![CBI_MI-productfoto_[Mango Puree]_2023 (2)](/sites/default/files/styles/hero_banner_1920_x_480_big/public/visuals/CBI_MI-productfoto_%5BMango%20Puree%5D_2023%20%282%29.jpg)

Entering the European market for mango puree

Food safety certification combined with laboratory testing can help mango puree suppliers create a favourable product image for exports to Europe. The strongest current competitor is India, with its well-established supply and recognised Alphonso variety. India’s high mango production gives Indian suppliers the power to keep the price of mango puree relatively low compared to the prices charged by suppliers from Latin America and other parts of the world.

Contents of this page

1. Which requirements and certifications must mango puree meet to be allowed on the European market?

General information on buyer requirements for processed fruit and vegetables is given in our study about buyer requirements on the European processed fruit and vegetable market. The sector level requirements are analysed further on the product level for mango puree.

What are the mandatory requirements?

Mango puree products sold in the European Union (EU), the European Free Trade Association (EFTA) countries and the United Kingdom (UK) must be safe. Only approved additives are allowed, and products must conform to maximum levels for harmful contaminants. The most common requirements regarding contaminants are related to pesticide residues, microbiological organisms, preservatives and food additives.

Due to the high level of optimisation of processing lines and pasteurisation used in mango puree production, microbiological contamination is rare. Physical and chemical contamination can be present, although are also rare. There were 14 mango-related notifications reported by the European Rapid Alert System for Food and Feed (RASFF) between 2018 and 2023, but none of them were related to mango puree.

A phytosanitary certificate is required to import fresh and chilled mango into the EU, but this does not apply to mango puree according to Regulation (EU) 2019/2072.

Contaminant control

The EU places strict controls on contaminants in food, as per Regulation (EU) 2023/915 on the maximum levels for certain contaminants in food. This regulation is updated frequently. Apart from the limits set for general foodstuffs, there are also several contaminant limits for specific products.

Pesticide residues

The EU has set maximum residue levels (MRLs) for pesticides in and on food products, and it maintains a list of approved pesticides. In 2023, the European Commission approved 36 new regulations that modified this list through new approvals, extensions and other changes.

EU legislation on MRLs sets limits for the chemicals authorised on crops. For an updated list of all the pesticides that are authorised for use on mangoes, please check the EU database for pesticide residues. Select the crop in the ‘Product box’, and the database will list the pesticides authorised on that crop as well as their MRLs. Note that buyers in several European countries, such as the UK, Germany, the Netherlands and Austria, use even lower MRLs than those that are required by EU legislation.

Food processing operations, in particular washing, blanching, peeling and cooking processes, can lead to a significant reduction of pesticide residue. Some studies estimate these activities can reduce residue levels by 10–82%.

Microbiological contaminants

As mango puree production normally involves pasteurisation, the final product is not a common source of microbiological contamination. However, the risk of bacterial and fungal contamination increases if mango puree is not stored in optimal conditions.

Product composition

Depending on the type of mango puree, the product must be labelled as ‘mango puree’ or ‘concentrated mango puree’. There is specific legislation for additives (for example, colours, thickeners) and flavourings, that lists which E numbers and substances are allowed. Authorised additives are listed in Annex II of the Food Additives Regulation. Other annexes of the regulation list authorised food enzymes, flavourings and colourants.

Tips:

- Read more about MRLs on the European Commission’s website on Maximum Residue Levels. Check with your buyers if they require additional requirements on MRLs and pesticide use.

- Read more about mango puree production in this concise guide (PDF) prepared by the Industrial Technology Development Institute in the Philippines.

- Check and test your mango puree by following the analytical methods published by the International Fruit and Vegetable Juice Association (available to subscribers).

- Be aware of the definitions of mango puree and concentrated mango puree according to the European fruit juice directive 2012/12/EU.

What additional requirements and certifications do buyers often have?

Quality requirements

The basic quality requirements for mango puree are based on the EU Fruit Juice Directive and the Reference Guideline for Mango Puree from the European Fruit Juice Association. The quality of mango puree is defined by a variety of parameters. The most important include:

- Brix value (sugar content of an aqueous solution): the Brix value of mango puree varies depending on the mango variety and production process. Brix values usually range from 13 to 24 (most often between 14 and 16), and from 28 to 40 for concentrated mango puree. Juice manufacturers prefer higher Brix values.

- The acidity level influences the quality and price. Acidity levels depend on the variety of mangoes used for making the puree. The acidity level is commonly expressed as a percentage of citric acid, and it usually varies between 0.2% and 1%. In concentrated puree, the level can reach 3%.

- The Brix/acid ratio is another quality indicator. It varies between 37 and 50 for puree and exceeds 8 for concentrated puree.

- Taste, flavour and consistency. Characteristics such as taste and flavour are subjective. These characteristics are influenced by various factors, including variety, production season and production technology. Quality mango purees have higher Brix values, a more intense flavour and a less fibrous consistency.

Puree produced with the Indian Alphonso variety is perceived to be of high quality, and it usually fetches the highest prices on the market. Some European processors prefer to use varieties they are familiar with.

Food safety certification

Although European legislation does not explicitly require food safety certification for mango puree, most European food importers do. Well-established importers will require you to provide the needed certification. Most European buyers will ask for certification recognised by the Global Food Safety Initiative (GFSI). GFSI recognises a few certifications that meet the GFSI benchmarking requirements. For mango puree, the most popular certification programmes recognised by GFSI are:

- International Featured Standards (IFS);

- British Retail Consortium Global Standards (BRCGS);

- Food Safety System Certification (FSSC 22000);

- Safe Quality Food Certification (SQF).

Make sure to check which certifications are currently recognised by the latest version of the GFSI benchmarking requirements. The EU, UK and EFTA generally recognise the same food safety standards and certifications due to their mutual recognition agreements. However, certain retailers may prefer one certification over another or demand additional certifications based on their own internal policies. Major buyers will also usually visit and/or audit production facilities before starting a business relationship.

For example, Sunrise Naturals exports BRCGS and FSSC 22000-certified mango purees from India. Patson Foods from India also exports BRCGS-certified mango puree made from different varieties.

The fruit juice industry also uses SGF certification, which aims to improve safety, quality and fair competition through industrial self-regulation. This scheme certifies fruit-processing companies, packers and bottlers, traders and brokers of fruit juices, as well as transport companies and cold stores. For mango puree producers that supply the fruit juice industry, the IRMA (International Raw Material Assurance) is an important part of the SGF certification system.

Corporate social responsibility (CSR) certification

Companies have different CSR requirements. Many importers ask mango puree suppliers to follow a specific CSR code of conduct. Most European retailers have their own codes of conduct, such as Lidl (PDF), Rewe, Carrefour (PDF), Tesco and Ahold Delhaize.

Other companies may insist on following common standards, such as the Sedex Members Ethical Trade Audit (SMETA) standard. SEDEX membership alone, without an audit, is not very complicated or expensive. Other CSR alternatives include Ethical Trading Initiative’s Base Code (ETI), the amfori Business Social Compliance Initiative code of conduct (amfori BSCI) and BCorp certification.

Packaging requirements

Packaging must protect the organoleptic characteristics and quality of mango puree and prevent bacteriological and other forms of contamination, such as contamination from the packaging material. Packaging must also protect the product from moisture loss, dehydration and leakage.

A common bulk packaging option for mango puree is ‘bag-in-drum’ aseptic packaging. This packaging consists of polyethylene aseptic bags placed in drums. The drums vary in size between 180 kg and 275 kg, but most are between 200 kg and 230 kg. Another type of packaging that is used mainly by the foodservice sector is ‘bag-in-a-box’ packaging, which contains smaller quantities, ranging from 10 to 20 kg.

New packaging solutions include bulk intermediate containers made of steel. This packaging eliminates the need for fumigation and heat treatment, and it makes it possible to transport larger quantities of packaged puree in each container, thus saving on transport costs.

Retail segment packaging for puree includes tins, laminated polyester bags, glass and plastic bottles, glass jars, cans and special cartons. Brick‐type packages can be used for aseptically processed mango purees. Some carton formats are protected (for example, Tetra Pak, Elopak). Direct export of mango puree to European retailers is uncommon.

Labelling requirements

Information about bulk packaging must be provided either on the packaging or in the accompanying documents. Bulk package labelling must include the following information:

- Product name;

- Lot identification number;

- Name and address of the manufacturer, packer, distributor or importer; and

- Storage instructions.

The lot identification number and the name and address of the manufacturer, packer, distributor or importer may be replaced by an identification mark.

For retail packaging, product labelling has to comply with EU Regulation No 1169/2011 on the provision of food information to consumers. If sulphites are used as a preservative in mango puree, they must be indicated as a potential allergen (at concentrations of more than 10 mg/litre). All food in retail packs in Europe must be labelled with an indication of origin. If sweeteners are added, the words ‘sugar(s) added’ must be included on the label.

Tips:

- Subscribe to the European Fruit Juice Association Code of Practice for access to the reference guideline for mango puree and to analytical methods used for quality control.

- Obtain food safety certification. Check with importers and experts to determine whether the food safety certification company you are considering is respected by EU buyers. Examples of independent internationally accredited certification companies include SGS, CIS, TÜV and Bureau Veritas.

- Refer to industry examples of product technical sheets, such as this technical sheet with a mango puree specification (PDF) by Turkish company Fruitstar and this technical sheet for aseptic mango puree (PDF) by US-based Brewer’s Orchard.

What are the requirements for niche markets?

Organic mango puree

To market mango puree as organic in Europe, the processed fruit has to be grown using organic production methods that conform with European legislation. Growing and processing facilities must be audited by an accredited certifier before you can put the EU’s organic logo on your products or the logo of the standard holder (for example, the Soil Association in the UK, Naturland in Germany and Agriculture biologique in France).

Figure 1: Organic mango lassi beverage made with mango puree sold by dm

Source: Autentika Global

Note that importing organic products to Europe is only possible with an electronic certificate of inspection (e‑COI). Every batch of organic products imported into the EU has to be accompanied by an e-COI as defined in the Annex of the Commission Regulation defining imports of organic products from third countries.

For equivalent countries (for example, Argentina, India and Tunisia) certificates are issued by control bodies designated by national authorities. Consult the list of control bodies operating in third countries under the equivalence regime. In other countries, organic certificates are issued by control bodies in the EU/EEA/CH.

Sustainability certification

Two commonly used sustainability certification schemes are Fairtrade and Rainforest Alliance. Fairtrade International has developed a specific standard for the purchase and sale of fresh fruit, which includes fresh fruit sold for further processing, for small-scale producer organisations. This standard (PDF), which has been in effect since 2018, covers seasonal fresh fruit used for further processing, including mangoes.

A group of mainly European companies and organisations formed the Sustainability Initiative Fruit and Vegetables (SIFAV). They aim to achieve 95% sustainable imports of fruits and vegetables from Africa, Asia and South America by 2025.

Ethnic certification

If you want to expand to include the Jewish or Islamic ethnic niche markets, implement Halal or Kosher certification schemes. The Kosher London Beth Din (KLBD) provides guidelines on how to obtain the Kosher certification. Halal certification in Europe can be obtained from certifying bodies, like Halal Certification Services (HCS), which provides certification services. India’s ABC Fruits exports Halal and Kosher-certified aseptic mango pulp.

Tip:

- Check out the Organic Farming Information System (OFIS) for new authorisations, control authorities and control bodies in the EU/EEA/CH and control bodies and authorities for equivalence.

2. Through which channels can you get mango puree on the European market?

Mango puree products are mostly used as ingredients in the food processing and beverage industries. Large quantities are placed on the market by specialised importers of fruit and vegetable ingredients. These companies are primarily suppliers of the European beverage industry.

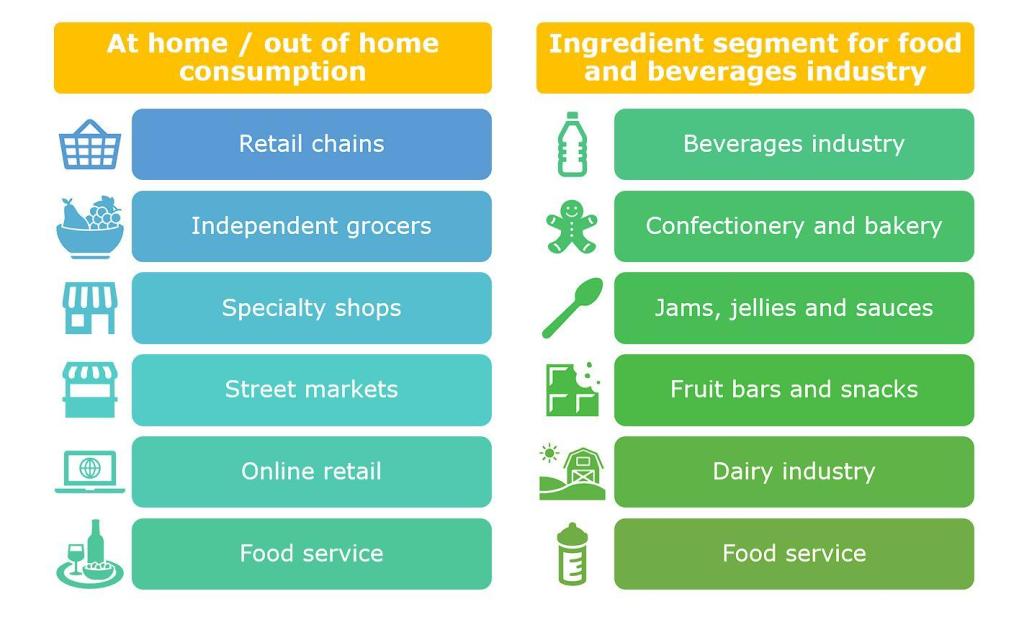

How is the end market segmented?

The largest user segment of mango puree in Europe is the beverage sector and the food industry. Puree is used for fruit drinks, milkshakes and various types of jams and jellies. The demand for mango puree is driven by its use as a unique ingredient and its rich, tropical flavour that enhances the taste and appeal of beverages and food items.

Much smaller volumes are sold in retail packaging. The repacking of mango puree is done by specialised European companies. In some cases, however, retail-ready products are imported directly, mostly by suppliers to specialised ethnic supermarkets.

The segmentation of the mango puree market into nature (organic and conventional), packaging (can, pouch, PET jars, and bottles) and distribution channels illustrates the market’s depth and the variety of options available to manufacturers, exporters and consumers.

Figure 2: End-market segments for mango puree in Europe

Source: Autentika Global

Ingredient segment

The beverage industry is the largest user of imported mango puree. It uses it to make smoothies, juices, nectars, soft drinks and cocktail mixers. Mango puree serves as a natural sweetener and flavour enhancer. Its rich, tropical flavour makes it a popular choice for summer beverages and health-oriented drink options.

For example, the beverage industry makes nectars from puree by using 20–30 Brix mango puree combined with water and other ingredients (citric acid, sugar) and stabilisers. Alternatively, to manufacture mango squash, a concentrated mango drink, the industry blends 68 Brix sugar syrup with mango puree, citric acid and preservatives. Even dried mango flakes and powder can be produced from mango puree through the so-called drum-drying technology, which involves blending the puree with wheat flour and sugar.

Figure 3: Multivitamin juice made with mango puree

Source: Autentika Global

Comparatively, the dairy industry uses mango puree in yoghurts, ice creams and flavoured milk, catering to the demand for fruit-flavoured dairy products. This is helped by the trend of incorporating natural fruit ingredients into traditional dairy products. The dairy-processing industry is often supplied through food ingredient companies with custom fruit preparation solutions.

Mango puree is used as an ingredient for cakes, pastries, fillings for chocolates and other bakery and confectionery items. It is used both as a flavouring agent and for its moisture content, which can enhance the texture of baked goods. As with the dairy industry, food ingredient companies mostly supply this segment. Fruit filling solutions for the bakery industry are usually made to be thermo-stable, which allows them to be stored at room temperature.

Fruit snacks or bars use mango puree as an exotic flavour. This aligns with the trend of on-the-go, healthier and nutritious snacks that offer a taste of exotic fruits. Although many fruit bars use dried fruit as an ingredient, they are also produced using dehydrating fruit purees, including mango puree.

Jam and preserve manufacturers value mango puree for its natural pectin content and tropical flavour. The sauces and condiments industry uses mango puree as a common ingredient in ‘chutney’ and ‘salsa’ products. The chutney market is particularly developed in the UK. The baby food industry uses mango puree (often organic), mixed with other purees and other ingredients.

Tip:

- Visit or exhibit at ISM Cologne, the leading European trade fair for sweets and snacks, to explore opportunities in the fruit snacks segment.

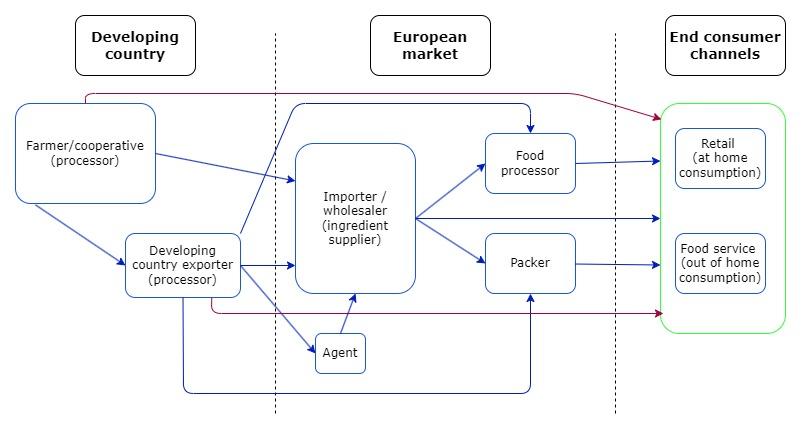

Through which channels does a product end up on the end market?

In Europe, mango puree reaches the end market through various distribution channels that cater to different industry segments. Direct sales involve selling mango puree to large food processing companies or retailers directly without going through intermediaries. This channel is beneficial for establishing long-term partnerships and may offer better margins, but it requires significant market knowledge, investment and compliance with European and corporate standards.

Specialised importers of fruit ingredients constitute the most important channel for mango puree in Europe. There are also several alternative channels, including agents, food processors and foodservice companies.

Figure 4: European market channels for mango puree

Source: Autentika Global

Importers/Wholesalers

Importers and wholesalers are a preferred contact for exporters as they have well-established distribution networks and relationships with end-users. This can ease the entry process for exporters by providing fast access to a broad customer base. Furthermore, they are well-versed in the local food safety standards, import regulations and consumer preferences. They can provide guidance on regulatory issues that vary across member states.

New suppliers should try to establish lasting relationships with well-known importers. Importers perform audits and visit producing countries on a regular basis. New suppliers will often be expected to offer the same quality as competitors at lower or equal prices. Still, going through importers is cost-effective as directly reaching retailers or the foodservice industry requires significant marketing and sales efforts. Importers and food manufacturers face pressure from retailers that effectively set the market terms downstream.

Germany’s Tropifruit is an example of an importer and supplier of processed mango purees and mango puree concentrates in Europe. UK-based JEM Fruits also sources mango puree from all over the globe to supply processing customers in the UK and Europe. Germany’s PRIPA Exotic Fruchtimport imports preservative-free organic mango puree from India.

Agents/brokers

The role of agents in the mango puree trade is not as significant as it is in other processed fruit and vegetables sectors. Most agents act as independent companies that negotiate on behalf of their clients, in addition to serving as intermediaries between buyers and sellers. They typically charge commissions between 2 and 4% of sales for their services.

Food processing companies

Although most processing companies are supplied by specialised importers, some juice-blending and bottling companies still import mango puree directly.

Specialised flavour ingredient companies also use significant quantities of mango puree to produce custom flavour solutions. One of the largest companies in this field is the Swiss company Firmenich, which uses mango puree as an ingredient for the production of flavours and bases for soft and alcoholic drinks. Other companies in this sector include German-based Doehler.

Retail channel

To directly target retail channels in Europe, mango puree exporters should focus on niche markets and specialty retailers, such as organic, ethnic and health food stores. These outlets are more open to sourcing unique and high-quality products from abroad. Building a strong brand story around the sustainability, ethical sourcing and unique characteristics of your mango puree can make it more appealing to such retailers.

For specialised ethnic supermarkets, mango puree can be sold directly as a branded retail product, created in the supplying country. Nevertheless, these products are not usually sold to such outlets directly, but through specialised suppliers to these retailers. Participating in food trade shows and organic food exhibitions in Europe can also provide valuable networking opportunities.

Tip:

- Search specialised trade fair Fi Europe’s list of exhibitors to find potential buyers for mango puree in the food ingredient segment.

What is the most interesting channel for you?

Specialised importers are the most useful contact for companies aiming to export mango puree to the European market. This is particularly relevant for new suppliers, as supplying the food-processing industry or retail segment directly is highly demanding and requires considerable investment in quality and logistics.

3. Which countries are you competing with?

The main competitor for emerging suppliers of mango puree to Europe is India, which is the market leader on the supply side of the global mango puree market. India supplies more than 70% of all mango purees to Europe according to some estimates. Other important suppliers include Colombia, Mexico, Brazil, Ecuador, Vietnam, Pakistan and Peru. Production by African countries is very limited, but Kenya, Egypt and Côte d'Ivoire play a role.

Precise statistical data regarding trade and production is not available for many countries that produce mango puree. India does track its exports, although it does not have a precise code for all forms of mango puree as of yet. The EU does not have a statistical code for monitoring imports of mango puree. The data presented here is based on industry sources, national statistical sources and estimates.

India: The world’s foremost supplier

Mango production in India is projected to account for nearly 38 million tonnes in 2032, or 45% of global production, according to the OECD-FAO Agricultural Outlook 2023–2032. More than 100 mango varieties are cultivated in India. India processes around 7% of its mango fruit. Southern and western Indian varieties are mostly used for processing, while northern varieties are mostly destined for the fresh fruit market.

Totapuri (75%) and Alphonso (14%) are the main processed varieties and, combined, they account for 90% of processed quantity in India. The remaining varieties that are significant for processing include Sindhura (4%), Dasheri (2%), Kesar (1%) and Neelam (1%). Good crop years in Mexico and South America often limit India’s exports to North America.

The main producers of Alphonso and Totapuri mangoes are Andhra Pradesh, Tamil Nadu and Karnataka. These 3 states supply most mango fruit for processing.

India takes up 70% of the mango puree market share in Europe. Some new markets are opening up with double-digit growth, such as Poland. The EU levies a 3.8% duty on mango puree imported from India and a 7.6% duty on mango concentrates, while Latin American countries have no duty, according to a report (PDF) by the Confederation of Indian Industries.

Source: Autentika Global, APEDA, APEDA historical data, 2024

India is also the world’s leading producer and exporter of mango puree. The country exported around 121,000 tonnes, with a value of 186 million USD, in the 2022/2023 export year. The average annual export volume of mango puree from India dropped by 4.6% between 2018/2019 and 2022/2023.

Despite reaching a high of more than 157,000 tonnes in 2021/2022, exports declined sharply in 2022/2023. This drop was mainly due to a severe shortage in 2022. The processing costs of Indian mango are somewhat higher than those of its main competitors, Mexico and Colombia.

There is no dedicated statistical trade code for analysing the European trade in mango puree alone. Indian exports of mango puree can be tracked through India’s harmonised product code 20079910 for mango jams, jellies, marmalades and puree. Some frozen processed mango puree can be tracked using India’s HS 20089911 code, and it is locally referred to as ‘mango squash’ in India’s harmonised product code list (PDF), which is maintained by the Agricultural and Processed Food Products Export Development Authority (Apeda).

Source: Autentika Global, APEDA, 2024

The Netherlands is the main export destination for India, accounting for more than 30,000 tonnes in 2022–2023. The next 5 major European destinations are France, the UK, Germany, Belgium and Spain.

The leading variety used for processing into puree is Totapuri (more than 70%), followed by Alphonso (less than 20%). Other mango varieties in India used to produce puree include:

- Sidhura (with prices in between those of Alphonso and Totapuri. It is sometimes blended with Alphonso to keep prices down);

- Kesar (a substitute for Alphonso that is becoming increasingly popular);

- Rumani (lower prices than those of Totapuri);

- Neelam (a substitute for Totapuri).

Alphonso puree is the reference for high-Brix purees, fetching the highest prices, while Totapuri puree is the reference for lower-Brix purees. Usually, the less expensive Totapuri is used for blending in mixed types of juices and other beverages, while Alphonso is used more in other processing industries due to its specific and prized flavour. Alphonso puree is commonly sold as single-strength (commonly with a Brix value of 16–18) to enhance flavour preservation, while Totapuri puree is sold as single-strength and concentrated.

Mexico: A major US supplier that also sells to Europe

Many juice packers in Europe that traditionally buy Indian mango puree were forced to seek alternative sources and qualities in South America because of the shortfall in production in India in 2022. This has helped Mexico and Colombia to increase their shares in the European market.

Mexico produces about 2 million tonnes of mango fruits annually but only exports a small part as mango puree. Most of it is destined for the US market, mainly as concentrates and frozen puree. The rest, about 7,000 tonnes, is sold to the European market. It is estimated that the leading importer of Mexican mango puree is the Netherlands, followed by the United Kingdom and Spain.

Mangoes are collected for processing on Mexico’s Pacific rim, from Chiapas to North Sinaloa. Several mango varieties are used to produce mango puree. Well-known varieties used for processing include Manila, Tommy Atkins, Ataulfo, Haden, Oro, Kent and Keith.

Colombia: A growing mango producer

Mango cultivation is expanding in Colombia with growers harvesting almost 400,000 tonnes of the fruit from more than 35,000 hectares in 2021, according to a 2023 report (PDF) by Colombia’s ministry of agriculture (in Spanish). The largest producer regions in the country were Cundinamarca (102,000 tonnes), Magdalena (64,000 tonnes) and Tolima (60,000 tonnes).

Of the total production, 40,000 tonnes went into making mango puree. The country exports most of the puree to the US, with smaller volumes destined for Europe. The varieties grown for puree production include Tommy Atkins, Kent and Magdalena River, with the latter being particularly favoured for this purpose. Colombia benefits from duty-free access to Europe for its mango products. Most mango processing operations are concentrated in northern Colombia (Atlántico Department).

The sector is supported by the Colombian Federation of Mango Producers (Fedemango), the country’s association of fruit and vegetable producers Asohofrucol, and the national exports promotion agency Procolombia.

Brazil: An emerging mango puree supplier

Brazilian processors mostly use the Palmer and Tommy Atkins varieties for puree production.

Brazilian mango growers harvested 1.54 million tonnes of mango fruit in 2022. Bahia is the main mango-producing state in Brazil and accounts for around 42% of national production, according to the Brazilian Association of Producers and Exporters of Fruit and Derivatives (Abrafrutas).

The mango puree sector is supported by the Abrafrutas association and the Brazilian Trade and Investment Promotion Agency (APEX). The EU is still negotiating a free trade agreement with Brazil as part of the EU’s Association Agreement negotiations with the Mercosur countries. Quantities exported to Europe are small due to higher prices resulting from the 11% custom duty on Brazilian products.

The Mercosul Common Nomenclature (NCM) trade code for mango puree is 20079925 and exports are relatively limited according to a CNA Brazil report (PDF). The Brazilian industry benefited from a mango puree shortfall in India in 2022, which allowed Brazil to export 873 tonnes of mango puree to Europe in 2022.

Tips:

- Follow the latest mango crop market reports from the Indian market prepared by ABC Fruits.

- Keep an eye on current Abrafrutas news from Brazil’s fruit sector (in Portuguese) to stay abreast with events in Brazil’s fruit processing sector.

Which companies are you competing with?

Many companies make puree from mangoes. Their production capacities vary greatly. Some companies process thousands of tonnes of mangoes and can be very price competitive. However, many small-scale processing operations produce high-quality mango puree instead.

Indian companies

Varadharaja Foods Private Limited has been in the market for more than 14 years. Located in Krishnagiri, its manufacturing facility covers about 40 acres of land. The plant is fully equipped with high-tech equipment for processing and packing fruit pulp.

Jain Farm Fresh Foods is one of the largest processors of mangoes in India and processes around 170,000 tonnes of mangoes each year. In 2018, Jain acquired the Belgian company Innovafood, an important trading company in the field of dried vegetables and spices. This European presence has helped the company penetrate European markets.

Other important processors include ABC Fruits, Tasa Foods, Vimal Agro Products (exporter and supplier of canned pulps on the Indian market), Allana (a very large processor), Mother Dairy (a milk-processing company with fruit-processing operations), Tmn International (one of the largest exporters), Shimla Hills, Ghousia Food, Jadli Foods, Tricom Fruit Products, Capricorn, Galla Foods, Keventer, MR Fruits, Sunrise Naturals and Sahyadri Farms.

Mexican companies

MexiFrutas is the largest Mexican processor of mango puree, with 3 processing facilities located in Nayarit, Chiapas and Acaponeta. In addition to producing mango puree, the company is rare in that it can produce clarified mango juice. Other Mexican mango-puree companies and exporters include Frozen Pulps, Interfrut, Fruxo, Citrofruit, Puremango, Valle Nuevo and Altex.

Colombian companies

Compañía Envasadora del Atlántico (CEA) is the largest exporter of mango puree from Colombia. The company currently has 5 aseptic pulping lines and one line for frozen pulp and juice, exporting to more than 37 countries around the world. It exports approximately 90% of all Colombian mango purees. Other Colombian mango-puree companies include Nutrium, FLP, SAS, Mah, Dream Foods Caribe, Frugy and Mapa Exportaciones.

Brazilian companies

Examples include Purea, Atlantica Foods, Strauss, Villa Puree, Minas Fruit, PolpasMr, Frutal and Petruz (which has a subsidiary in Denmark).

Tips:

- Visit major European trade fairs regularly to meet competitors and potential customers. Examples include ANUGA, SIAL and FI Europe.

- Participate in the conference organised by the International Juice Association to meet mango puree producers, exporters and traders.

Which products are you competing with?

One key substitute for mango puree is fresh mango, which can be used to make fresh puree at home. Other tropical purees and juices also compete with mango puree. Juice-blending machines are very popular in Europe, and consumers usually make their own smoothies from fresh mangoes. European consumers do not usually buy mango pulp for home consumption, except for use in baby food.

Tip:

- Read the CBI’s study on fresh mangoes to understand the mango industry and learn about promotional tools used by fresh mango suppliers.

4. What are the prices of mango puree on the European market?

Export prices vary depending on country, season, variety, quality and company. It is also difficult to compare the prices of varieties that are rarely traded in the form of concentrated puree to those of varieties that are traded as single-strength puree. For example, puree made from Alphonso mangoes is rarely traded as a concentrate as the removal of extra water reduces the quality of the flavour. In general, concentrated Totapuri sells for about the same price as single-strength Alphonso.

Totapuri is the leading commodity in single strength form and it sets the price. When it comes to the 28/30 Brix mango puree, India’s share is much smaller. Large volumes of 28/30 puree come from Latin America due to the duty-free regime.

The fruit costs account for roughly 35% of the cost of mango puree exports from India, followed by packaging costs, which account for roughly 24% of the cost of mango puree, according to the Confederation of Indian Industries (PDF).

The global demand for mango puree declined in mid-2023, leading to lower prices and limited supply, contrasting sharply with the situation in 2022. In late 2023, demand for Totapuri mango puree (TMP) was sluggish, while Alphonso mango puree (AMP) stocks were nearly sold out, with prices slightly dropping to 1,600 USD per tonne FOB India. Meanwhile, TMP saw a price drop to 650 USD per tonne FOB in November, a nearly 40% decrease year-on-year thanks to large stocks. However, Totapuri concentrate (TMC) sales have improved with prices slightly lower at 1,050 USD per tonne FOB India.

Mexican mango puree prices have increased significantly for both single strength and concentrate, due to strong demand and outstanding contracts from 2022. Brazil and Colombia have reported higher projected and spot market prices for their mango puree products, indicating a varied pricing landscape across different regions.

Source: Autentika Global, Confederation of Indian Industries, 2024

Tip:

- In-depth market pricing information is available from paid market information portals like S&P Global Connect.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research