Entering the European market for self-drive

Self-drive tourists require clear communications when booking their trips, and they like to know that destinations – and tour operators – are well-prepared for this type of travel. They also like to personalise their journeys, so they need flexibility in making reservations. These travellers tend to book through online travel agencies (OTAs) or directly with local operators, as this often allows for greater customisation.

Contents of this page

- What requirements must self-drive tourism comply with to be allowed on the European market?

- Through what channels can you get self-drive tourism products on the European market?

- What competition do you face on the European self-drive tourism market?

- What are the prices for self-drive tourism products on the European market?

1. What requirements must self-drive tourism comply with to be allowed on the European market?

By law, tour operators active in the European market must comply with various regulations to ensure that their customers are safe when they travel and are protected financially. Individual businesses also have their own requirements when working with local operators, which they set out in a code of conduct and/or terms of business. Make sure that you understand and observe these requirements. If necessary, update your business processes in order to meet expectations. These will include sustainability requirements.

As for self-drive tourists specifically, they require clear and constant communications and expect you to provide good safety information and equipment.

What mandatory and additional requirements do buyers have?

The requirements for tourism services are standard across the sector. They include…

- Compliance with the European Package Travel Directive.

- Compliance with the General Data Protection Regulation (GDPR).

- Liability insurance and insolvency protection

You can find out more about these topics in the CBI document What are the requirements for tourism services in the European market?. That will help you understand the legal rules that European tour operators must comply with, as well as non-legal but standard requirements. If you understand what is expected of them and can adapt your operations to suit their requirements, they are more likely to do business with you. European buyers need to know that they can trust their suppliers to meet their – and their customers’ – needs.

Sustainability

Operating sustainably is now mandatory for all European tourism suppliers. So make sustainability an integral part of your business. Sustainable tourism reduces negative impacts on the environment and local cultures, while increasing the positive impacts tourism can have for communities, vulnerable groups and the wider economy.

Sustainability is sometimes thought of only as an environmental consideration. In reality, however, sustainability in tourism covers a much wider range of areas.

- Economic sustainability. Developing tourism in a way that is beneficial to the economy of the local destination (for example, contributing towards gross domestic product and employment), and intentionally spreading the economic benefits to local people and communities.

- Sociocultural sustainability. Protecting local cultures and heritage sites by developing authentic experiences and celebrating local history.

- Environmental sustainability. Ensuring that tourism does not negatively affect the environment, but also attempting to improve the environmental situation where possible, including protection of wildlife and habitats.

To comply with demanding environmental regulations, many car hire companies in Europe are turning to electric vehicles. European holidaymakers are already highly aware of their impacts when they travel. Electric vehicles can be a good way to reduce visitor worries about their contribution to carbon emissions.

While places like China, Europe and the United States have made good progress in increasing the number of electric vehicles in use, many developing destinations have limited infrastructure to support them. Figure 1 shows the numbers of electric vehicle charging stations available in China, Europe, the US and the rest of the world. Altogether, those “other countries” have only 132,000 charging stations between them. This is something to consider in the future, in order to attract more sustainably minded self-drive travellers.

Source: International Energy Agency

Here are some practical examples of sustainability in self-drive tourism.

Rolandia is a tour operator in Romania that is taking a lead in sustainability. For each trip booked, Rolandia donates 10% of the profits to a company called Rovis, which supports the sustainable development of Romania. Rovis’ projects help local communities and ecosystems in line with the UN Sustainable Development Goals.

Say Hueque is a small, locally-run tour operator in Argentina. Sustainability is important to its business operations: it offsets 100% of its carbon emissions, helps to protect natural landscapes and supports local economies. More than 80% of the price paid by the customer stays in local communities.

Tips:

- Keep up with electric vehicle developments in your country or region and work with your trade association to promote the installation of charging stations to improve the sustainability of road travel in the destinations you serve.

- Read CBI study How to be a sustainable tourism business for a deeper discussion of sustainable tourism and some of the business practices you can implement in order to improve your performance in this critical area.

What are the requirements for niche markets?

Self-drive tourists have specific requirements when they travel, for both destinations and tour operators. This niche market is looking for clear communications at all stages of their trip. They also want suitable equipment and information for a successful, safe and stress-free visit. You need to understand these requirements and attempt to meet them when targeting this market.

Clear communications

Self-drive tourists like freedom, the ability to adjust their own itinerary and spontaneous adventures. To make this happen in a well-organised and safe way, clear communications are essential. Communications should also be consistent across all phases of the trip, starting when the customer is thinking about and planning their journey.

Communicate directly with the customer to understand how active they want the trip to be, whether they want all their activities prebooked and the types of thing they want to do. Before confirming an itinerary, make sure that you understand exactly what type and quality of accommodation they want to stay in and the distances they want to travel. Provide recommended itineraries, but leave room for personalisation.

Once the customer decides to book the trip, be clear about what is included in the price. Will visitors need to pay extra for accommodation, fuel, food and drink, activities and entry fees? Also helpful are recommendations about when to hire a guide or take a guided tour. That can be useful in difficult-to-reach places, or at sites and attractions with a lot of history that needs interpretation.

Tips:

- Ask guests how you can contact them before and during their trip. That may be by e-mail, WhatsApp or another social media application.

- Help your guests buy a local SIM card so that they can communicate easily and cheaply with you.

- Develop a number of itineraries for different niche tourism segments (such as adventure, cultural or food and wine), and make sure that these are adaptable for different groups if necessary.

- Provide a full itinerary or information pack to visitors when they book. This should explain clearly what is included in the price, what is not included and so needs to be booked or paid for separately, where to hire guides (with recommendations for high-quality guides) and so on. Also include detailed information about each day of the trip, such as the length of drive that day, where they will be staying that night, what meals are included (if any) and activity options.

- To provide peace of mind, let visitors know how they can contact you in case of an emergency. This contact should be available 24/7.

Safety and security

The self-drive niche may be more adventurous than other tourism markets, but having a safe destination is still critical to attract customers. Self-driving through some regions can be risky and complicated, with difficult road conditions, no roadside assistance, poor road signs, unpredictable police and dangerous areas for travellers. One of your strongest selling points should be reassuring potential customers that you can guarantee their safety in a destination they are unfamiliar with.

Self-drive tourists want to know they will be safe on their trip and not encounter any major problems. To gain their interest, be sure to advertise your destination as safe. But also provide honest, up-to-date information about any areas they should avoid. A website can keep visitors informed about current dangers or changing road conditions, as well as the impact of weather on roads or access to sights.

Customers also want tips on practical matters such as how to deal with the police and border crossings, as well as (if relevant) things like demands for bribes. So include these topics in the itinerary or information pack. People also want to be certain that they have rented a safe vehicle. To reassure them, provide details of its recent service history. Also describe what safety checks they need to perform before setting off. And how they can summon roadside assistance if they break down.

Obviously, the vehicle you supply should be safe, clean and in good condition. Once on the road, visitors expect to have any essential equipment they might need during their trip. This means things like a first-aid kit and basic breakdown gear. Knowing that they are prepared for unexpected situations makes your customer feel more secure.

Other essentials include insurance for the vehicle: at least the cover required by law, plus the option to upgrade this (for an extra fee) at the customer’s own discretion. Finally, always provide a satellite navigation system or GPS; self-drive tourists have come to expect this in recent years, and it is essential for road trips. Drivers need to be able to locate the stops on their itinerary and find their way if they get lost.

Figure 2 shows an example of a checklist for a successful road trip. As a self-drive operator, provide your customers with something similar or at least give them clear information and instructions to ensure that their trip is safe and successful.

Figure 2: Tips for a successful road trip

Source: American Family Insurance

For inspiration, here is an example of best practice.

Safari Drive‘s website provides answers to a range of frequently asked question. These cover safety, what to do if you break down and what is included in your car rental package. It also links to the insurance company that covers every rental, so that customers can find specific information about that aspect of their trips. SafariDrive supplies vehicles appropriate to each of its itineraries, all equipped with satellite phones and extended-range fuel tanks so that visitors know they are in good hands.

Tips:

- Provide clear guidance on security at your destination. Link to government travel advice websites where appropriate, such as the UK Foreign Travel Advice site and the Directorate-General for Consular Affairs and French Nationals Abroad.

- Before they arrive, send visitors a list of tips on how to deal with the police and border crossings, as well as (if relevant) things like demands for bribes.

- Before they leave on long-distance journeys, provide visitors with a checklist for the trip: regularly check their tyres, fuel gauge, windscreen wiper fluid, etc.

- Include roadside assistance in the cost of vehicle rental and provide contact details and clear instructions on how to use this service.

- Provide emergency and breakdown equipment, such as a first aid kit, warning triangle and tyre-changing gear.

2. Through what channels can you get self-drive tourism products on the European market?

Most self-drive tourists use online travel agencies (OTAs) or direct bookings when buying holiday packages. OTAs allow travellers to compare prices and itineraries across a lot of companies serving a destination. Direct bookings are popular because they allow the personalisation of itineraries, which is popular with self-drive tourists.

How is the market segmented?

The self-drive market is segmented by visitors’ level of adventure and their budget for the trip. This creates groups along a scale between the following extremes.

- Those on a low budget who are mid-level adventurous. They often prefer to stay at campsites or in their vehicle, tend to take shorter trips and like free activities.

- Those with a high budget and a great sense of adventure. These travellers tend to be older, or family groups with older children. They may travel for longer and stay in more luxurious accommodation such as hotels, glamping sites and luxury RVs (recreational vehicles). This group participates in more activities they have to pay for, such as safaris, food and wine tours and hiking tours.

Remember that the different segments have different preferences, priorities and characteristics. More information on the segmentation of the self-drive niche market can be found in the CBI study the European Market Potential for Self-Drive Tourism[A2] .

Through what channels do self-drive tourism products end up on the market?

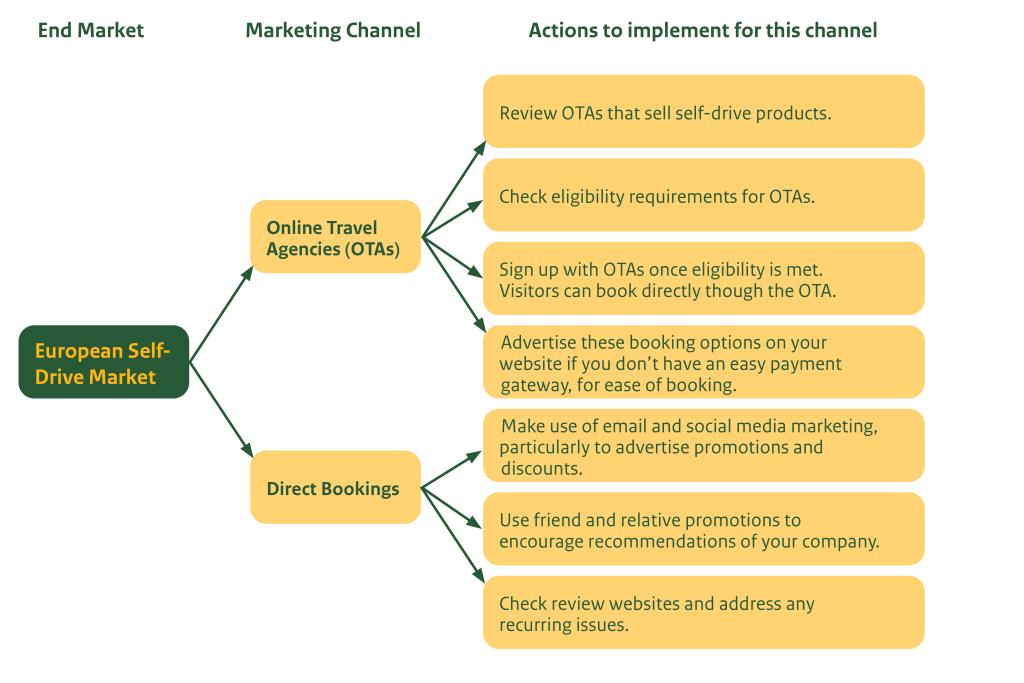

The main channels available to reach the European self-drive market are OTAs and direct bookings. The chart below lists actions you can take to exploit each of these.

Figure 3: Summary of channels to reach the self-drive market

Source: Acorn Tourism Consulting

Online Travel Agencies (OTAs)

OTAs are the method most used for planning and booking, by both European self-drive travellers in general and young Europeans in particular (Millennials and Gen Z). OTAs are web-based marketplaces that enable travellers to research and book accommodation, flights, rental vehicles, tours and activities. They allow visitors to compare options across each of these subsectors by such factors as price, traveller rating and quality.

This channel is popular because of that comparison ability. Self-drive tourists are budget-conscious and want to make sure that they find a quality deal. The number of OTAs has grown in recent years, as they have increased in popularity, so there are many options to consider when choosing to market through this channel.

Tour operators should look at OTAs that are currently selling self-drive tours in their region, such as the ones below.

- SafariBookings offers self-drive safaris in Namibia, South Africa, Tanzania, Uganda and Botswana.

- Viator offers self-drive tours ranging in length from one day to two weeks or more. These are all over the world, but with a lot of one-day-tours in the US and longer tours in other destinations. The site even includes self-drive boat tours (with boat rental) in some regions.

- TourRadar offers self-drive tours on five continents, with most in Europe. Other popular destinations include Costa Rica, Australia and southern Africa.

- GetYourGuide offers some self-driving tours, many of them in North America. The majority are day tours around cities, self-drive 4x4 day tours and boat or motorcycle day tours.

- Goway offers self-drive tours in Australia, southern Africa, Costa Rica, Europe and Malaysia. These range in length from four days to three weeks.

Direct bookings

Self-drive travellers enjoy flexibility and want personalised trips. Direct bookings allow visitors to communicate directly with local operators, to personalise itineraries and so meet their needs exactly. Tour operators should advertise the option to make personalised itineraries by either adapting existing itineraries or developing unique products.

European Millennials are most likely to be influenced in their travel decisions by deals, promotions and word of mouth from friends and experts. They are also the group most likely to use smartphones when planning travel, and laptops when booking the trip. You can reach this market through social-media promotions, including special deals and discount offers. Millennials are more likely than other generations to use hotel and destination websites, but still use these less than search engines and metasearch sites.

Europeans have a preference for OTAs (49%), search engines (49%) and travel review sites (39%) when planning their trips. When they book, they are more likely to use OTAs than any other option (49% versus 36% for search engines and 26% for travel review sites). The European market is most influenced by deals and promotions, travel pictures from friends and travel experts and blogs/articles about destinations. It is least influenced by celebrity travel.

Many Europeans also use recommendations from friends and relatives as inspiration when choosing a destination to visit. Friend and family promotions may therefore be a good way to reach independent self-drive travellers. This means developing promotional offers that are sent to previous customers to share with a friend or relative. If they book, then both parties receive a discount.

Review websites are another great avenue to advertise and provide details of your offering – 84% of European Millennials will read reviews of places and sights before making a decision. Keep track of your review ratings and check if any weaknesses are being highlighted. Most sites allow operators to respond to negative reviews where necessary. Popular review sites include the following,

- Tripadvisor is the world’s largest travel review website. It provides comparisons for hotels, attractions, tours, restaurants and more.

- Google Maps reviews allow customers to post about their experiences with a business. This can be anything from a laundry service to a restaurant, hotel or tour operator.

- Facebook is a popular social media platform, but also the fourth most popular review site. Users can review all types of business.

- Foursquare is a geographically based review site. You can search for information about, and reviews of, facilities and events in your current region.

- Yelp is a review platform for restaurants, arts and entertainment, local services and more.

Tips:

- Research the best marketing channels to reach your specific source markets, as these are likely to differ between countries.

- Ask local car rental companies to display your brochures in their offices to encourage bookings from independent travellers.

- Find more information about attracting free independent travellers and how to work with OTAs on CBI’s tourism platform.

- Learn more about using online marketing. Read the CBI studies How to be a successful tourism company online? and 10 tips to go digital.

What is the most interesting channel for you?

Direct bookings are the best way to reach your market. These allow self-drive tourists to adapt their itineraries and select alternative accommodation types if desired. So a good website is crucial: one that allows direct bookings and provides all the details required by self-drive tourists (see above). An integrated payment system will also be needed, to take deposits and even full payments online when visitors make reservations.

Tips:

- Update your website with all the details required by self-drive tourists. They include information about costs (what is included and not included), accommodation options, insurance and safety.

- Add a payment gateway to your website to make it easy to booking. If you cannot do this, consider OTAs as an alternative booking channel.

- Check your current rating on popular review sites, and if necessary work out what you can do to improve this. Self-drive tourists are likely to check these sites before making reservations.

3. What competition do you face on the European self-drive tourism market?

Self-drive travellers have to choose not only between tour operators, but also between destinations. This market tends to have unique requirements for its preferred destinations. In particular, a good road network and good general safety throughout the areas people want to drive in. Before opting for a particular tour operator, most self-drive tourists decide on a destination that meets their requirements and has the type of sights and activities they want to experience.

Every self-drive tour operator is competing with other destinations, and with operators in each of those destinations. At both these levels, learn from the competition and understand how it appeals to this market. You will also need to differentiate yourself from these competitors, with products that target specific needs or fill gaps in the market. To attract customers, you should highlight those characteristics of your destination that make it perfect for self-drive tourists.

Popular destinations you may be competing with include Namibia, South Africa, Argentina, Costa Rica, Mongolia and Oman.

What countries are you competing with?

Some destinations already have strong self-drive markets. They include Namibia, South Africa and Argentina. These countries already possess the necessary infrastructure and are well-known for this type of tourism, so they will be strong competitors. Other destinations – such as Costa Rica, Mongolia and Oman – are still developing their self-drive tourism facilities but have certain features that make them great for this niche market. They will be your greatest competitors.

South Africa

South Africa is the number-one destination in Africa for self-drive tourism. The country offers a wide range of activities for different market segments, including adventure activities, wildlife tourism and safaris, hiking and outdoor fun, camping, food and wine tours and interesting cities. South Africa also has a range of accommodation options, from camping and campers to short-term rentals and hotels, glamping and resort stays. All this makes it a great destination for every segment of the self-drive market.

South Africa received 5.7 million visitors in 2022, with most arrivals from other southern African countries. Its top long-haul source markets are the UK, the US and Germany. The self-drive sector in South Africa is well-served by inbound tour operators, local ground operators and car rental companies. The country has several well-known road-trip itineraries, including the Garden Route from Mossel Bay in the west to Storms River in the east.

Figure 4: Enjoying the scenery on a self-drive trip

Source: Unsplash

Namibia

Namibia is another very popular self-drive destination. In 2019 it received 1.6 million visitors. In 2012, 47% of visitors travelled around the country using private cars (27%) or rented cars (20%). If these percentages were similar in 2019, that would mean that about 752,000 visitors travelled by road in Namibia in that year. Most road surfaces in Namibia are gravel (87%), which can pose a challenge for two-wheel-drive vehicles, especially in the rainy season. On the other hand, traffic is usually light, which makes driving relatively easy for visitors.

Many companies in Namibia offer self-drive tours. Some of these are guided, which means that a guide vehicle leads the way and the travellers follow behind. Guided tours like this are helpful when the roads are difficult and drivers are unfamiliar with 4x4 vehicles.

In terms of attractions, Namibia is home to the world’s largest cheetah populations and 43.6% of the country is managed through conservation programmes. There is a hub for activities in Swakopmund on the west coast, where visitors can participate in adventure activities such as skydiving, sandboarding and quad biking. The country is also home to excellent outdoor activity areas such as the Namib Desert, the Sossusvlei sand dunes and Fish River Canyon.

Argentina

Argentina received 1.5 million visitors in 2022 and is a popular self-drive destination in South America. The country is 3,800 km from north to south and offers a huge variety of areas to visit. Some of the most popular regions include Patagonia for hiking and nature-based activities, Mendoza for wine and the lake district around Bariloche. Renting a car is relatively easy in Argentina, and road conditions in the popular tourist areas tend to be good.

The country’s destination management organisation, Visit Argentina, offers a range of road trip itineraries on its website. These are freely available to anyone planning a trip to Argentina and provide ideas for things to see during the trip as well as mapping out the routes, including driving times.

Costa Rica

Costa Rica received 2.1 million overnight visitors in 2022 and is a popular ecotourism and adventure tourism destination. In 2018 (the date of the most recent available tourist survey), approximately 68.8% of visitors to Costa Rica took part in adventure activities, 67.8% took part in ecotourism activities and 44.3% took part in cultural activities.

Driving in Costa Rica is a great option for visitors who want to get away from the crowds. The main roads throughout the country are paved and in good condition. But most back roads are unpaved and can become muddy and difficult to drive in wet conditions. That may make this a destination for those higher on the adventure scale.

Visitors to Costa Rica can take self-drive trips lasting anything from a few days to several weeks. There is plenty to explore, including volcanoes, beautiful beaches, culture and history, rainforests and wildlife. Some 28% of the country is protected land, making it a great place to head out into nature.

Mongolia

Mongolia received 577,297 visitors in 2019. Its top source markets are China, Russia and South Korea. Most of its European visitors currently come from Germany, France and the UK. The roads in Mongolia are quiet but, out of 50,000 km of roads in the country, only about 5,000 km are paved. Unpaved roads can be difficult to navigate in wet weather.

This, however, makes Mongolia particularly popular for off-road driving as it is home to beautiful landscapes, fun gravel roads and many different geographical and climate zones. Many self-drive visitors to Mongolia opt to camp, but others enjoy homestays, guesthouses and yurts (traditional tents).

Figure 5: The empty road ahea

Source: Unsplash

Oman

Oman received 3.5 million visitors in 2019, before the pandemic, and is slowly returning to pre-Covid arrival levels. The country makes a great backdrop for self-drive tours, with a range of landscapes to see – from deserts to mountains and beaches. Hotel accommodation outside the capital, Muscat, is fairly basic, but there are also unique desert camps for visitors to experience.

Figure 6: Coastal roads are popular with self-drive tourists

Source: Unsplash

Key points

- Destinations offering a range of different landscapes can be great for self-drive tours, as the scenery is unique and interesting every day.

- Self-drive destinations should have activities to suit the niche market they are trying to appeal to. This may be great food and wine, exciting adventure activities and hiking, superb wildlife viewing or something else.

- Road conditions are important for self-drive tourists. If conditions are good, advertise that in order to appeal to a broader market. Countries where the roads are not so good can also make great self-drive destinations, for more adventurous 4x4 tours, but should be advertised as such.

- Itineraries on destination websites are a great way to help visitors plan their road trip and to give them an idea of the different experiences available.

What companies are you competing with?

As you develop self-drive experiences and decide how to cater to this niche market segment, it may be useful to look at successful tours by operators in competitor countries. Comparing these with your own offering can help you understand what is available, how operators appeal to this market, how much attention they pay to current trends and so on. You also gain an idea of what is already available to your target market, what best practices you could implement and how to make the most of this segment.

For inspiration, below we introduce some of the leading operators in the main self-drive destinations.

Namibia

Namibia Tours & Safaris is a local operator offering tours through Namibia and neighbouring countries. It has a variety of vehicles for rent, to match different visitor needs, and offers camping equipment where desired. Alternatively, it books accommodation at a variety of safari lodges. The company provides a map showing approximate driving times to ensure that customers are well-prepared. Other services include reservations for game drives, hikes and nature walks where guides are recommended.

Namibia Experience offers self-drive itineraries and works with local car rental firms to provide vehicles. To ensure visitor safety, it partners only with the most trusted and reputable agencies. The company arranges all accommodation in advance; visitors can stay at camps, lodges, farms and guesthouses. Namibia Experience allows customers to adapt their itineraries in line with their personal preferences.

South Africa

SA-Venues is a South African operator providing self-drive tours lasting between three and 24 days. The company plans the itineraries and prebooks accommodation at lodges. The standard of accommodation depends on the type of tour booked – some have “luxury” options. SA Venues also organises activities for visitors that they cannot do by themselves, such as safari drives and boat cruises.

Cedarberg Africa is a company from South Africa specialising in local tours. As well as luxury tours, family holidays and adventure tours, it offers a range of self-drive tours throughout South Africa for people with different interests. All can be customised to meet activity requirements and the standard of accommodation required.

Argentina

Say Hueque is a small, locally-run tour operator in Argentina. It offers a range of self-drive options, mostly through the Patagonia region but also in the country’s lake district. Tours can be tailored to meet visitors’ needs and budget, and each has different pricing options according to the type of accommodation included – from inns and bed and breakfasts (B&Bs) to luxury hotels. Accommodation is booked in advance and the itineraries include optional hikes and other activities along the way.

Argentina On The Go offers self-drive tours across much of the country. The itineraries include all rental services and accommodation, and some meals. The prices do not include optional excursions – recommendations are made, but these have to be purchased separately.

Costa Rica

Costa Rica Specialists is a small tour operator active only in Costa Rica. It offers one self-drive holiday: eight days experiencing some of the country’s main highlights. They including Arenal hot springs and volcano, ziplining in a rainforest, walking trails through a private reserve and visiting a local beach popular with sea turtles. Car rental is included and all accommodation is prebooked, as are some activities. But the schedule also provides free time, when guests can choose to relax or take part in optional activities.

Native’s Way is a Costa Rican operator that hires local guides only and supports local communities through the sponsorship of schools. This company mostly offers one-day tours, including self-drive all-terrain vehicle (ATV) excursions. These explore local areas, with visitors driving their own vehicle for the day. Typical stops are viewpoints, waterfalls and rainforest areas, and guests have a chance to learn about the local cultures and history.

Mongolia

Follow The Tracks is a small business in Mongolia offering self-drive tours and photography masterclasses. Tours range in length from seven to 22 days, and accommodation on them includes a mix of hotels, guesthouses, yurts and camping. The company’s website provides great details for each itinerary, complete with a map showing exactly where the tour goes.

Drive Mongolia is more a car-rental service from a small business in Mongolia. It supplies 4x4 vehicles equipped and ready for trips across the steppe. But it has an option to help develop a self-drive itinerary for visitors, personalised for different groups, fitness levels and types of adventure. The firm knows the country well and ensures that the vehicle and the camping equipment are in perfect condition for the chosen itinerary.

Oman

Oman Self Drive Tours is a local operator specialising in this type of tour. It offers a number of itineraries with different themes. Most focus on desert landscapes and coastal areas. Prices include all accommodation, car rental, GPS and some activities and meals. Accommodation is mostly in local hotels, with some camping where these are unavailable. Itineraries are provided with full details and images of each activity and accommodation option.

Panorama Travel is a locally-run tour operator in Oman that, as well as offering trips within the country, has recently expanded into international tours through more of the Middle-East. Panorama Travel has a vision to build bridges across cultures by helping visitors to understand the local people and their land. Its self-drive tours include accommodation in three and four-star hotels, 4x4 car hire and all meals. Visitors can request customisations to tailor their tour it to their own needs.

Key points

- Safety is a priority for all tourists. So highlight the added value your company delivers to ensure a safe self-drive holiday, compared with using a local car rental firm. For example, you provide good communications, a local SIM card, roadside assistance, detailed local maps and local knowledge about accommodation, attractions, local culture, food and activities.

- Provide a range of accommodation options for different budgets where possible, with different prices for each level.

- Provide clear information on your website, including maps with driving distances, accommodation options and what the price includes/excludes.

- Itineraries and prices should include some activities along the way, but also allow enough free time for relaxation or optional activities. This allows more flexibility.

- Let visitors make requests and changes to itineraries to suit their needs.

- Specify the level of activity on each tour, and any experience needed. With 4x4 tours in particular, mention the level of difficulty as well.

What products are you competing with?

Self-drive tourists choose to rent a vehicle as their primary means of transport. The main competing products, therefore, are other forms of transport that visitors could use to travel around. These differ by country, according to what is available. In Kenya, for example, visitors could instead travel by passenger train between Nairobi and Mombasa. In Egypt they may choose to travel by boat. These modes of transport may also form part of package tours, such as cruises in Egypt or cycling holidays through southeast Asia.

In order to successfully penetrate this market, you need to communicate the benefits of self-drive tourism. Above all, it is the most flexible and easy-to-personalise way to travel. Let visitors know that with self-drive they can adapt their itineraries to meet their own needs, and they do not need to travel to a tight schedule. Also important is the level of safety at your destination, and you need to reassure potential customers that self-drive is a viable way to travel around.

Tips:

- Compare your prices with those of alternative transport options such as cycle tours, cruises and train journeys. If your price is higher than competing products, highlight the value you add to a visitor’s holiday.

- Promote your destination as safe and be clear and honest about any safety or security issues that visitors may encounter. Also explain how you mitigate the risks they face.

- Promote the ability to personalise itineraries to meet individual needs and offer people the flexibility they want.

- Learn about other niche travel markets that self-drive tourists may also be part of by reading other CBI reports, such Food tourism, Wildlife tourism, Nature tourism and Adventure tourism.

4. What are the prices for self-drive tourism products on the European market?

Self-drive tourists may travel by car for just a day or weekend, or they may take a longer trip – even as much as two weeks or more. Each of these options has a wide range of prices, based on the length of the trip, the standard of accommodation used and the destination. Some prices also include a number of meals and/or fuel.

In order to price your self-drive tourism product correctly and competitively, you need understand the market’s existing pricing structure. This means looking at price levels both locally and in competing destinations. Table 2 lists a number of products currently available in this segment, with their consumer prices in euros. The amounts shown exclude international air fares.

Table 2: Self-drive tourism product prices in various countries

| Product name | Country | Duration | Price pp from (€) |

| Experiences lasting between one day and one week | |||

| Jungle and Malekus ATV Arenal Tour | Costa Rica | 2 hours | 75 |

| Garden Route | South Africa | 3 days | 470 |

| Jebels, Desert and Wadis | Oman | 7 days | 850 |

| Self-Drive Trip to Classic Patagonia | Argentina | 6 days | 900 |

| Self-Drive Around Namibia Mid-Range Tour | Namibia | 7 days | 1,260 |

| Fox Route | Mongolia | 7 days | 3,000 |

| Experiences lasting between one and two weeks | |||

| Namibia Highlights Safari | Namibia | 11 days | 1,250 |

| Beaches, Desert and Wadis | Oman | 9 days | 1,500 |

| Costa Rica Self-Drive Holiday | Costa Rica | 8 days | 1,750 |

| Luxury Honeymoon Garden Route Tour | South Africa | 8 days | 1,900 |

| Infinite Patagonia – Self-Drive | Argentina | 13 days | 3,400 |

| Yak Route | Mongolia | 13 days | 3,500 |

| Experiences lasting more than two weeks | |||

| The Best of Namibia | Namibia | 20 days | 1,750 |

| Mellow South Africa Self-Drive | South Africa | 18 days | 2,200 |

| Costa Rica Self-Drive Family Adventure | Costa Rica | 16 days | 4,700 |

| Horse Route | Mongolia | 22 days | 5,000 |

Source: Acorn Tourism Consulting

Tips:

- Research existing products in your own destination for a range of durations and levels of service.

- Calculate the base level cost of your tour – that is, the lowest price you could charge and still make a profit. Check whether this is similar to market prices or whether you could increase the cost. If your base level cost is higher than the market price, look at what you could do to cut costs or to market your tour as a luxury product.

- For more help on setting prices, consult the CBI study 10 tips for doing business with European tourism buyers – in particular tip 7: Set a fair price for your services.

Acorn Tourism Consulting carried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research