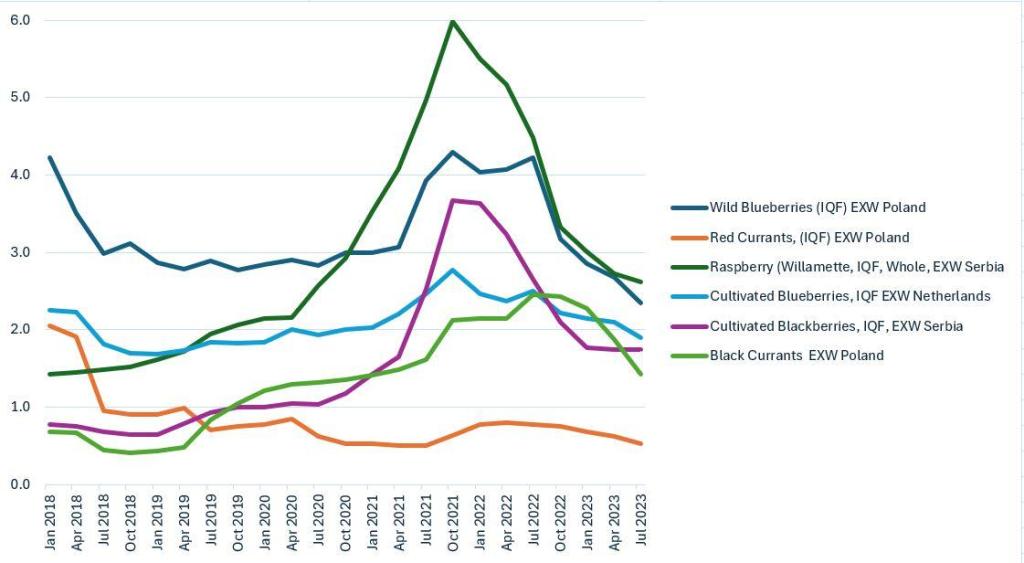

4. What are the prices of frozen berries on the European market?

The prices of frozen berries vary by berry type. Wild-picked berries (for example, blueberries and wild small strawberries) are the most expensive of all frozen berries. Frozen raspberries tend to be more expensive than frozen blackberries, while frozen strawberries are the cheapest. Another factor that influences price is the form in which they are exported. Berries sold in blocks are the cheapest, while IQF berries are the most expensive.

Source: Autentika Global based on industry sources, 2024

Frozen berry prices, especially raspberry prices, peaked in the second half of 2021 and in 2022. This affected demand and motivated growers to increase their production. This led to a lower demand and higher supply in mid-2023, resulting in a price correction. Frozen red currants prices followed a different subdued trend, dropping from €2/kg in early 2018 to levels below €1/kg in the following years.

Figure 8: Frozen berry prices in Europe (€/kg)

Source: Autentika Global based on industry sources, 2024

Tips:

- Get in-depth market pricing information from paid market information portals like S&P Global Connect.

- Read this analysis from East-Fruit for an independent look at the cyclical nature of frozen berry prices.

- Consult berry production prices from some key origins in this free compilation from East-Fruit.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research