The European market potential for self-drive tourism

Self-drive tourists are adventurers who want the freedom to decide where and when they visit sights and destinations. This niche is influenced by recent trends in sustainability, the use of personal electronic devices during travel and the desire for personalised trips. The European markets with the greatest opportunity for self-drive tourism are those with large populations, an interest in nature and adventure and a history of renting vehicles. They include Germany, France, the UK, Spain, Italy and the Netherlands.

Contents of this page

1. Product description

The self-drive tourism market refers to visitors who travel to and around their chosen destination by vehicle. Their journeys can be short overnight trips, multi-day trips or longer. Generally, this niche includes travellers in four groups.

Table 1: Types of self-drive traveller

| Traveller group | Length of travel | Distance from home | Type of vehicle |

| Group 1: travellers who fly to a destination and rent a car there (fly-drive holidays). | Generally short-term (between one day and one month). | Long-haul or short-haul | Rental |

| Group 2: travellers who self-drive their own vehicle from home to their holiday destination. | Generally short-term (between one day and one month). | Short-haul | Own vehicle |

| Group 3: travellers who rent a car in their home country and drive to their holiday destination. | Generally short-term (between one day and one month). | Short-haul | Rental |

| Group 4: travellers who travel and live long-term in their own vehicle (for example, recreational vehicle (RV) travellers). | Long-term. | Long-haul or short-haul | Own vehicle |

Source: Acorn Tourism Consulting

All the self-drive tourists listed in Table 1 are motivated to travel in this way for the following reasons.

- It gives them freedom and independence during their trip, so that they can determine the pace of their holiday and where they visit.

- They can drive off the beaten track, see more of a country and learn more about its local environments and people than package tourists or visitors on group tours.

- They can make unexpected, unplanned and spontaneous discoveries and be flexible in updating their itineraries when that happens.

- They can base their travel plans on recommendations from locals or from friends and family who have visited the destination in the past.

- They can customise their own itinerary to the activities they want.

Self-drive tourists can choose to travel independently or with package tours. Since they like their freedom, this niche is more likely to choose independent travel. Self-drive package tours differ widely in what they offer visitors, but they may include some or all of the following.

- A set itinerary.

- Prebooked accommodation.

- Prebooked activities, or suggested activities.

- Vehicle hire.

- A guide (in a separate vehicle).

The rest of this report focuses on self-drive tourists who book package tours. This is because those who travel independently can be considered free independent travellers (FITs). For more information on how to target that group, read the CBI report on opportunities in the European FIT travel market. Table 2 lists some examples of package tours for the self-drive market.

Table 2: Examples of self-drive holiday providers and how they position themselves in the market

| Self-drive providers and their unique selling points (USPs) | How the provider appeals to the market |

(South Africa) “Our Adventure range of tours are aimed at the off-road adventurer that is looking for a true bush experience, camping in Africa’s wildest destinations.” | An adventure tour operator that offers guided self-drive tours. Packages include all accommodation costs, meals, park entry fees and a guide in a separate vehicle. Vehicle hire is not included. This type of package appeals to adventurous travellers who want to explore off-the-beaten-track locations and try four-wheel-drive tracks. However, they feel safer knowing that a guide is always available in case something goes wrong. These itineraries are mostly group tours (more than one travel party) and follow a set itinerary with less room for flexibility. |

(United Kingdom) “We create our tailor-made self-drive holidays using a well of personal experience.” | Audley Travel offers self-drive tours in Namibia, Oman, South Africa, Argentina, Chile and many more destinations. Tour prices include all accommodation and fully insured vehicle hire. Itineraries can be adapted according to individual preferences, since tours are only for one travel party. This appeals to groups who want flexibility in their itinerary, but also want everything to be pre-organised to reduce stress. |

(South Africa) “It couldn't be easier. Fly in and collect your prebooked vehicle, load up and go.”

| Appeals to a market that wants an adventure in Africa, but also needs a little hand-holding. They use language like “Our African self-drive holidays… are far less daunting than you might imagine” and “Our range of self-drive holidays through Namibia and South Africa are perfectly manageable”. They encourage visitors to take the jump into self-drive itineraries, but ensure that it remains a safe and enjoyable experience. All tours include vehicle rental. All safari game drives are still done through safari camps, with professional guides and 4x4 vehicles. |

(United Kingdom) “Comfortable prebooked hotels in each location.” | Freedom Destinations offers luxury self-drive tours in popular destinations, including Namibia and South Africa in Africa and Malaysia in Asia. Packages include prebooked accommodation at luxury hotels and glamping sites. Visitors can still participate in nature and wildlife activities, but in full comfort. |

(United Kingdom) “The actual journey you choose to take through this wonderful country is up to you.” | Self-drive tours are available in a number of interesting locations, including Jordan, Oman, South Africa, Namibia and parts of eastern Europe. On the Jordan itinerary, the site states, “Your rental car and hotels are booked for you in advance – but the actual journey you choose to take through this wonderful country is up to you”. This encourages visitors to adapt the suggested itineraries. Responsible Travel will work with the customer to develop the perfect experience. |

This market tends to have specific destination-level needs. Some of the most popular destinations for self-drive package tours include New Zealand, Iceland, Costa Rica, Scotland and South Africa. These destinations are all safe to travel through as tourists, have good road networks and have good infrastructure (particularly access to GPS/internet). Developing destinations need to ensure that similar infrastructure is in place in order to attract this niche. Developing destinations with high potential include Namibia, Argentina, Mongolia, Costa Rica and Oman. Learn more about these in our Self-drive market entry study.

Like rural tourism, self-drive tourism is a great way to spread the economic benefit from tourism across a wider area. These tourists are more likely to travel further than other visitors and will spend money in the communities they pass through on the way. They may also stay longer, so they see more of a country and learn more about the cultural and natural heritage of their destination.

End-market segmentation and consumer behaviour

Self-drive tourists can be segmented in a number of ways. One way is by their preferred accommodation. In this case, the following segments can be defined.

- Dedicated tenters. Committed to using tents as these provide a way to really immerse themselves in nature. They are against staying in vehicles or indoor accommodation. Dedicated tenters are more adventurous and more physically active than other segments. They are also more interested in sustainability. They are motivated to travel this way because it gives them greater access to remote areas.

- Convenience tenters. Previously dedicated tenters who have changed their style of travel after increasing their budget, growing older, having children or visiting different environments. These travellers usually carry a tent but will stay in hotels or more up-market accommodation on occasion. They like the flexibility of different accommodation options.

- Bed and breakfasters. Enjoy meeting people from the communities they visit. They are highly sociable and are interested in local cultures. They want to visit local communities and interact with local people during their trips.

- Dedicated hotel stayers. Want to stay exclusively in hotels. They like this form of accommodation because they do not have to engage with bed and breakfast (B&B) owners or stick to a fixed schedule for meal times. They also want accommodation that is somewhat separated from the local environment, because they do not need or want the intense immersion in nature that appeals to other groups. This group is more interested in historical and cultural activities.

- Small-scale RVers (recreational vehicle users). This group may have been tenters but have upgraded to small camper vans, often due to a higher income or more advanced age. This group enjoys engaging with local communities during their travels.

- Large-scale RVers. These can be divided into many subgroups. They include people who live full-time in their RVs, and others who travel regularly in RVs. Overall, members of this group are less physically active than other segments, want more “home comforts” when they travel and are conscious of safety.

Figure 1: Self-driving along a coastal road

Source: Unsplash

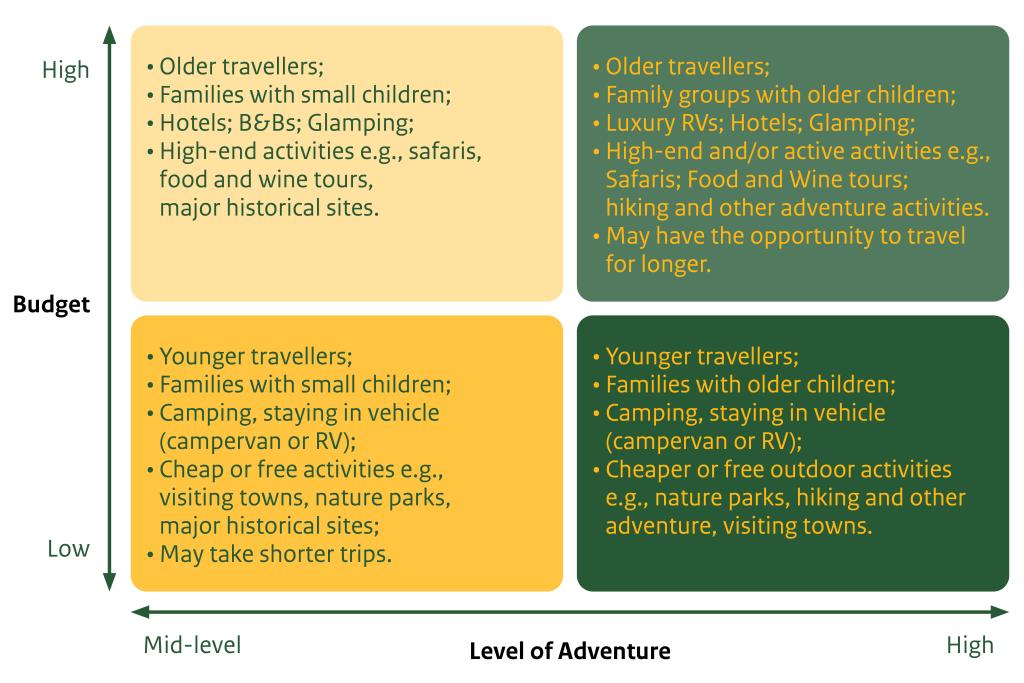

A second way to segment the market is by budget and by the level of adventure being sought, as shown in figure 1. From that we can identify the main demographic groups in each category, the types of accommodation they prefer and the types of activity they are interested in.

Note that the adventure scale in figure 1 starts at “mid-level”. This is because self-drive travellers are generally more adventurous than the average tourist, so they rarely fall within the “low adventure” category.

Figure 2: Self-drive market segments

Source: Acorn Tourism Consulting

Consultations with tour operators suggest that younger people make up the greatest proportion of the self-drive market. When booking, younger travellers like to find everything in one place, so online travel agencies (OTAs) are popular with them. They also like to use search engines and travel review sites when planning and booking. Millennials care more about review sites than other generations, and they use search engines to book independently more than others.

Self-drive travellers usually fall within other niche markets as well, depending on the activities they enjoy. Some also count as adventure tourists, others as luxury travellers, and some enjoy food tourism. These groups will personalise their itineraries to include their desired activities where possible.

Tips:

- Allow flexibility in self-drive itineraries to give this group more freedom with what they see and do.

- Consider activities at your destination that might interest self-drive visitors, and develop a draft itinerary.

- Assess the quality of accommodation and the types of activity you can offer. That will help you decide which segment(s) of the self-drive tourism market you should target.

- Develop itineraries for different self-drive interests, such as food and wine or adventure.

- Learn more about other niche markets that self-drive tourists may fall into by looking at the CBI niche market infographic.

Accessible tourism for the European market

Accessible tourism is the ongoing effort to ensure that tourist destinations, products and services are accessible to everyone, regardless of their physical limitations, disabilities or age. It encompasses both publicly and privately-operated tourist facilities. The improvements not only benefit those with permanent physical disabilities, but also parents with small children, elderly travellers and people with temporary injuries (such as broken bones), as well as their travelling companions. Tourists with disabilities may travel individually, in groups, with their family or with carers.

Accessibility and self-drive tourists

More self-drive tourism may increase the number of visitors with accessibility needs. After all. this form of travel reduces the need to use public transport to move around. Parents with young children, the elderly, pregnant women and those with physical disabilities may also prefer this form of tourism. For them, it can reduce stress because they by travel in groups and can drive from door to door. Be aware of this growth and prepare for it by developing good solutions for people with accessibility needs.

Tips:

- Indicate how physically demanding each day/activity will be for travellers.

- Invest in one or two vehicles with wheelchair access.

- For each itinerary, provide detailed information about possible accessibility challenges.

- Provide equipment for guests with accessibility needs to rent on arrival, such as wheelchairs, pushchairs and walking sticks.

- Read the CBI study What are the opportunities in the European market for accessible tourism? for more tips on how to deliver accessible tourism for all visitors.

2. What makes Europe an interesting market for self-drive tourism?

Europe is an interesting market for self-drive tourism because driving holidays have become even more popular there since Covid-19. Interest in driving holidays has been growing for a while, and statistics show that it will keep growing for years to come.

The global car rental market was valued at US$98.4 billion in 2021 and is expected to reach a total value of US$126.6 billion by 2028. This suggests that self-drive will remain an important niche segment for many years.

Statistics also suggest that self-drive is a popular activity in Europe. A recent TomTom survey found that over three-quarters of European holidaymakers said they wanted to travel by car in 2021, with the main motivation being freedom and flexibility.

Figure 3: Self-drive tourists camping under the stars

Source: Unsplash

Road travel is trending. The overall self-drive market has grown since Covid-19. TrekkSoft has found that, post-pandemic, many activity providers in driving-friendly destinations are performing better than others. The Expedia Traveller Value Index 2023 found that traveller searches for car rentals in 2022 were above 2019 search volumes.

People want to self-drive more since Covid-19. In one survey, 38% of respondents said that they would be more likely to take a driving holiday now than before the pandemic. This is most likely due to travellers wanting to have more space and to spend more time outdoors, because of concerns about health and safety. Self-drive travel lets people keep their distance from other travellers and make last-minute changes to their itineraries.

Finally, the growth of the self-drive market in Europe is related to trends in favour of more authentic and local experiences. In a 2023 survey, 89% of respondents said that they want to travel to destinations they have not visited before. Another 68% said that they take pride in finding lesser-known destinations for their holidays.

Tips:

- Research generational differences in travel markets to understand what different age groups want when they travel. Read the CBI reports on Baby Boomers, Generatiohttps://www.cbi.eu/market-information/tourism/generation-xn X and Millennials.

- In your marketing, use language that encourages visitors to head outdoors and explore lesser-known destinations. Since Covid-19, people want to spend more time outdoors and will be looking for opportunities to do so.

3. Which European countries offer the most opportunities for self-drive tourism?

The most interesting European source markets for self-drive tourism are Germany, the UK, France, Italy, Spain and

the Netherlands. Many people in these countries have already rented cars or motorhomes when travelling. The Netherlands has the highest proportion of travellers who have rented vehicles in the past: 38%.

Holidaymakers from Countries like Germany, the UK and the Netherlands have an interest in nature-based tourism and adventure activities. They like self-drive destinations that offer natural landscapes and wildlife experiences. These might include Namibia and Tanzania, say. People from France and Italy are less adventurous but like to have good food. Jordan and South Africa could be destinations with high potential for these source markets.

Germany

Germany is the market with greatest potential in Europe because of its large long-haul travel market, preference for nature and wildlife holidays and high usage of rental cars and motorhomes. Germany has the largest population in Europe: a total of 83.4 million people in 2022. It also has a large outbound tourism market, totalling 99.5 million people in 2019. Approximately 8.5 million of them (8% of the outbound market) travelled long-haul.

Approximately 44% of German travellers are interested in nature-based tourism, and 38% are interested in adventure travel. Figure 4 shows that 32% of this population used a car or motorhome as their main means of transport when travelling in 2019.

Figure 4: What makes Germany an interesting market for self-drive?

Sources: ReiseAnalyse, World Bank, UNWTO

For Germans, the natural environment is their number-one consideration when choosing a holiday destination (48%). This interest in nature, and their tendency towards adventure tourism, makes them interested in places with lots of natural areas, wildlife and adventure activities. But 76% say that relaxation and rejuvenation are important as well, so they will also pick destinations that allow them an opportunity to relax in comfort.

Germans like to be sustainable when travelling, by purchasing local products at their destinations. They are even willing to pay more to protect the natural environments they visit. Destinations can make the most of this by charging for access to protected areas, but should also communicate what the fees are used for.

For this market, destinations like South Africa and Namibia could be a good option. After all, they offer safaris and excellent nature-based experiences and adventure travel, but also have beautiful beaches and vineyards for relaxation. Moreover, Namibia has German as one of its official languages.

United Kingdom

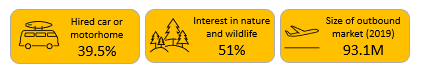

The UK has the largest long-haul outbound market in Europe, plus a high percentage of nature and wildlife travellers. This makes it a great market to target. The country has a total population of 67.3 million, and its total outbound tourism market in 2019 (before the pandemic) was 93.1 million journeys (figure 4). UK holidaymakers like to relax and rejuvenate (75%), but are also very interested in seeing natural scenery and wildlife (51%) and participating in adventure activities (32%).

In 2019, 38.6% of UK travellers to the United States rented a car during their trip. Another 0.9% rented a motorhome or camper. This source market likes destinations that offer more luxurious accommodation, such as high-end hotels and resorts, as well as fine dining. Nature-based attractions and wildlife are also popular. UK tour operator Audley offers self-drive packages to many countries, including the developing destinations Namibia, Oman, Costa Rica, Argentina and Chile. All of these have great nature-based offerings but also provide comfortable accommodation and dining.

Figure 5: What makes the UK an interesting market for self-drive?

Sources: US National Travel and Tourism Office, World Bank, UNWTO

France

France is a large market, and many French holidaymakers have previously hired cars or motorhomes when travelling. This makes it an interesting source market for self-drive operators. France has a total population of 64.5 million, including 24.5 million younger residents. Its outbound tourism market was 30.4 million journeys in 2019 (currently 8 million) (figure 5). In 2019, 32.7% of French travellers to the US hired a car. Another 1.3% rented a motorhome or camper.

For French travellers, the natural environment is only the third most important consideration when selecting a destination. Their two top priorities are the price of the trip and the cultural experiences on offer. They like places with good food and drink and that are easy to travel around.

This market will therefore be interesting for destinations with good cultural offerings as well as food trails. French visitors like accessible nature-related activities rather than hard adventure. Countries of interest could include Jordan, for example, with its interesting culture, luxury accommodation options and great food.

Figure 6: What makes France an interesting market for self-drive?

Sources: US National Travel and Tourism Office, UNWTO

Italy

Italy represents a great opportunity for self-drive operators because of the size of its outbound market. The country has a total population of 59.2 million people, who took 34.7 million outbound journeys in 2019 (figure 7). Italian holidaymakers want somewhere that is easy to move around, provides good local food and drink and is easily accessible. When choosing a destination, they put cultural offerings and the cost of the trip before the natural environment. In this respect, they are similar to the French.

In 2019, 26% of Italian visitors to the US rented a car. Another 0.8% rented a motorhome or camper. This group is more interested in luxury than other Europeans and is most likely to enjoy fine dining, shopping and sightseeing during their trip. Southern and eastern Africa could therefore prove popular in the Italian market, as those regions offer luxury accommodation options and excellent food.

Figure 7: What makes Italy an interesting market for self-drive?

Sources: US National Travel and Tourism Office, Eurobarometer, UNWTO

Italians are slightly less interested in travelling sustainably than many other Europeans. However, they still try to purchase local products and to take holidays outside peak seasons in order to reduce overtourism.

The Netherlands

Of all Europeans, the Dutch are the most likely to rent a vehicle when they travel. In 2019, 36% of Dutch travellers to the US rented a car. Another 2.1% rented a motorhome or camper. This makes the Netherlands an excellent potential market for emerging self-drive destinations.

The size of the Dutch source market and its interest in outdoor activities are also interesting for self-drive operators. It had an outbound market of 22 million journeys in 2019 (figure 8). And for Dutch travellers the natural environment is the most important factor when choosing where to go – 54% say that this is a priority.

These visitors are therefore likely to choose destinations with excellent nature-based experiences, great adventure and off-the-beaten-track sights. 333travel offers self-drive holidays for Dutch travellers. Its top developing destinations include South Africa, Costa Rica and Mexico. All of these are places with a focus on nature-based tourism. Other developing destinations with great potential for this market include Namibia, Jordan and Oman.

Figure 8: What makes the Netherlands an interesting market for self-drive?

Source: US National Travel and Tourism Office, Eurobarometer, UNWTO

The Netherlands is one of the more sustainability-minded source markets in Europe. To travel sustainably, the Dutch try to limit the amount of waste they produce, travel outside high seasons and visit less touristed destinations. This makes them a valuable market for developing destinations, because they like to get off the beaten track. To appeal to travellers from the Netherlands, you should communicate sustainable practices used by your business and publicise less well-known attractions.

Spain

In the past, the Spanish have been less likely than other Europeans to rent vehicles. Nevertheless, its size and its interest in nature tourism make Spain an interesting market. The country had a population of 47.5 million in 2022, and approximately 19.8 million Spanish travellers took trips abroad in 2019 (figure 7). For them, the natural environment is a leading factor when choosing a destination (49%). But its cultural offerings are slightly more important (51%), while the overall price of the trip also ranks just as highly (49%).

In 2019, 22% of Spanish travellers to the US rented a car. Another 0.7% rented a motorhome. That suggests that they do have some interest in this form of travel.

Figure 9: What makes Spain an interesting market for self-drive?

Sources: US National Travel and Tourism Office, Eurobarometer, UNWTO

Spanish travellers prioritise sustainability during their trips. A huge 71% of them like to source local products when they travel – far higher than the European average of 55%. They also try to limit the amount of waste they produce, contribute to carbon offsetting and reduce their water usage. To appeal to the Spanish market, then, publicise how you are being sustainable and share tips for visitors to do the same. Possible examples include reducing laundry and using reusable water bottles rather than plastic.

Tips:

- Develop nature-based and wildlife itineraries specifically for German and Dutch travellers. Offer visits to natural attractions, wildlife viewing or sustainable interaction and outdoor activities.

- For visitors from France and Italy, recommend outstanding gastronomic experiences – even if these are not part of your set itinerary.

- Use existing research to better understand your key source markets: many have publicly available market profiles, such as those at Visit Britain, South Africa Tourism and the US National Travel and Tourism Office.

- Read the CBI factsheets on nature tourism, adventure tourism, food tourism and luxury tourism. Most self-drive tourists also fall into one or more of these segments.

- Check the “barometer” tests done by the EU for most European markets to see how market preferences change over time.

4. Which trends offer opportunities or pose threats on the European self-drive tourism markets

Self-drive tourism has been influenced by trends across the global travel market, as well as by broader global trends like sustainability. These range from growing demand for electric vehicles and completely personalised itineraries to greater use of personal electronic devices while travelling.

Sustainability – electric vehicles

Sustainability has been trending across tourism markets for many years now. Sustainable travel recognises both the positive and negative impacts that tourism can have on the environments, people and places being visited. And it means taking action to minimise the negative impacts and maximise the positive ones.

Self-drive tourists may attempt to reduce their impact by renting electric vehicles. That is, vehicles with electric motors powered by a battery that can be recharged at the roadside. According to the Expedia Traveller Value Index, electric vehicle charging stations were the sustainability-related amenity mentioned most often in traveller reviews in 2022.

The electric car rental market is expected to grow quickly over the next five years, with an estimated global value increase of US$11.2 billion by 2027. This growth is being driven by the following factors.

- The desire for sustainable travel options and reduced emissions.

- The overall growth in international tourism.

- Increasing government incentives and regulations related to electric vehicles.

The trend toward electric vehicles is most prominent in China, North America and Europe. These countries currently host around 89% of all the world’s charging stations. There are fewer stations in developing countries. In Africa they are available only in South Africa, Namibia, Morocco, Tunisia and Kenya. But they are gaining in popularity in that region, in line with growing awareness of sustainability issues. In South Africa, 150 new charging stations are expected to open by the end of 2023.

Hiring electric vehicles for longer road trips is a new trend in Europe and North America, and is still not possible in these developing countries. In the future, however, it is likely to become an important selling point for self-drive operators in all destinations as concern about sustainability and climate change continue to increase.

Destination countries need to prepare by developing networks of electric vehicle charging stations. Eventually, once enough stations are in place for travellers to move easily between key locations, operators can add electric vehicles to their fleets.

For inspiration, here is an example of best practice.

Overland Ireland Tours now offers an eight-day tour of Ireland by electric vehicle. It describes this as the “greenest self-drive tour of Ireland”. The itinerary includes accommodation and recommended sightseeing activities. And unlike users of petrol and diesel cars, customers do not need to pay for fuel; the company provides a preloaded payment card to cover charging costs and so incentivise this sustainable mode of travel.

Tips:

- Publicise your sustainability commitments and the actions you are taking to reduce your impact on the local environment.

- Invest in electric vehicles to provide this sustainable option to travellers (once sufficient charging stations are available along your itineraries).

- Lobby local governments to increase resources for electric vehicles, including enough charging stations to enable road trips.

- Learn more about sustainable travel by reading the CBI report How to be a sustainable tourism business.

Desire for personalised travel

One of the main current trends in the global tourism industry is personalisation. Travellers want experiences that are customised to their own needs, likes and desires. This ensures that their trip is exactly what they want, with the types of activity they enjoy most. As part of this trend, travellers (and particularly adventurous young travellers) are moving away from preset tour options, standard communications and rigid itineraries.

This trend is relevant for the self-drive sector because it tends to attract more adventurous tourists who appreciate flexibility and freedom. Its products are usually easier to personalise, too, since they are private rather than group tours. So it is important to provide these customers with the option to adapt any preset or suggested itineraries to suit their own needs. This might even include changes during the trip itself, if guests change their minds about certain activities or want to stay longer in a particular place.

For a full personalised experience, recent research recommends customising across all aspects of the trip. To do so, you need to understand exactly what your guests want out of their trip. For example...

- The types of activity they want (or do not want).

- How active they want to be, and if they also want to spend time relaxing.

- The type and standard of accommodation they want to stay in.

- The types of holiday they have taken in the past.

For inspiration, here is an example of best practice.

Selfdrive4x4.com is a small business offering self-drive tours through southern Africa. The company has a range of itineraries available, lasting between 11 and 28 days. Each comes with a full guest information pack including a map with driving distances, details of the accommodation booked and recommended activities. Plus a note about creating custom self-drive itineraries by request, as shown in figure 10. Customers can adjust any of the itineraries to suit their exact needs. Selfdrive4x4 also provides personal support and advice to every group making a reservation.

Figure 10: Selfdrive4x4 note on personalising itineraries

Source: Selfdrive4x4.com

Tips:

- Learn about your customers’ likes and dislikes so that you can provide targeted recommendations for activities, destinations, restaurants and so on.

- Be available and ready to suggest itinerary adjustments during their trip if they hear of new places or receive recommendations from other travellers.

Use of personal electronic devices

Nowadays, most international travellers spend a large amount of time on their personal electronic devices. In the planning and booking phases, the majority of people use their mobile phones. And particularly the younger generations: 63% of Gen Z and 51% of Millennials travellers use a smartphone when looking for inspiration, and 76% of Gen Z and 73% of Millennials use devices during their trip.

Travellers now also use a range of mobile phone applications. These include online maps, booking tools like Booking.com, language apps, travel review sites and activity planners. Self-drive travellers also use apps specific to road trips to plan, track or guide them on their journey. Some of the most interesting and popular are…

- Polarsteps travel tracker, an app that can automatically record the route you have taken – including spots you loved – allowing you to revisit them once your journey is over. You can also share your experiences with friends and family as you go and turn them into a hardback travel book once you are back home.

- PlugShare, a charging station finder that lists 610,000 places to recharge electric vehicles. Most are in North America and Europe, but charging stations in developing countries are also included where data is available. For example, in South Africa, Rwanda, Egypt and Indonesia.

- Google Maps, an app providing detailed local navigation in over 220 countries and territories. Visitors can also use it to search for restaurants and other services near them.

Tips:

- Make your planning and booking platforms mobile-friendly.

- Include a GPS or satellite navigation system with every vehicle – most visitors will rely on this to move between locations.

- Check whether there are any applications that can be used at your destination. If not, see whether you can add geodata and information to an existing platform to make these available to your customer.

- For more about current trends that may create opportunities or pose threats in the European outbound market, read the CBI trends study.

Acorn Tourism Consultingcarried out this study on behalf of CBI.

Please read our market information disclaimer.

Search

Enter search terms to find market research