![CBI_MI-productfoto_[Mango Puree]_2023 (4)](/sites/default/files/styles/hero_banner_1920_x_480_big/public/visuals/CBI_MI-productfoto_%5BMango%20Puree%5D_2023%20%284%29.jpg)

The European market potential for mango puree

Dairy products and innovative beverages are the 2 product categories that drive the growth of the mango puree market in Europe. The European market for mango puree is expected to continue growing at a moderate pace thanks to the versatility of mango puree in the processed food industry and growing consumer familiarity with tropical fruits. Growth is also driven by health-conscious consumers in Europe opting for plant-based products with health benefits. The Netherlands, the United Kingdom, Germany, France, Spain and Italy offer opportunities for suppliers from developing countries.

Contents of this page

1. Product description

The cultivation of mangoes (genus Mangifera Indica) is believed to have begun in southeast Asia. The mango stone fruit has been cultivated in southern Asia for nearly 6,000 years. Most mango production takes place in India, China, Thailand, Pakistan and Mexico. Global production of mangoes, mangosteens and guavas is projected to increase by 3.3% per year over the next decade to reach 84 million tonnes by 2032, according to the OECD-FAO Agricultural Outlook 2023–2032. Asia, the native region of mangoes and mangosteens, will continue to account for around 70% of global production in 2032.

Mangoes are processed into puree for re-manufacturing into fruit juices and nectars, squash, jams, jellies and even dehydrated products. Mango puree can be preserved by freezing, through chemical processes, or it can be canned or stored in barrels. The difference between mango puree and mango pulp is that mango puree is a smooth and homogenous liquid, while mango pulp is the soft, juicy and slightly coarser content of the fruit, effectively containing solid chunks of flesh.

Mango puree has a significant market presence in Europe thanks to its extensive application in the food and beverage industry. This product, which is commonly traded under various Harmonized System (HS) codes, is essential for manufacturers due to its flavour, nutritional benefits and potential as a natural sweetener.

Although similar, mango puree is not mango juice. According to the Food and Agriculture Organization of the United Nations (FAO), while 100% juice must be ‘all juice’, puree is ‘pulp-containing’ and is ‘more viscous than juices, totally fruit’. The Codex Alimentarius general standard for juices and nectars (PDF) explains that fruit puree is the unfermented but fermentable product obtained by suitable processes (for example, by sieving, grinding, milling the edible part of the whole or peeled fruit without removing the juice).

Mango puree is available in several forms including:

- Single strength puree: This is the most natural form, consisting of pure mango pulp without any additives;

- Concentrated puree: Water content is reduced to achieve higher Brix levels, suitable for products that require less volume and more intense flavour;

- Organic puree: Produced from mangoes grown without synthetic pesticides and fertilisers, meeting the growing demand for organic products in Europe;

- Frozen puree: To ensure year-round availability, mango puree is also offered frozen, which extends its shelf life and preserves its nutritional value and taste.

Mango concentrate is a condensed form of mango puree, where water is removed through aseptic evaporation means, such as heating. Although the concentrate might lose some of the flavour in the process, it is much cheaper to transport.

Figure 1: Mango puree in a bowl

Source: ‘Mango puree and poori’ by Shobha Elizabeth John is licensed under CC BY-SA 4.0

As India is the world’s largest mango supplier, its 2 main mango varieties for puree processing serve as reference points for the market. Three presentations of Indian mango puree that are of market significance are:

- Alphonso mango puree single strength (AMP): Alphonso is a premium variety of mango known for its rich aroma, sweetness and deep orange colour. Alphonso mangoes are good for desserts, smoothies and drinks with a sweet, creamy texture.

- Totapuri mango puree single strength (TMP): Totapuri is a variety of mango that is not as sweet as Alphonso but has a vibrant taste. Totapuri mangoes are good for tangy chutneys, pickles and beverages that need a tangy flavour profile. Totapuri mango puree is commonly used in products in which a balanced mango flavour is desired.

- Totapuri puree concentrate (TMC): This refers to mango puree that has been concentrated by removing water to achieve a higher solids content. Concentrate has a stronger flavour and longer shelf life.

Mango puree is also produced from other varieties, including Kesar, Sindhura, Neelam and Amrapali (India), Carabao (Philippines), Tommy Atkins, Palmer, Atualfo, Kent and Keitt (Latin America).

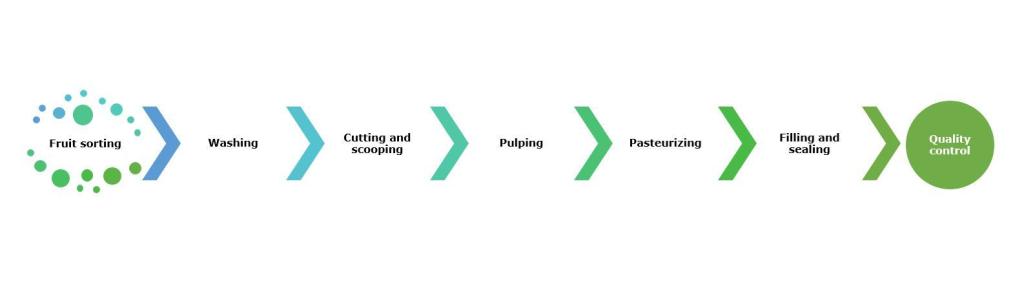

Mango puree processing can vary according to the country and processor, but a more detailed breakdown generally includes the operations described below. For a more in-depth understanding, consult specialised resources like the ‘Handbook of Mango Fruit: Production, Postharvest Science, Processing Technology and Nutrition’.

Figure 2: The mango puree manufacturing process

Source: Autentika Global, Industrial Technology Development Institute

For a good visualisation of the mango puree production process, watch this video of an industrial line in operation in Makueni, Kenya, and this video of a mango puree plant in Asia.

This study covers general information regarding the overall market for mango puree in Europe that is of interest to producers in developing countries. The term ‘Europe’ in this study refers to the 27 Member States of the European Union (EU), plus the United Kingdom (UK) and EFTA countries (Iceland, Liechtenstein, Norway and Switzerland).

There is no dedicated statistical trade code for analysing the European trade in mango puree alone. The closest code that can provide any insight into the European trade of mango puree is 20089948: ‘Guavas, mangoes, mangosteens, papaws “papayas”, tamarinds, cashew apples, lychees, jackfruit, apodilla plums, passion fruit, carambola and pitahaya, prepared or preserved, not containing added spirit but containing added sugar, in immediate packaging of a net content >1 kg’. The description is an umbrella code that includes several products.

Indian exports of mango puree can be tracked using India’s Harmonized Product Code 20079910, although some frozen processed mango puree can be tracked using India’s HS 20089911 code. This is locally referred to as ‘mango squash’, according to India’s Harmonized Product Code list (PDF). Frozen mango puree can be used for the production of smoothies, ice cream, sorbet, juice, sauces and sundaes.

2. What makes Europe an interesting market for mango puree?

Mango puree is a sought-after ingredient in the European market for the production of beverages with tropical flavours, as well as for dairy products to add natural sweetness and colour. The bakery and confectionery industries also use it as a filling or flavouring agent in cakes, pastries and sweets. It is also used in baby food owing to its high nutritional content and natural sweetness. The diversity of applications underlines mango puree’s value to food manufacturers in Europe, driving demand for high-quality imports from developing countries.

Europe accounts for over 40% of the world’s mango puree imports. Mango puree imports have increased in volume by an estimated yearly average of 3% between 2018 and 2022. Virtually all imports from outside Europe come from developing countries. The term ‘developing countries’ is used in this report to denote countries listed on the OECD-DAC list of ODA recipients for 2024 and 2025 flows (PDF). The annual growth rate is expressed as the cumulative annual growth rate (CAGR).

Precise data for European imports of mango puree and other tropical fruit purees cannot be satisfactorily quantified due to the lack of statistical data. The market situation can only be estimated based on information from industry participants and wider trade code categories. However, this data needs to be treated with caution. Imports of all forms of mango puree to Europe in 2022 were estimated at around 90,000 to 100,000 tonnes. About one-quarter of this total consisted of concentrated mango puree and the rest of single-strength mango puree.

Over the next 5 years, the European market for mango puree is likely to increase at an annual growth rate of 2–3%. The main reasons for the expected market growth are the continued usage of mango puree in food and beverage products and the popularity of mango as a flavour. Mango is now regularly used by fruit-preparation producers for beverages, by the dairy industry for yoghurts, and by the bakery industry as a filling. Mango puree is also very popular as baby food and is used in the production of fruit bar snacks.

Source: Autentika Global, estimates based on industry sources, 2024

Precise data on mango puree imports per European country is not available due to the lack of a dedicated European trade code for mango puree as a commodity. Fluctuations in imports for mango puree are often caused by the size and quality of the harvested raw materials and the supply and demand factors in the global market, which all influence prices. The influence of Indian mango puree on global trade is outsized due to India’s domination of the processed mango industry.

Tip:

- Consult the latest news and publications on the European market for processed fruit and vegetables published by PROFEL, the European Association of Fruit and Vegetable Processing Industries. The PROFEL website provides links to its members’ websites.

3. Which European countries offer the most opportunities for mango puree?

The lack of trade statistics for mango puree makes it difficult to determine precise data about destinations in Europe. Based on estimates and export data from India, the 2 main importers are the Netherlands and the UK. The next most important buyers are France and Spain, followed by Germany and Portugal. These countries all have large importing companies that further distribute the mango puree.

The Netherlands: Europe’s largest importer of mango puree

The Netherlands is Europe’s largest importer of mango puree. Most mango puree imported into the Netherlands comes from India. The Netherlands serves as a key redistribution hub for fresh mangoes and mango puree in Europe, sourcing significant quantities from other mango puree exporting countries like Colombia, Mexico and Brazil. Industry estimates indicate that most imported mango puree is re-exported to other European destinations. The Netherlands is a much larger importer than consumer market.

The Dutch non-alcoholic beverage segment is in constant flux, with consumers becoming increasingly attentive to the amount of sugar in their beverages and the higher taxes on sugary beverages. Water is the most-consumed drink during the day, while fruit juices are most consumed during breakfast and lunch. Light and zero soft drinks, fruit juice and flavoured water are often chosen for variety, according to the Dutch association for Soft Drinks, Waters and Juices (FWS).

Mango is a popular ingredient for Dutch producers of mixed-flavour and multivitamin tropical-flavoured juices. The retail market share of mixed-flavour juices in the Netherlands is high, with mango being a frequently-used ingredient. The industry also combines tropical flavours with super fruits, such as dragon fruit, to maximise flavour and vitamin content.

The industry also uses mango puree to create smoothies that meet the demand for healthy products without added flavours or sugars or artificial colours. The smoothie production segment has seen particularly high growth, as mango puree adds sweetness, thickness and smoothness to final products.

The soft drinks sector has agreed to reduce the calories consumed through soft drinks by 30% in 2030. This is achieved by, among other things, reducing sugar in existing products, introducing more fresh drinks without sugar (zero) or very little sugar (light) and introducing smaller packaging. Recent research has shown that sugar intake from drinks in the Netherlands is declining rapidly (in Dutch), which may affect the sales of beverages containing mango puree, even though it only contains natural sugars.

On the other hand, recent increases in sugar taxes have not affected the sweets, bakery and dairy products industries in the same way, so mango puree may not face problems here.

A lot of imported puree is traded by large Dutch beverage industry suppliers, including SVZ, one of the country’s largest suppliers. Döhler, a global producer and provider of ingredients for the beverage industry, bought SVZ and all its production sites in Europe and the US, as well as its tropical trading house, Netra Agro, in July 2023. Another large importer is Prodalim, which has processing facilities in Brazil, Vietnam, Mexico and Poland. Other traders include Verbruggen Juice Trading, Fruitlife and Santos Enterprise Food.

Imports of organic mango puree into the Netherlands are also increasing, specifically boosted by increased demand from the baby food industry. Some Dutch companies, such as Ariza, are specialised suppliers to users of organic mango puree, including baby food producers. Dutch baby food brands that use mango puree in their products include Nutricia (with its ‘Olvarit’ brand) and De Kleine Keuken. Danish brewer Royal Unibrew agreed to acquire 100% of soft drink maker Vrumona from Heineken for € 300 million in July 2023. The impact of this purchase on mango puree usage is still uncertain.

Tips:

- Follow the latest news in the fruit beverages market in the Netherlands through the FWS news page (in Dutch, can be read using the Google Translate button) or by contacting the FWS.

- Reach out to potential fruit puree importers from the Netherlands to discover their needs and expectations.

- Keep an eye on the latest trends in the market through the news and blog pages of leading importers like Santos Enterprise Food, Prodalim and SVZ.

United Kingdom: Europe’s hotbed for mango puree used in baking

Mango puree is a very popular ingredient in the UK. The UK food manufacturing industry uses it for a wide variety of products, including smoothies, ice cream and sorbets, desserts, sauces and cocktails. Concerns regarding the sustainability and sugar content of fruit juice, juice drinks and smoothies continue to hamper the UK non-alcoholic beverages market, according to a 2023 market report. And with the income squeeze set to continue, consumers are likely to keep cutting back on discretionary spending.

A February 2024 report on UK juice industry revenues showed that annual revenues are expected to have shrunk at a compound annual rate of 1.3% over the 5 years before 2023/2024, totalling 556.1 million GBP. However, sales in the 2024/2025 market year have shown a rise of 4.9%. Juice has seen a decline in off-trade demand as consumers switch out of the category or to the ‘on-trade’, according to the latest Euromonitor International report.

‘On-trade’ is used to describe places that offer beverages for immediate consumption on the premises like bars, restaurants and pubs. ‘Off-trade’ usually means places like stores, supermarkets and other places where you do not consume the beverage right away.

Thorne Produce is a leading UK-based tropical puree specialist importer that supplies ice cream and sorbet makers, chocolatiers, cocktail bars, bakeries and restaurants. E.E. & Brian Smith are a supplier of mango puree sourced from India, Peru, Brazil and Mexico. Kiril Mischeff is a leading supplier of mango puree to UK food and drink manufacturers and the foodservice industry. The company sources its mango purees from India in a range of varieties, including Totapuri, Kent and the world’s most popular mango, Alphonso. Uren Food Ingredients is a major supplier of single strength and concentrated mango purees, covering all the industrial application areas.

Other leading importers and suppliers of mango puree include Symrise, David Berryman, Fuerst Day Lawson, Döhler UK and Billington Foods. The leading smoothie brand is Innocent (owned by Coca Cola), followed by Naked. In the baby food category, the largest user of organic mango puree is Ella’s Kitchen.

One important trend helping mango puree demand is the popularity of baking reality TV shows and a revival of consumer interest in home baking. The Great British Bake Off TV show has been running uninterruptedly since 2010, raising consumer awareness of baked treats that can be made with fruit purees. Mango purees are in high demand as an ingredient for baking because they improve the flavour profile and texture of baked goods.

Mango purees are used in the creation of fruit-filled pastries, cakes, muffins and other confectioneries, offering a convenient way to add real fruit flavours to baked treats. The bakery revival in the UK offers synergies to mango puree suppliers due to the convenience and time-saving aspects of using fruit purees, as they eliminate the need for manual fruit preparation while providing a consistent taste profile.

As juices face pressure from inflation and sugar concerns, fresh opportunities can be found in more natural offerings. A new trend that benefits mango puree consumption in the UK is the growing popularity of pouch snacks for consumption on the go. These snacks are targeted at adult consumers and children. For example, Organix has a line of organic, vegan apple and mango pouches. Similarly, Yeo Valley has pouches with organic mango and creamy yoghurt.

Smoothies are still a widespread and popular snacking option in the UK market for consumers of all ages. The UK had the largest share of the European market in 2023, and it is predicted to keep growing until 2029. Tropicana, the popular chilled juice brand, expanded into the smoothie category with the launch of Tropicana Kids in 2023, including a pineapple and mango flavour made with mango puree. UK consumers are being offered new product options all the time, such as the kefir mango and orange smoothies launched by Müller at the Big Four grocers Tesco and Sainsbury’s, as well as the convenience store SPAR.

Tips:

- Consult the website of the British Soft Drinks Association (BSDA) if you want to link up with UK-based producers of soft drinks, including fruit juice and still and dilutable drinks. Most of Great Britain’s soft drinks manufacturers, franchisors, importers and suppliers to the industry are members of the BSDA.

- Search for advice on possible buyers in the Federation of Bakers Limited (FoB), the trade association that represents the UK’s bread and bakery industry.

France: A market in flux

The demand for mango puree in France, as in other developed European markets, is driven by a desire for convenience in food preparation and consumption. Mango puree is used extensively in a variety of ways, from juices and drinks to bakery fillings, dairy products and more.

Opportunities in the French mango puree market may be found in government initiatives aimed at promoting healthy eating habits amongst French consumers. The nutritional benefits of mangoes, such as their high vitamin C content, play into this. This makes mango puree a desirable ingredient for health-conscious French consumers.

The future of fruit juices as a category is bleak in France, according to a 2023 Euromonitor report on the French juice market. The category faces fierce competition from flavoured waters and ready-to-drink tea products. A major concern is the sugar content of juice. Opportunities for mango puree (juice) exporters seem to be in non-traditional product formats, such as healthy, natural smoothies without additives.

The decline in supermarket sales of juice and nectars continued in 2022, with a 2.2% drop in volume. This decline mainly affected pure juices (-2.7%). The organic channel also faces difficulties, as there was a marked decline (-3.5%) after several years of growth according to the 2022 annual report (PDF) (in French) of French juice association Unijus.

Unijus also says that, between May 2022 and May 2023, the price of pure juices increased by almost 9%, while the price of juices made from concentrate increased by almost 17% and that of nectars by 16%. Cheaper distribution channels, such as lower-cost retailers Leclerc, Lidl and Aldi, gained more of a market share at the expense of traditional brands.

More specifically, in France, mango puree is increasingly being sold as an ingredient in soft sweets and comfort foods, such as mousses, fruit yoghurts, panna cotta and puddings. In addition, several producers offer mango purees as a final product, such as Valade Group, Ethiquable, Capfruit, Ponthier and Léa Nature Group. Many of these companies source mango puree directly from suppliers in developing countries. Marseille-based Equateur Fruits is a trading and brokerage company for processed fruit for the food industry, including mango puree.

Tips:

- Consult the 2022 Unijus annual report (PDF) for deeper insight into market trends and consumer priorities in France.

- For mango puree exporters to France, engaging with Association Nationale des Industries Alimentaires (ANIA) can be beneficial. ANIA represents a broad spectrum of the French agri-food industries, including trade unions and regional associations.

Spain: A port of entry for Latin America’s mango puree

The structure of the market for mango puree in Spain is different from other European markets, as it is one of the rare countries for which India is not the leading supplier. It is estimated that at least one third of all mango puree is imported from Mexico, followed by India, Brazil and Colombia.

Spain also has its own mango production area totalling around 4,700 hectares. In Spain, mangoes are grown in the southern part of the country (Huelva, Cádiz, Málaga, Granada, Almería and Murcia), as well as on the Canary Islands. The overall production potential is approximately 40,000 tonnes, mainly in the Málaga region. The available varieties include Osteen, Kent, Keitt and Tommy Atkins. Local varieties La Gomera-1 and La Gomera-3 are often used as rootstocks.

Mango puree offers unique opportunities for use in Spanish cuisine. For example, ‘gazpacho de mango’ or ‘mango gazpacho’ is a variety of Spanish gazpacho, a refreshing soup traditionally enjoyed cold.

Mango purees are used primarily in the fruit juice and nectars industry, with Don Simon and Juver (part of Conserve Italia) being the leading brands. Other large non-alcoholic beverage makers include Refresco, AMC Natural Drinks, Cofrutos and Granini. Mango puree is used in several different market segments (for example, smoothies, yoghurt and ice cream). One special characteristic of the Spanish market is the use of mango puree in ‘salsa’ type dips. Products include Montosa and Hacendado (a private label of the Mercadona retail chain).

Tip:

- Keep track of the use of mango puree in the juice market by visiting the website of the National Association of Manufacturers of Juices and Gazpachos (ASOZUMOS).

Germany: A large mango puree consumer market

Germany consumes more mango puree than it imports. A large share of Germany’s mango puree is imported from the Netherlands.

German fruit juice and smoothie companies use the largest quantities of mango puree. As a flavour, mango is very popular in exotic fruit drinks, and many new products feature mango puree as an ingredient. Germany has a large health-conscious consumer base, which is a major supportive factor for the German smoothie market. Many large cities feature numerous smoothie bars that cater to health-conscious smoothie consumers.

Germany is the main fruit juice and nectar consumer in Europe, with consumption amounting to 28 litres per capita in 2022 (PDF) according to the fruit juice industry association VdF. This is down from 28.5 litres in 2021 and 30.0 litres in 2020. The country has 309 fruit juice producing companies with a combined annual turnover of € 3.26 billion. Almost 70% of the industry’s turnover comes from the 7 largest member companies. Nevertheless, the structure of the industry is also characterised by a large number of medium-sized companies.

The smoothie industry in Germany is an especially significant user of mango puree. According to some estimates, one third of all smoothies sold in the country were private label, with the remainder being brand names. The international brand Innocent is one of the leading brands, but there is also significant local production. One of the most innovative companies is TrueFruits, which uses mango puree in several types of products.

Germany is also one of Europe’s leading markets for organic products, and it is the largest market for healthy beverages in the region. This means there are opportunities for suppliers from developing countries that offer organic mango puree. The baby food industry is a major user of organic mango puree in Germany, led by one of the foremost organic baby food pioneering companies, Hipp.

Figure 4: Organic baby food with mango puree produced by Hipp

Source: Autentika Global

The leading organic food brands Alnatura and dm-Bio have several products in which mango puree is an ingredient, including baby food, curries, yoghurts and sorbets. There are also smaller independent organic brands, such as Rapunzel, Clasen Bio, Sunday Natural, Keimling, Morgenland and KoRo.

Germany is a particularly attractive market for organic mango puree as it is the largest European market for organic food. One of the market segments that provides specific opportunities for suppliers of mango puree is the fruit bar segment. There are growing numbers of fruit bars and similar snacks that contain mango. Examples include Alnatura and dm-drogerie markt. However, note that some fruit bars that contain mango are produced with dried mango and not mango puree.

Figure 5: Organic and vegan mango bar, sold by dm

Source: Autentika Global

Leading importers and industry suppliers of mango puree in Germany include Döhler, Binder International, Carrière and Pijahn, as well as Austrian companies that have facilities in Germany (Agrana and Grünewald). In the German fruit juice industry, mango puree is used primarily in juice blends (‘multivitamin juices’). Most fruit juices that feature mango puree are sold under the brands of retail chains (private labels), with Refresco being a leading fruit juice player. Although Refresco’s headquarters are in the Netherlands, Germany is one of its key markets.

Tips:

- Find German traders of mango puree on the Waren-Verein website and in the German company directory Wer liefert was.

- Stay abreast of goings on in the German fruit juice industry by visiting the website of the Association of German Fruit Juice Industry (in German).

- Stay informed about developments in the German baby food sector by consulting the German Special Nutrition Association.

Portugal: Growing sales of refreshing beverages

Portugal imports most of its mango puree from India. The share from other suppliers is small. Juices that contain mango puree as an ingredient are also imported from the South African beverage company Ceres.

Portugal is one of Europe’s largest consumers of mango puree per capita, and it has a strong preference for mango flavourings in fruit drinks. In fact, the Portuguese are credited with bringing mangoes from India to Europe in the 15th century. Most of the mango puree imported by Portugal is used by the fruit juice and nectar industry.

The Portuguese companies active in the production and sales of non-alcoholic soft drinks have a turnover of over € 475 million, according to the industry association Probeb. Sales of refreshing beverages increased from 63.6 litres per capita in 2017 to 69.8 litres in 2022. In 2022, bottled water accounted for 60% of sales, refreshments accounted for 31% of sales, and fruit juices and nectars accounted for 6.5% of sales. Sales of refreshing beverages increased by 9.7% from 2017 to 719.3 million litres.

The leading users of mango puree in Portugal are fruit juice bottlers and blenders, with Compal, Ceres and Um Bongo being the leading brands. Mango puree is also sold as a final product by producers like Panegara. The Portuguese smoothies segment is an emergent user of mango puree, with innovative companies like GL (smoothies brand Sonatural).

Tips:

- Read our study on market statistics and the outlook for processed fruit and vegetables for more information on general trade developments within the European processed fruit and vegetable sector.

- Consult relevant trade statistics using tools like ITC TradeMap and Access2Markets.

4. Which trends offer opportunities or pose threats in the European mango puree market?

Consumer demand for mango puree in Europe is driven primarily by the increasing popularity of healthy beverages and of mango as an exotic flavour, combined with the increasing demand from the food processing industry.

Healthy snacking and convenience food

The influence of wider health and wellness trends in all aspects of consumer lives is changing consumer spending patterns and product consumption habits.

Busier lifestyles in Europe are pushing consumers to seek convenience and on-the-go options, leading to increased demand for convenient, ready-to-drink beverages as an instant nutritional solution. Non-sweetened smoothies made with fruit purees are seen as a convenient and tasty way to incorporate more nutrients into one's diet.

Improvements in food processing technologies have boosted food producers’ production options, affecting global fruit puree demand. The shift towards convenience is a partial consequence of increasing urbanisation, busy daily routines and higher per capita income, pushing consumers towards the convenience of packaged food options.

The trend of natural and clean-label products aligns with the qualities often associated with mango puree, making it an attractive choice for health-focussed consumers. The increasing health awareness amongst consumers represents a significant opportunity.

The cost of living crisis has taken its toll on the market, especially on costlier products. This means exporters from developing countries can address consumer concerns over fruit juice/smoothies made from concentrate by demystifying the processes involved. Celebrating native ingredients and spotlighting the correlation between low food miles and sustainability will tap into concerns in this area.

In the UK, manufacturers are already trying to adapt to regulations by restricting high fat, salt or sugar (HFSS) products. Starburst recently launched new pineapple, mango, passionfruit and lemon Fruit Squares, which are HFSS compliant. The snacks are intended to meet the growing demand for healthier, innovative confectionary.

The shift towards healthier products seems to be more than a temporary movement. A 2023 Euromonitor International report warns that the future of the juice category is not positive, with reductions expected in most markets and categories. The report warns that manufacturers face an uphill battle against the perception of juice as unhealthy. Potential strategies to address this include the development of products that use exotic flavours with functional ingredients.

Sustainability surge and slowing demand for organic

The demand for organic and sustainably-grown tropical fruit in multiple forms has risen in Europe in recent years. European consumers are increasingly aware of the positive environmental impacts and health benefits of organic food. This surge in demand is tied with growing concern for the environment, which is heavily affected by climate change, and a desire for healthier food choices.

However, the recent inflationary environment contributed to the EU’s imports of organic products (PDF) falling by 5.1% in 2022. A significant part of this decline is attributed to the reduced imports of fruit and vegetables according to the previously mentioned European Commission report. Imports of processed products, such as fruit juices and other processed organic products, went down 7.4%.

According to new market research, more than half of Europeans have eaten more sustainably since the COVID-19 pandemic. Research by Kerry Group also showed that 51% of consumers in the foodservice segment were happy to pay more for sustainable options. Keep in mind that this attitude may have changed due to the recent period of high inflation in Europe.

Exporters from developing countries can consider focussing more on sustainable sourcing and eco-friendly packaging. Start-ups are also well-positioned to cater to dietary trends, such as plant-based and healthier lifestyle choices, by developing products that align with these preferences.

Innovations in packaging and distribution channels, including online retail, are expected to facilitate the accessibility and popularity of mango puree amongst a broader consumer base. The food miles of juice, drinks and smoothies made with tropical fruit are a concern for 44% of category users in the UK.

Concerns surrounding ingredients’ food miles are likely to grow as issues like climate change are here to stay, especially as the inflationary trends in Europe seem to be abating. This would allow consumers to prioritise sustainability in their purchase considerations. Be aware of the differences in the carbon footprint of transporting single-strength and concentrated mango puree. Concentrated 28/30 mango puree is much cheaper to transport as it does not contain any bulky water, also making it less carbon intensive to transport.

India’s NAVA Quality Foods offers Alphonso mango puree produced from fruit sourced from a group of contract farms. The fruit is grown under direct supervision to ensure compliance with sustainability standards, such as the Rainforest Alliance standards. Nicaragua’s Sol Organica produces single-strength mango puree. The company promotes sustainability in all areas of the business, from agricultural practices to processing.

Exporters and producers of mango puree can explore increasing the sustainability of their production. Recent research has shown that mango waste is one of the most promising sources of renewable energy. This waste currently represents 40% of the weight of mango fruit and contains a large amount of fat and cellulose that can be converted into energy products.

Tips:

- Subscribe to the free newsletter of the UK’s Grocery Gazette to get all the latest retail news, trends and insights from the UK grocery market.

- Consider using a free carbon footprint calculator to calculate the carbon footprint of your products and to see how you can improve your score.

Autentika Global carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research