The European market potential for frozen berries

Frozen berries have a lot of appeal among European consumers thanks to their versatility, nutritional benefits and healthy profile. The use of berries in desserts, breakfast meals and cooking shows a growing appetite for culinary exploration. European consumers like to consume berry-flavoured smoothies and frozen berries. Industry users also create innovative products using frozen berries as an ingredient. The European market for frozen berries is expected to return to a growth of around 1–2% annually, in terms of volume. Germany, France, the United Kingdom, the Netherlands, Belgium and Italy are the leading importing countries.

Contents of this page

1. Product description

The European market is known for its consistent and robust demand for frozen berries. This is helped by the ever-growing number of available berry varieties. These varieties offer attractive qualities to the food industry and companies that supply the direct consumer market.

There are several key species in the frozen berry category, each with unique characteristics and applications:

- Strawberries (Fragaria × ananassa): Among the most popular kind of frozen berry, strawberries are valued for their versatility.

- Blueberries (Vaccinium spp.): Including both wild (Vaccinium angustifolium) and cultivated varieties, blueberries are prized for their antioxidant properties.

- Raspberries (Rubus idaeus L.): Available in red, yellow and black varieties, raspberries are popular for their delicate flavour and nutritional content.

- Blackberries (Rubus fruticosus): Known for their rich colour and unique taste, blackberries are used in a variety of food products.

Frozen berries are available in several forms that meet different market needs. Quick-frozen berries can be presented as whole and free-flowing (individually quick frozen – IQF) and non-free-flowing in the form of blocks. They are also available crumbled (crushed berries), sliced (strawberries) or a combination of both crumbled and whole.

Figure 1: Frozen blueberries sold in European supermarkets

Source: Autentika Global

In the direct consumption segment, consumers view frozen berries as a healthy, convenient and light snack. They also use them as an addition to breakfast cereals, yogurts and smoothies. The food industry uses frozen berries to produce jams, jellies, preserves, bakery goods, desserts and ice creams. Beverage makers use them for fruit juices, smoothies and flavoured alcoholic drinks. Frozen berries are also used in smaller quantities for sauces, dressings and as garnishes for various dishes.

Frozen berries are traded under several Harmonized System (HS) codes. The term ‘frozen berries’ is used in this report to refer to the products in Table 1 unless stated otherwise. The only optional ingredient allowed for frozen berries is sugar, which can be in the form of sucrose, inverted sugar, inverted sugar syrup, dextrose, fructose, glucose syrup or dried glucose syrup.

Frozen berries are the product of a quick-freezing process. The process is regarded as complete when the product temperature has reached -18°C at the thermal centre of the fruit after thermal stabilisation. Repacking quick-frozen berries under controlled conditions is permitted.

Table 1: Products in the frozen berries product group

| Combined Nomenclature Number | Product |

|---|---|

| 08111011 | Frozen sweetened strawberries with a sugar content of > 13% |

| 08111019 | Frozen sweetened strawberries with a sugar content of =< 13% |

| 08111090 | Frozen unsweetened strawberries |

| 08112011 | Frozen sweetened raspberries, blackberries, mulberries, loganberries, black, white or red currants and gooseberries with a sugar content of > 13% |

| 08112019 | Frozen sweetened raspberries, blackberries, mulberries, loganberries, black, white or red currants and gooseberries with a sugar content of =< 13% |

| 08112031 | Frozen unsweetened raspberries |

| 08112039 | Frozen unsweetened black currants |

| 08112051 | Frozen unsweetened red currants |

| 08112059 | Frozen unsweetened blackberries and mulberries |

| 08112090 | Frozen unsweetened loganberries, white currants and gooseberries |

| 08119050 | Frozen European blueberries (Vaccinium myrtillus) |

| 08119070 | Frozen Canadian blueberries (Vaccinium myrtilloides and Vaccinium angustifolium) |

Source: Autentika Global

2. What makes Europe an interesting market for frozen berries?

The market for frozen berries in Europe is driven by their perceived health benefits, convenience and year-round availability. The versatility and extended shelf life of frozen berries makes them a common ingredient in both household kitchens and professional food establishments across Europe.

The term ‘Europe’ in this study refers to the 27 member states of the European Union (EU), plus the United Kingdom (UK) and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland).

Europe is by far the largest importing region for frozen berries, accounting for approximately 56% of global imports. European imports of frozen berries have decreased by an average of 0.6% in volume per year between 2018 and 2022. Most imports from outside Europe come from developing countries. The role of developing country suppliers is growing.

High energy prices, the war in Ukraine and a recent period of high inflation have suppressed buyer demand for frozen berries. Despite their nutritional benefits, frozen berries can be perceived as an optional purchase. Bread, milk and vegetables are seen as staple foods. Producers of frozen fruits and berries avoid having overly large stocks due to the high energy costs involved in storage.

Source: Autentika Global, ITC Trademap, national statistics, 2024

Import growth trends were mixed in the 2018-2022 period. Many European countries showed a marked slowdown in import volumes. This was especially noticeable in 2022, when energy prices spiked because of the war in Ukraine. On 24 February 2022, Russia launched a full-scale invasion of Ukraine in an escalation of the Russo-Ukrainian war that started in 2014.

Over the next 5 years, the European market for frozen berries is likely to return to growth with an annual volume growth rate of 1–2%. This growth will be supported by the recent normalisation of European energy markets and a gradual decline in price inflation. Other favourable trends include the enduring popularity of frozen berries and the perceived health benefits of berries. Berries are often used in smoothies as a healthier breakfast option.

Europe’s frozen berry import demand is influenced by changes in global supply and demand. These changes can lead to significant price swings. The market can experience significant changes in import volumes depending on the size of harvests in major origins and pricing. Sometimes a drop in European imports might not reflect a drop in consumer demand; importers may wait for a better entry point in terms of price. For example, the frozen raspberry market is largely dominated by the offer from Poland and Serbia.

Source: Autentika Global, ITC Trademap, *frozen berry HS codes 081110 and 081120, 2024

Data on exports from developing countries that precisely targets blueberries at the level of 8-digit national tariff codes is not easily accessible. Using the parent 6-digit HS code (081190) is inadequate as it also covers trade in other frozen fruits and nuts. This is why blueberries are not included in Figure 3.

European imports of frozen berries (HS codes 081110 and 081120) from developing countries grew annually by an average of 17%, to €901 million between 2018 and 2022. Imports of strawberries, raspberries, blackberries, mulberries, loganberries, currants and gooseberries from developing countries surpassed the €868 million value of intra-European imports.

The 17% increase in the imported value of frozen berries is thanks to higher prices of frozen berry imports. This was caused by food inflation and higher energy costs, which have a strong impact on frozen products.

The term ‘developing countries’ is used to denote countries that are listed on the OECD-DAC list of ODA recipients for 2024 and 2025 flows (PDF). Annual growth rate is expressed as the cumulative annual growth rate (CAGR).

Internal European trade accounts for 50% of all trade in terms of value for frozen berry HS codes 081110 and 081120. Internal European trade covers both the re‑exporting of imported frozen berries and the production and supply of Poland, Spain and Bulgaria.

While the consumption of frozen berries has been declining in Europe, consumption of frozen vegetables has been growing. Some reports have attributed this difference in market performance to the fact that vegetables are included in daily diets and are not too expensive. European consumers can more easily do without more expensive frozen berries in times of economic difficulty.

Tips:

- Read CBI’s demand study for a broader view of the processed fruit and vegetables market in Europe.

- Seek new European market opportunities by consulting CBI’s study on trends in the processed fruit and vegetables market.

3. Which European countries offer most opportunities for frozen berries?

As Europe’s main importer and consumer of frozen berries, Germany is an interesting focus market. Germany also provides opportunities for organically certified frozen berries. Germany is the leading organic market in Europe. Belgium and the Netherlands are also important trade hubs with significant re-exports of imported frozen berries. Other European countries that are large net importers are France, the United Kingdom and Italy. These countries consume the most imported frozen berries.

Source: Autentika Global, ITC Trademap, *apparent consumption calculation does not include local production, 2024

Germany: Europe’s leading importer of frozen berries

Germany is Europe’s largest importer of frozen berries. The country imported around 213,000 tonnes of frozen berries in 2022. The average annual growth rate was -3.7%. The country’s apparent consumption amounted to 173,000 tonnes. Germany’s apparent consumption decreased by 5.7% between 2018 and 2022. Apparent consumption is roughly calculated as the difference between imports and exports.

The sector performed poorly in 2022 during which all frozen fruit sales suffered. This was mainly due to high prices in the energy sector and inflation. It is likely that a similar negative trend extended well into 2023 because of continued food price inflation in Europe. Prospects may improve in 2024 and beyond as inflation and energy prices come under control.

The inflation rate in Germany, measured as the year-on-year change in the consumer price index (CPI), stood at 2.5% in February 2024. The inflation rate was 2.9% in January 2024, and 3.7% in December 2023, according to the Federal Statistical Office. However, the increase in German food prices slowed markedly in early 2024.

Germany’s Frozen Food Institute (dti) revealed that Germans consumed more frozen food than ever before in 2022. Total sales of frozen foods increased by 3.6% to 3.9 million tonnes in 2022. The frozen food category is performing strongly, even though the frozen fruit category is underperforming.

Overall, the latest trends in the German frozen food market show that the ‘breakfast & dessert’ frozen food category grew rapidly in 2022. Furthermore, a positive trend towards frozen food was seen in the out-of-home market. This bodes well for exporters of frozen fruit. However, sales of frozen fruit dropped in 2022, mostly due to lower retail sales. As frozen berries are at the higher end of the frozen fruit market, it is likely that their sales suffered more during the recent cost of living crisis.

Table 2: German domestic sales of frozen food (in tonnes)

| Retail market | Out-of-home market | Total | ||||

| 2021 | 2022 | 2021 | 2022 | 2021 | 2022 | |

| Frozen bakery products | 259,672 | 248,343 | 619,460 | 753,670 | 957,345 | 1,076,100 |

| Frozen fruit (including juice) | 33,596 | 27,818 | 34,396 | 34,690 | 67,992 | 62,508 |

| Frozen dairy products, frozen desserts | 5,678 | 6,212 | 4,543 | 5,367 | 10,221 | 11,579 |

Source: Autentika Global, dti (pdf), 2024

German fruit ingredient companies manufacture a wide range of products with frozen berries. These companies supply different market segments, such as dairy, ice‑cream, bakery, beverages and other food industries. The frozen food industry in Germany has a turnover of around €18.5 billion. It supplies 80 million people with frozen food every day.

Frozen strawberries are the number one imported frozen berry product in Germany, accounting for around 100,000 tonnes of frozen berry imports in 2022. However, on average, frozen strawberry imports fell by 2.3% per year in the 2018–2022 time frame. The largest supplier of frozen strawberries was Egypt. Egypt saw its strawberry exports to Germany increase by 13.7% every year to almost 50,000 tonnes in 2022. Second-ranked Poland saw a 14.3% average annual decrease to 20,600 tonnes in 2022.

The second most important frozen berry import commodity is frozen raspberries. These imports also underwent an average annual decrease of 4.1% during the same period. The 2 largest suppliers, Poland and Serbia, decreased their exports to Germany. Poland saw exports fall by 5.0%, on average, while Serbian frozen raspberry exports declined 7.5% per year on average. Each country exported around 29,000 tonnes to Germany in 2022. Other suppliers benefitted from their decreased exports. Ukrainian exports to Germany rose by 38%, Moroccan exports by 393% and Mexican by 270%.

Figure 5: Frozen mixed fruit product containing frozen berries sold by Lidl

Source: Autentika Global

The consumption of frozen berries in Germany has benefitted from greater consumer attention to healthy eating. Consumers are also willing to introduce variety into their diets. German consumers use frozen berries for home preparation of smoothies and in breakfast cereals and bowls. To facilitate the home preparation of smoothies, German retailers offer many ready-to-blend mixtures of frozen berries. Examples of frozen berry retail brands in Germany include Frosta and Jütro, but most retail sales involve private label brands.

Tips:

- Find German traders of frozen berries on the websites of the specialised German Association Waren-Verein and the German company directory Wer liefert was.

- Keep up to date about the German frozen food market by following news from the German Frozen Food Institute (dti). The news is in German only so use Google Translate to read it.

France: A rising market dominated by the jam industry

France is Europe’s second-largest importer and consumer of frozen berries. In 2022, French total apparent consumption was 100,900 tonnes. Apparent consumption is calculated as the difference between imports and exports, excluding local production. French imports increased annually by 0.6% in volume between 2018 and 2022, reaching 110,700 tonnes.

Figure 6: Häagen-Dazs raspberry mango ice cream made in France by British-French ice cream manufacturer Froneri

Source: Autentika Global

Like in Germany, frozen strawberries dominate the frozen berry segment. Imports of frozen strawberries increased by 0.8% per year between 2018 and 2022, reaching 61,600 tonnes in 2022. Frozen raspberries came in second place, with imports of 26,700 tonnes in 2022. Frozen raspberry imports decreased annually by 4.5% over the same period. Frozen European blueberries experienced a 6.5% annual growth rate over the last 5 years. Imports of frozen Canadian blueberries fell by 10% per year on average, reaching 4,000 tonnes in 2022.

In 2022, France’s leading supplier was Morocco (frozen strawberries), followed by Serbia (frozen raspberries and blackberries) and Poland (mostly frozen strawberries and currants). The strongest import growth from a larger supplier over the last 5 years was seen in imports from Egypt (19.6% average annual growth; frozen strawberries) and Ukraine (45.6%; frozen raspberries). French imports of frozen strawberries from Egypt increased from 4,900 tonnes in 2018 to 10,030 tonnes in 2022.

The largest consumer of frozen berries in France is the jam industry. France is the largest producer of strawberry and raspberry jams in the world. This sector is represented by brands like Andros, Bonne Maman (a brand owned by Andros), St Dalfour and Confipote.

Frozen berries are increasingly used in the home preparation of smoothies. Because of this trend, producers are increasingly making ready-to-blend smoothie mixtures, such as the smoothie mixtures of the leading French retailer Carrefour. Private-label products dominate French retail sales.

A large consumer of frozen berries is the bakery industry, which uses fruit preparations as fillings for pastries, cakes and other products. These fruit preparations are made by specialised companies, such as Valade Groupe, Capfruit and Ponthier.

The frozen foods market in France has an estimated annual turnover of €4 billion. Short and longer-term (2026 and beyond) prospects for exports to France remain strong. The average annual growth rate in the frozen food market is projected to reach 5.1% between 2019 and 2023 according to France’s association of frozen and ice cream product companies (Les EGS). Data published by the association shows that 98.6% of French people consume frozen products every year.

With a well-developed market for frozen fruit, the French market for frozen berries is likely to grow at a pace of 1–2% per year in the short term.

Tips:

- Find a list of French frozen fruit and ice cream companies in the member directory of Les EGS (under the “Les adhérents Les E.G.S” subheading).

- Get in touch with Les EGS to explore possibilities for participating in their campaigns to promote frozen berry products to restaurants, distributors, professionals and the general public. You can use a contact form on the website of its parent association, Adepale.

- If you are not from a French-speaking country, consider investing in French-speaking staff for easier entry into the French market.

United Kingdom: Frozen berries fuel the country’s growing smoothie industry

The United Kingdom’s imports of frozen berries fell from 46,800 tonnes in 2018 to 39,900 tonnes in 2022. This represents an average annual contraction of 3.9%. However, the general outlook for the frozen foods market in the United Kingdom seems to have improved in 2023. Frozen food sales returned to growth in the first quarter of 2023, according to the British Frozen Food Federation (BFFF).

Consumption of frozen berries is driven in good part by the consumption of smoothies in the United Kingdom. The retail segment is almost completely dominated by private label brands. There are very few independent brands with a significant market share. As a result, innovation comes from the private label brands, such as ‘ready to blend’ mixtures by Pack’d. The British retail chain Waitrose has also developed LoveLife smoothie mixtures in cooperation with the frozen food company Ardo UK.

Figure 7: High-protein milk products made with frozen berries

Source: Autentika Global

One of the best-known smoothie brands in Europe, Innocent, is from the United Kingdom. Innocent is also a leading brand in British food retail. Naked smoothies, manufactured by Naked Juice, is another important brand in the UK market.

The cost of living crisis has encouraged more Brits to change their shopping behaviours. More consumers are shopping at Aldi and Lidl rather than at Morrisons as they look to reduce the cost of their shopping baskets. In June 2023, the BFFF stated that more shoppers are choosing frozen food during the cost of living crisis due to its value for money, convenience, and high quality. This offers new opportunities for exporters from developing countries.

UK imports of frozen strawberries totalled 19,722 tonnes in 2022, after rising 4.1% per year between 2018 and 2022. Most frozen strawberries are sourced from Egypt. Egypt has seen its frozen strawberry exports to the UK increase by 236% per year on average. The country exported 6,390 tonnes of frozen strawberries to the UK, which is equal to roughly a third of UK imports. Second-ranked Spain saw its frozen strawberry exports to the UK grow by 16.7% per year. Moroccan exports rose by 45% per year to 626 tonnes in 2022.

Frozen raspberries were the second key import commodity, although average annual imports decreased by 5.1% in the same period to 8,439 tonnes in 2022. The 2 largest suppliers were Poland and Serbia. Both countries increased their exports to the UK. Serbian raspberry exports expanded by 5% per year on average, to 16,150 tonnes in 2022. Polish frozen raspberry exports went up by 48.7%, to 14,640 tonnes in 2022. Ukrainian frozen raspberry exports to the UK increased by 57% per year on average, reaching 184 tonnes in 2022.

Tips:

- Learn more about the UK’s frozen market by reading the latest news on the BFFF website. Also keep an eye on the Brexit-related developments that affect the frozen fruit sector on the BFFF’s Brexit Hub.

- Search for potential UK partner companies in the frozen fruit import segment by filtering the BFFF’s membership list.

- Read our study on the demand for processed fruit and vegetables for more information about general trade developments within the European market.

Belgium: A European trade hub for frozen berries

Belgium is a very concentrated market for frozen food as it is home to a few very large importers and European market leaders, such as Crop’s, Greenyard Frozen (Pinguin Foods) and Ardo. These companies act as re-exporters, processors and suppliers of the food retail, food service and food industry segments across Europe.

One of the drivers of the increased consumption of frozen berries is the home preparation of smoothies and the development of smoothie and juice bars. One of the leading suppliers of frozen smoothy solutions in Belgium is Crop’s. Crop’s organises lectures to produce innovative smoothie flavours in their development centre in Ooigem (the ‘Smoothie Academy’).

Belgium is the fourth largest importer of frozen berries in Europe. The country had the fastest average annual growth rate of imports among the 6 largest importers between 2018 and 2022. Frozen berry imports by volume rose by an average annual rate of 1.2% in this period. The growth of frozen berry imports is likely to continue at a slightly higher pace of 2–3% per year in the short term. Long-term prospects for growth beyond 2027 remain strong thanks to Belgium’s strategic trade position and developed industry.

Frozen strawberries are the main commodity in Belgium’s frozen berry imports, with more than 31,000 tonnes imported in 2022. Imports of frozen strawberries have declined by 3.9% per year on average between 2018 and 2022. Imports of frozen raspberries declined by 3.9% per year, to 15,950 tonnes in 2022. The Belgian import market for frozen European blueberries grew by 6% per year, reaching a total of 6,850 tonnes in 2022.

Peru grew its 5-year exports of frozen European blueberries to Belgium by 21% per year, to almost 9,000 tonnes in 2022. Costa Rica’s blueberry exports to Belgium also performed well increasing 10% per year, to 5,700 tonnes in 2022. Egypt was the dominant frozen strawberry exporter to Belgium with exports rising 14% per year, to 8,800 tonnes in 2022.

Industrial demand comes from jams and spreads producers such as Materne, Belberry and Nutrition & Santé. Other important buyers are fruit preparation producers such as Greenyard Prepared.

Tip:

- Keep an eye on current trends in the Belgian food market by periodically consulting the news page (in French; use Google Translate to read it) of the Federation of the Belgian Food Industry (FEVIA).

The Netherlands: An important re-exporter of frozen berries

The Netherlands has seen a decline in imports of frozen berries. Annual imports declined by 0.5% in terms of volume between 2018 and 2022. Dutch imports of frozen berries fell to 87,000 tonnes in 2022. Part of this can be attributed to larger berry supplies arriving through ports in southern Europe. Frozen strawberries account for 56% of volume imports, followed by frozen blueberries (22% share) and frozen raspberries (13% share).

Egypt and Morocco were the largest suppliers of frozen strawberries. Both countries increased their share of the market. Egypt increased its supply from 11,570 tonnes in 2018 to more than 18,400 tonnes in 2022. Frozen European blueberries underwent strong import growth from 9,640 tonnes in 2018 to 11,420 tonnes in 2022, after peaking at 12,160 tonnes in 2021.

Dutch frozen strawberry exports dropped from 65,000 tonnes in 2018 to 56,000 tonnes in 2022. Declines in average annual exports were seen in the top 3 destination markets: Germany (-8%), France (-6%) and Belgium (-1%).

In the Netherlands, the consumption of frozen berries has been boosted by a trend towards healthier eating and the popularity of smoothie and juice bars. Exporters of frozen berries to the Netherlands can also benefit from other important trends, such as the switch to more plant-based foods, according to Rabobank.

Longer-term prospects (so, 2027 and beyond) for frozen food exports to the Netherlands are strong according to a recent report by FoodService Institute Netherlands (FSIN). According to FSIN, in 2023, the Dutch food market was expected to grow to a turnover of €68.9 billion (PDF); an increase of 3.9%. Consumers also eat and drink out more often and choose luxury and convenience products more often. FSIN expects these trends to continue.

Tip:

- Keep an eye on current trends in the Dutch food market by periodically consulting FSIN’s news page (in Dutch; use Google Translate to read it).

Italy: Growing imports and re-exports

Since 2018, Italian imports of frozen berries have decreased in quantity annually by 0.6% on average, reaching 38,400 tonnes in 2022. Italy imports more than half of its frozen strawberries from North Africa. It imports 55% of frozen strawberries from Egypt, followed by 8% from Türkiye, 7% from Poland and 7% from Morocco.

Another characteristic of the Italian market is the large import share of frozen European blueberries. Frozen European blueberries account for almost one third of total Italian imports of frozen berries. They are mainly imported from Ukraine, followed by the Netherlands (as a transit country), Romania, Latvia, Lithuania, Ukraine and Finland.

The largest Italian users of frozen berries are jam and fruit preparation producers, such as Zuegg or Menz & Gasser. The private labels of Italian supermarket chains dominate retail sales. Examples of independent brands include Asiago Food and Bosco Buono (a Green Ice company, part of Eurofood group).

Tips:

- See our study on the market demand for processed fruit and vegetables for more information on general demand trends within the European market.

- Check relevant trade statistics via ITC TradeMap, Access2Markets or the COMEXT database. COMEXT is Eurostat’s reference database for international trade in goods.

4. Which trends offer opportunities or pose threats in the European frozen berry market?

Healthy and unprocessed foods are very popular amongst European consumers. They increasingly demand healthy and plant-based foods that are convenient, such as smoothies for breakfast and snacks. There is increasing demand for non-dairy, vegan, convenient and easy-to-prepare food. However, high food inflation reduced European consumers’ purchasing power in 2022 and 2023.

A summary of the most important trends specifically for frozen berries is given below. To learn more about general trends, read our study on trends in the European processed fruit and vegetables market.

Economic slowdown and food price inflation

The recent cost of living crisis in Europe, with exceptionally high inflation in 2022 and early 2023, saw consumers migrate away from more expensive fresh fruit. Europeans are choosing options that are better value for money, such as cheaper frozen fruit. In May 2023, the British Frozen Food Federation revealed that high inflation had had a significant impact on consumer spending habits over the winter months. This resulted in a significant boost in the sales of frozen food in early 2023. Similar trends were seen in Germany and Poland.

However, growth is not uniform across the entire frozen food market. For example, more indulgent products like ice cream and confectionery saw a drop in sales volume in the same period. And while consumers may find it more cost efficient to buy frozen fruit mixtures to make smoothies at home, they might also opt for fruits cheaper than frozen berries.

The switch towards frozen fruit aligns with a wider food industry desire to reduce food waste and its environmental impact. Every year, the UK food industry wastes 3.6 million tonnes of food, with a market value of 1.2 billion GBP at farm gate prices. Blast freezing maintains the quality of the fruit at the highest standards while extending shelf life. This provides a great opportunity for exporters of frozen berries to help address important issues in Europe, such as food waste and longer fruit shelf-life.

The European Union’s annual inflation was 2.8% in January 2024, down from 2.9% in December 2023. A year earlier, inflation was 8.6%. However, the highest contribution to the annual euro area inflation rate came from services and food, alcohol and tobacco. The annual inflation in the food segment of the European economy was 5.6%, which indicates there is still significant pressure on consumer spending.

In August 2023, the Bank of England warned that inflation in the UK is still above its 2% target. Inflation in the UK fell from a peak of 11% in 2022 to 4% in December 2023. Food price inflation also dropped. According to the bank, prices of food and non-alcoholic beverages have now plateaued, after rising by around 30% between September 2021 and May 2023.

Tips:

- Monitor headline economic data of European countries relevant to you through Eurostat’s free monthly inflation reports. High inflation, especially in the food sector, could lead to lower consumer purchases and a shift in consumer patterns.

- If you are interested in the latest economic data for the UK, consult the Bank of England’s monthly monetary policy reports and inflation attitudes surveys. Both are available for free from the bank’s publications web page.

- Keep an eye on events in the ongoing war in Ukraine, which is currently (2024) in its third year. Food inflation has been affected by wider developments in global agricultural commodity prices, which reflect Russia’s invasion of Ukraine and other pressures along the supply chain.

Frozen berries as a tool in Europe’s sustainable food supply toolbox

Global production and the trade of frozen fruit have grown dramatically in recent years. Fruit is part of a healthy diet for millions of people. It also contributes to development in producer countries. However, companies need to address business risks related to sustainability to ensure continued success in these value chains. Estimates show that about one-third of all food goes to waste, considering all stages from field to fork.

Sustainability specialists have pointed out that locally produced fruits and vegetables may not have lower carbon footprints than frozen counterparts shipped from further away. Food waste is often cited as the biggest factor for determining the true carbon impact of fruits and vegetables. Frozen berries have a small waste footprint compared to fresh berries. Frozen fruits also have a significantly longer shelf life than fresh fruits. This is especially true for frozen berries, as berries are very delicate and spoil and bruise easily.

International academic research (PDF) from 2017 has shown that household food waste associated with frozen products is much lower than for fresh food categories. Overall, the amount of reported food waste derived from fresh foods was almost 6 times larger than that of frozen foods in 2,800 Austrian households. However, the fresh to frozen food waste ratio was the highest in the case of fruit. The study revealed that 10.3 times more fresh fruit is wasted compared to frozen fruit.

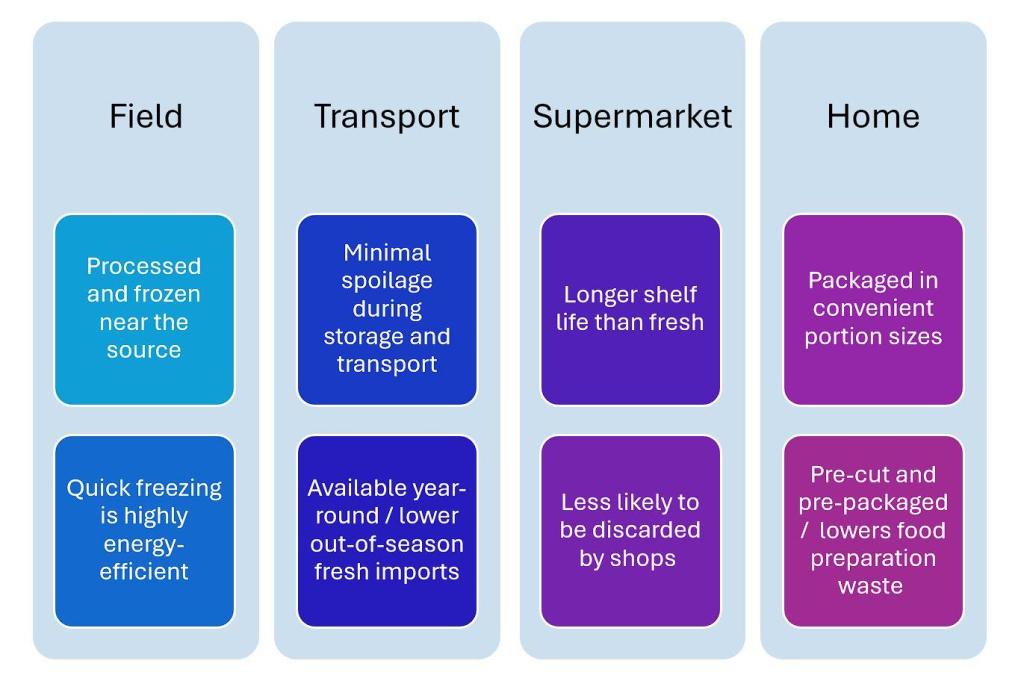

Figure 8: Role of frozen berries in reducing food waste

Source: Autentika Global

More than 13% of food produced globally is lost in the supply chain in the period after harvest and before it reaches retail. A further 17% is wasted in households, in food services and in retail, according to a Food and Agriculture Organization of the United Nations (FAO) release in September 2023. In developing countries, FAO estimates that 30–40% of total production may be lost before reaching the market. These losses can be as high as 50% for fruits.

There is room for improvement. New research from the Centre for Sustainable Cooling has shown that raising the temperature of frozen food by just 3°C could safely reduce food losses and cut carbon emissions by 17.7 million tonnes of carbon dioxide a year. The 2023 study proposes that a change of frozen food temperatures from -18°C to -15°C (pdf) could result in the saving of the equivalent carbon dioxide emissions of 3.8 million cars per year.

Frozen berries play a major role in the future supply of sustainable and healthy food to the European market. Their use leads to a reduction of food waste and allows consumers to implement correct meal portioning, which is equally important.

Even in terms of other sustainability parameters, frozen berries can gain a competitive edge over fresh variants of the same fruit. For example, there is potential for the better utilisation of cheaper transport solutions. Frozen fruits can use sea cargo instead of air cargo, leading to a lower carbon footprint.

Al-Saad is a fruit processing company in Egypt that specialises in producing high-quality strawberries using clean, renewable energy. The company states that it works with growers to help them follow sustainable farming practices. This is achieved by offering farmers training and financial support.

Tips:

- EcoVadis, a leading provider of business sustainability ratings, offers free videos about how to make your supply chain more sustainable.

- Follow news from the AGRINFO programme. Launched in 2023, it is designed to keep low and middle-income countries up to date on new European Union (EU) policies, regulations and standards with potential impacts on all agri-food value chains.

- Consider investing in sustainable certification schemes, such as Rainforest Alliance, Fairtrade, Fair for Life or Fair Trade Certified, to ensure a stable production and better access to European markets.

- Consider using a free carbon food print calculator to calculate the carbon footprint of your products and to explore how you can improve your score.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research